United States Tax Forms and Templates

Related Articles

Documents:

2432

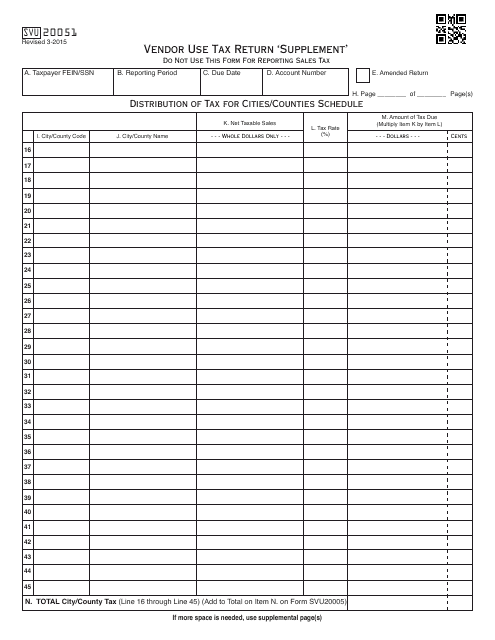

This type of document is a supplement to the OTC Form SVU20051 Vendor Use Tax Return, which is used in Oklahoma.

This form is used for reporting and paying use tax owed by vendors in the state of Oklahoma. Vendors must file this return to comply with Oklahoma's tax laws.

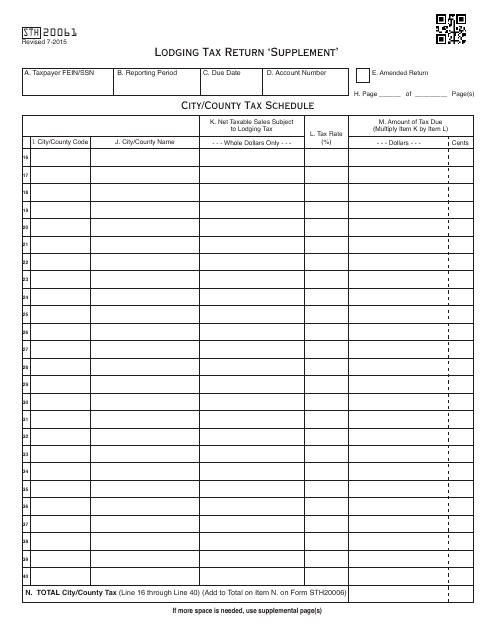

This document is a supplemental form for the OTC Form STH20061 Lodging Tax Return in Oklahoma. It is used to provide additional information or updates to the original tax return.

This form is used for submitting lodging tax returns in Oklahoma.

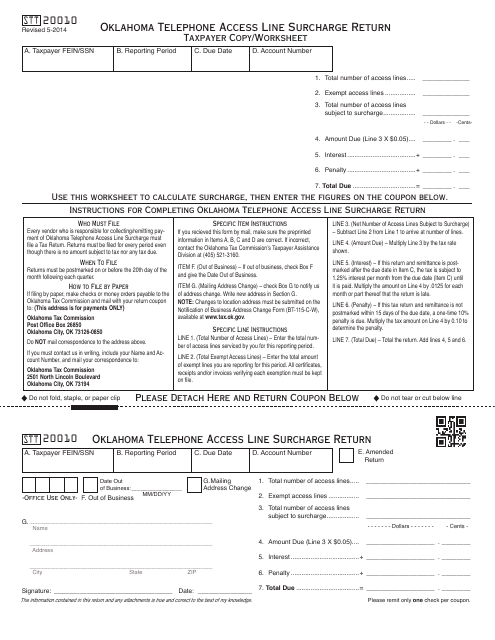

This document is used for filing the Oklahoma Telephone Access Line Surcharge Return in Oklahoma.

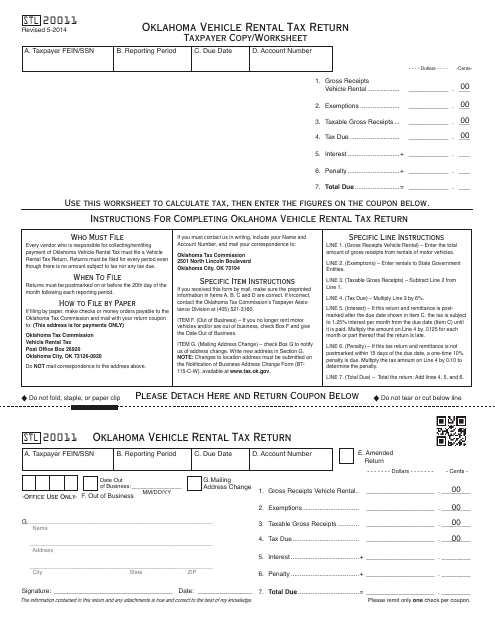

This Form is used for reporting and paying vehicle rental tax in Oklahoma.

