United States Tax Forms and Templates

Related Articles

Documents:

2432

This form is used for applying for a tax exemption on real and personal property in Oklahoma.

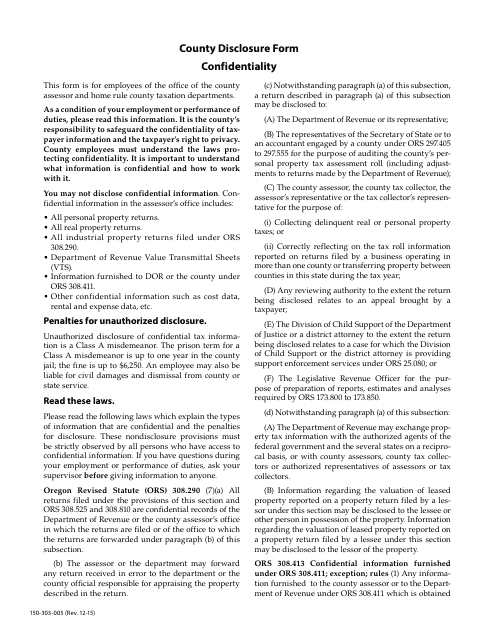

This form is used to disclose confidential information on a county level in Oregon. It also serves as a certificate of confidentiality.

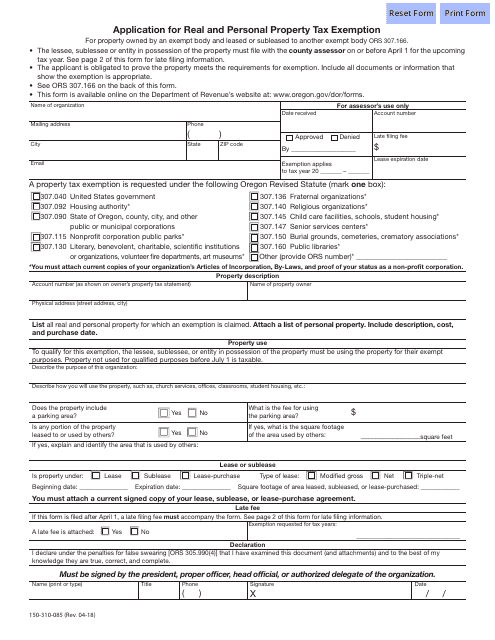

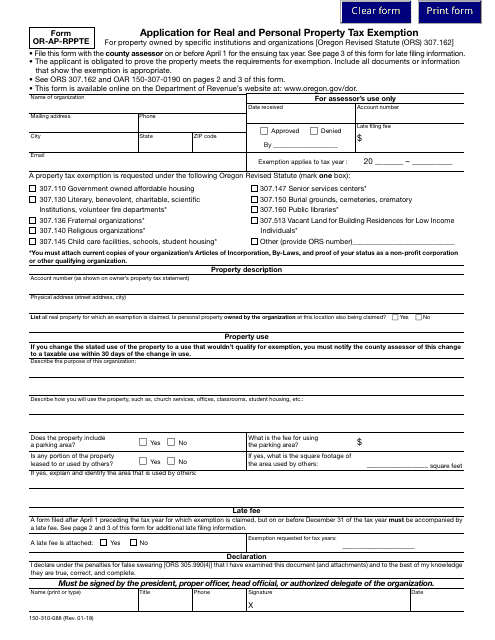

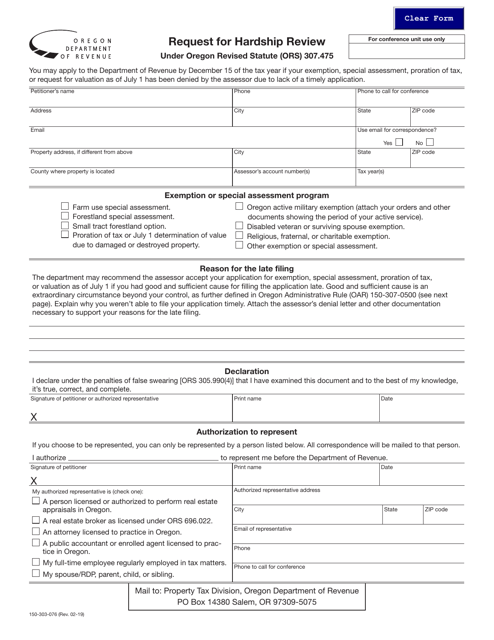

This Form is used for applying for a real and personal property tax exemption in Oregon.

