United States Tax Forms and Templates

Related Articles

Documents:

2432

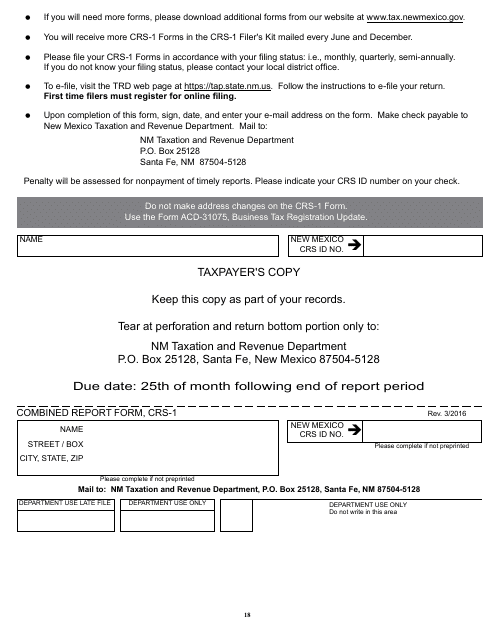

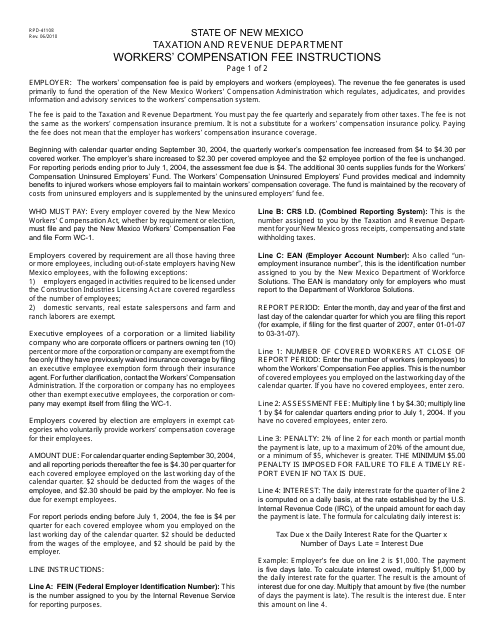

This form is used for submitting a combined report in the state of New Mexico. It allows businesses to report their financial information and activities to the appropriate authorities.

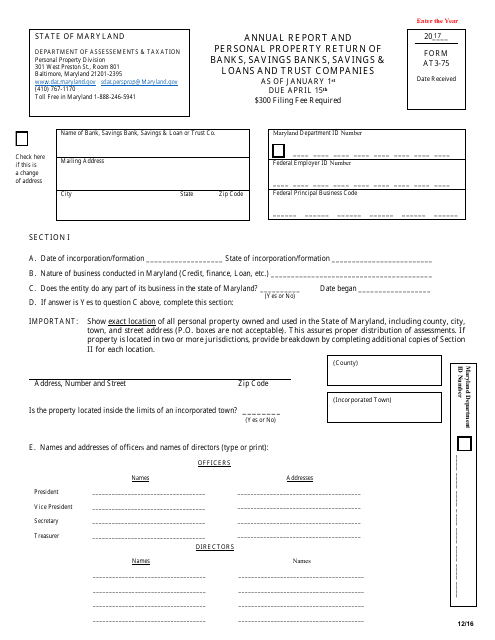

This Form is used for banks, savings banks, savings & loans and trust companies in Maryland to file their annual report and personal property return.

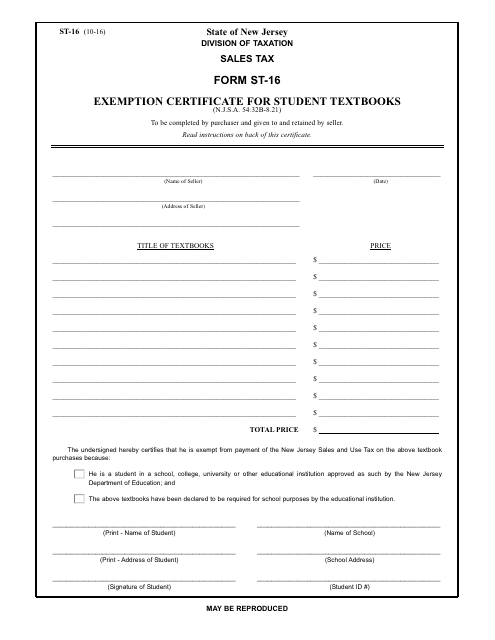

This form is used for requesting an exemption from sales tax on student textbooks in New Jersey.

