United States Tax Forms and Templates

Related Articles

Documents:

2432

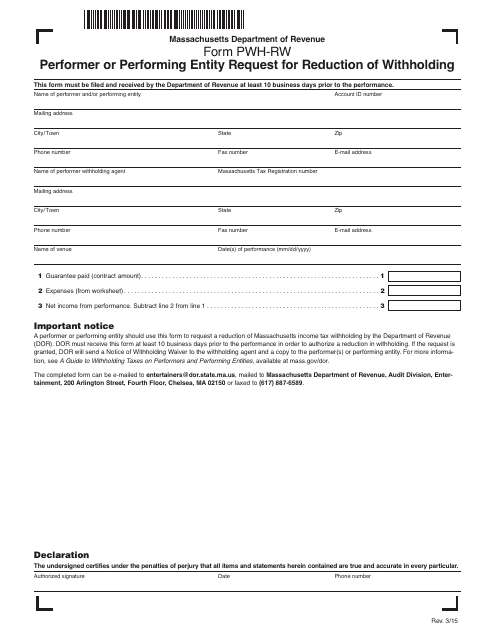

This Form is used for performers or performing entities in Massachusetts to request a reduction of withholding taxes.

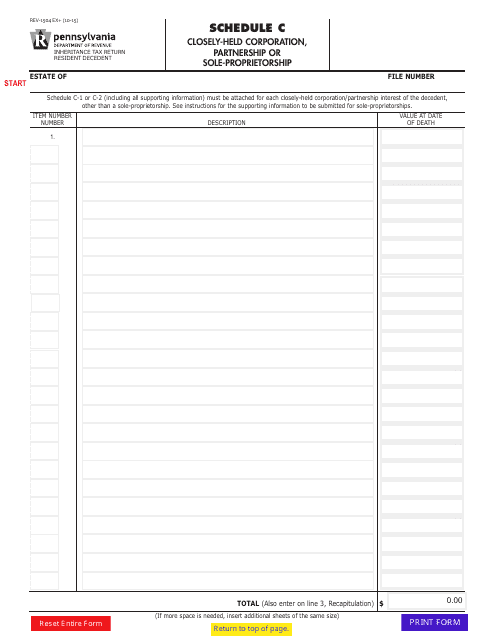

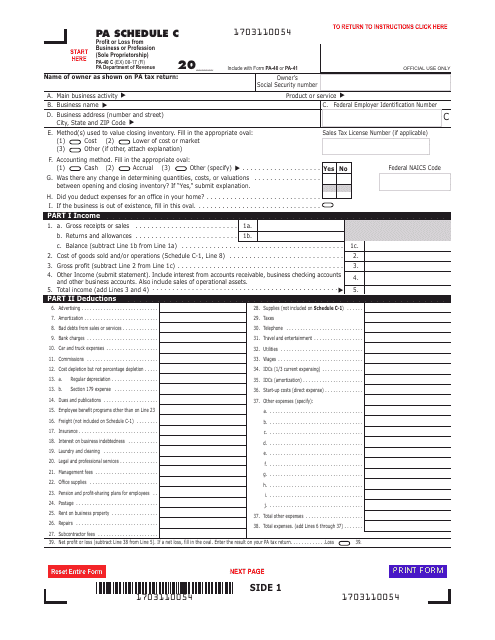

Form REV-1504 Schedule C Closely-Held Corporation, Partnership or Sole-Proprietorship - Pennsylvania

This Form is used for reporting the income, deductions, and credits of a closely-held corporation, partnership, or sole-proprietorship in the state of Pennsylvania.