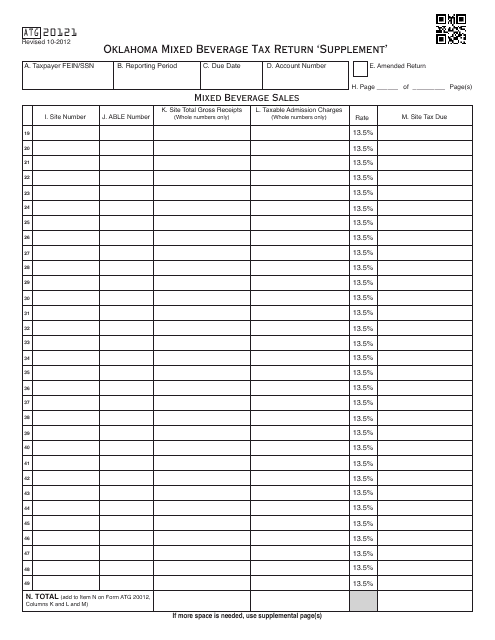

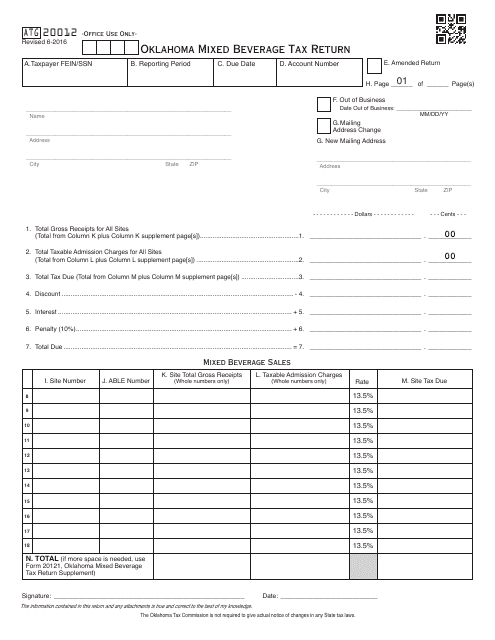

This type of document is a supplement to the OTC Form ATG20121, which is used for filing Oklahoma Mixed Beverage Tax Returns. It is specific to Oklahoma.

This Form is used for returning the 9-1-1 wireless telephone fee in Oklahoma.

This form is used for filing Mixed Beverage Tax Return in Oklahoma.

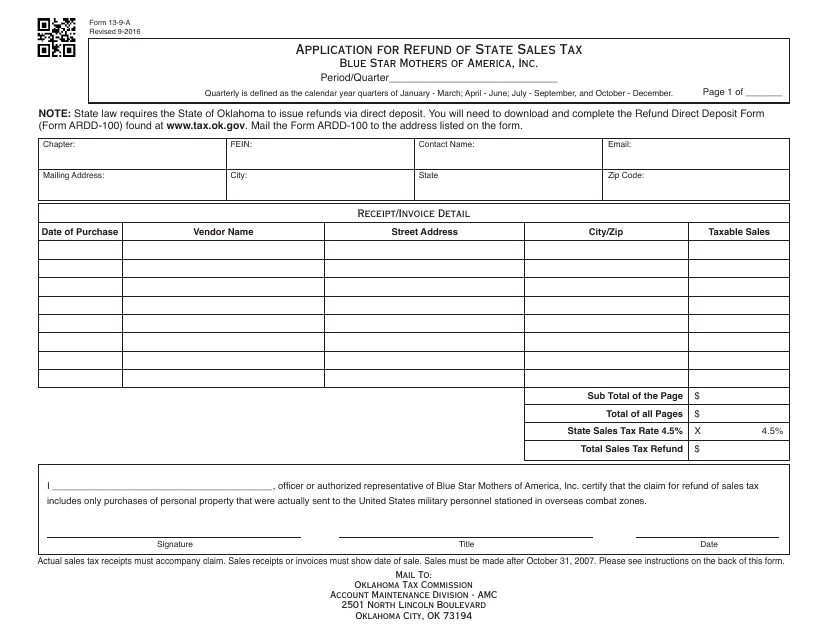

This form is used for applying for a refund of state sales tax in Oklahoma.

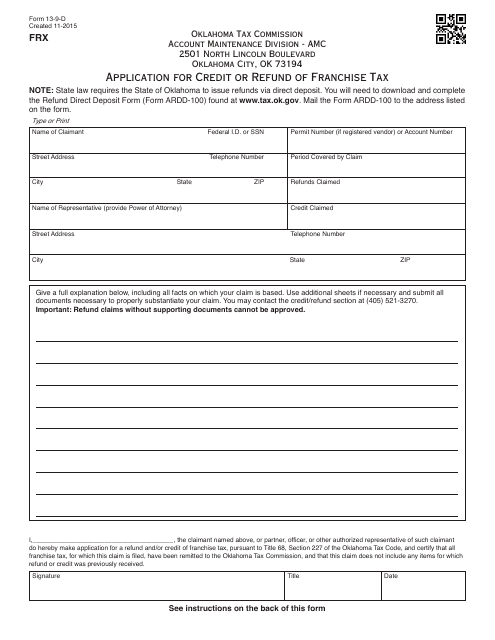

This form is used for applying for credit or refund of franchise tax in Oklahoma.

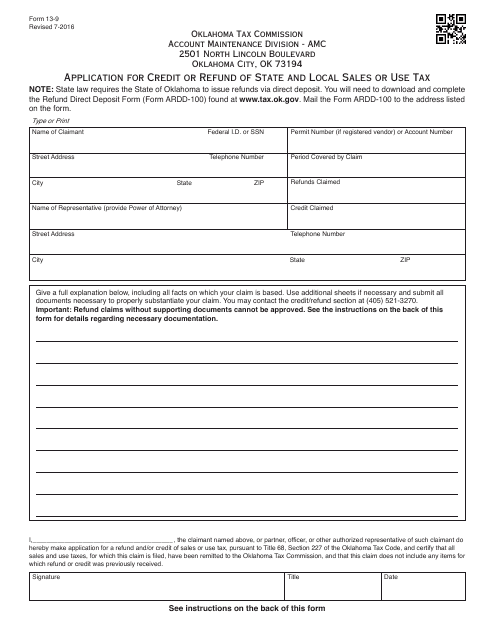

This form is used for applying for a credit or refund of state and local sales or use tax in Oklahoma.

