United States Tax Forms and Templates

Related Articles

Documents:

2432

This form is used for applying for residential property improvement in certain towns in New York, specifically in Amherst.

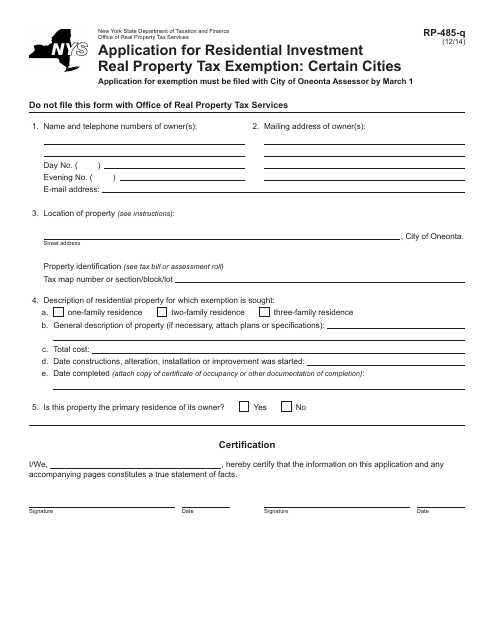

This Form is used for applying for a residential investment real property tax exemption in certain cities in New York.

This form is used for applying for a residential investment real property tax exemption in certain school districts in New York.

This form is used for applying for a tax exemption on residential investment properties in certain school districts in New York.

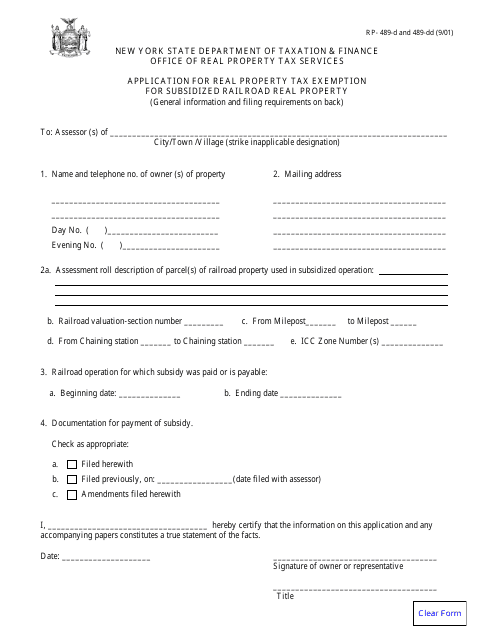

This Form is used for applying for a real property tax exemption for subsidized railroad real property in New York.