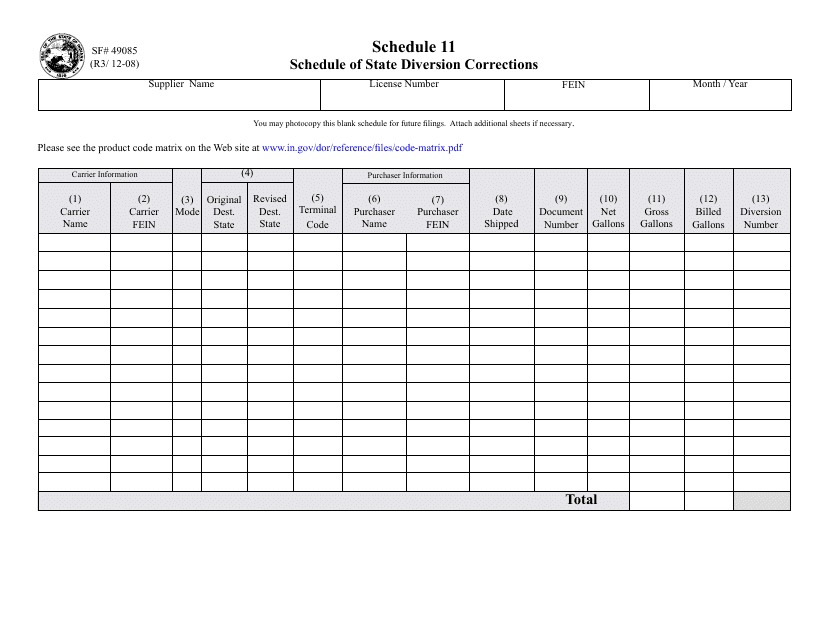

This Form is used for reporting the Schedule of State Diversion Corrections for Indiana. It helps to track and document the diversion programs and corrections activities in the state.

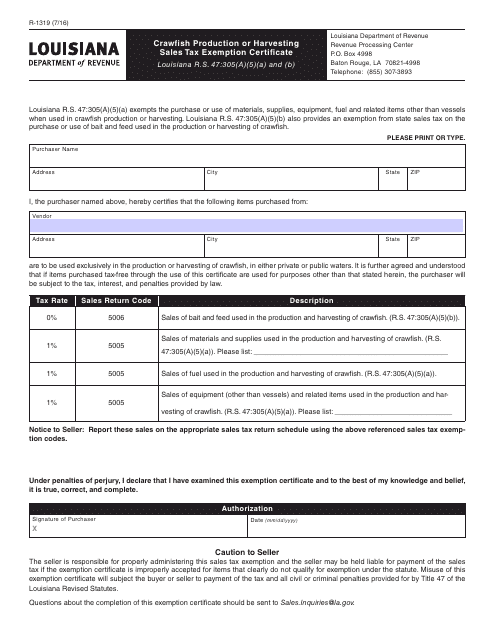

This document is used for applying for a sales tax exemption for crawfish production or harvesting in Louisiana.

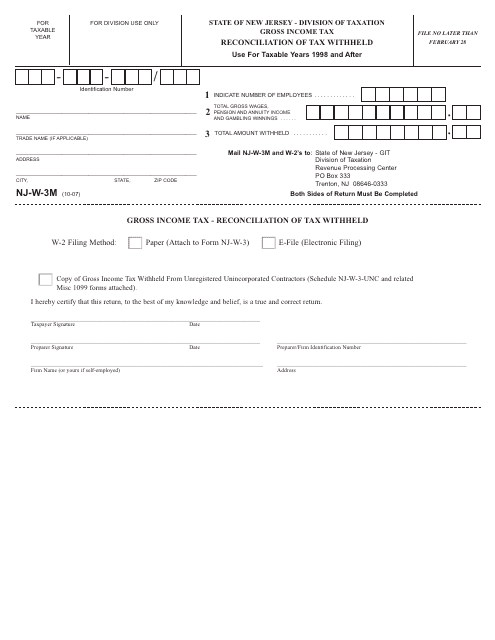

This form is used for reconciling tax withheld by employers in the state of New Jersey. It helps ensure accurate reporting and payment of payroll taxes.

