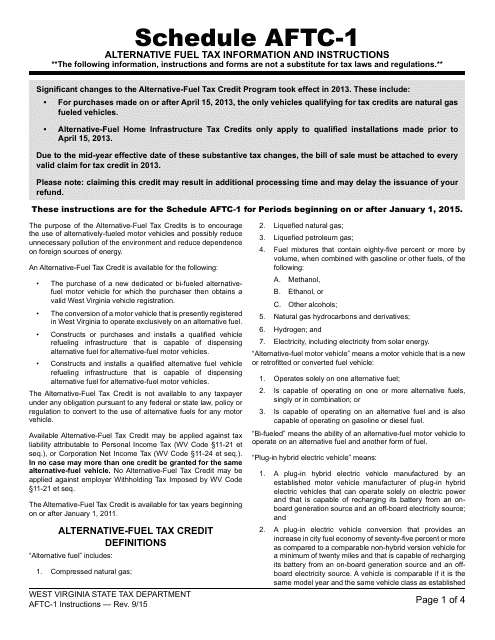

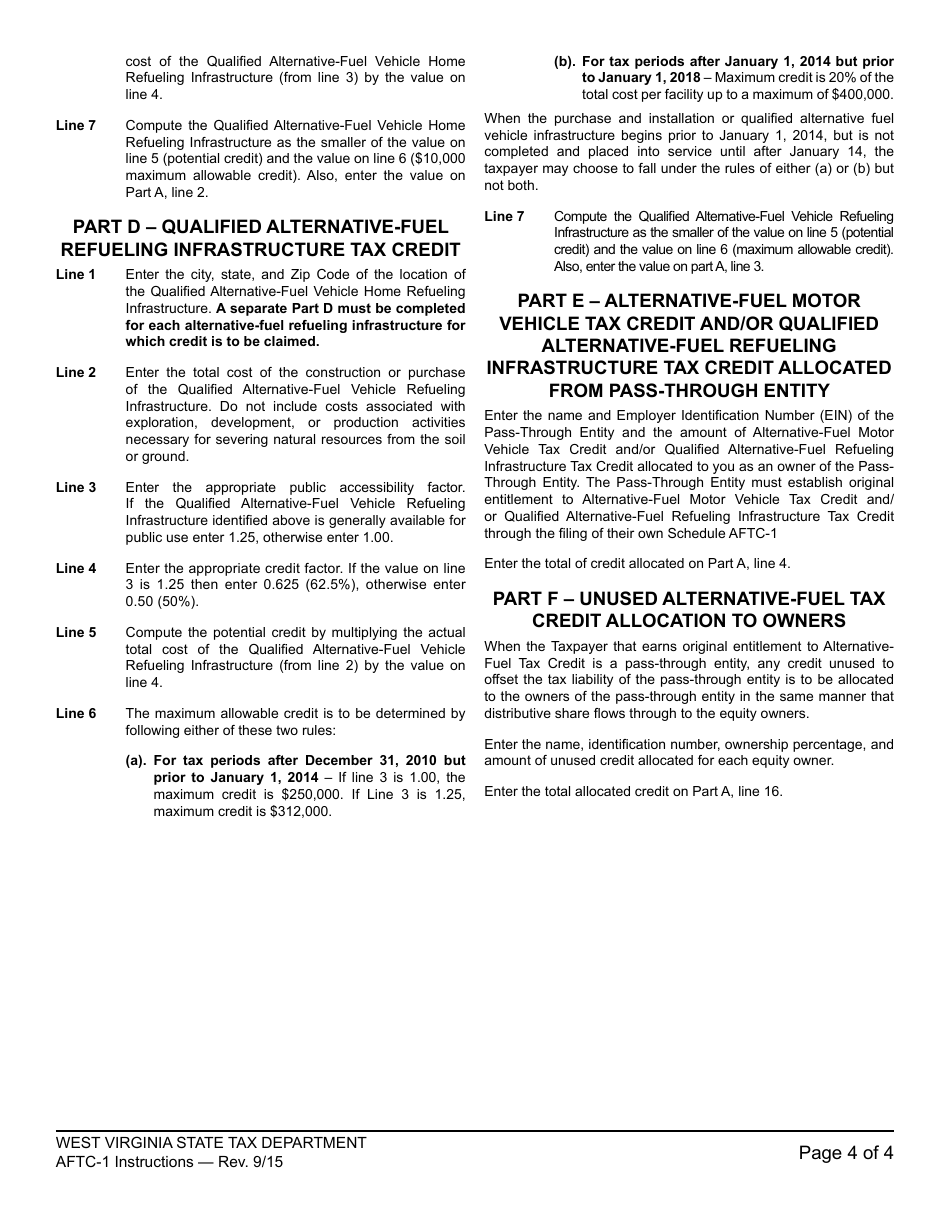

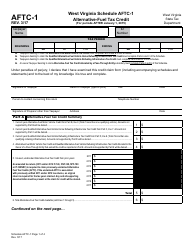

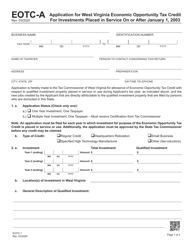

Instructions for Schedule AFTC-1 Alternative Fuel Tax Credit for Periods Beginning on or After January 1, 2015 - West Virginia

