United States Tax Forms and Templates

Related Articles

Documents:

2432

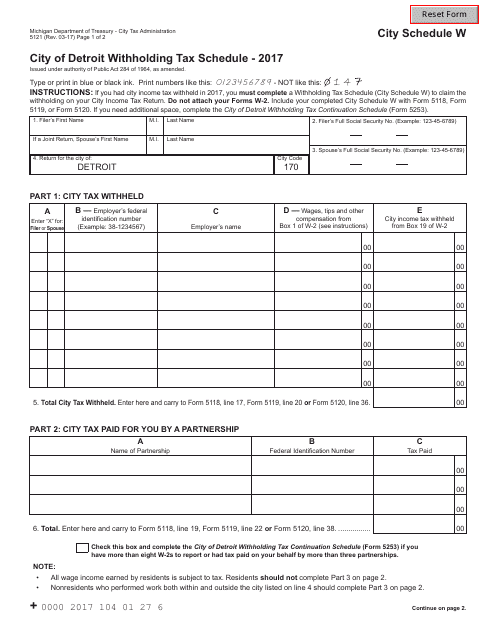

This form is used for reporting and calculating the withholding tax for City of Detroit residents in Michigan.

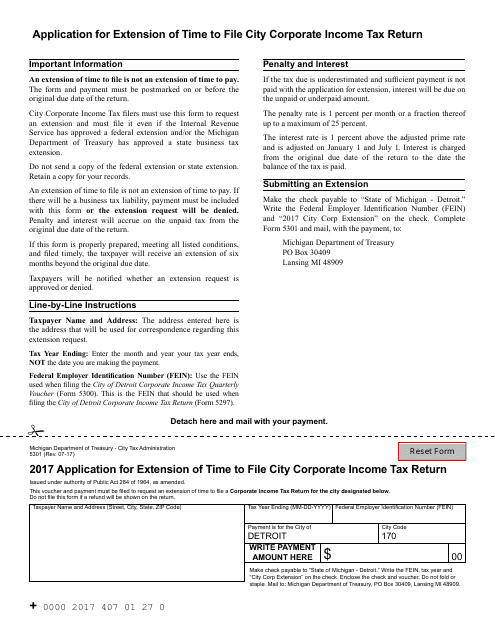

This document is for businesses in the City of Detroit, Michigan who need more time to file their city corporate income tax return.

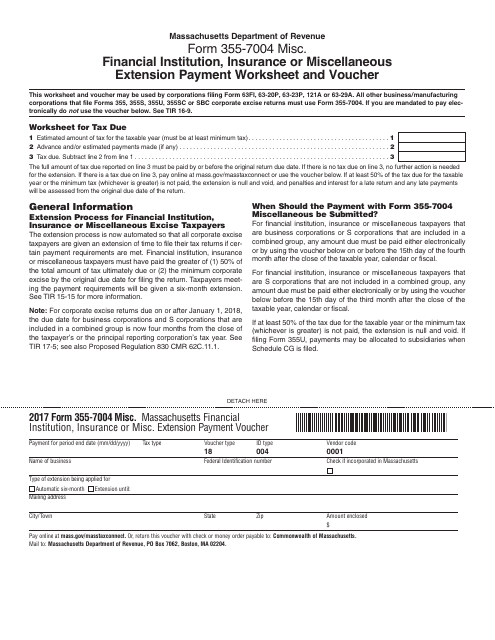

This form is used for making extension payments for financial institutions, insurance companies, or other miscellaneous entities in Massachusetts. It serves as a worksheet and voucher for making the payment.

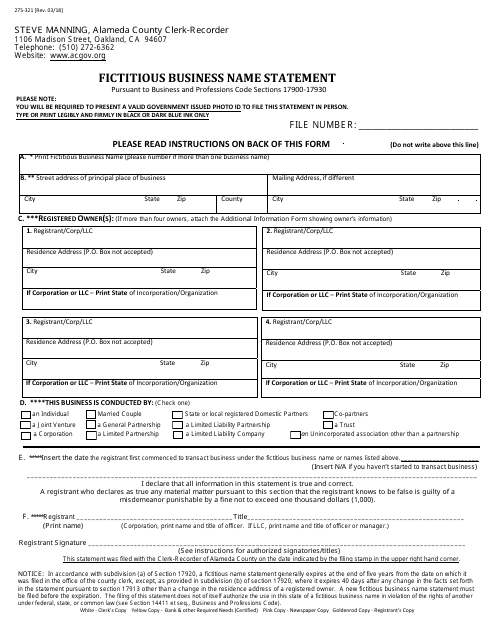

This Form is used for filing a Fictitious Business Name Statement in Alameda County, California.