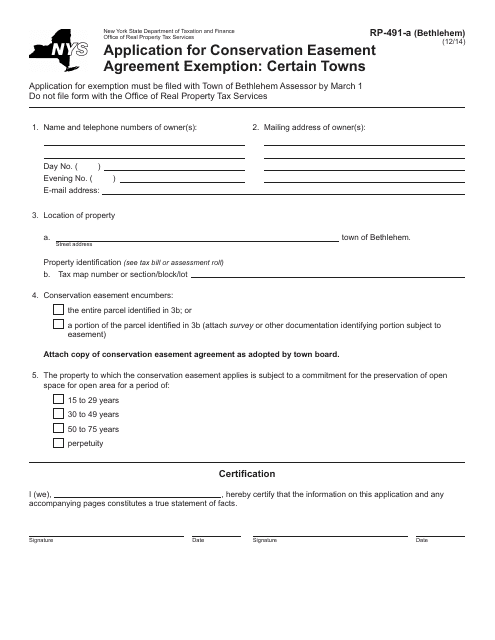

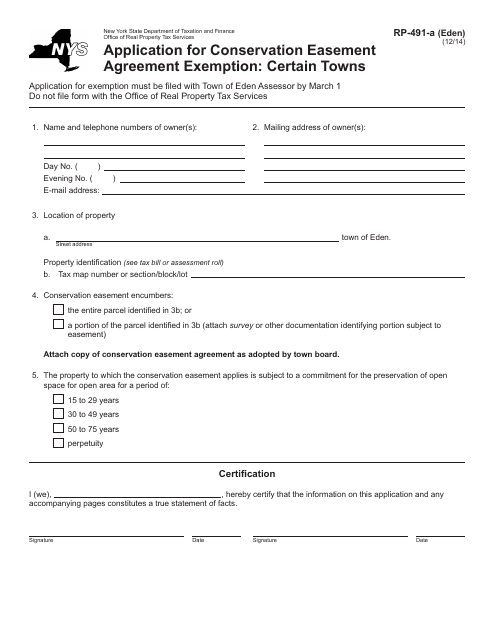

This form is used for applying for a conservation easement agreement exemption in certain towns in New York.

This Form is used for applying for an exemption on a Conservation Easement Agreement in certain towns in New York.

This Form is used for applying for a conservation easement agreement exemption in certain towns in New York, specifically Orchard Park. It allows individuals to request an exemption from certain requirements for conservation easements.

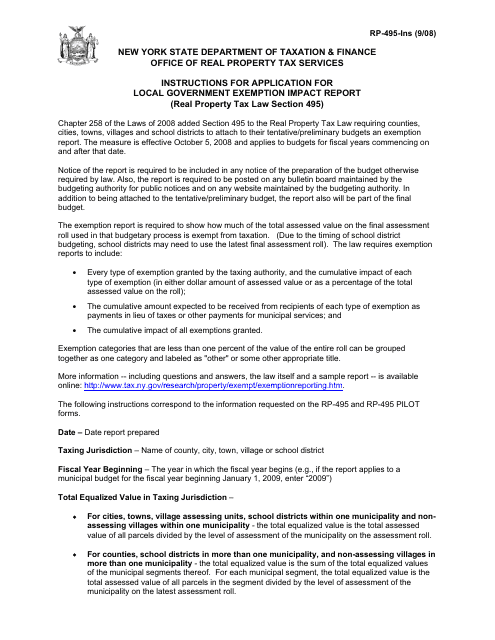

This document is used for applying for a local government exemption impact report in New York. It provides instructions on how to complete the Form RP-495.

This form is used for applying for a conservation easement agreement exemption in certain towns in New York, specifically Bethlehem.

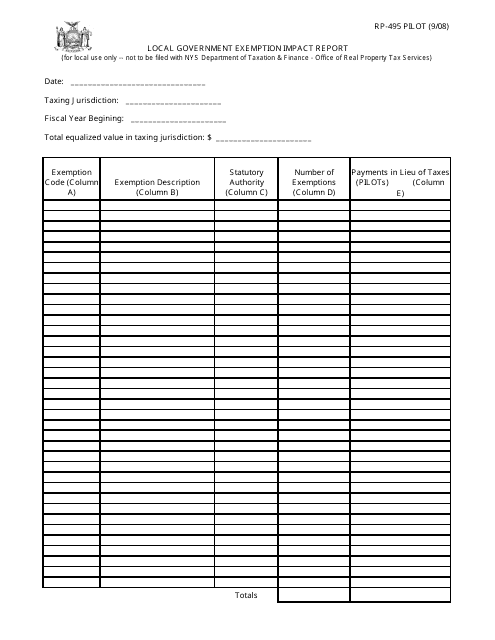

This form is used for reporting the impact of local government exemptions for the pilot program in New York.

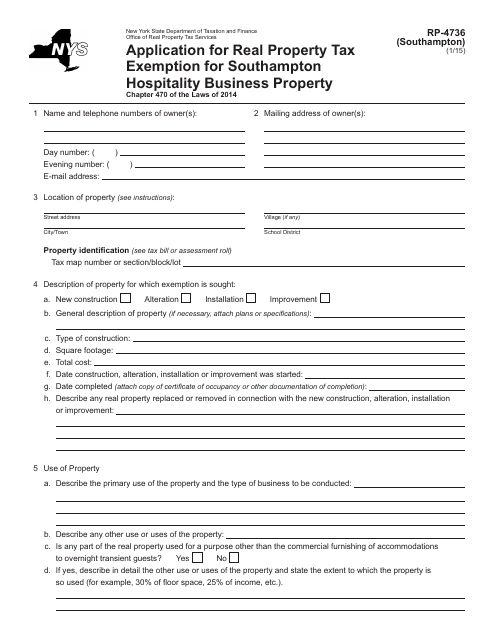

This form is used for applying for a real property tax exemption for hospitality businesses in Southampton, New York.

