United States Tax Forms and Templates

Related Articles

Documents:

2432

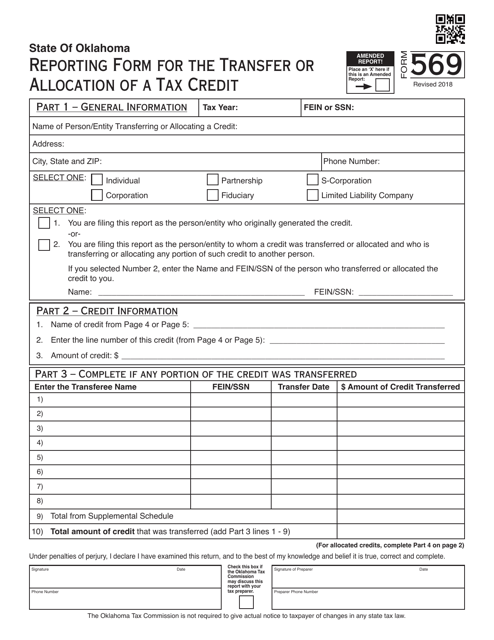

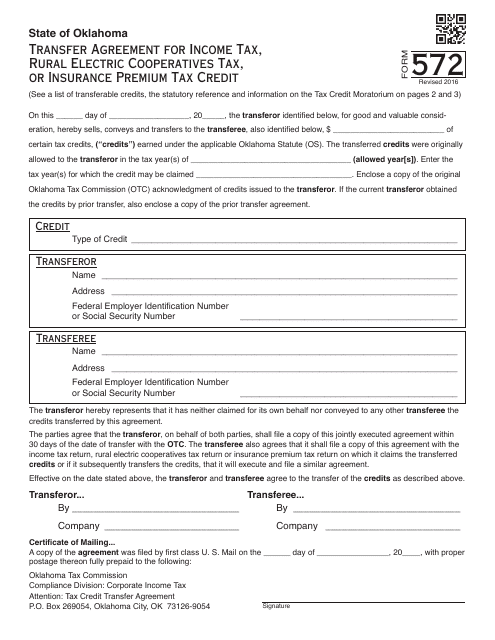

This document is used for transferring agreement related to income tax, rural electric cooperatives tax, or insurance premium tax credit in Oklahoma.

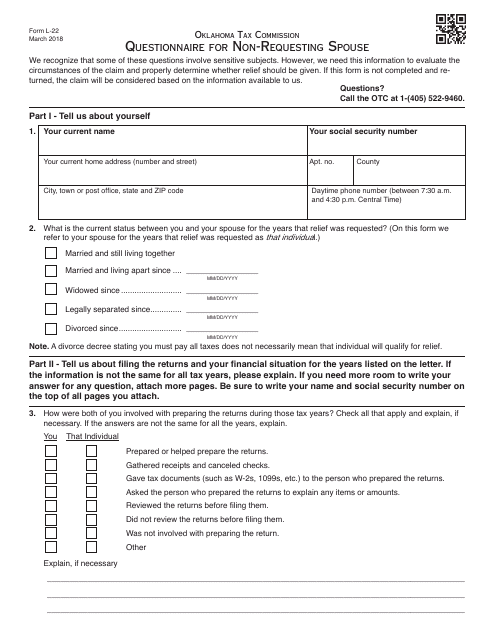

This form is used for non-requesting spouses in Oklahoma to complete a questionnaire as part of the OTC Form L-22 process.

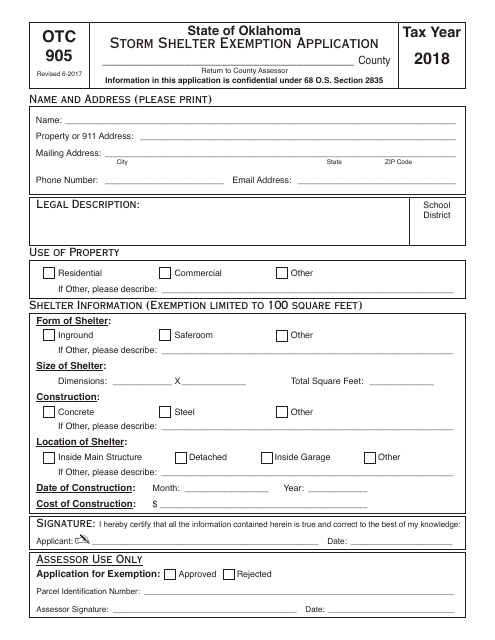

This Form is used for applying for a storm shelter exemption in the state of Oklahoma.