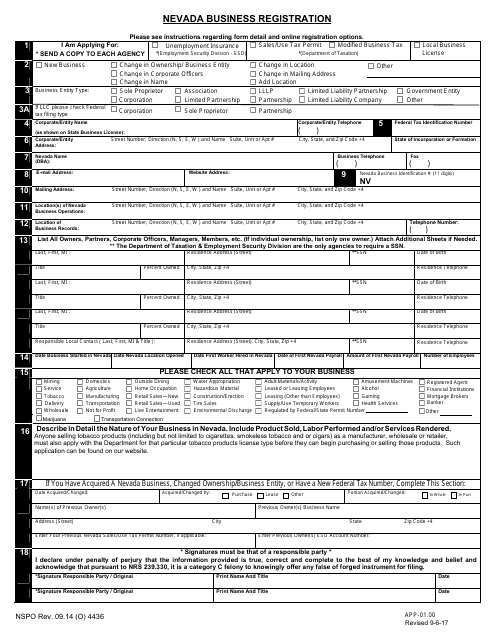

This Form is used for registering a business in Nevada.

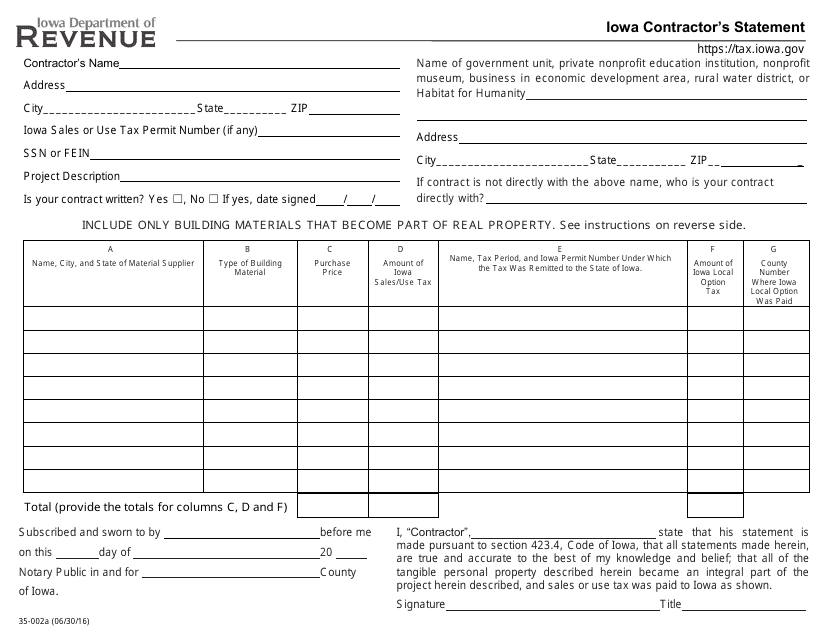

This form is used for Iowa contractors to provide a statement regarding their work.

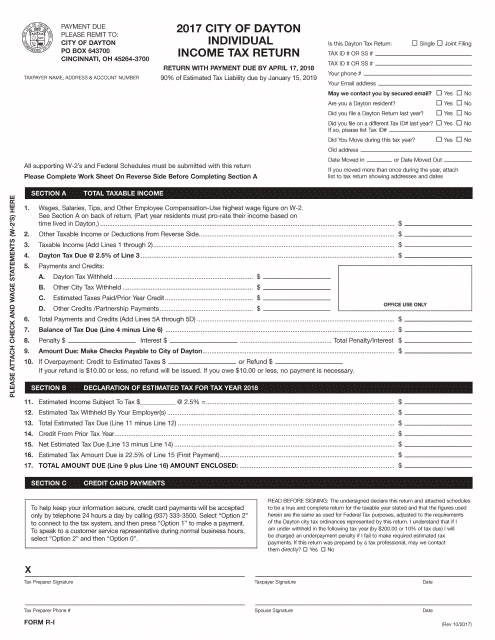

This form is used to report individual income tax return for residents of the City of Dayton, Ohio.

