United States Tax Forms and Templates

Related Articles

Documents:

2432

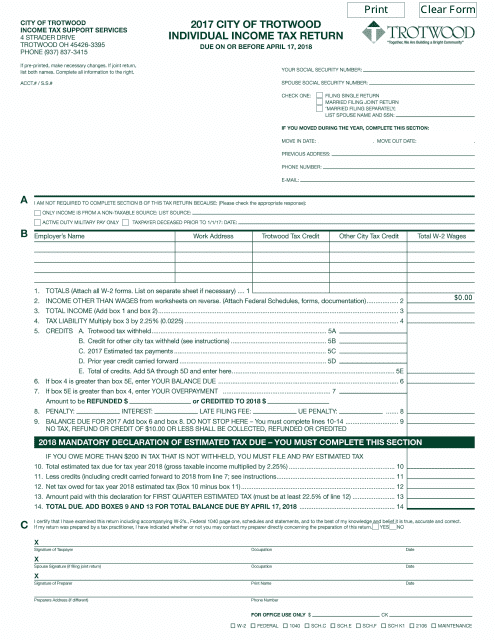

This form is used for filing individual income tax returns for residents of the City of Trotwood, Ohio.

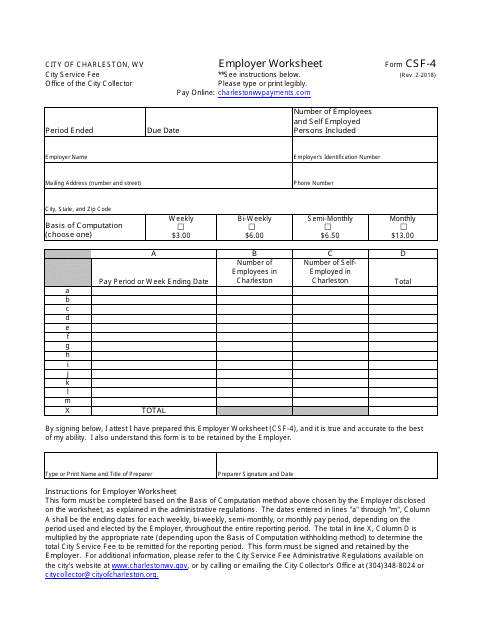

This form is used for employers in the City of Charleston, West Virginia to fill out and provide information related to their business.

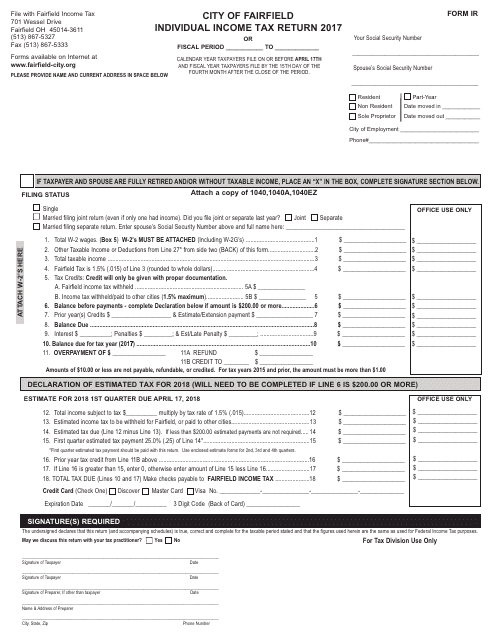

This form is used for filing an individual income tax return in the city of Fairfield, Ohio.

