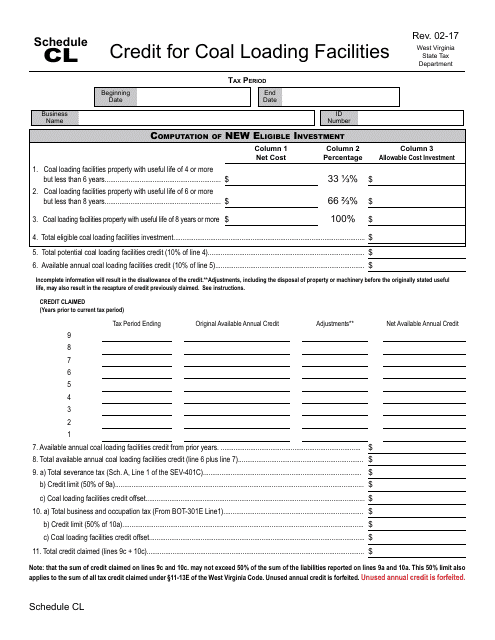

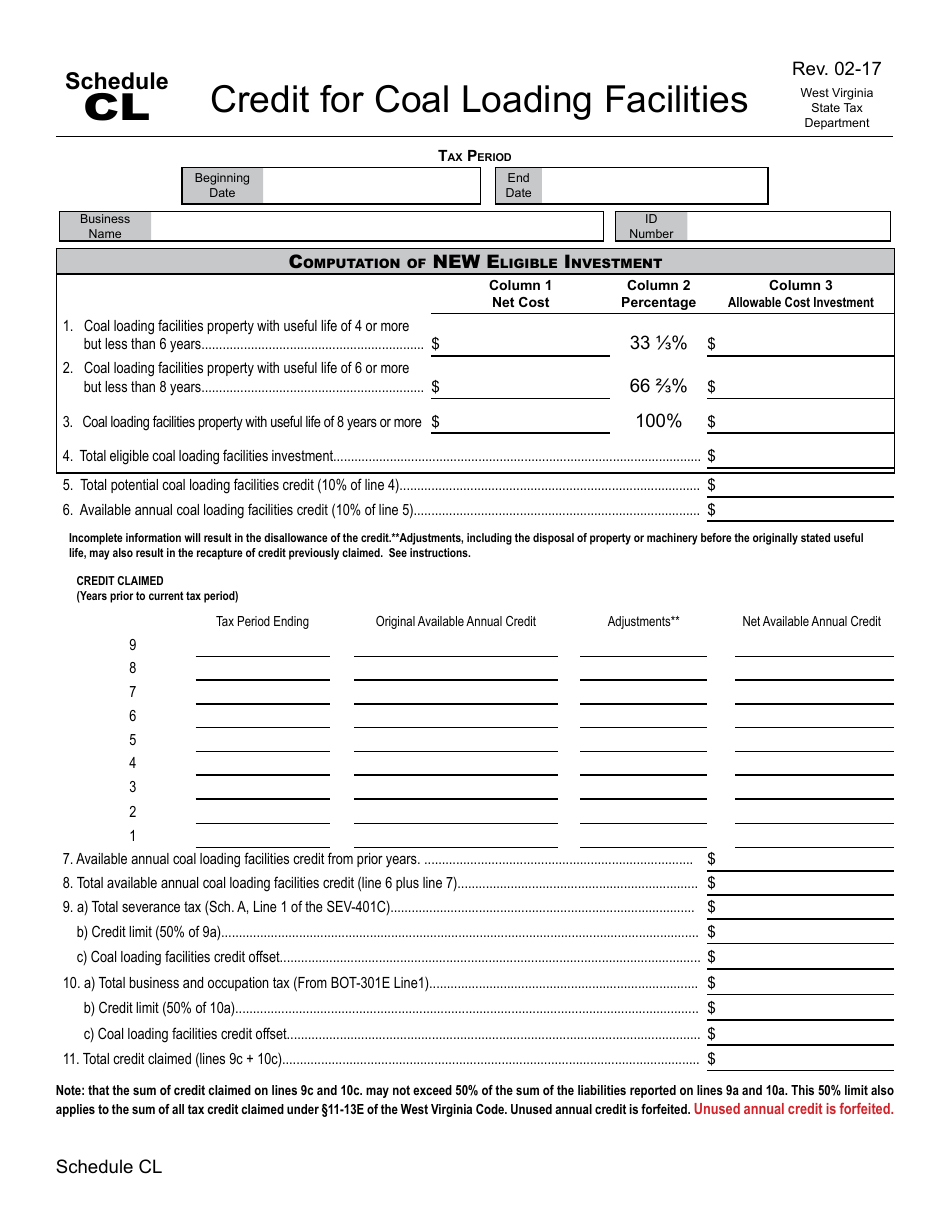

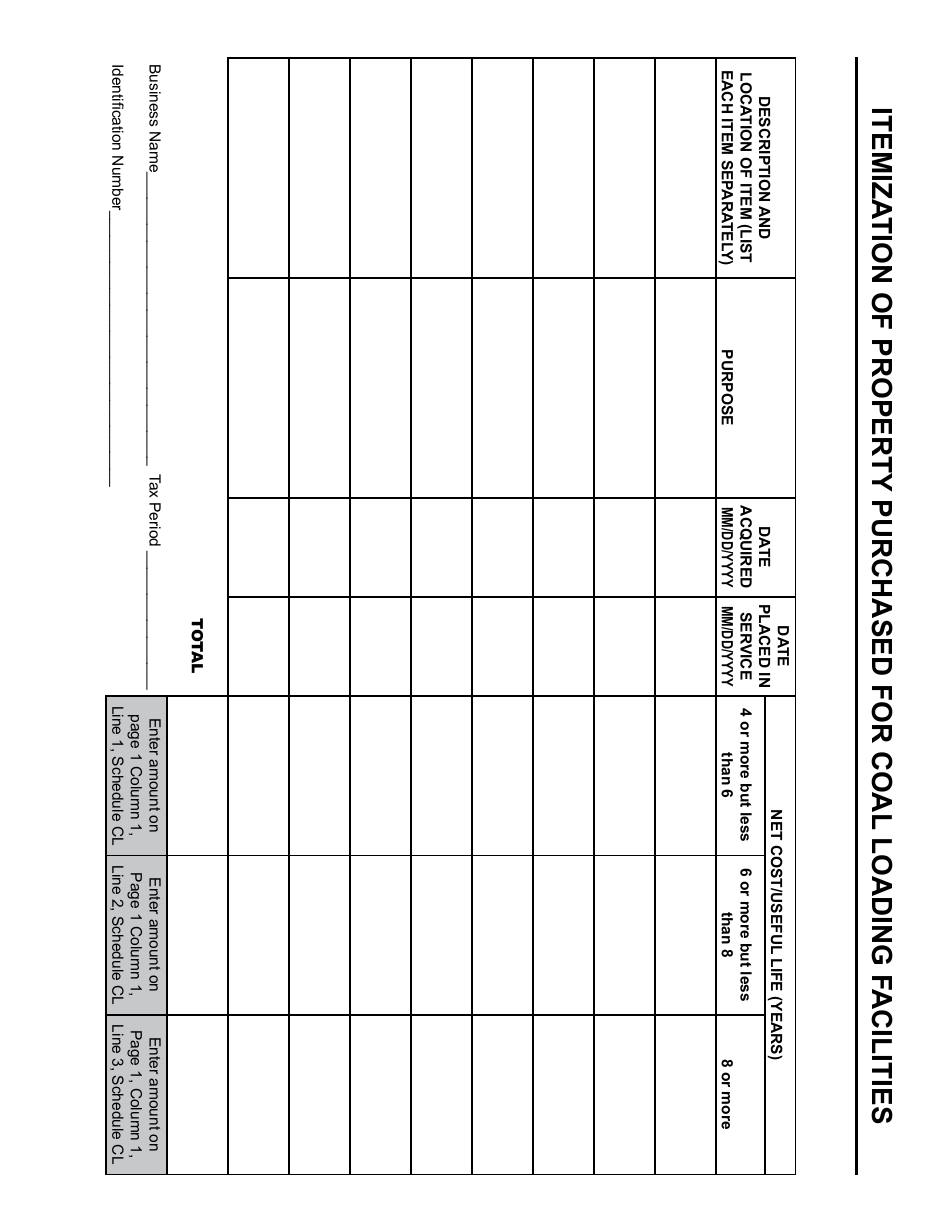

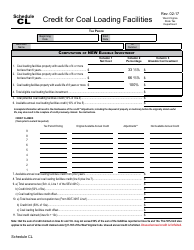

Schedule CL Credit for Coal Loading Facilities - West Virginia

What Is Schedule CL?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

