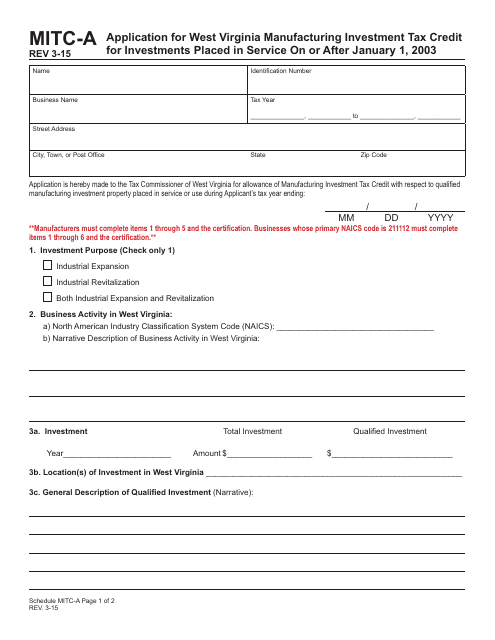

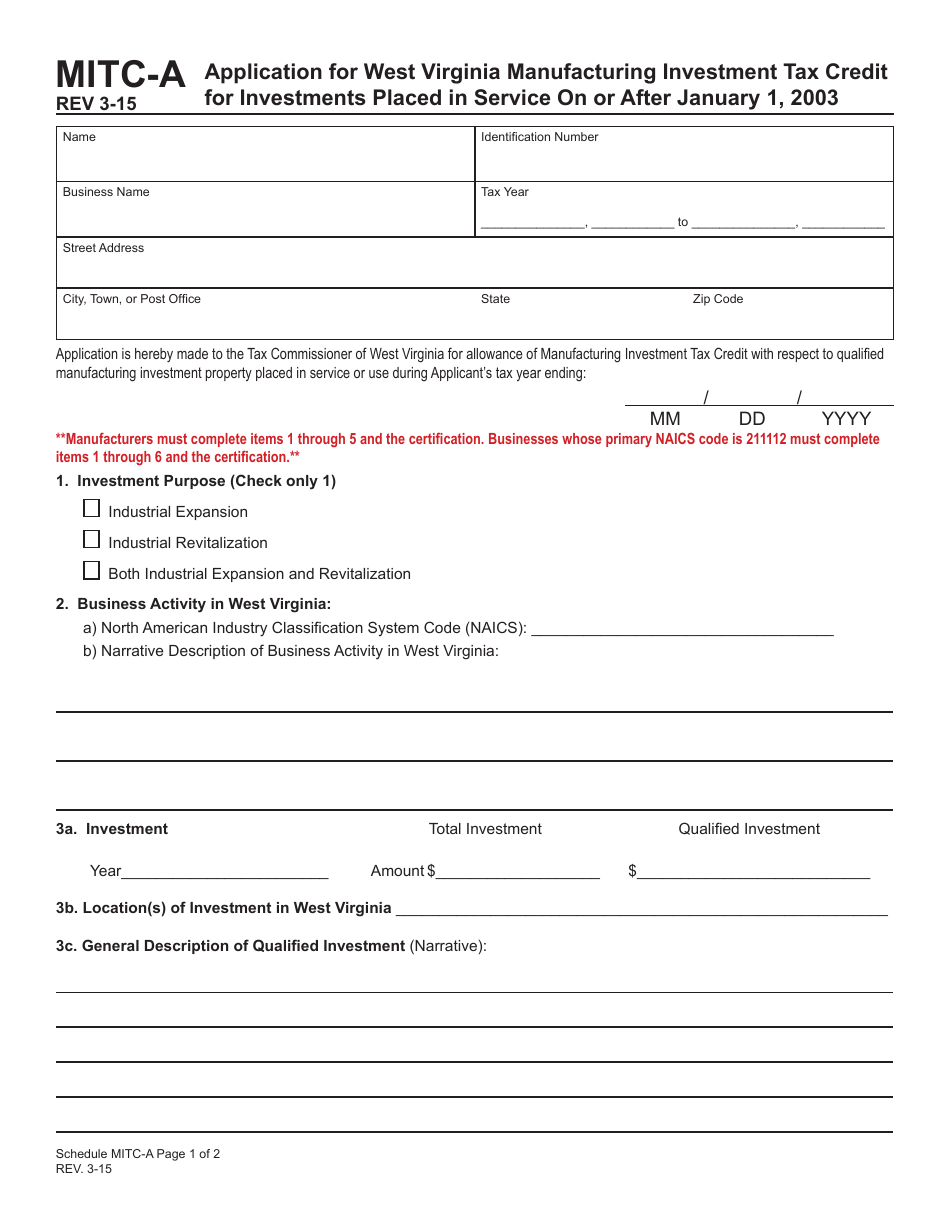

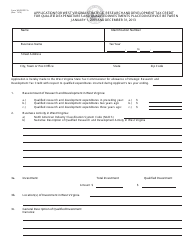

Form MITC-A Application for West Virginia Manufacturing Investment Tax Credit for Investments Placed Into Service on or After January 1, 2003 - West Virginia

What Is Form MITC-A?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MITC-A application?