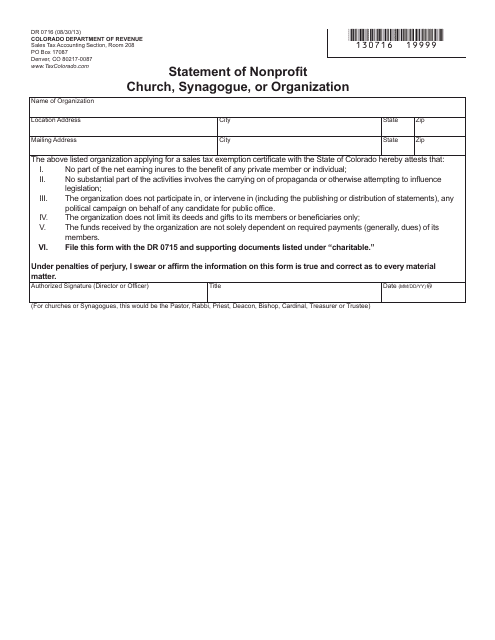

This form is used for nonprofit churches, synagogues, or organizations in Colorado to provide a statement of their status.

This document is used to report the profit or loss from a sole proprietorship business or profession in Pennsylvania.

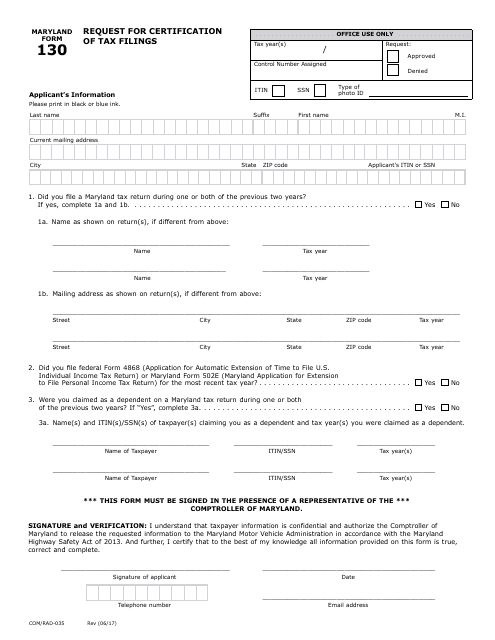

This form is used for requesting certification of tax filings in the state of Maryland.

