United States Tax Forms and Templates

Related Articles

Documents:

2432

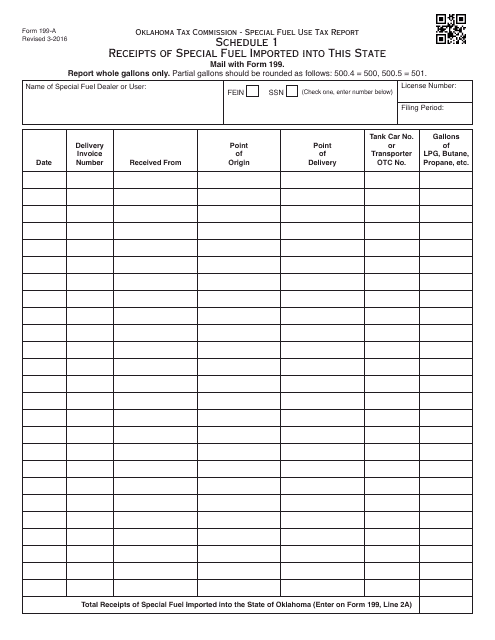

This Form is used for reporting the receipts of special fuel imported into the state of Oklahoma.

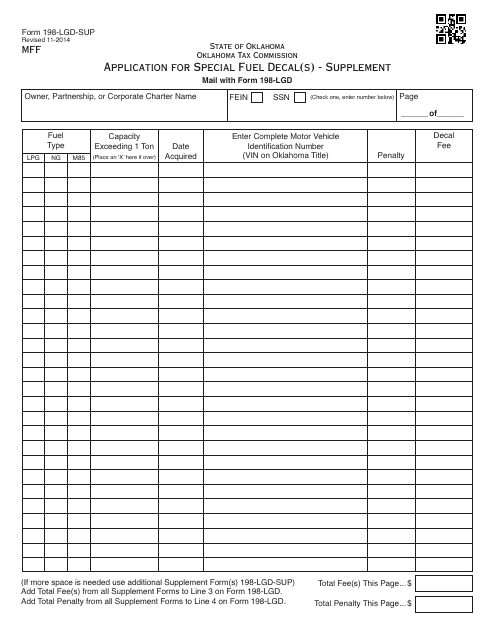

This document is an application form used in Oklahoma for obtaining special fuel decals. It is for individuals or businesses seeking to apply for these decals to use special fuel in their vehicles.

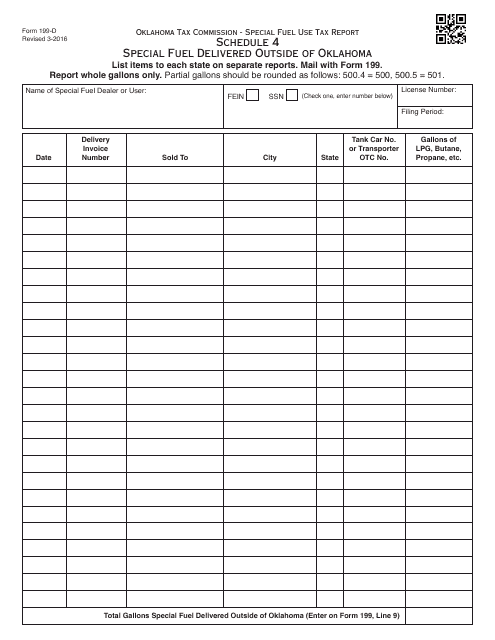

This document is used for reporting special fuel deliveries made outside of Oklahoma as part of OTC Form 199-D Schedule 4.

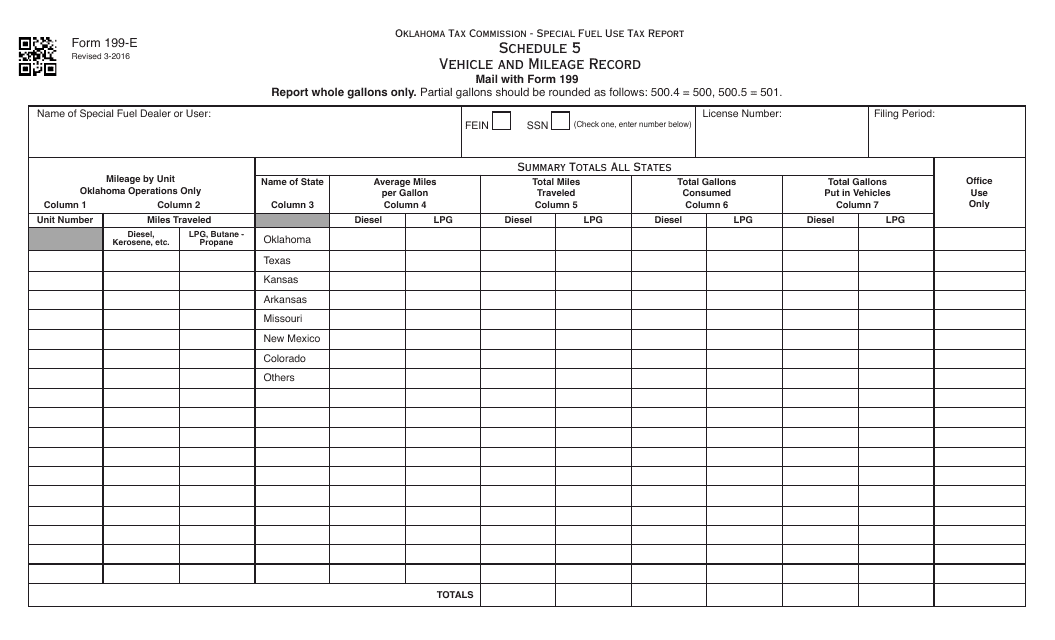

This form is used for recording vehicle and mileage information in Oklahoma.

