United States Tax Forms and Templates

Related Articles

Documents:

2432

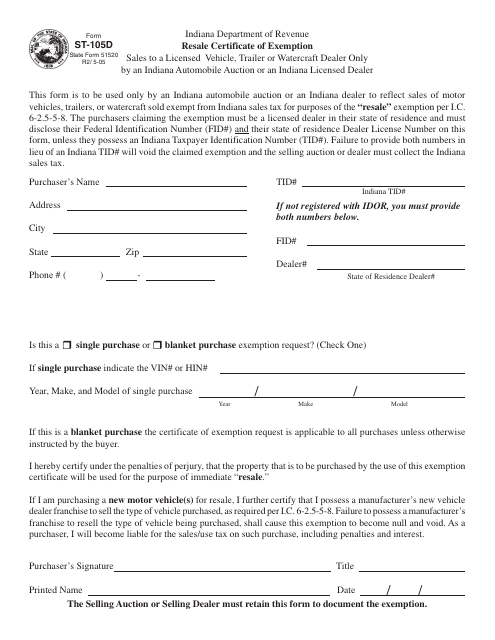

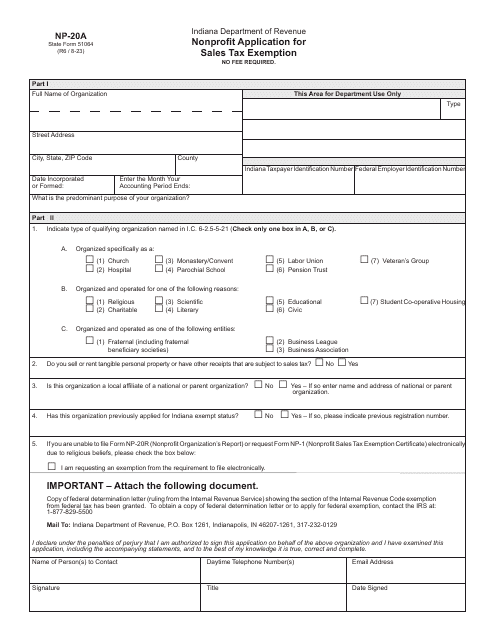

This form is used for claiming a resale exemption in the state of Indiana. It allows businesses to purchase items for resale without paying sales tax.

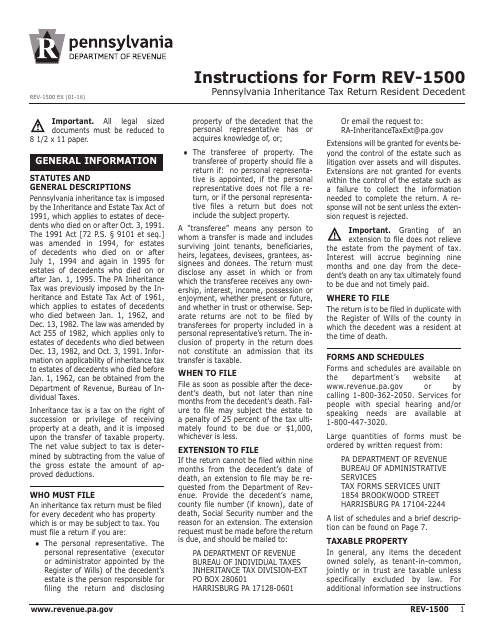

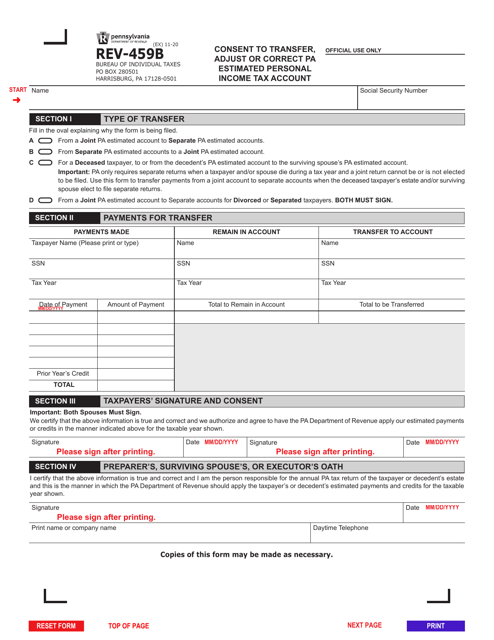

This Form is used for filing the Pennsylvania Inheritance Tax Return for a deceased resident of Pennsylvania. It provides instructions on how to complete the form accurately and report any applicable inheritance tax owed.