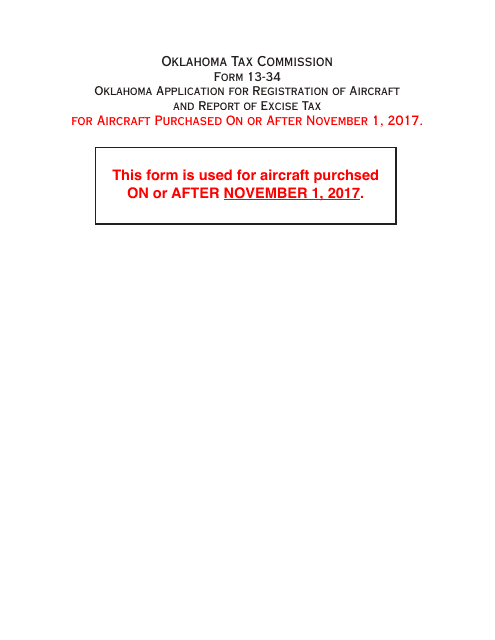

This form is used for registering an aircraft and reporting excise tax in Oklahoma.

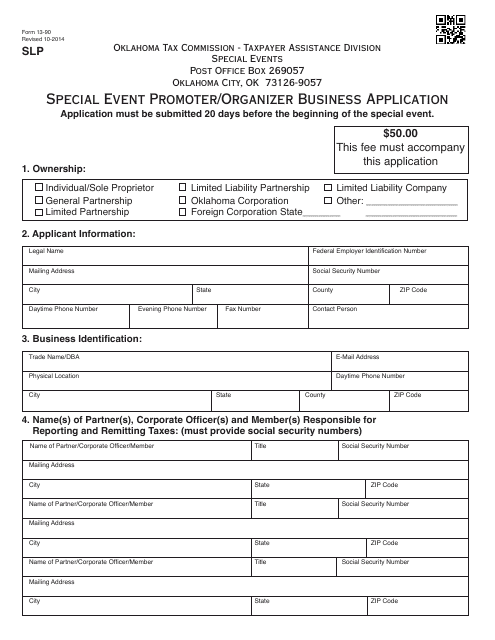

This Form is used for applying for a special event promoter/organizer business license in Oklahoma.

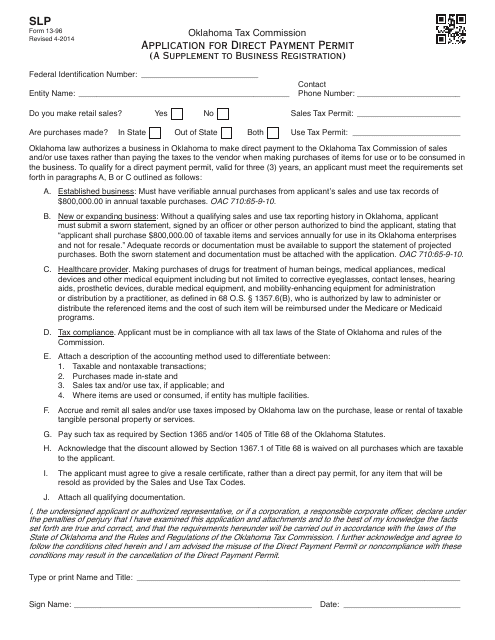

This form is used for applying for a direct payment permit in Oklahoma. It is a supplement to the business registration process.

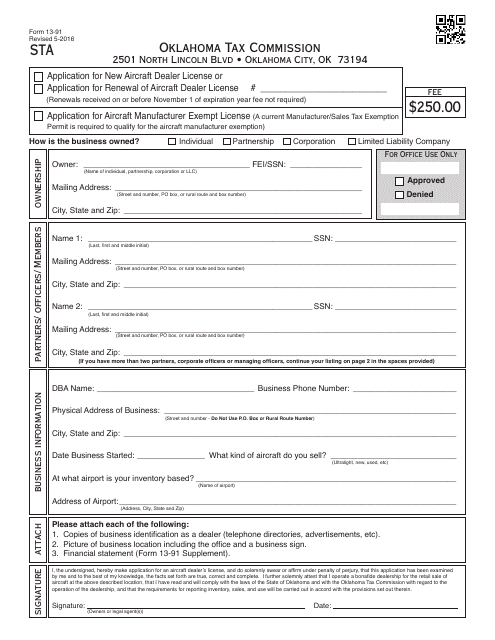

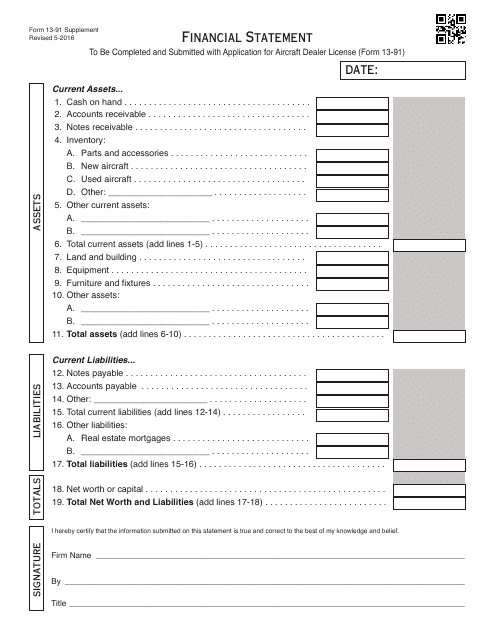

This document is used for applying for a new aircraft dealer's license or renewing an existing license in Oklahoma.