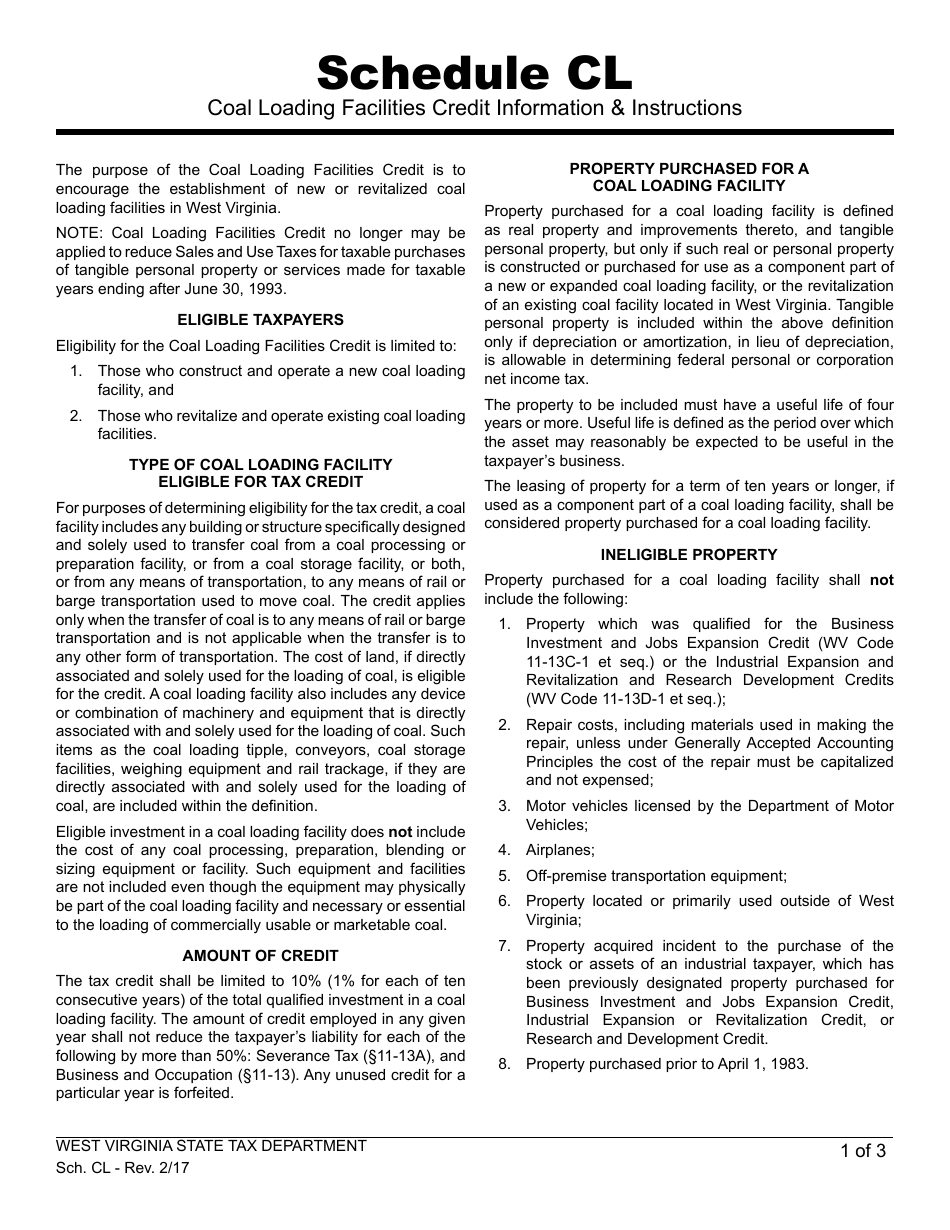

Q: What is Schedule CL Credit?

A: Schedule CL Credit is a type of tax credit available for coal loading facilities in West Virginia.

Q: Who is eligible for Schedule CL Credit?

A: Coal loading facilities in West Virginia are eligible for Schedule CL Credit.

Q: What is the purpose of Schedule CL Credit?

A: The purpose of Schedule CL Credit is to provide financial incentives for coal loading facilities in West Virginia.

Q: How can coal loading facilities benefit from Schedule CL Credit?

A: Coal loading facilities can benefit from Schedule CL Credit by reducing their tax liability.