This document contains official instructions for Schedule AFTC-1 , Alternative Fuel Tax Credit for Periods Beginning on or After January 1, 2015 - a form released and collected by the West Virginia State Tax Department.

FAQ

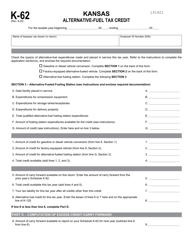

Q: What is Schedule AFTC-1?

A: Schedule AFTC-1 is a form used to claim the Alternative Fuel Tax Credit in West Virginia.

Q: What does the Alternative Fuel Tax Credit apply to?

A: The Alternative Fuel Tax Credit applies to alternative fuels used in vehicles.

Q: When can the Alternative Fuel Tax Credit be claimed?

A: The credit can be claimed for periods beginning on or after January 1, 2015.

Q: How do I claim the Alternative Fuel Tax Credit?

A: You can claim the credit by filling out Schedule AFTC-1 and attaching it to your West Virginia tax return.

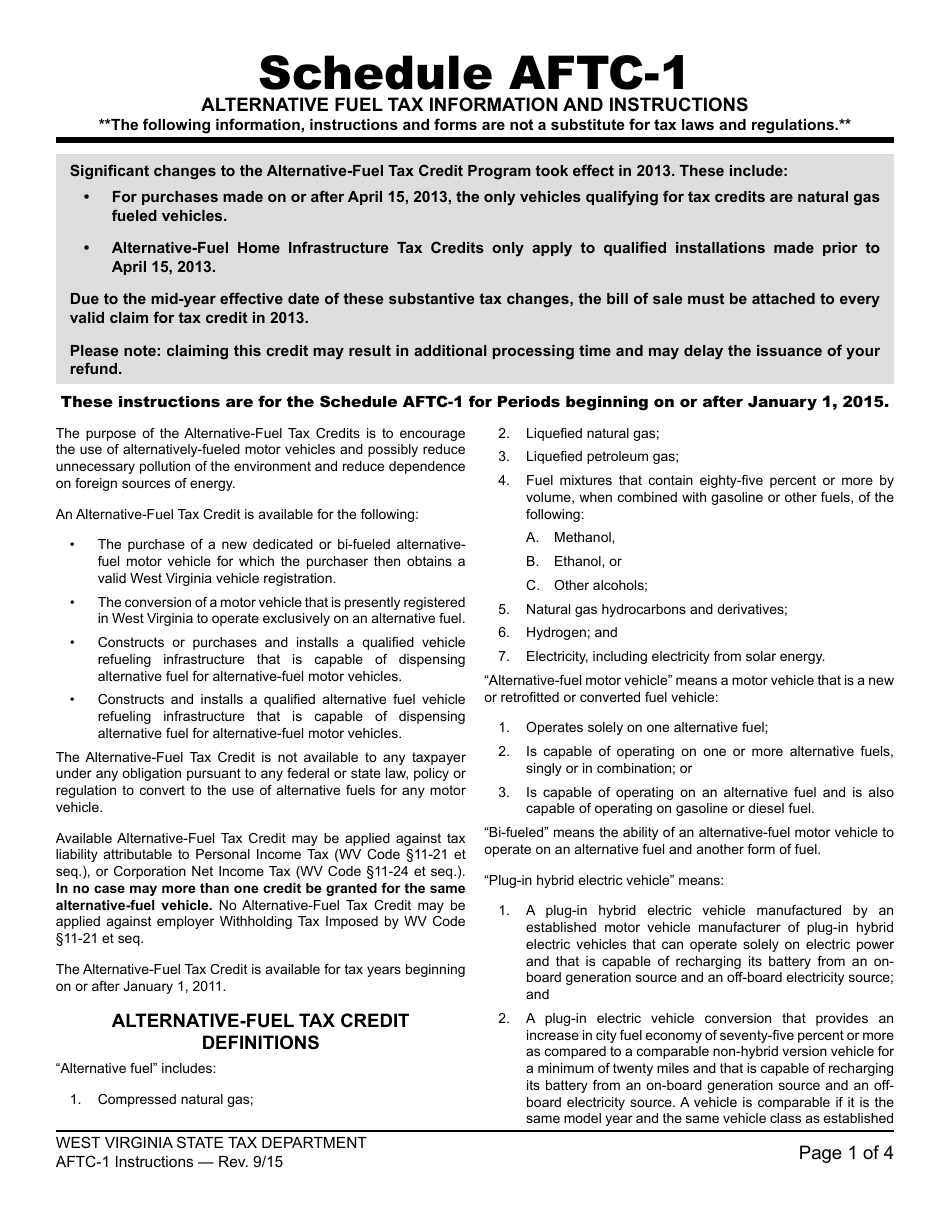

Q: Are there any eligibility requirements for claiming the Alternative Fuel Tax Credit?

A: Yes, you must have purchased or produced the alternative fuel and used it in a qualified vehicle.

Q: What type of vehicles are considered qualified vehicles?

A: Qualified vehicles include those powered by electricity, natural gas, propane, or hydrogen.

Q: Is there a limit to the amount of credit that can be claimed?

A: Yes, the credit is limited to $7,500 per vehicle.

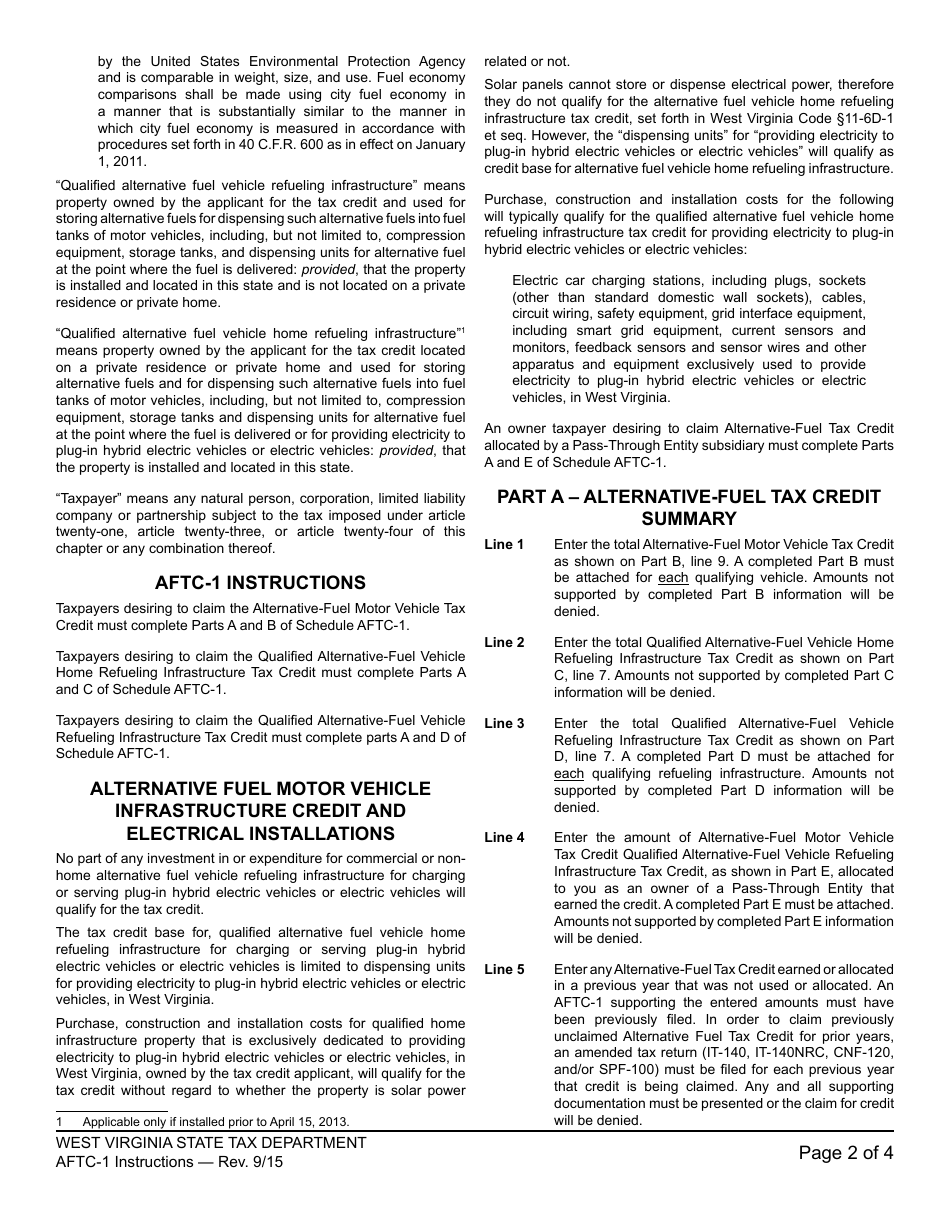

Q: Are there any documentation requirements for claiming the Alternative Fuel Tax Credit?