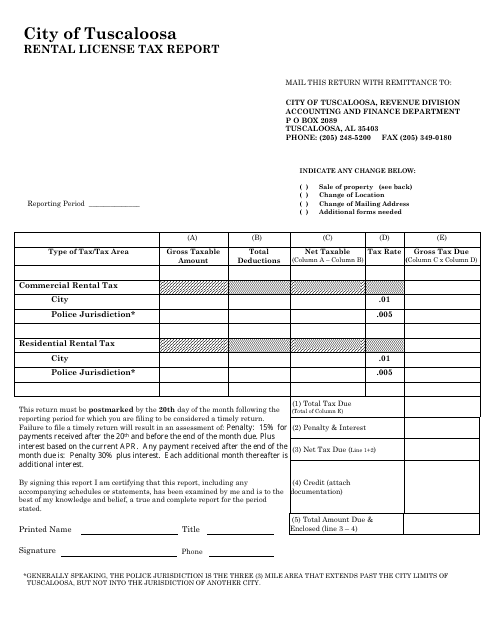

This document is a rental license tax report form specific to the City of Tuscaloosa, Alabama. It is used by rental property owners to report and pay taxes related to their rental income in the city.

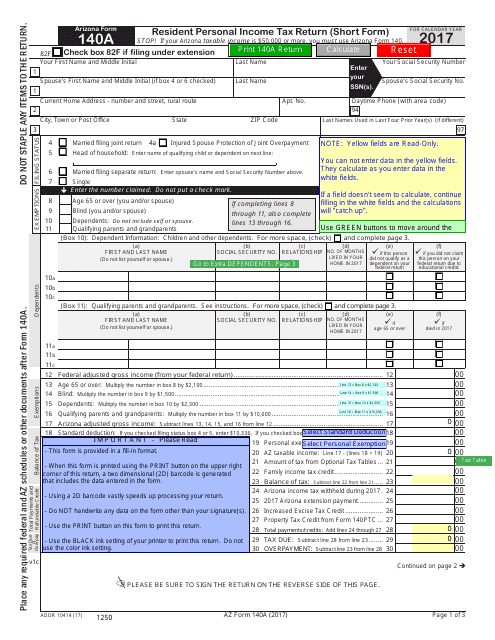

This Form is used for Arizona residents to file their personal income taxes using the short form.

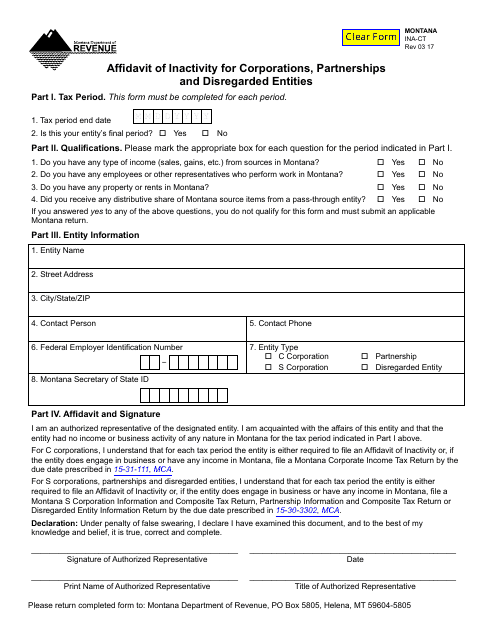

This form is used for declaring inactivity of corporations, partnerships, and disregarded entities in Montana.