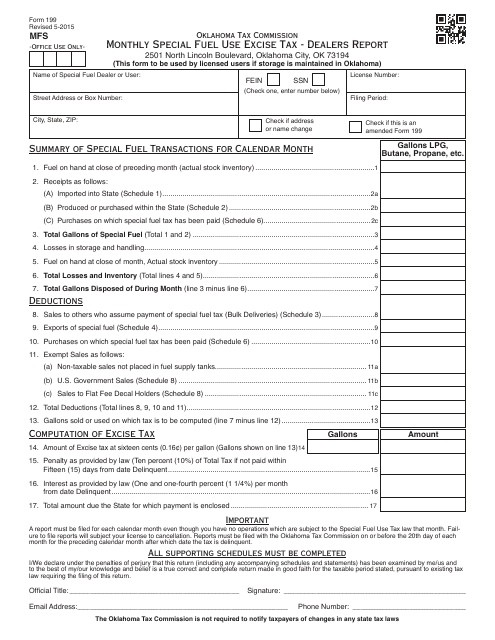

This document is for Oklahoma dealers to report their monthly special fuel use excise tax.

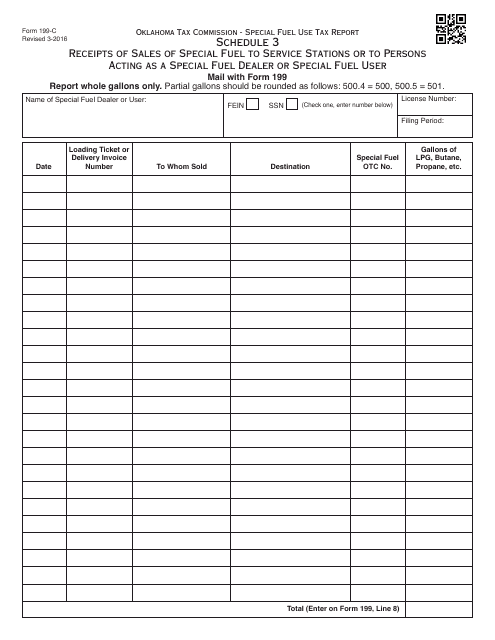

This Form is used for reporting sales of special fuel to service stations or special fuel dealers/users in Oklahoma.

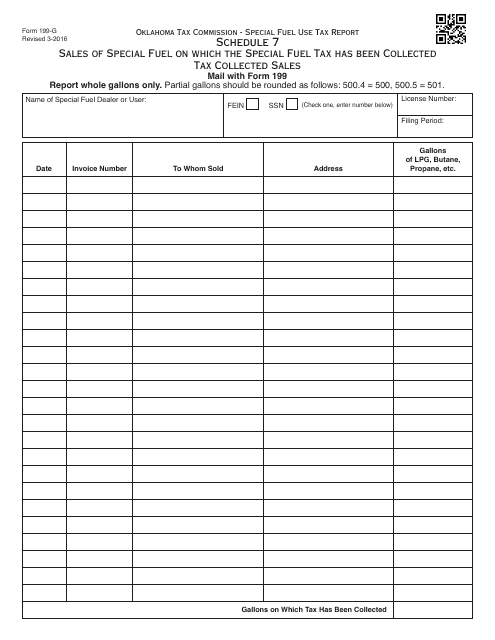

This form is used for reporting the sales of special fuel on which the special fuel tax has been collected in Oklahoma.

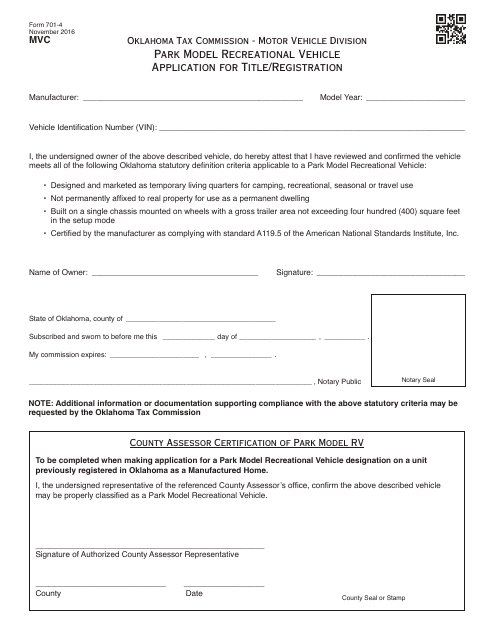

This Form is used for applying for a title and registration for a park model recreational vehicle in the state of Oklahoma.

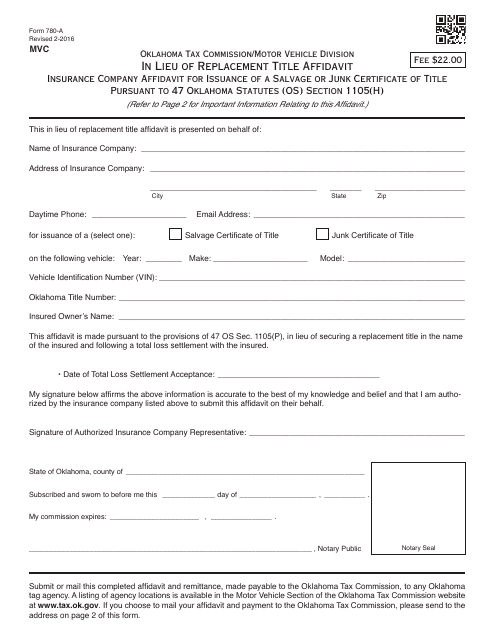

This form is used for insurance companies in Oklahoma to request a salvage or junk certificate of title for a vehicle instead of a replacement title.

