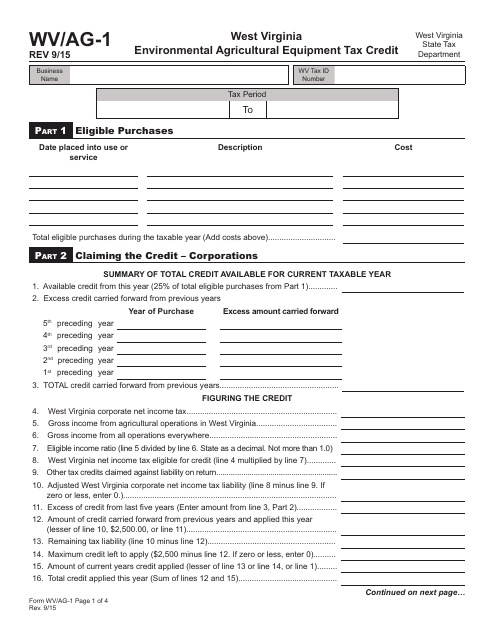

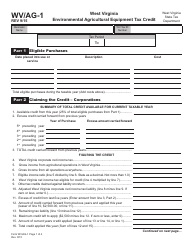

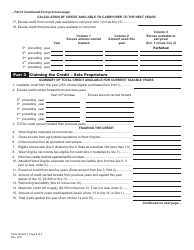

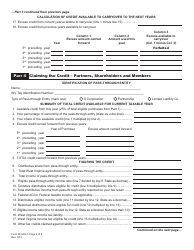

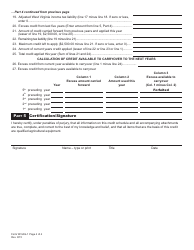

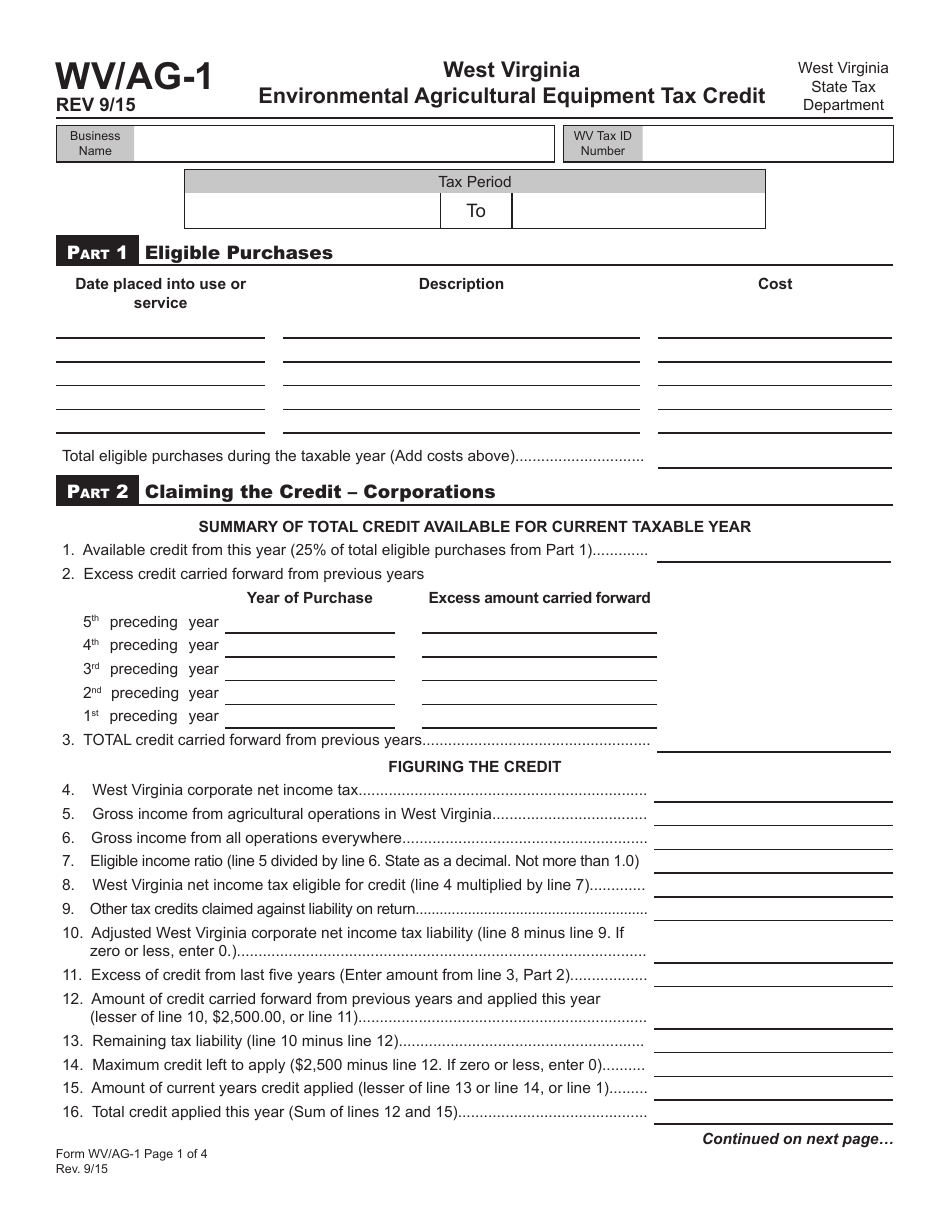

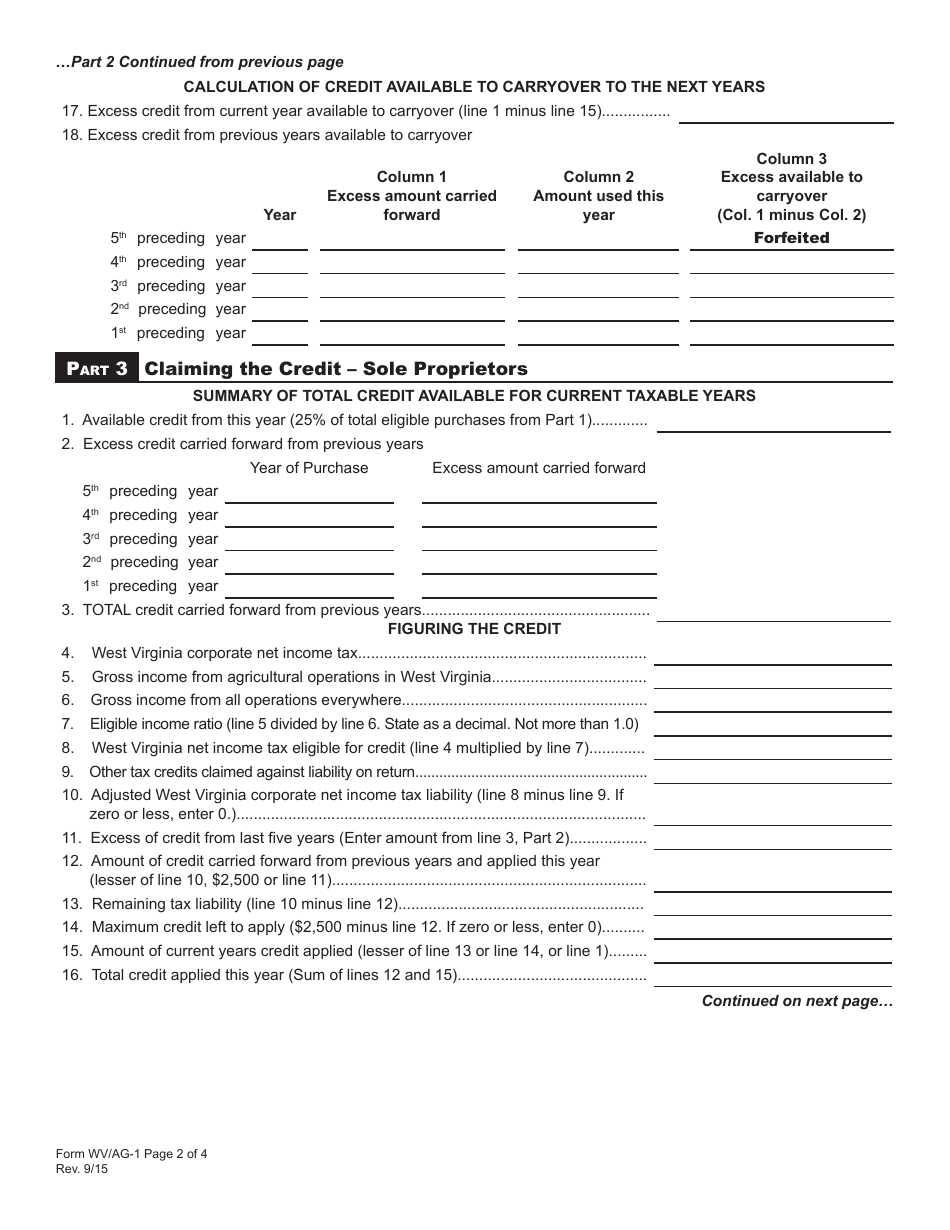

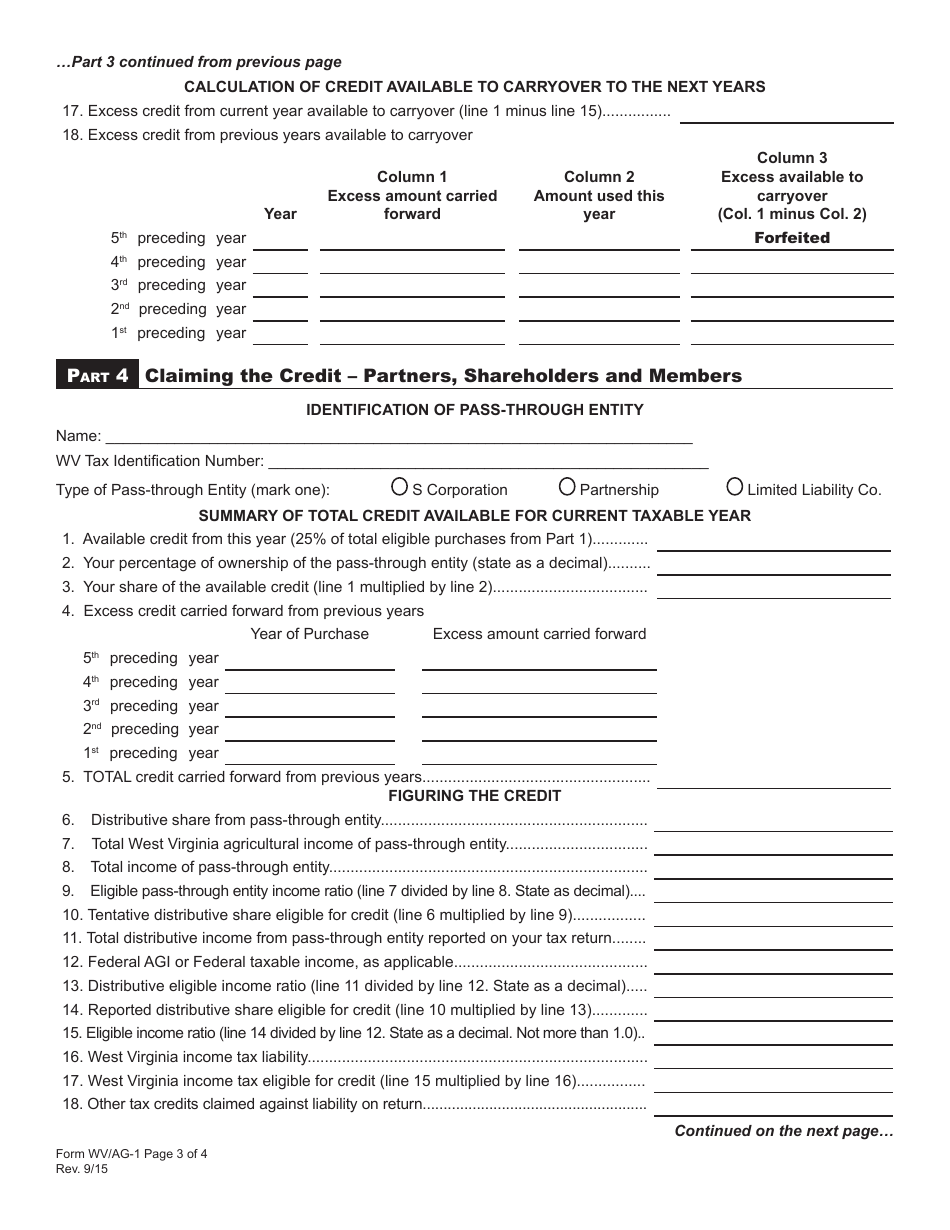

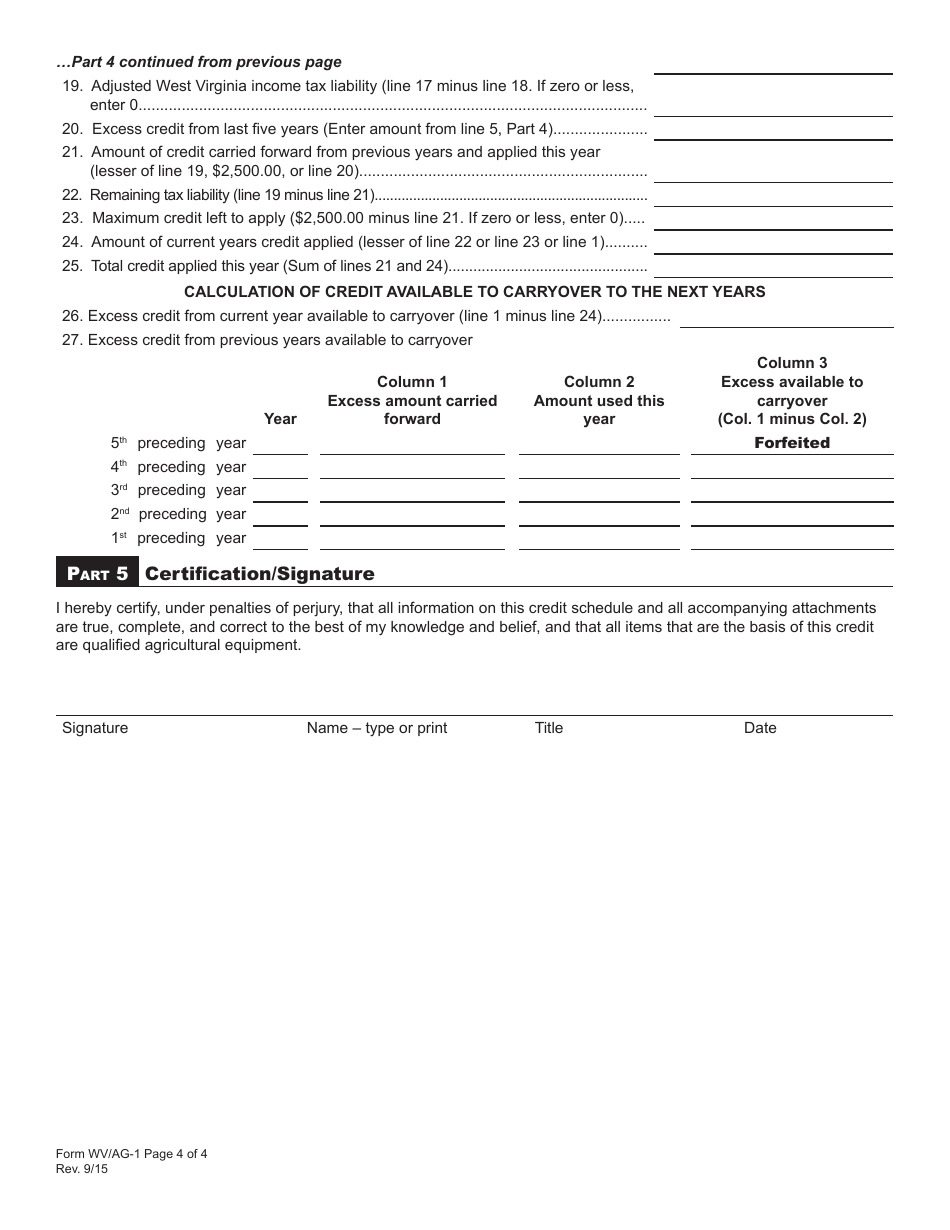

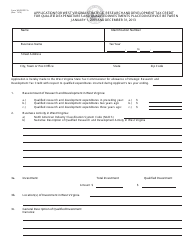

Schedule WV / AG-1 Environmental Agricultural Equipment Tax Credit - West Virginia