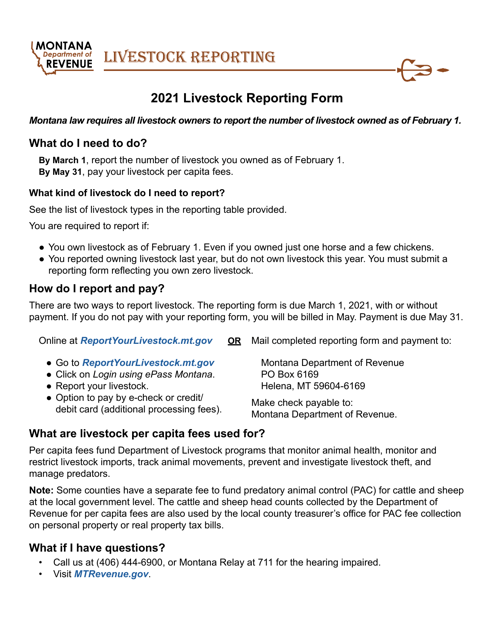

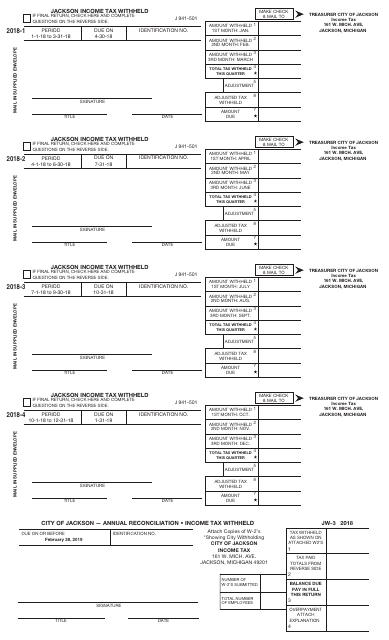

This form is used for reporting income tax withheld by employers in the City of Jackson, Michigan.

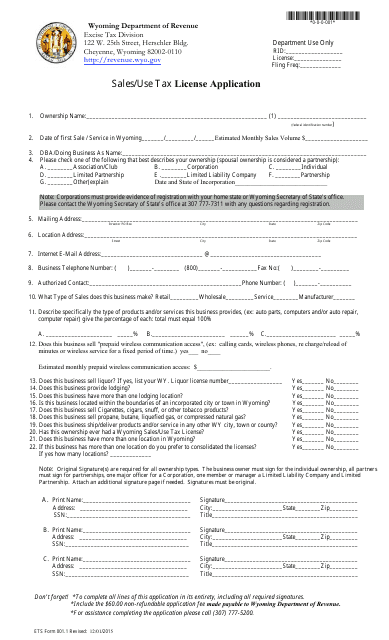

This form is used for applying for a sales and use tax license in the state of Wyoming.

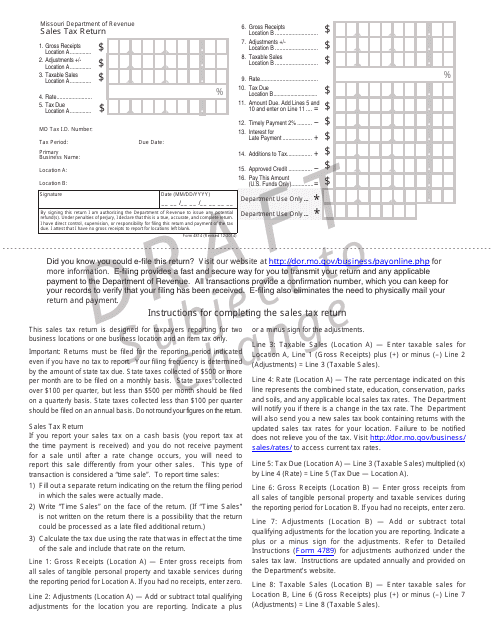

This Form is used for filing sales tax return in the state of Missouri.

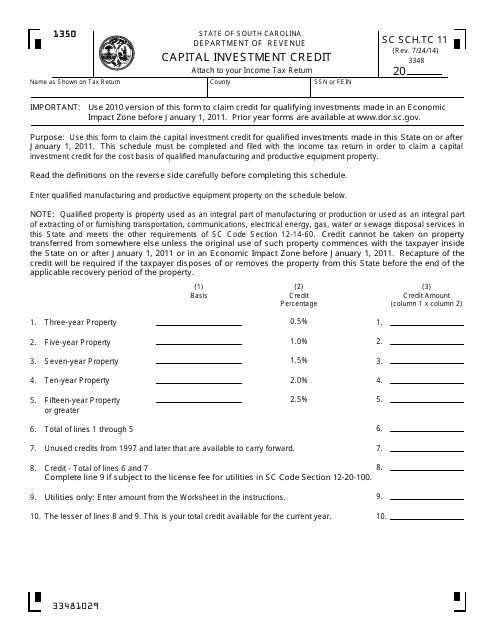

This Form is used for claiming the Capital Investment Credit in South Carolina.