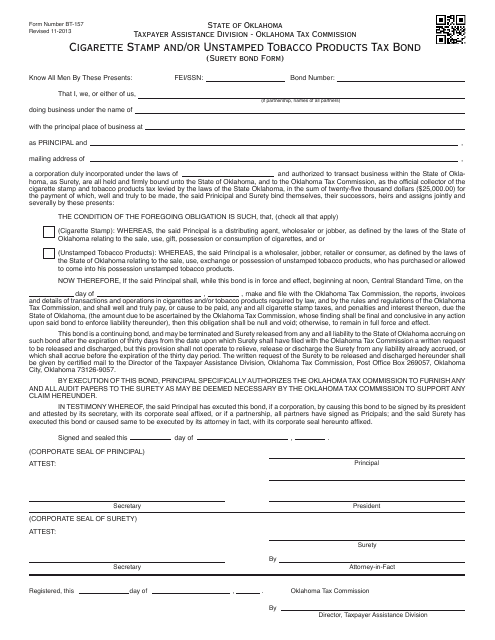

This form is used for a Cigarette Stamp and/or Unstamped Tobacco Products Tax Bond in Oklahoma. It is a surety bond form required for certain businesses selling cigarettes or tobacco products in the state.

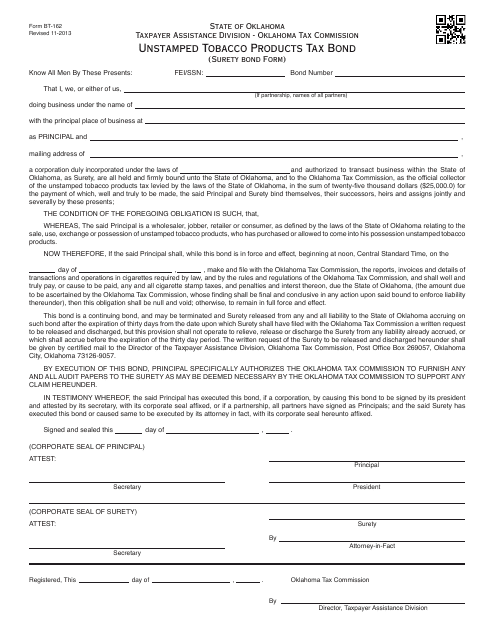

This document is used for obtaining an unstamped tobacco products tax bond in Oklahoma.

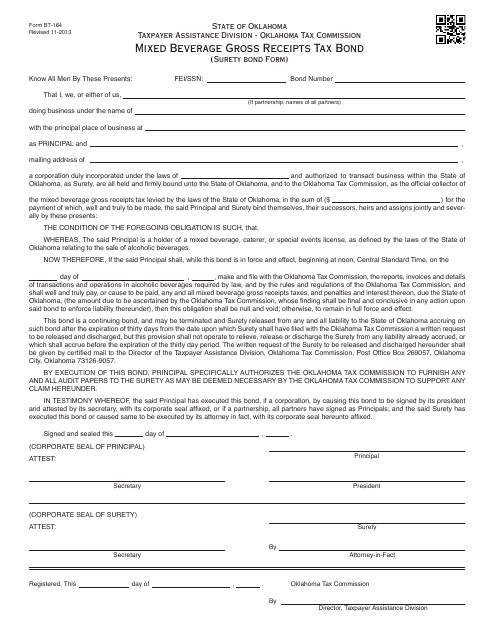

This document is used for obtaining a surety bond for the Mixed Beverage Gross Receipts Tax in Oklahoma. It is known as Form BT-164 and is used for compliance with tax regulations.

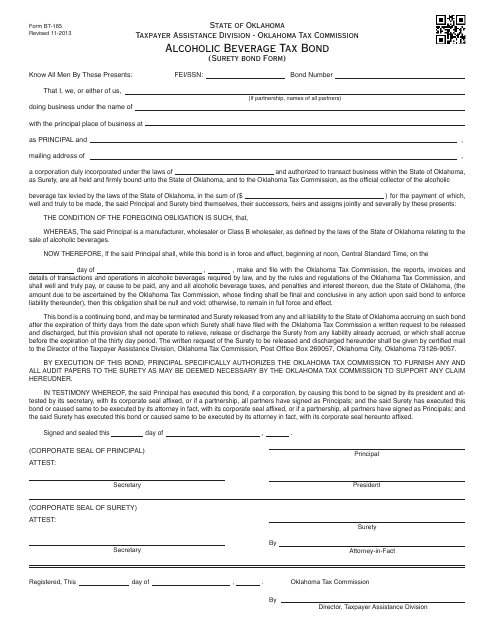

This Form is used for obtaining an Alcoholic Beverage Tax Bond (Surety Bond) in Oklahoma.

