This version of the form is not currently in use and is provided for reference only. Download this version of

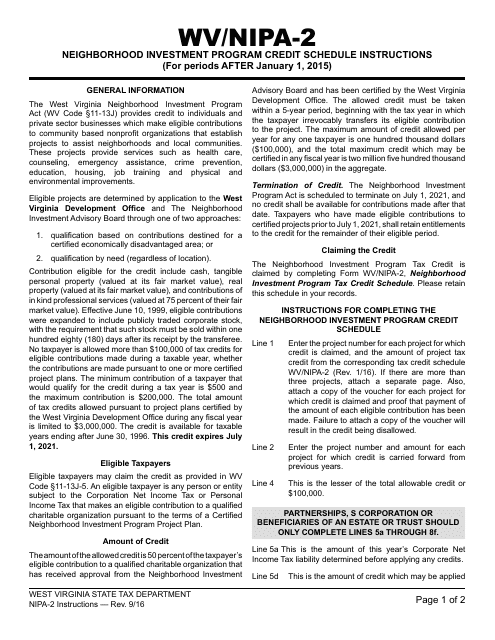

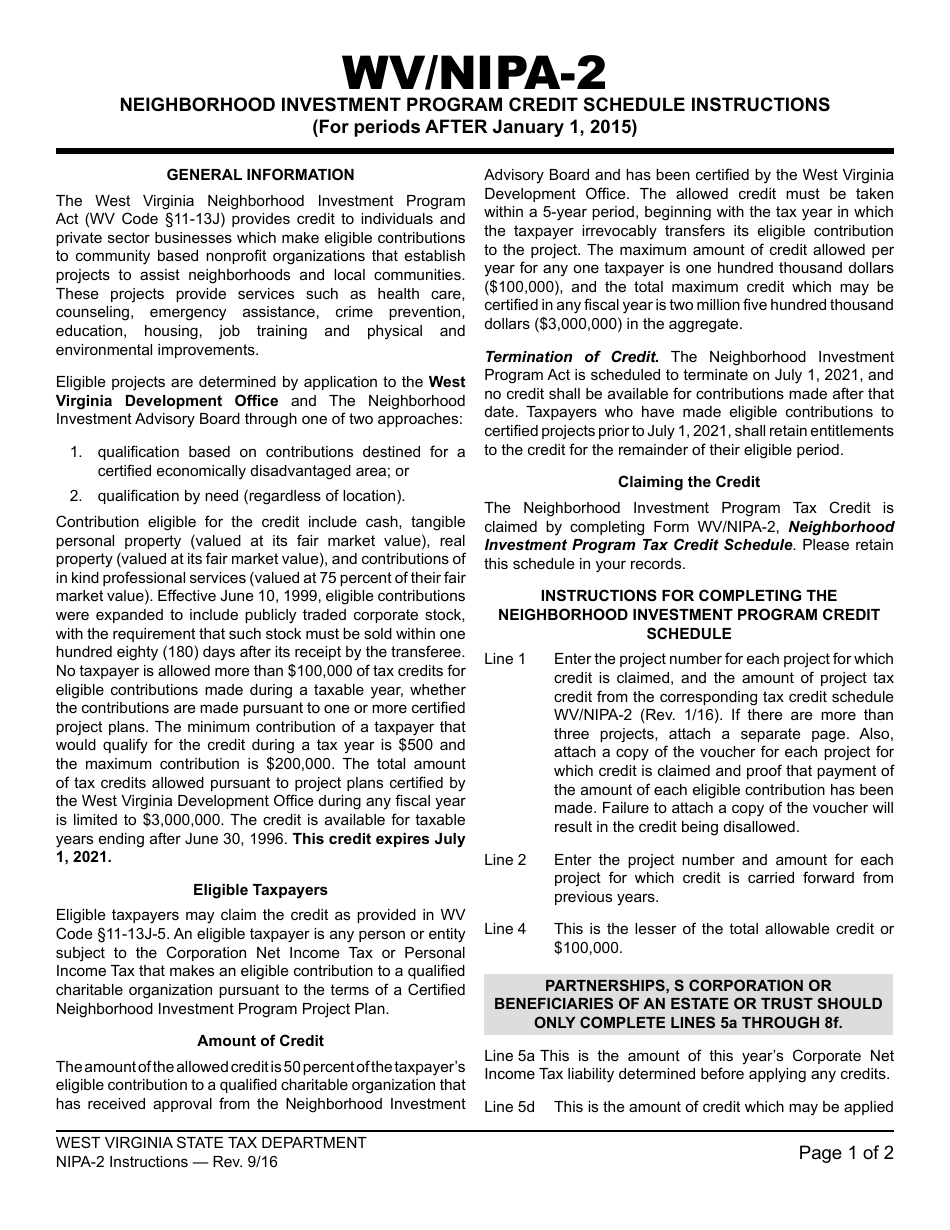

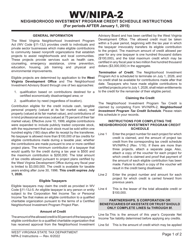

Instructions for Schedule WV/NIPA-2

for the current year.

