United States Tax Forms and Templates

Related Articles

Documents:

2432

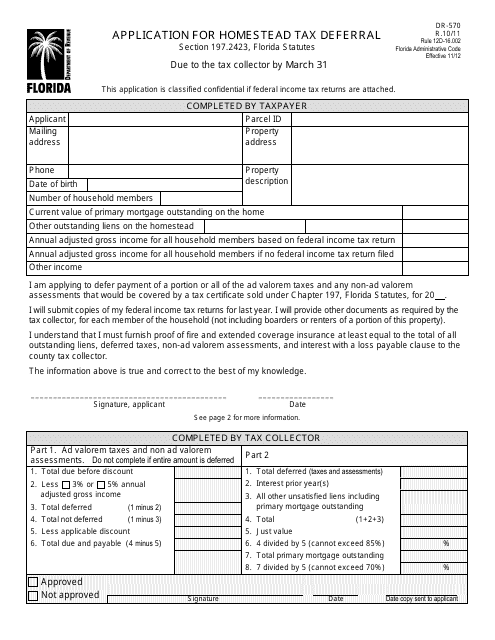

This form is used for applying for the Homestead Tax Deferral program in Florida.

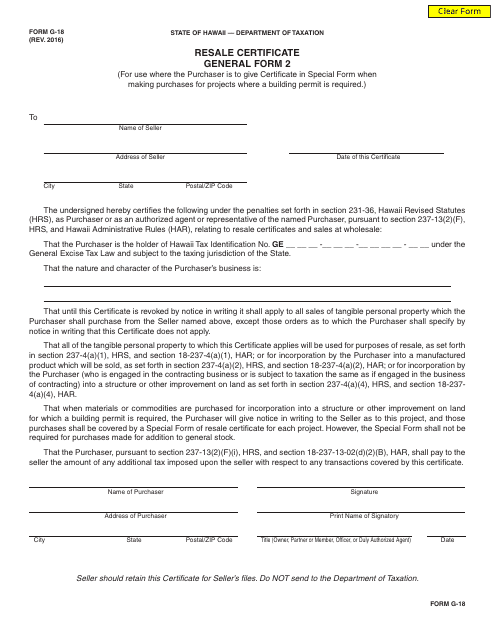

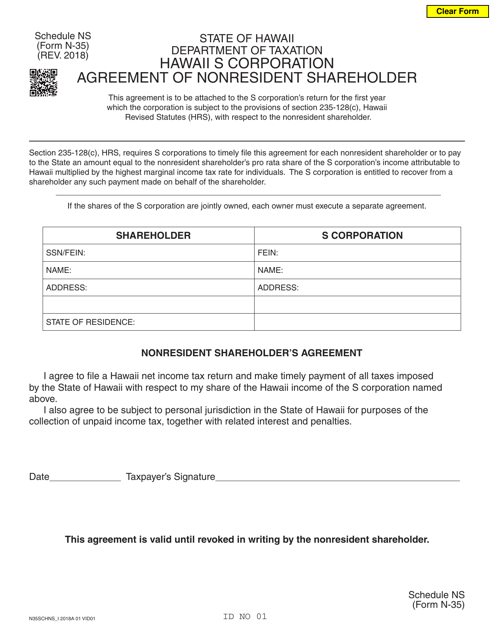

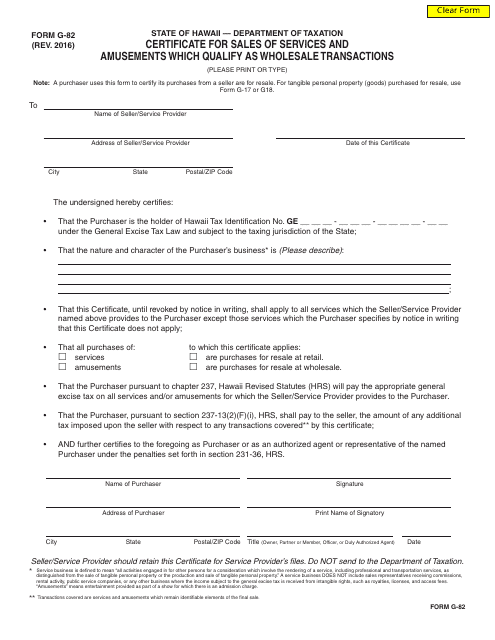

This form is used for applying for a resale certificate in Hawaii. It is a general form that allows businesses to make tax-exempt purchases for resale purposes.

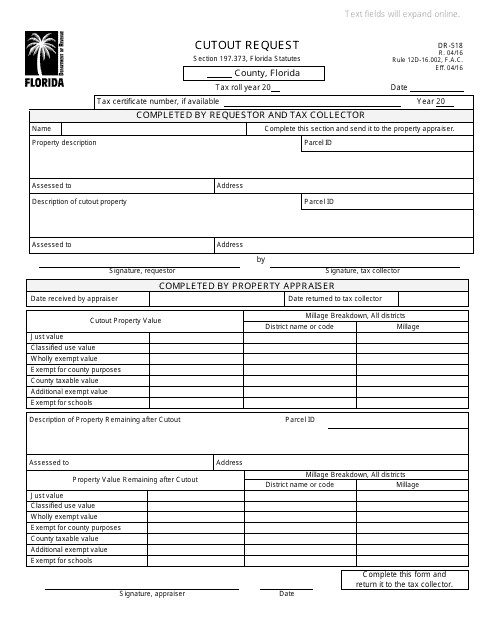

This form is used for requesting a cutout in the state of Florida. It allows individuals to submit a request for a cutout in a specific location for various purposes such as construction or landscaping.