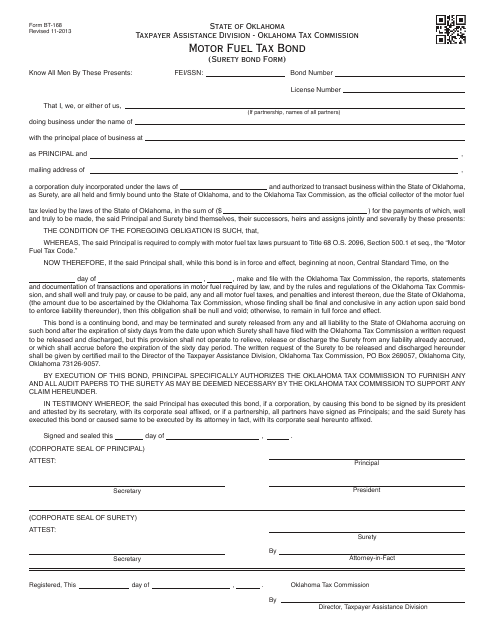

This Form is used for obtaining a Motor Fuel Tax Bond (Surety Bond) in Oklahoma for businesses that sell motor fuel over-the-counter. This bond ensures that the business complies with state laws and regulations regarding motor fuel taxes.

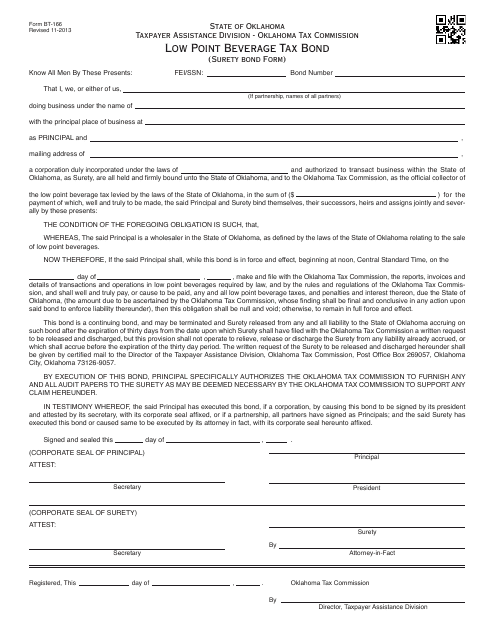

This document is for obtaining a surety bond for the Low Point Beverage Tax in Oklahoma.

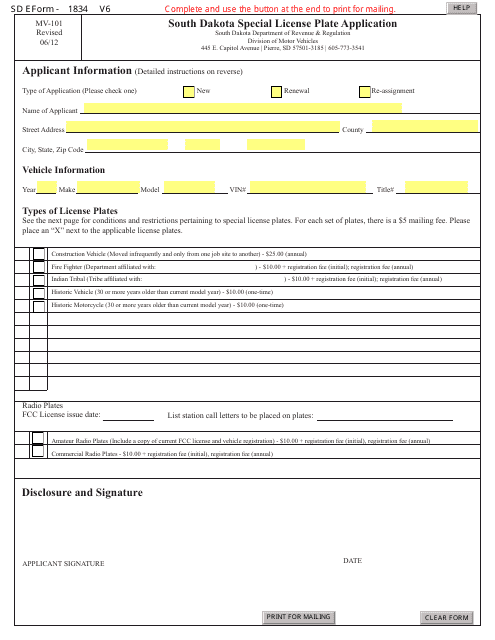

This Form is used for applying for special license plates in South Dakota.

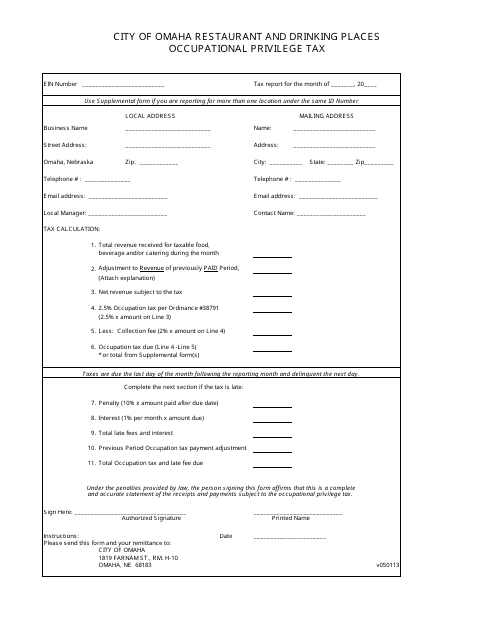

This form is used for filing the Occupational Privilege Tax for restaurants and drinking places located in Omaha, Nebraska.