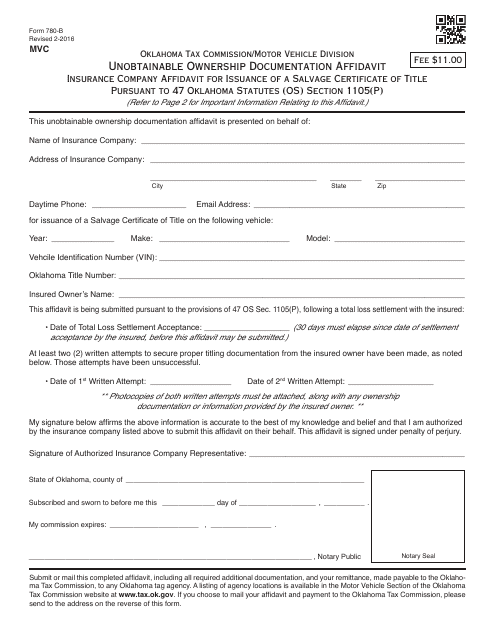

This form is used for insurance companies in Oklahoma to provide an affidavit stating that the required ownership documentation for a salvage certificate of title is unobtainable.

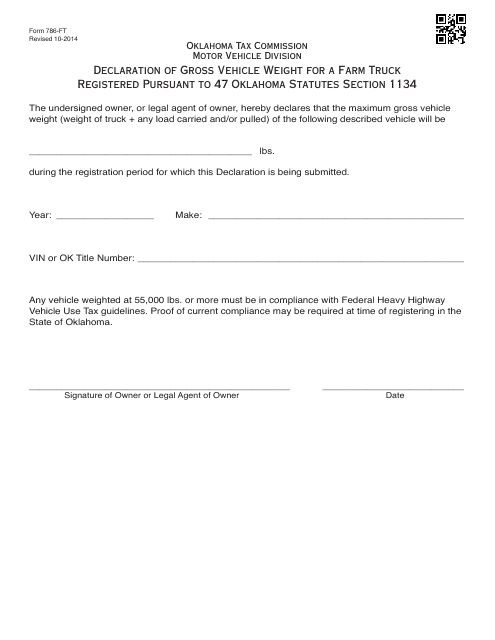

This document is used to declare the gross vehicle weight of a farm truck that is registered in Oklahoma, as required by Oklahoma Statutes Section 1134.

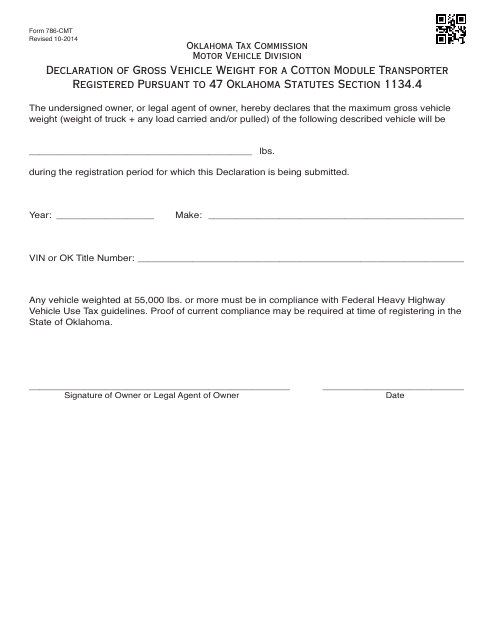

This type of document is used for declaring the gross vehicle weight of a cotton module transporter that is registered in the state of Oklahoma.

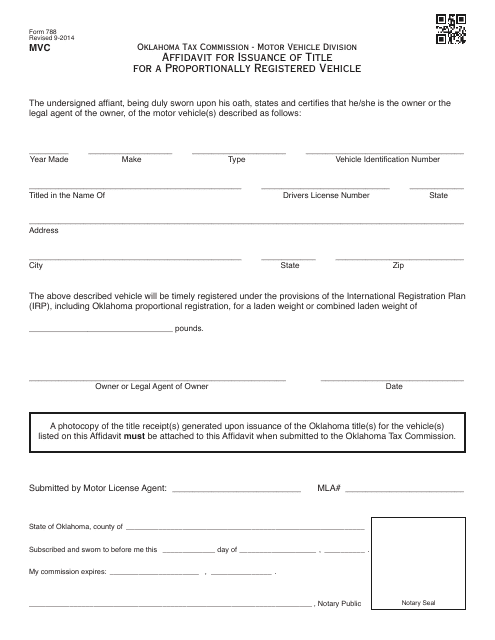

This form is used for requesting an affidavit to acquire a title for a proportionally registered vehicle in Oklahoma.

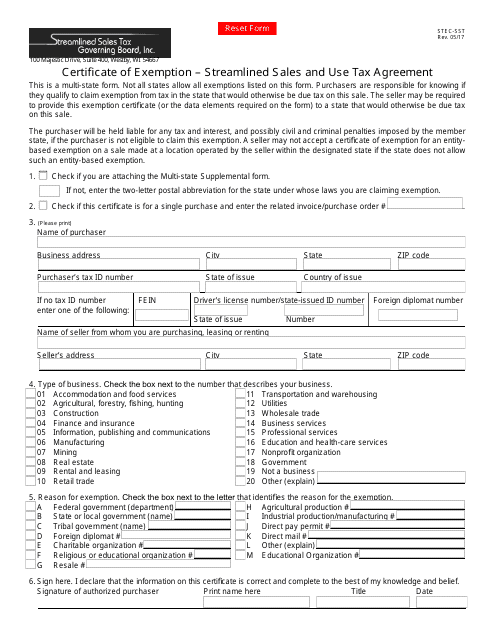

This form is used for Ohio residents or businesses to request a certificate of exemption from sales and use tax under the Streamlined Sales and Use Tax Agreement.

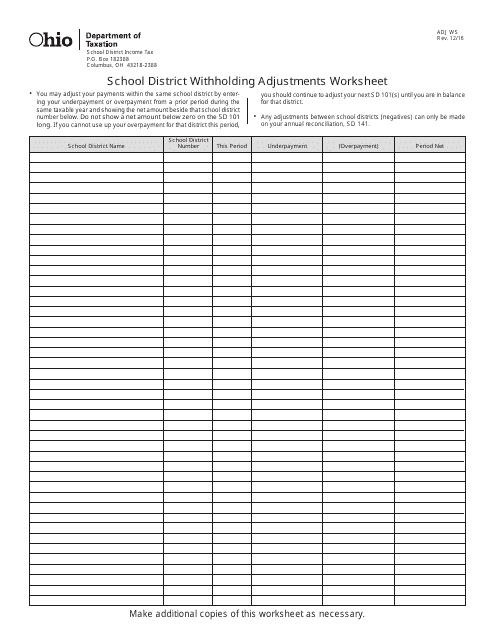

This Form is used for making adjustments to school district withholding in Ohio. It helps taxpayers calculate and report any necessary changes to their withholding amounts.