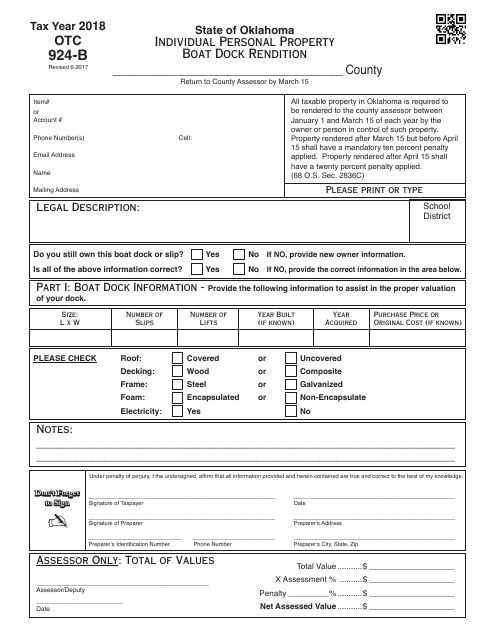

This form is used for individuals in Oklahoma to report their personal property boat dock for tax purposes.

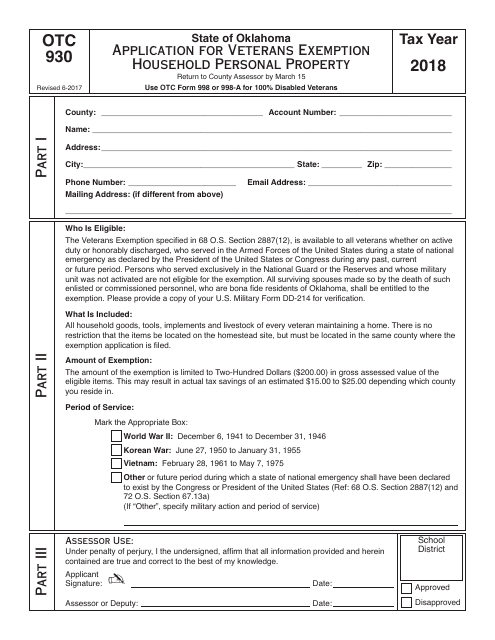

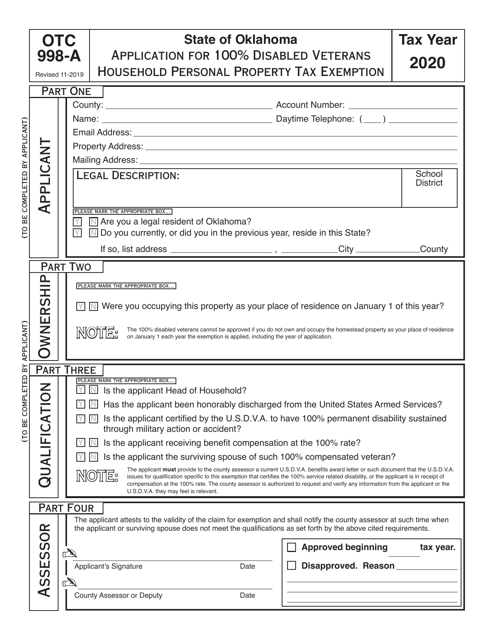

This form is used for residents of Oklahoma to apply for a veterans exemption for household personal property.

