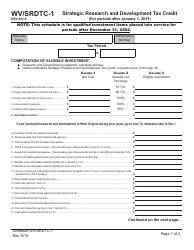

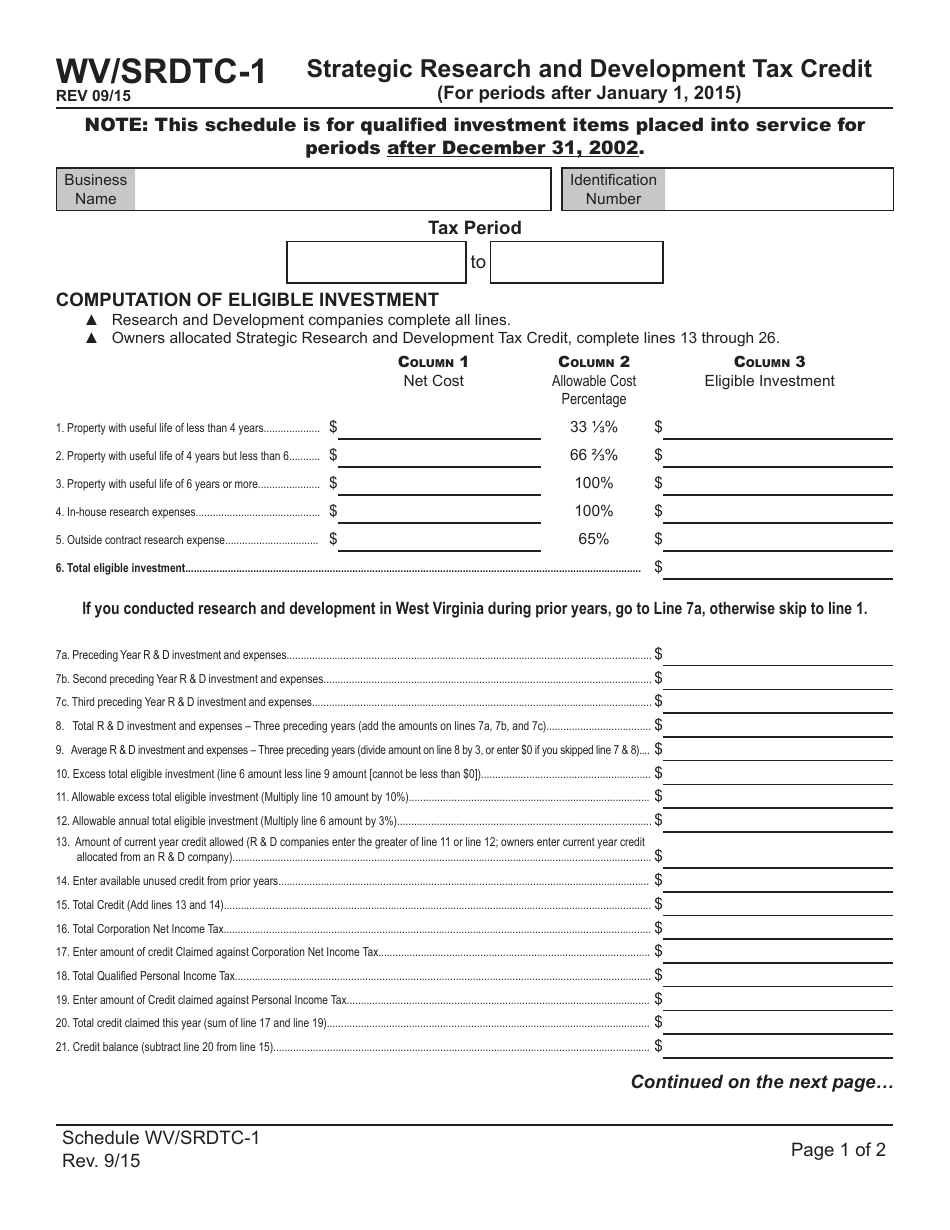

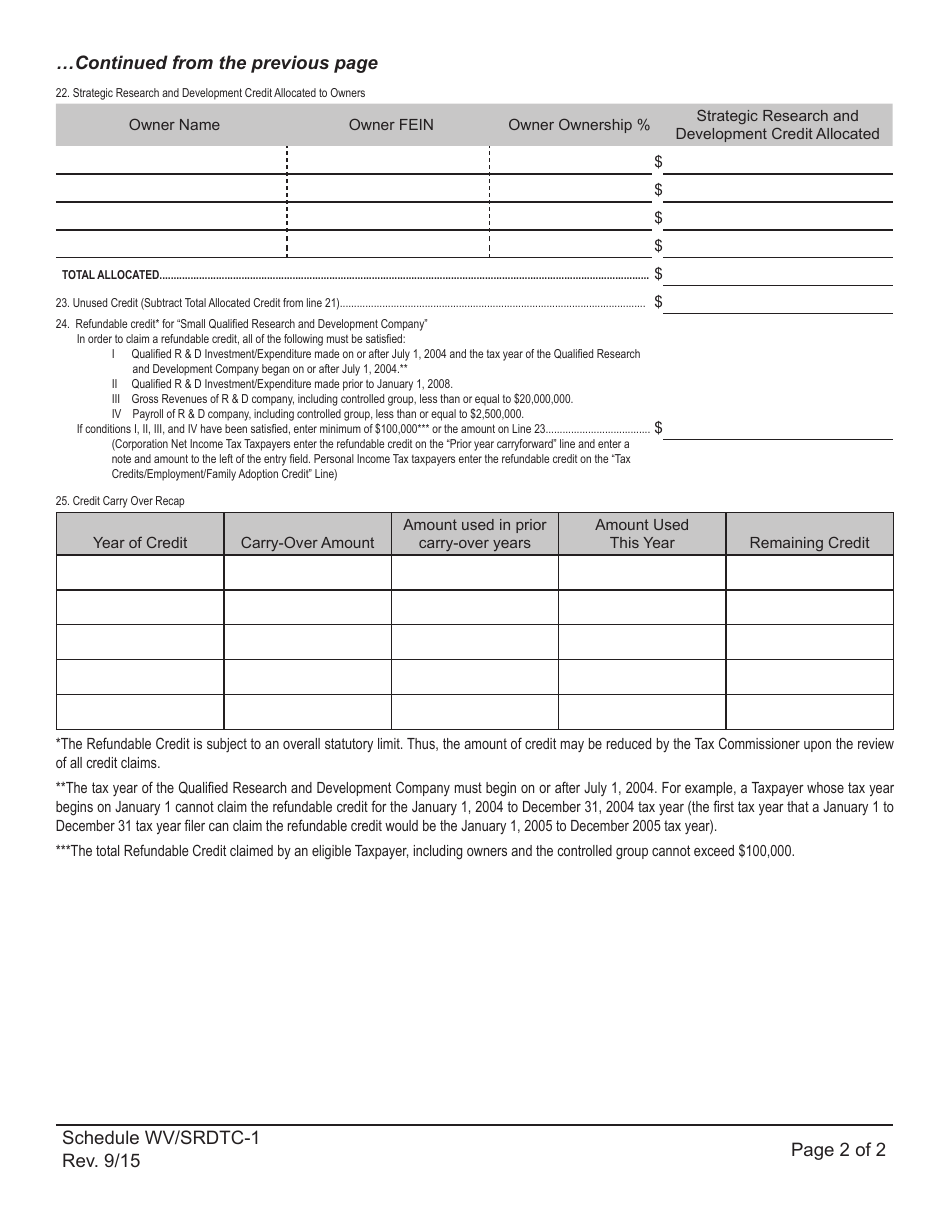

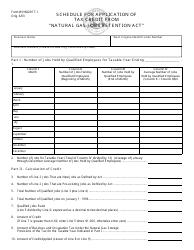

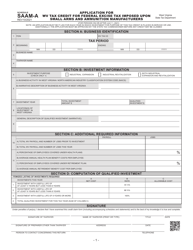

Schedule WV / SRDTC-1 Strategic Research and Development Tax Credit - West Virginia

What Is Schedule WV/SRDTC-1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is WV/SRDTC-1?

A: WV/SRDTC-1 stands for Strategic Research and Development Tax Credit in West Virginia.

Q: What is the purpose of WV/SRDTC-1?

A: The purpose of WV/SRDTC-1 is to provide a tax credit for eligible research and development expenses.

Q: Who is eligible for WV/SRDTC-1?

A: Eligible taxpayers, including individuals, corporations, and pass-through entities, can claim the tax credit.

Q: What expenses are eligible for WV/SRDTC-1?

A: Qualified research expenses, including wages, supplies, and contract research expenses, are eligible for the tax credit.

Q: How much is the tax credit for WV/SRDTC-1?

A: The tax credit is 27% of the eligible expenses incurred in West Virginia.

Q: Is there a limit to the tax credit for WV/SRDTC-1?

A: Yes, the tax credit is subject to a cap, which is $2 million per year for all taxpayers.

Q: How can I claim WV/SRDTC-1?

A: Taxpayers must file Form WV/SRDTC-1 and include it with their West Virginia tax return.

Q: Are there any deadlines for claiming WV/SRDTC-1?

A: Yes, the tax credit must be claimed within three years from the end of the tax year in which the eligible expenses were incurred.

Form Details:

- Released on September 1, 2015;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule WV/SRDTC-1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.