This form is used for filing a financial statement in Oklahoma for OTC (Oklahoma Tax Commission) purposes.

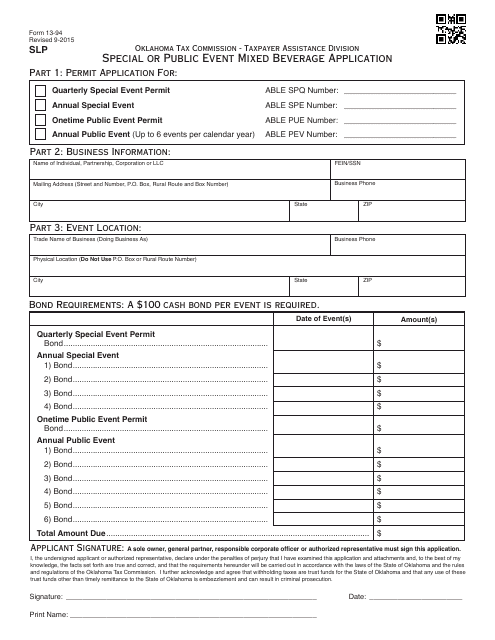

This form is used for applying for a special or public event mixed beverage license in Oklahoma.

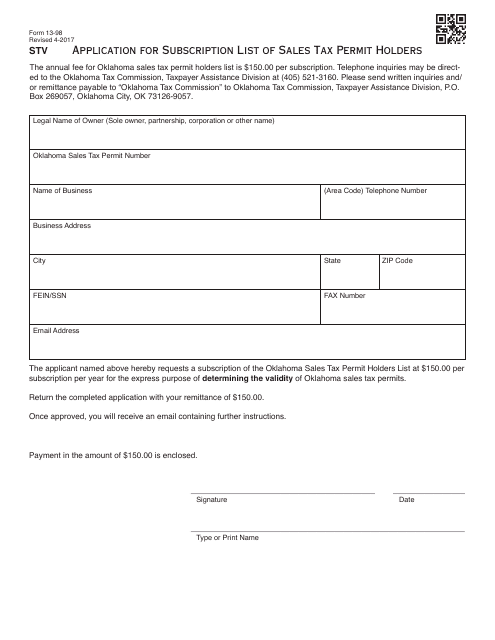

This form is used for applying for a subscription list of sales tax permit holders in Oklahoma.

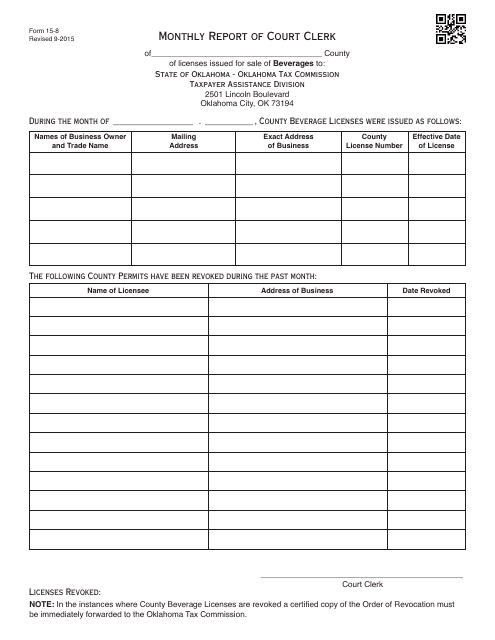

This form is used for submitting a monthly report by court clerks in Oklahoma. It helps to track and document court activities for administrative and record-keeping purposes.

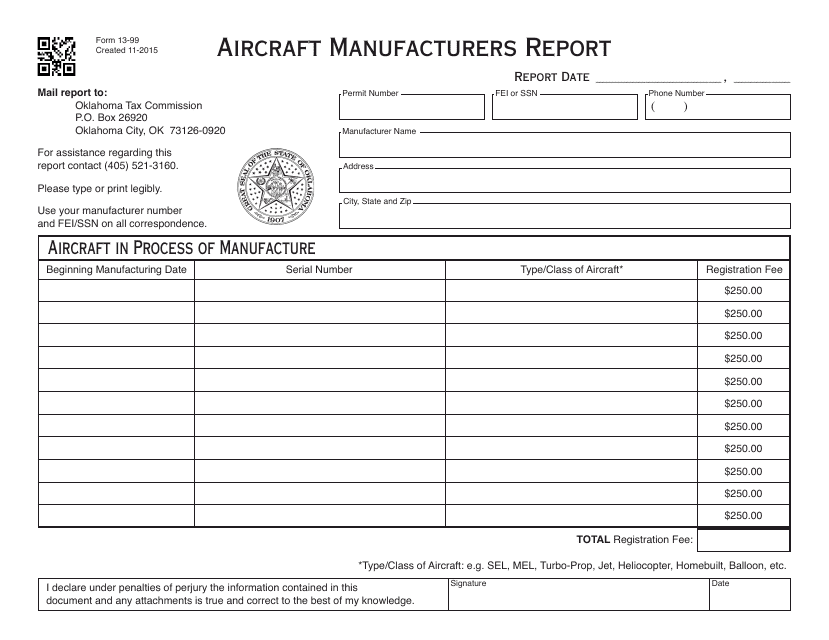

This document is used for reporting aircraft manufacturers in Oklahoma.

