United States Tax Forms and Templates

Related Articles

Documents:

2432

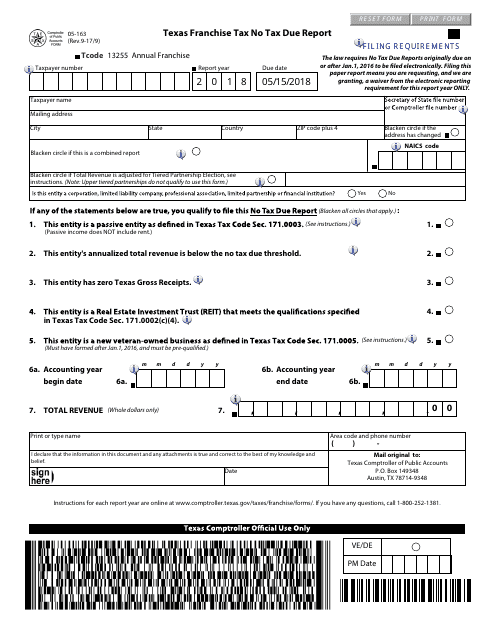

This is a legal document completed by a taxable entity that does not owe any taxes to the State of Texas for the report year. This form was released by the Texas Comptroller of Public Accounts.

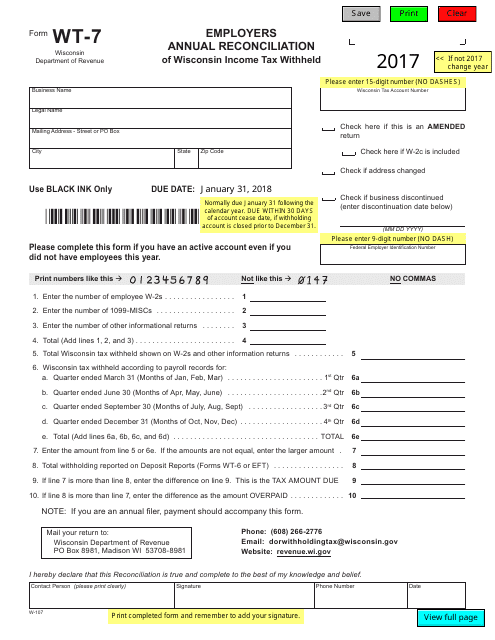

This Form is used for employers in Wisconsin to reconcile their annual income tax withholdings.