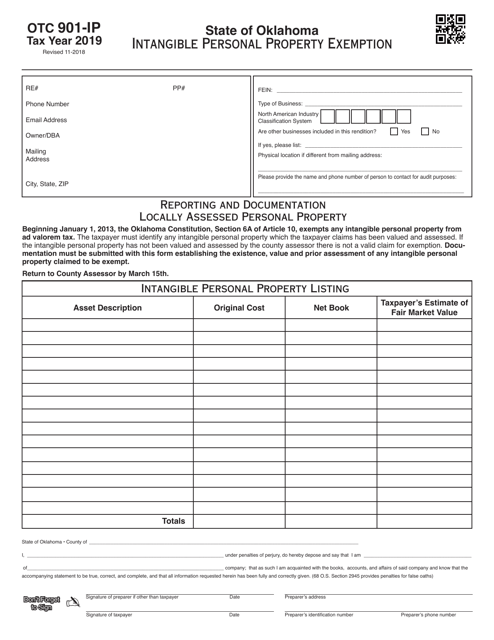

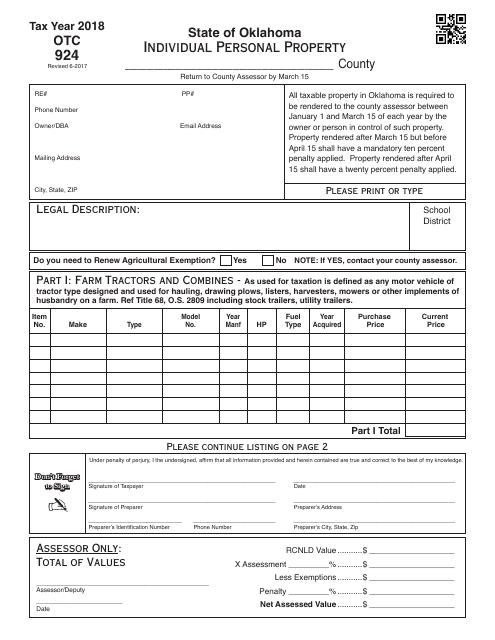

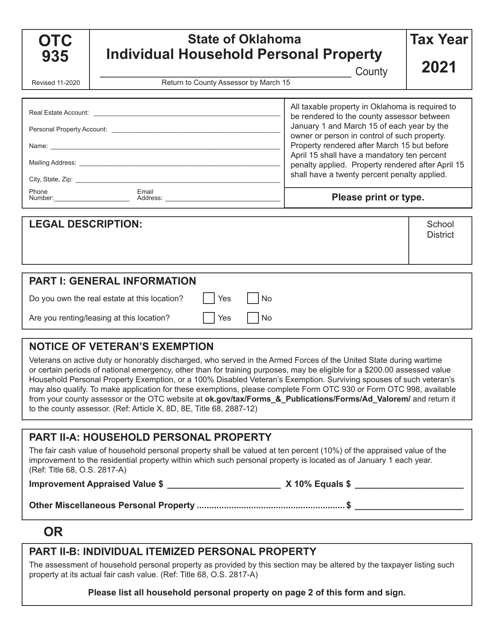

This Form is used for reporting individual personal property in Oklahoma.

This form is used for applying for tax exemption on manufacturing in Oklahoma.