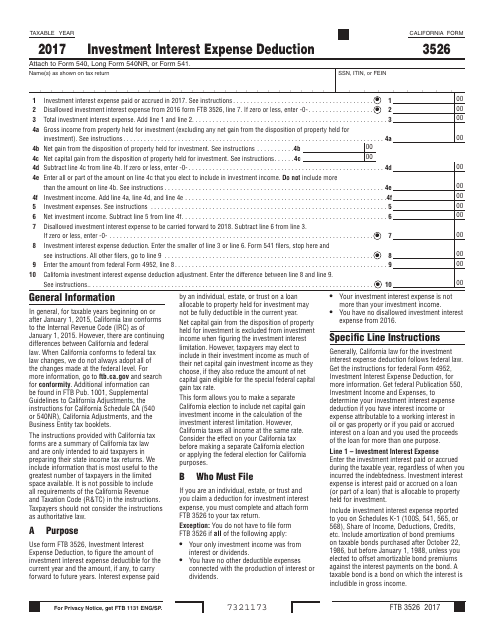

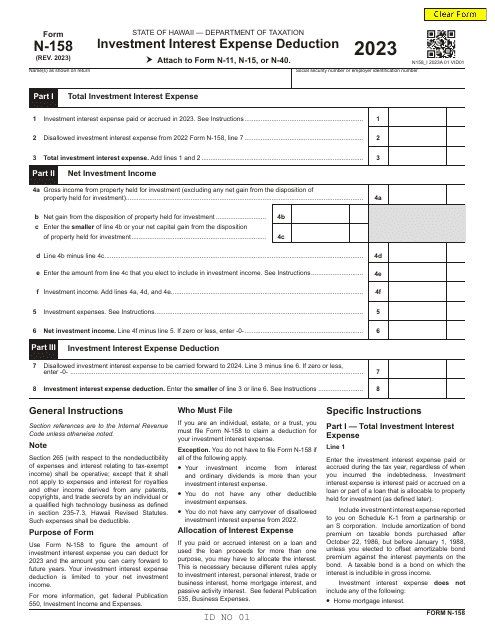

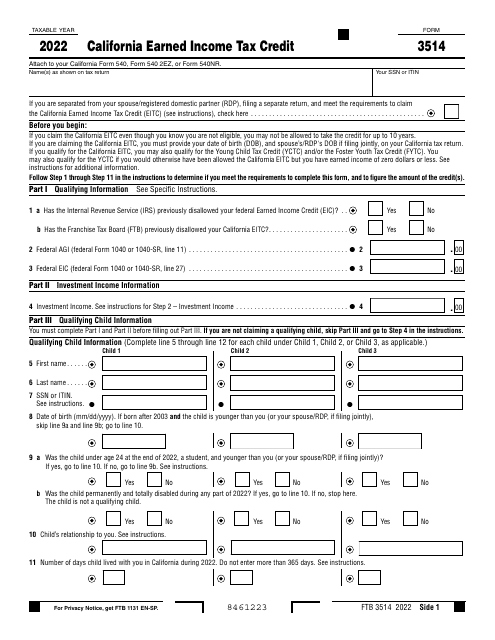

This form is used for claiming the investment interest expense deduction in the state of California. It allows taxpayers to deduct the interest expense paid on their investment loans.

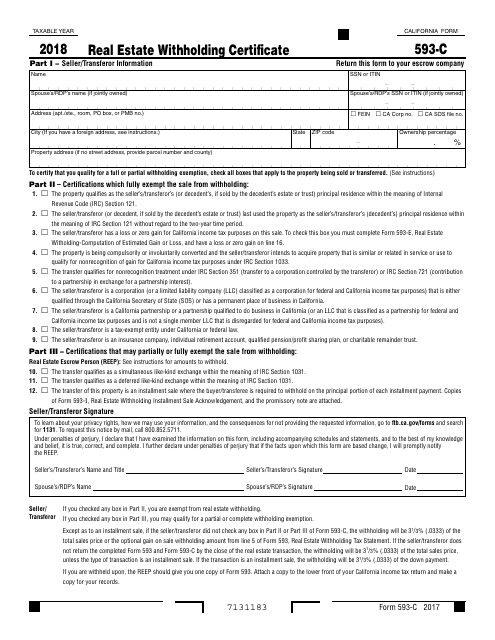

This Form is used for reporting and withholding taxes on real estate transactions in California.

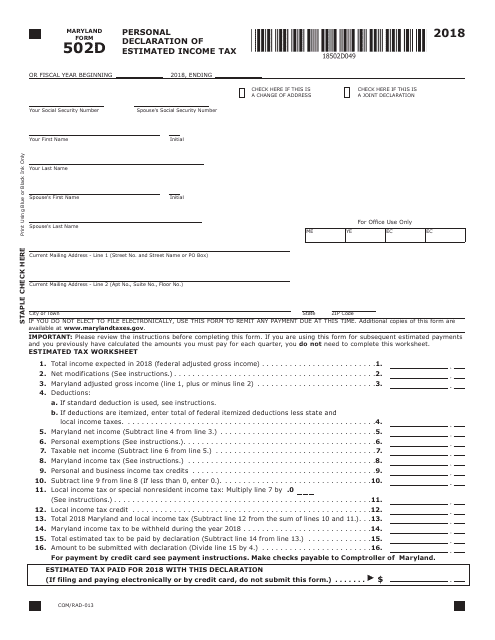

This form is used for residents of Maryland to declare their estimated income tax for the year. It allows individuals to calculate and submit their projected income tax liability to the state.