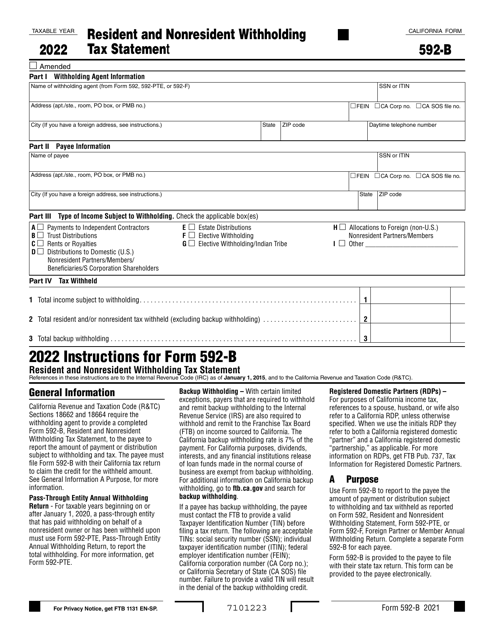

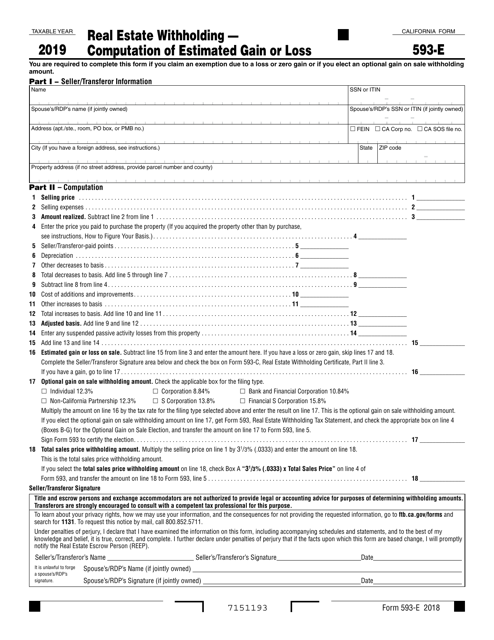

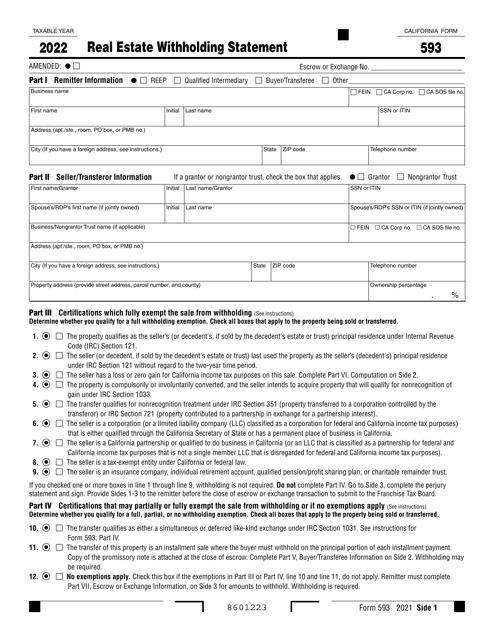

This is a California tax form required for all real estate sales or transfers for which you, the seller/ transferor, are claiming an exemption due to a loss or zero gain or if you elect an optional gain on sale withholding amount.

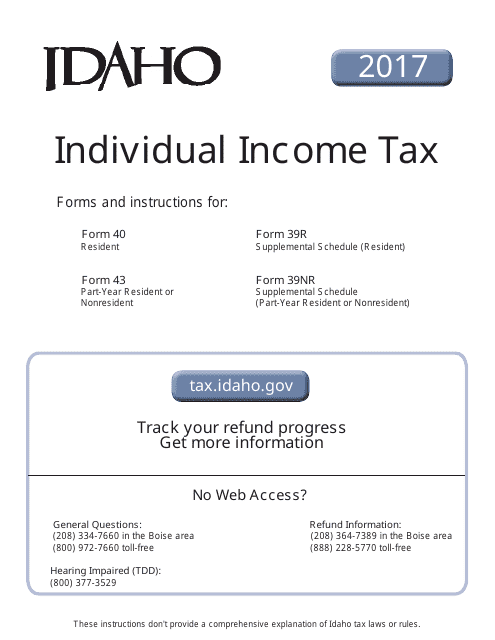

This Form is used for filing individual income tax returns in the state of Idaho. It includes instructions on how to fill out Form 40 for residents, Form 43 for part-year residents, and Form 39NR for nonresidents. The instructions provide guidance on what information to include, how to calculate taxable income, and how to claim deductions and credits.

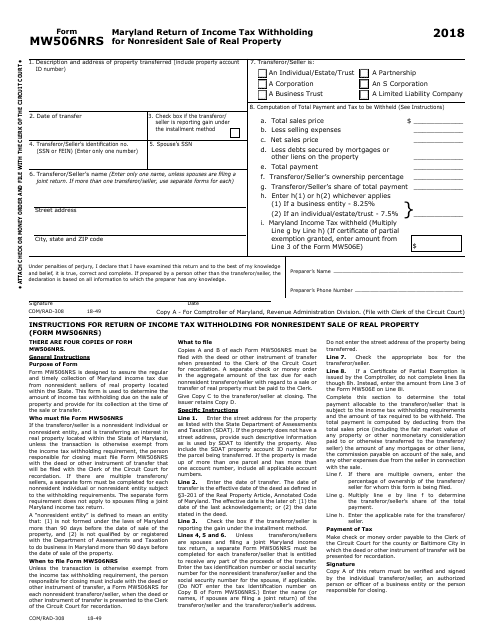

This form is used for reporting income tax withholding on the sale of real property in Maryland by nonresidents.