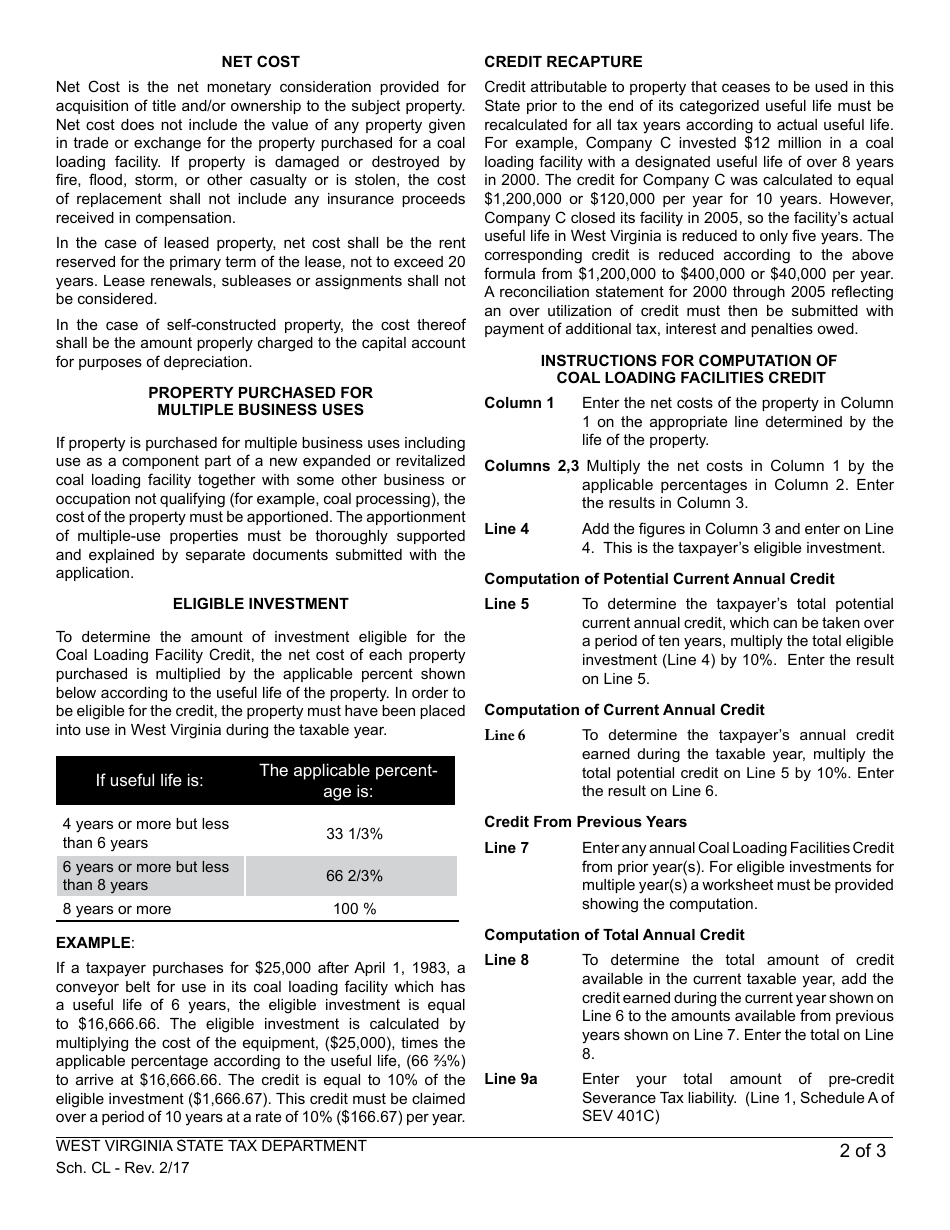

Q: How is Schedule CL Credit calculated?

A: The amount of Schedule CL Credit is based on the qualified coal loading equipment and infrastructure expenditures.

Q: Is there a maximum limit for Schedule CL Credit?

A: Yes, there is a maximum limit for Schedule CL Credit, which is determined by the West Virginia Department of Environmental Protection.

Q: Is Schedule CL Credit transferable?

A: No, Schedule CL Credit is not transferable.

Q: What is the deadline for claiming Schedule CL Credit?

A: The deadline for claiming Schedule CL Credit is typically July 1st of the year following the taxable year in which the expenditures were made.

Form Details:

- Released on February 1, 2017;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule CL by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.