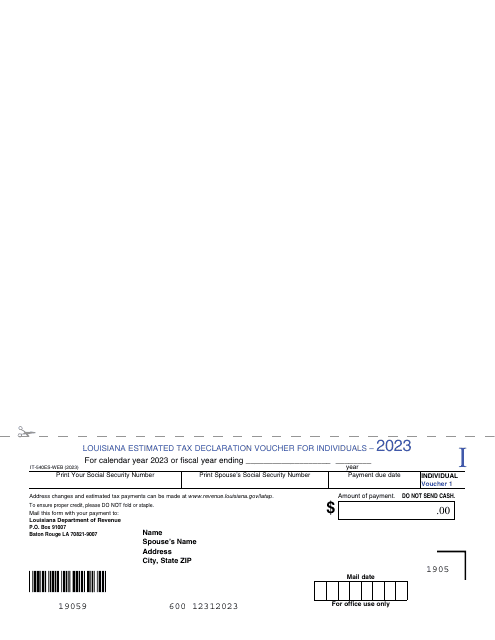

This form is used for reporting gifts made by a donor for tax purposes in the state of Louisiana.

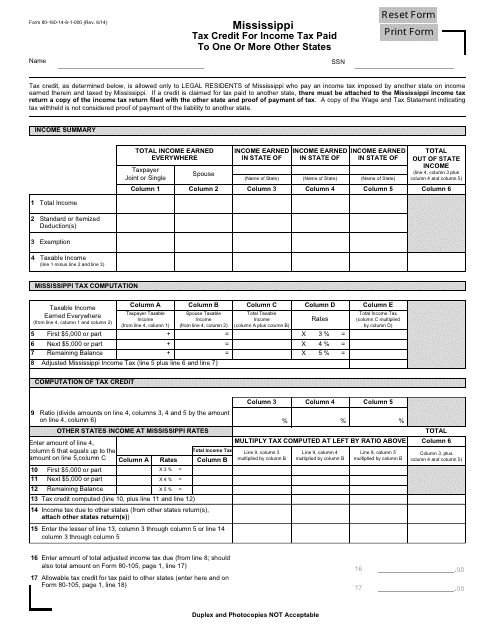

This Form is used for claiming a tax credit in Mississippi for income tax paid to other states.

This form is used for reporting and paying inheritance tax for residents of New Jersey.

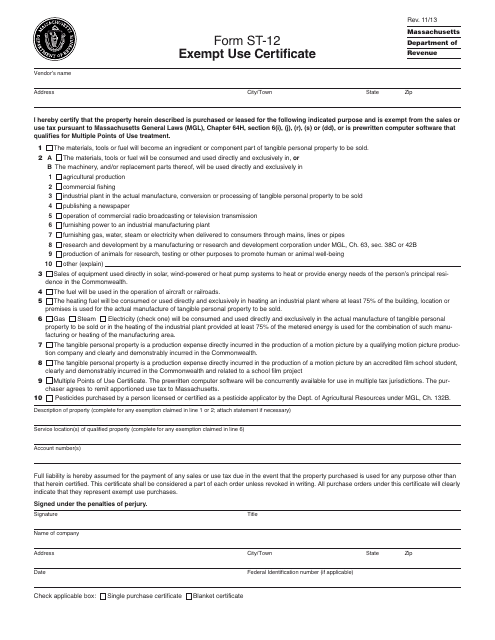

This document is a form used in Massachusetts for claiming exemption from certain taxes. It is known as the ST-12 Exempt Use Certificate.