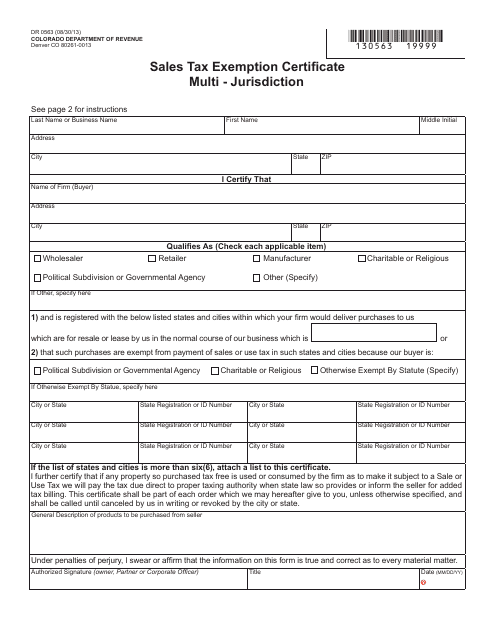

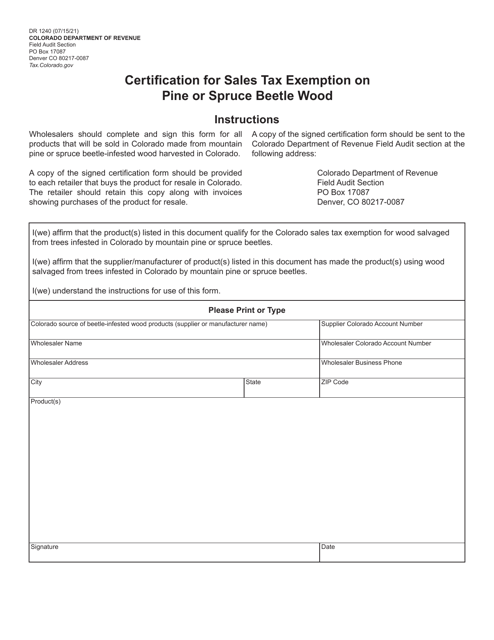

This form is used for requesting sales tax exemption in multiple jurisdictions in the state of Colorado.

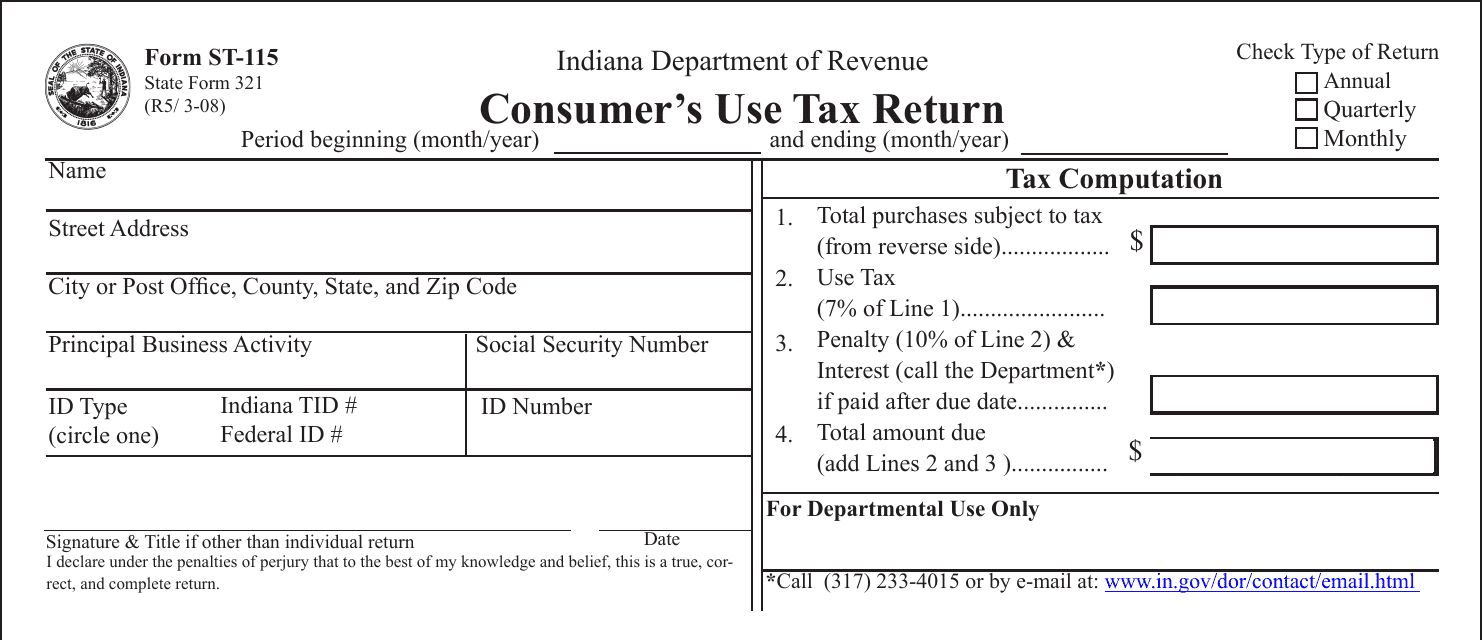

This document is used for reporting and paying consumer's use tax in the state of Indiana. It is required for individuals who have made purchases without paying sales tax and need to remit the use tax owed.

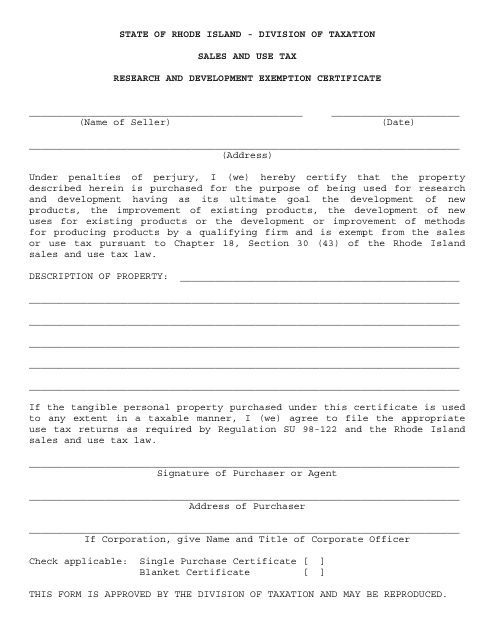

This Form is used for applying for a Research and Development Exemption Certificate in Rhode Island. The certificate exempts businesses from certain taxes for qualified research and development activities.