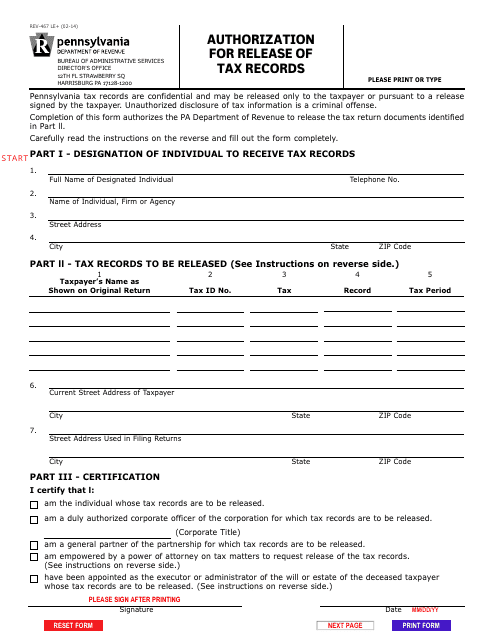

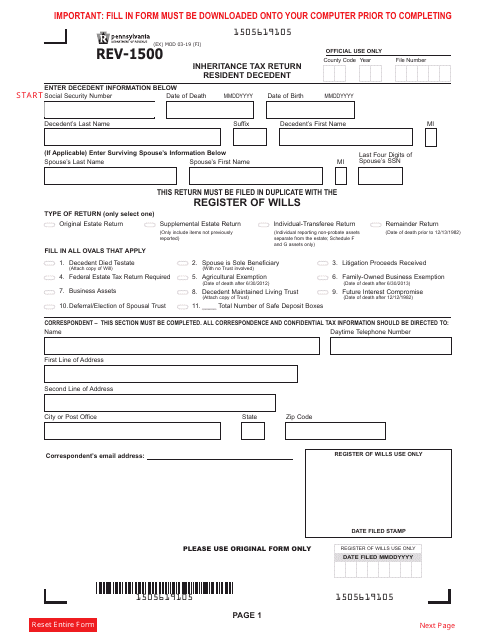

This form is used for authorizing the release of tax records in Pennsylvania.

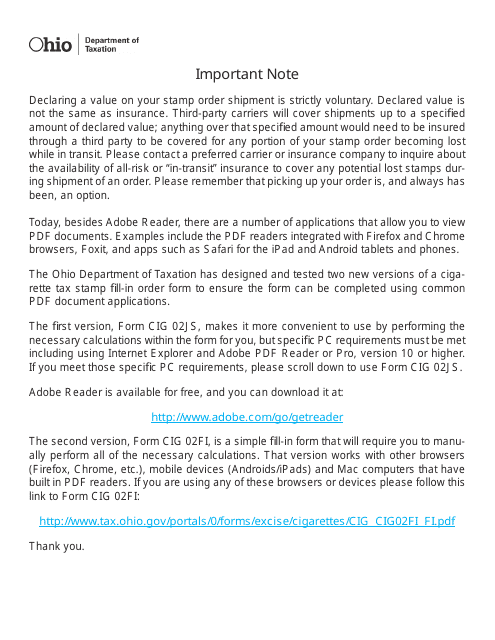

This Form is used for ordering cigarette tax stamps in Ohio.

