United States Tax Forms and Templates

Related Articles

Documents:

2432

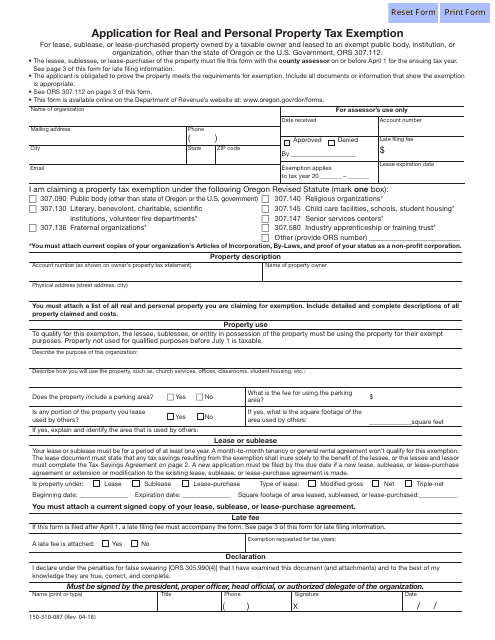

This form is used for applying for a tax exemption on real and personal property in Oregon.

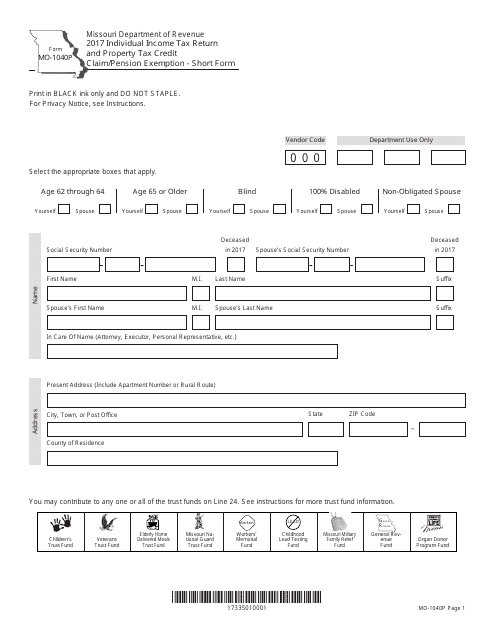

This form is used for filing individual income tax returns, claiming property tax credit, and pension exemption in the state of Missouri.

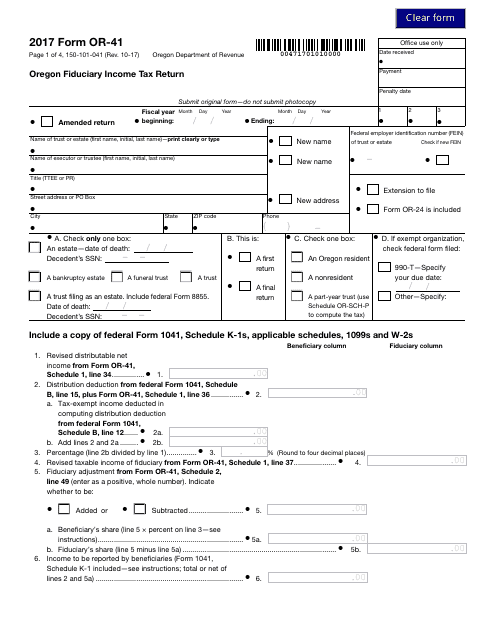

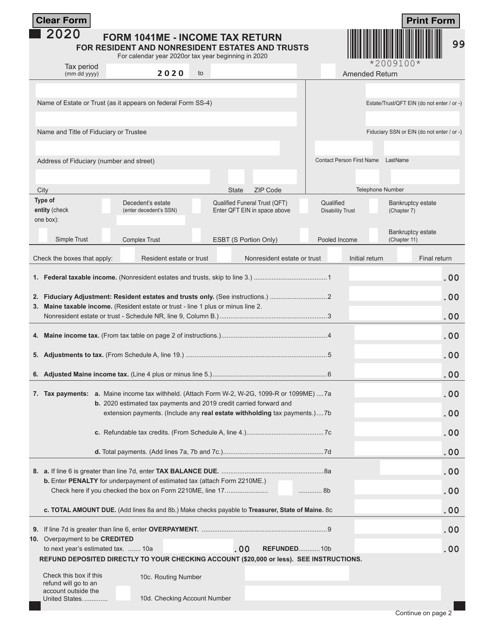

This form is used for filing the Oregon Fiduciary Income Tax Return in the state of Oregon. It is specifically used by fiduciaries to report income earned by an estate or trust.