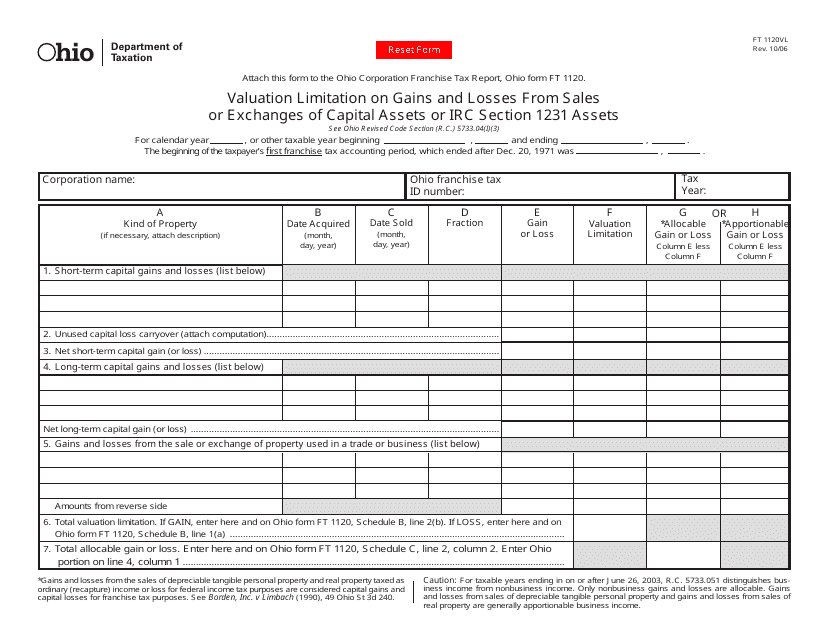

This form is used in Ohio to calculate the valuation limitation on gains and losses from sales or exchanges of capital assets or IRC Section 1231 assets.

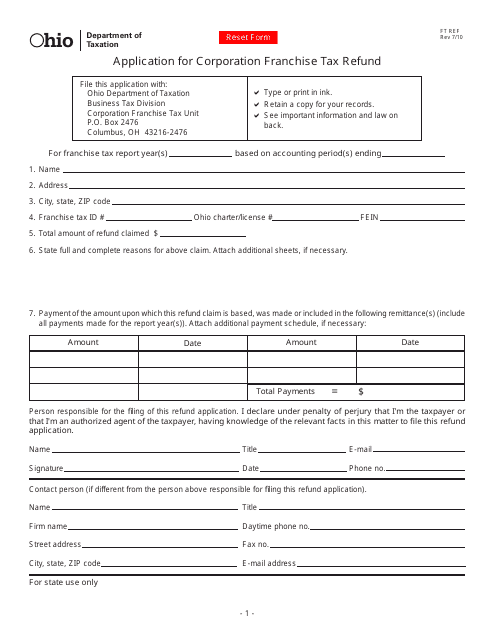

This Form is used for corporations in Ohio to apply for a refund of their franchise tax payments.

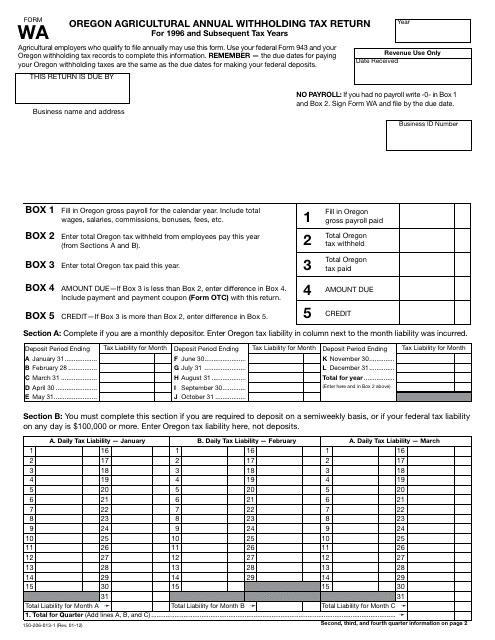

This document is used for reporting and paying the annual withholding tax for agricultural businesses in the state of Oregon.