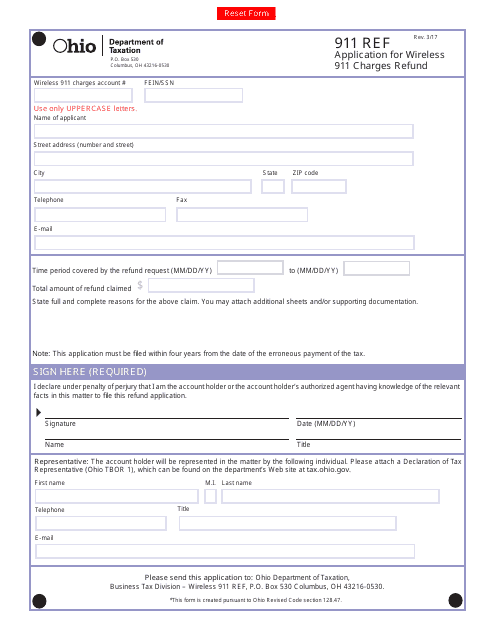

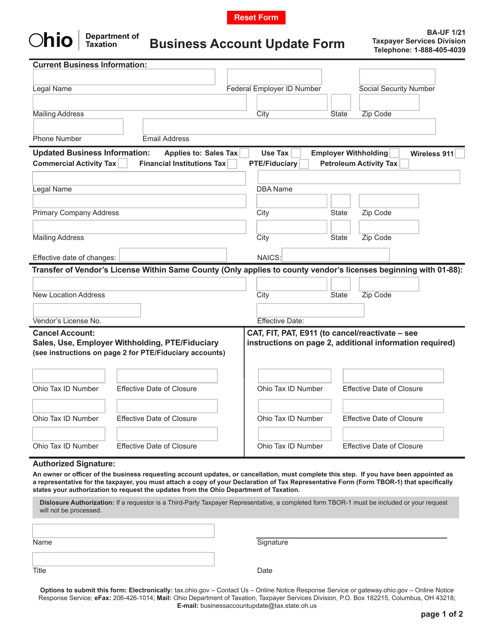

This form is used for applying for a refund of wireless 911 charges in the state of Ohio.

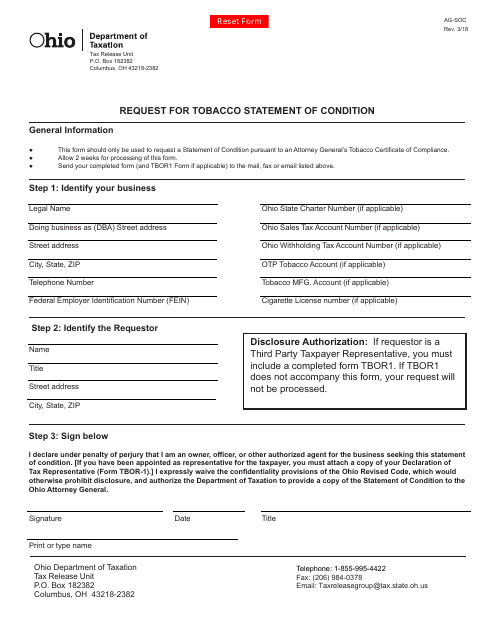

This form is used for requesting a tobacco statement of condition in the state of Ohio. It provides information on the condition of tobacco plants or crops.

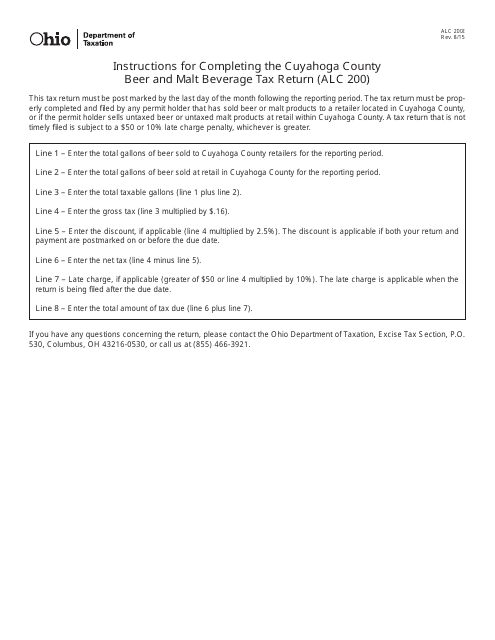

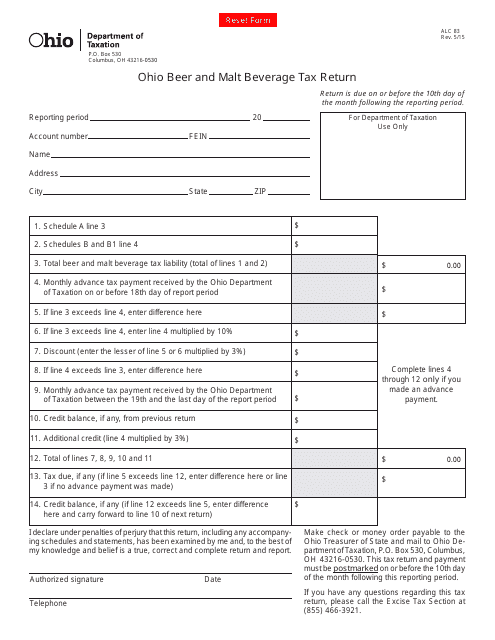

This Form is used for reporting and paying the beer and malt beverage tax in Cuyahoga County, Ohio. Beer distributors and retailers are required to fill out this form and submit it along with the corresponding payment to the county tax department. The form provides instructions on how to complete it accurately and where to send it.