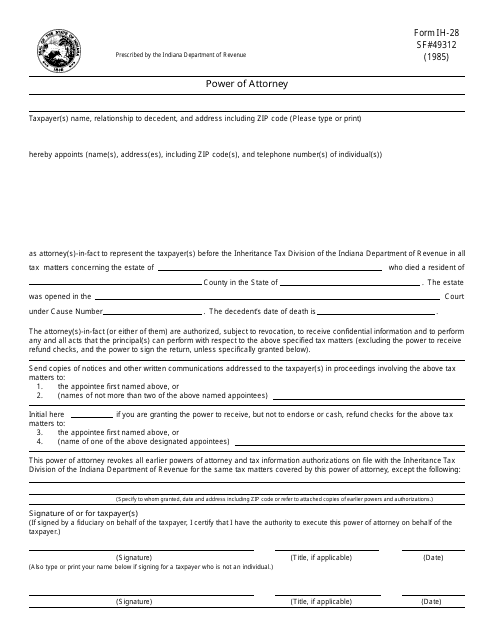

This document allows an individual to grant someone else the authority to make decisions on their behalf in the state of Indiana.

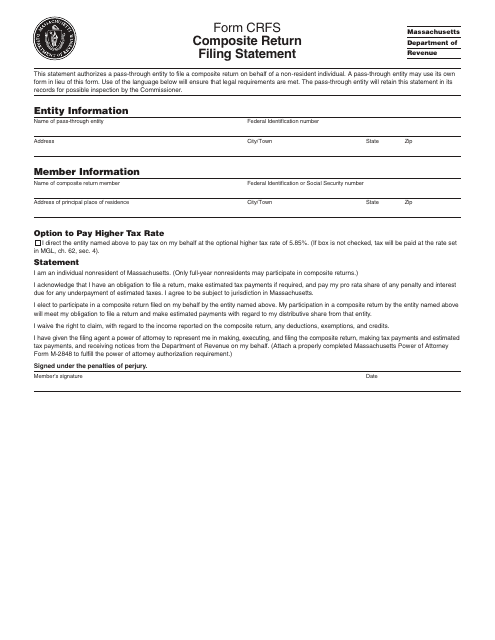

This Form is used for filing a composite return statement in Massachusetts.

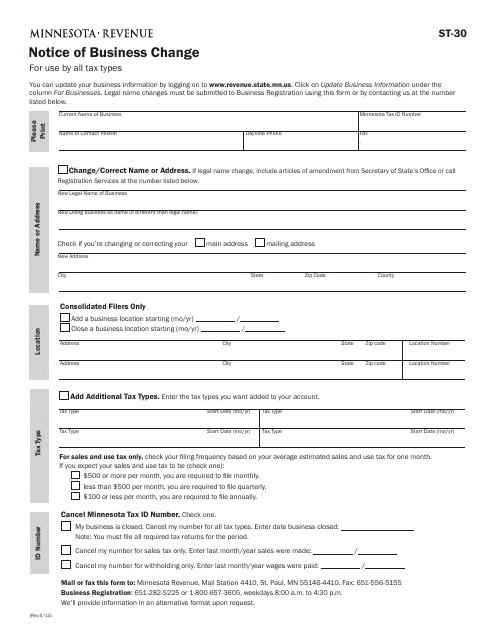

This Form is used for notifying the state of Minnesota about changes in business information. It helps businesses update their records with the state.