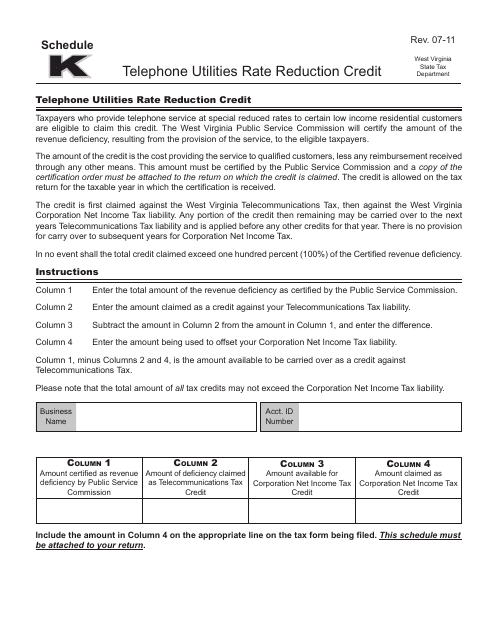

This Form is used for claiming the Telephone Utilities Rate Reduction Credit in West Virginia. This credit may help reduce the amount of tax you owe on your telephone bill.

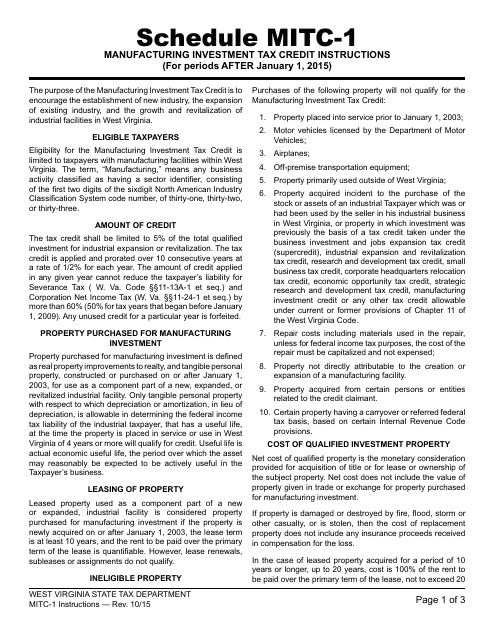

This Form is used to claim a tax credit for manufacturing investment in West Virginia for periods after January 1, 2015. It provides instructions on how to fill out the form and what documentation is required.

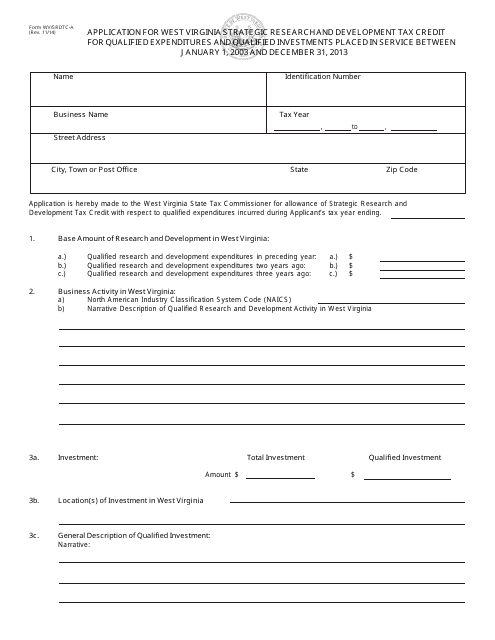

This Form is used for applying for the West Virginia Strategic Research and Development Tax Credit. It applies to qualified expenditures and qualified investments placed in service on or after January 1, 2003.

