United States Tax Forms and Templates

Related Articles

Documents:

2432

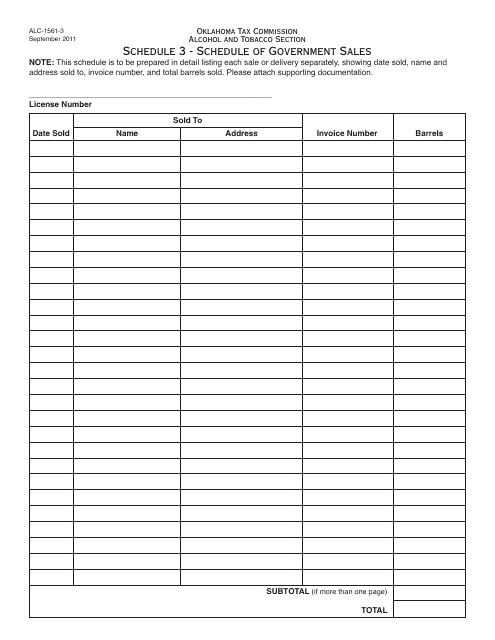

This document is used for reporting government sales in Oklahoma. It is a schedule that provides information about the sales made by governmental entities in the state.

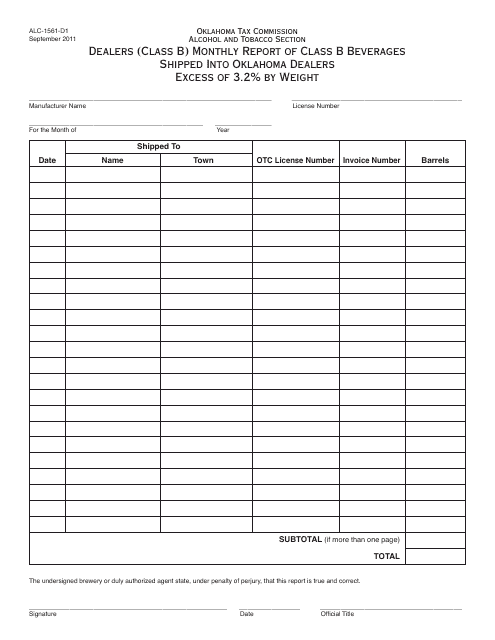

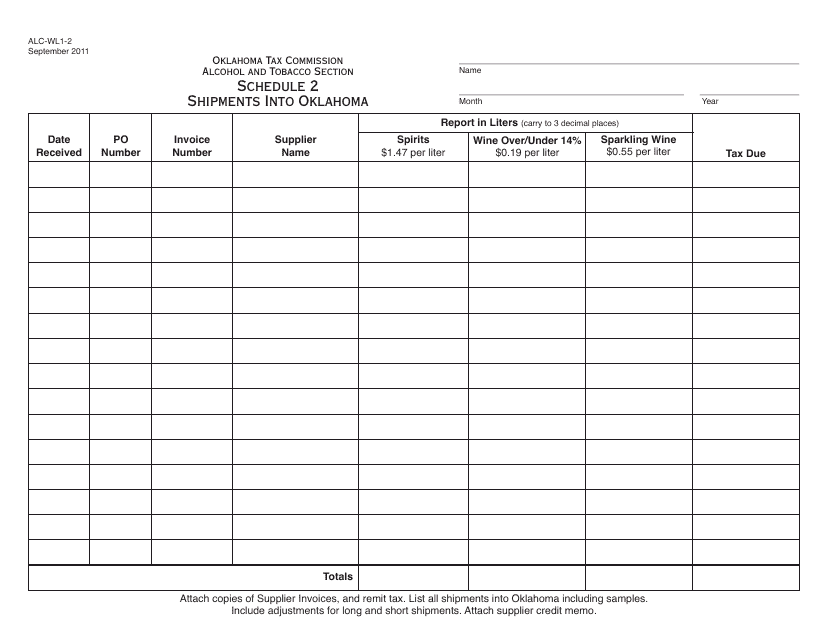

This form is used for dealers to report monthly shipments of Class B beverages exceeding 3.2% by weight into Oklahoma.

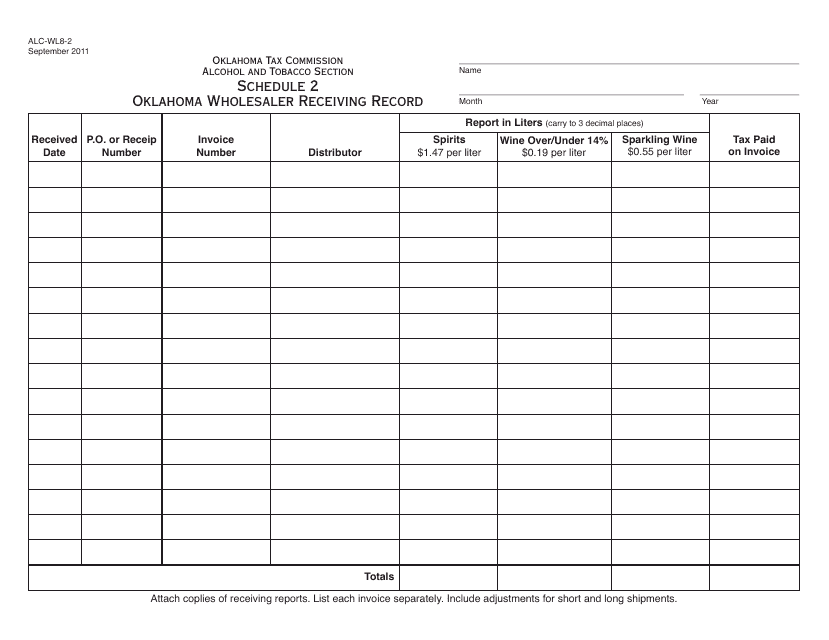

This document is used for recording the receiving of goods by wholesalers in Oklahoma.

