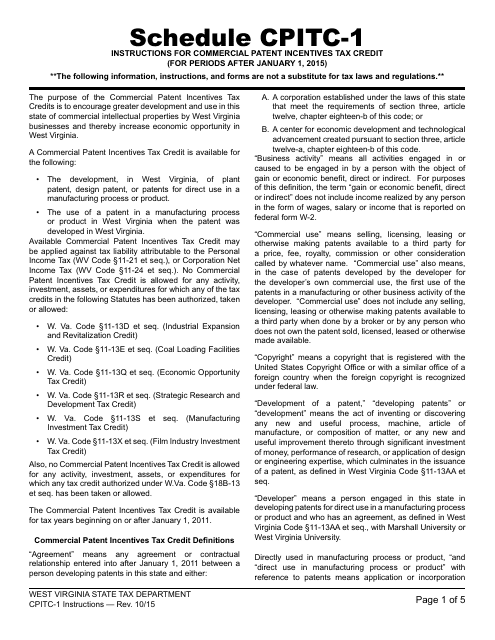

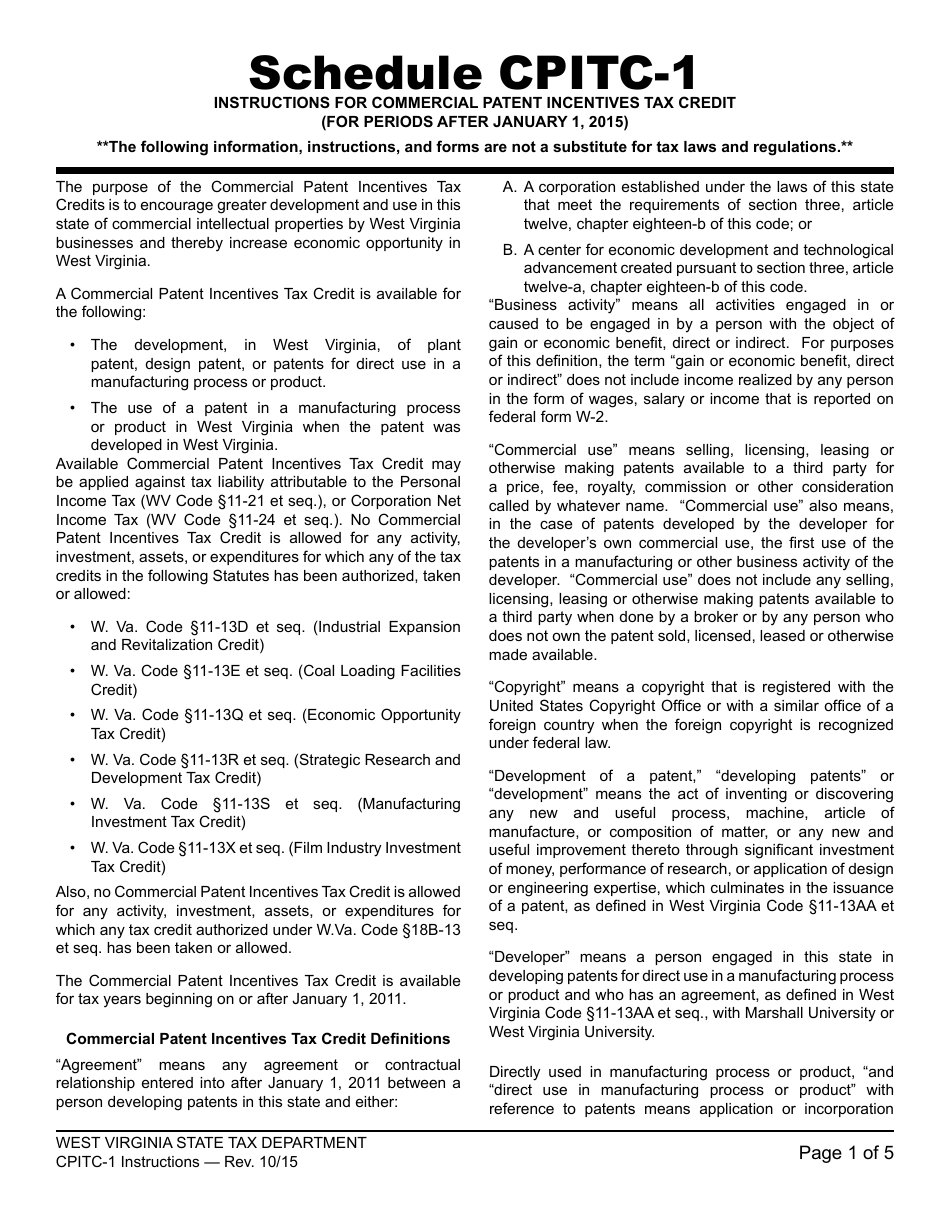

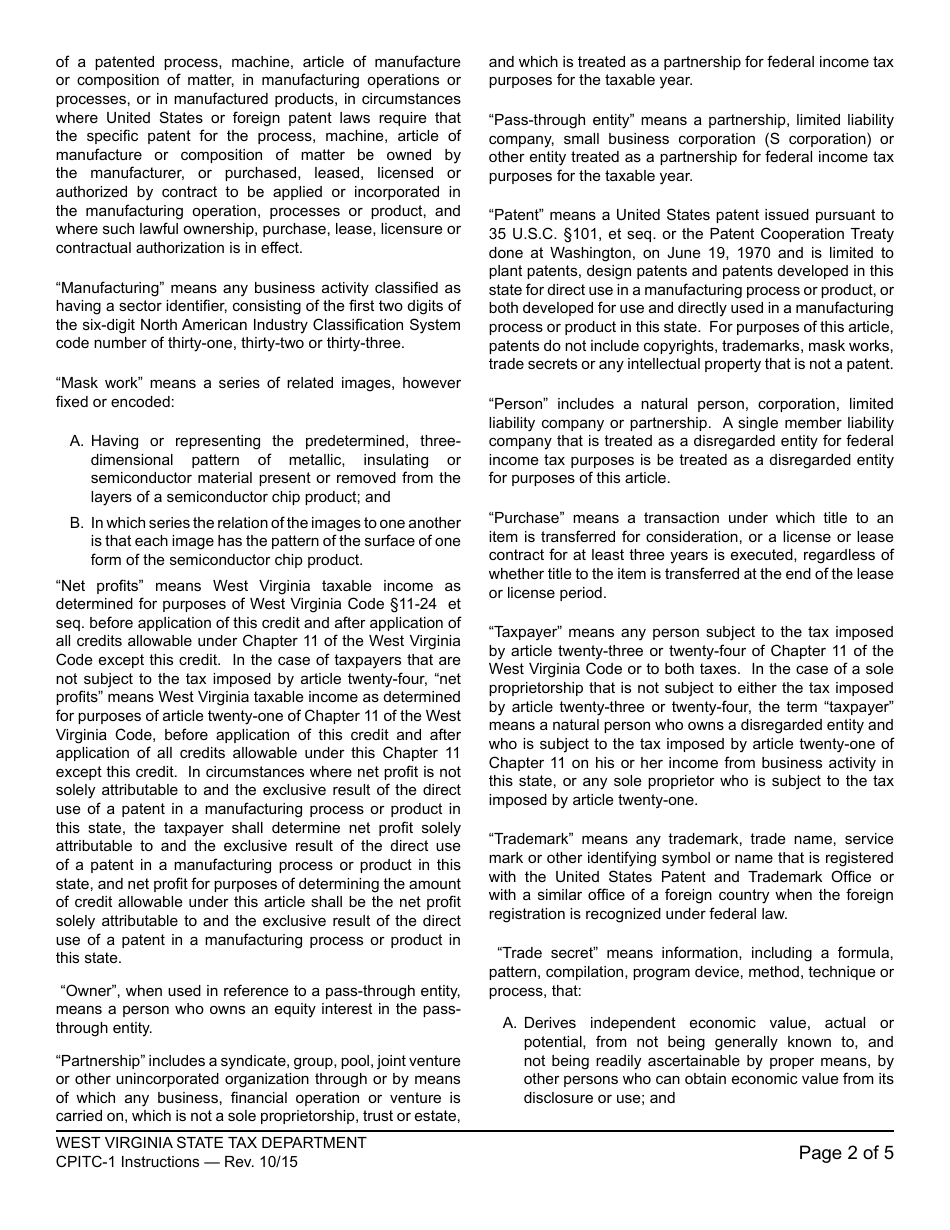

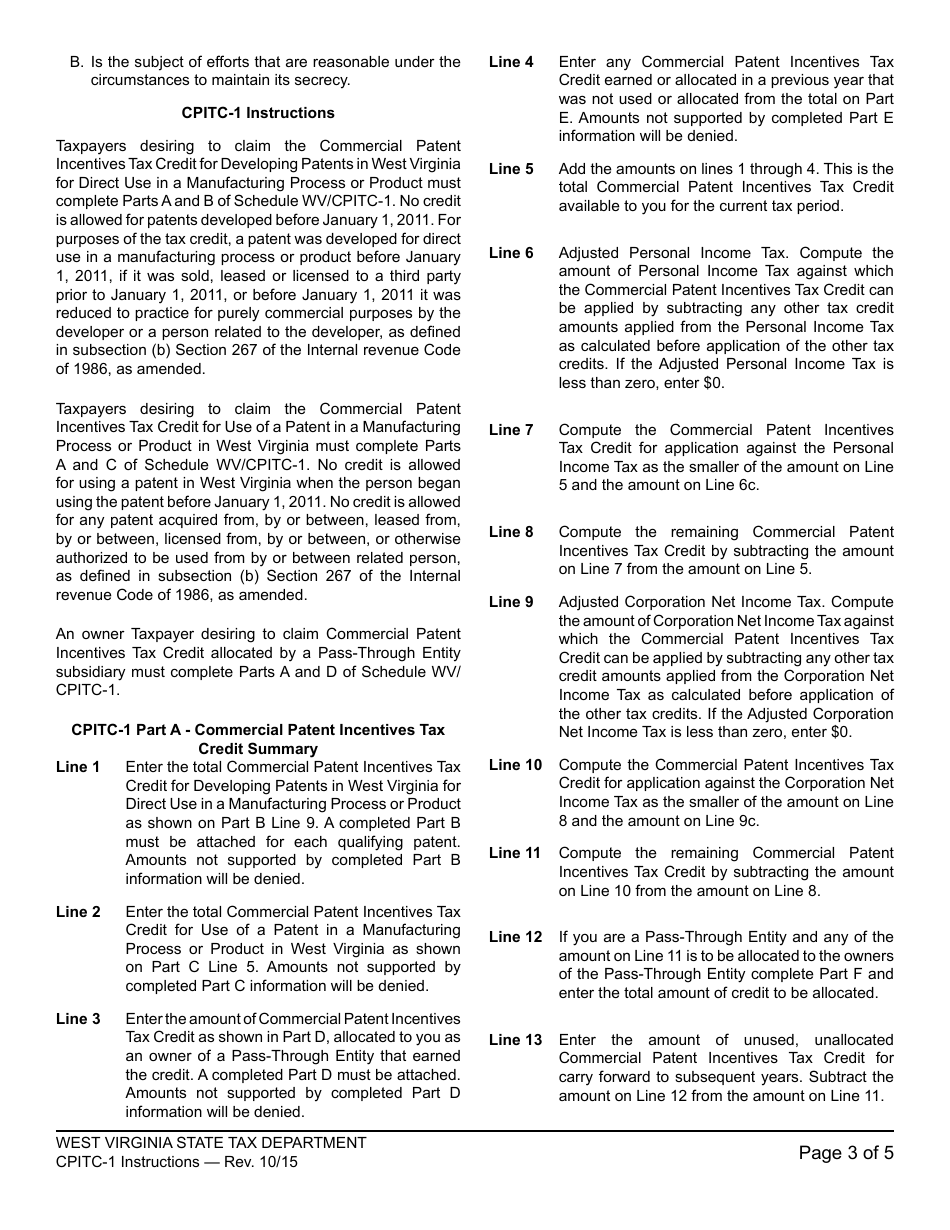

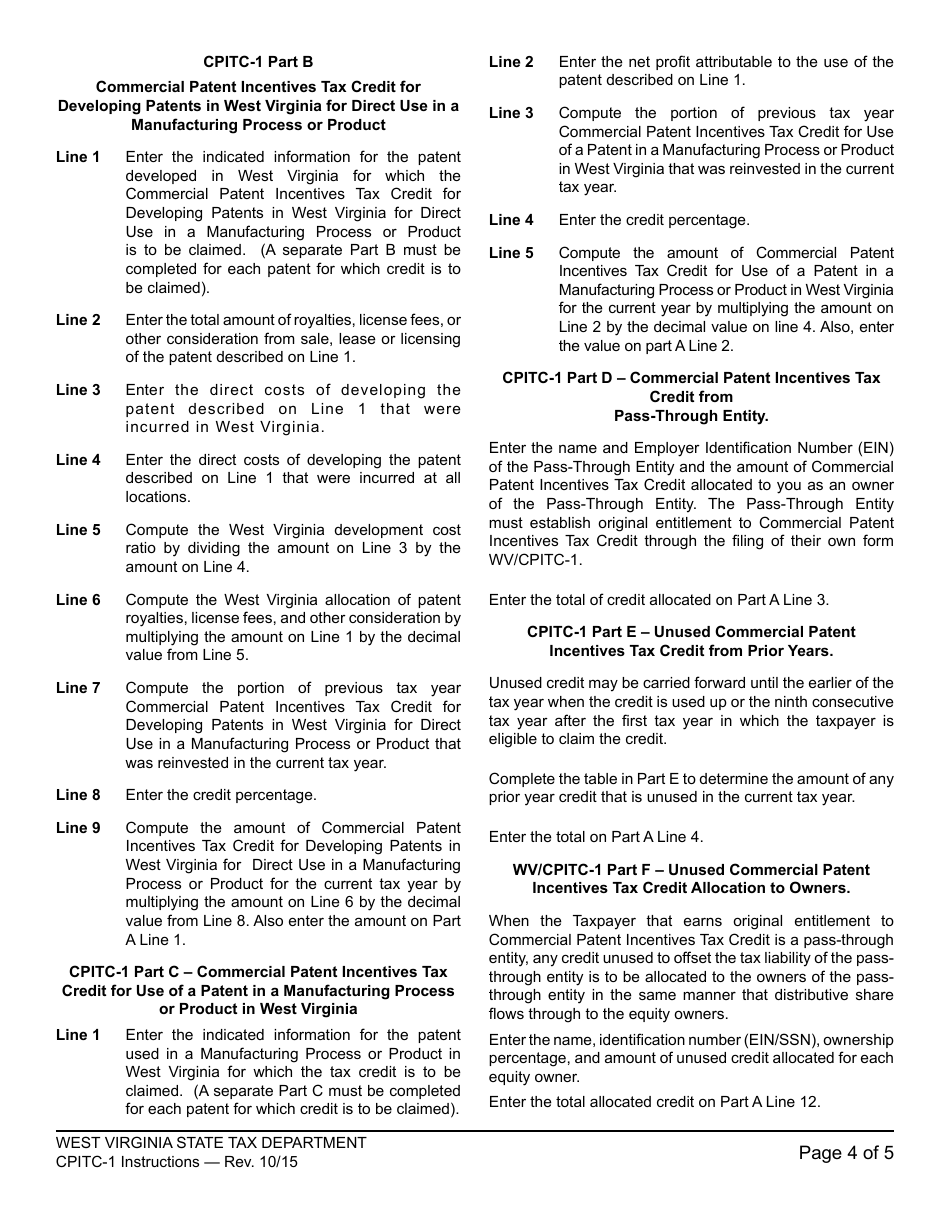

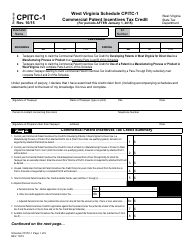

Instructions for Schedule CPITC-1 Commercial Patent Incentives Tax Credit for Periods After January 1, 2015 - West Virginia

This document contains official instructions for Schedule CPITC-1 , Commercial Patent Incentives Tax Credit for Periods After January 1, 2015 - a form released and collected by the West Virginia State Tax Department.