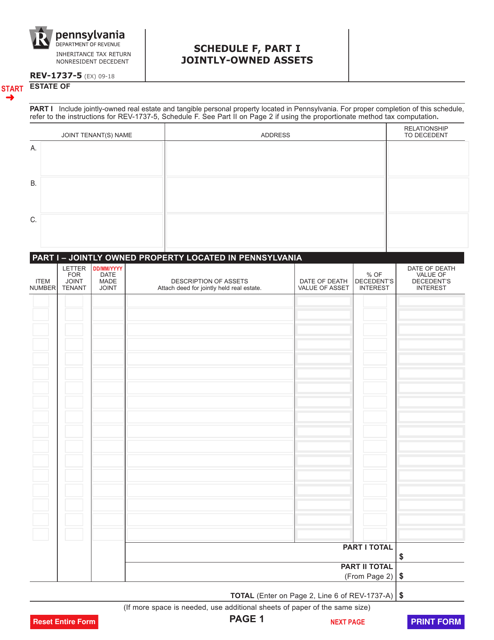

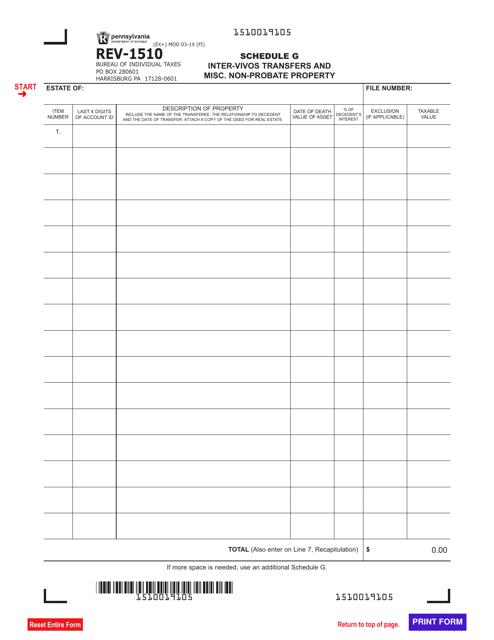

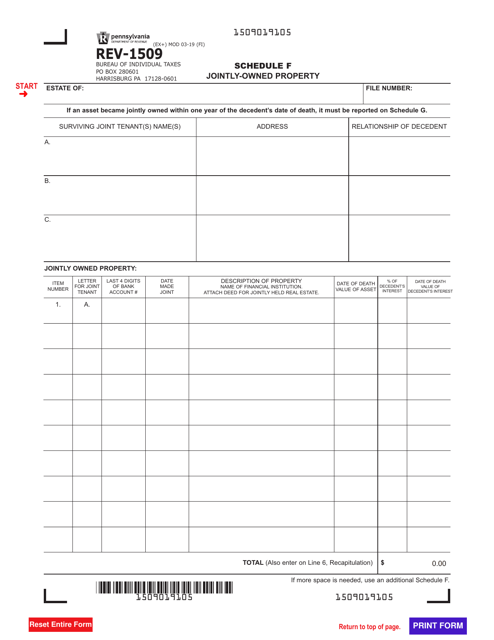

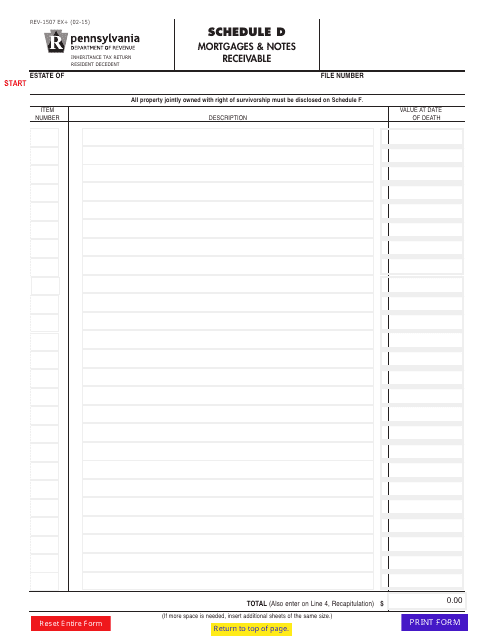

This form is used for reporting mortgages and notes receivable in Pennsylvania for tax purposes.

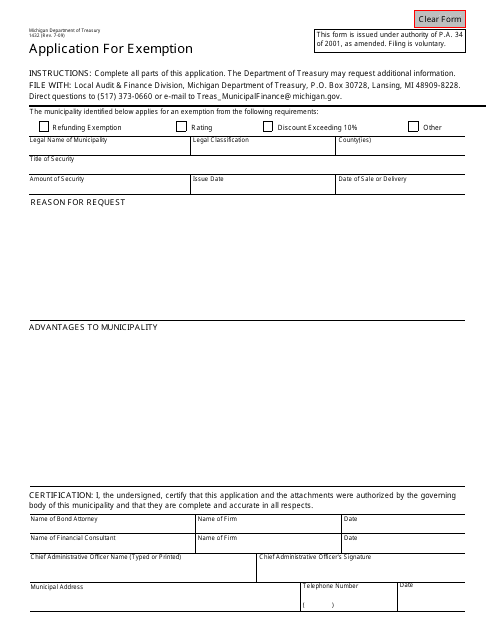

This form is used for applying for an exemption in Michigan. It is specifically for Form 1432.

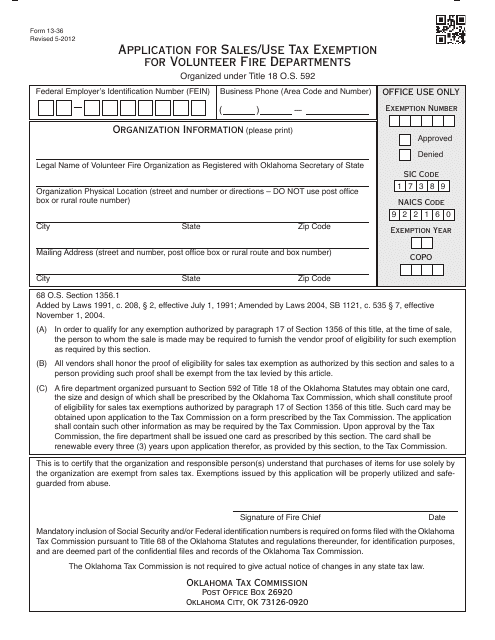

This document is used for volunteer fire departments in Oklahoma to apply for sales/use tax exemption.

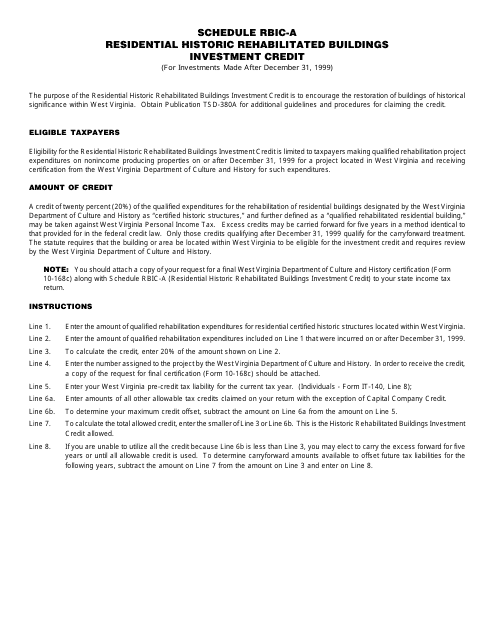

This form is used for claiming the Residential Historic Rehabilitated Buildings Investment Credit for investments made in West Virginia after December 31, 1999.