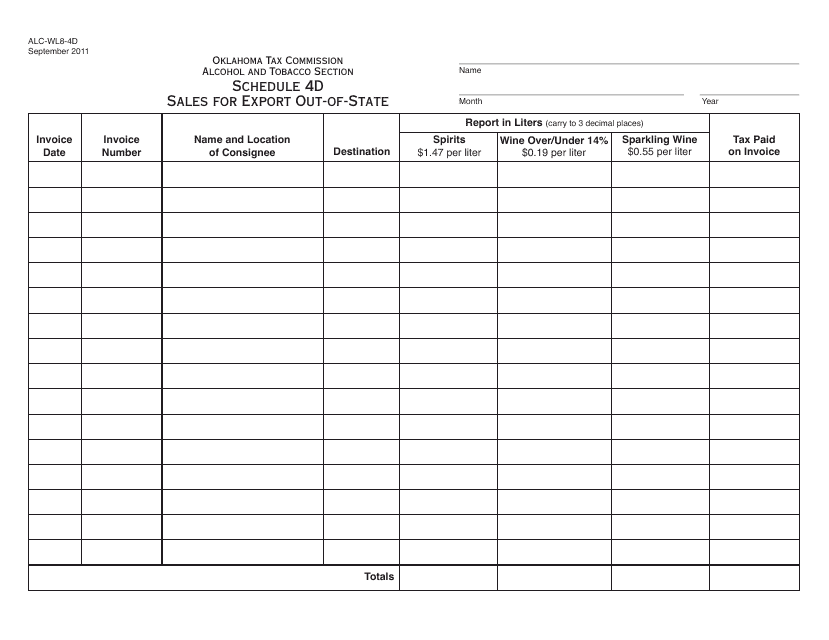

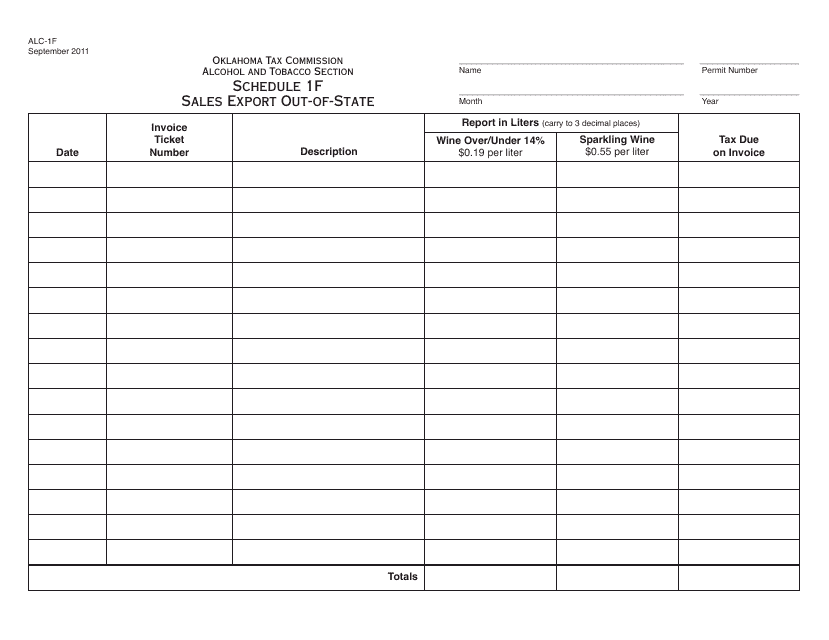

This Form is used for reporting sales of goods for export out-of-state in Oklahoma.

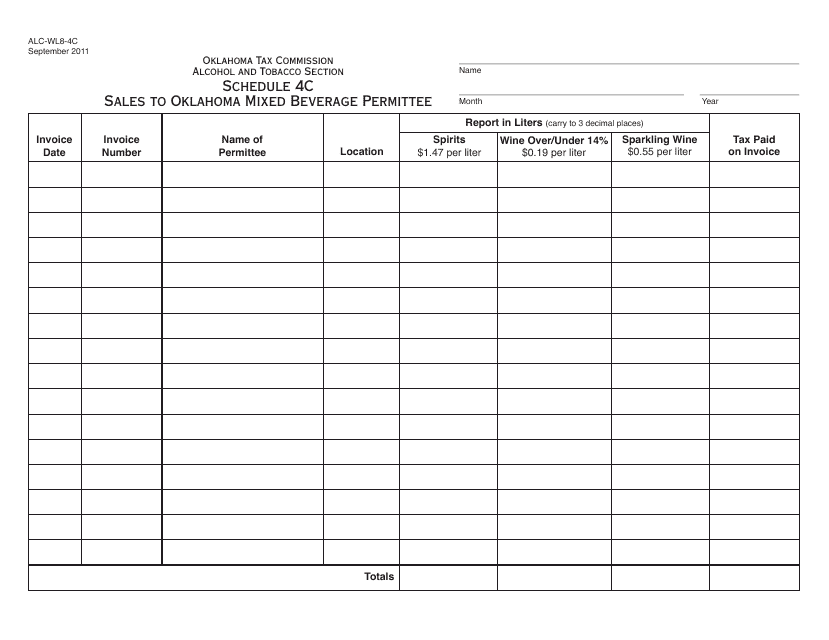

This document is used for reporting sales to Oklahoma mixed beverage permittees in Oklahoma.

This form is used for scheduling shipments into Oklahoma.

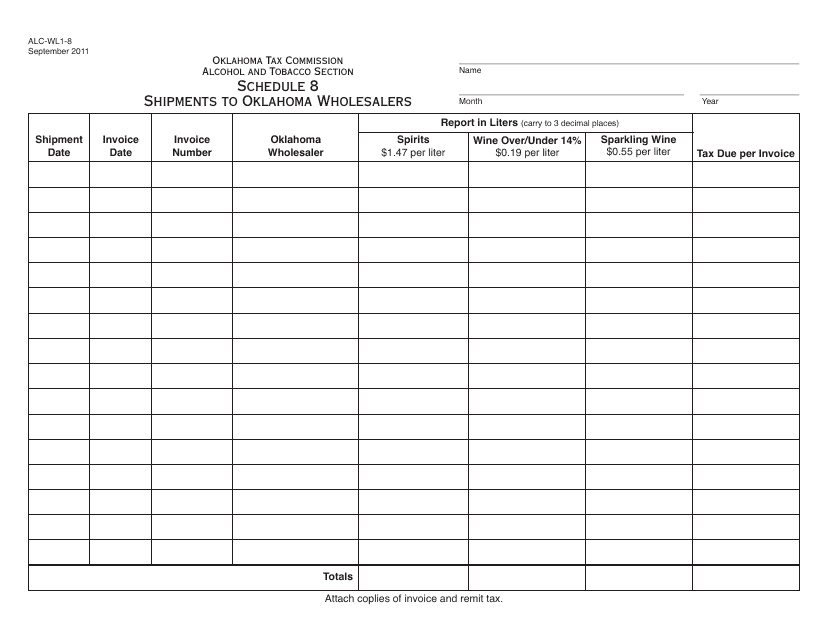

This Form is used for reporting shipments of goods to wholesalers in Oklahoma.