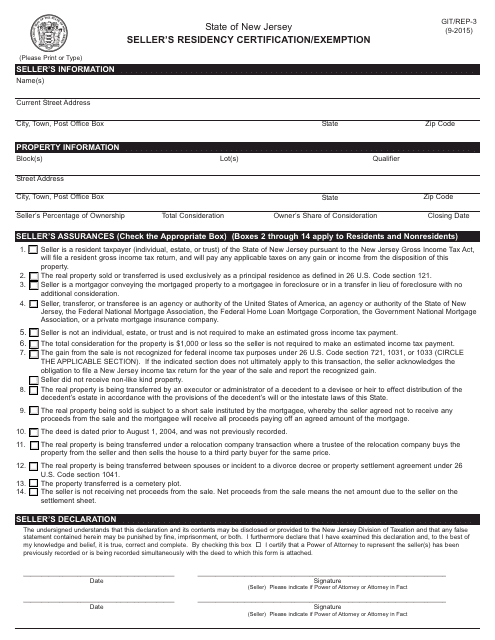

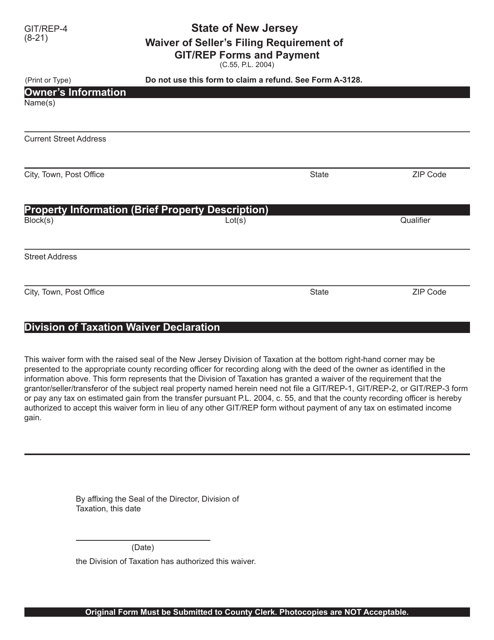

This document is used for declaring the residency status or claiming exemption as a seller in the state of New Jersey.

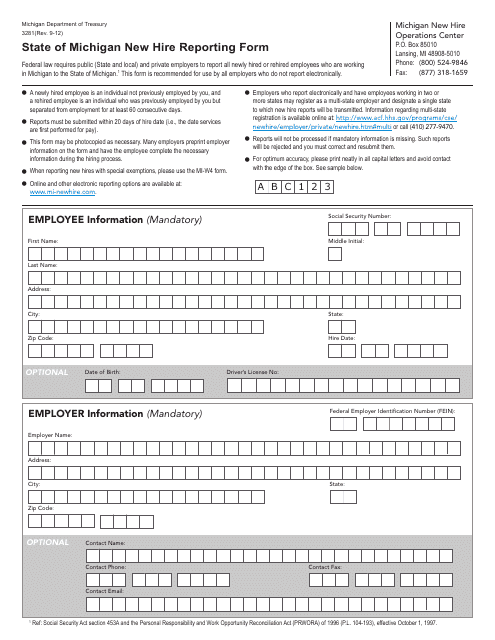

This is a legal document used by an employer to report information on newly hired employees to the Department of Treasury shortly after the date of hire in the state of Michigan.

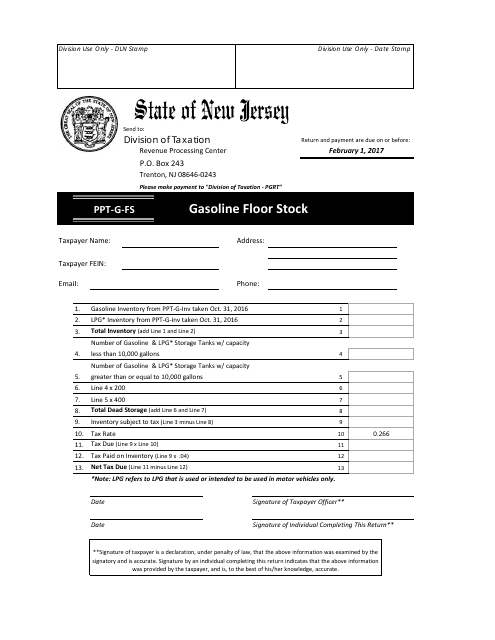

This Form is used for reporting and tracking gasoline floor stock inventory in the state of New Jersey.