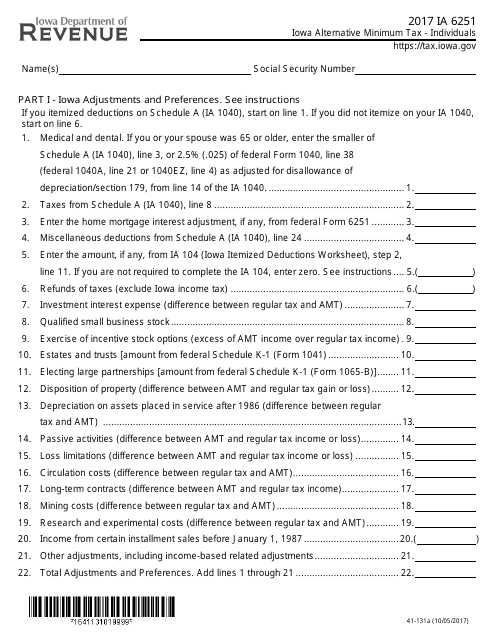

This Form is used for calculating the alternative minimum tax for individuals in the state of Iowa.

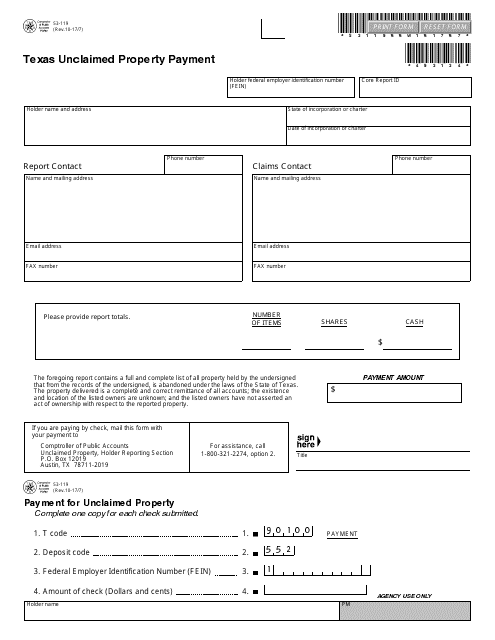

This form is used for making a payment related to unclaimed property in the state of Texas. It helps individuals or businesses to submit payments for abandoned or unclaimed property to the Texas Comptroller's office.

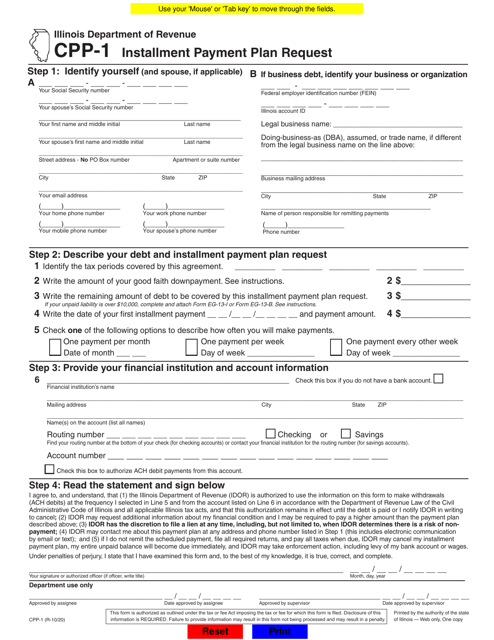

This Illinois form is filled out by taxpayers who have tax delinquencies they cannot pay in full. If you have a financial hardship and would like to sign an installment payment plan with the Department of Revenue, complete a CPP-1 Form.