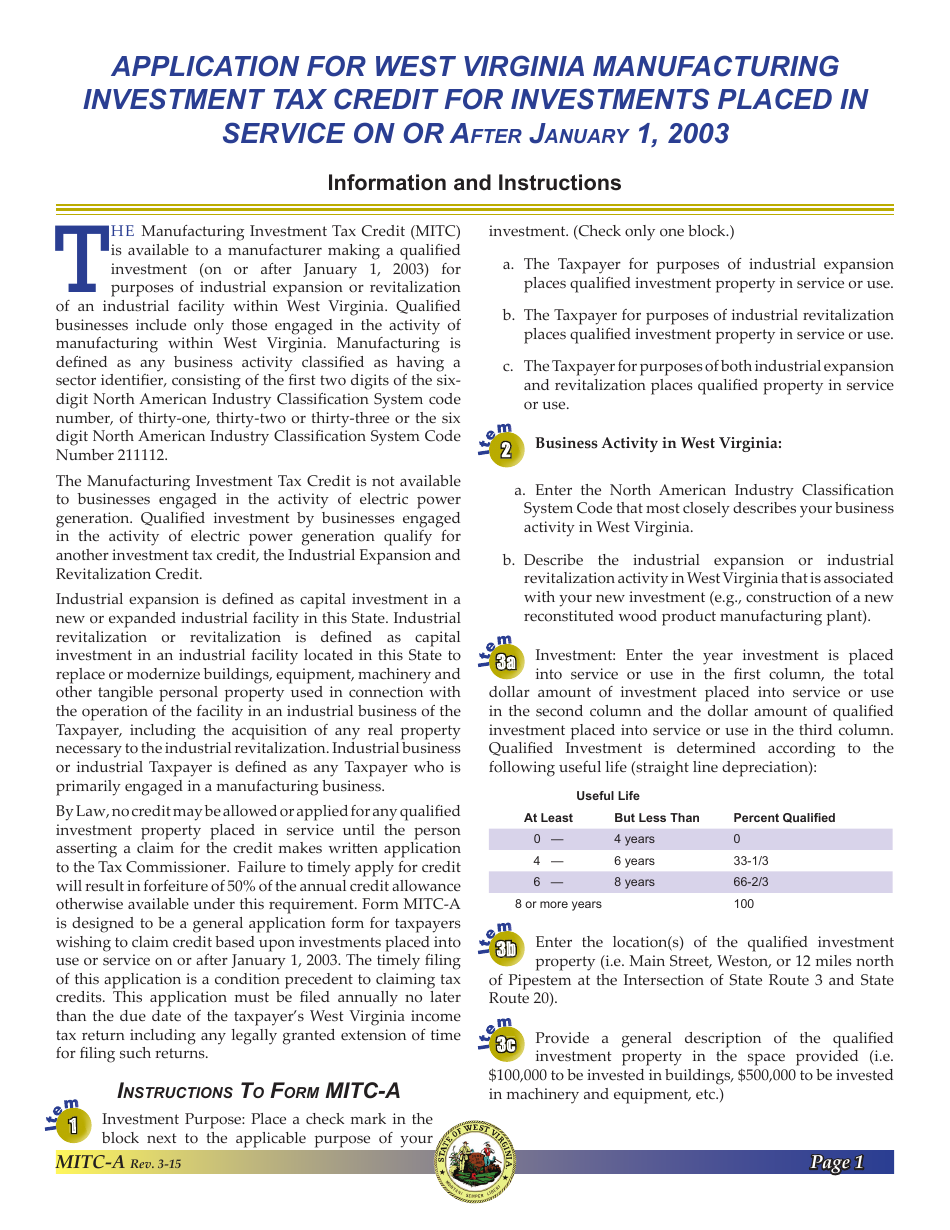

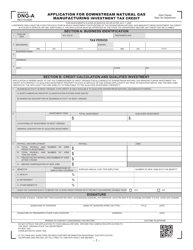

A: The MITC-A application is the form used to apply for the West Virginia Manufacturing Investment Tax Credit for investments placed into service on or after January 1, 2003.

Q: Who is eligible to apply for the MITC-A tax credit?

A: Any individual or entity that makes qualifying investments in manufacturing facilities in West Virginia and places them into service on or after January 1, 2003, may be eligible to apply for the MITC-A tax credit.

Q: What is the purpose of the MITC-A tax credit?

A: The purpose of the MITC-A tax credit is to encourage investment in manufacturing facilities in West Virginia and promote economic growth and job creation in the state.

Q: When can investments be placed into service to be eligible for the MITC-A tax credit?

A: Investments must be placed into service on or after January 1, 2003, in order to be eligible for the MITC-A tax credit.

Q: What types of investments qualify for the MITC-A tax credit?