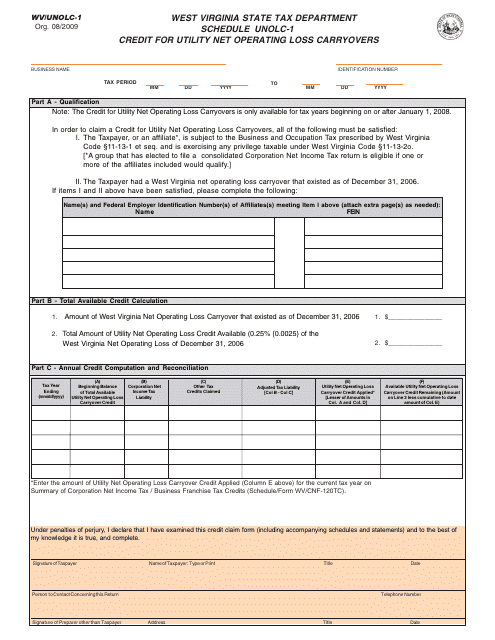

This form is used for claiming credits for utility net operating loss carryovers in West Virginia.

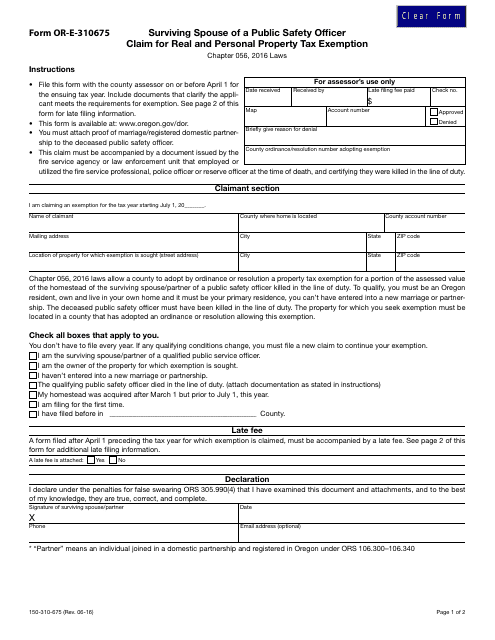

This form is used for a surviving spouse of a public safety officer to claim a real and personal property tax exemption in the state of Oregon.

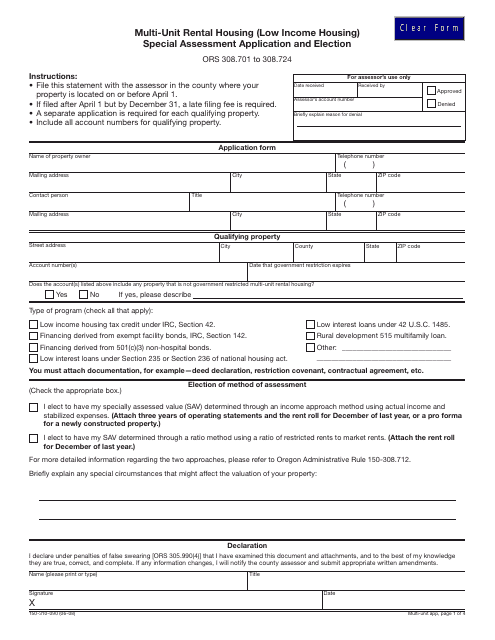

Form 150-310-090 Multi-Unit Rental Housing Special Assessment Application and Election Form - Oregon

This Form is used for applying for special assessment and conducting elections for multi-unit rental housing in Oregon.