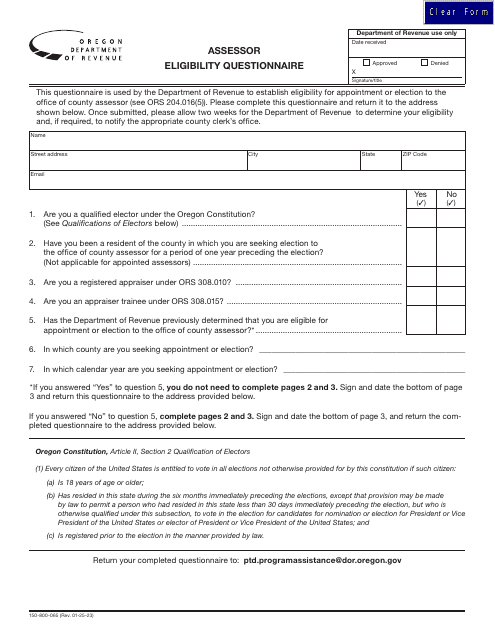

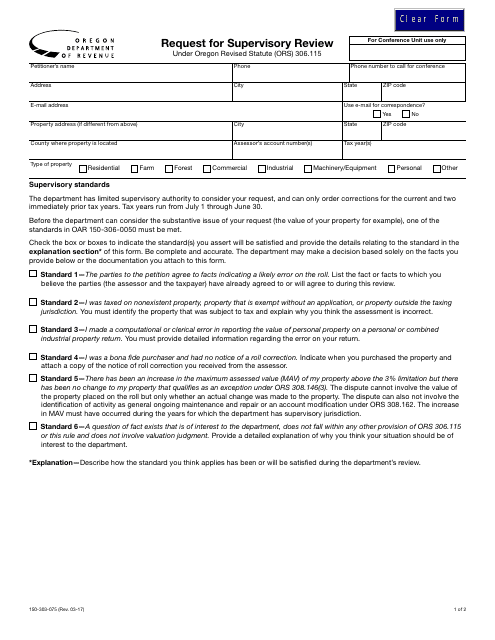

This Form is used for requesting a supervisory review in the state of Oregon.

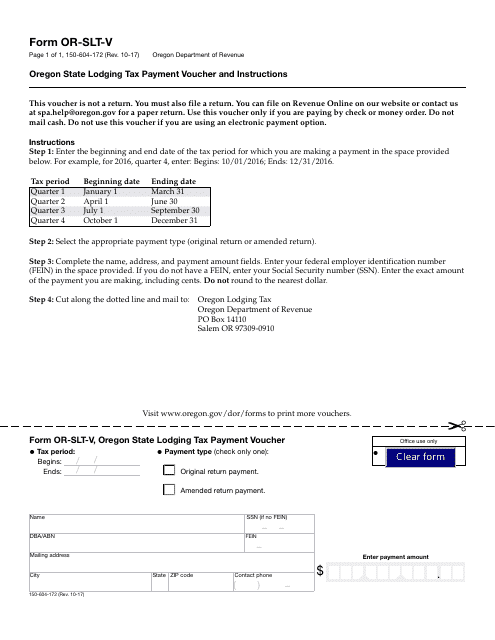

This Form is used for making lodging tax payments in the state of Oregon. It includes instructions on how to fill out the form and submit the payment.