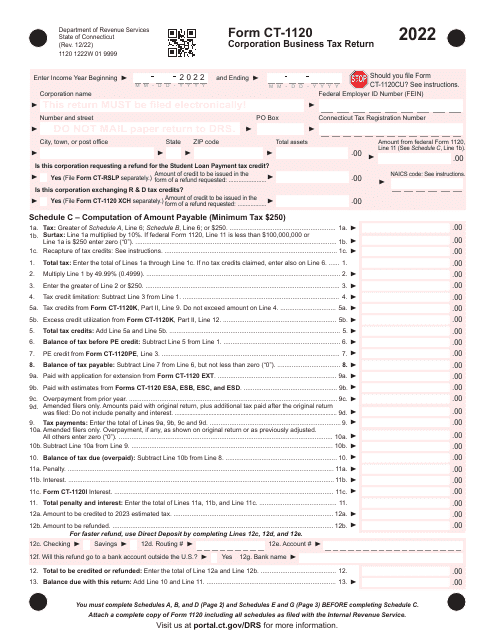

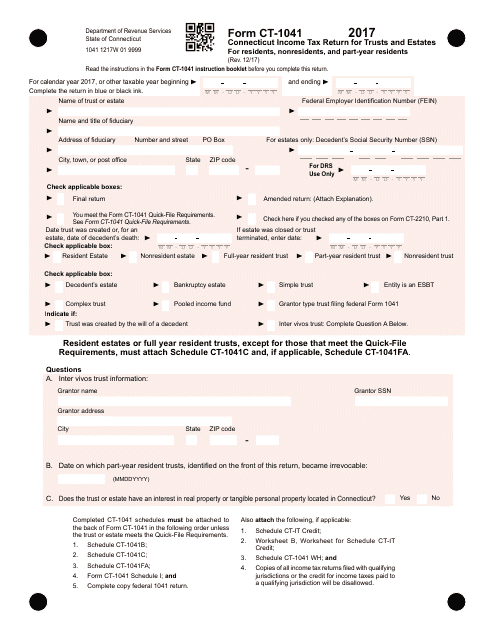

This Form is used for filing Connecticut state income tax return for trusts and estates. It is applicable for residents, nonresidents, and part-year residents in Connecticut.

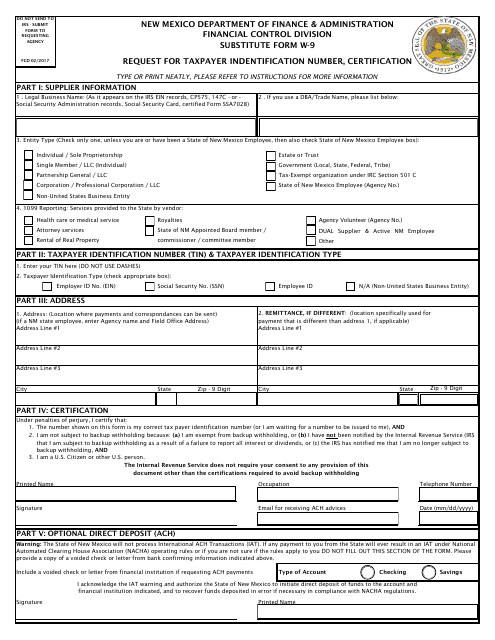

This form is used for requesting taxpayer identification number and certification for individuals or businesses in New Mexico.