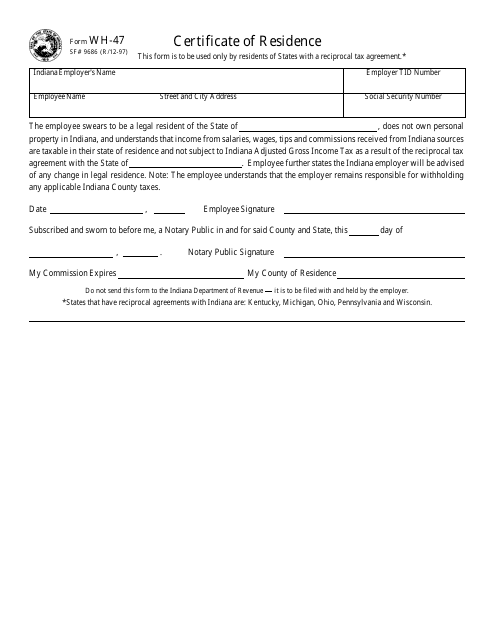

This form is used for obtaining a Certificate of Residence in the state of Indiana. It verifies that an individual is a resident of Indiana for purposes such as tax filings or tuition eligibility.

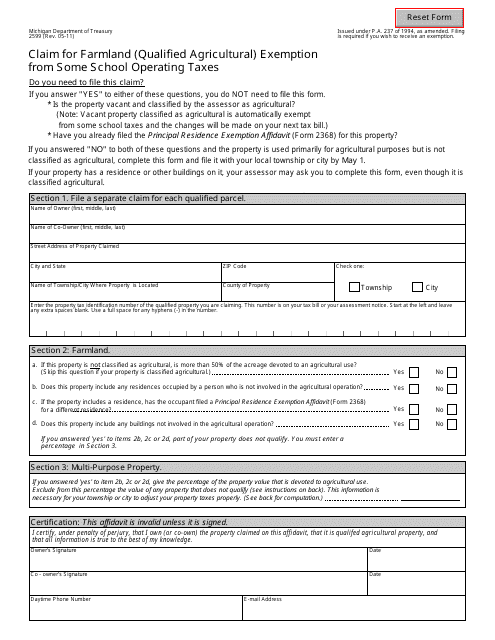

This form is used for claiming a farmland exemption from some school operating taxes in Michigan.

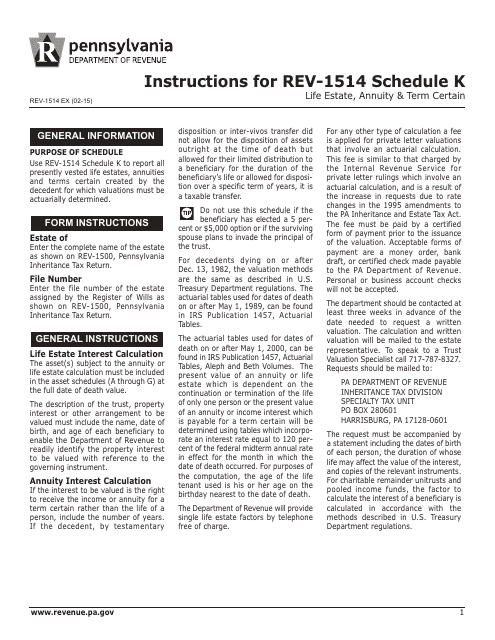

This type of document provides instructions for filling out Form REV-1514 Schedule K, which is used in Pennsylvania to report income from life estates, annuities, and term certain arrangements. It guides taxpayers on how to accurately complete the form and report their income.

