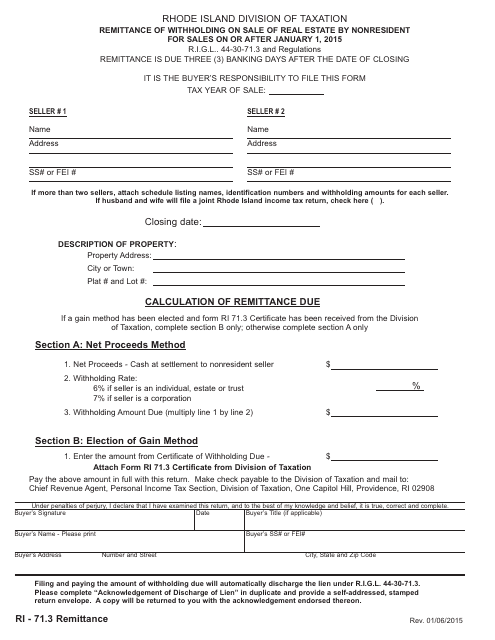

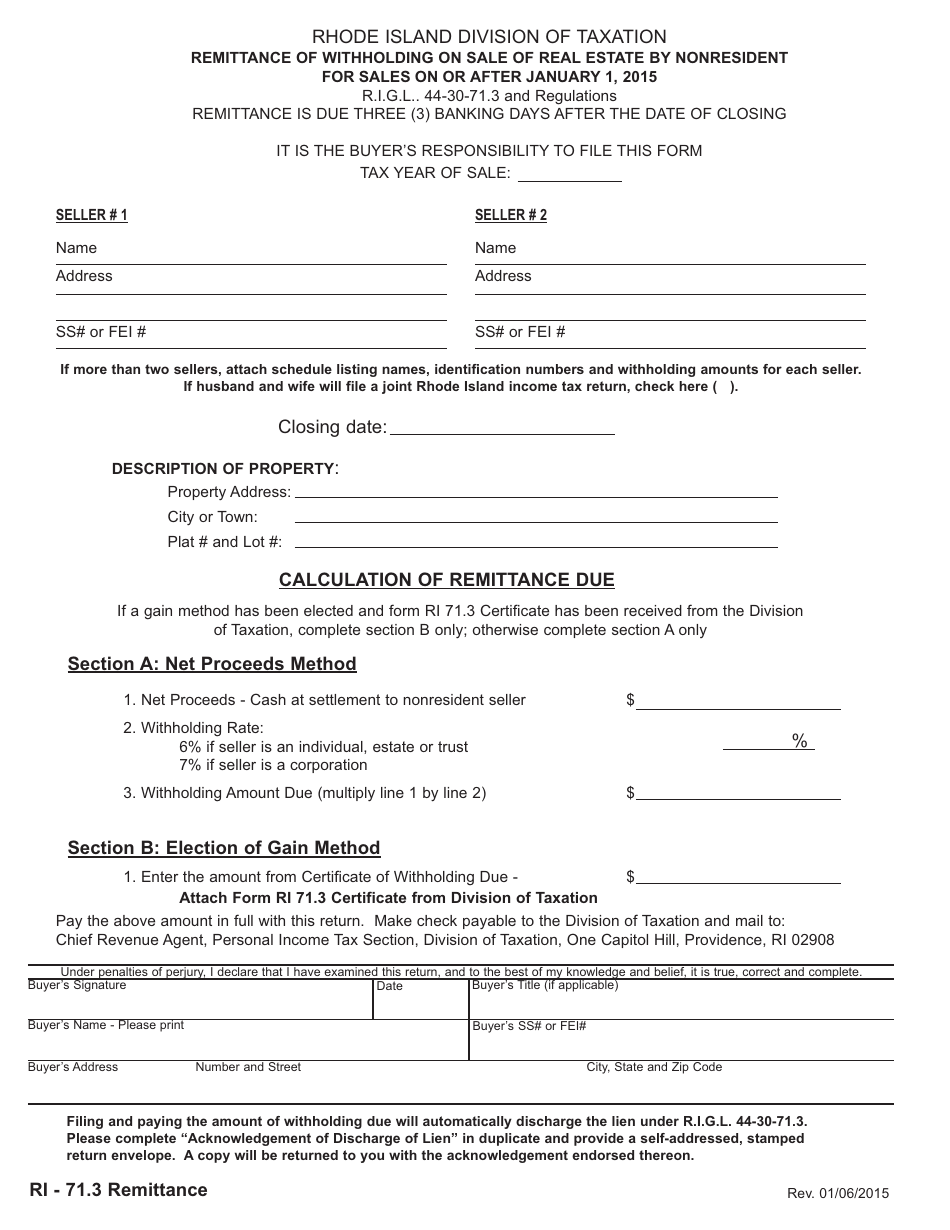

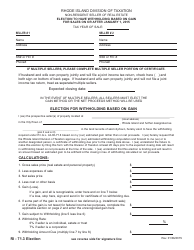

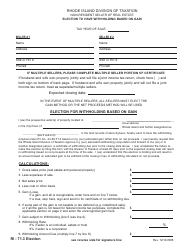

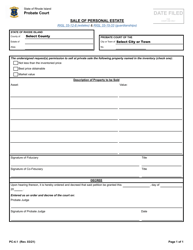

Remittance of Withholding on Sale of Real Estate by Nonresident for(sales(on(or(after(january 1, 2015 - Rhode Island

Remittance of Withholding on Sale of Real Estate by Nonresident for'(sales'(on'(or'(after'(january 1, 2015 is a legal document that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.

FAQ

Q: What is the remittance of withholding on sale of real estate?

A: Remittance of withholding on sale of real estate refers to the process of withholding and remitting a certain percentage of the sale proceeds when a nonresident sells real estate in Rhode Island.

Q: Who is considered a nonresident for sales of real estate in Rhode Island?

A: A nonresident for sales of real estate in Rhode Island is someone who is not a resident of the state for tax purposes.

Q: When did the remittance of withholding on sale of real estate by nonresident start in Rhode Island?

A: The remittance of withholding on sale of real estate by nonresident started on or after January 1, 2015 in Rhode Island.

Q: What is the purpose of withholding on sale of real estate by nonresident?

A: The purpose of withholding on sale of real estate by nonresident is to ensure that taxes owed by nonresidents on the sale of real estate are paid.

Q: How much is the withholding percentage for nonresident sellers of real estate in Rhode Island?

A: The withholding percentage for nonresident sellers of real estate in Rhode Island is 6% of the sale proceeds.

Form Details:

- Released on January 6, 2015;

- The latest edition currently provided by the Rhode Island Department of Revenue - Division of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.