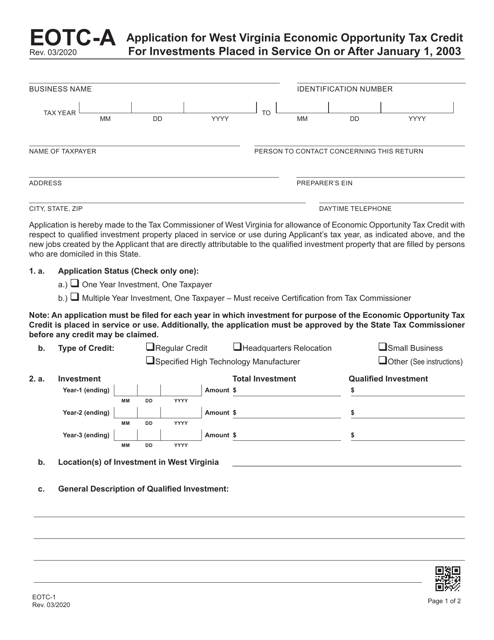

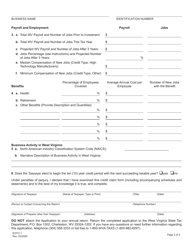

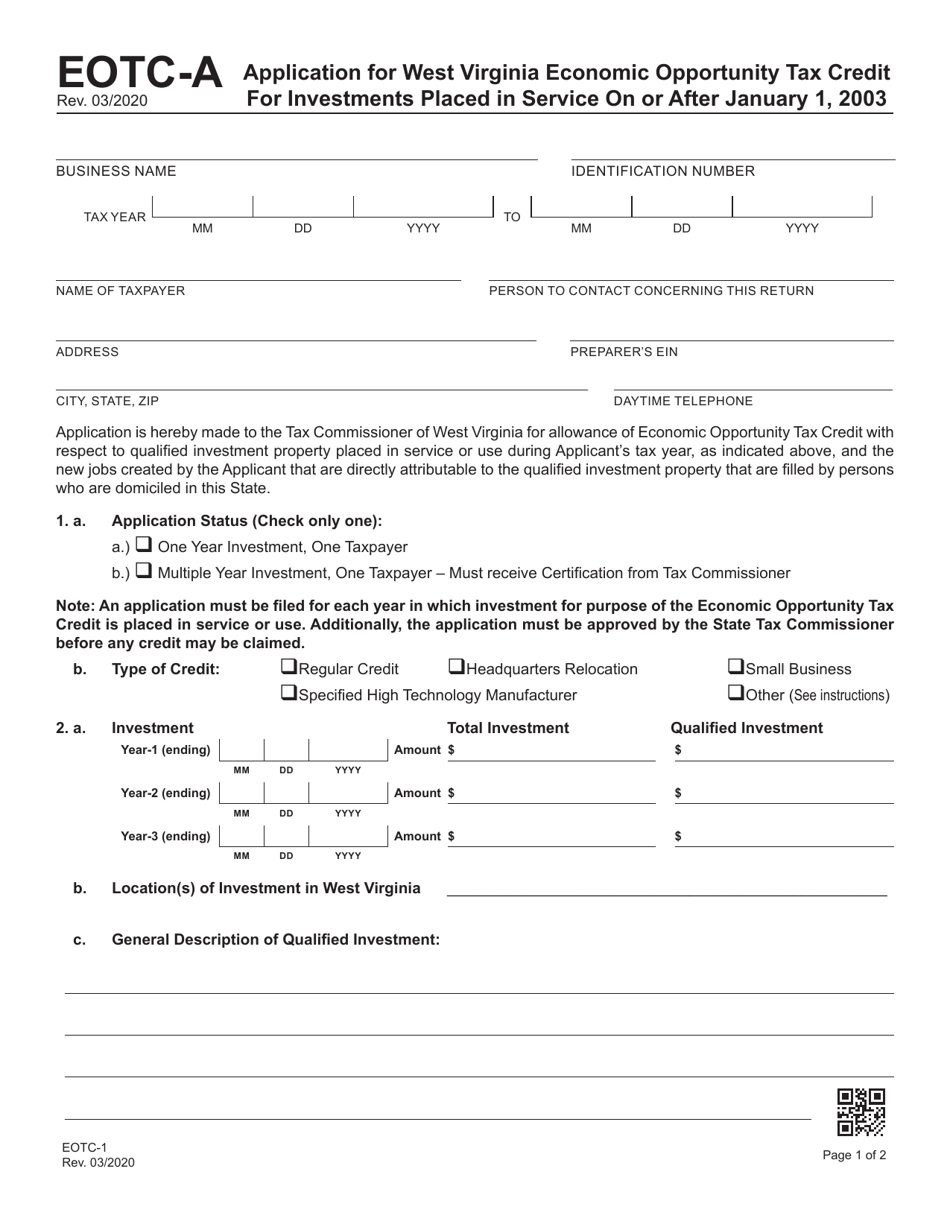

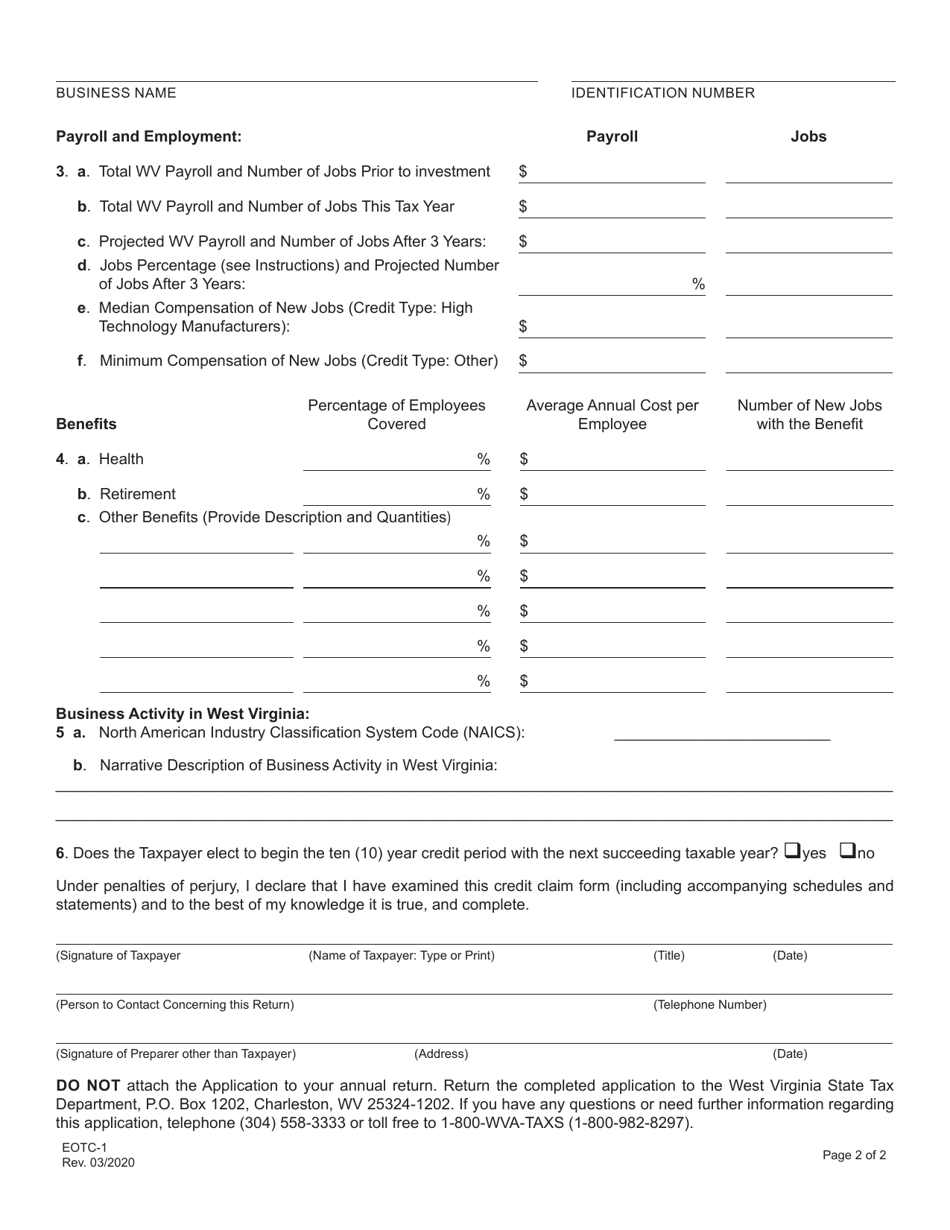

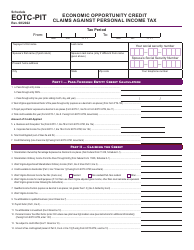

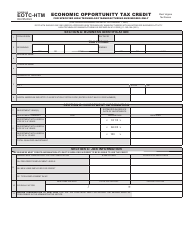

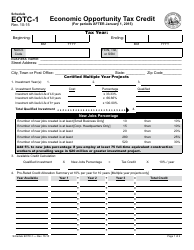

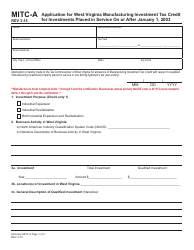

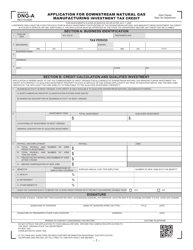

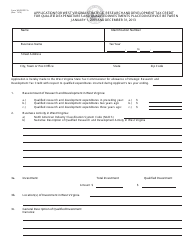

Form EOTC-A (EOTC-1) Application for West Virginia Economic Opportunity Tax Credit for Investments Placed in Service on or After January 1, 2003 - West Virginia

What Is Form EOTC-A (EOTC-1)?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