What Is Schedule WV/AG-1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the WV/AG-1 Environmental Agricultural Equipment Tax Credit?

A: The WV/AG-1 Environmental Agricultural Equipment Tax Credit is a tax credit in West Virginia specifically designed for purchasing environmentally-friendly agricultural equipment.

Q: Is the tax credit available for all agricultural equipment purchases in West Virginia?

A: No, the tax credit is only available for purchases of environmental agricultural equipment.

Q: What is the purpose of the tax credit?

A: The purpose of the tax credit is to encourage farmers in West Virginia to invest in environmentally-friendly equipment that reduces pollution and fosters sustainable agriculture.

Q: How much is the tax credit?

A: The tax credit is equal to 30% of the net cost of eligible equipment, up to a maximum credit of $10,000 per taxpayer.

Q: Who is eligible for the tax credit?

A: Farmers and individuals engaged in farming activities in West Virginia are eligible for the tax credit.

Q: Are there any restrictions on the type of equipment that qualifies for the tax credit?

A: Yes, the equipment must meet certain environmental standards and be used primarily for agricultural purposes.

Q: How can farmers claim the tax credit?

A: Farmers can claim the tax credit by completing and submitting the WV/AG-1 Tax Credit Schedule along with their state tax return.

Q: Does the tax credit expire?

A: Yes, the tax credit is scheduled to expire on December 31, 2025.

Form Details:

- Released on September 1, 2015;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule WV/AG-1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.