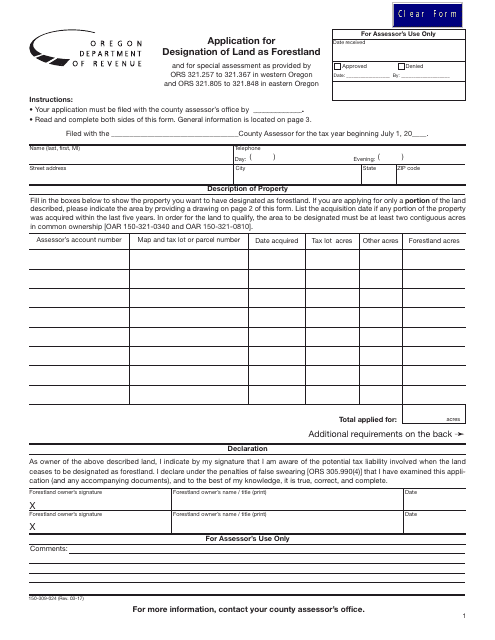

This form is used for applying to designate land in Oregon as forestland.

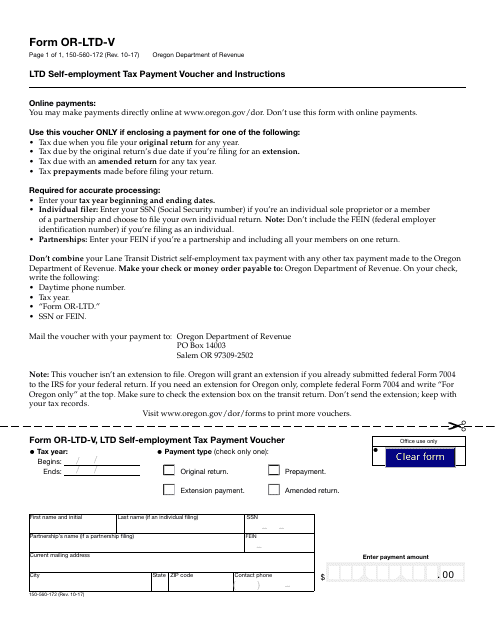

This Form is used for making self-employment tax payments in Oregon and provides instructions on how to fill it out.

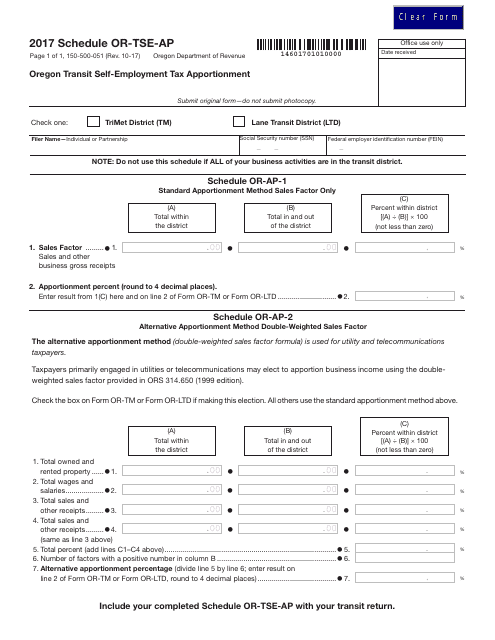

This document is used for apportioning self-employment tax for transit in Oregon.

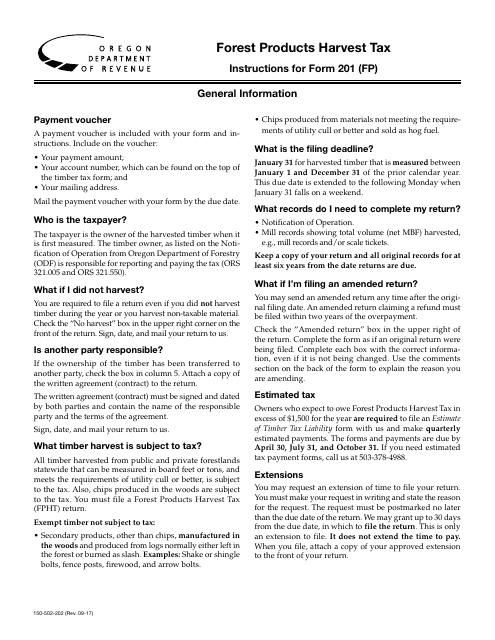

This form is used for reporting and paying the Forest Products Harvest Tax in the state of Oregon.