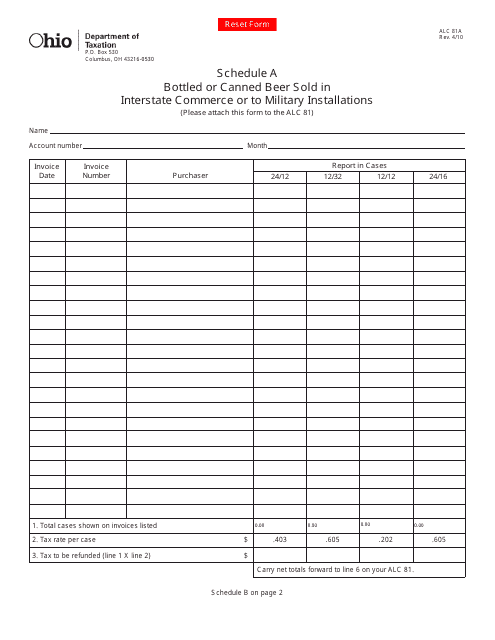

This form is used for reporting the sales of bottled or canned beer in Ohio that are sold in interstate commerce or to military installations.

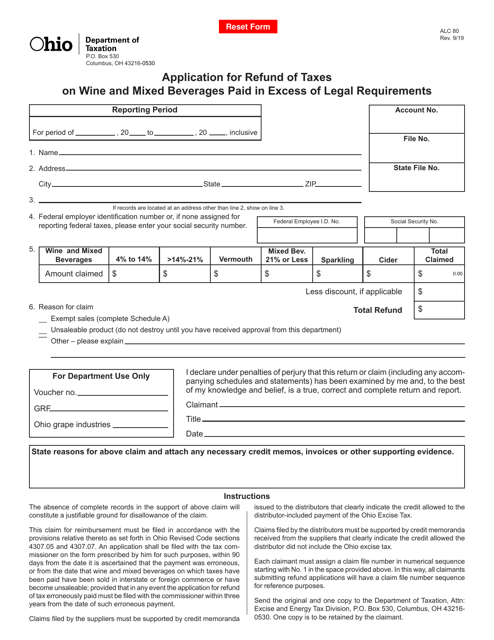

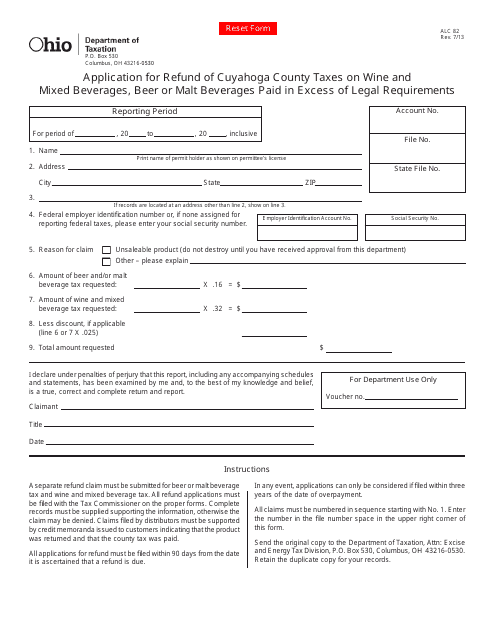

This form is used for applying for a refund of Cuyahoga County taxes on wine and mixed beverages, beer or malt beverages in Ohio.

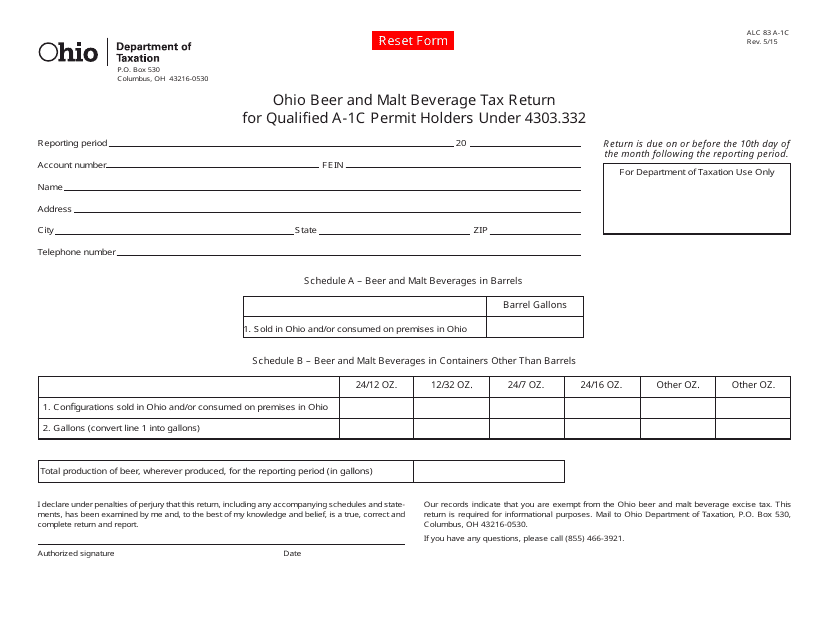

This type of document is used by qualified A-1C permit holders under Ohio law to file their beer and malt beverage tax return.

This Form is used for reporting and paying the taxes on beer and malt beverages in the state of Ohio.