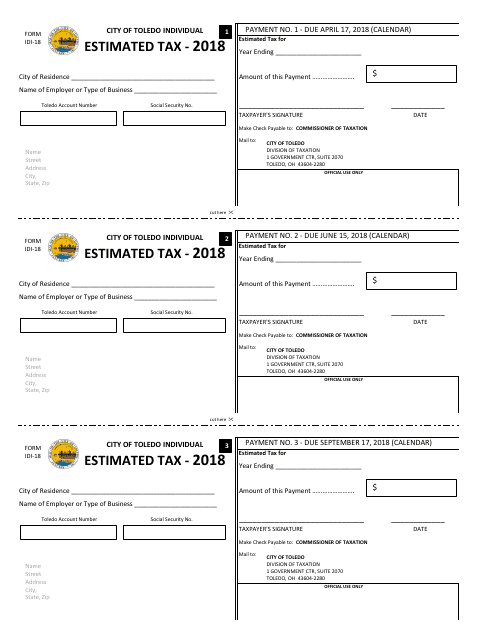

This form is used for individuals in Toledo, Ohio to submit their estimated taxes.

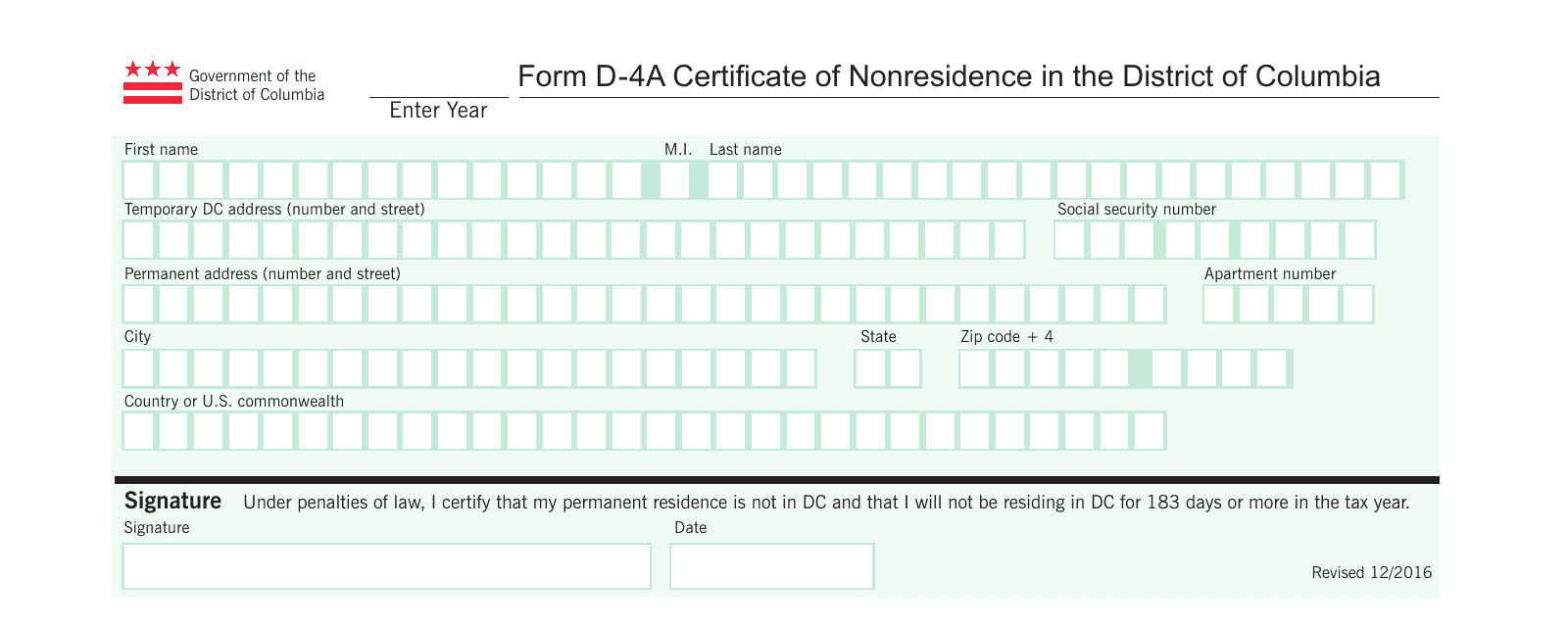

This Form is used for declaring nonresidence status in the District of Columbia for tax purposes.