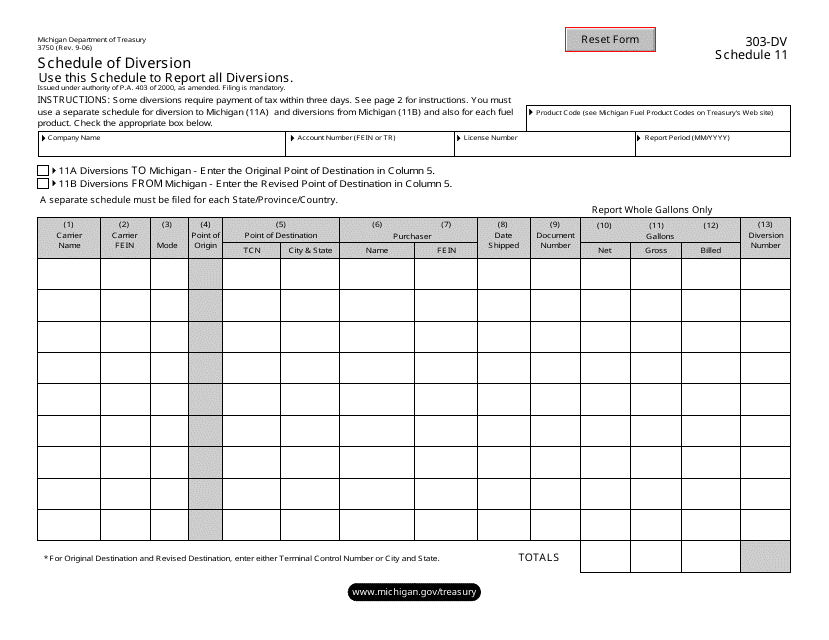

This form is used for reporting the schedule of diversion in Michigan. It is specifically designed for Form 3750 (303-DV) Schedule 11.

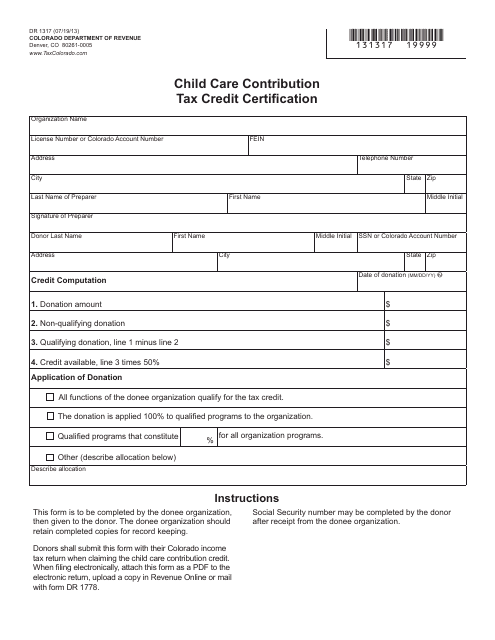

This form is used for applying for the Child Care Contribution Tax Credit in Colorado. It certifies that the taxpayer has made a qualifying contribution to a licensed child care facility.

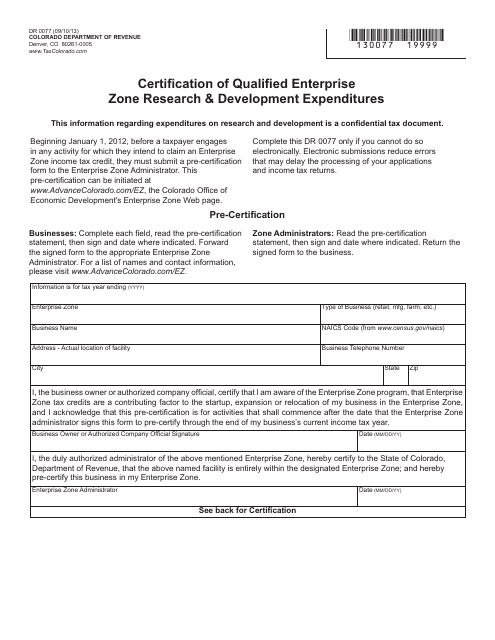

This Form is used for certifying qualified enterprise zone research and development expenditures in the state of Colorado. It is used to demonstrate eligibility for certain tax credits and incentives.

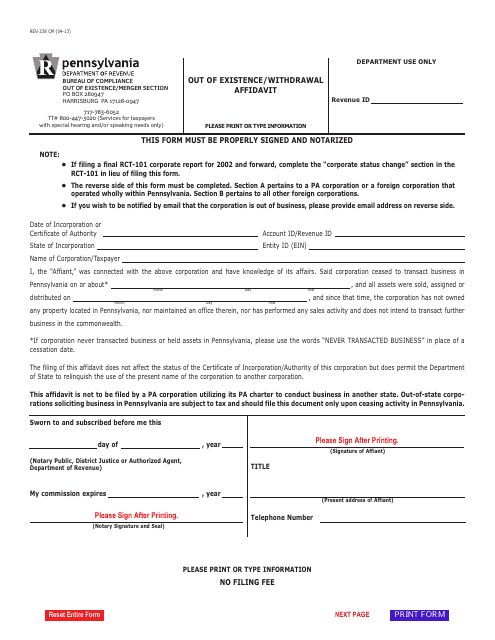

This Form is used for filing an Out of Existence/Withdrawal Affidavit in Pennsylvania. It is used when a business entity wants to dissolve or withdraw from the state.

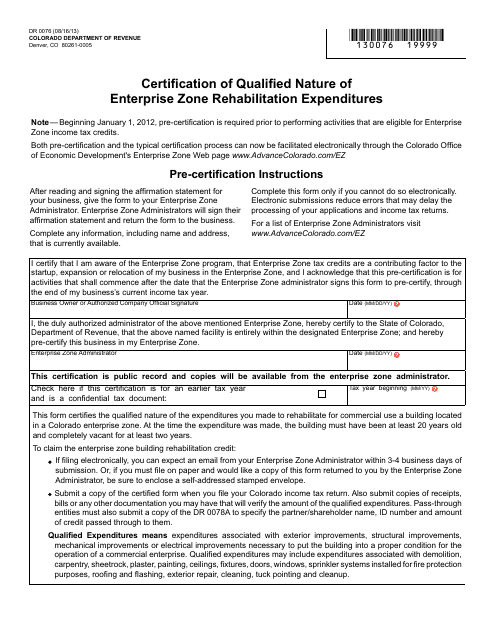

This form is used for certifying the qualified nature of enterprise zone rehabilitation expenditures in Colorado.