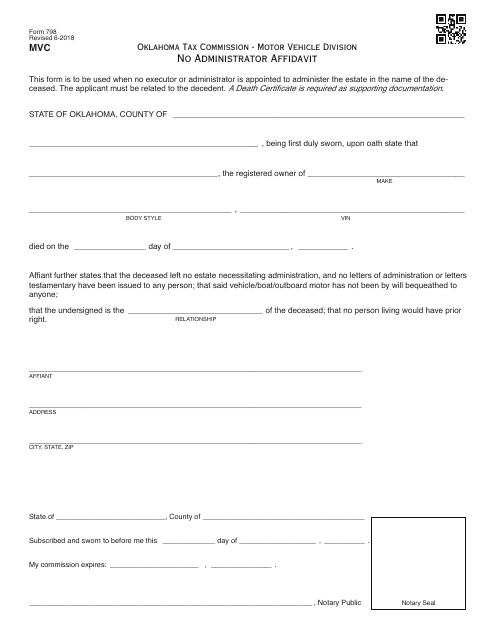

This document is used for filing an affidavit in Oklahoma when there is no administrator for a certain matter.

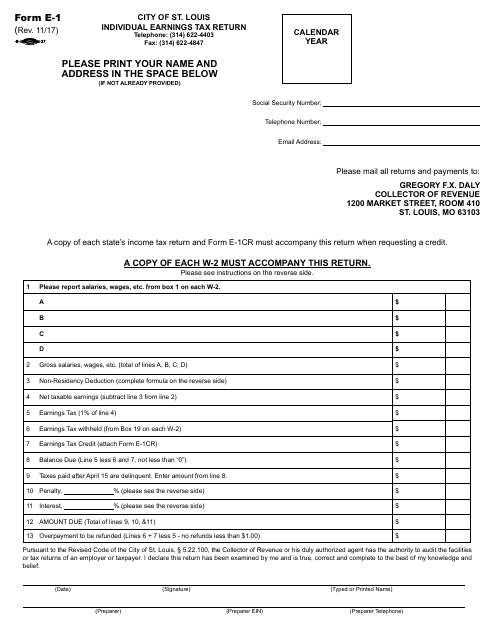

This document is for individuals in the City of St. Louis, Missouri, to file their earnings tax return.

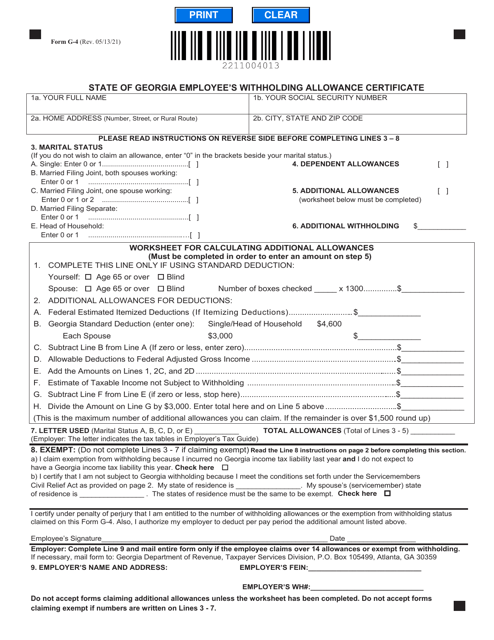

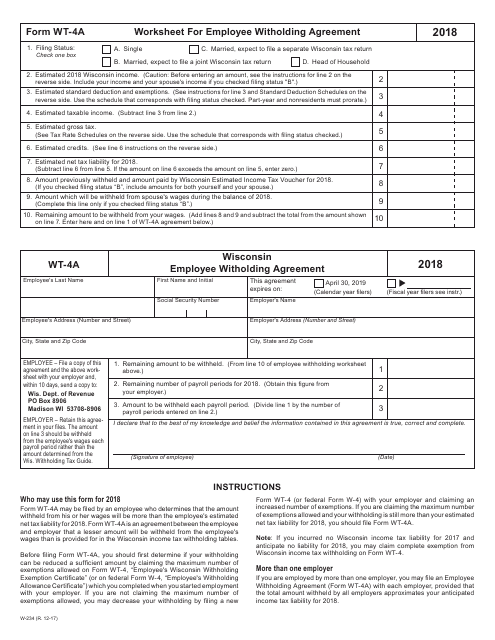

This Form is used for calculating employee withholding agreement in Wisconsin.