FAQ

Q: What is Schedule CPITC-1?

A: Schedule CPITC-1 is a tax form for claiming the Commercial Patent Incentives Tax Credit in West Virginia.

Q: What is the Commercial Patent Incentives Tax Credit?

A: The Commercial Patent Incentives Tax Credit is a tax credit aimed at encouraging businesses to develop and commercialize patents in West Virginia.

Q: Who is eligible for the Commercial Patent Incentives Tax Credit?

A: Businesses that have been issued a patent and have qualified expenditures related to the development and commercialization of that patent may be eligible for the tax credit.

Q: What types of expenditures qualify for the Commercial Patent Incentives Tax Credit?

A: Qualifying expenditures may include research and development costs, legal expenses, and costs associated with marketing and selling products or services covered by the patent.

Q: Is there a limit to the amount of tax credit that can be claimed?

A: Yes, there is a limit to the amount of tax credit that can be claimed. The maximum credit that can be claimed in any one taxable year is $100,000.

Q: How can I claim the Commercial Patent Incentives Tax Credit?

A: You can claim the tax credit by completing Schedule CPITC-1 and including it with your West Virginia tax return for the applicable tax year.

Q: Are there any deadlines for claiming the Commercial Patent Incentives Tax Credit?

A: Yes, there are deadlines for claiming the tax credit. The schedule must be filed with your West Virginia tax return by the due date of the return, including any extensions.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the West Virginia State Tax Department.