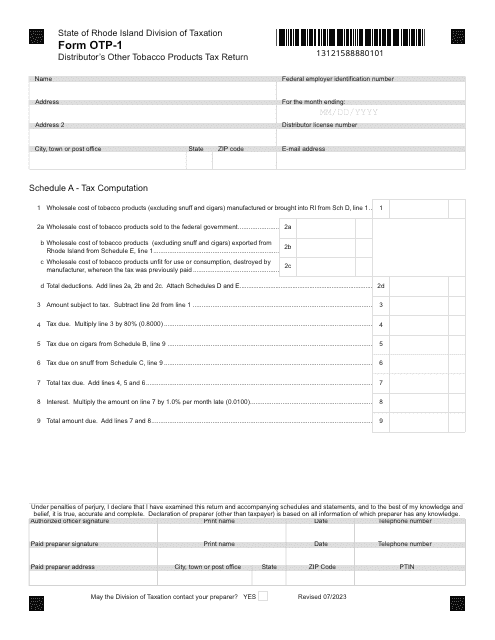

This form is used to collect information about activities that have taken place in North Dakota over the past ten years.

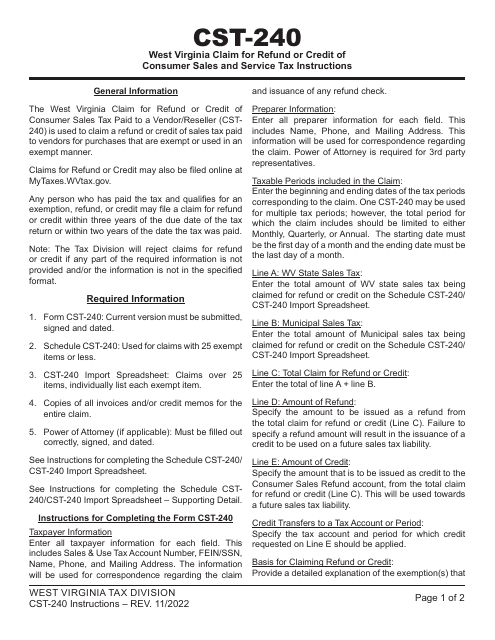

This Form is used for the injured spouse in West Virginia to allocate the tax refund between two spouses when the other spouse has past-due obligations.

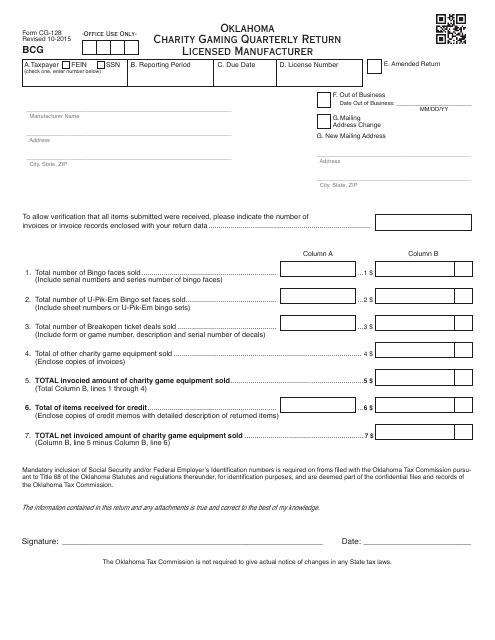

This form is used for Oklahoma licensed manufacturers to report their quarterly gaming activity for charitable purposes. It is required by the Oklahoma Charity Gaming Division.

This Form is used for reporting and paying the New Jersey Motor Vehicle Tire Fee, which is required for anyone selling new tires in the state of New Jersey.

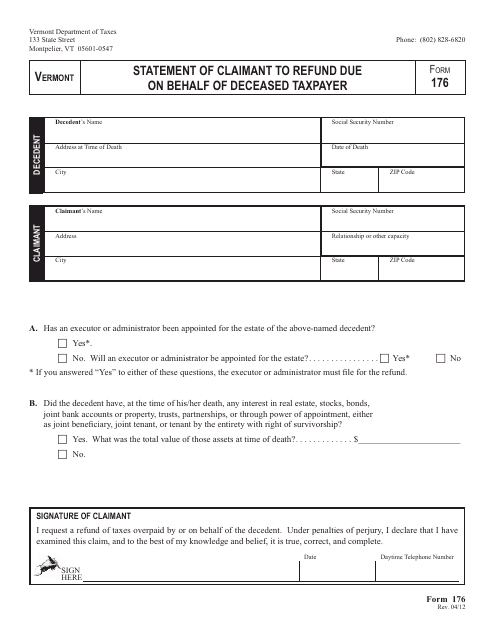

This document is used for making a claim for a refund on behalf of a deceased taxpayer in the state of Vermont.

