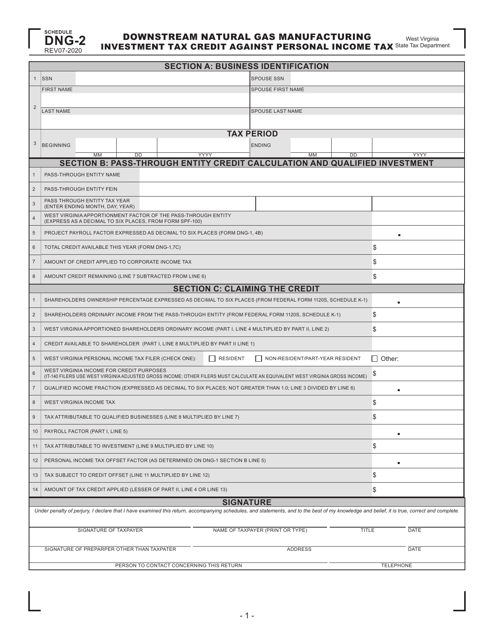

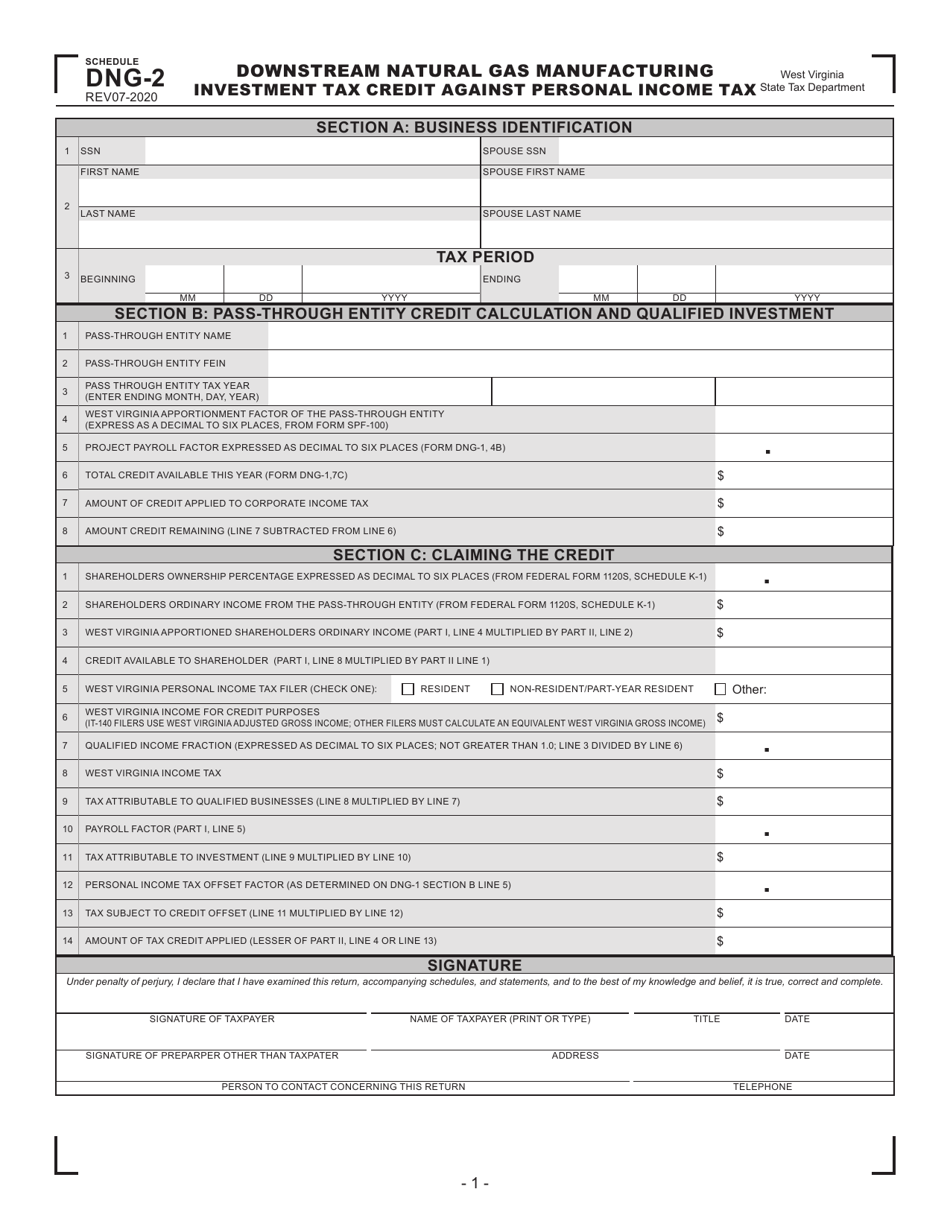

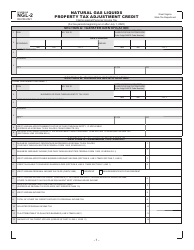

Schedule DNG-2 Downstream Natural Gas Manufacturing Investment Tax Credit Against Personal Income Tax - West Virginia

What Is Schedule DNG-2?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule DNG-2?

A: Schedule DNG-2 is a form used in West Virginia that calculates the Downstream Natural Gas Manufacturing Investment Tax Credit against personal income tax.

Q: What does the Downstream Natural Gas Manufacturing Investment Tax Credit do?

A: The Downstream Natural Gas Manufacturing Investment Tax Credit allows individuals to claim a credit against their personal income tax for eligible investments in natural gas manufacturing in West Virginia.

Q: Who is eligible for the Downstream Natural Gas Manufacturing Investment Tax Credit?

A: Individuals who make eligible investments in natural gas manufacturing in West Virginia are eligible for the tax credit.

Q: What types of investments qualify for the tax credit?

A: Eligible investments include the construction, acquisition, or expansion of facilities for downstream natural gas manufacturing.

Q: How much is the tax credit?

A: The amount of the tax credit is based on a percentage of the qualified investment, up to a maximum credit amount.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule DNG-2 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.