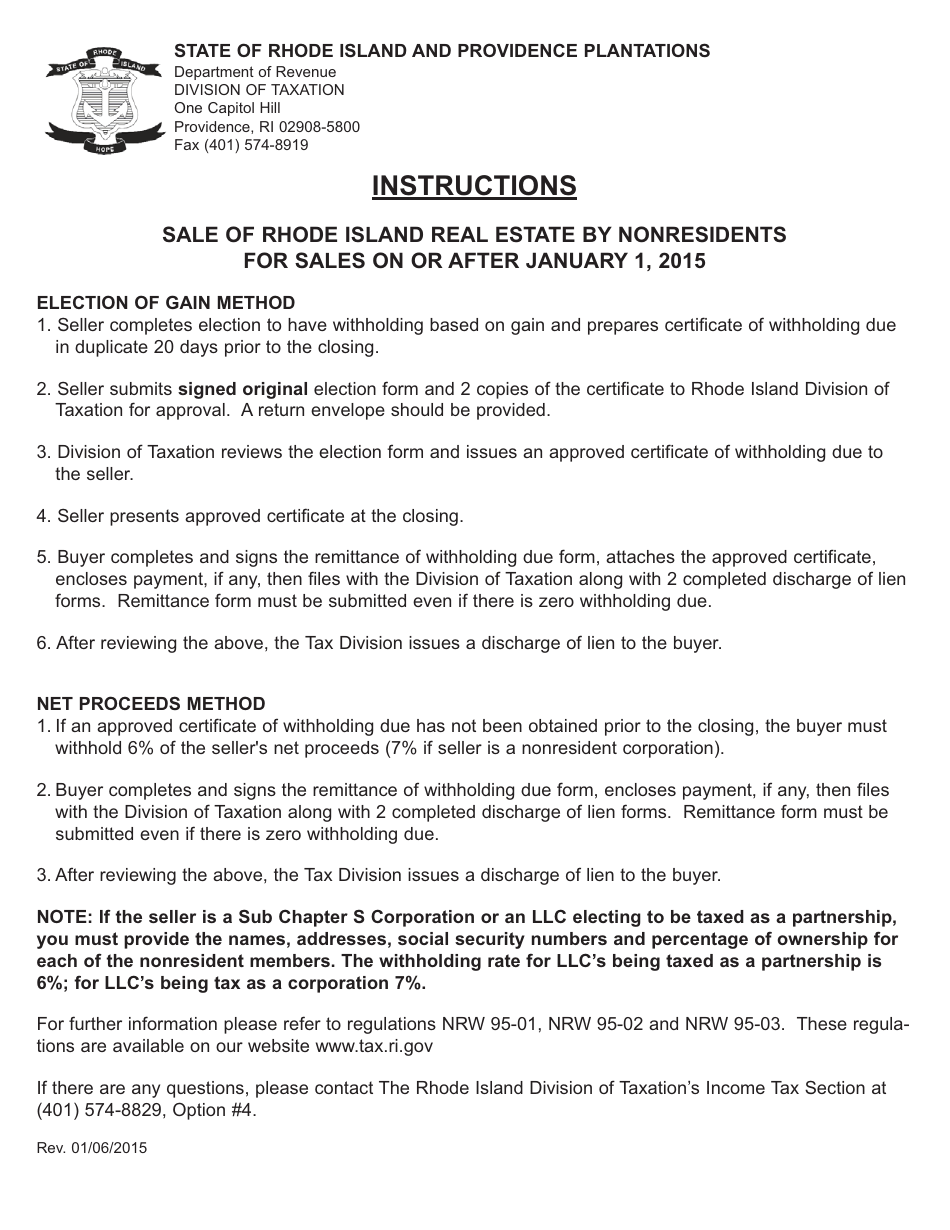

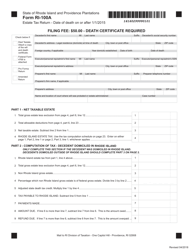

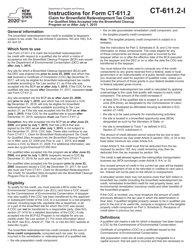

Instructions for Sale of Rhode Island Real Estate by Nonresidents for Sales on or After January 1, 2015 - Rhode Island

This document was released by Rhode Island Department of Revenue - Division of Taxation and contains the most recent official instructions for Sale of Rhode Island Real Estate by Nonresidents for Sales on or After January 1, 2015 .

FAQ

Q: What are the instructions for selling Rhode Island real estate?

A: The instructions are for nonresidents selling real estate in Rhode Island after January 1, 2015.

Q: When do these instructions apply?

A: These instructions apply for sales on or after January 1, 2015.

Q: Who do these instructions apply to?

A: These instructions apply to nonresidents who are selling real estate in Rhode Island.

Q: What is considered real estate in Rhode Island?

A: Real estate refers to land and any structures or improvements on the land.

Q: What are the requirements for nonresidents selling real estate in Rhode Island?

A: Nonresidents must comply with the instructions and requirements outlined by the state of Rhode Island.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Rhode Island Department of Revenue - Division of Taxation.