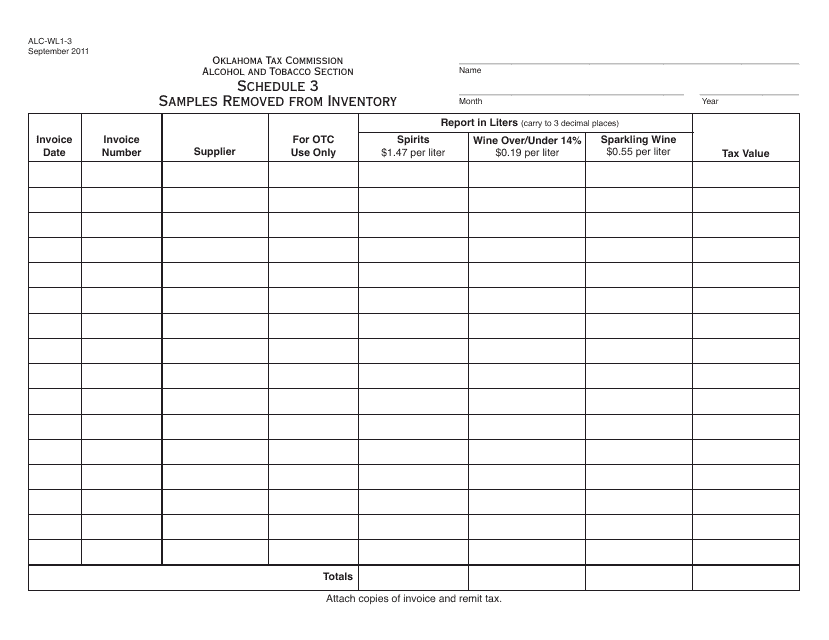

This Form is used for reporting the removal of samples from inventory in Oklahoma.

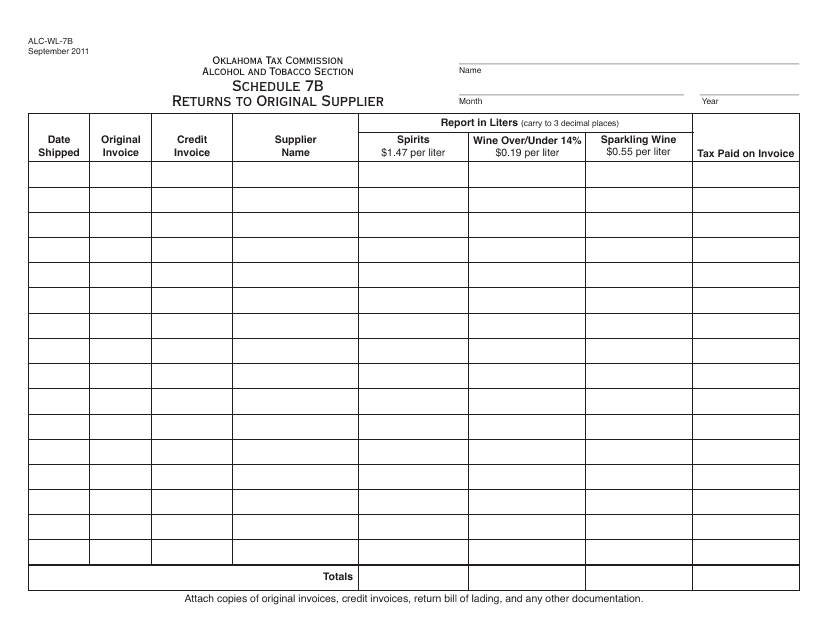

This Form is used for returning items to the original supplier in Oklahoma.

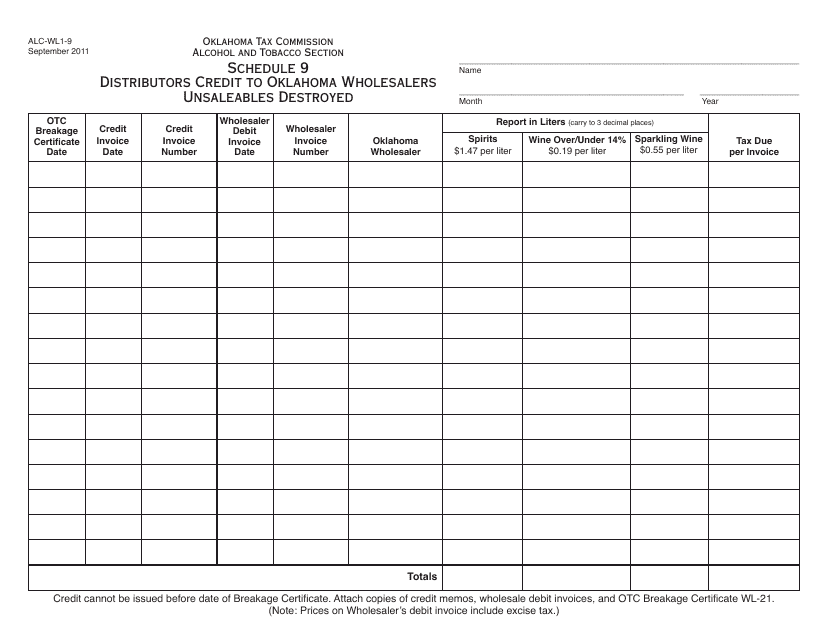

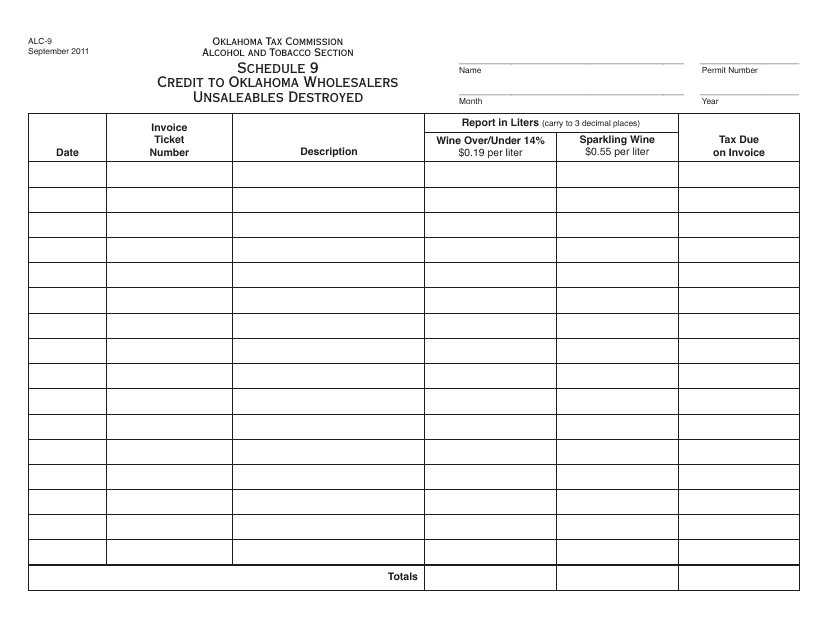

This type of document is a schedule to report distributors' credits for unsaleable products destroyed by wholesalers in Oklahoma.