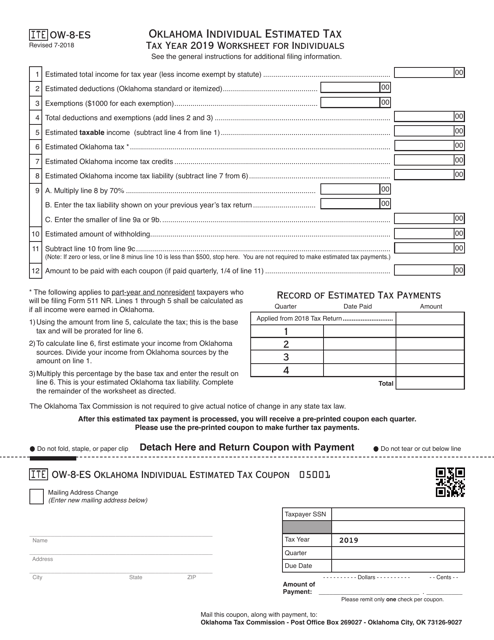

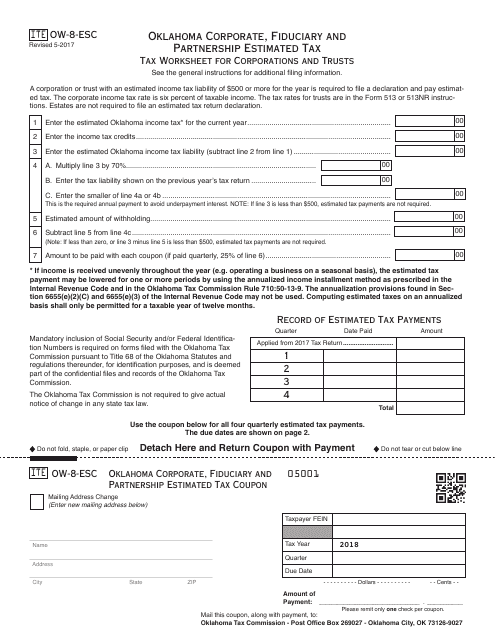

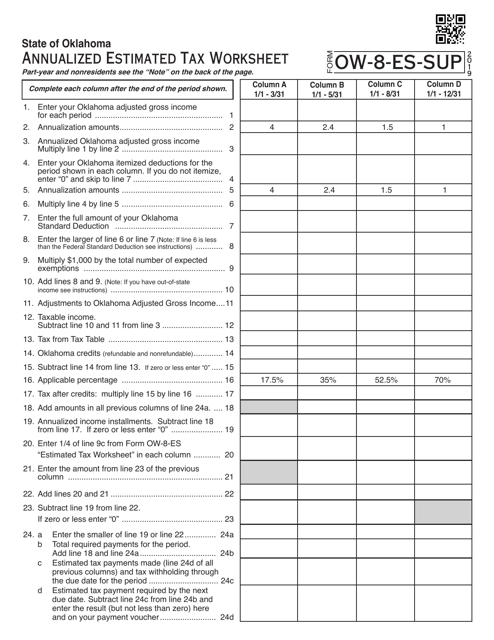

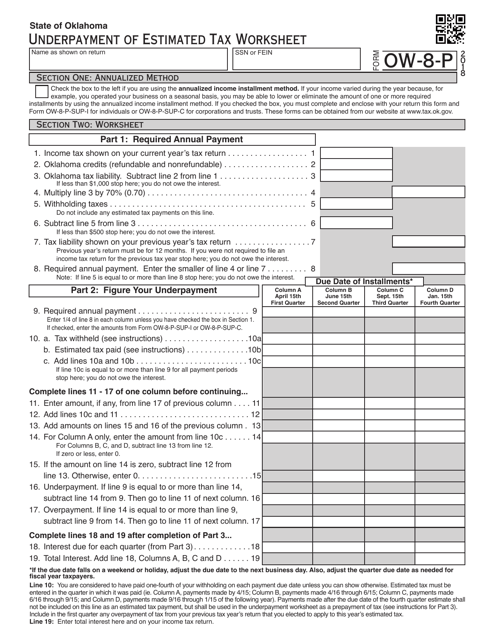

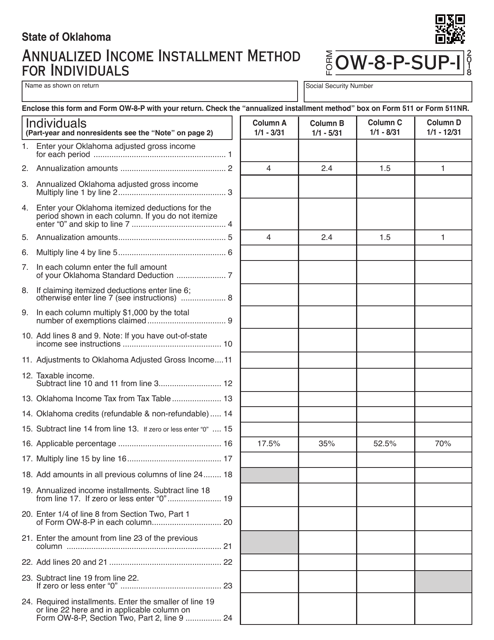

This form is used for corporations and trusts in