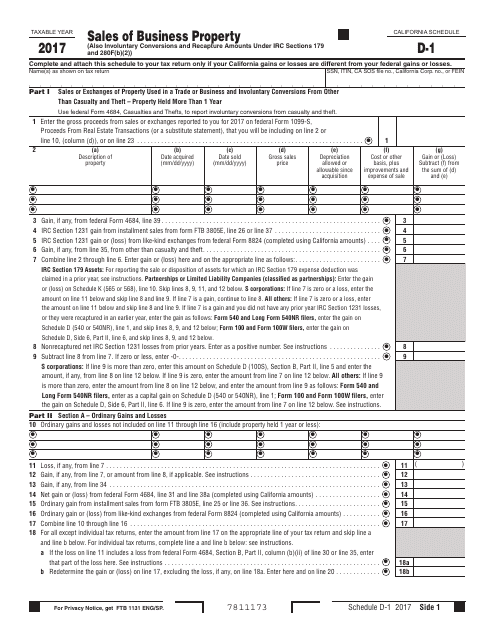

This form is used for reporting sales of business property in California on Form 540 Schedule D-1.

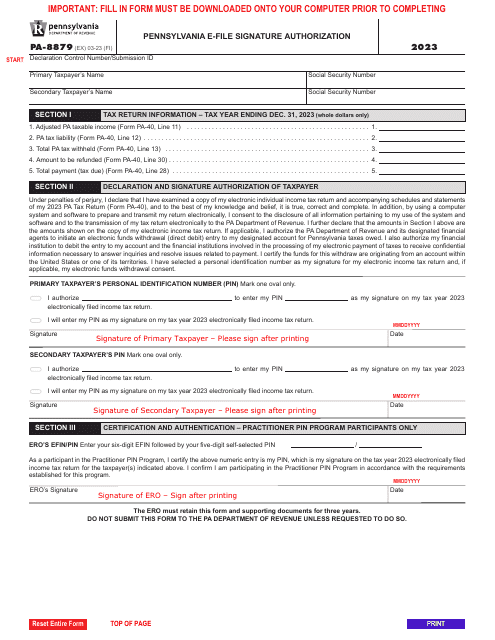

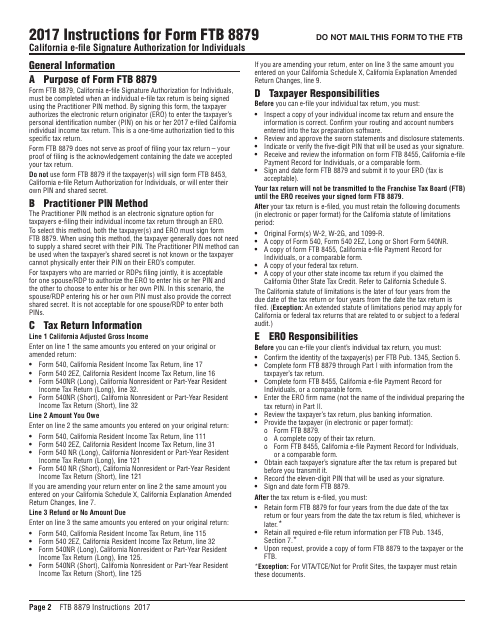

This document is used for authorizing electronic filing of tax returns for individuals in California. It provides instructions on how to complete Form FTB8879 for electronic signature authorization.

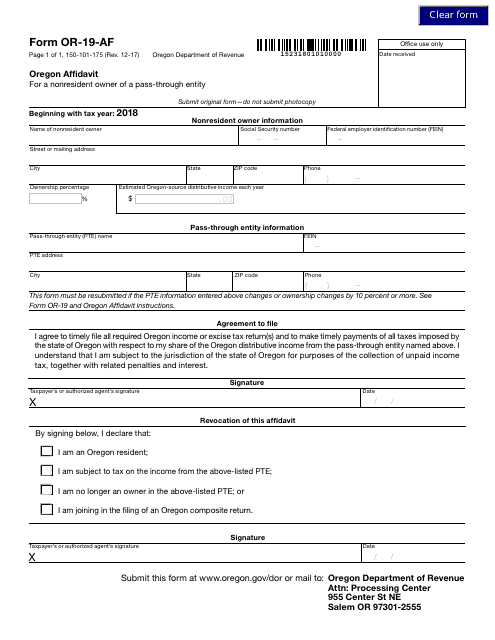

This document is used for filing an affidavit in the state of Oregon. It is known as Form OR-19-AF and is used to provide a sworn statement or declaration under oath.

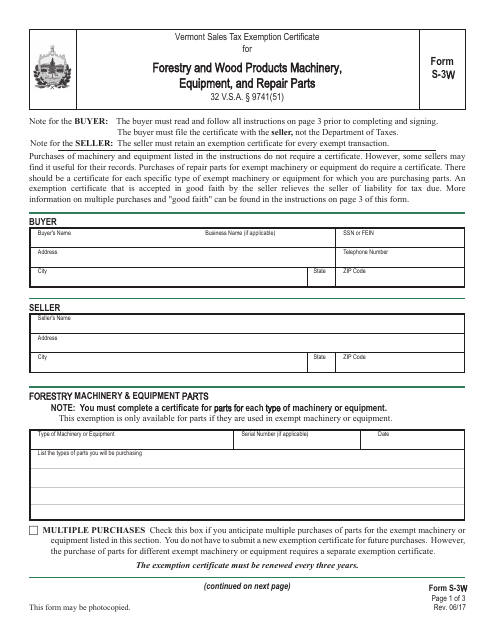

This Form is used for reporting forestry and wood products machinery, equipment, and repair parts in the state of Vermont.