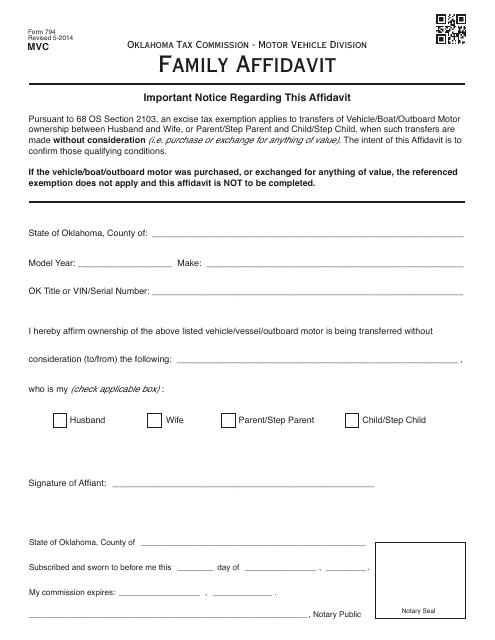

This Form is used for submitting a Family Affidavit in Oklahoma for over-the-counter (OTC) transactions.

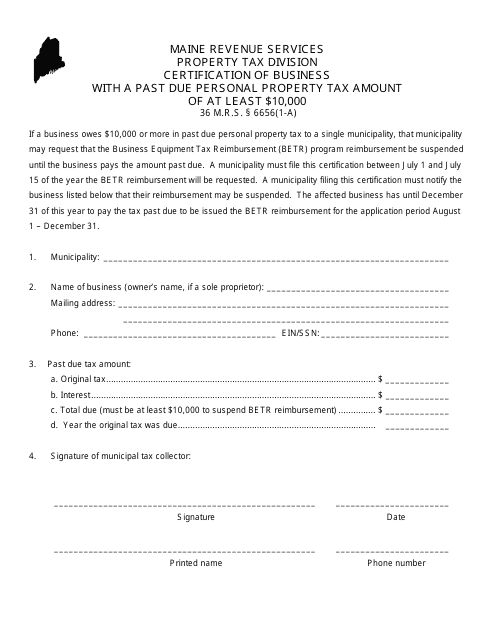

This document certifies a business with a past due personal property tax amount of at least $10,000 in the state of Maine.

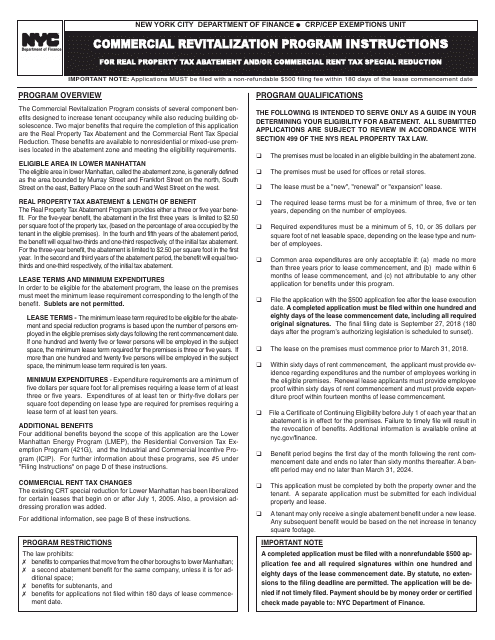

This document provides instructions for the Commercial Revitalization Program in New York City. It explains how to participate in the program and outlines the steps and requirements.