Oklahoma to declare their estimated tax payments.

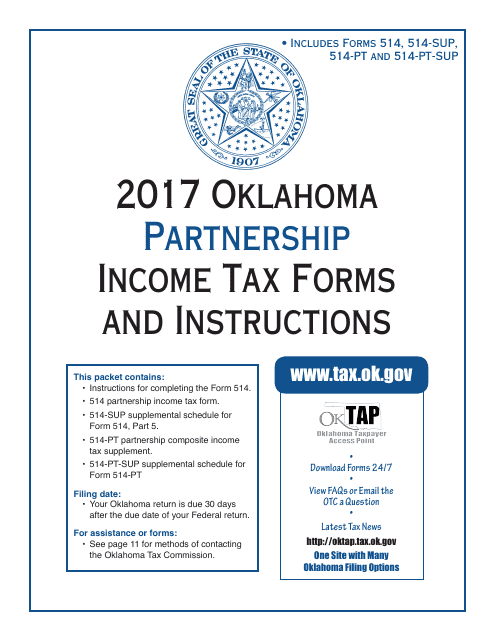

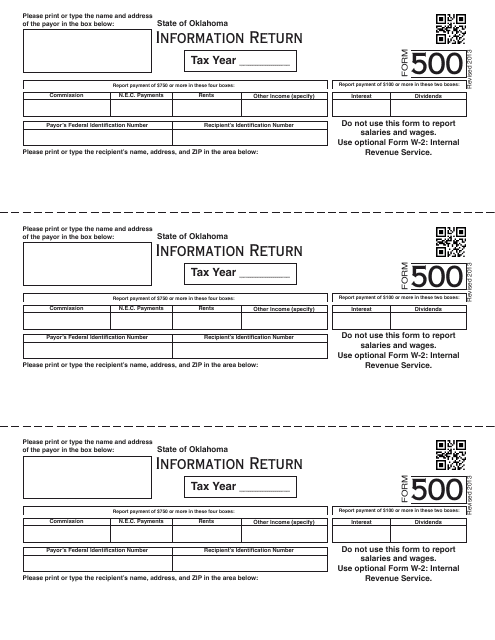

This document provides the necessary forms and instructions for filing partnership income taxes in the state of Oklahoma.

