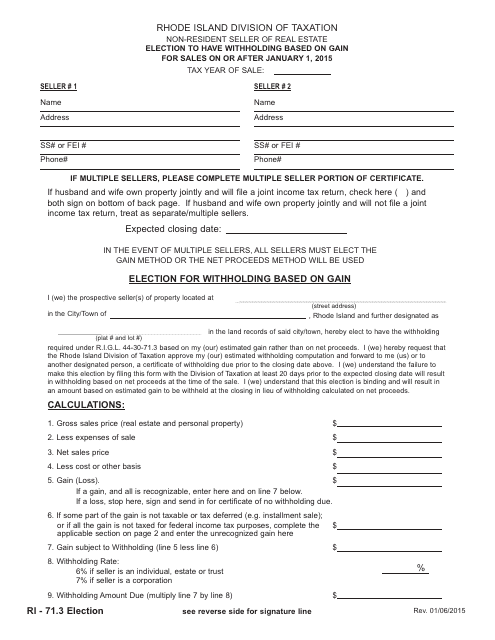

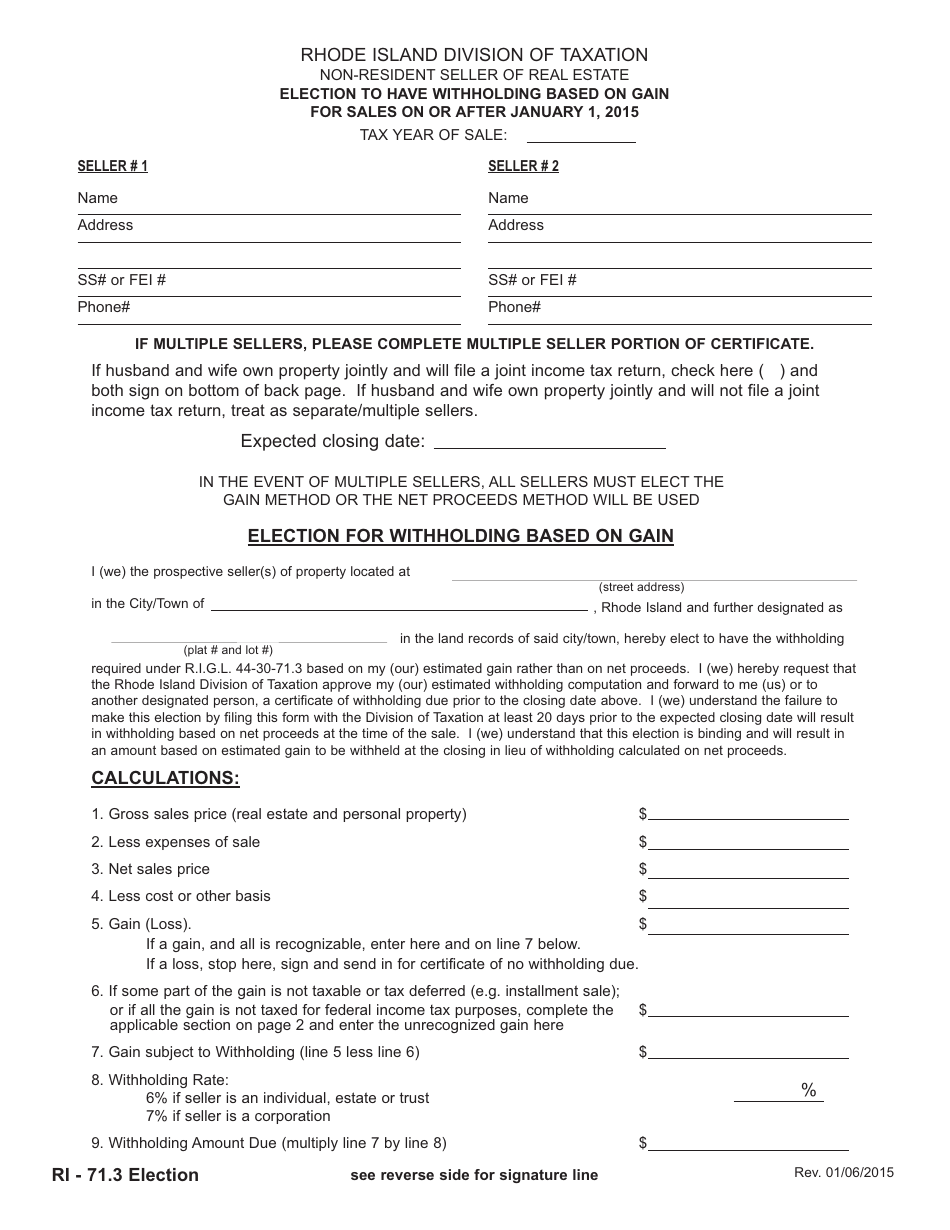

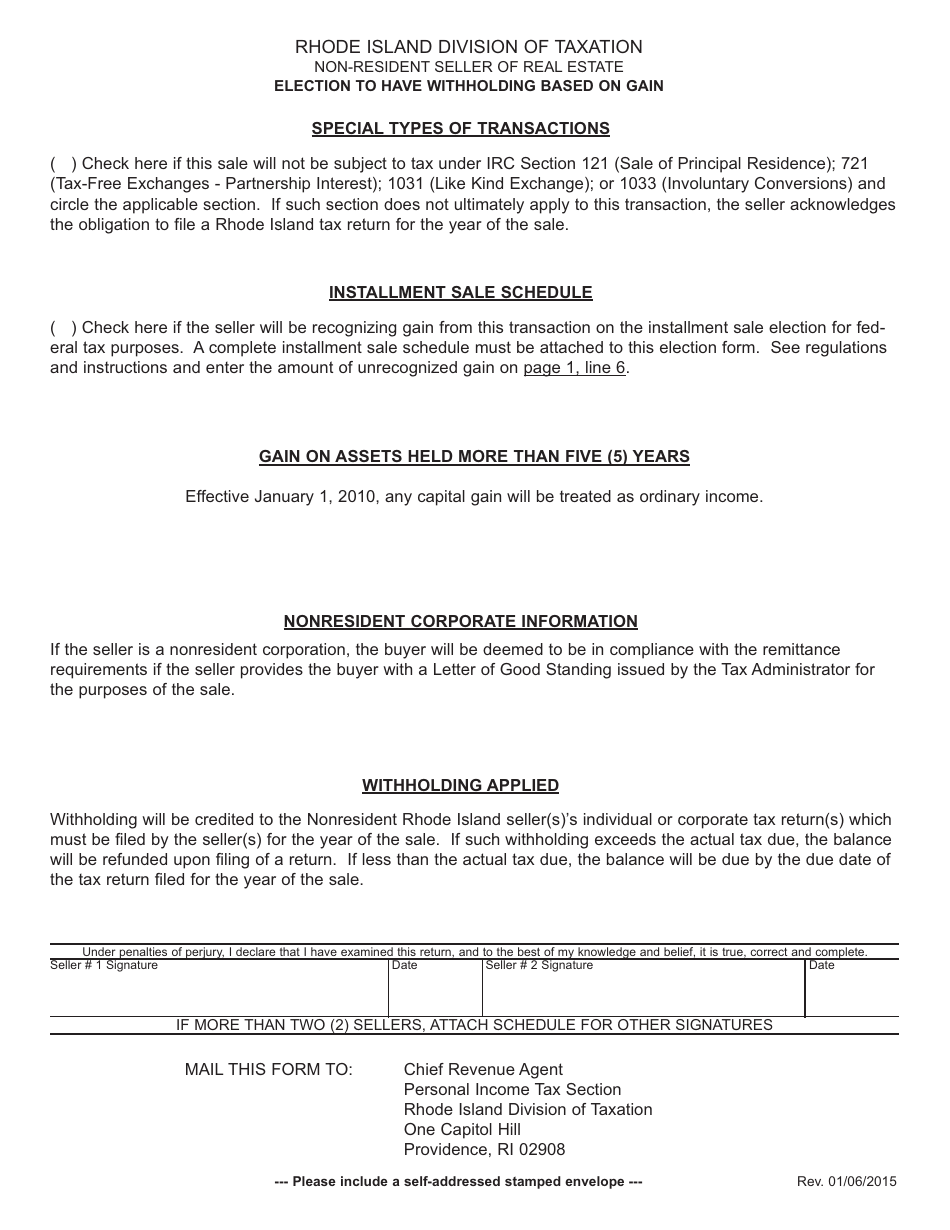

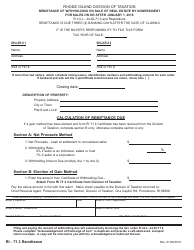

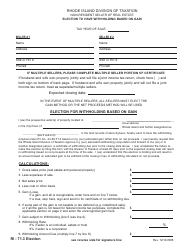

Non-resident Seller of Real Estate Election to Have Withholding Based on Gain for(sales(on(or(after(january(1, 2015 - Rhode Island

Non-resident Seller of Real Estate Election to Have Withholding Based on Gain for'(sales'(on'(or'(after'(january'(1, 2015 is a legal document that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.

FAQ

Q: What is the Non-resident Seller of Real Estate Election to Have Withholding Based on Gain?

A: It is a withholding requirement for non-resident sellers of real estate in Rhode Island.

Q: Who does this election apply to?

A: It applies to non-resident sellers of real estate in Rhode Island.

Q: What is the purpose of this election?

A: The purpose is to ensure that taxes are withheld from the gain on the sale of real estate by non-resident sellers.

Q: When does this election apply?

A: It applies to sales of real estate that occurred on or after January 1, 2015 in Rhode Island.

Form Details:

- Released on January 6, 2015;

- The latest edition currently provided by the Rhode Island Department of Revenue - Division of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.