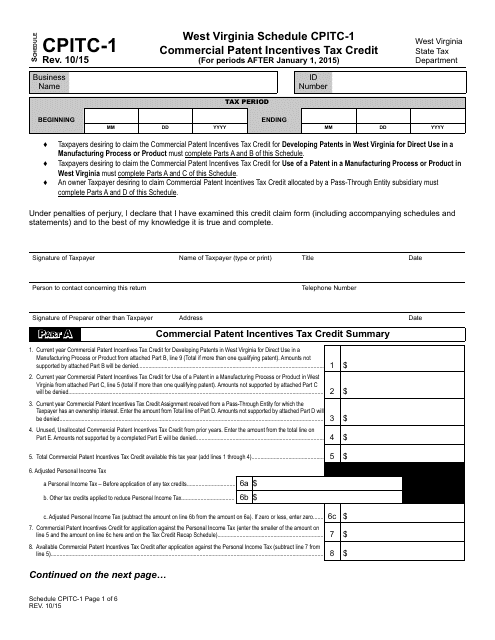

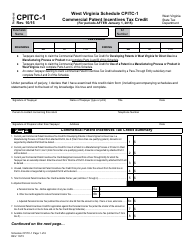

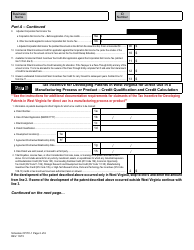

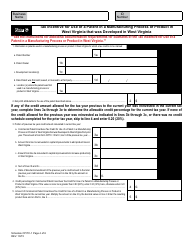

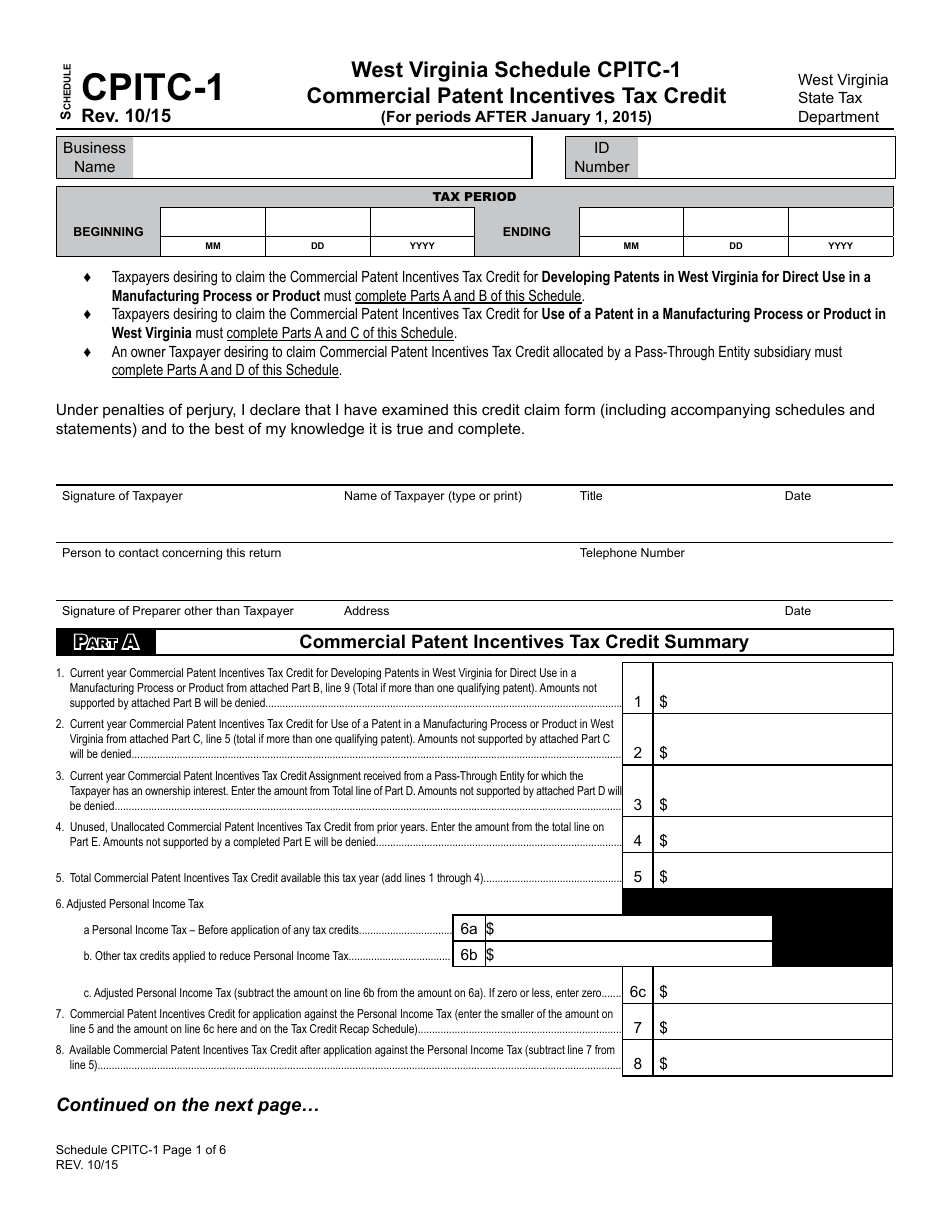

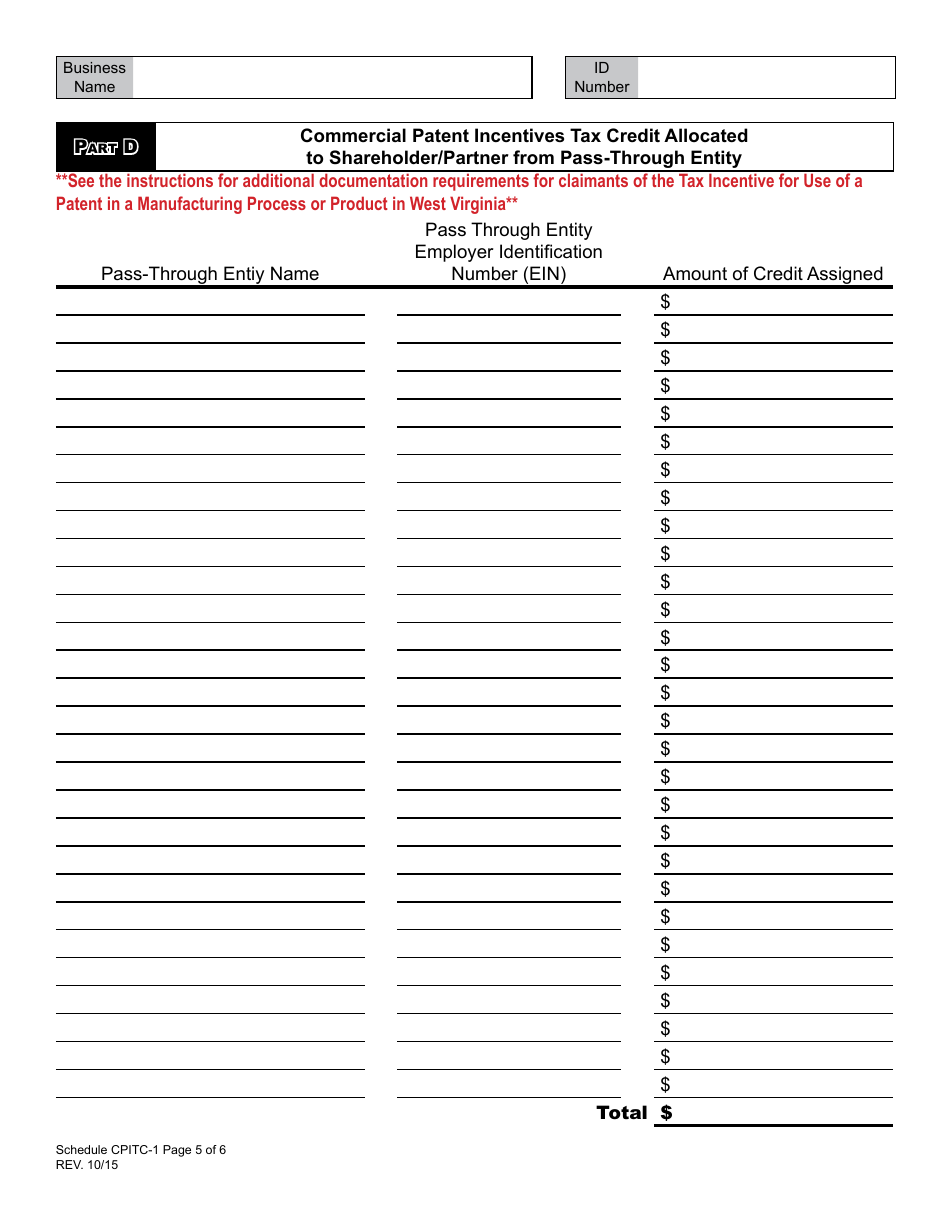

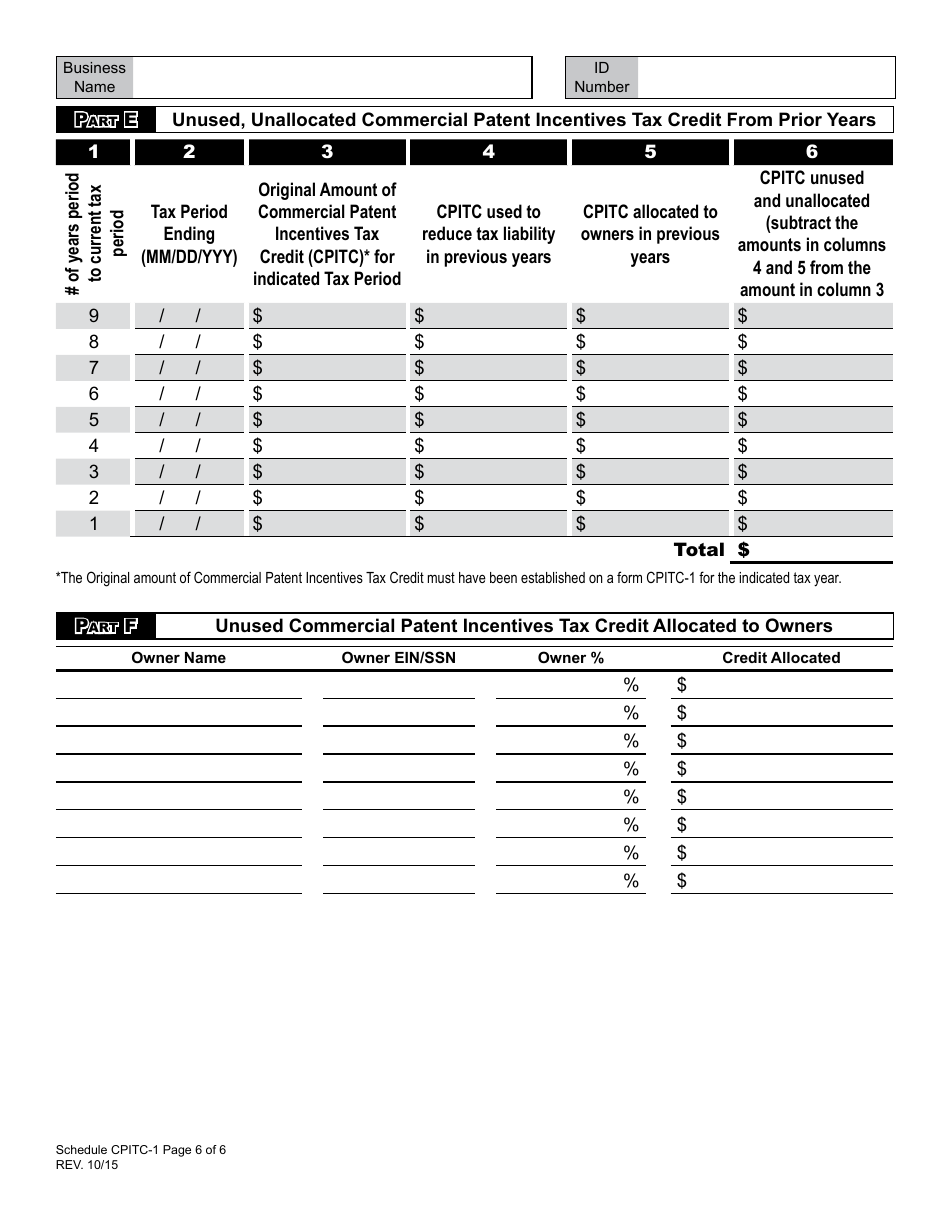

Schedule CPITC-1 Commercial Patent Incentives Tax Credit (For Periods After January 1, 2015) - West Virginia

What Is Schedule CPITC-1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CPITC-1?

A: CPITC-1 refers to the Commercial Patent Incentives Tax Credit.

Q: What is the purpose of CPITC-1?

A: The purpose of CPITC-1 is to provide tax incentives for commercialization of patents in West Virginia.

Q: When did CPITC-1 come into effect?

A: CPITC-1 is applicable for periods after January 1, 2015.

Q: Who is eligible for CPITC-1?

A: Eligibility for CPITC-1 is dependent on meeting certain criteria related to the commercialization of patents in West Virginia.

Q: What are the benefits of CPITC-1?

A: The benefits of CPITC-1 include tax credits for qualified expenses related to patent commercialization.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule CPITC-1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.