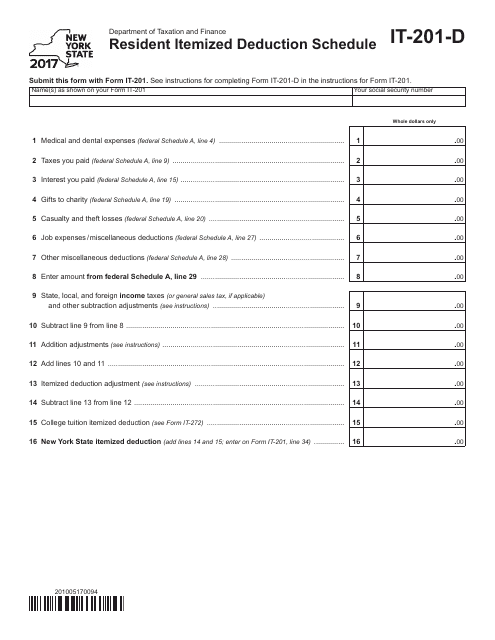

This form is used for reporting itemized deductions for residents of New York on their state tax return.

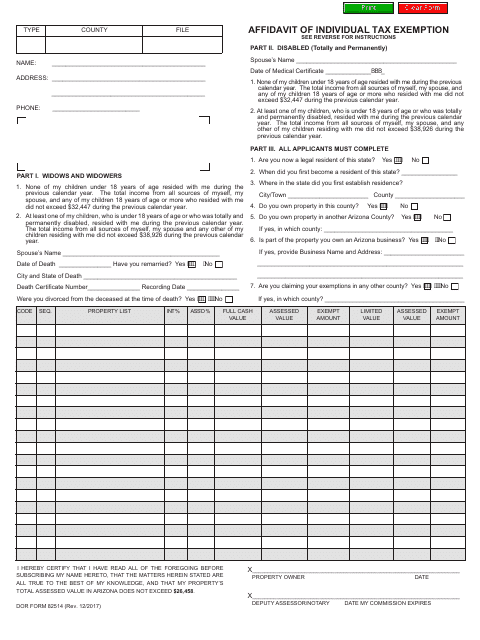

This form is used for individuals in Arizona to claim a tax exemption.

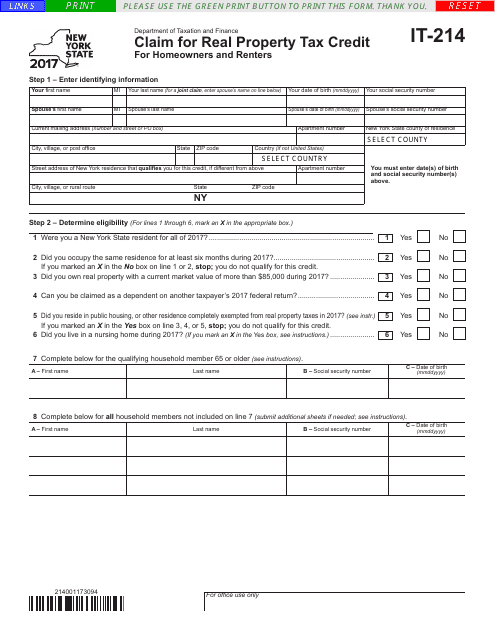

This form is used for claiming a real property tax credit in New York. It allows residents to receive a credit for the taxes they paid on their residential property.

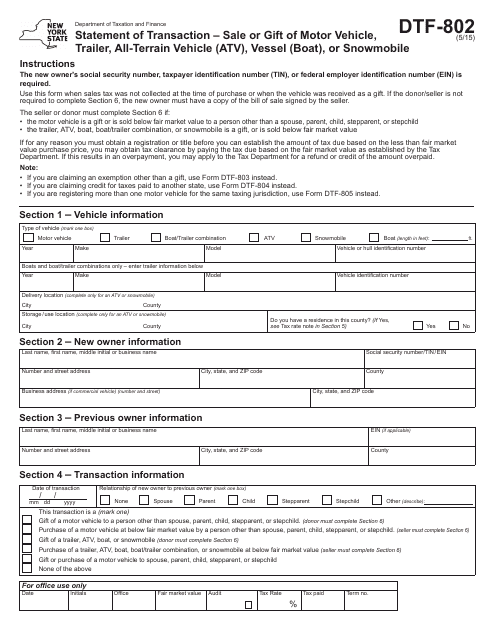

This form is a legal document signed in New York State when a vehicle is received as a gift or when sales tax was not collected at the time of the transaction.

