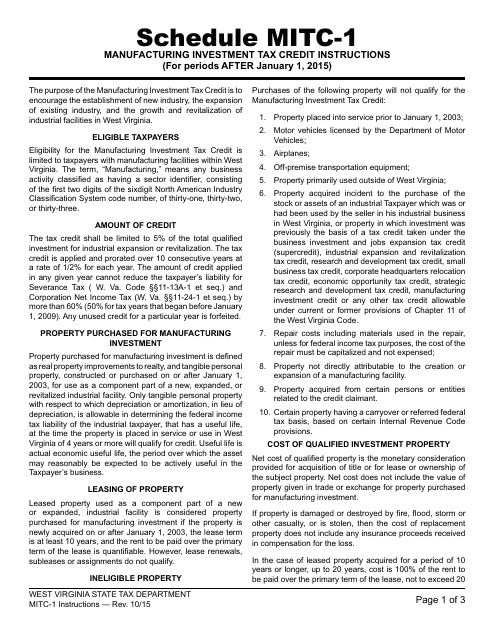

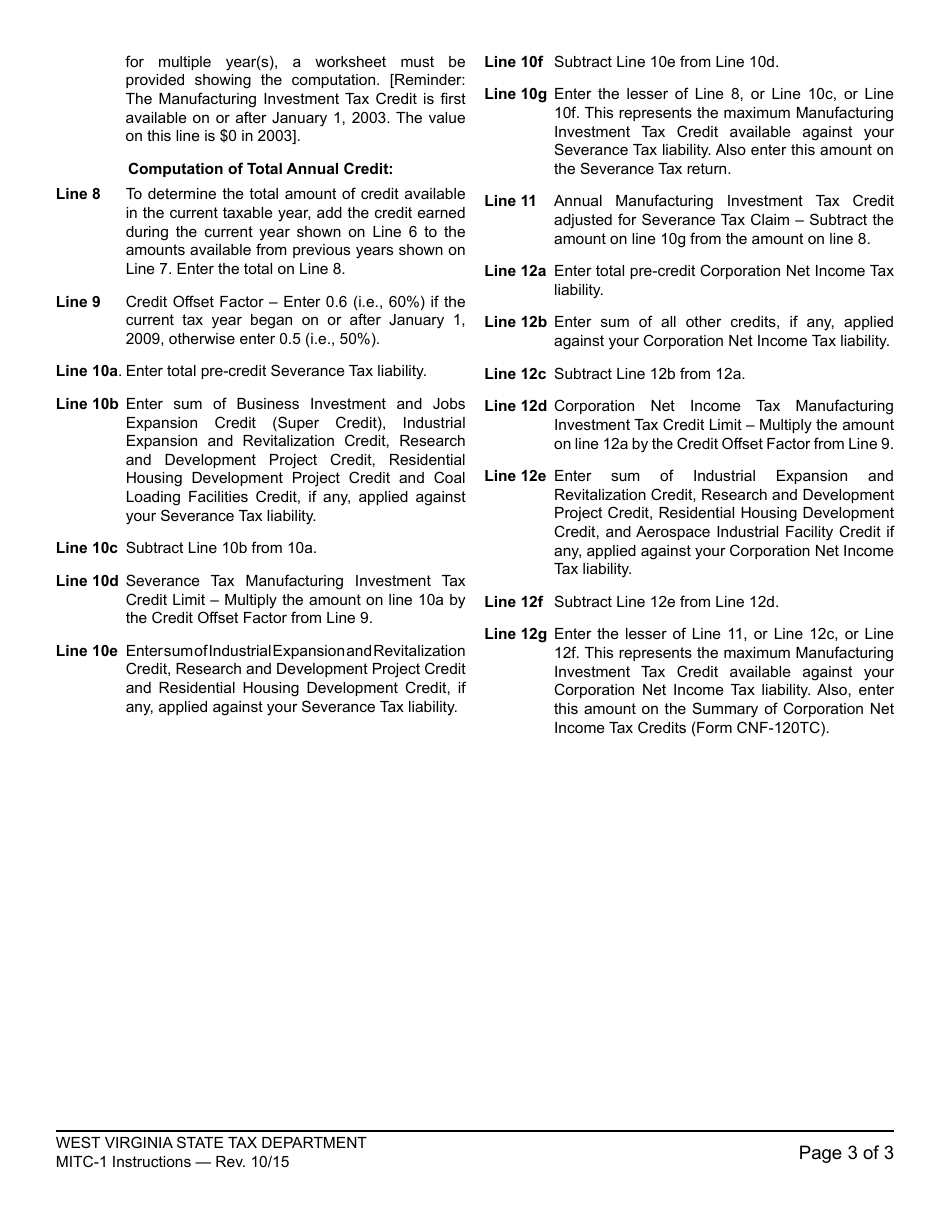

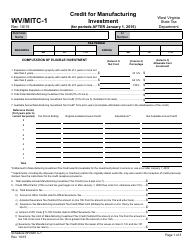

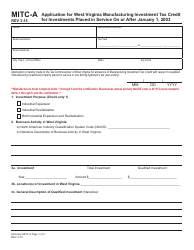

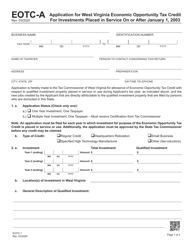

Instructions for Form WV / MITC-1 Credit for Manufacturing Investment (For Periods After January 1, 2015) - West Virginia