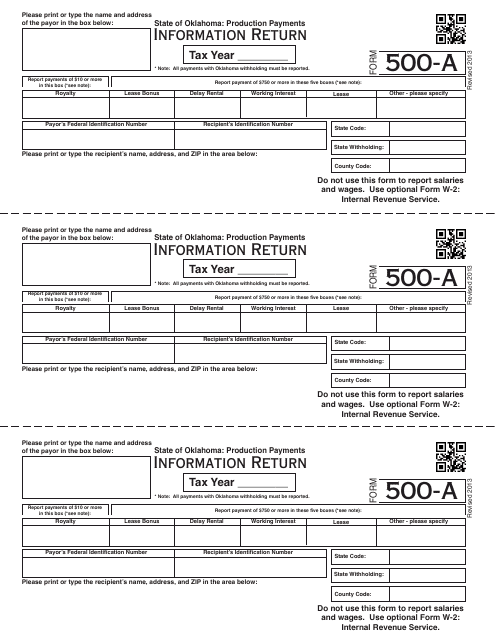

This Form is used for reporting production payments in Oklahoma.

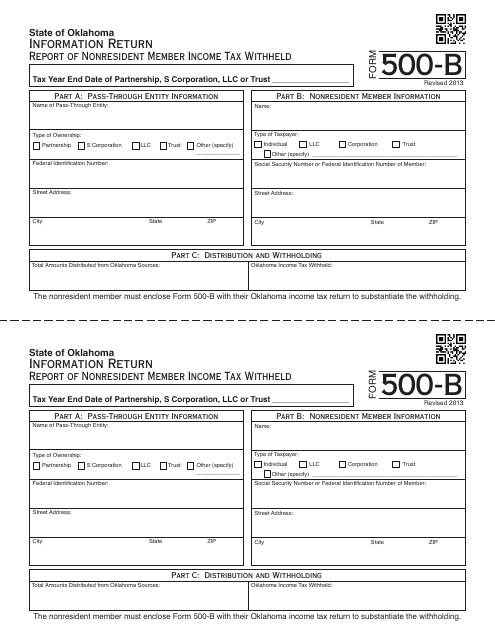

This form is used to report and withhold income tax for nonresident members in Oklahoma.

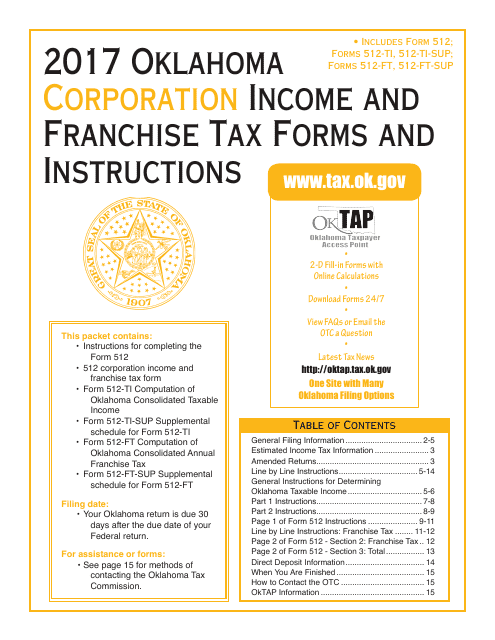

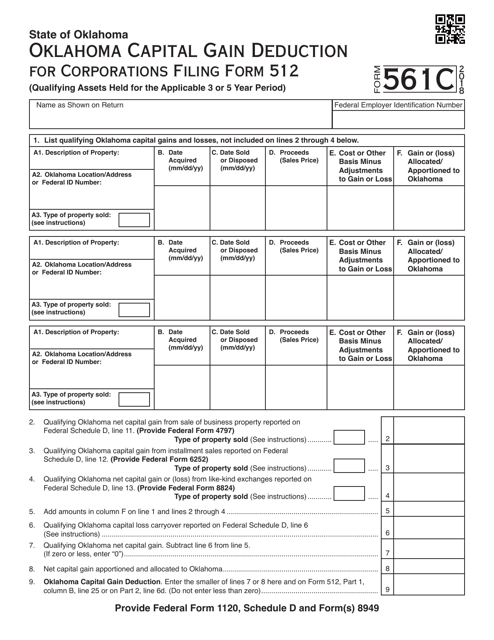

This document provides the necessary forms and instructions for filing corporation income and franchise taxes in the state of Oklahoma.

