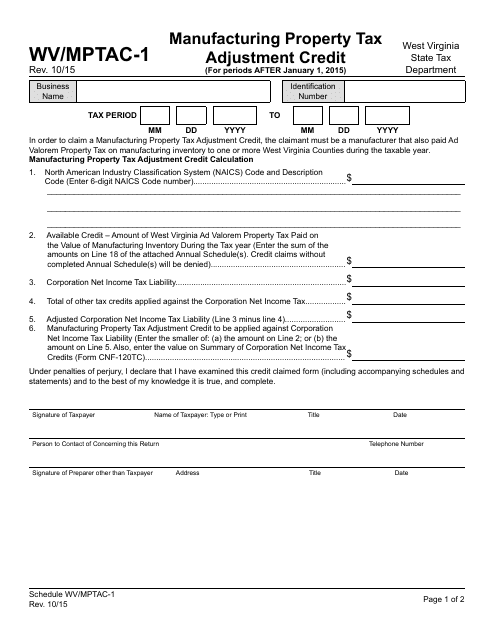

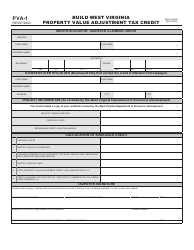

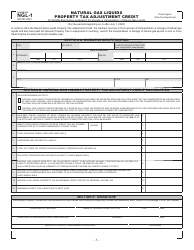

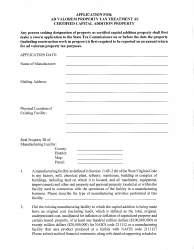

Schedule WV / MPTAC-1 Manufacturing Property Tax Adjustment Credit - West Virginia

What Is Schedule WV/MPTAC-1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

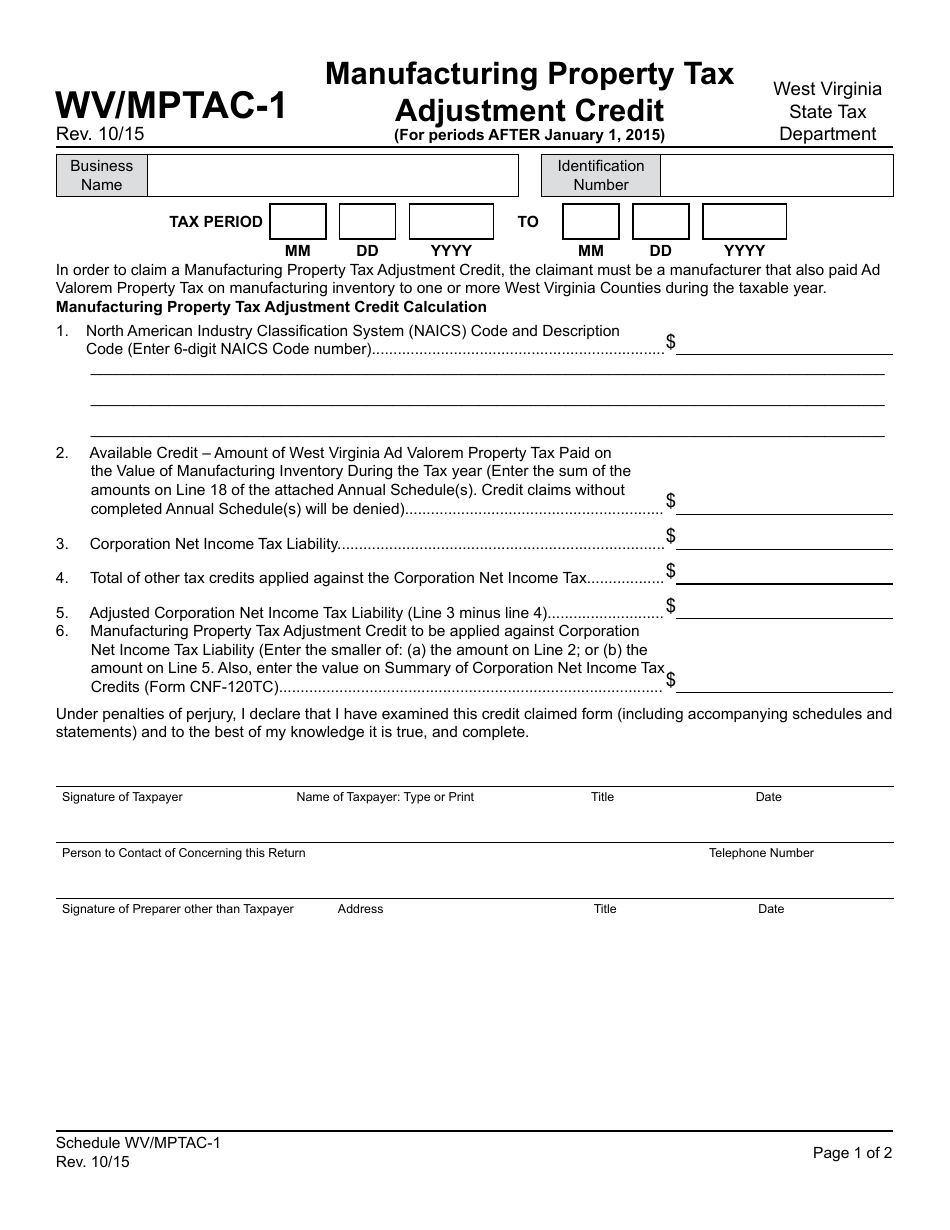

Q: What is the WV/MPTAC-1 Manufacturing Property Tax Adjustment Credit?

A: The WV/MPTAC-1 is a manufacturing property tax adjustment credit in West Virginia.

Q: Who is eligible for the WV/MPTAC-1 Manufacturing Property Tax Adjustment Credit?

A: Manufacturing businesses in West Virginia are eligible for this tax credit.

Q: What is the purpose of the WV/MPTAC-1 Manufacturing Property Tax Adjustment Credit?

A: The purpose of this credit is to reduce property taxes for manufacturing businesses in West Virginia.

Q: How does the WV/MPTAC-1 Manufacturing Property Tax Adjustment Credit work?

A: The credit amount is calculated based on the eligible manufacturing property's value and the applicable tax rate.

Q: What are the benefits of the WV/MPTAC-1 Manufacturing Property Tax Adjustment Credit?

A: The credit helps reduce the tax burden on manufacturing businesses, promoting economic growth and job creation.

Q: How can manufacturing businesses apply for the WV/MPTAC-1 Manufacturing Property Tax Adjustment Credit?

A: Manufacturing businesses can apply for the credit through the West Virginia State Tax Department.

Q: Is there a deadline to apply for the WV/MPTAC-1 Manufacturing Property Tax Adjustment Credit?

A: Yes, there is a deadline to apply for this credit. It is typically April 1st of each year.

Q: Are there any limitations or restrictions for the WV/MPTAC-1 Manufacturing Property Tax Adjustment Credit?

A: Yes, there are certain eligibility criteria and restrictions for this credit. Manufacturing businesses need to meet specific requirements to qualify.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule WV/MPTAC-1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.