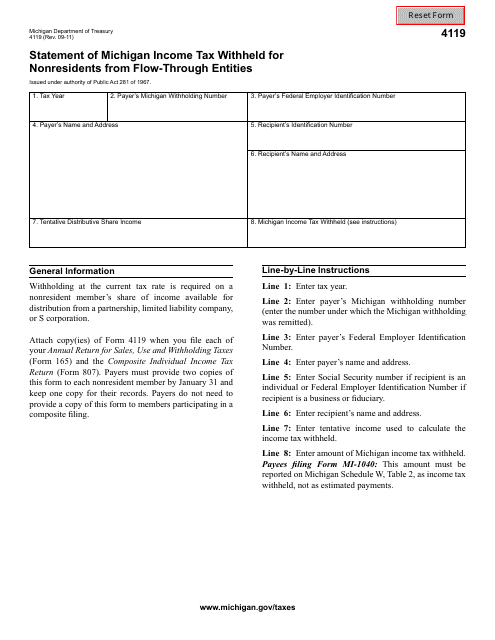

This Form is used for reporting income tax withheld from nonresidents in Michigan by flow-through entities.

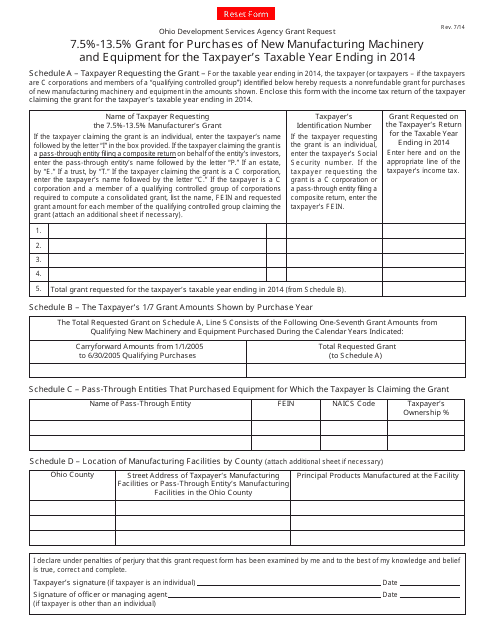

This form is used to apply for a grant of 7.5%-13.5% for the purchase of new manufacturing machinery and equipment in Ohio for the taxpayer's taxable year ending in 2014.

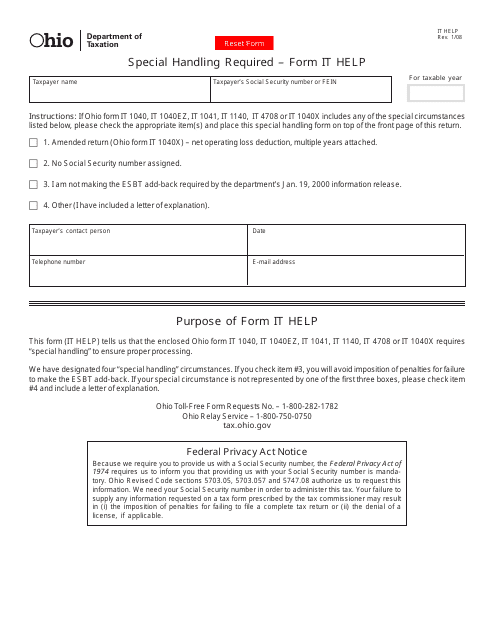

This Form is used for IT support requests from Ohio residents that require special handling.

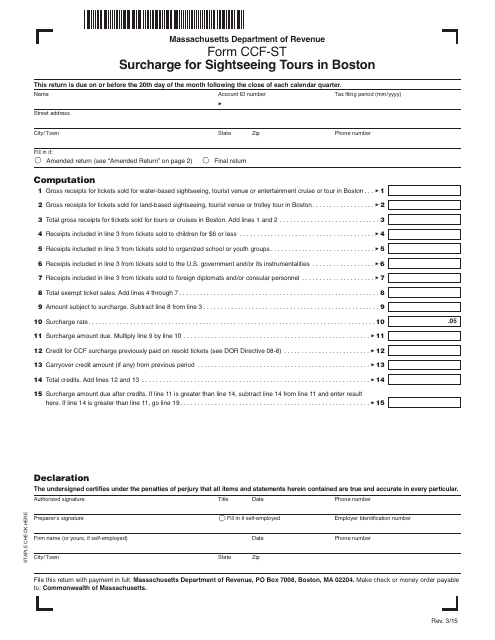

This Form is used for paying surcharges for sightseeing tours in Boston, Massachusetts.

