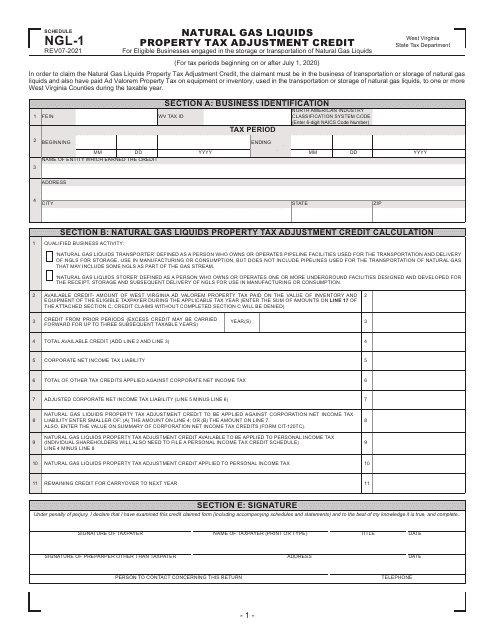

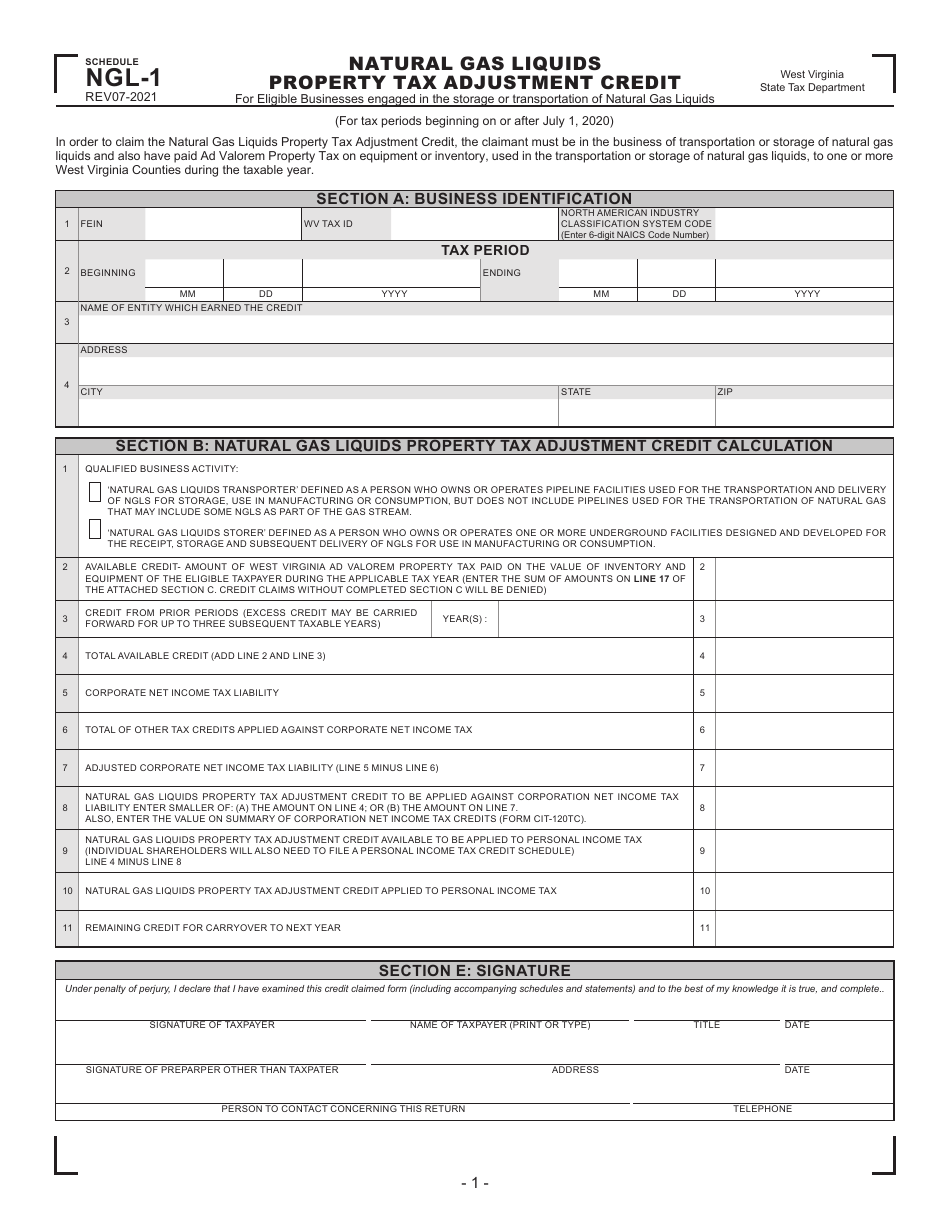

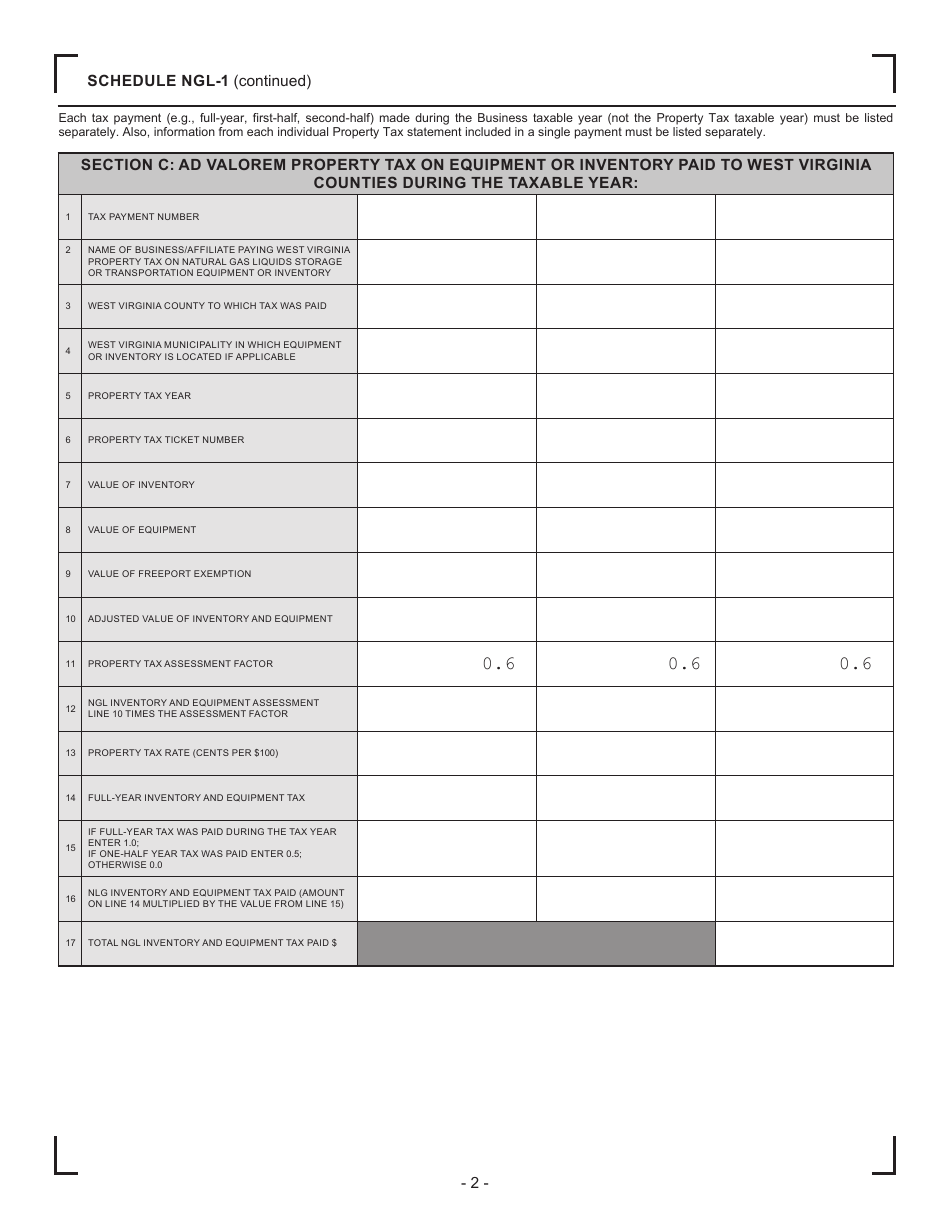

Schedule NGL-1 Natural Gas Liquids Property Tax Adjustment Credit for Eligible Businesses Engaged in the Storage or Transportation of Natural Gas Liquids (For Tax Periods Beginning on or After July 1, 2020) - West Virginia

What Is Schedule NGL-1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule NGL-1?

A: Schedule NGL-1 is a form used for the Natural Gas Liquids Property Tax Adjustment Credit in West Virginia.

Q: Who is eligible for the Natural Gas Liquids Property Tax Adjustment Credit?

A: Eligible businesses engaged in the storage or transportation of natural gas liquids are eligible for the credit.

Q: When does the tax period for the credit begin?

A: The tax period for the credit begins on or after July 1, 2020.

Q: What is the purpose of the credit?

A: The credit is meant to provide property tax relief for businesses involved in the storage or transportation of natural gas liquids.

Q: What is the name of the credit form for West Virginia?

A: The credit form is called Schedule NGL-1.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule NGL-1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.