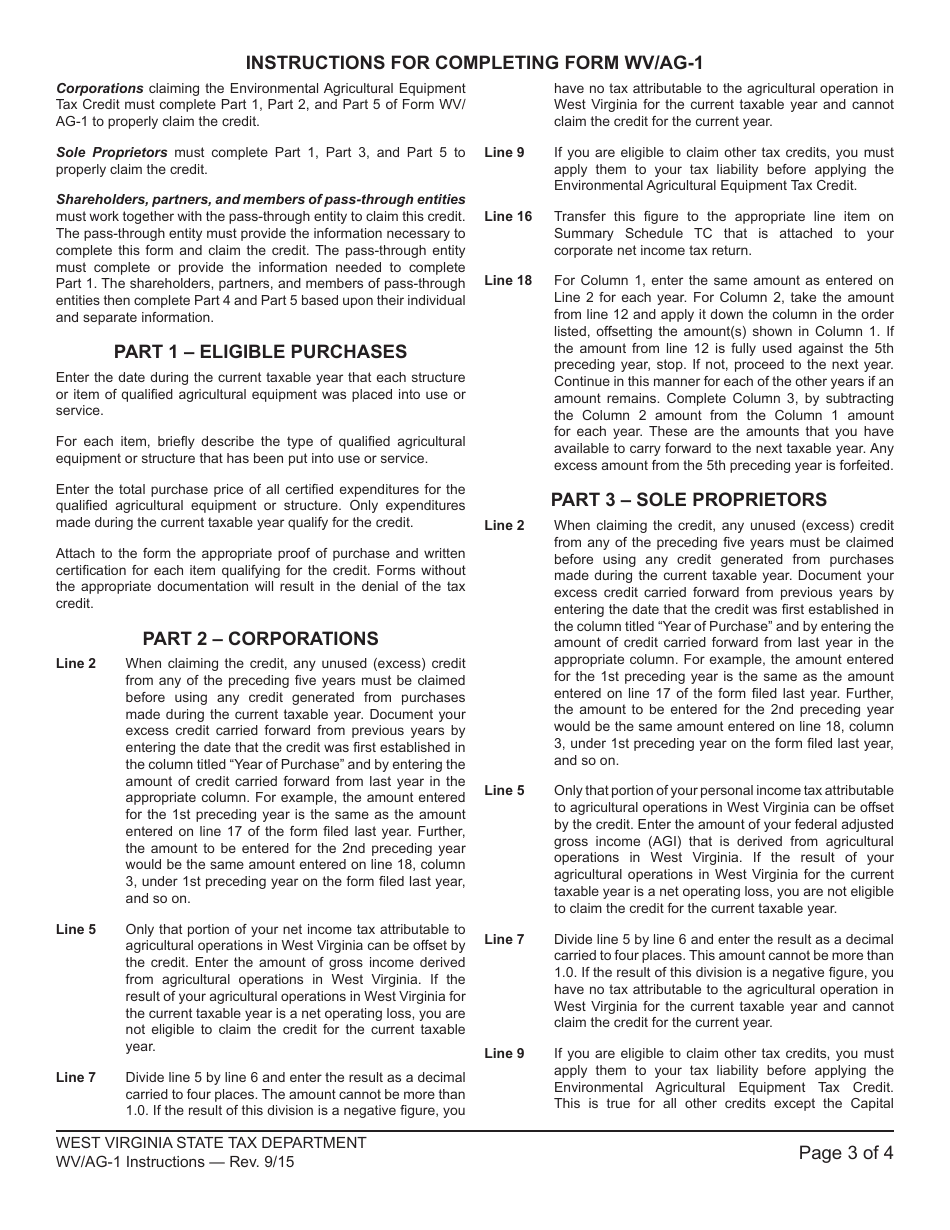

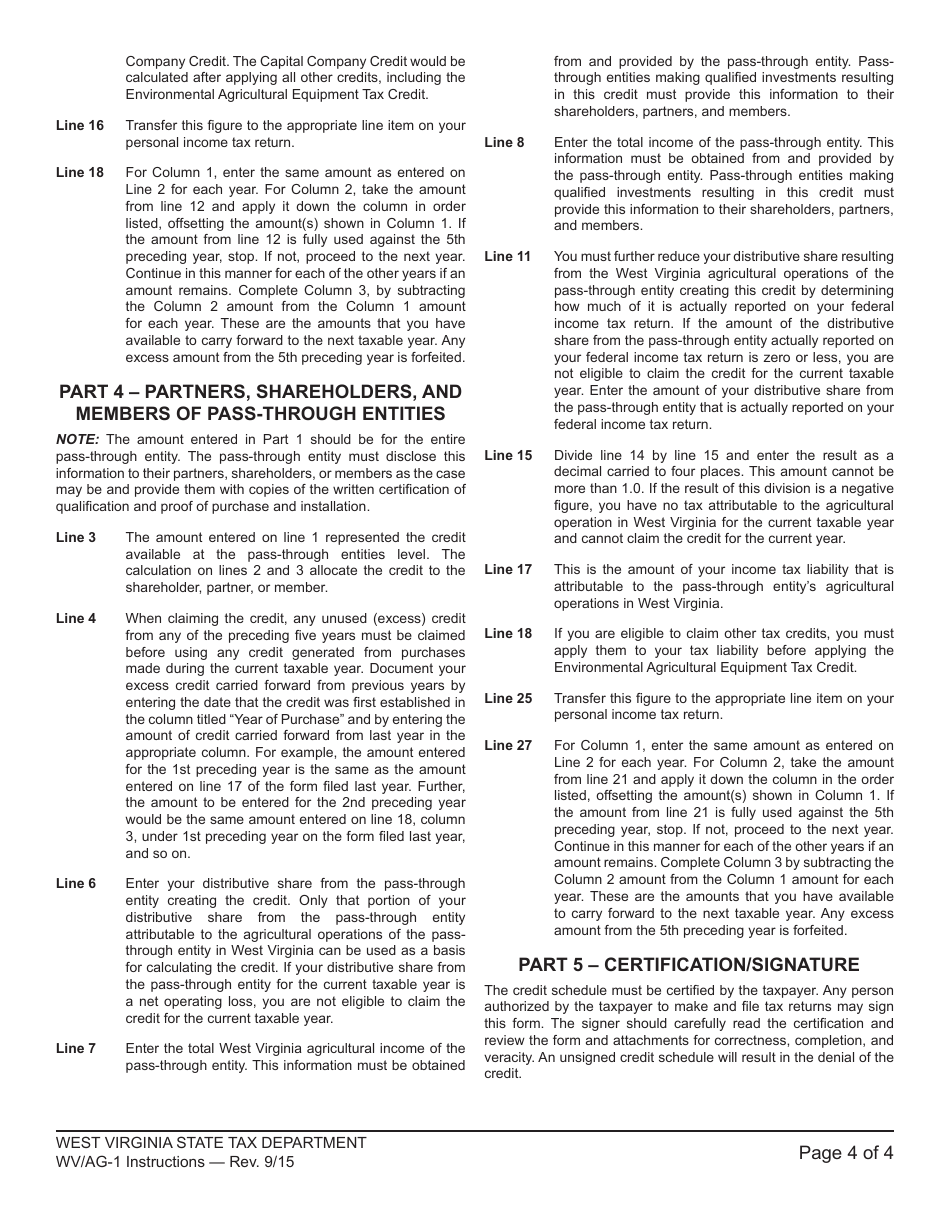

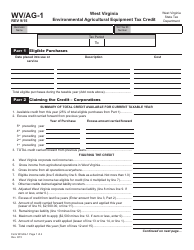

Instructions for Schedule WV / AG-1 Environmental Agricultural Equipment Tax Credit - West Virginia

This document contains official instructions for Schedule WV/AG-1 , Environmental Agricultural Equipment Tax Credit - a form released and collected by the West Virginia State Tax Department.

FAQ

Q: What is Schedule WV/AG-1?

A: Schedule WV/AG-1 is a tax form in West Virginia.