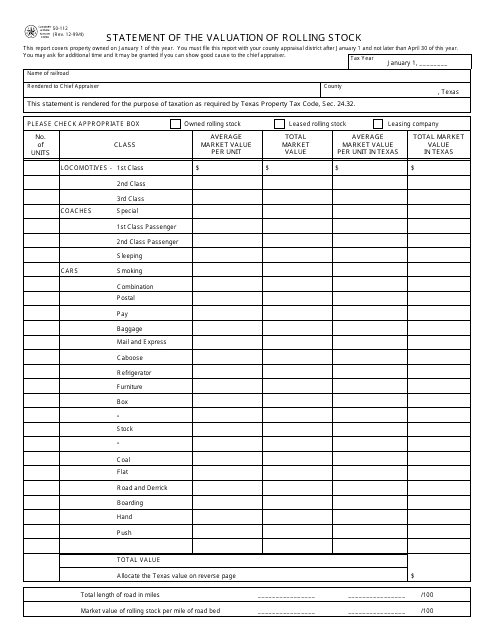

This form is used for reporting the valuation of rolling stock, such as locomotives and freight cars, in the state of Texas.

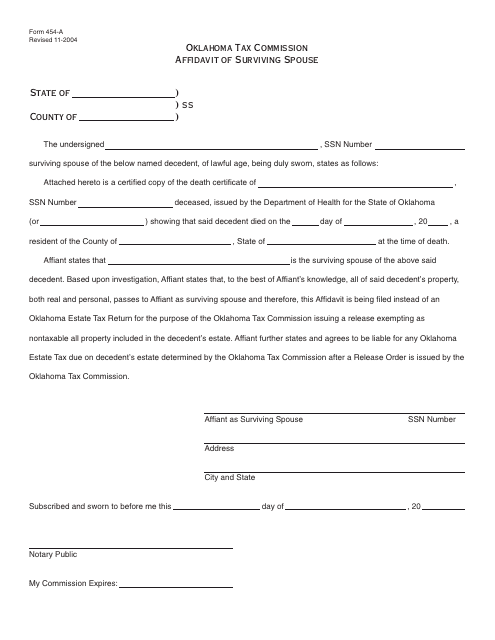

This form is used for a surviving spouse in Oklahoma to declare their status in order to claim certain benefits or rights.

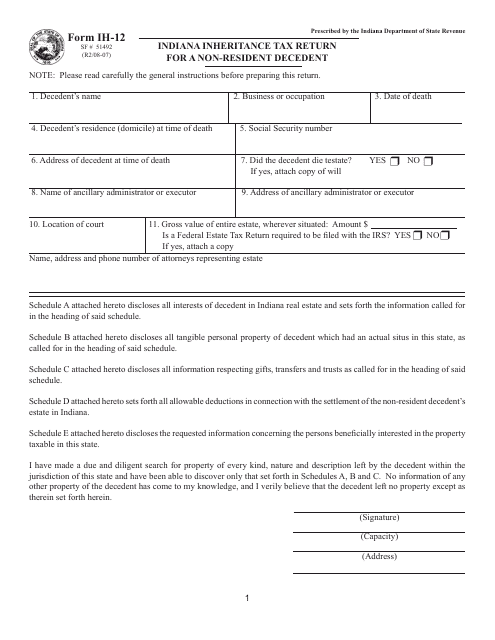

This form is used for filing an Indiana inheritance tax return for a non-resident decedent in Indiana.

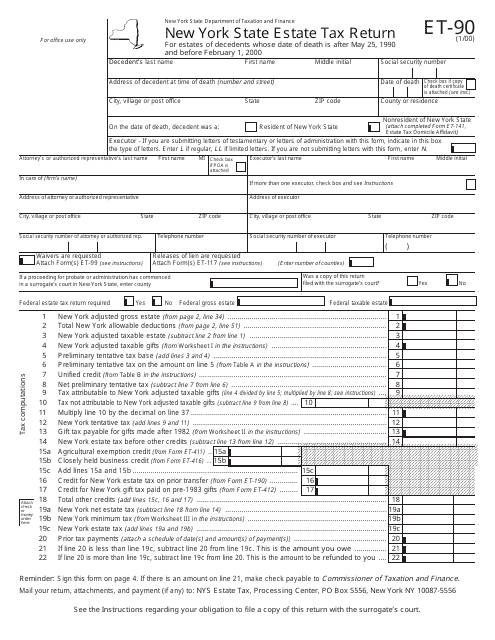

This form is used for reporting and paying estate taxes in the state of New York.