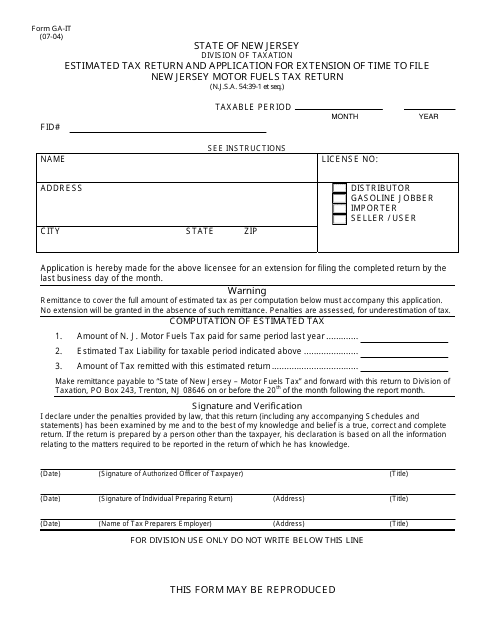

This Form is used for filing a Georgia state estimated tax return and applying for an extension of time to file a New Jersey Motor Fuels Tax Return.

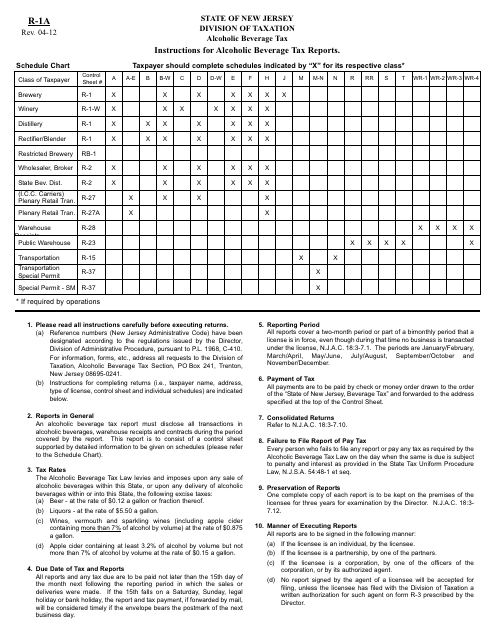

This document provides instructions for completing and filing the Alcoholic Beverage Tax Reports (Form R-1A) in the state of New Jersey. It is a necessary form for businesses involved in the sale of alcoholic beverages in order to report and pay the required taxes.

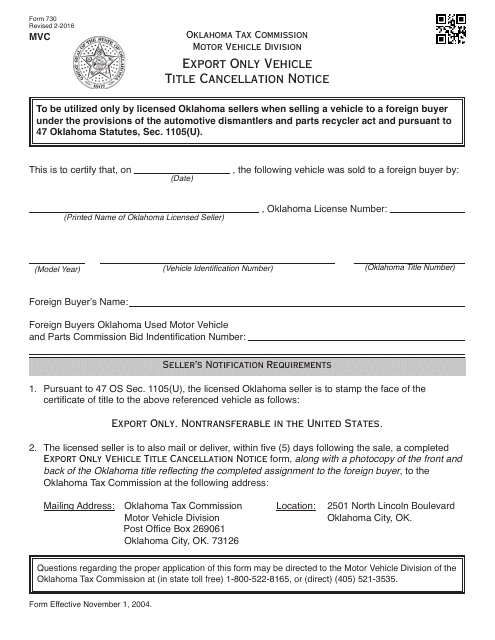

This type of document is used for canceling the title of an export-only vehicle in Oklahoma.

This form is used for filing Indiana inheritance tax return in the state of Indiana.

