United States Tax Forms and Templates

Related Articles

Documents:

2432

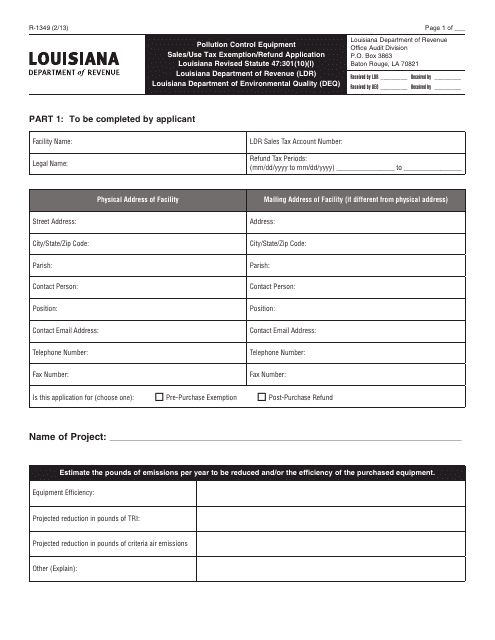

This type of document is an application form used in Louisiana to request an exemption or refund for sales or use tax related to pollution control equipment.

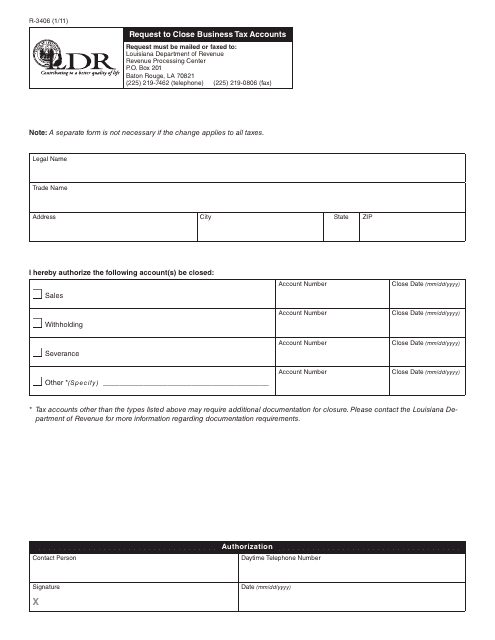

This form is used for requesting the closure of business tax accounts in the state of Louisiana.

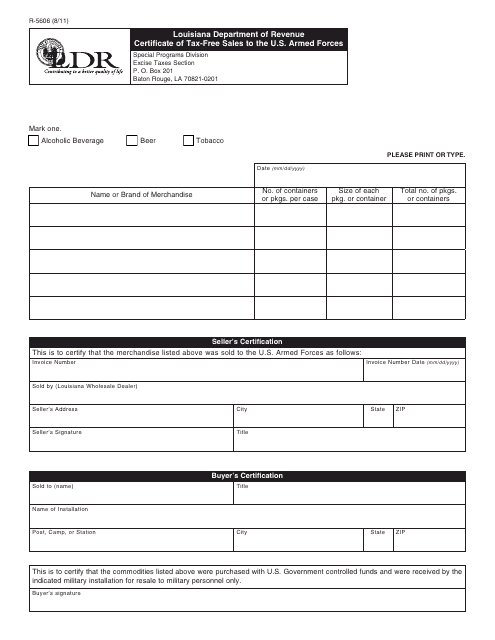

This form is used for certifying tax-free sales made to the U.S. Armed Forces in Louisiana.

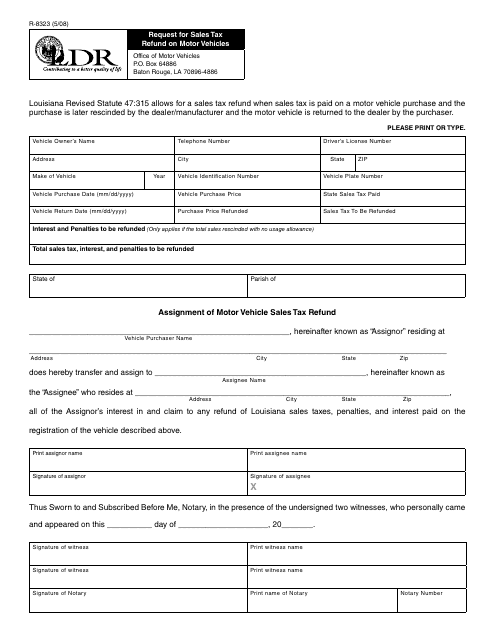

This form is used for requesting a sales tax refund on motor vehicles in the state of Louisiana.