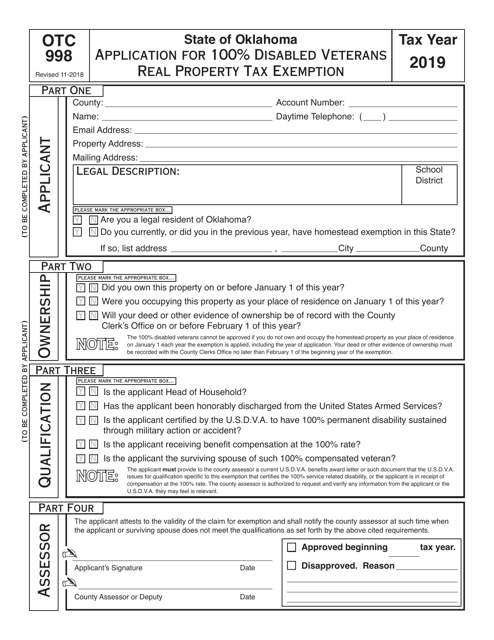

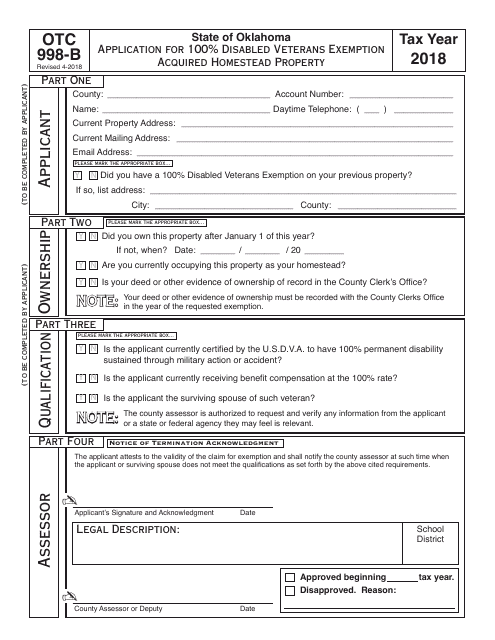

This Form is used for applying for the 100% Disabled Veterans Exemption for acquired homestead property in Oklahoma.

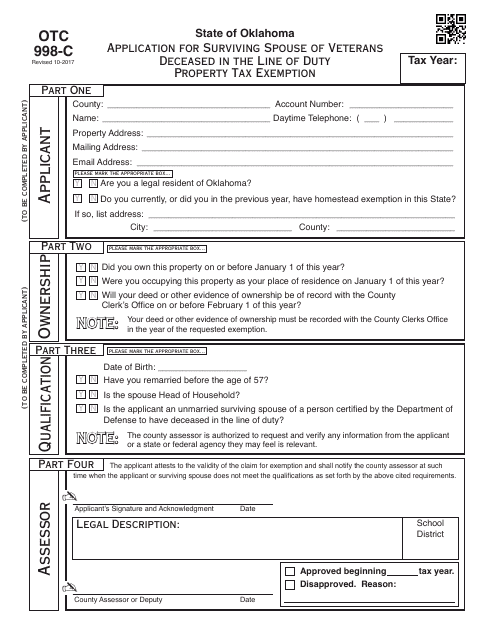

This form is used for applying for a property tax exemption in Oklahoma for surviving spouses of veterans who died in the line of duty.

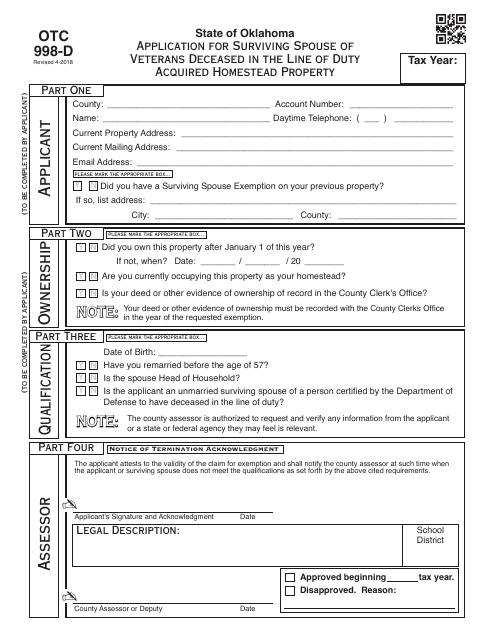

This form is used for applying for the OTC998-D program in Oklahoma, which provides property tax exemptions for surviving spouses of veterans who acquired homestead property.

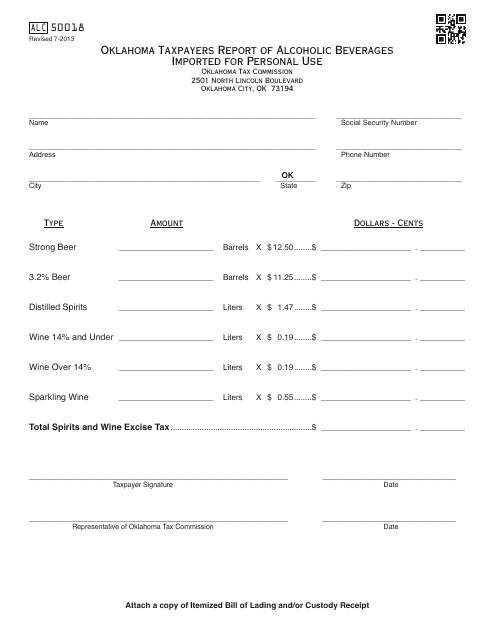

This form is used for Oklahoma taxpayers to report the importation of alcoholic beverages for personal use in the state.