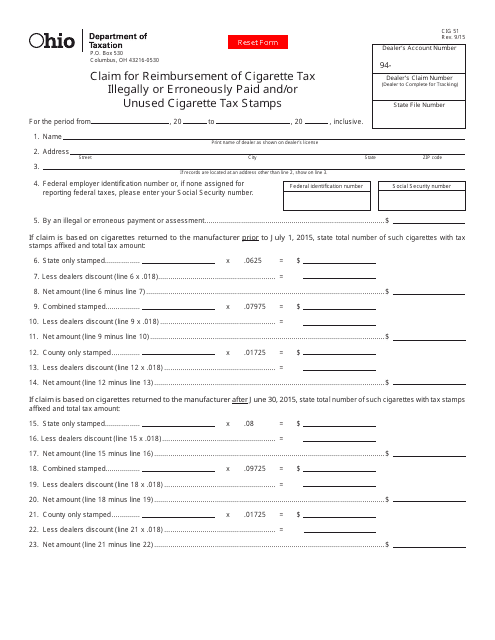

This Form is used for claiming reimbursement of cigarette tax illegally or erroneously paid and/or unused cigarette tax stamps in the state of Ohio.

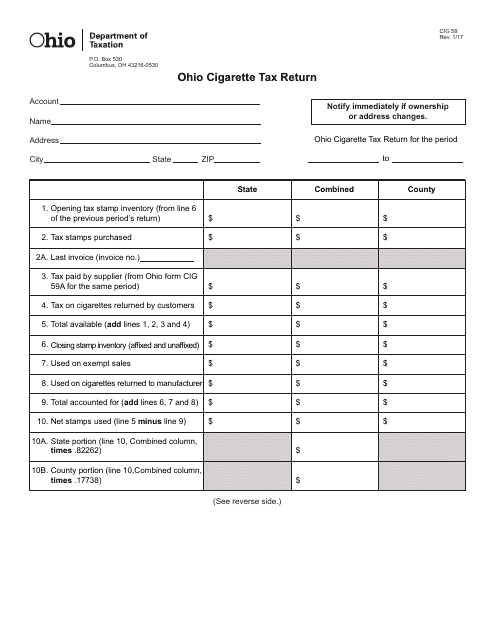

This Form is used for reporting and paying cigarette tax in the state of Ohio.

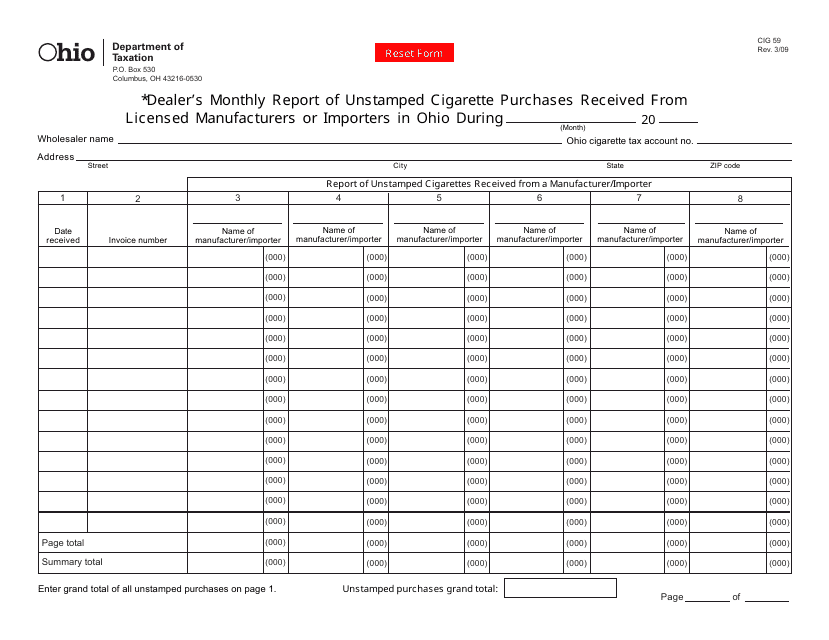

This form is used for dealers in Ohio to report the monthly quantity of unstamped cigarettes they have received.

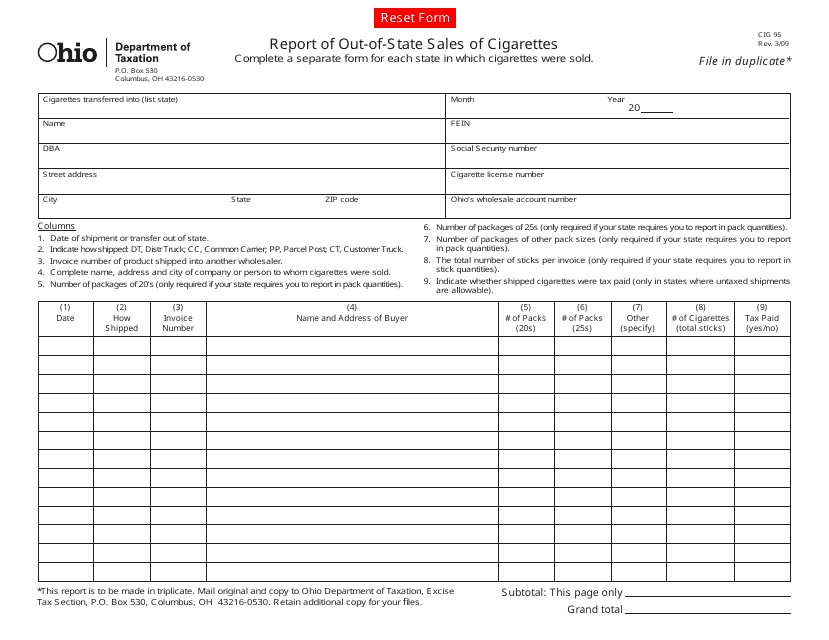

This form is used for reporting out-of-state sales of cigarettes in Ohio.