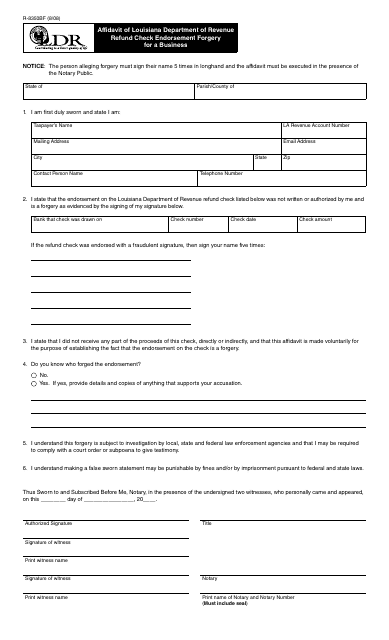

This form is used for reporting and addressing incidents of check forgery involving business refund checks issued by the Louisiana Department of Revenue.

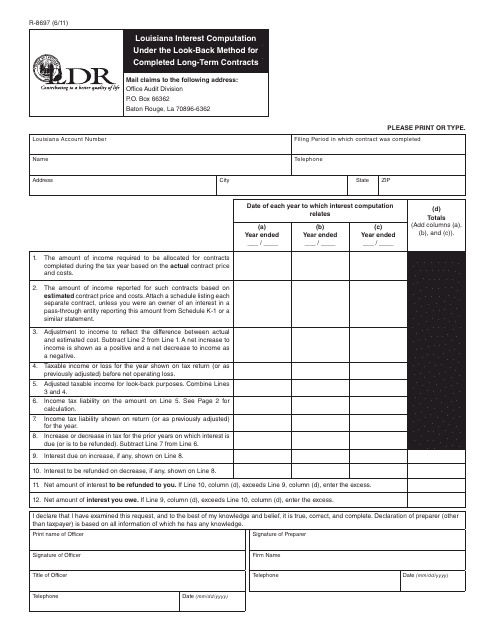

This form is used for calculating interest under the look-back method for completed long-term contracts in the state of Louisiana.

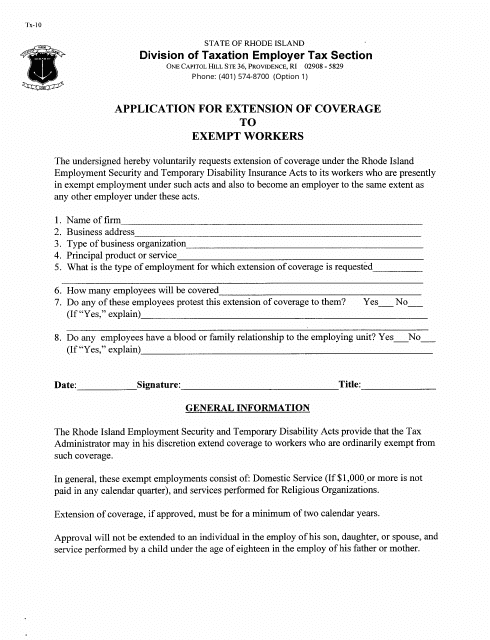

This Form is used for religious organizations in Rhode Island to apply for an extension of coverage to exempt workers.

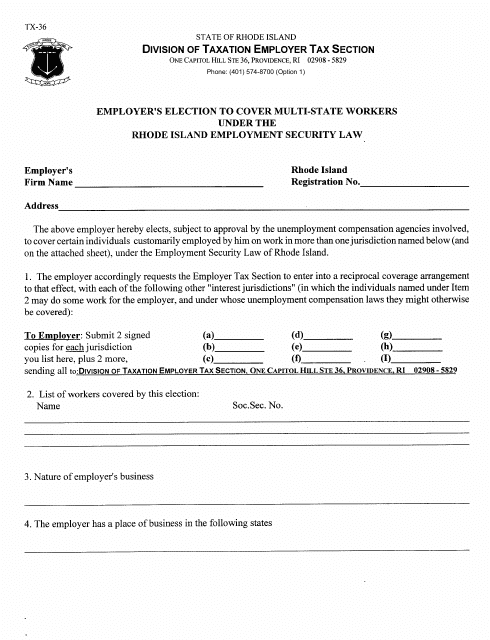

This document is for employers who have workers in multiple states and want to elect coverage for their workers in Rhode Island.