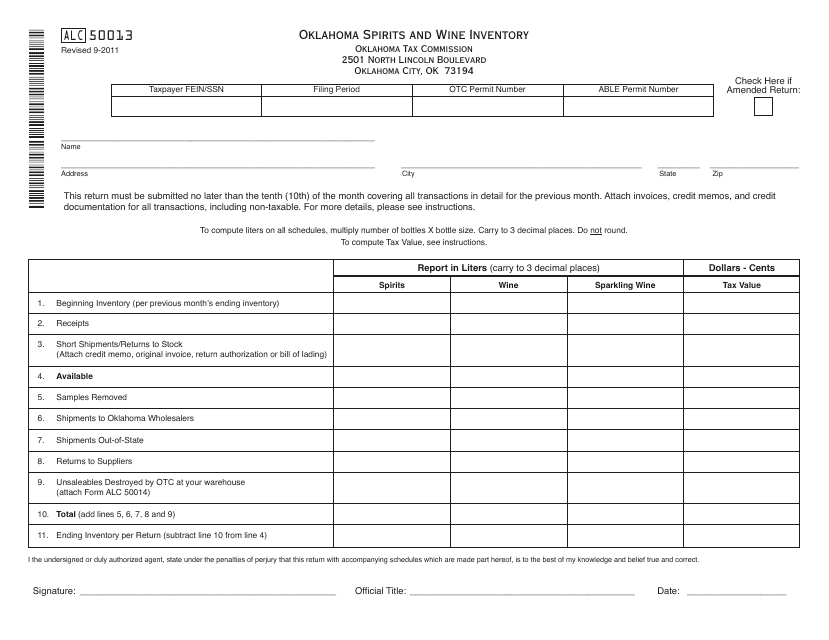

This form is used for inventory management of spirits and wine in Oklahoma, specifically for over-the-counter (OTC) sales.

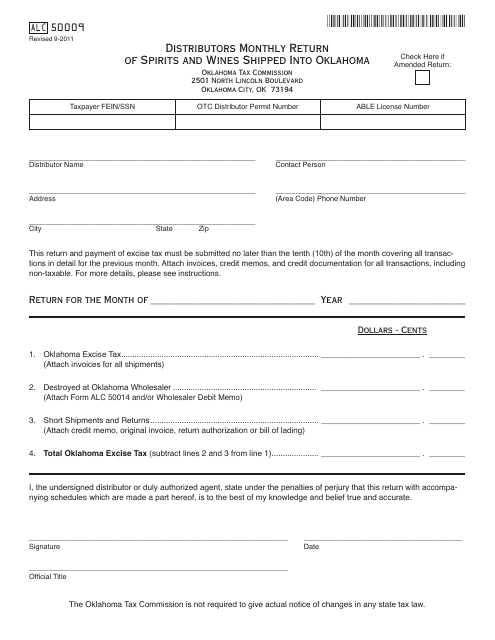

This Form is used for Oklahoma distributors to report and track the monthly shipment of spirits and wines into the state.

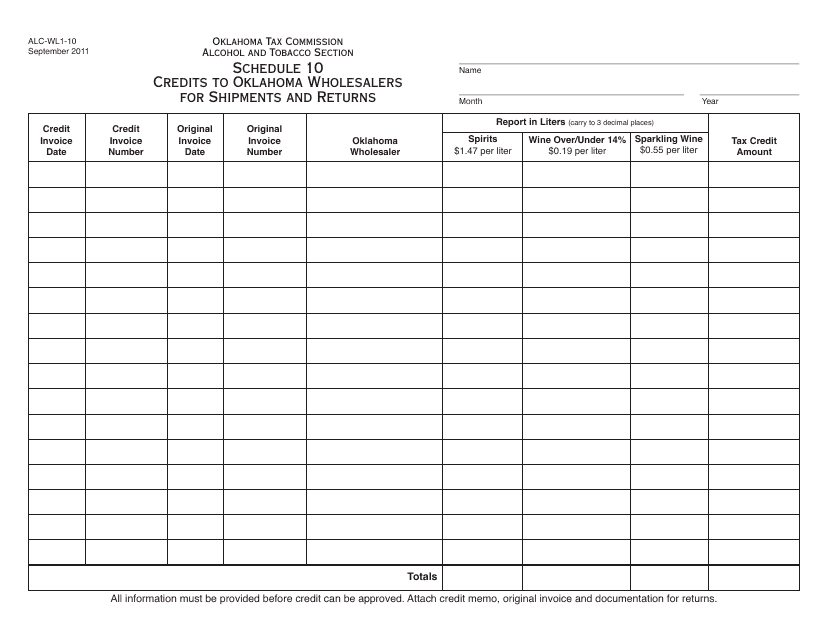

OTC Form ALC-WL1-10 Schedule 10 Credits to Oklahoma Wholesalers for Shipments and Returns - Oklahoma

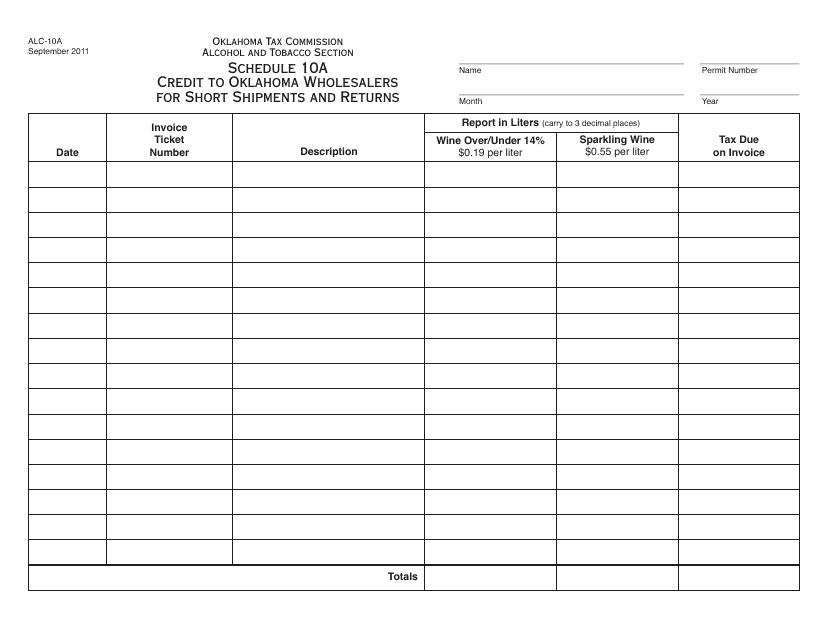

This form is used for crediting Oklahoma wholesalers for shipments and returns of goods.