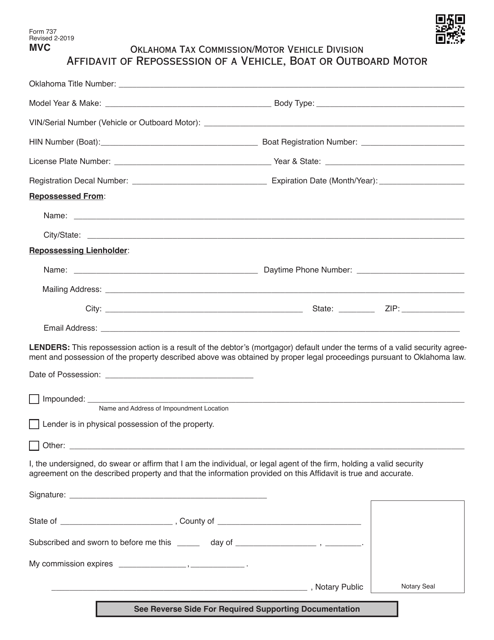

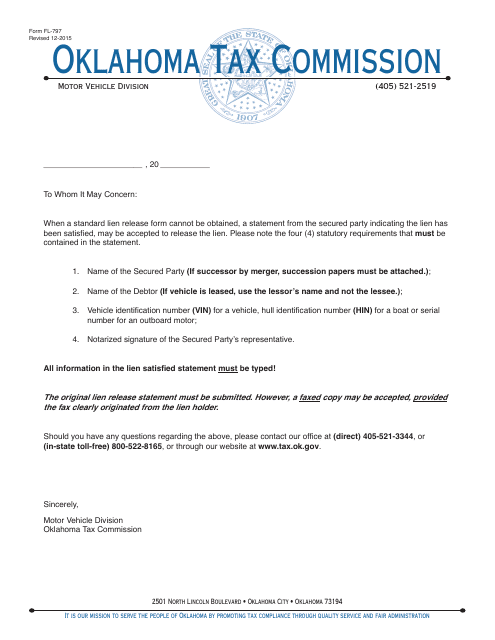

This form is used for releasing a lien on a property in Oklahoma. It is an affidavit letter that confirms the lien is no longer active.

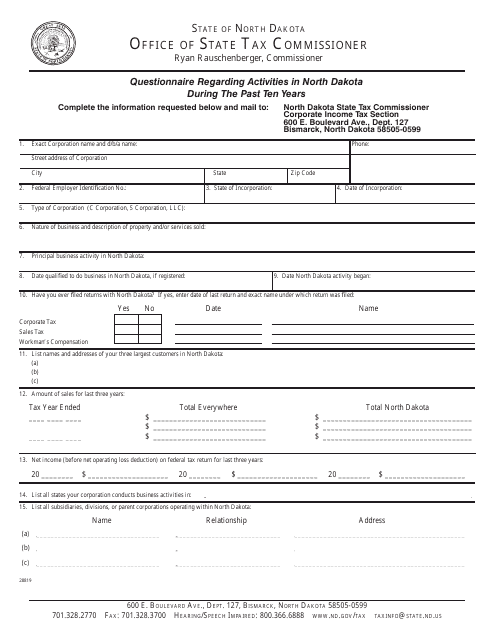

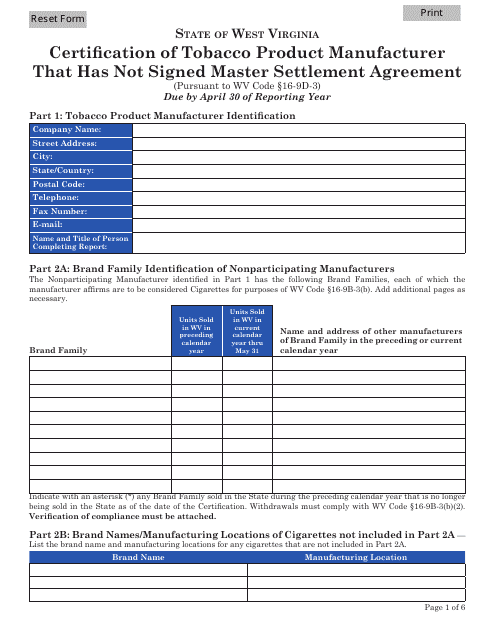

This document certifies a tobacco product manufacturer in West Virginia who has not signed the Master Settlement Agreement.