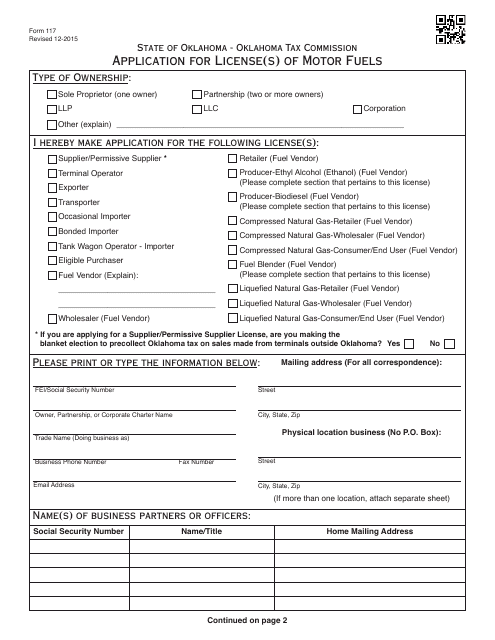

This Form is used for applying for a license(s) to sell motor fuels in Oklahoma.

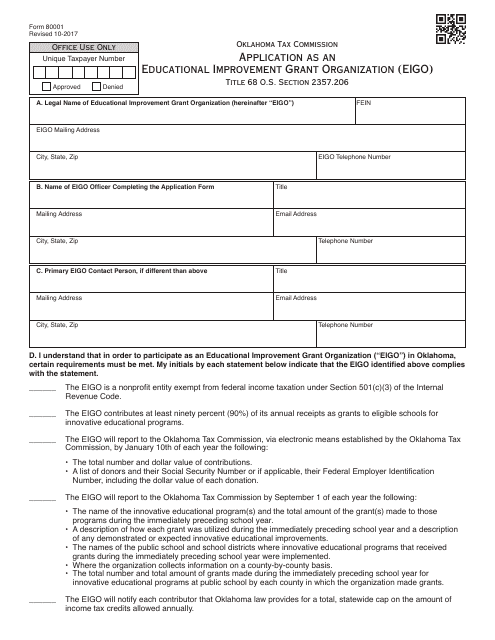

This form is used for applying as an Educational Improvement Grant Organization (EIGO) in Oklahoma.

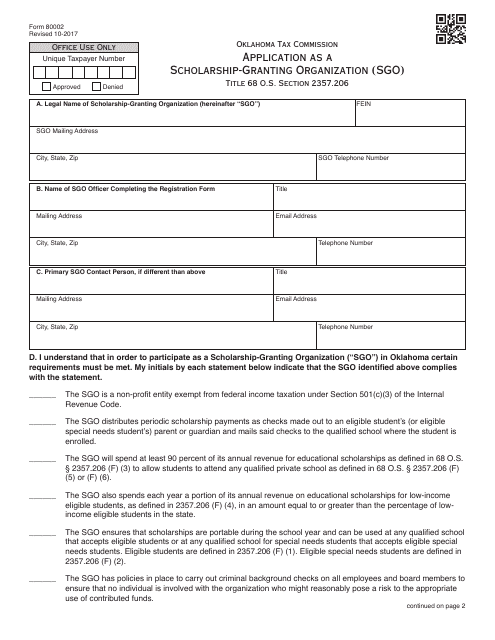

This form is used for organizations in Oklahoma to apply as a Scholarship-Granting Organization (SGO). It allows them to provide scholarships to students.

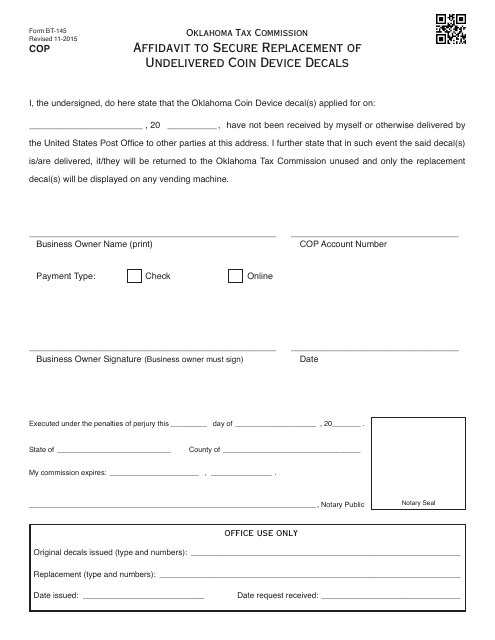

This document is used in Oklahoma to secure replacement coin device decals that were not delivered.

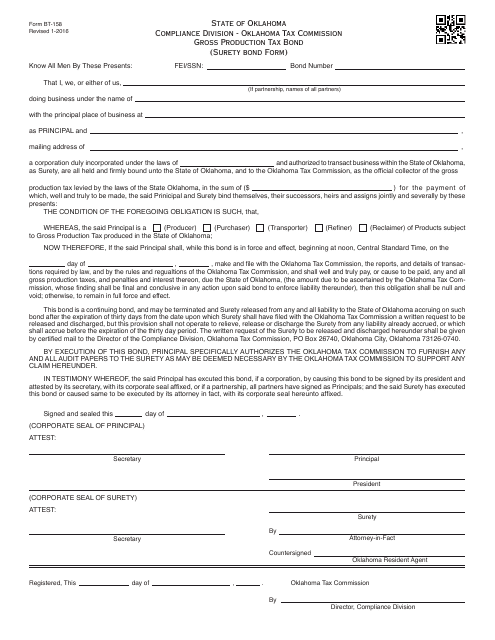

This Form is used for obtaining a Gross Production Tax Bond in Oklahoma.