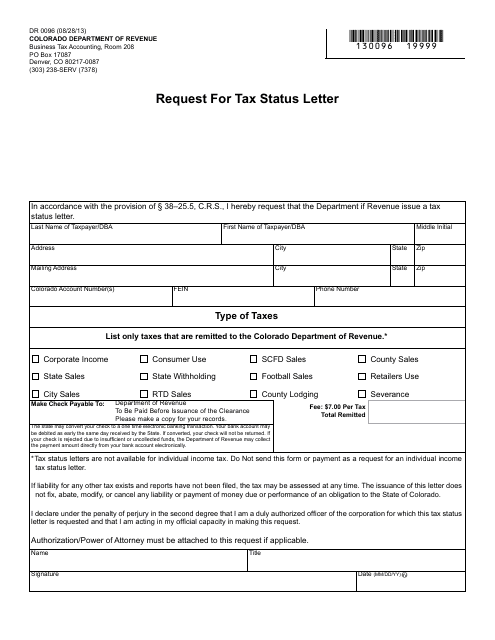

This form is used to request a tax status letter from the state of Colorado. It is typically used by individuals or organizations to obtain documentation of their tax status for various purposes such as loan applications or legal requirements.

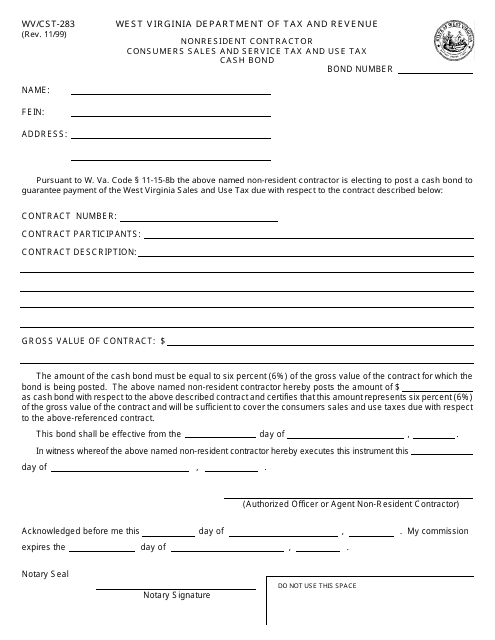

This form is used for contractors who are not residents of West Virginia to provide a cash bond for the payment of sales and service tax and use tax.

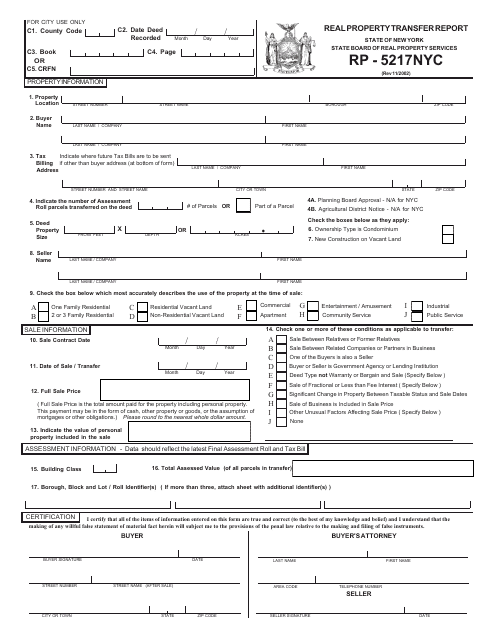

This form is used for reporting transfers of real property in New York City.

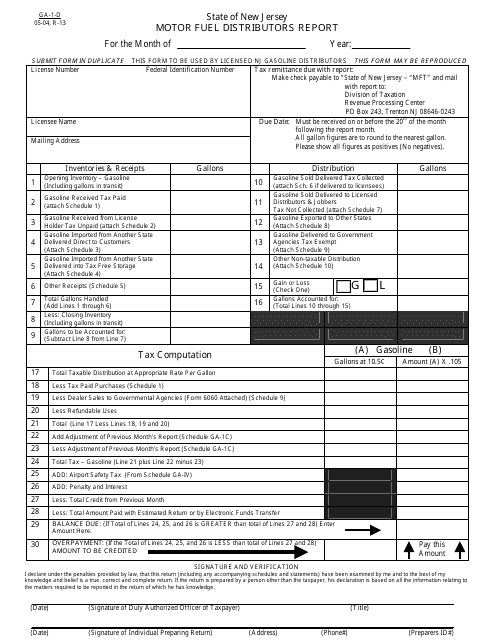

This Form is used for motor fuel distributors in New Jersey to report their activities.

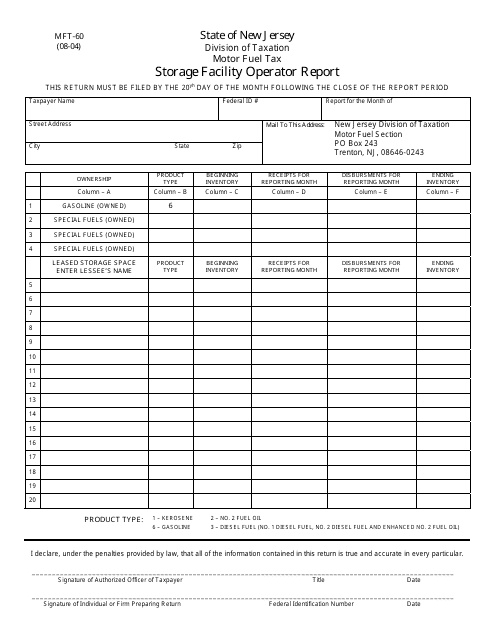

This Form is used for storage facility operators in New Jersey to report their operations and activities.