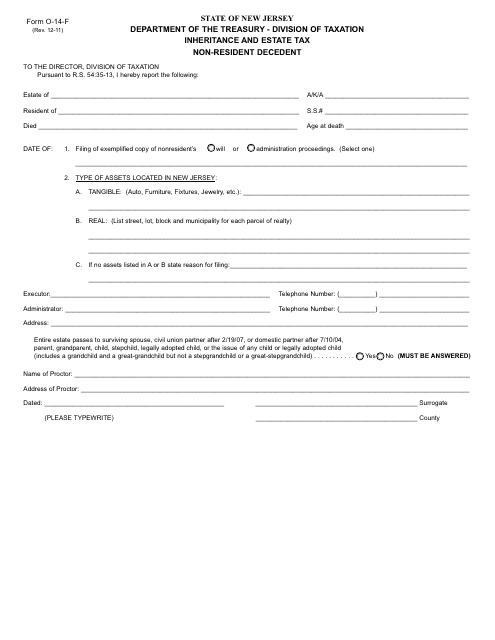

This form is used for reporting inheritance and estate taxes for non-resident decedents in the state of New Jersey.

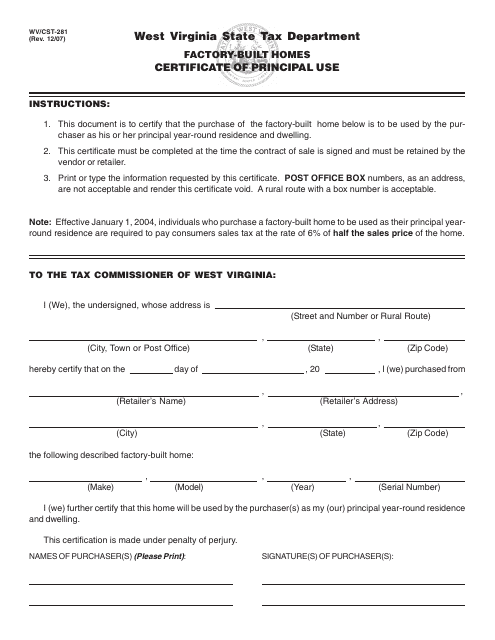

This form is used for obtaining a certificate of principal use for factory-built homes in West Virginia.

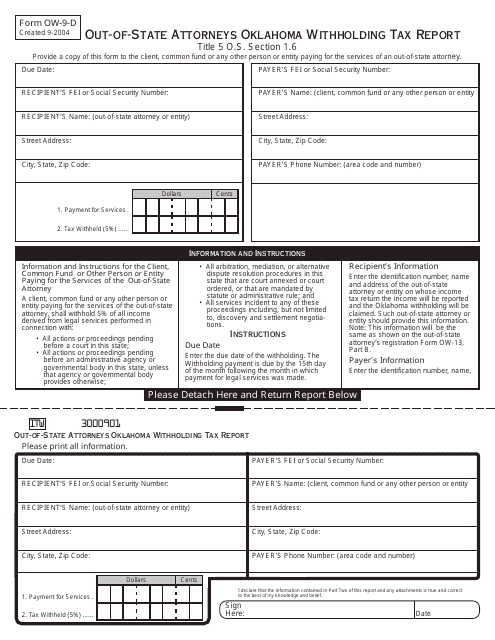

This form is used for Out-of-State Attorneys in Oklahoma to report Oklahoma withholding tax.

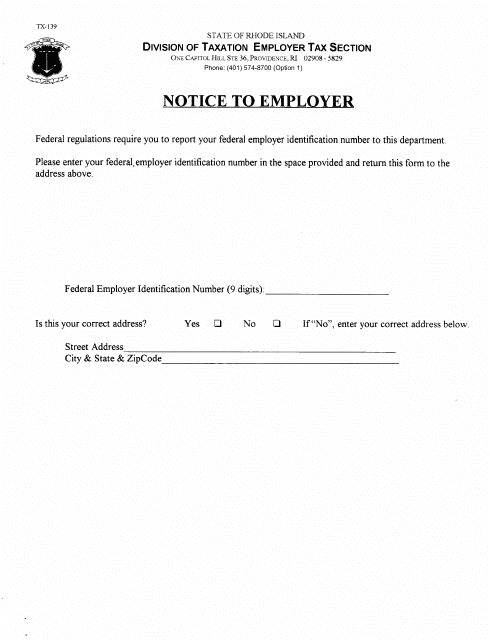

This document notifies an employer in Rhode Island of certain information or actions that they need to know or take.