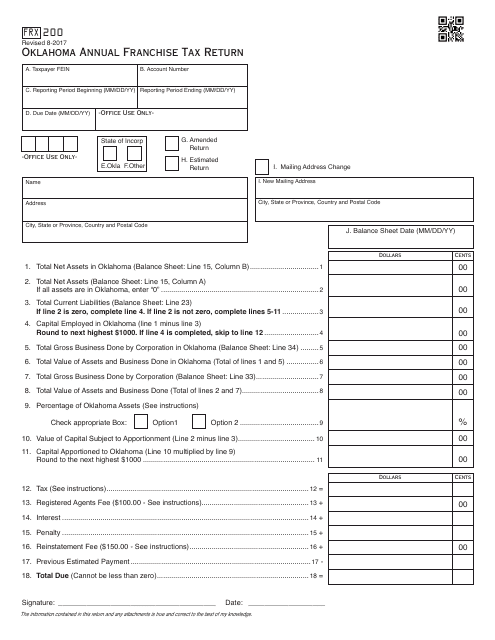

This form is used for filing the Oklahoma Annual Franchise Tax Return in Oklahoma.

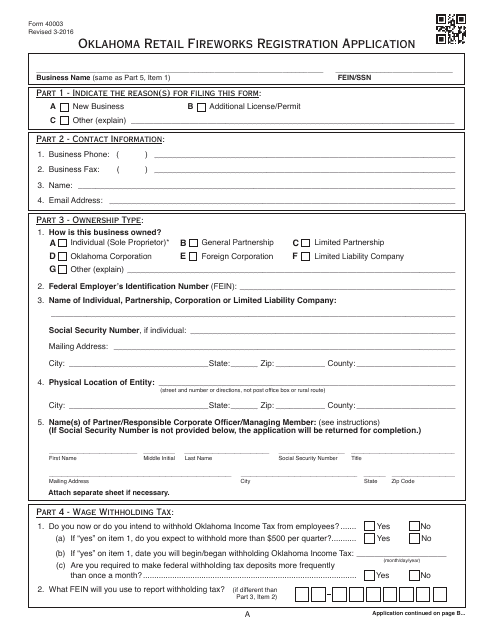

This form is used for Oklahoma retailers to register for selling fireworks.

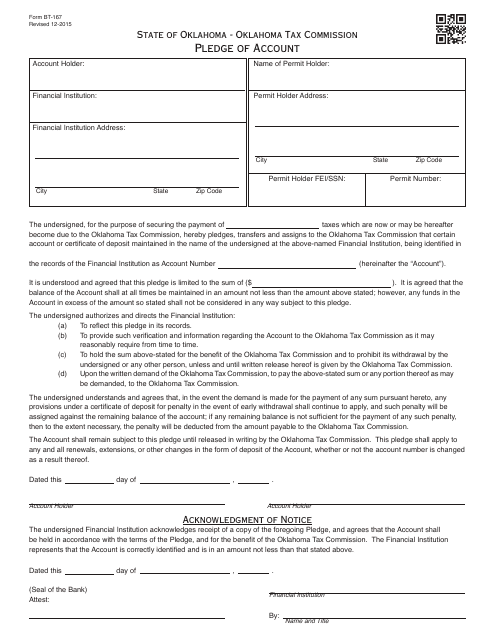

This Form is used for pledging an account in the state of Oklahoma.

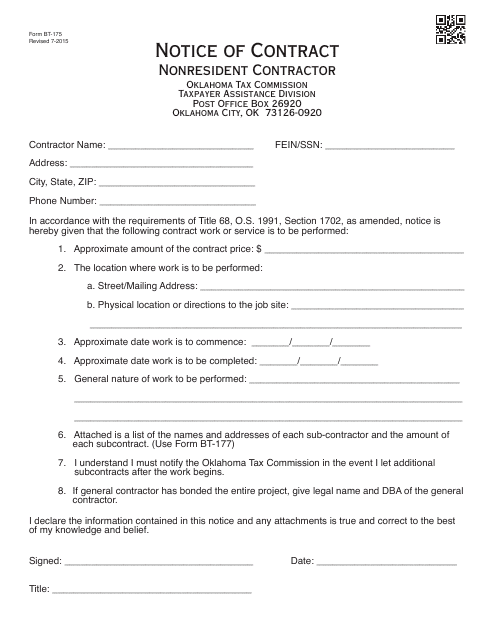

This Form is used for providing notice of contract by a nonresident contractor in the state of Oklahoma.

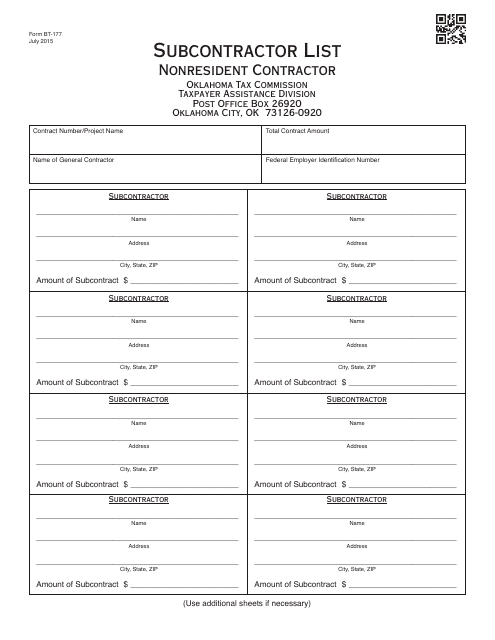

This form is used for subcontractors who are nonresidents of Oklahoma working with a contractor in the state. It helps to maintain a list of subcontractors for record-keeping purposes.