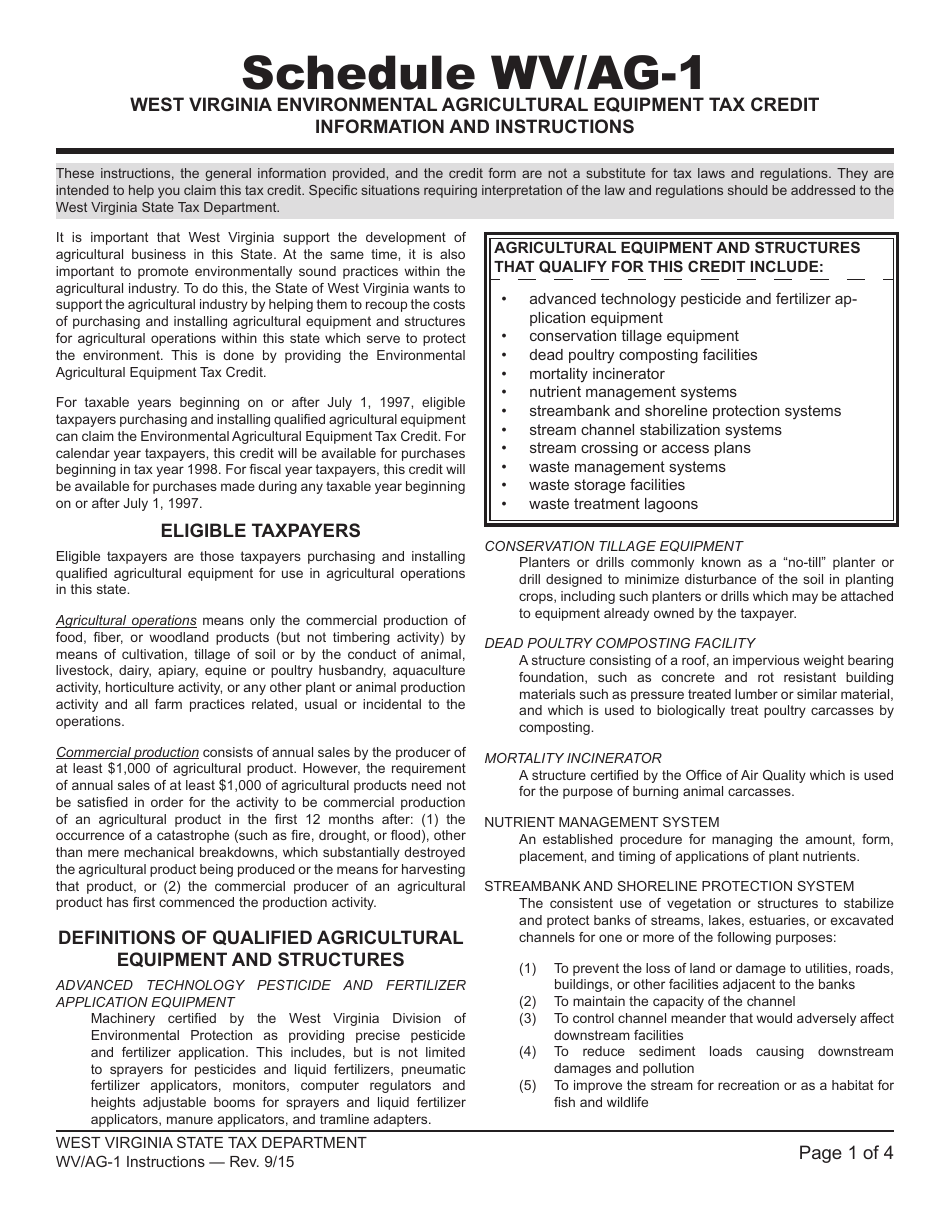

Q: What is the Environmental Agricultural Equipment Tax Credit?

A: The Environmental Agricultural Equipment Tax Credit is a tax credit available in West Virginia.

Q: What does the tax credit apply to?

A: The tax credit applies to purchases of certain environmentally friendly agricultural equipment.

Q: Who is eligible for the tax credit?

A: Farmers and agricultural producers in West Virginia are eligible for the tax credit.