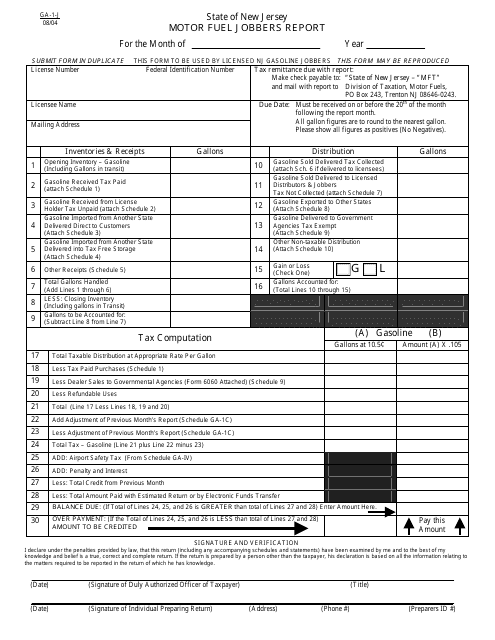

This form is used for motor fuel jobbers in New Jersey to report their activity related to fuel sales and distribution.

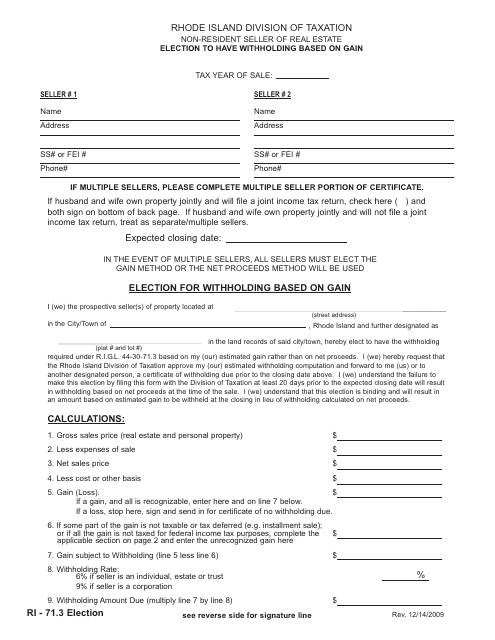

This form is used for non-resident sellers of real estate in Rhode Island to elect withholding based on gain.

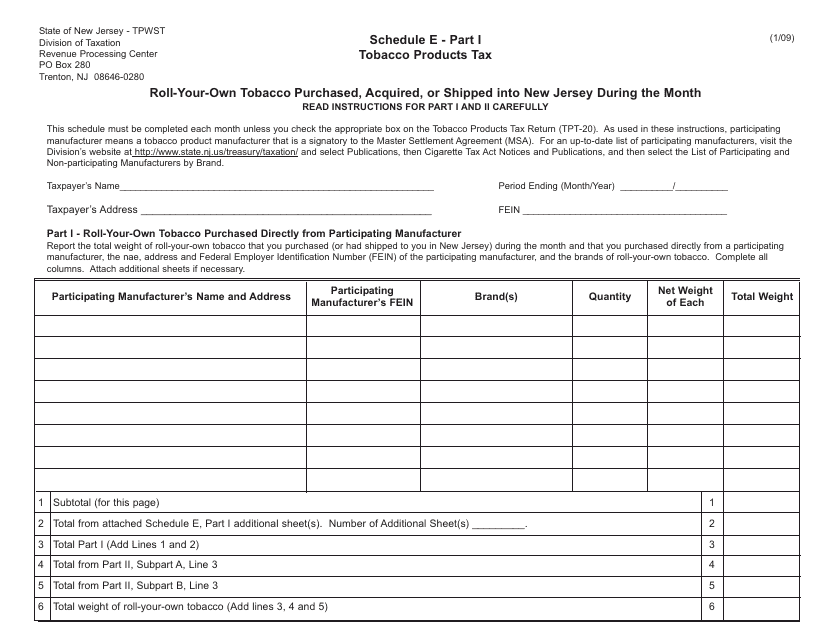

This form is used for reporting the purchase, acquisition, or shipment of roll-your-own tobacco into New Jersey during a specific month.

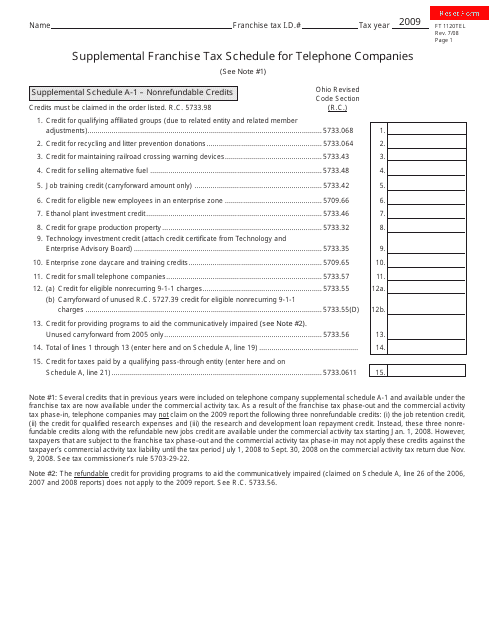

This form is used for Ohio telephone companies to report their supplemental franchise tax.

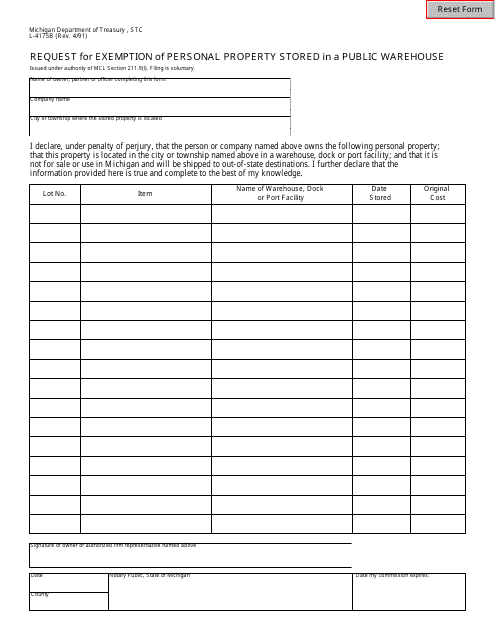

This form is used for requesting an exemption for personal property that is stored in a public warehouse in Michigan.