This document contains official instructions for Form WV/MITC-1 , Credit for Manufacturing Investment (For Periods After January 1, 2015) - a form released and collected by the West Virginia State Tax Department.

FAQ

Q: What is Form WV/MITC-1?

A: Form WV/MITC-1 is a tax form for claiming the Credit for Manufacturing Investment in West Virginia.

Q: Who can use Form WV/MITC-1?

A: This form can be used by businesses and individuals who have made qualifying manufacturing investments in West Virginia after January 1, 2015.

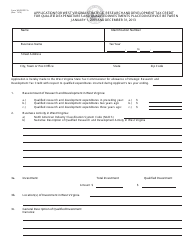

Q: What is the purpose of the Credit for Manufacturing Investment?

A: The purpose of the credit is to encourage investment in manufacturing facilities and equipment in West Virginia.

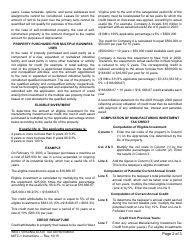

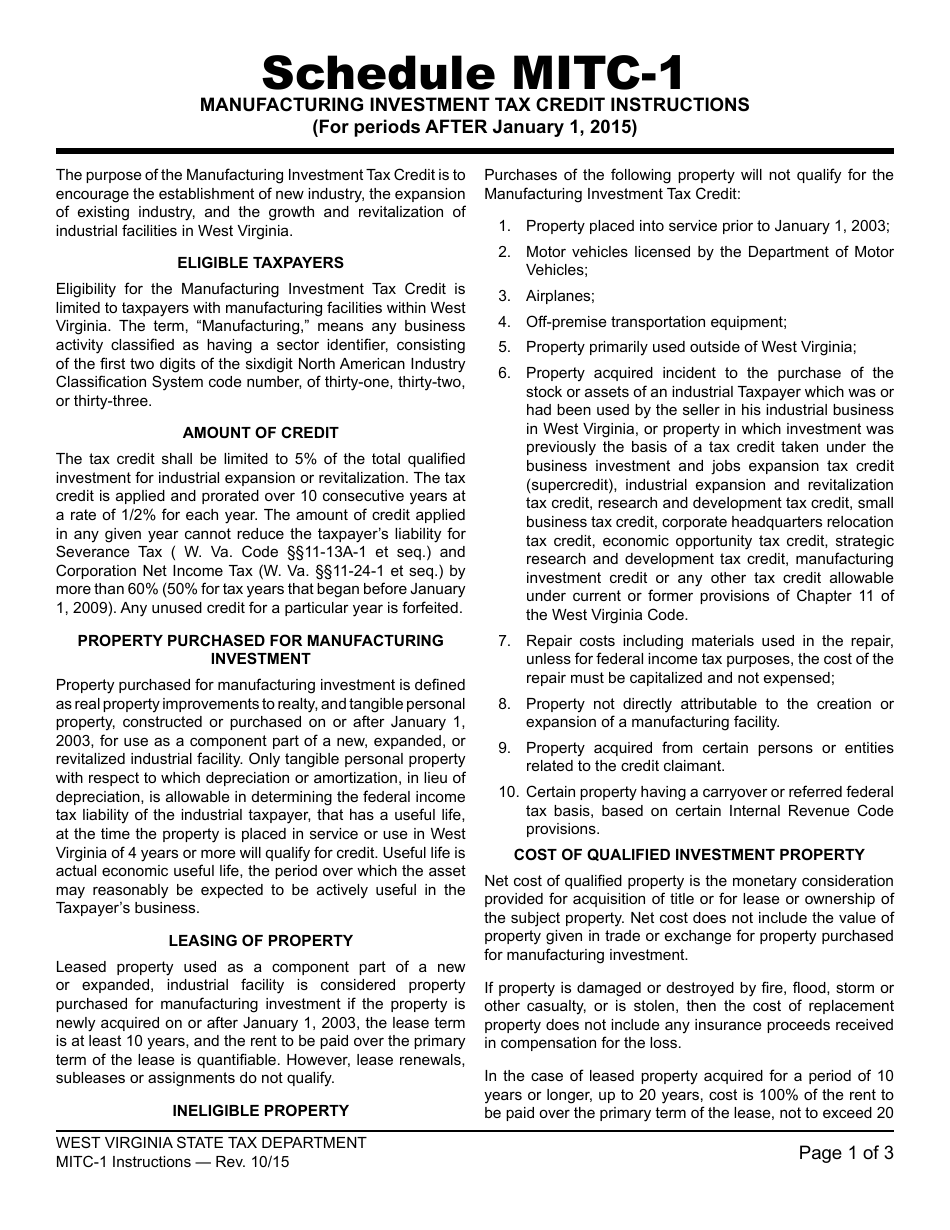

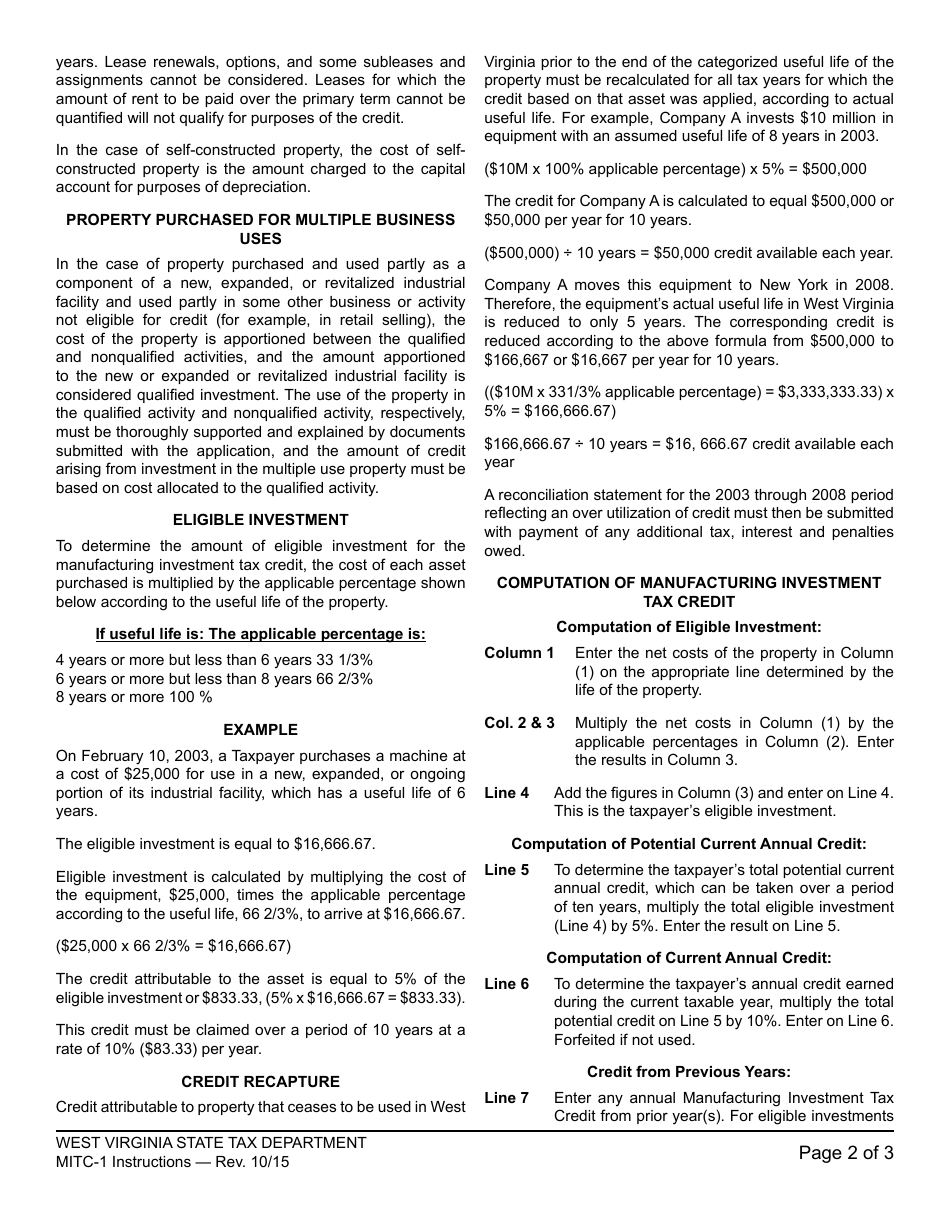

Q: What types of investments qualify for the credit?

A: Qualifying investments include the purchase of machinery, equipment, or buildings used for manufacturing in West Virginia.

Q: How much is the credit?

A: The credit amount is equal to a percentage of the qualified investment, as determined by the West Virginia Tax Department.

Q: When is the deadline for filing Form WV/MITC-1?

A: The form must be filed on or before the due date of the applicable tax return for the tax year in which the qualified investment was made.

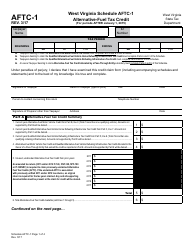

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the West Virginia State Tax Department.