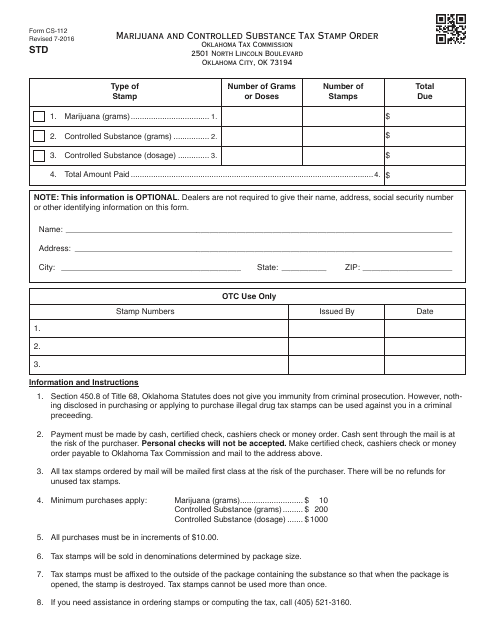

This document is used for ordering a tax stamp for marijuana and controlled substances in Oklahoma.

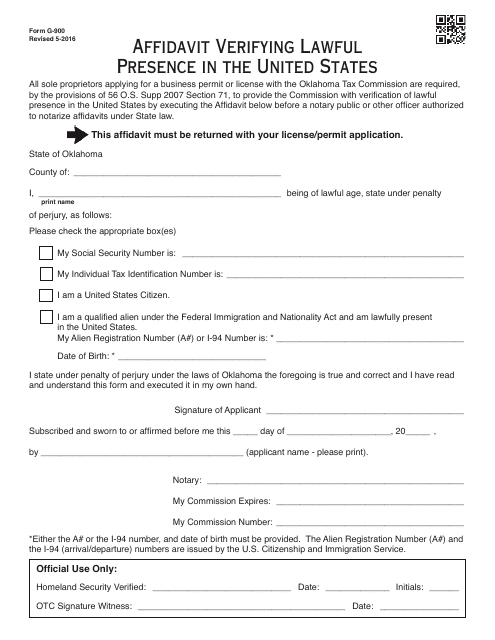

This form is used for verifying the lawful presence of an individual in the United States, specifically in the state of Oklahoma.

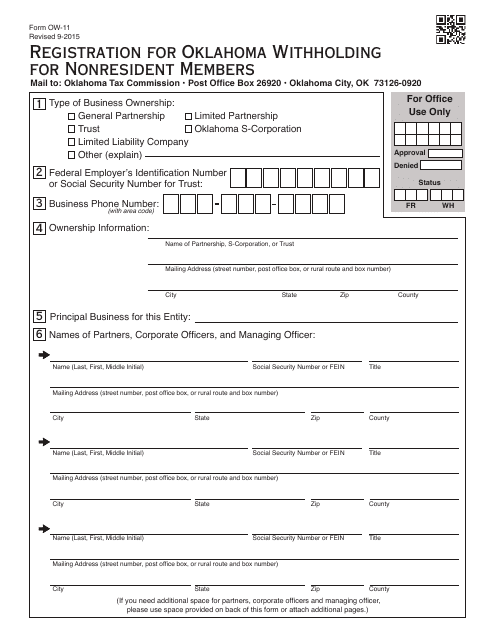

This Form is used for nonresident members to register for Oklahoma withholding for their income earned in Oklahoma. It is required for those who are not Oklahoma residents but have income sources within the state.

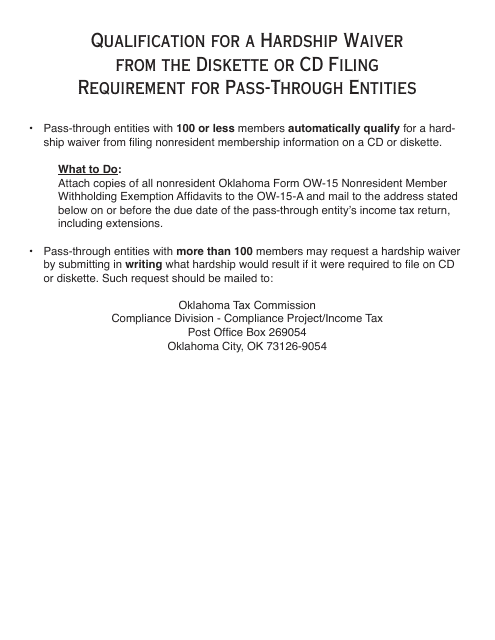

This Form is used for nonresident members to claim withholding exemption in Oklahoma. It allows nonresidents to request exemption from income tax withholding on their share of income from an Oklahoma partnership or limited liability company (LLC).

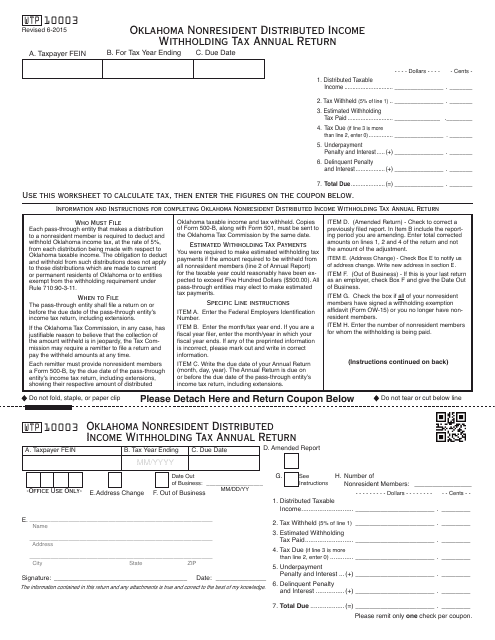

This Form is used for reporting and paying nonresident distributed income withholding tax in Oklahoma for the tax year.