This Form is used for filing Oklahoma Sales Tax Return in the state of Oklahoma.

This form is used for reporting and declaring quarterly franchise and excise taxes in the state of Tennessee.

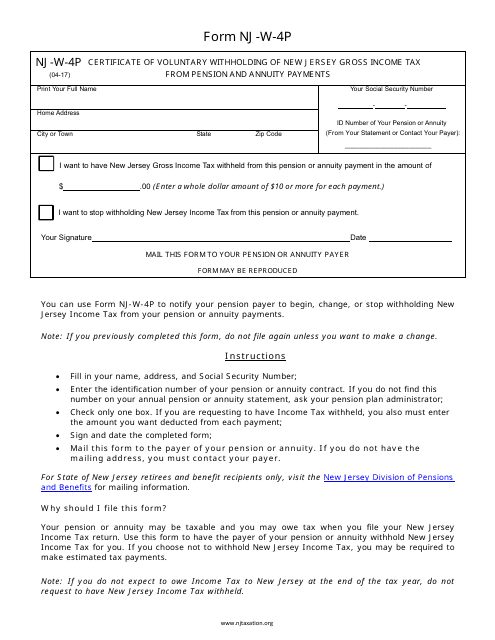

This Form is used for voluntary withholding of New Jersey Gross Income Tax from pension and annuity payments in the state of New Jersey. It allows individuals to request the withholding of a certain amount from their pension or annuity payments to cover their state income tax liability.

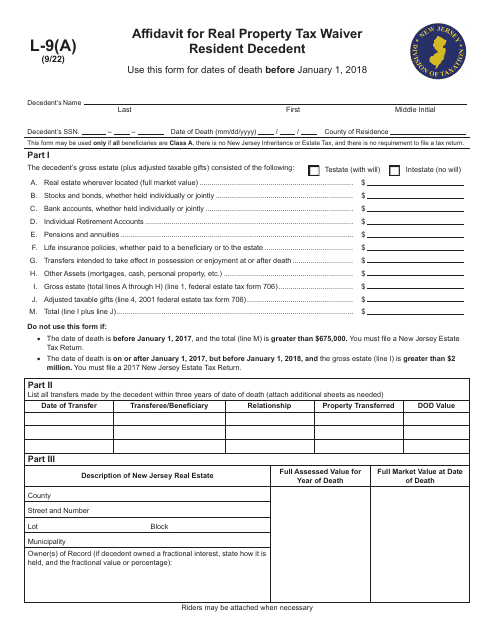

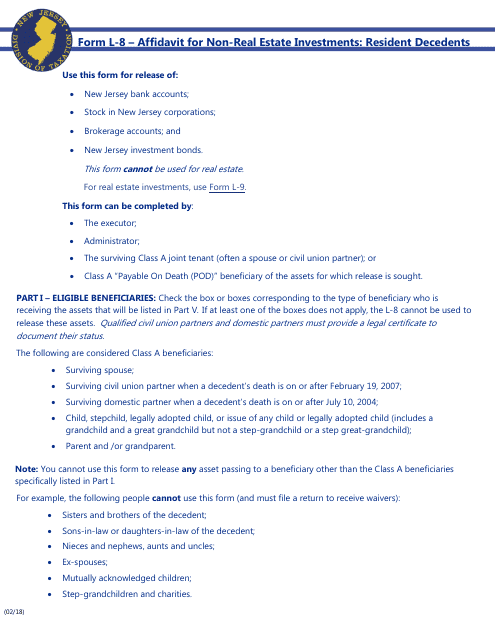

This form is used for New Jersey residents to declare their non-real estate investments in the event of a resident's death.