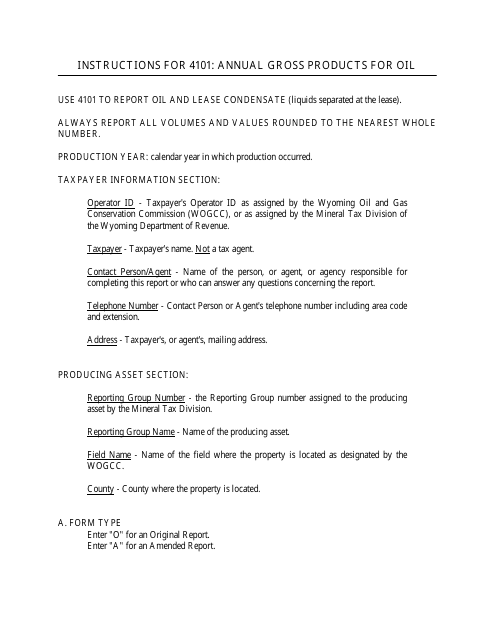

This Form is used for reporting the annual gross products for oil in the state of Wyoming. It provides instructions on how to properly fill out and submit the form.

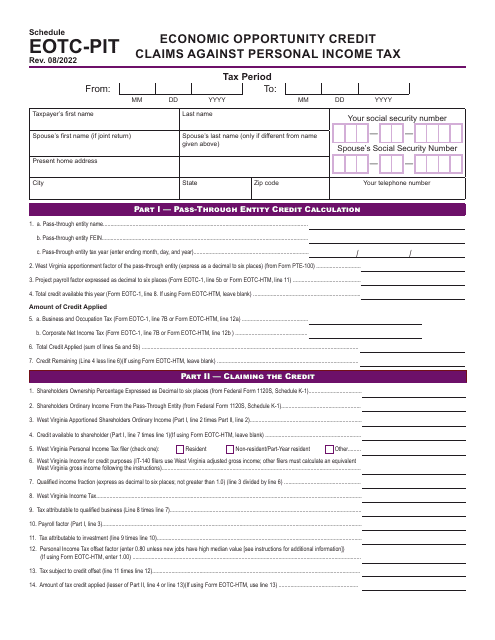

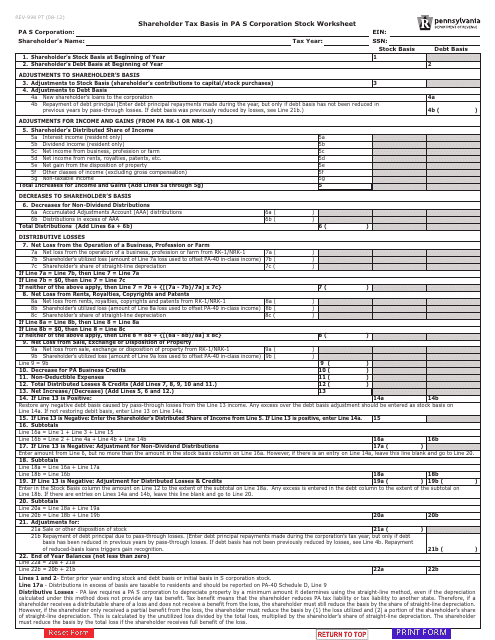

This form is used for calculating the tax basis in Pennsylvania S Corporation stock for shareholders.