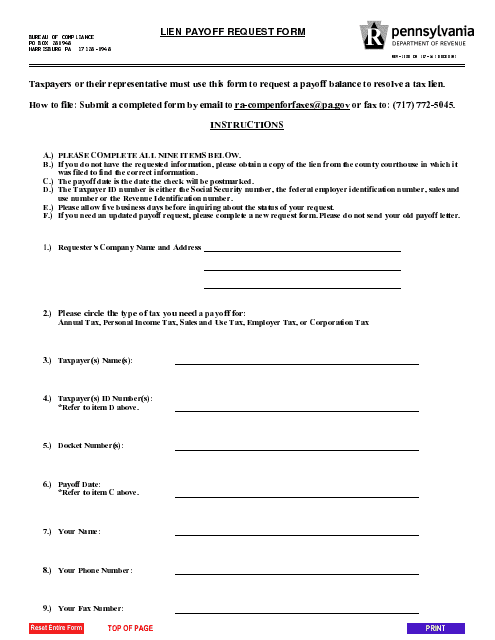

This form is used for requesting a lien payoff in Pennsylvania. It is used to request information about existing liens on a property and to facilitate the payment of those liens.

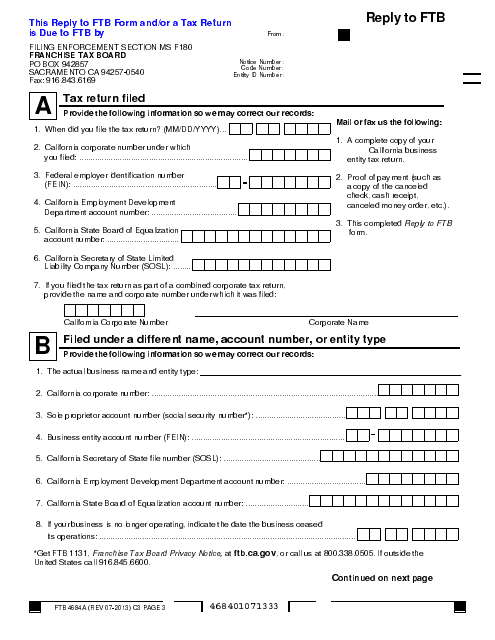

This Form is used for submitting a demand to file a tax return in California.

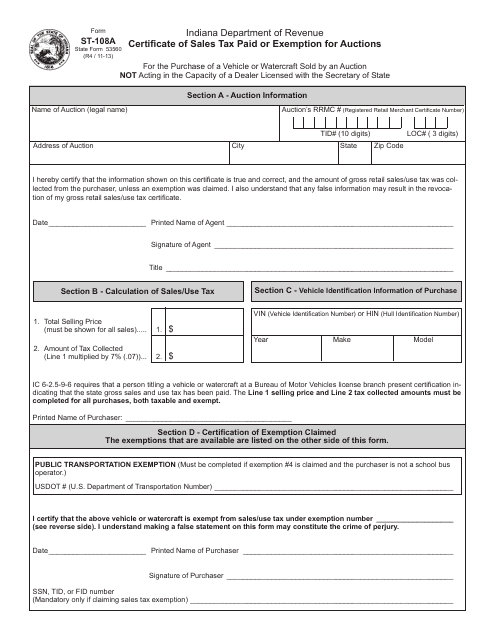

This form is used for reporting sales tax paid or claiming exemption for auctions conducted in the state of Indiana.