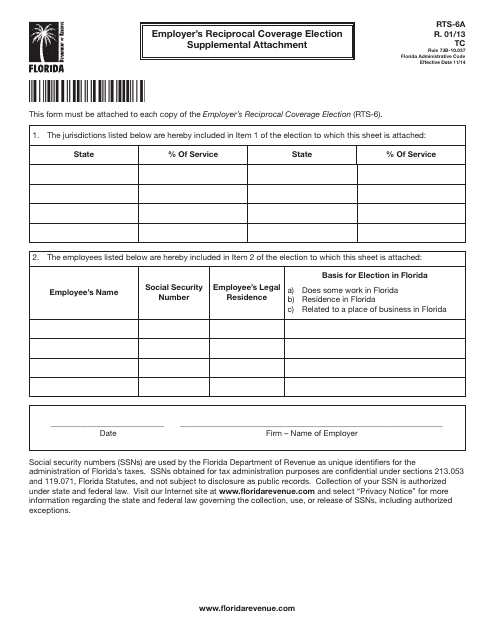

This form is used for employers in Florida to provide additional information and make an election for reciprocal coverage.

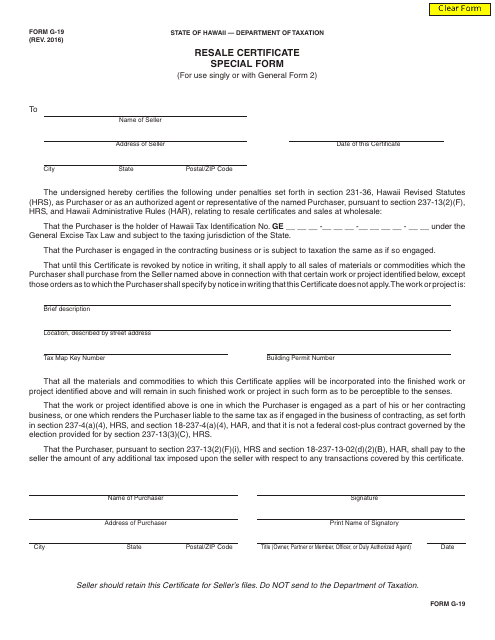

This form is used for filing a resale certificate in Hawaii for special situations. It allows businesses to make tax-exempt purchases for resale purposes.

This Form is used for certifying sales of goods, services, and amusements that qualify for the phased-in wholesale deduction in Hawaii.

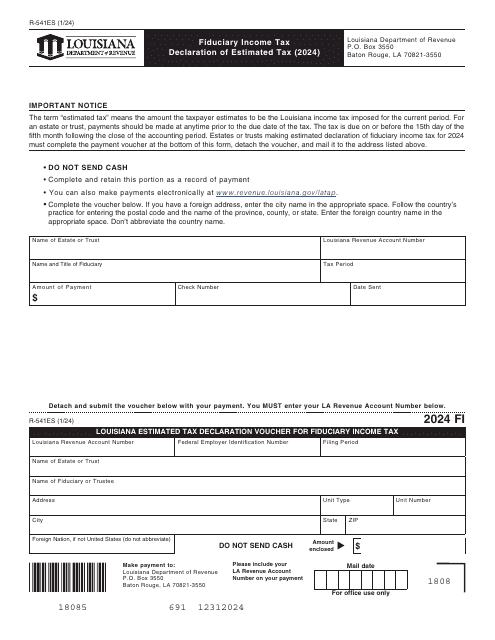

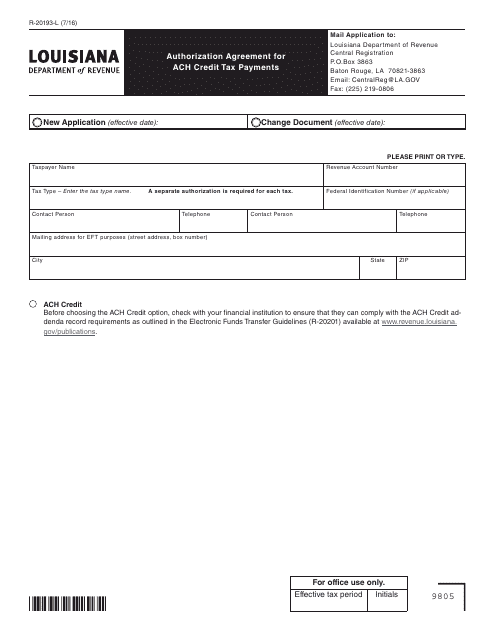

This form is used for authorizing automatic tax payments via ACH credit in the state of Louisiana.

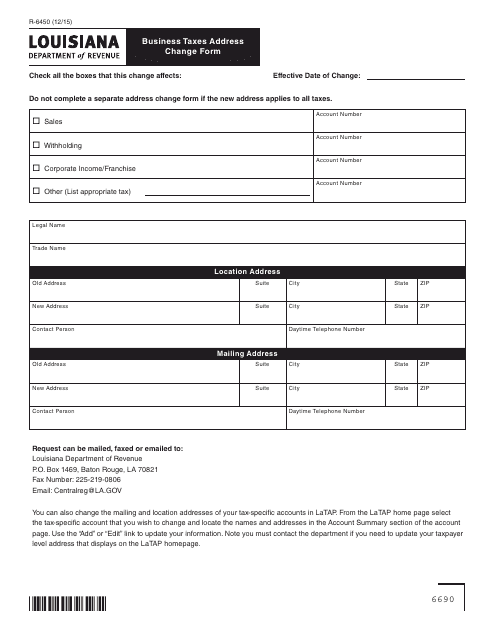

This Form is used for reporting any changes in business address for tax purposes in the state of Louisiana.