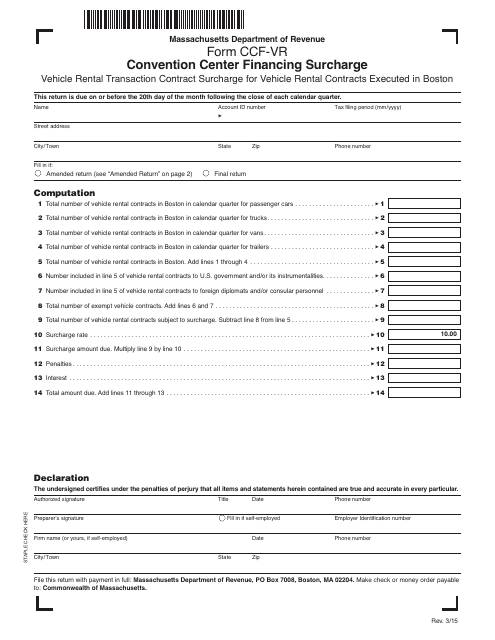

This form is used for the Convention Center Financing Surcharge in Massachusetts.

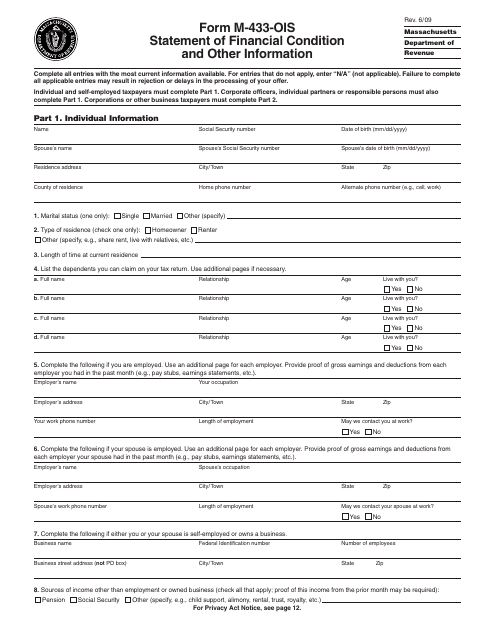

This form is used for individuals in Massachusetts to provide their financial information and other relevant details.

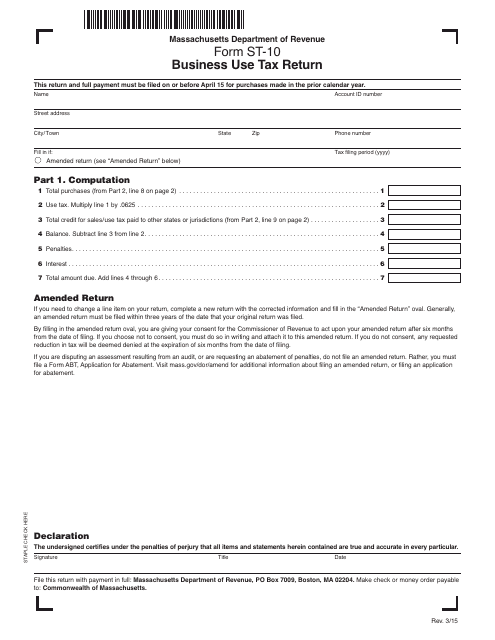

This form is used for reporting and paying business use tax in the state of Massachusetts.