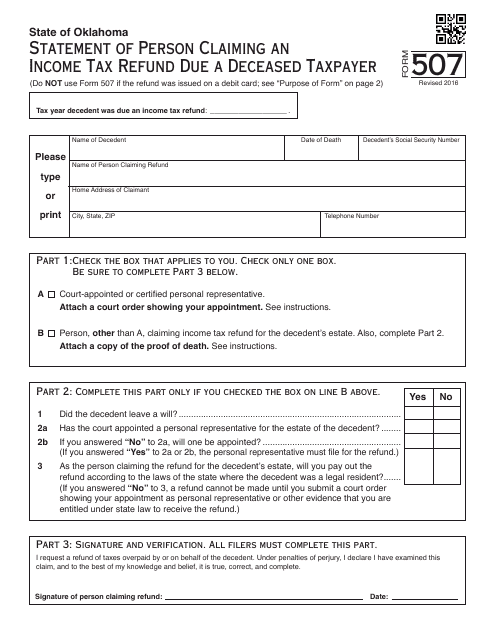

This form is used for claiming a refund on behalf of a deceased taxpayer in the state of Oklahoma.

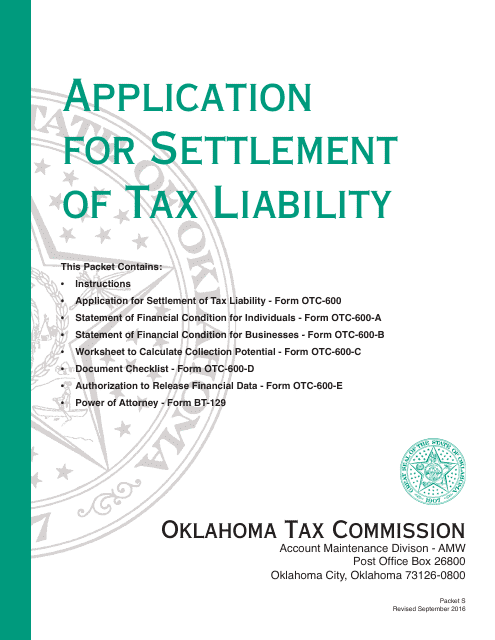

This type of document is used for applying to settle tax liability in the state of Oklahoma.

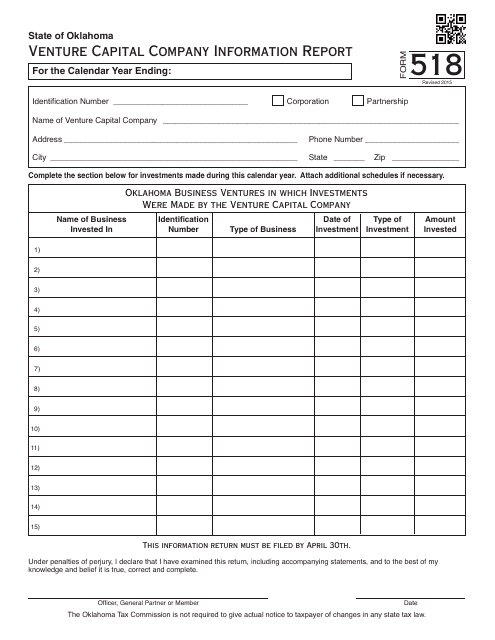

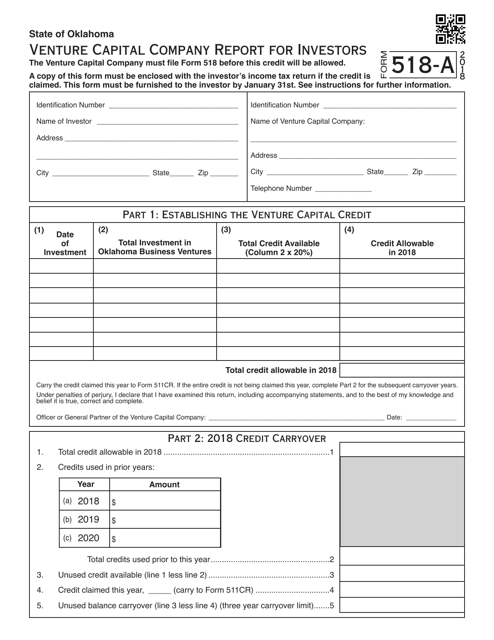

This document is used for reporting information about venture capital companies in Oklahoma.