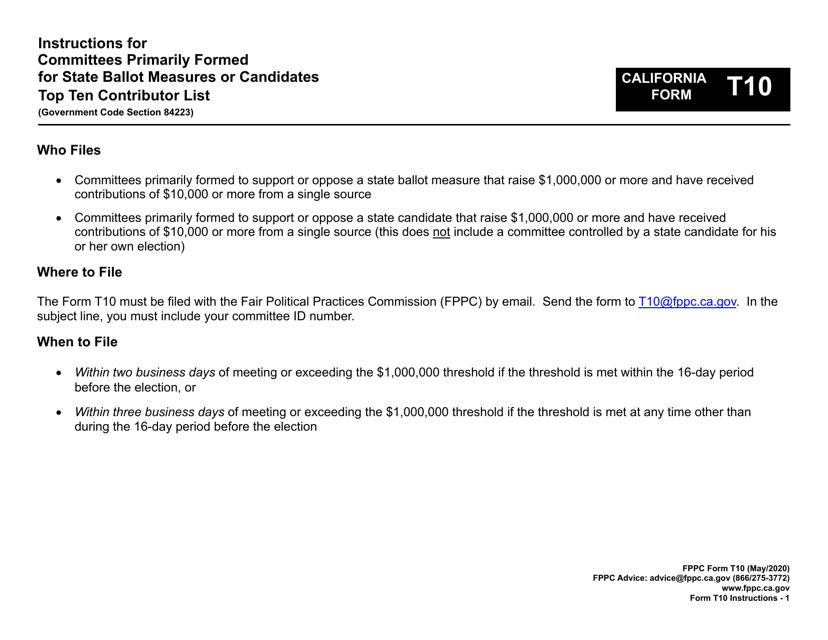

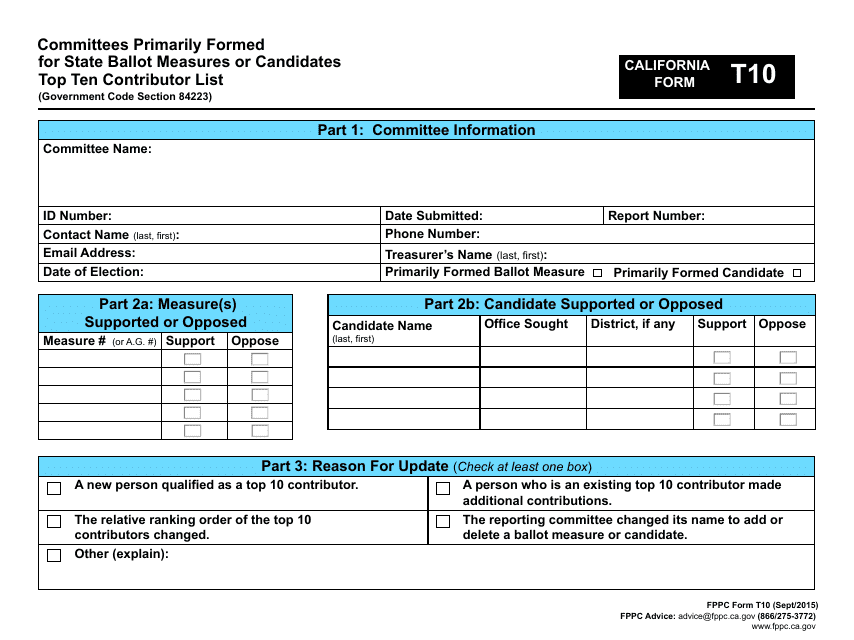

This document is used for disclosing the top ten contributors to committees primarily formed for state ballot measures or candidates in California. It provides transparency in campaign financing.

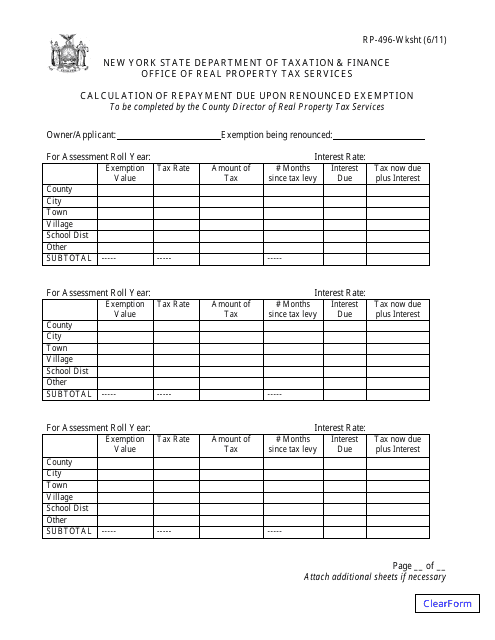

This form is used for calculating the repayment amount due upon renounced exemption in the state of New York.