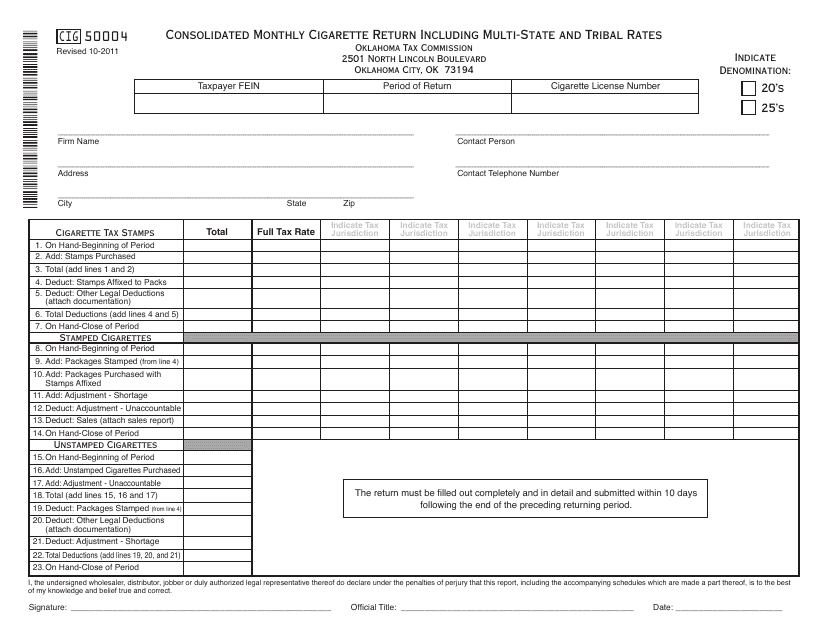

This form is used for submitting the consolidated monthly cigarette return including multi-state and tribal rates in the state of Oklahoma.

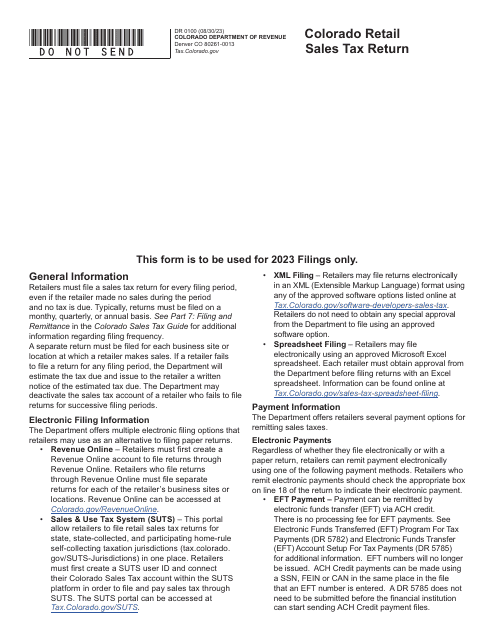

This form is required for any retail establishment within the state of Colorado and must be filed every quarter, even if no tax has been collected or no tax is due.

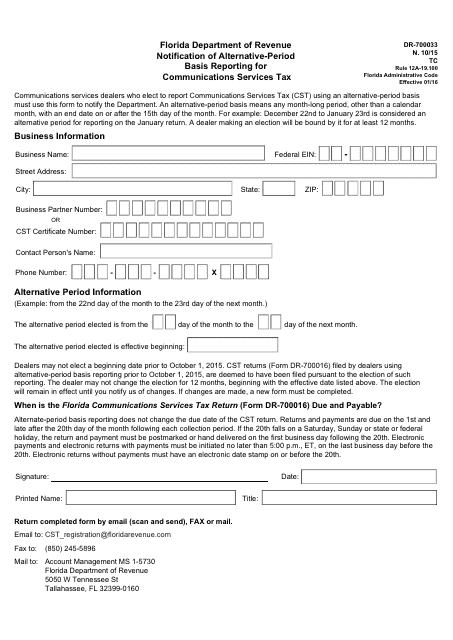

This form is used for notifying the Florida Department of Revenue about alternative-period basis reporting for communications services tax.

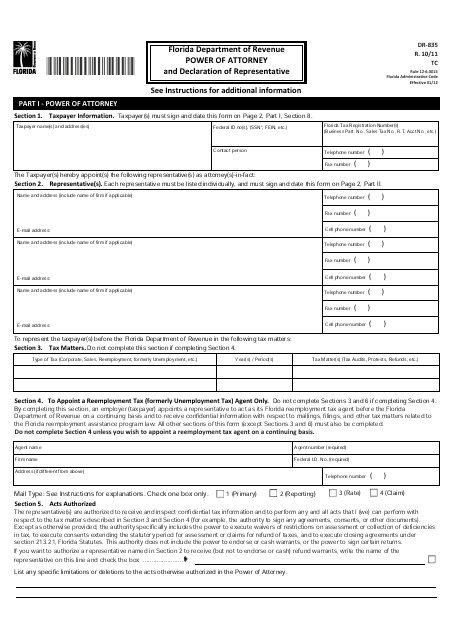

This form is used for appointing a representative to act on your behalf for tax matters in the state of Florida.