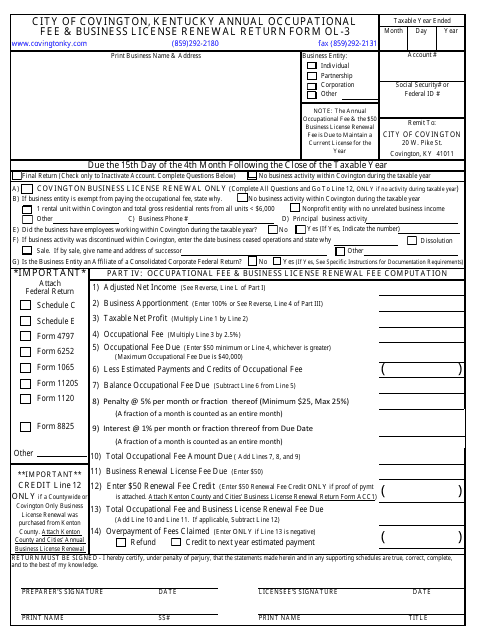

This form is used for renewing the annual occupational fee and business license in the City of Covington, Kentucky.

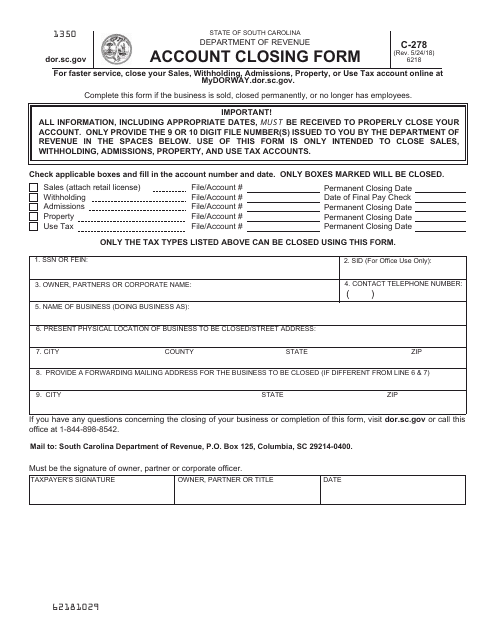

This Form is used for closing a financial account in South Carolina.

This Form is used for filing income tax returns specifically for residents of the city of Brunswick, Ohio.

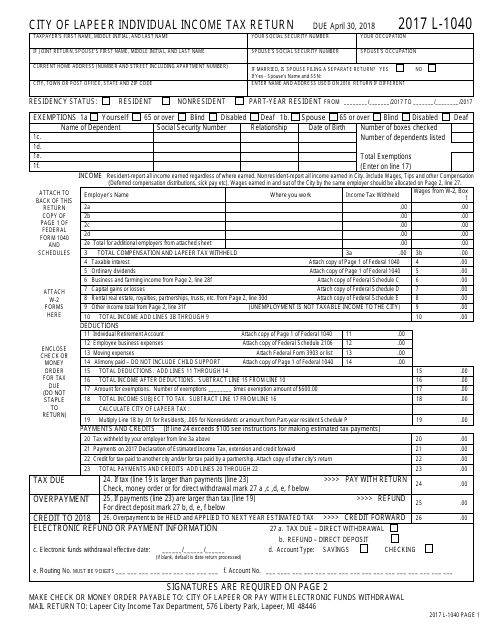

This Form is used for filing your individual income tax return in the CITY OF LAPEER, Michigan.

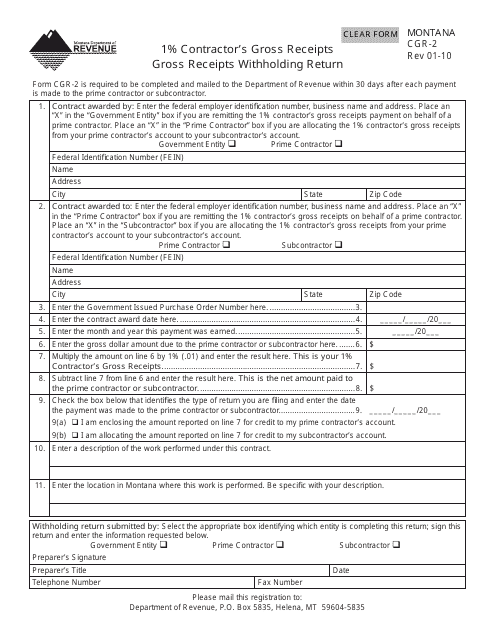

This form is used for filing and reporting 1% withholding tax on contractors' gross receipts in Montana.