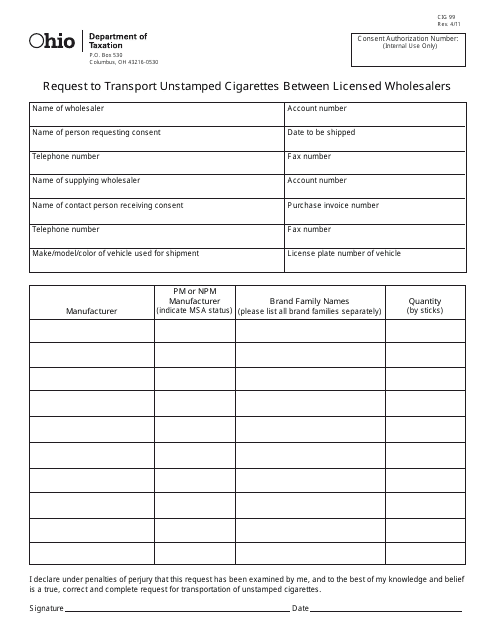

This form is used for requesting permission to transport unstamped cigarettes between licensed wholesalers in the state of Ohio.

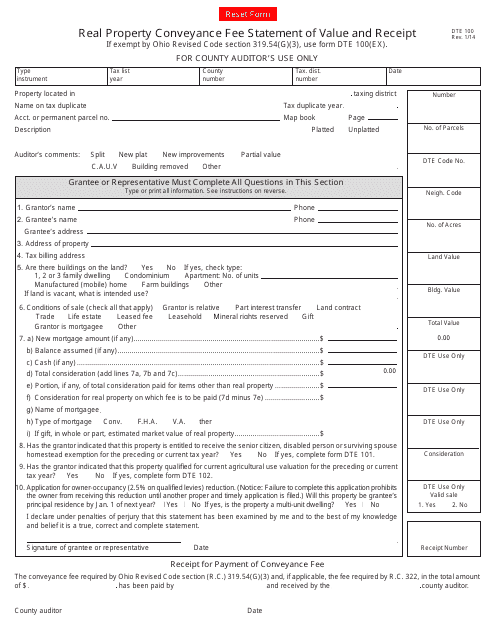

This form is used for reporting the value and receipt of real property conveyance fees in Ohio.

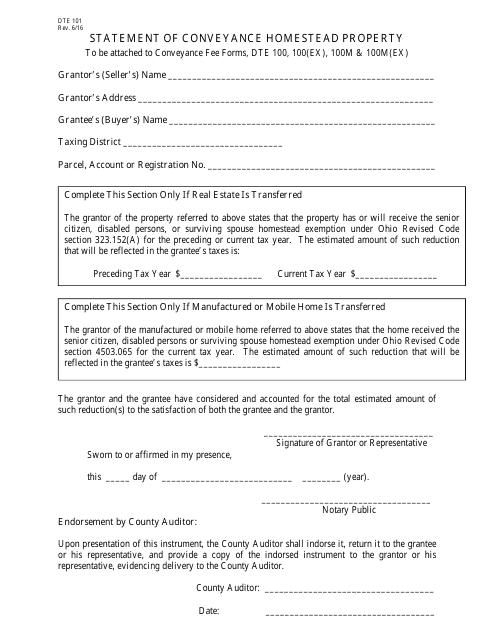

This form is used for submitting a statement of conveyance for homestead property in Ohio.

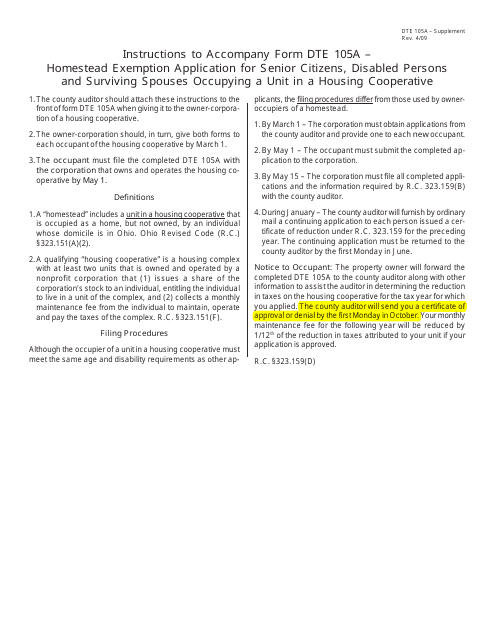

This form is used for applying for the Homestead Exemption in Ohio for senior citizens, disabled persons, and surviving spouses who live in a housing cooperative. It provides instructions on how to complete the application.

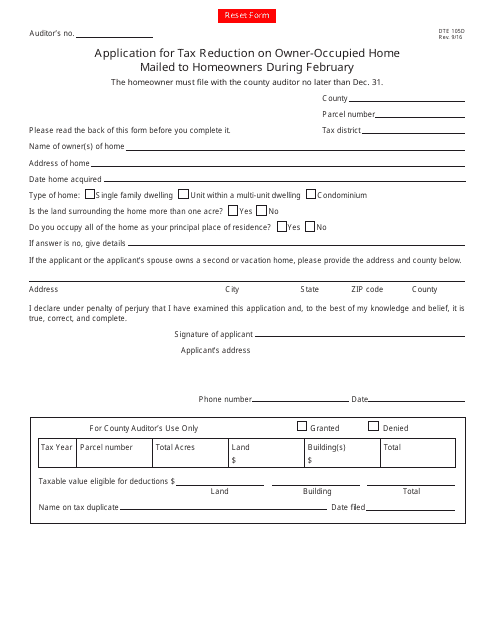

This form is used for applying for a tax reduction on owner-occupied homes in Ohio. It is mailed to homeowners during February.

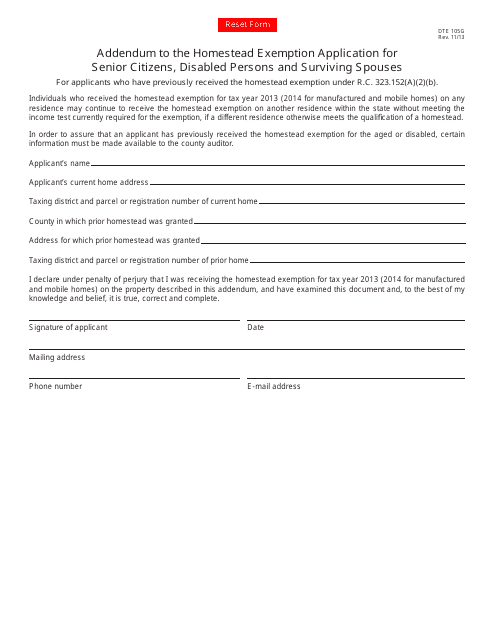

This form is used as an addendum to the Homestead Exemption Application for Senior Citizens, Disabled Persons, and Surviving Spouses in Ohio. It provides additional information and updates to the original application.