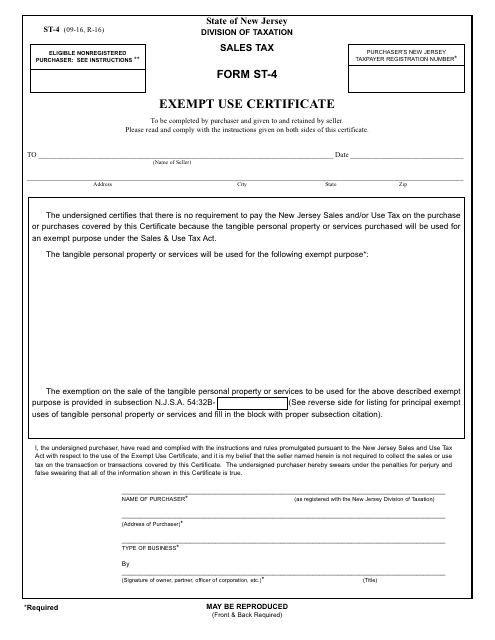

This form is used for claiming exemption from sales tax for specific items or services in the state of New Jersey.

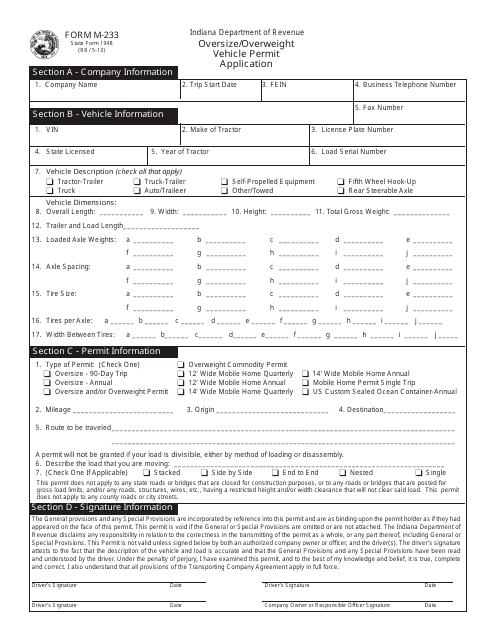

This form is used for applying for an oversize/overweight vehicle permit in Indiana.

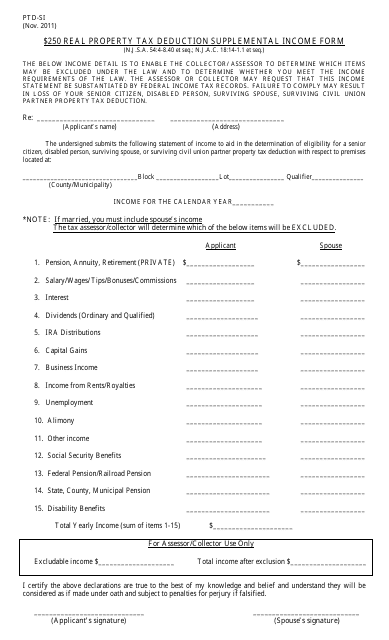

This form is used for reporting supplemental income for the Real Property Tax Deduction in New Jersey.

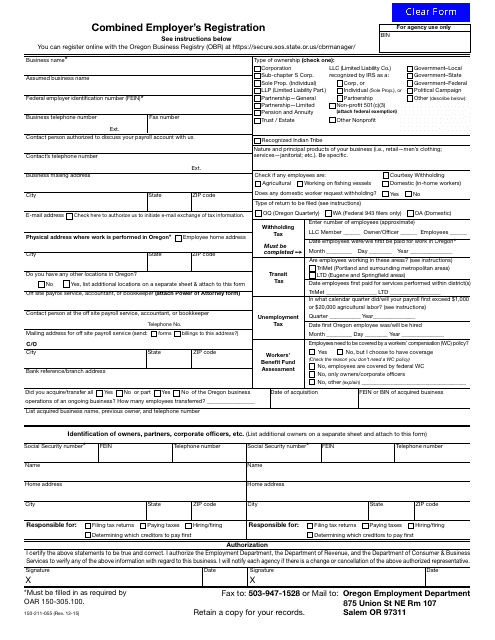

This form is used for combined employer's registration in the state of Oregon.

