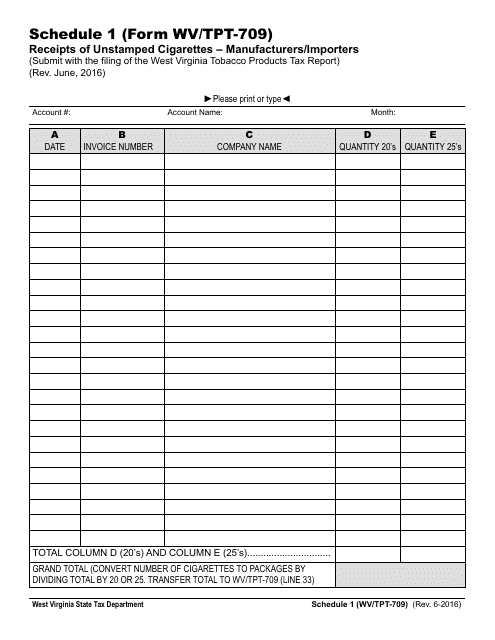

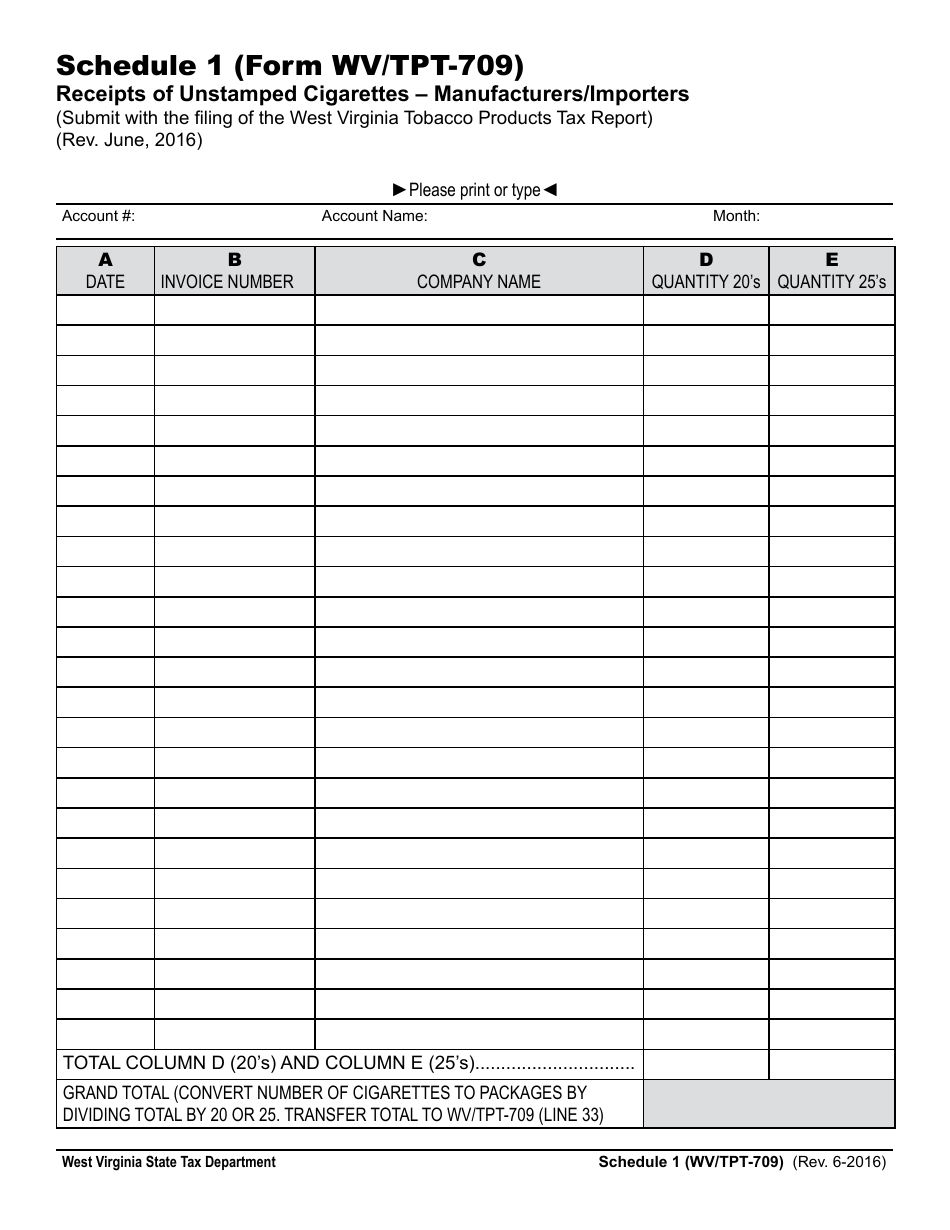

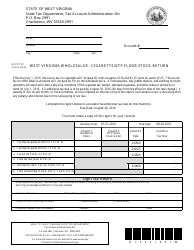

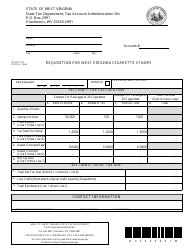

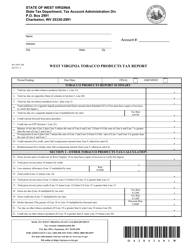

Form WV / TPT-709 Schedule 1 Receipts of Unstamped Cigarettes - Manufacturers / Importers - West Virginia

What Is Form WV/TPT-709 Schedule 1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia.The document is a supplement to Form WV/TPT-709, West Virginia Tobacco Products Tax Report. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WV/TPT-709 Schedule 1?

A: Form WV/TPT-709 Schedule 1 is a tax form used by manufacturers and importers of unstamped cigarettes in West Virginia.

Q: Who should fill out Form WV/TPT-709 Schedule 1?

A: Manufacturers and importers of unstamped cigarettes in West Virginia should fill out Form WV/TPT-709 Schedule 1.

Q: What is the purpose of Form WV/TPT-709 Schedule 1?

A: The purpose of Form WV/TPT-709 Schedule 1 is to report the receipts of unstamped cigarettes by manufacturers and importers in West Virginia.

Q: Are there any penalties for not filing Form WV/TPT-709 Schedule 1?

A: Yes, failure to file Form WV/TPT-709 Schedule 1 or filing it incorrectly may result in penalties and fines imposed by the West Virginia Department of Revenue.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/TPT-709 Schedule 1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.