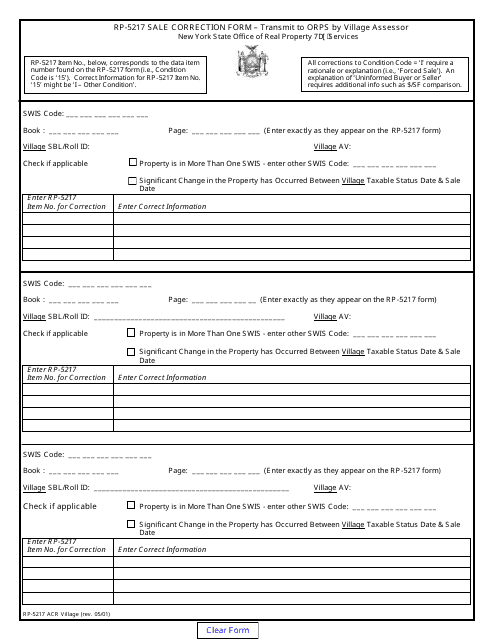

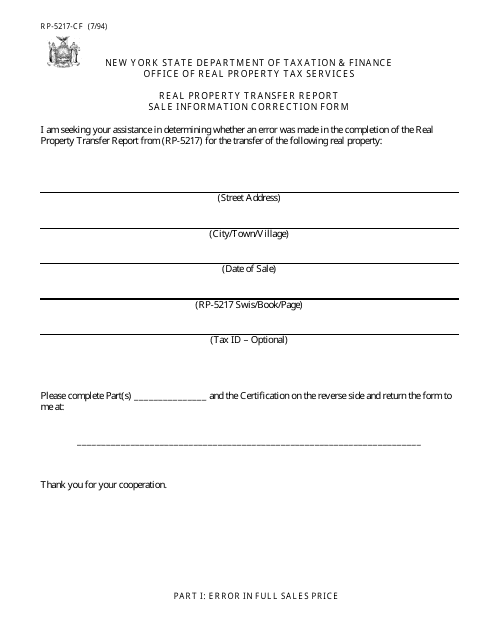

This form is used for correcting the sales information for a property in a village in New York.

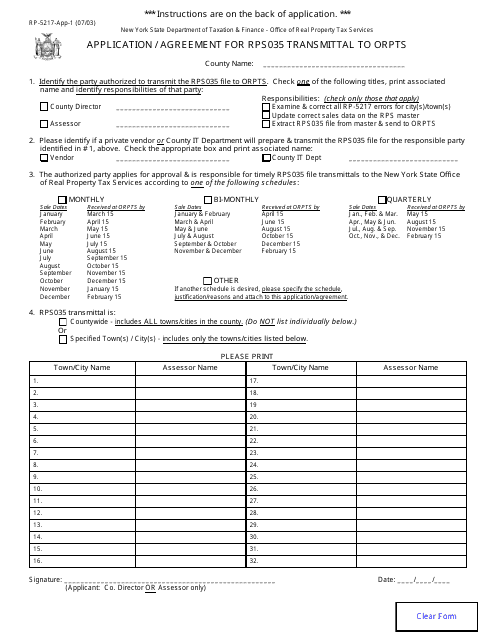

This form is used for submitting an application and agreement for the transmittal of RP-5217-APP-1 to the Office of Real Property Tax Services (ORPTS) in New York.

This form is used for correcting sale information on a real property transfer report in New York.

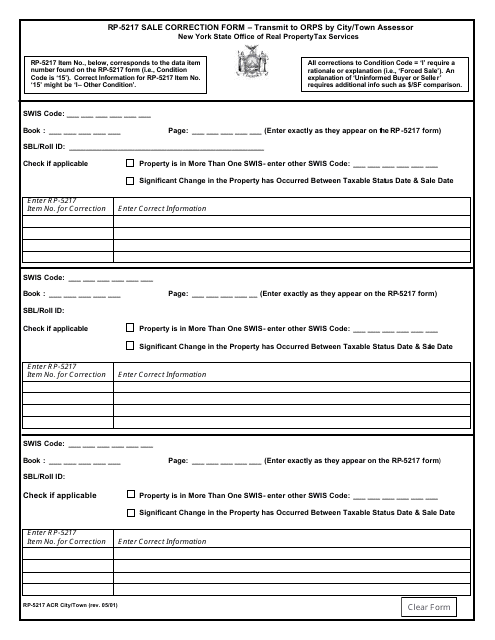

This Form is used for correcting the sale information for a property in a specific city or town in New York.