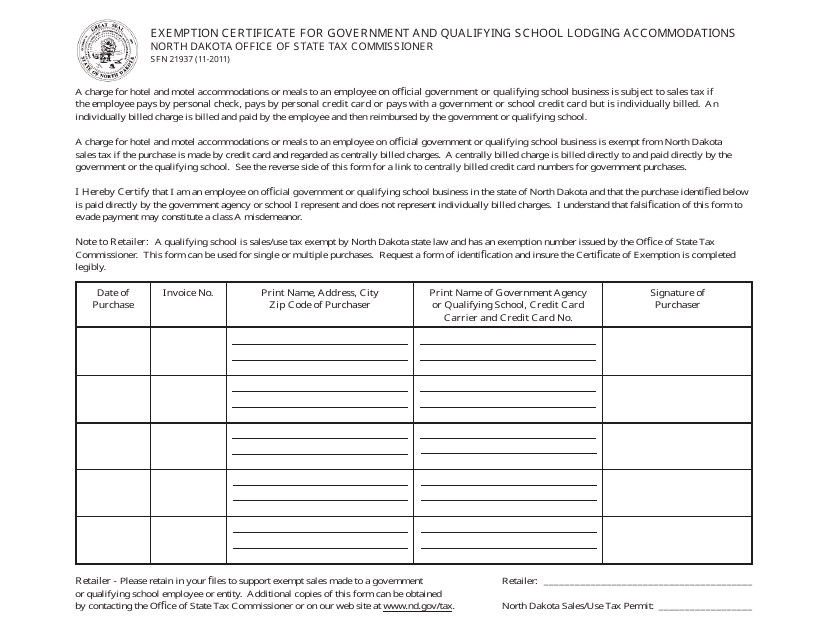

This form is used for requesting an exemption certificate for government and qualifying school lodging accommodations in North Dakota.