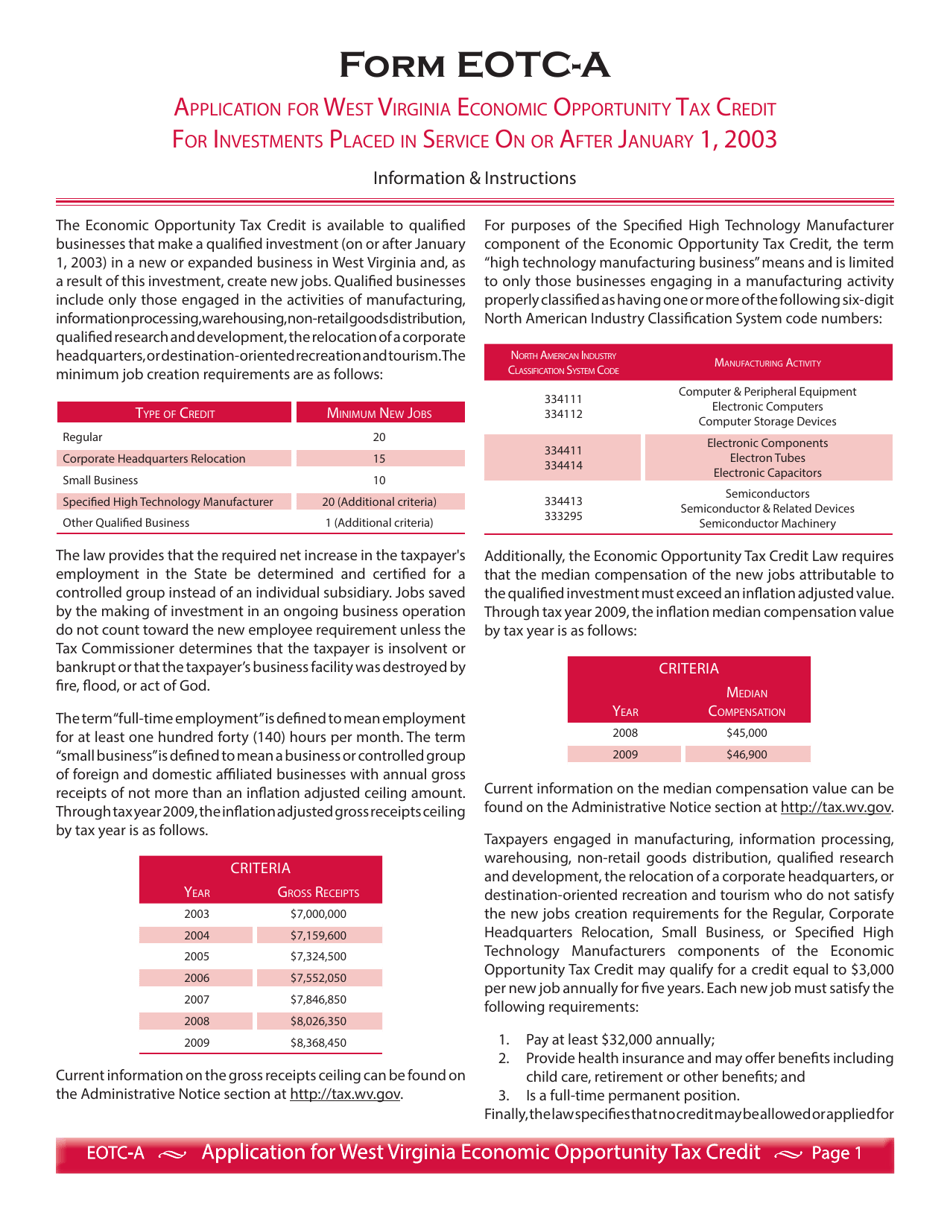

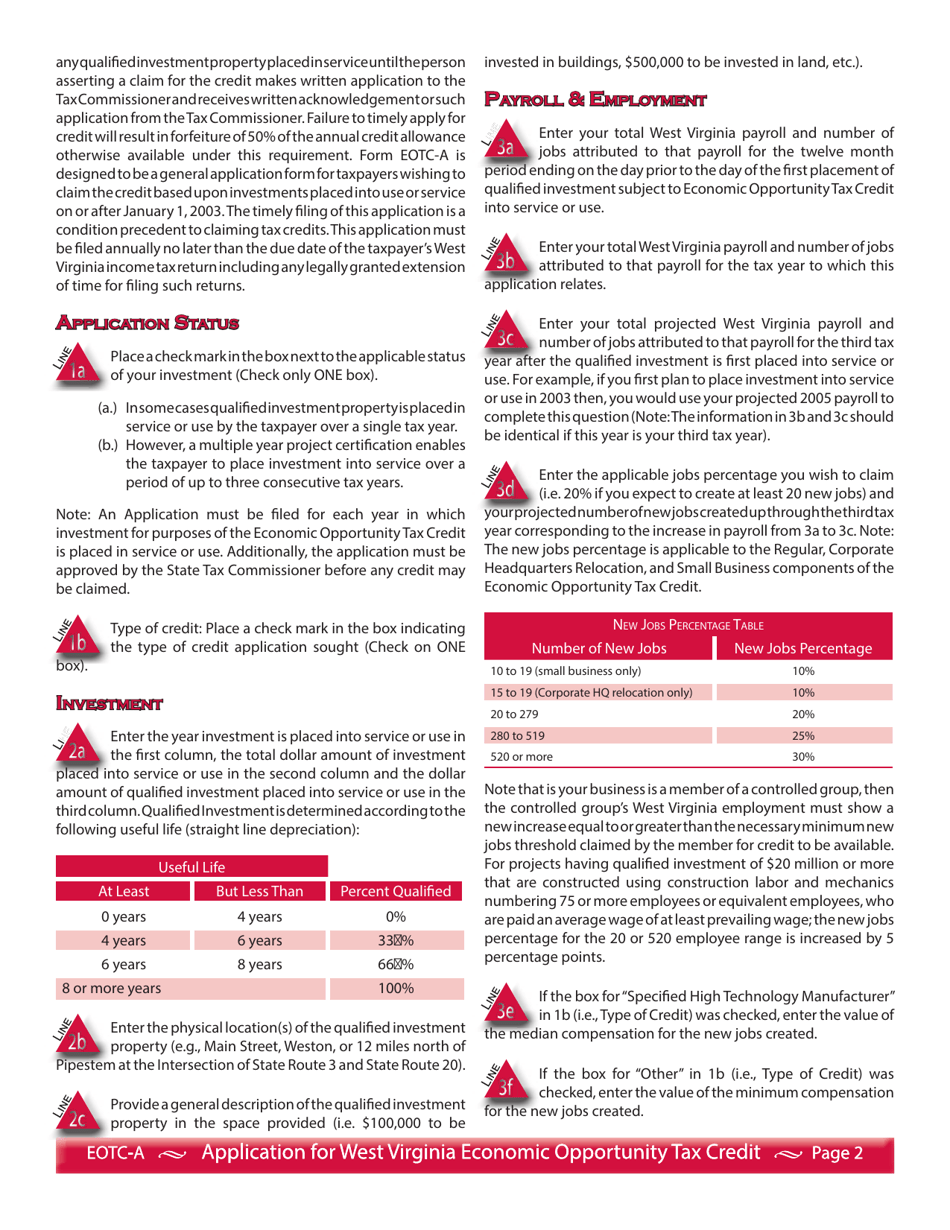

Q: What is Form EOTC-A?

A: Form EOTC-A is the application for the West Virginia Economic Opportunity Tax Credit for Investments Placed in Service on or After January 1, 2003.