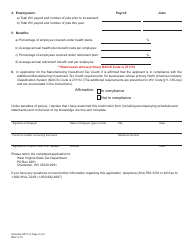

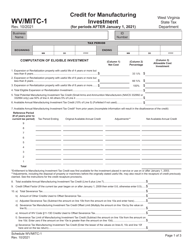

A: Qualifying investments include the construction, reconstruction, or acquisition of manufacturing facilities, as well as the purchase of machinery and equipment used in manufacturing processes.

Q: How much is the MITC-A tax credit?

A: The MITC-A tax credit may be equal to 16% of the investment in manufacturing facilities or 10% of the investment in machinery and equipment, depending on certain eligibility criteria.

Q: How can I apply for the MITC-A tax credit?

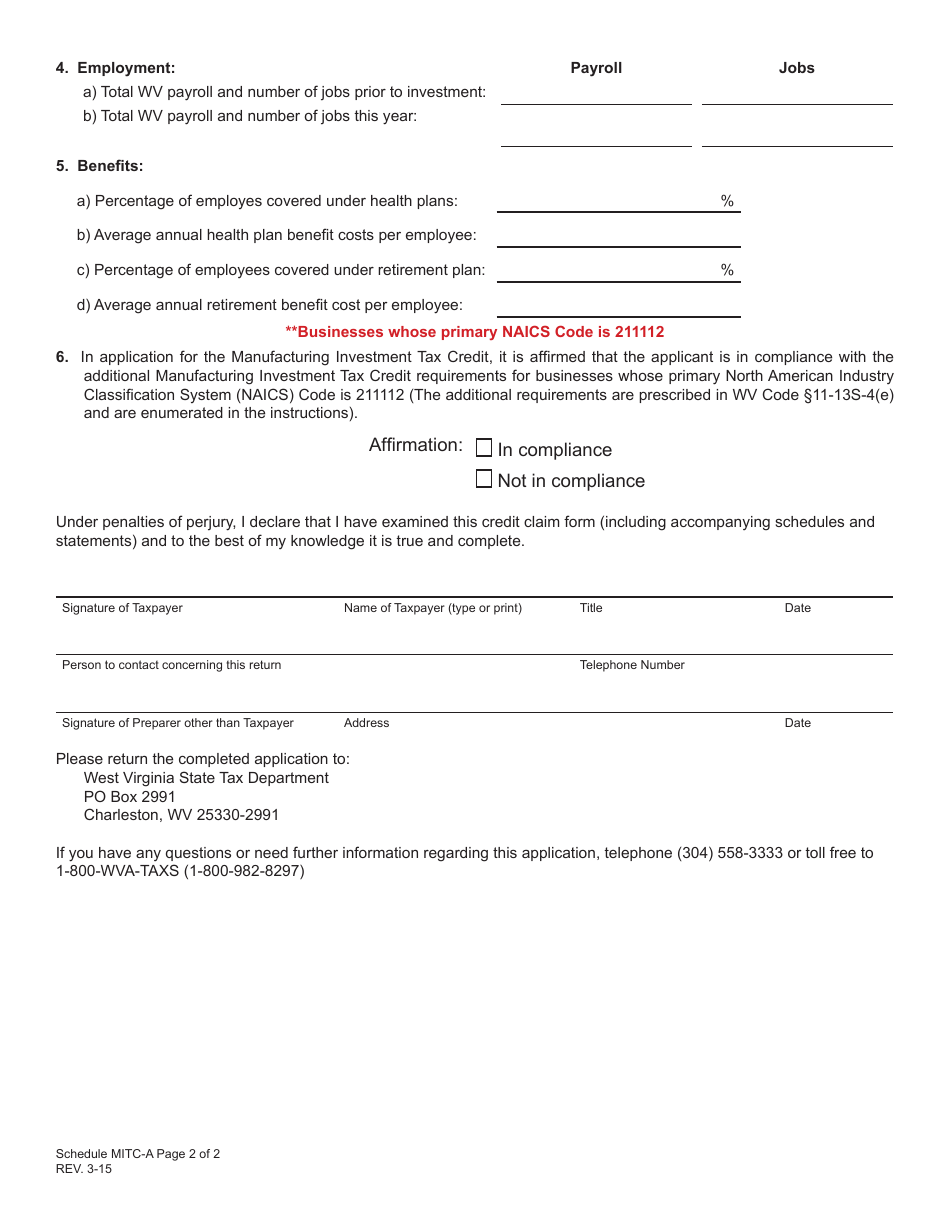

A: You can apply for the MITC-A tax credit by completing and submitting the MITC-A application form to the West Virginia State Tax Department.

Q: Are there any deadlines for submitting the MITC-A application?

A: The MITC-A application must be submitted on or before the due date of the taxpayer's West Virginia tax return for the taxable year in which the investment is placed into service.

Q: Is the MITC-A tax credit refundable?

A: No, the MITC-A tax credit is not refundable. However, any unused credit may be carried forward for up to fifteen years.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MITC-A by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.