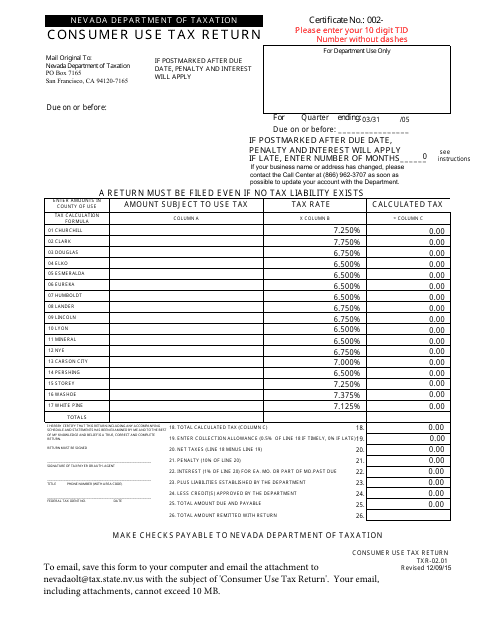

This Form is used for reporting and paying consumer use tax in the state of Nevada.

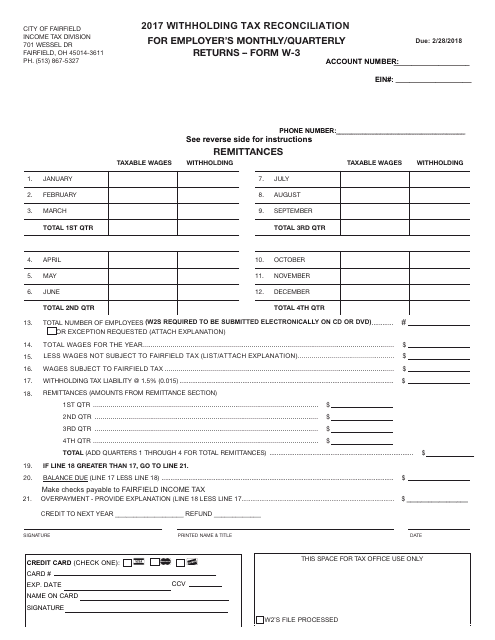

This form is used by employers in Fairfield, Ohio to reconcile withholding taxes from their monthly or quarterly returns. It helps ensure accurate reporting and payment of taxes to the city.

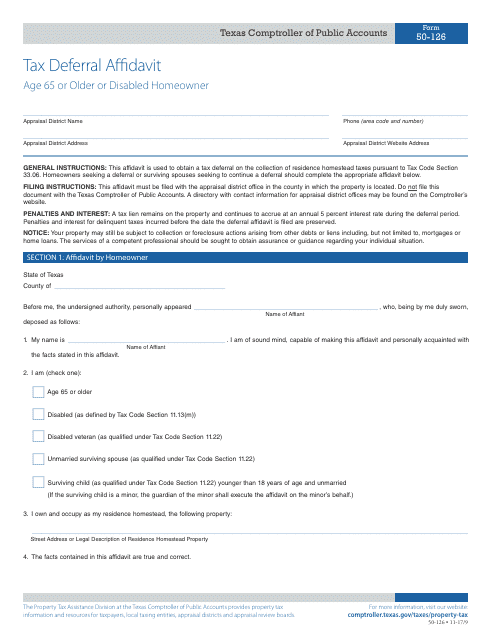

This form is used for requesting a tax deferral for homeowners in Texas who are 65 years or older or who have a disability.