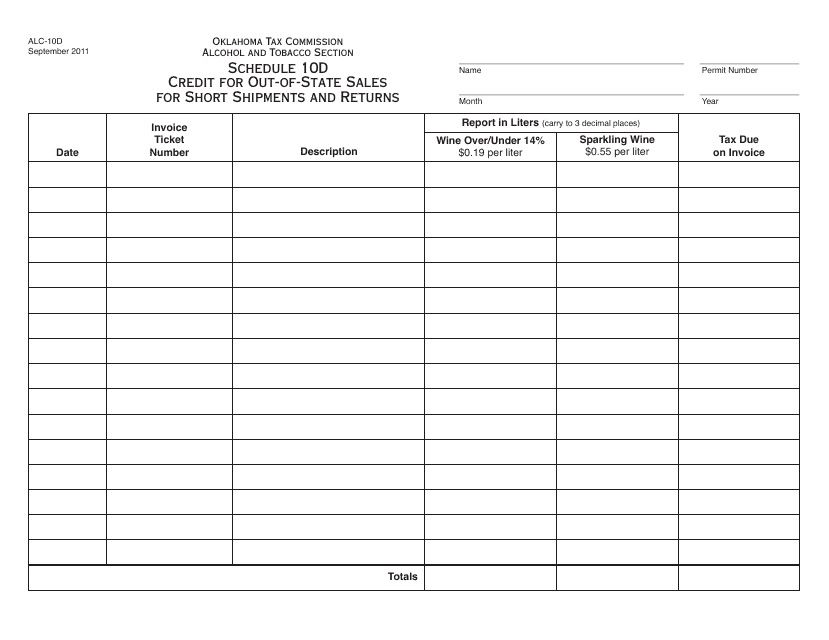

This type of document, Form ALC-10D Schedule 10D, is used in Oklahoma to claim a credit for out-of-state sales for short shipments and returns.

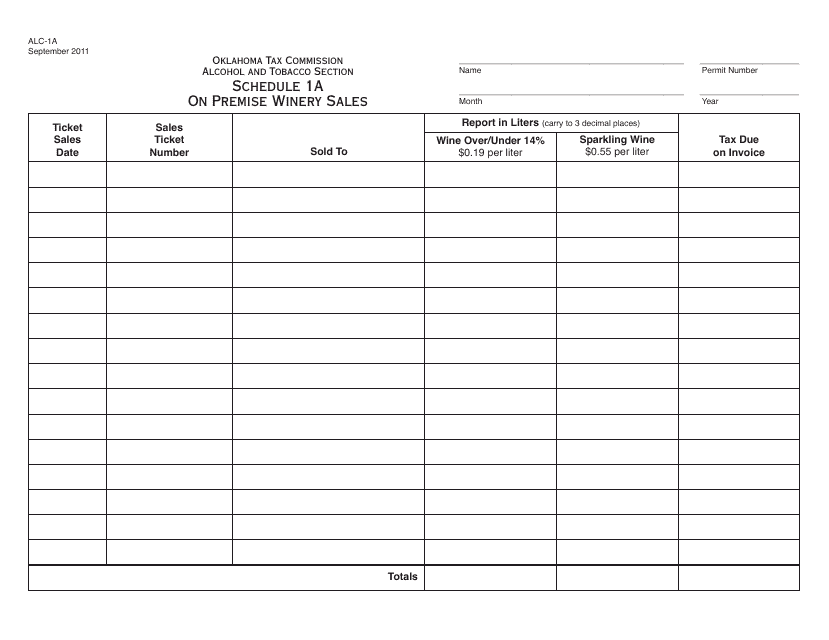

This form is used for reporting on-premise winery sales in Oklahoma.

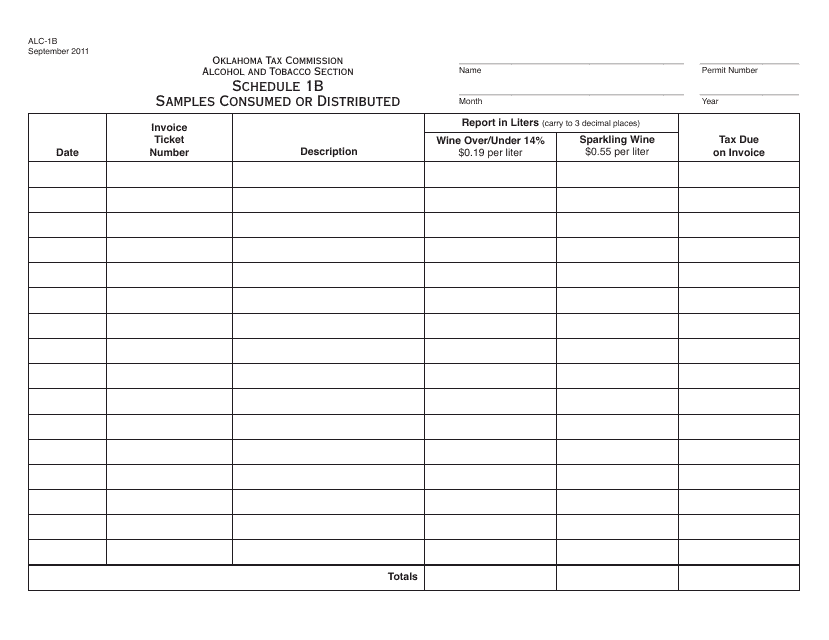

This document is used for reporting samples consumed or distributed in Oklahoma.

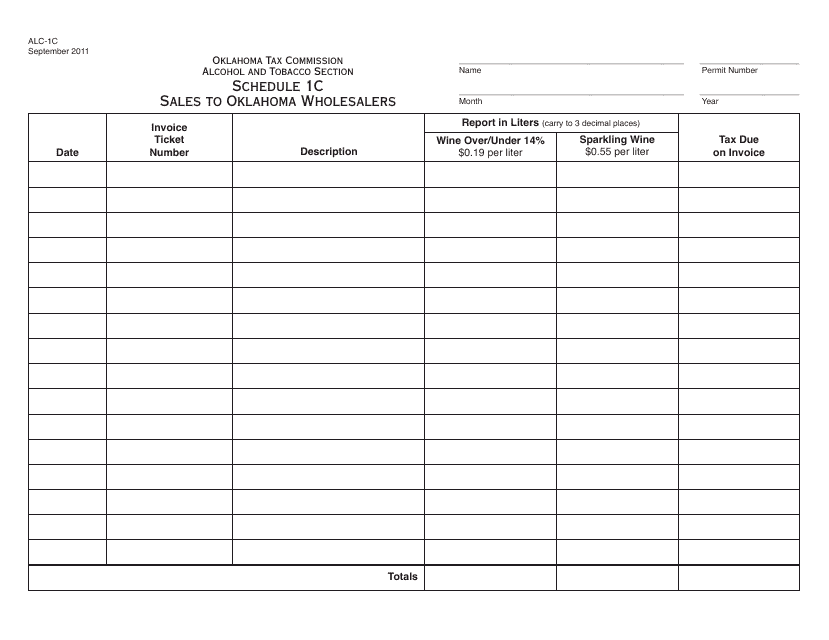

This form is used for reporting sales to wholesalers in Oklahoma. It is specifically designed for use in Oklahoma and is part of the OTC Form ALC-1C.