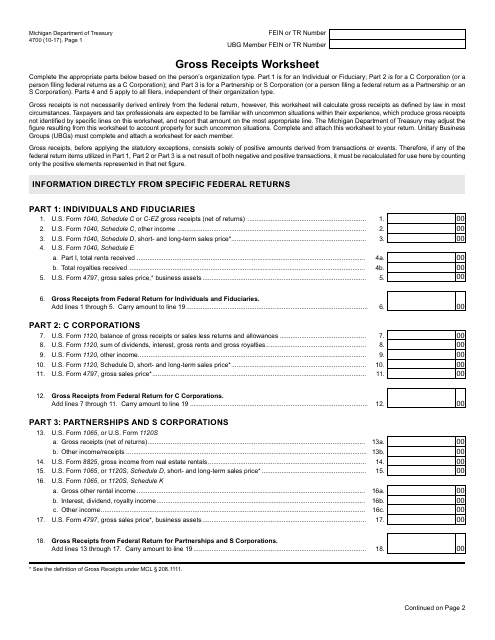

This form is used for calculating gross receipts in the state of Michigan. It helps businesses determine their total income for tax purposes.

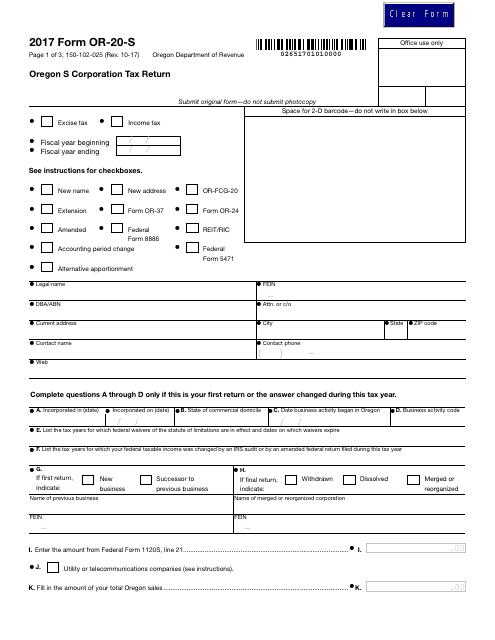

This form is used for Oregon S corporations to file their state tax return.

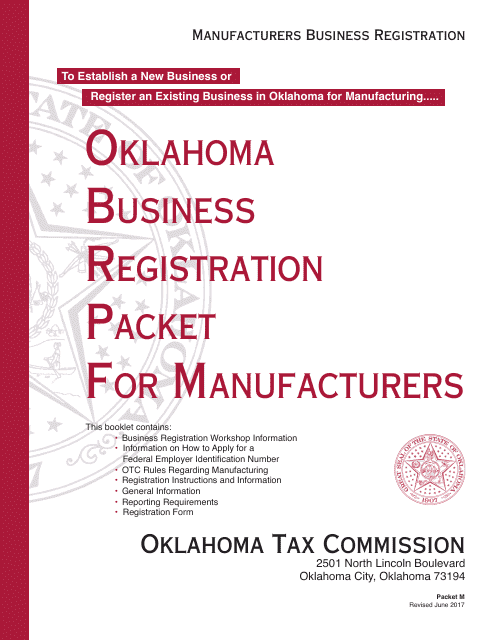

This form is used for registering businesses that manufacture products in Oklahoma. It is part of the OTC Form M Oklahoma Business Registration Packet.

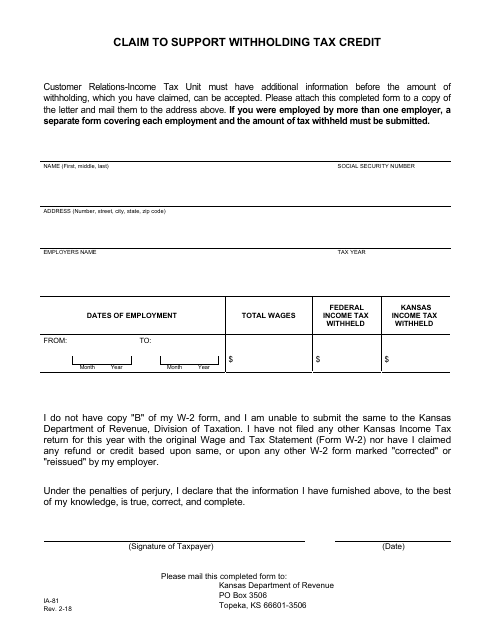

This Form is used for residents of Kansas to claim a withholding tax credit.