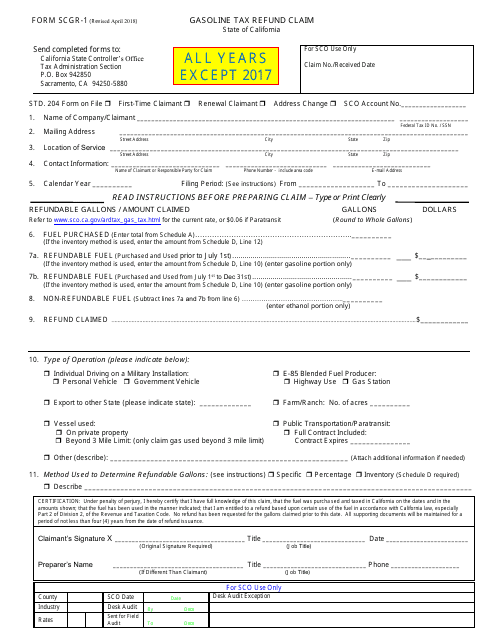

This Form is used for claiming a refund of gasoline tax in California.

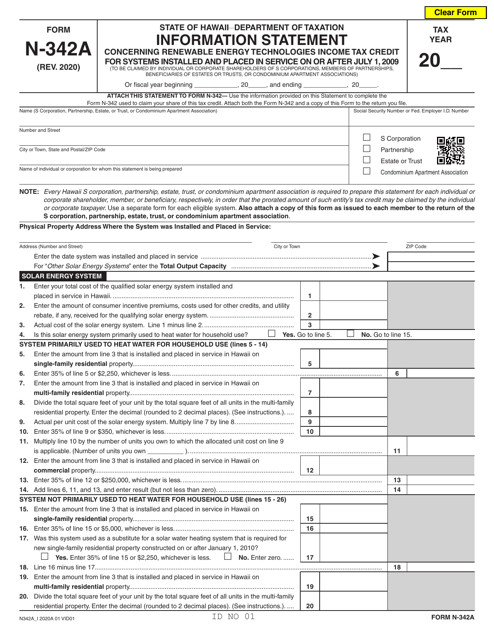

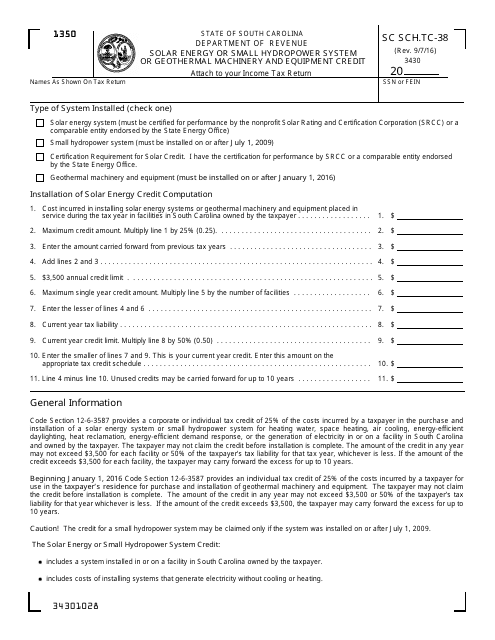

This Form is used for claiming the Solar Energy or Small Hydropower System or Geothermal Machinery and Equipment Credit in South Carolina.

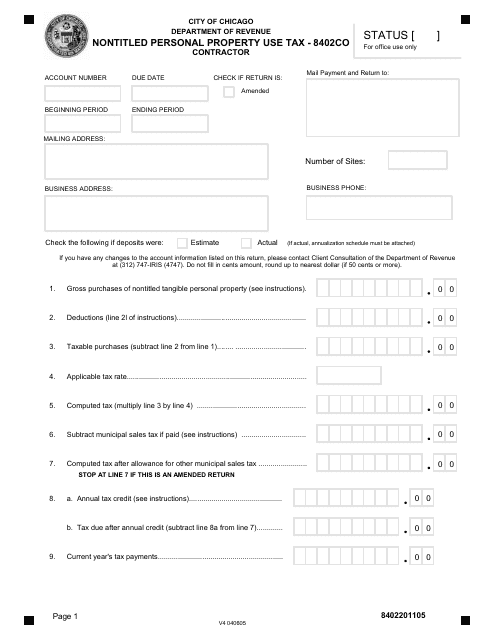

This form is used for reporting and paying the nontitled personal property use tax in the City of Chicago, Illinois.