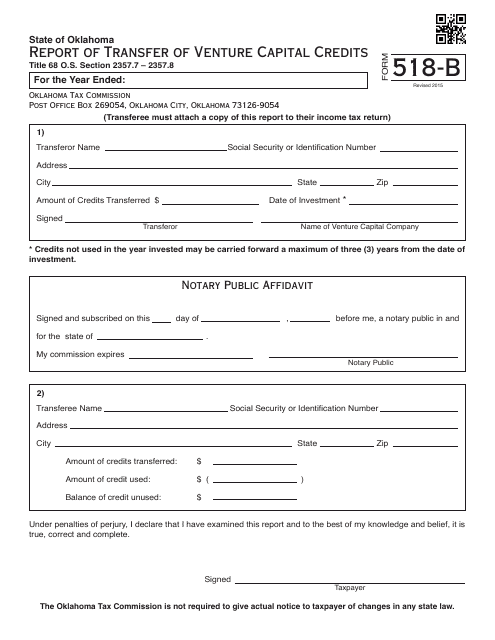

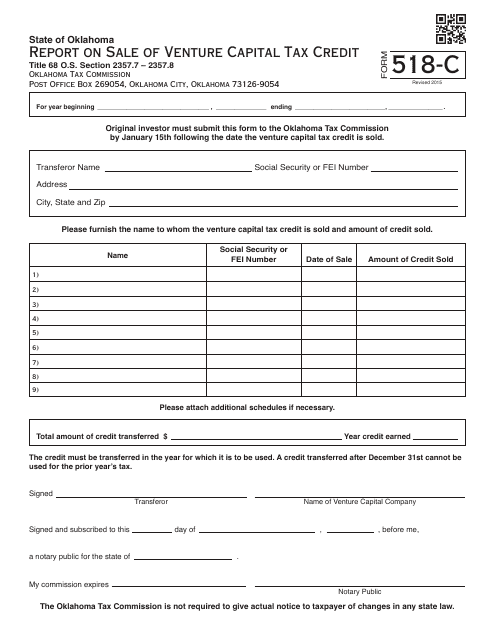

This Form is used for reporting the transfer of venture capital credits in Oklahoma.

This form is used for reporting the sale of Venture Capital Tax Credit in Oklahoma.

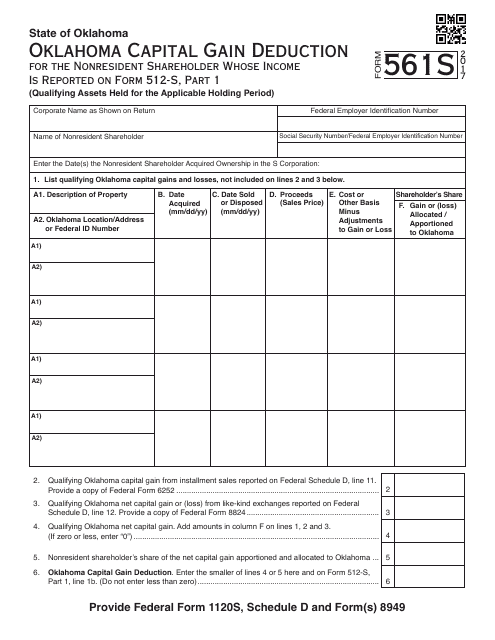

This OTC Form 561S is used for capital gain deduction for nonresident shareholders whose income is reported on Form 512-s, Part 1 in the state of Oklahoma.