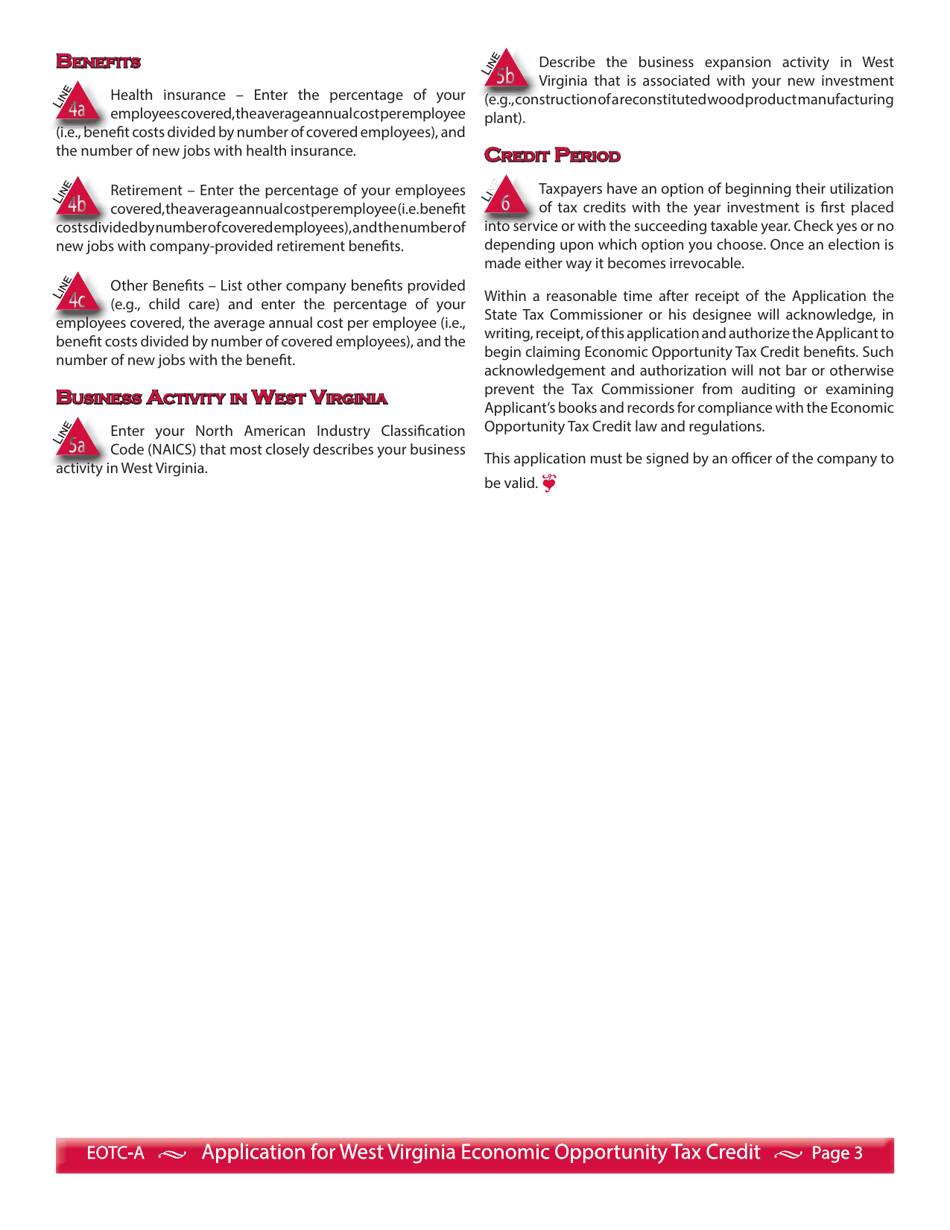

Q: What is the purpose of the West Virginia Economic Opportunity Tax Credit?

A: The purpose of the West Virginia Economic Opportunity Tax Credit is to encourage investments in the state.

Q: When does the investment need to be placed in service to be eligible for the tax credit?

A: The investment needs to be placed in service on or after January 1, 2003.

Q: Who is eligible to apply for the West Virginia Economic Opportunity Tax Credit?

A: Any individual or business that has made qualifying investments in West Virginia is eligible to apply.

Q: What is the deadline to submit Form EOTC-A?

A: The deadline to submit Form EOTC-A is usually April 15th of the following year.

Q: Are there any fees associated with applying for the tax credit?

A: Yes, there is a $100 processing fee for each application submitted.

Q: How long does it take to receive a decision on the tax credit application?

A: It usually takes 30 days to receive a decision on the tax credit application.

Q: Can the tax credit be carried forward or transferred?

A: Yes, the tax credit can be carried forward for 10 years or transferred to another eligible taxpayer.

Q: Is there a maximum amount of tax credit that can be awarded?

A: Yes, the maximum amount of tax credit that can be awarded is $5 million per applicant per year.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form EOTC-A (EOTC-1) by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.