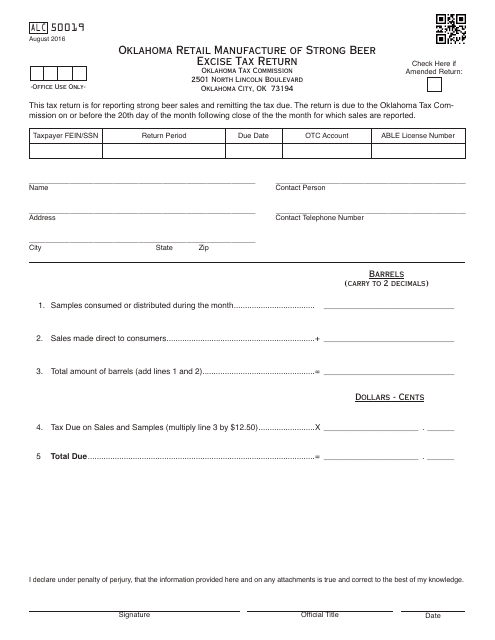

This Form is used for filing the Oklahoma Retail Manufacture of Strong Beer Excise Tax Return in Oklahoma. It is used by retail manufacturers of strong beer to report and pay the excise tax.

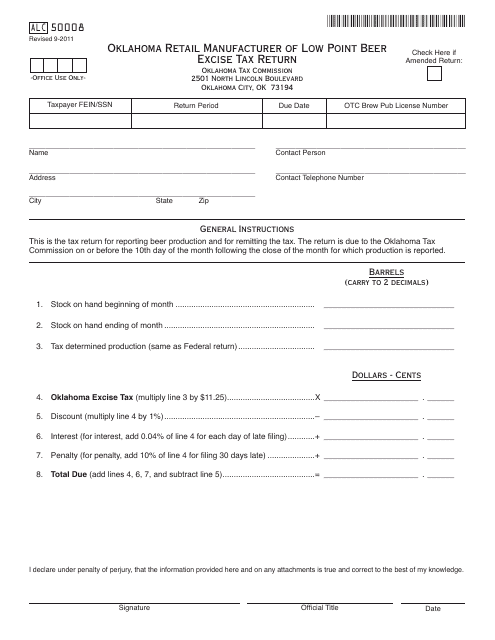

This form is used for Oklahoma retailers who manufacture and sell low point beer to report and pay the excise tax.

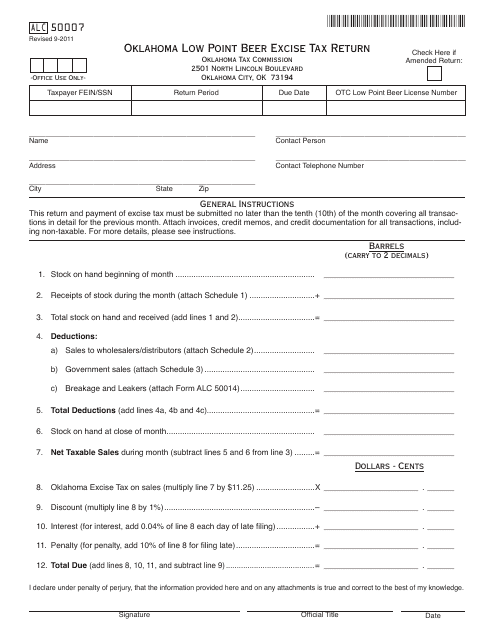

This form is used for filing the Oklahoma Low Point Beer Excise Tax Return for businesses selling low point beer in Oklahoma.