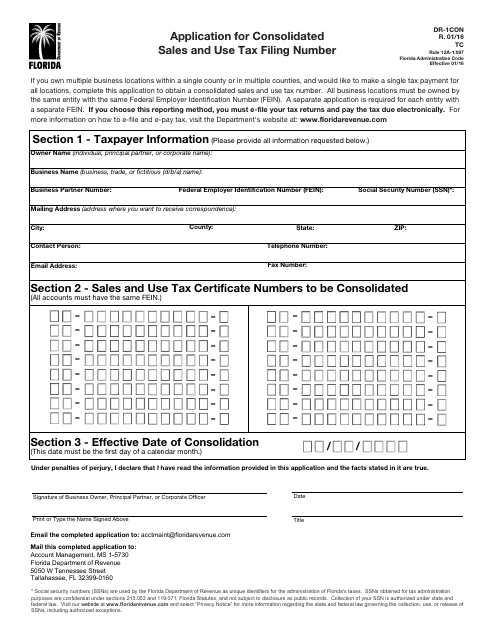

This Form is used for applying for a Consolidated Sales and Use Tax Filing Number in the state of Florida.

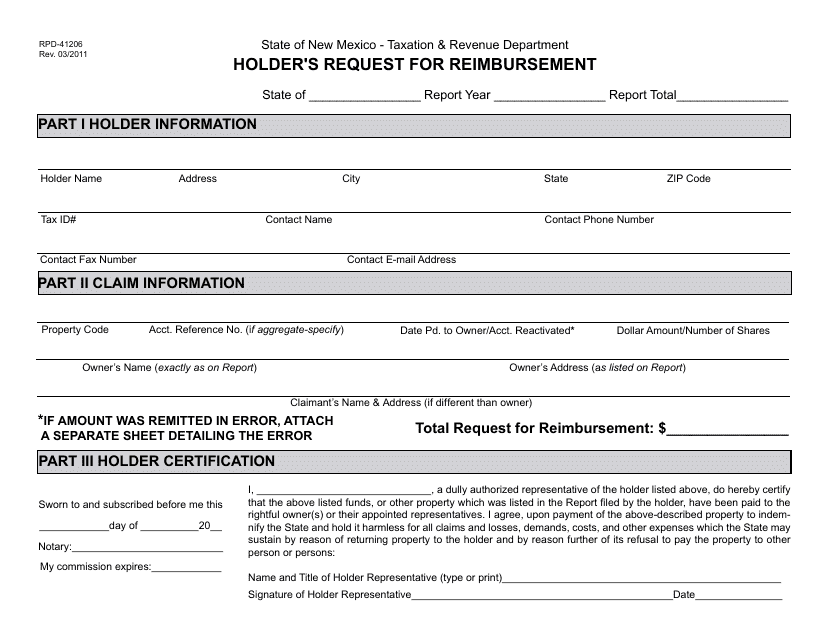

This Form is used for New Mexico residents to request reimbursement as a holder.

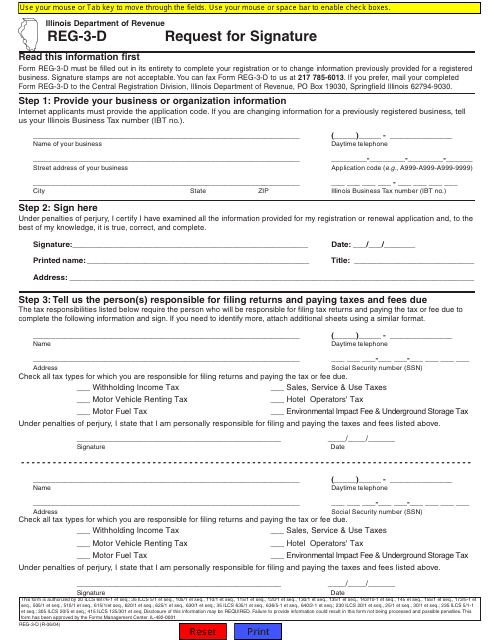

This Form is used for requesting a signature in the state of Illinois.

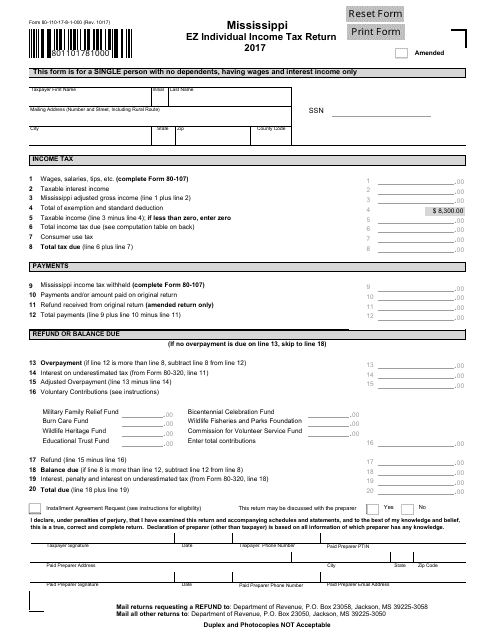

This Form is used for filing an individual income tax return in the state of Mississippi.