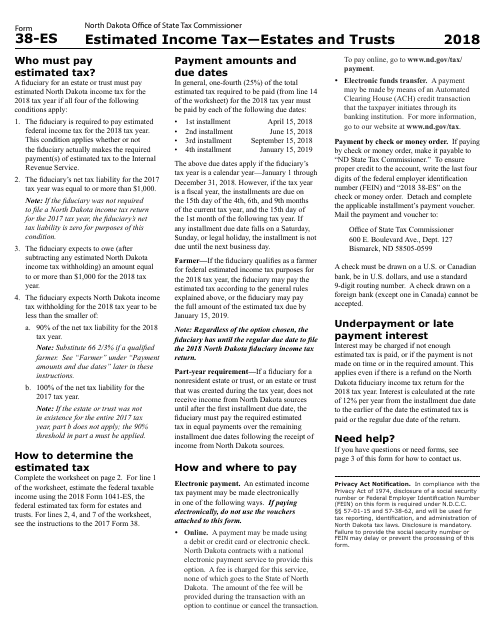

This Form is used for estimating income tax for estates and trusts in North Dakota.

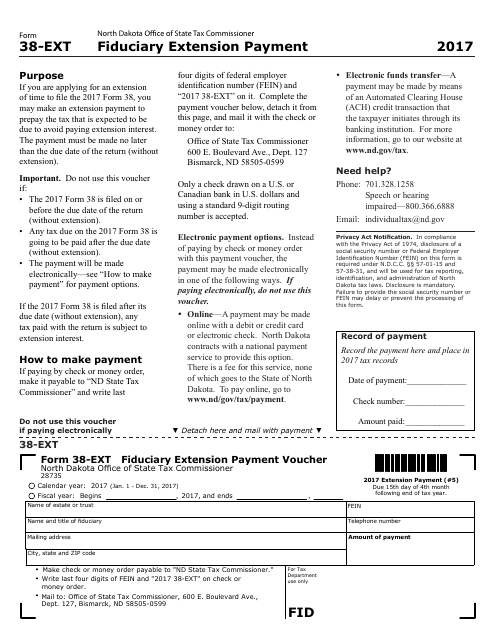

This Form is used for making an extension payment as a fiduciary in North Dakota.

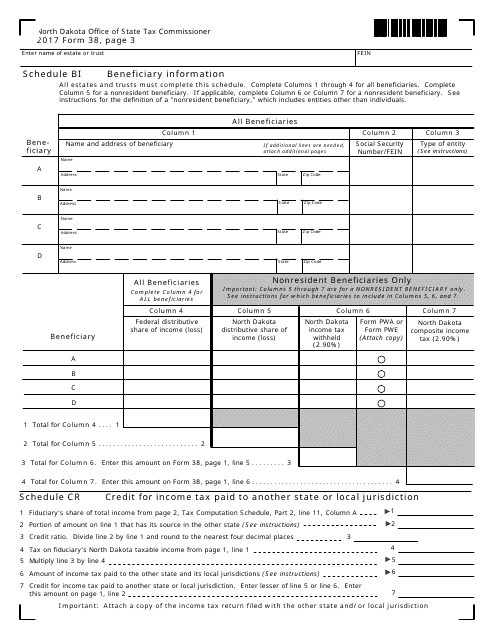

This form is used for providing beneficiary information in North Dakota.

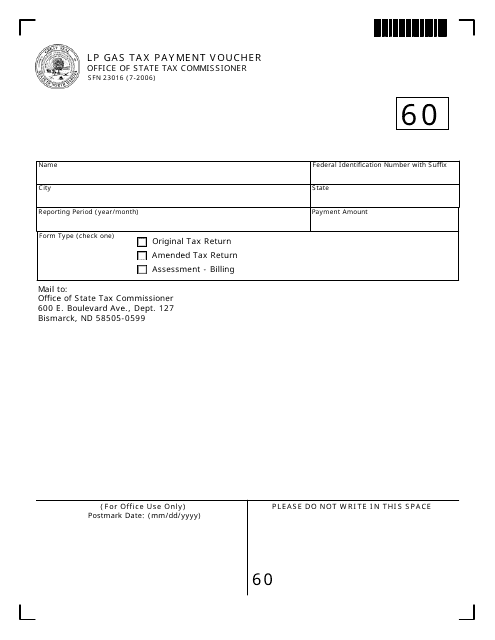

This form is used for making LP gas tax payments in North Dakota.

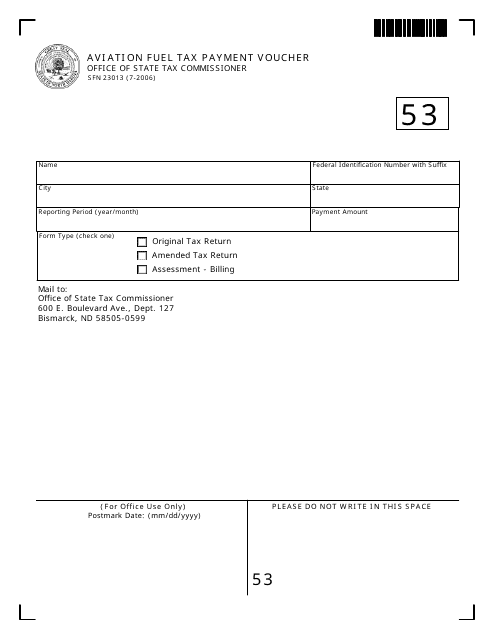

This Form is used for paying aviation fuel tax in North Dakota.