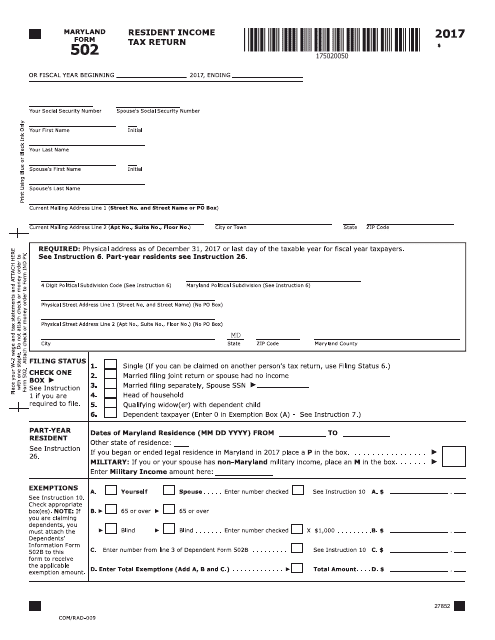

This tax form is used for Maryland residents to report their income and calculate state taxes owed or refunds.

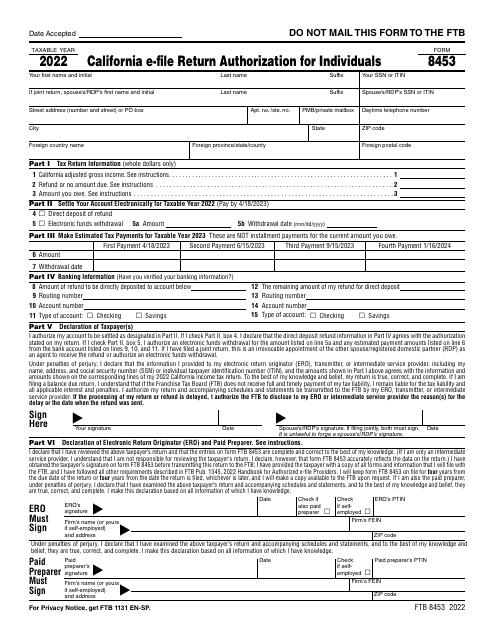

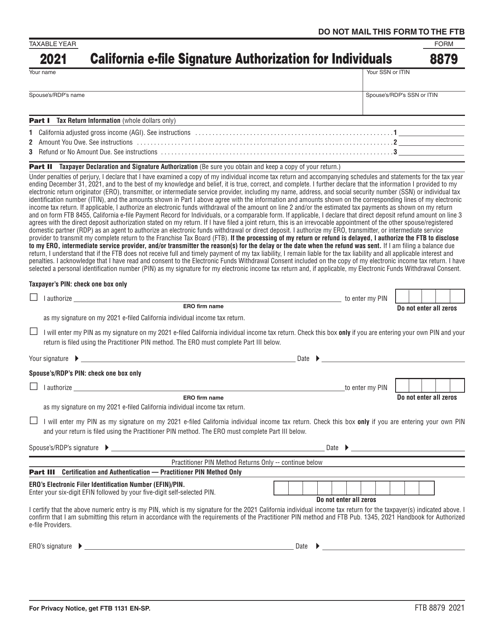

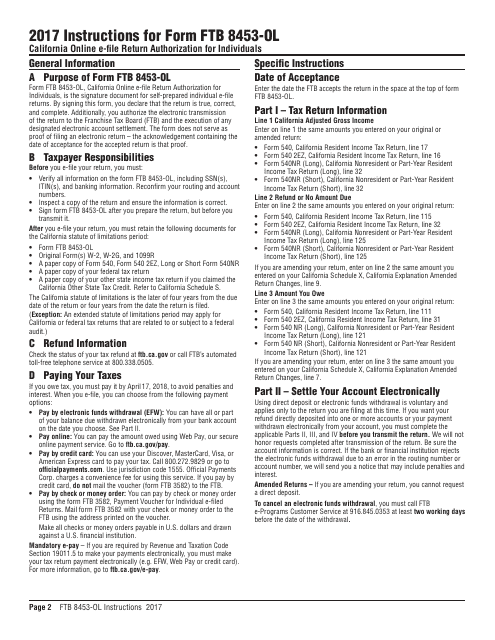

This Form is used for authorizing the electronic filing of individual tax returns in California.