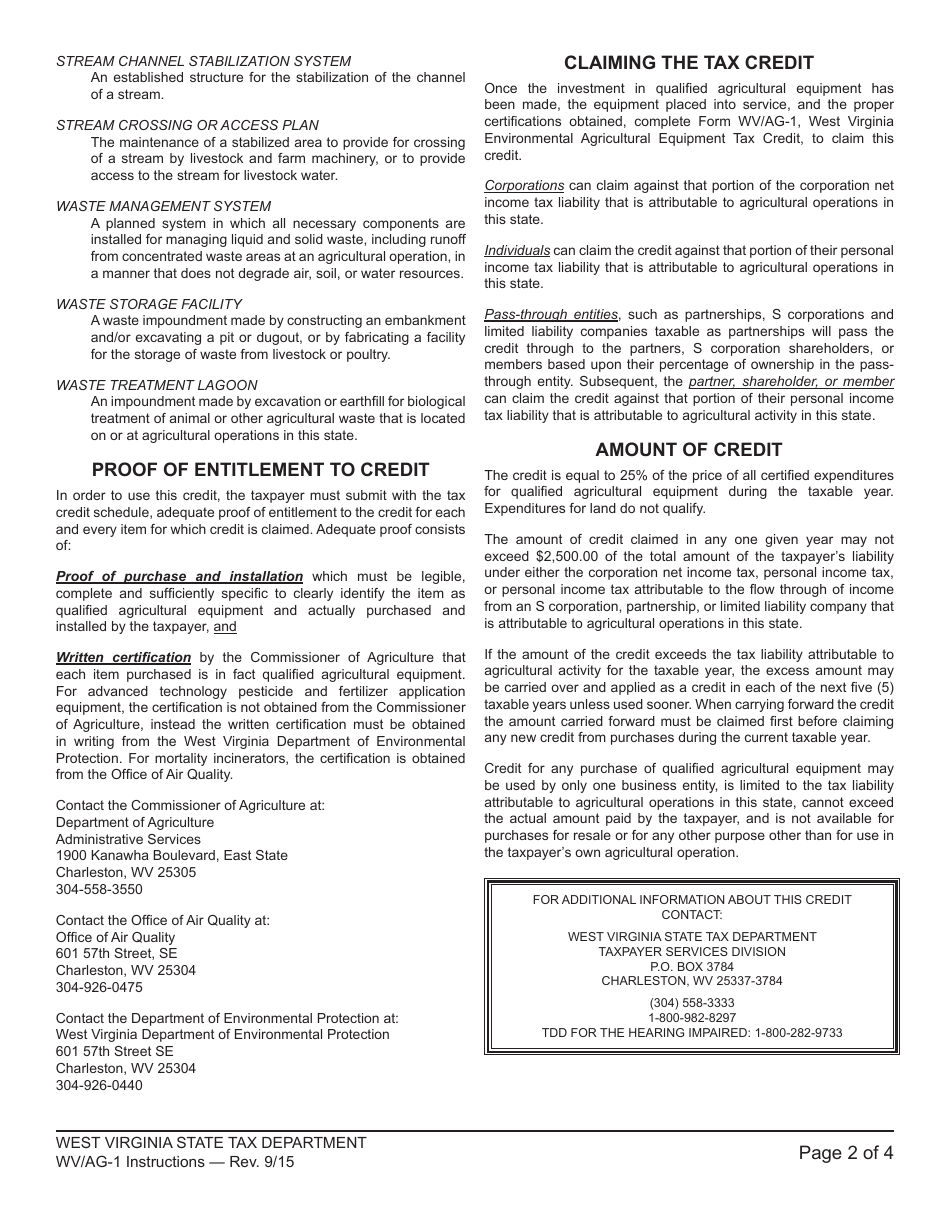

Q: How much is the tax credit?

A: The tax credit is equal to 50% of the cost of eligible equipment, up to a maximum credit of $10,000.

Q: How do I claim the tax credit?

A: You can claim the tax credit by completing Schedule WV/AG-1 and attaching it to your West Virginia state income tax return.

Q: What documentation do I need to provide?

A: You need to provide documentation of the purchase and installation of the eligible equipment, including receipts and invoices.

Q: When is the deadline to claim the tax credit?

A: The tax credit must be claimed in the same tax year that the equipment was purchased.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the West Virginia State Tax Department.