A: Yes, you must keep records of your alternative fuel purchases and vehicle usage to support your claim.

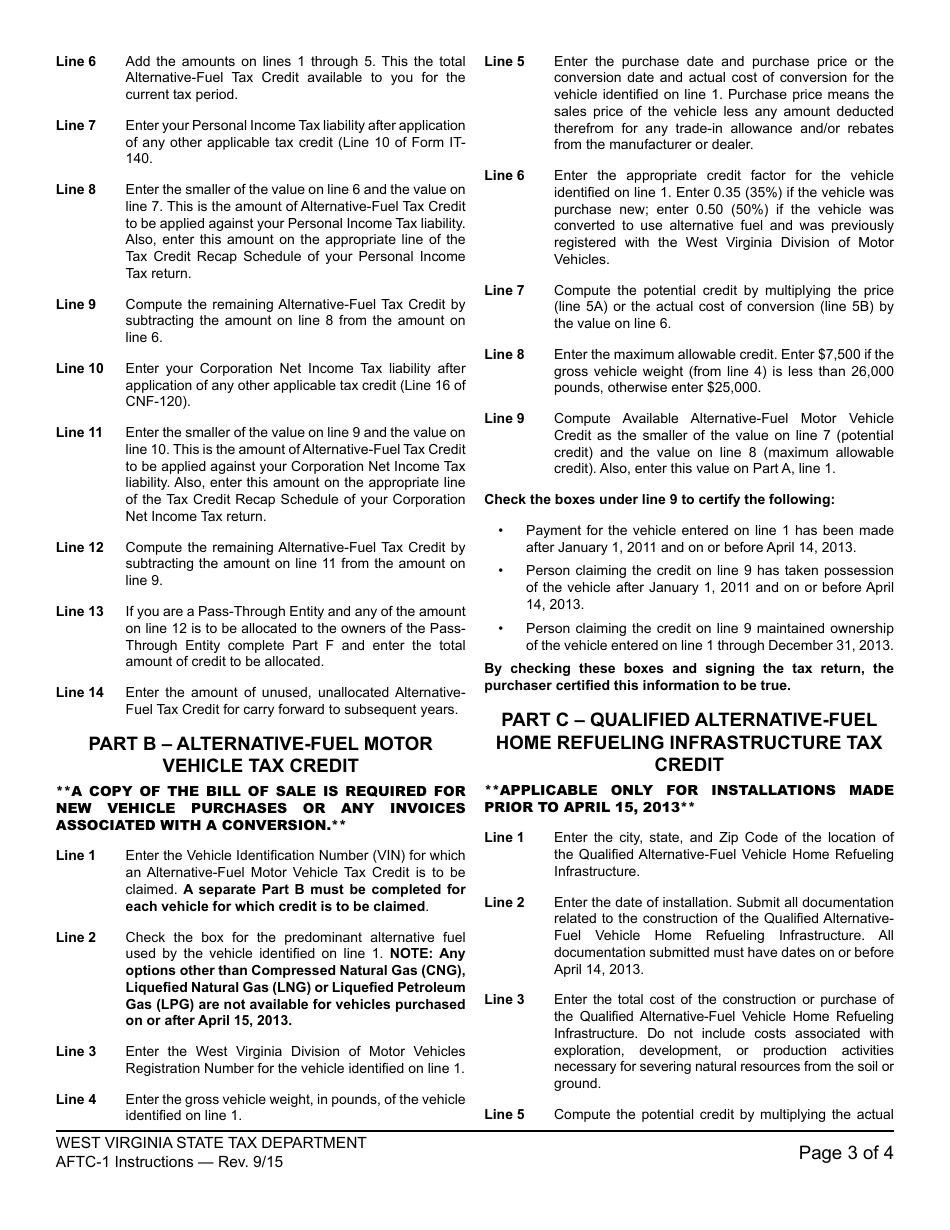

Q: When is the deadline for claiming the Alternative Fuel Tax Credit?

A: The credit must be claimed within three years from the due date of the original tax return for the period in which the alternative fuel was purchased or produced.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the West Virginia State Tax Department.