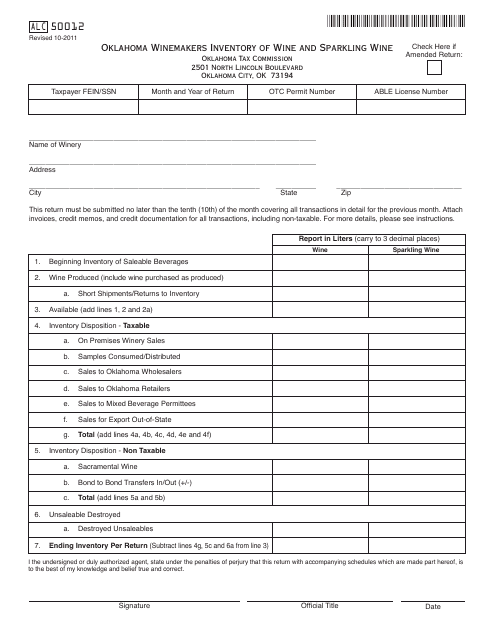

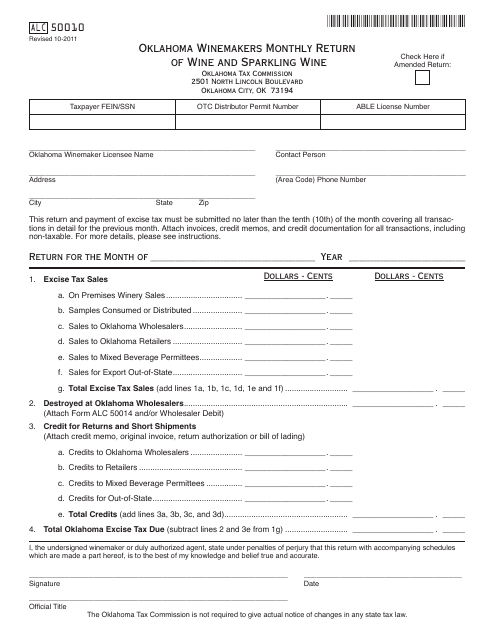

This Form is used for Oklahoma winemakers to report their inventory of wine and sparkling wine.

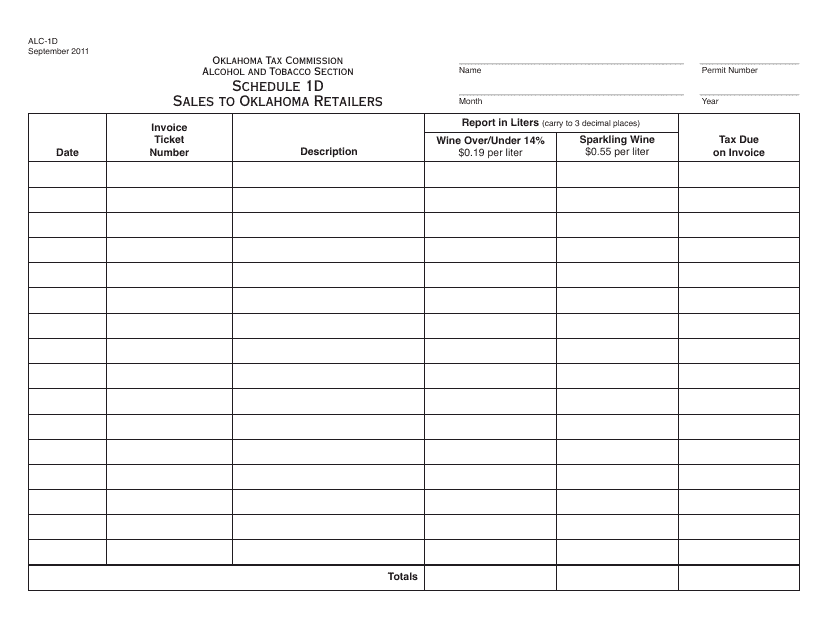

This form is used for reporting sales to Oklahoma retailers in the state of Oklahoma. It is specifically for over-the-counter sales and is known as Form ALC-1D Schedule 1D.

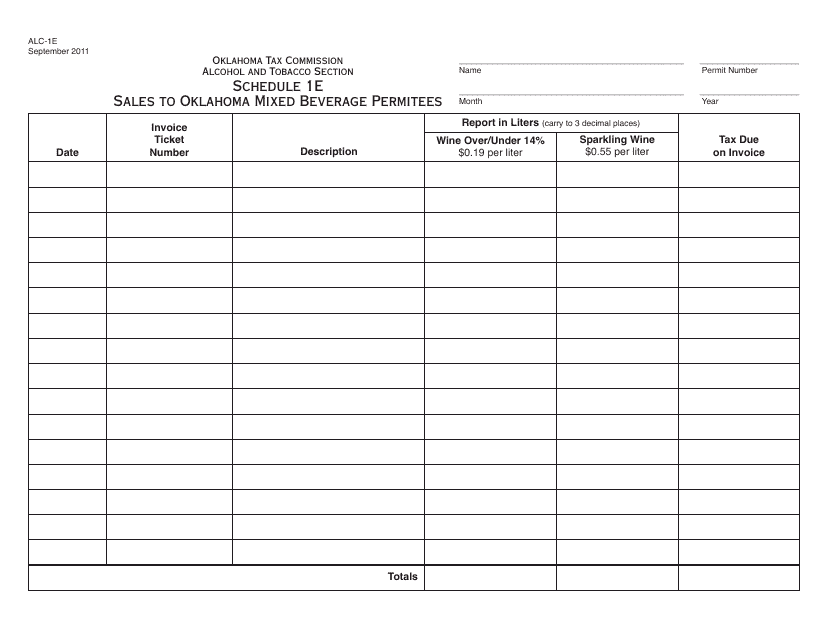

This form is used for reporting sales to Oklahoma Mixed Beverage Permittees in Oklahoma.

This Form is used for reporting sales exports out-of-state in Oklahoma.

This form is used by winemakers in Oklahoma to report their monthly sales of wine and sparkling wine.