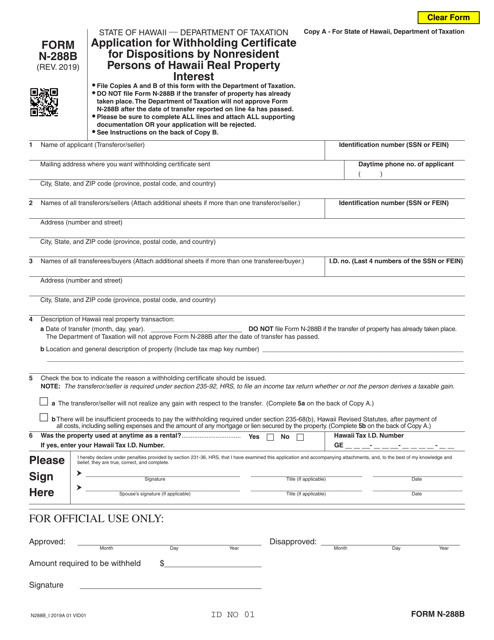

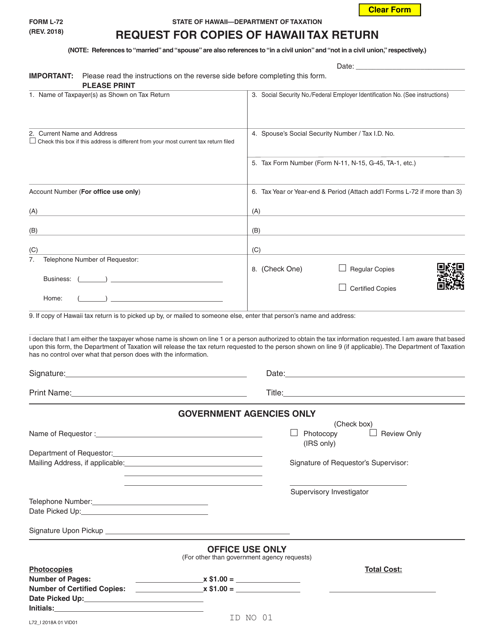

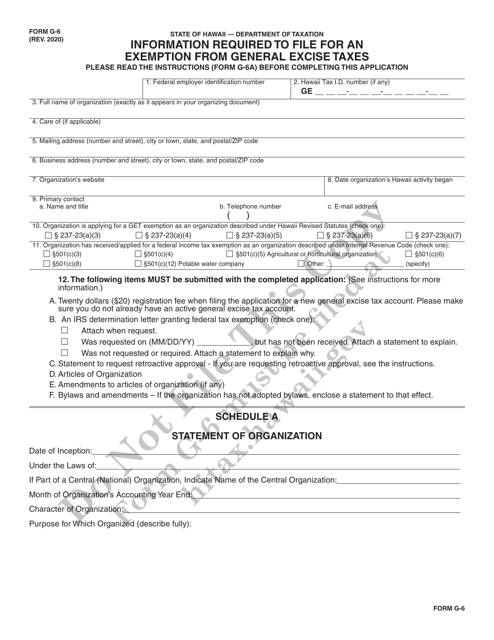

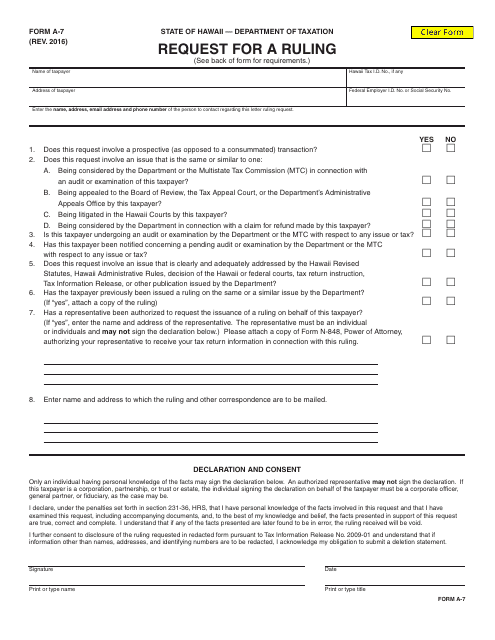

This form is used for requesting a ruling in the state of Hawaii.

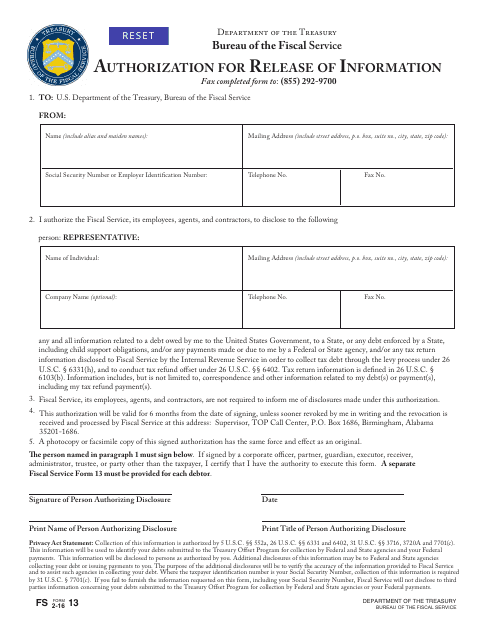

This Form is used for authorizing the release of information to a specified recipient.

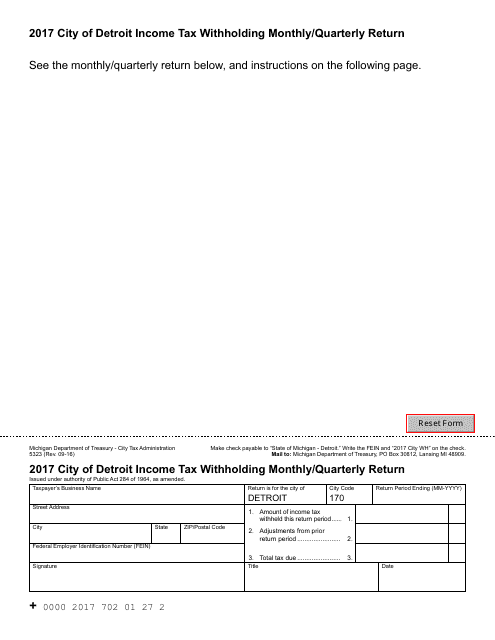

This form is used by businesses in the City of Detroit to report their monthly or quarterly income tax withholdings for employees.