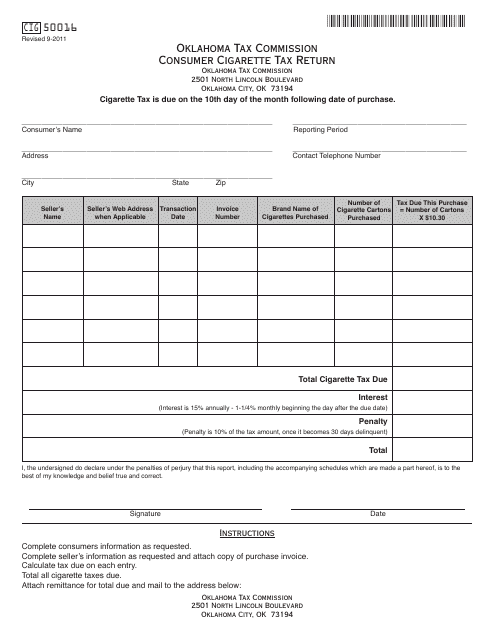

This Form is used for reporting and paying consumer cigarette tax in Oklahoma.

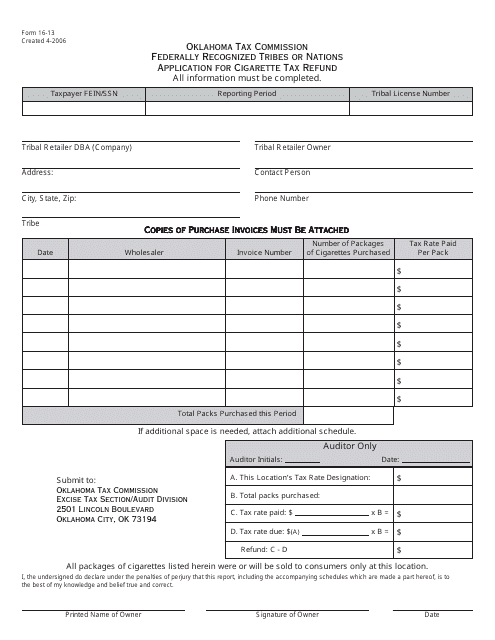

This form is used for applying for a cigarette tax refund in Oklahoma for Federally Recognized Tribes or Nations.

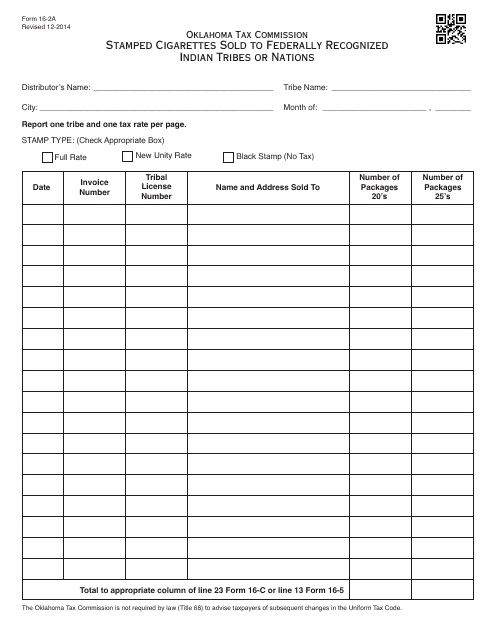

This form is used for reporting the sale of stamped cigarettes to federally recognized Indian tribes or nations in Oklahoma.

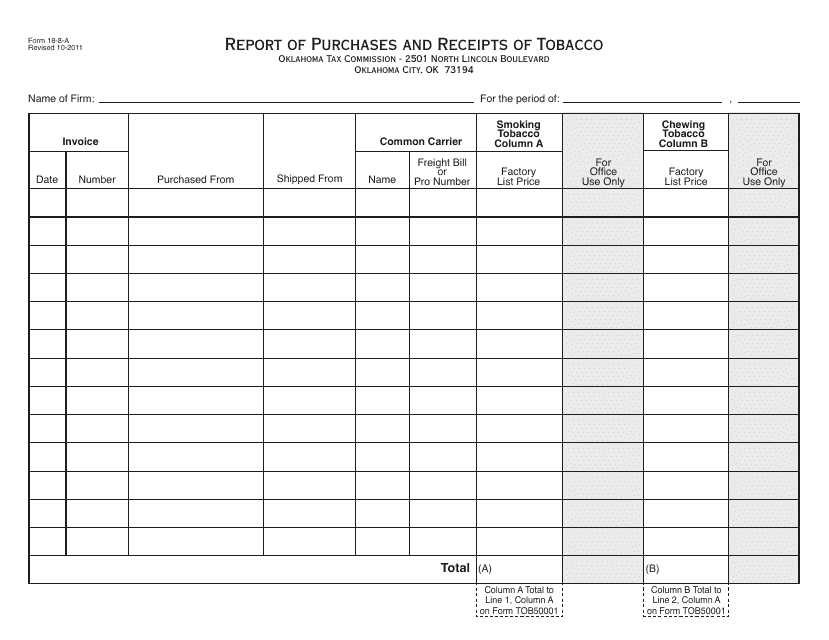

This form is used for reporting purchases and receipts of tobacco in Oklahoma. It is specifically for Over-the-Counter (OTC) transactions.