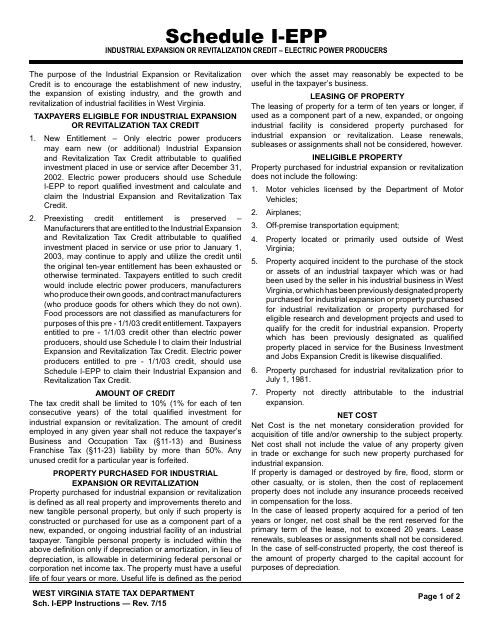

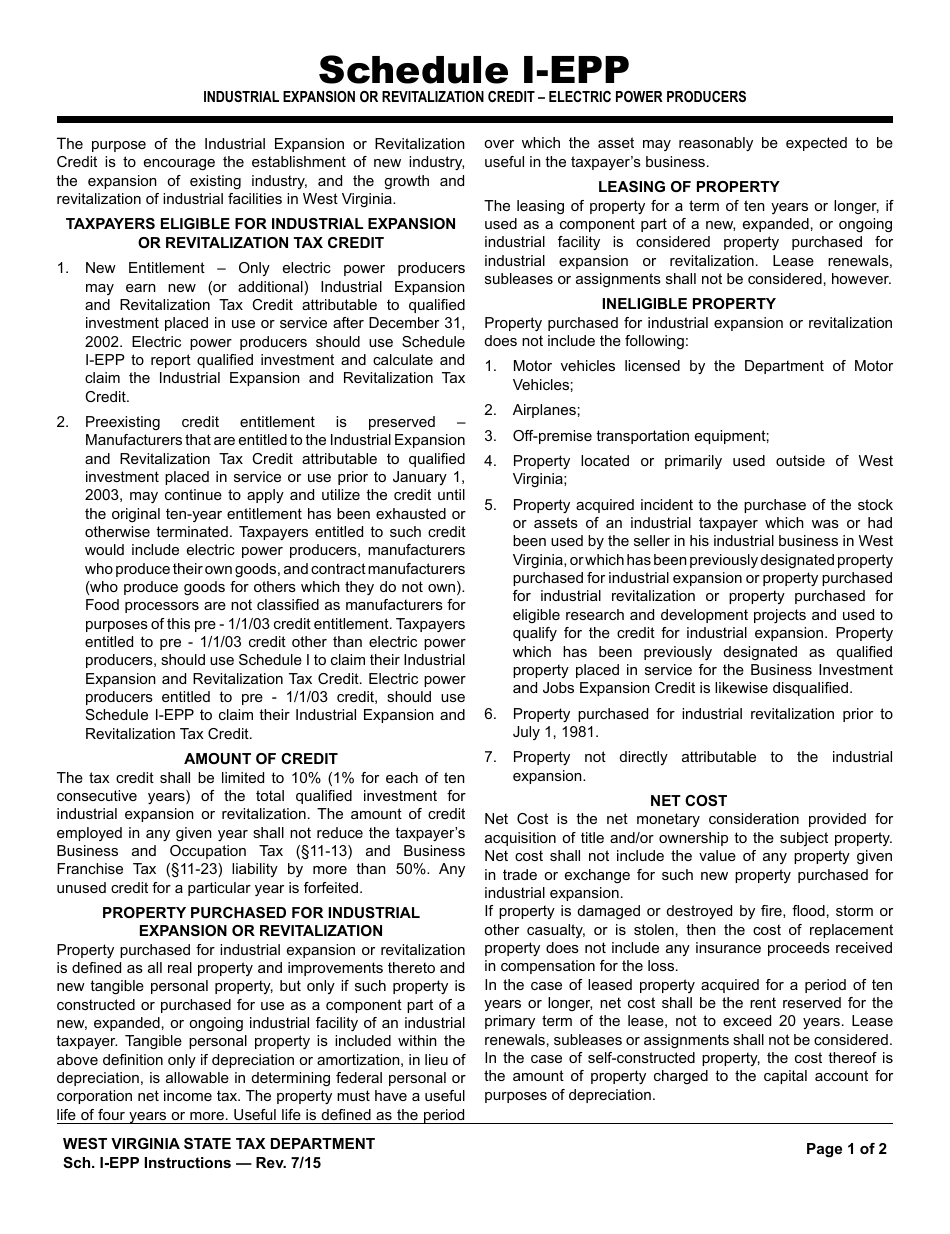

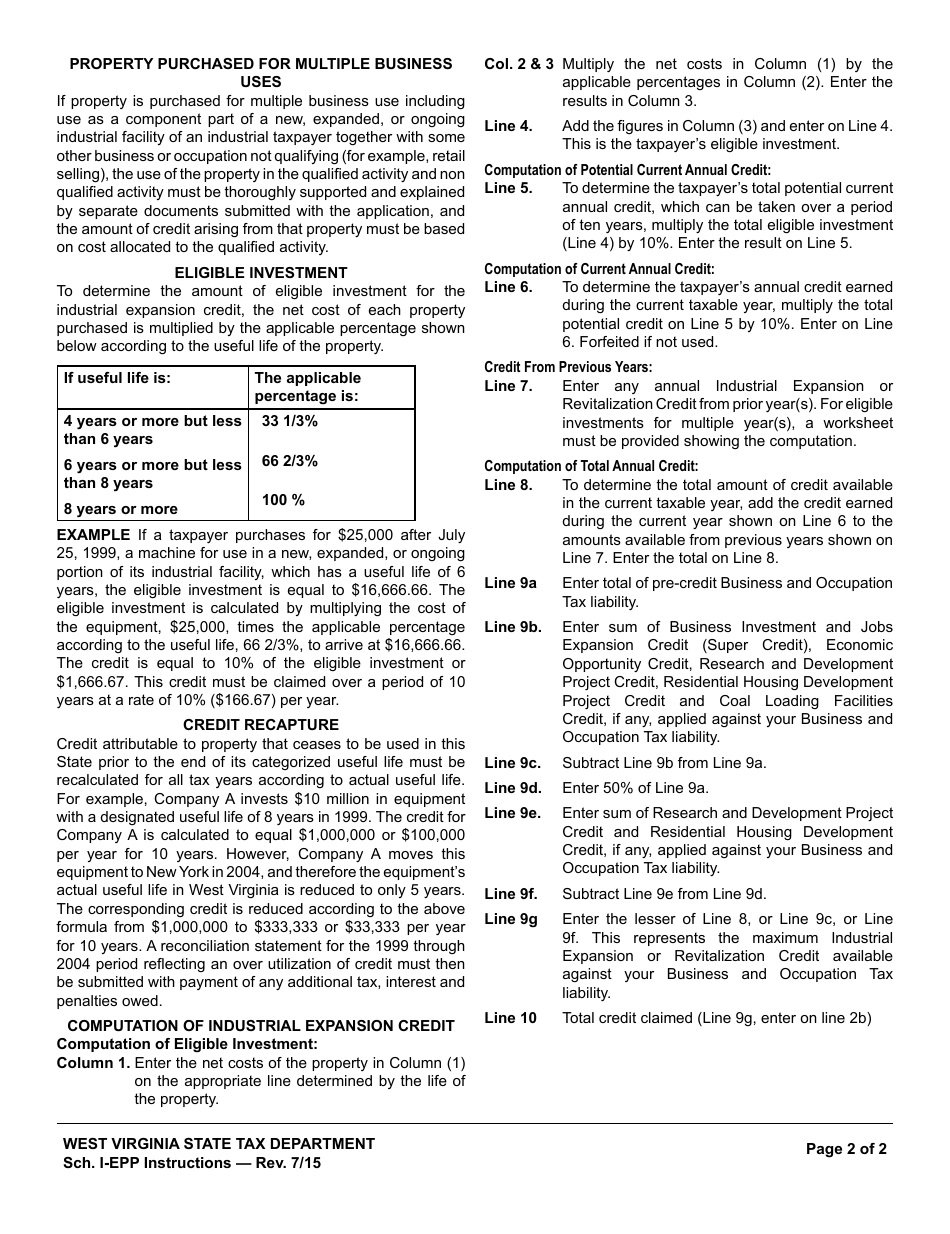

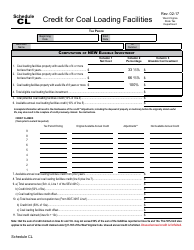

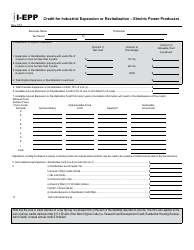

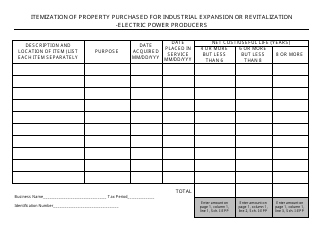

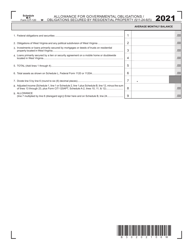

Instructions for Schedule I-EPP Industrial Expansion or Revitalization Credit - Electric Power Producers - West Virginia

This document contains official instructions for Schedule I-EPP , Industrial Expansion or Revitalization Credit - Electric Power Producers - a form released and collected by the West Virginia State Tax Department.

FAQ

Q: What is Schedule I-EPP?

A: Schedule I-EPP refers to the Industrial Expansion or Revitalization Credit specifically for Electric Power Producers.

Q: Who is eligible for the I-EPP credit?

A: Electric Power Producers in West Virginia are eligible for the I-EPP credit.

Q: What is the purpose of the I-EPP credit?

A: The purpose of the I-EPP credit is to incentivize and support industrial expansion or revitalization of electric power producers in West Virginia.

Q: What are the requirements to claim the I-EPP credit?

A: To claim the I-EPP credit, electric power producers must meet certain criteria including but not limited to job creation and investment in the state.

Q: Are there any limitations or restrictions for the I-EPP credit?

A: Yes, there may be limitations or restrictions on the amount of credit that can be claimed and the duration of the credit.

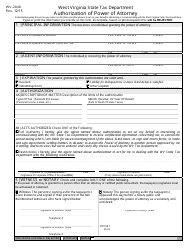

Q: How can I apply for the I-EPP credit?

A: Applicants can apply for the I-EPP credit by following the instructions provided in Schedule I-EPP and submitting the required documentation.

Q: Is the I-EPP credit available for both new and existing electric power producers?

A: Yes, both new and existing electric power producers can be eligible for the I-EPP credit.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the West Virginia State Tax Department.