Instructions for Schedule WV / NIPA-2 Neighborhood Investment Program Credit Schedule for Periods After January 1, 2015 - West Virginia

This document contains official instructions for Schedule WV/NIPA-2 , Neighborhood Investment Program Credit Schedule for Periods After January 1, 2015 - a form released and collected by the West Virginia State Tax Department.

FAQ

Q: What is Schedule WV/NIPA-2?

A: Schedule WV/NIPA-2 is the Neighborhood Investment Program Credit Schedule.

Q: What is the Neighborhood Investment Program?

A: The Neighborhood Investment Program is a program in West Virginia that provides tax credits to businesses or individuals who invest in approved community development projects.

Q: What does Schedule WV/NIPA-2 provide information about?

A: Schedule WV/NIPA-2 provides information about the credits received through the Neighborhood Investment Program for periods after January 1, 2015.

Q: Who is eligible to receive tax credits through the Neighborhood Investment Program?

A: Businesses and individuals who invest in approved community development projects are eligible to receive tax credits through the Neighborhood Investment Program.

Q: What is the purpose of the Neighborhood Investment Program?

A: The purpose of the Neighborhood Investment Program is to encourage private investment in community development projects in West Virginia.

Q: When did Schedule WV/NIPA-2 become effective?

A: Schedule WV/NIPA-2 became effective for periods after January 1, 2015.

Instruction Details:

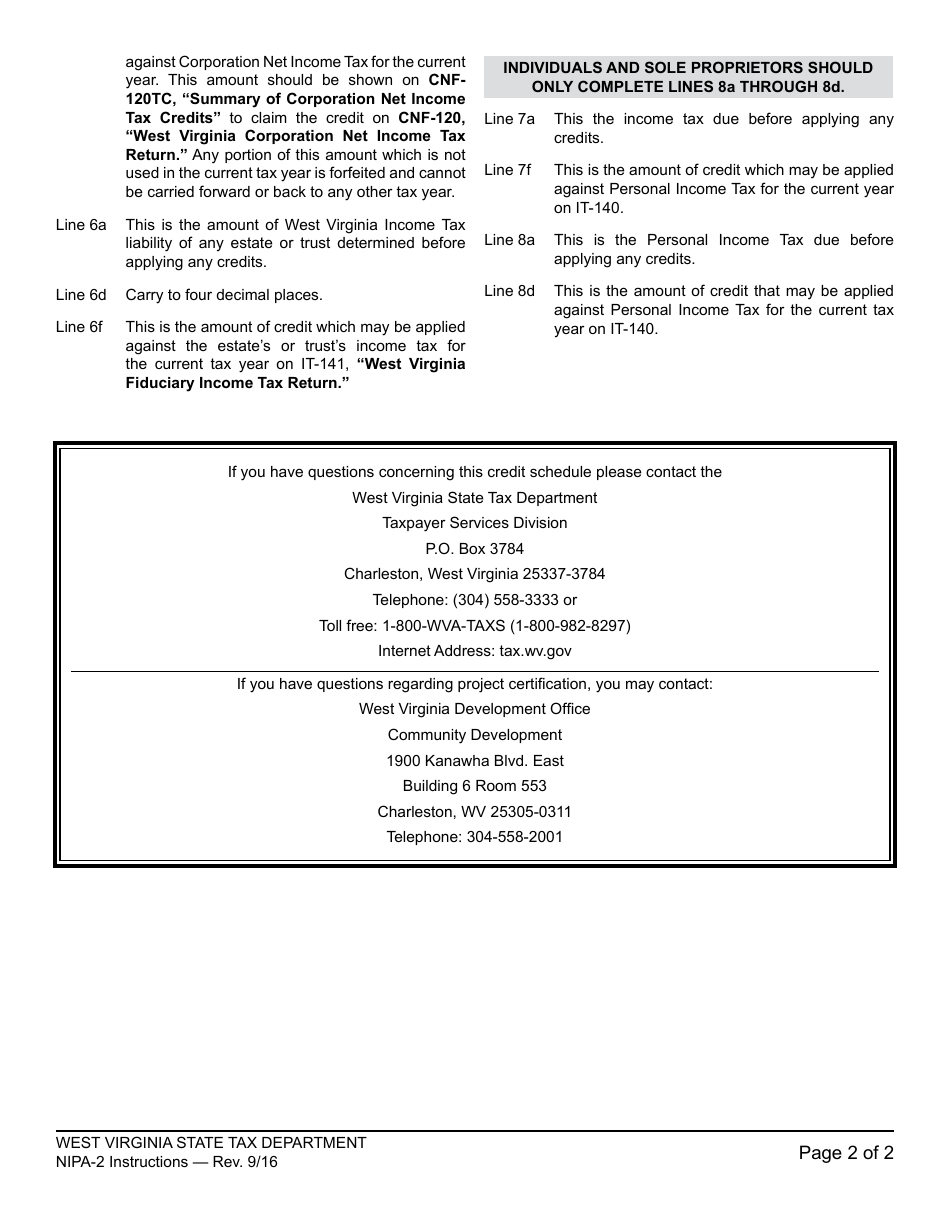

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the West Virginia State Tax Department.