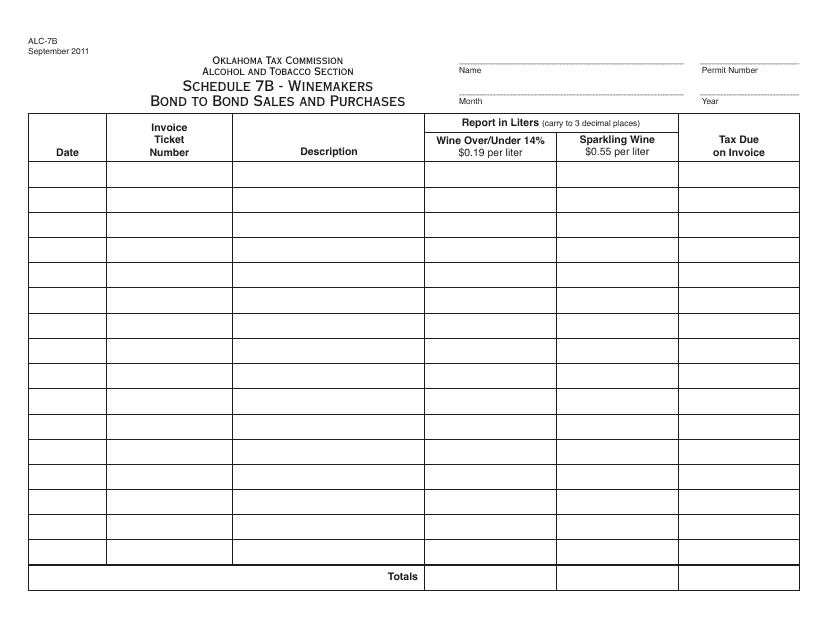

This document is used for reporting and recording the bond sales and purchases of winemakers in Oklahoma.

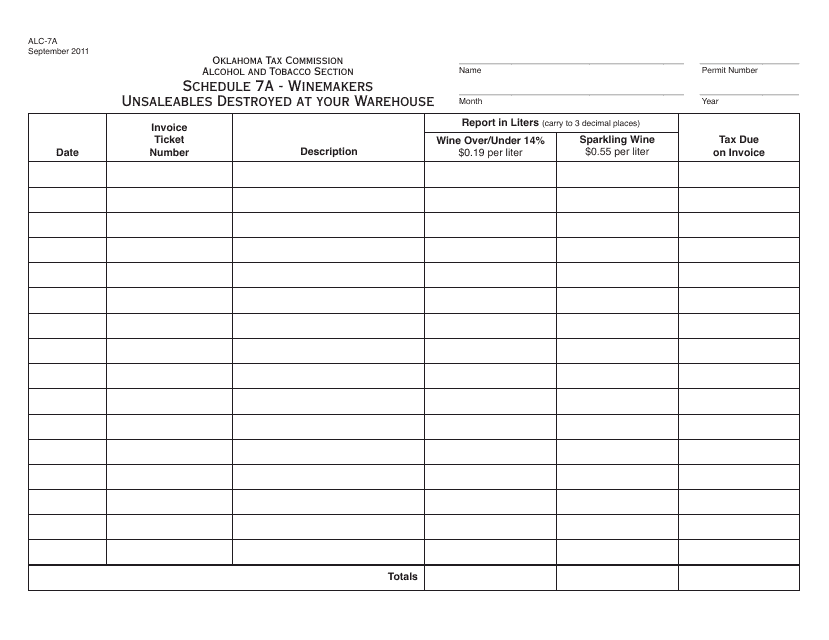

This form is used for reporting the unsaleable wines that have been destroyed at your warehouse in Oklahoma.

This form is used for documenting the credit given to Oklahoma wholesalers for destroyed unsaleable products.

This form is used for providing credit to Oklahoma wholesalers in cases of short shipments and returns. It is specifically for wholesale transactions that take place in Oklahoma.

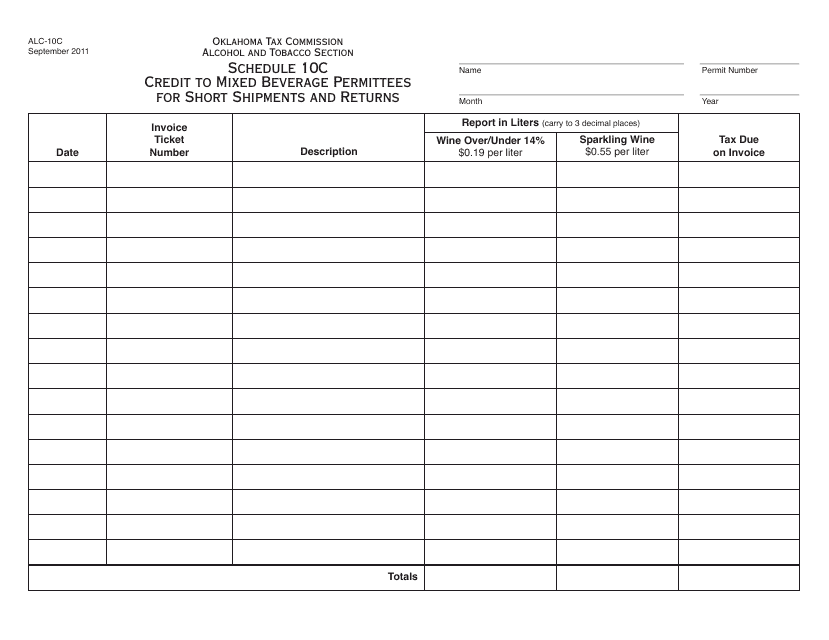

This Form is used for claiming credit to mixed beverage permittees in Oklahoma for short shipments and returns.

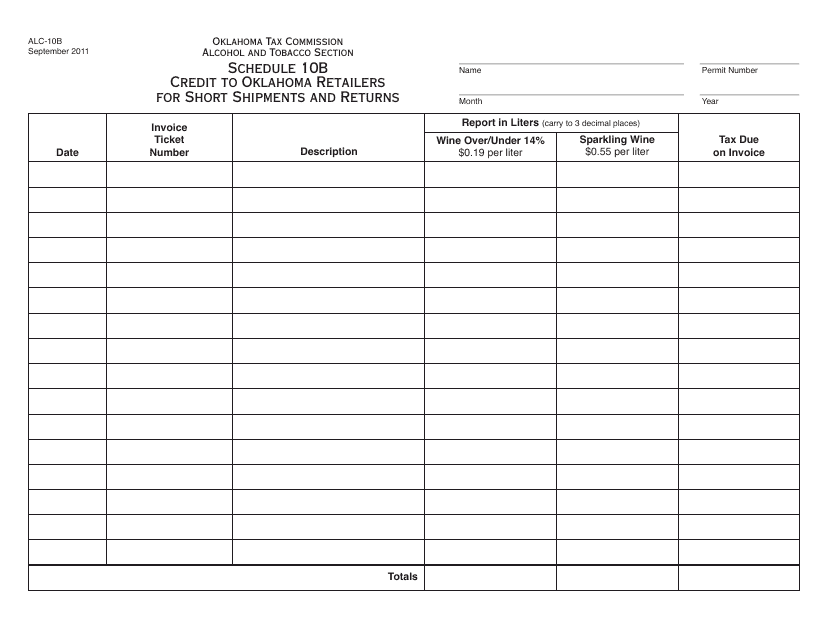

This Form is used for crediting Oklahoma retailers for short shipments and returns.