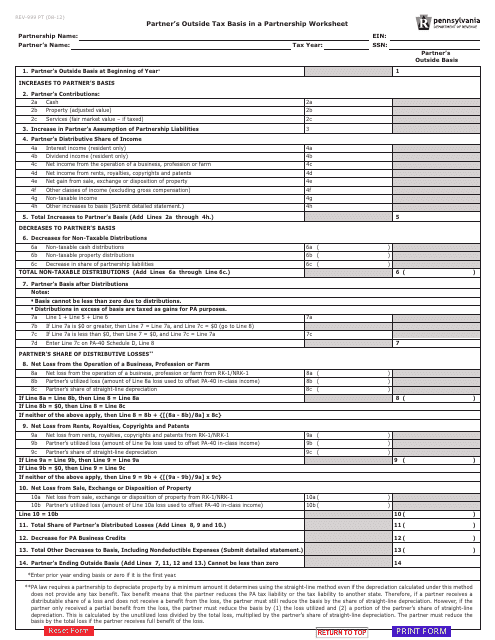

This form is used for calculating the partner's outside tax basis in a partnership in Pennsylvania.

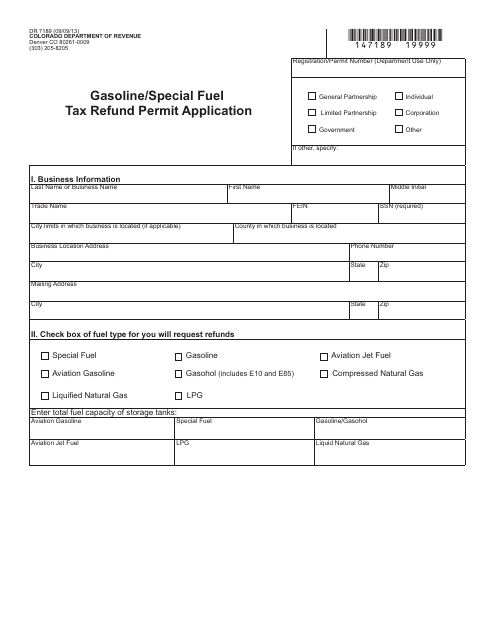

This form is used for applying for a gasoline/special fuel tax refund permit in Colorado.

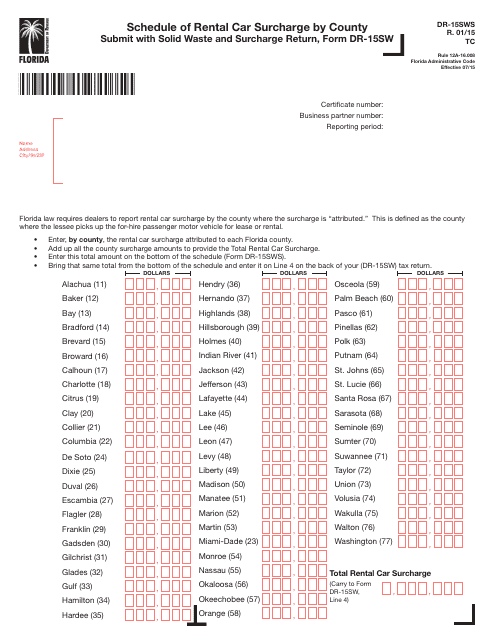

This form is used for reporting the rental car surcharge by county in the state of Florida. It helps in tracking and documenting the surcharges on rental cars in different counties.

This is a legal document needed to gain tax exemption for the purpose of product resale in the state of Georgia.

![Form RP-485-L [AMHERST] Application for Residential Property Improvement; Certain Towns - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733926/form-rp-485-l-amherst-application-residential-property-improvement-certain-towns-new-york_big.png)

![Form RP-485-I [AMSTERDAM SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733928/form-rp-485-i-amsterdam-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york_big.png)

![Form RP-485-M [ROME SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733929/form-rp-485-m-rome-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york_big.png)

![Form RP-491 [ELMA] Application for Conservation Easement Agreement Exemption. Certain Towns - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733932/form-rp-491-elma-application-conservation-easement-agreement-exemption-certain-towns-new-york_big.png)

![Form RP-491 [ORCHARD PARK] Application for Conservation Easement Agreement Exemption. Certain Towns - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733934/form-rp-491-orchard-park-application-conservation-easement-agreement-exemption-certain-towns-new-york_big.png)