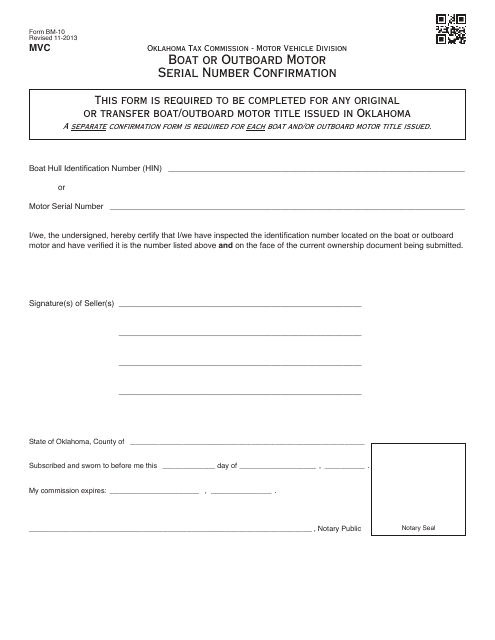

This Form is used for confirming the serial number of a boat or outboard motor in the state of Oklahoma.

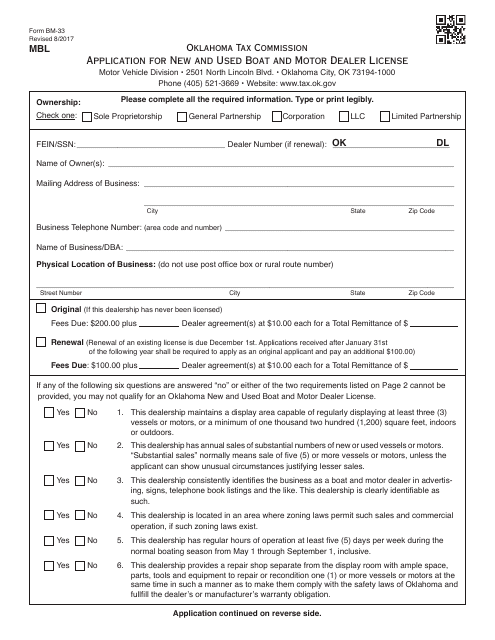

This form is used for applying for a new or used boat and motor dealer license in Oklahoma.

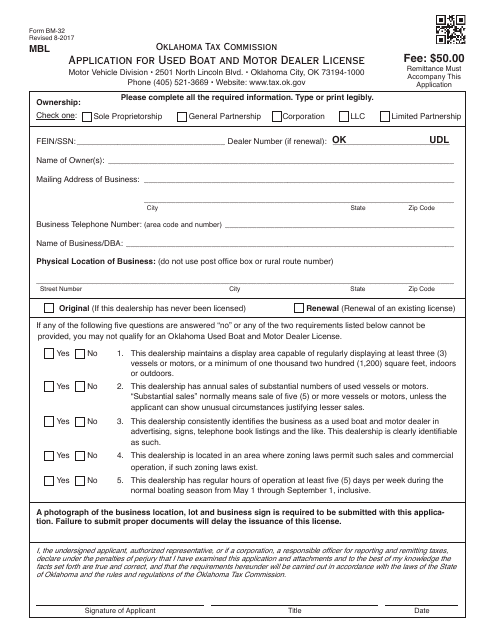

This Form is used for applying for a Used Boat and Motor Dealer License in Oklahoma.

This Form is used for registering a business in Oklahoma specifically for obtaining a cigarette and tobacco license.

This form is used for applying for a refund of motor vehicle payment in Oklahoma.

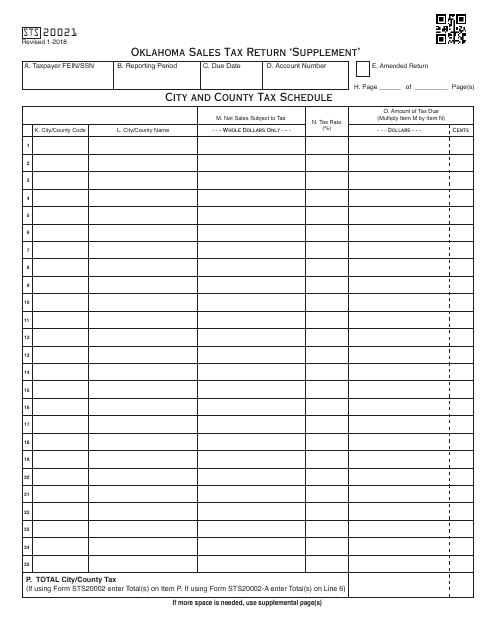

This Form is used for filing supplementary sales tax return in Oklahoma.

This Form is used for protesting the closure of a business and requesting an administrative hearing in Oklahoma.

This packet contains the necessary forms and instructions for registering motor fuel in the state of Oklahoma. It is used by individuals or businesses who produce, distribute, or sell motor fuel in Oklahoma.

This document is a packet for Oklahoma Sales Tax Exemption. It provides information on how to apply for sales tax exemption in Oklahoma. This packet includes the necessary forms and instructions for individuals or businesses seeking exemption from paying sales tax in Oklahoma.

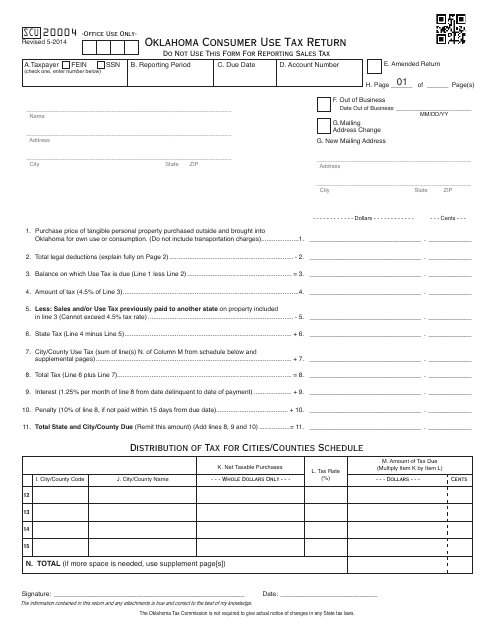

This form is used for reporting and paying consumer use tax in Oklahoma. It is necessary for individuals who have made purchases out-of-state or online and did not pay sales tax at the time of purchase. The form helps ensure that individuals fulfill their tax obligations.