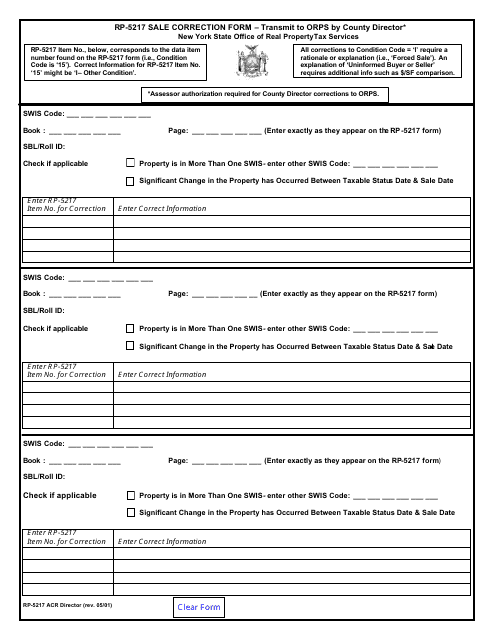

This form is used for correcting sales information on a property in New York.

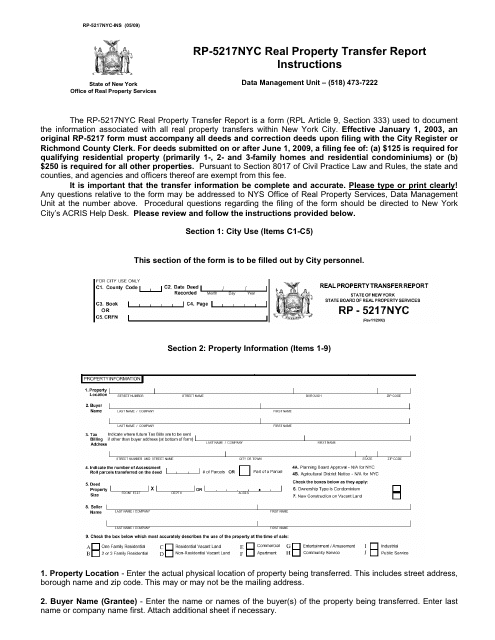

This form is used for reporting the transfer of real property in New York City. It provides instructions on how to properly complete the RP-5217NYC form.

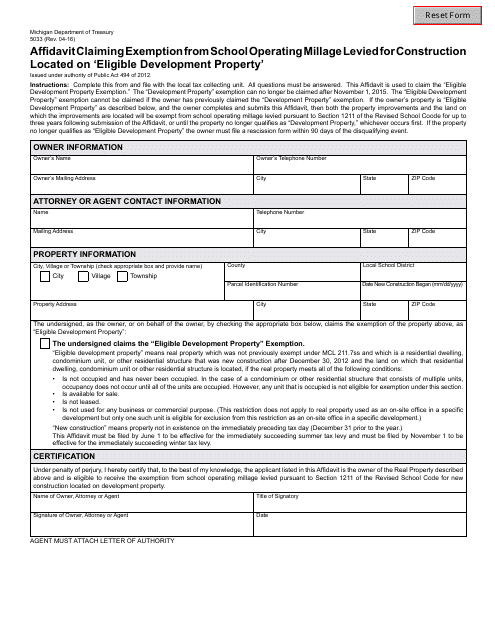

This form is used for claiming an exemption from school operating millage for constructions located on eligible development property in Michigan.

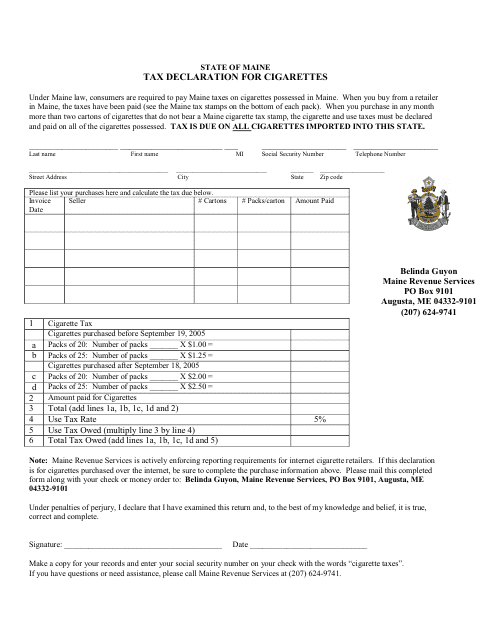

This Form is used for declaring and reporting taxes on cigarettes in the state of Maine.

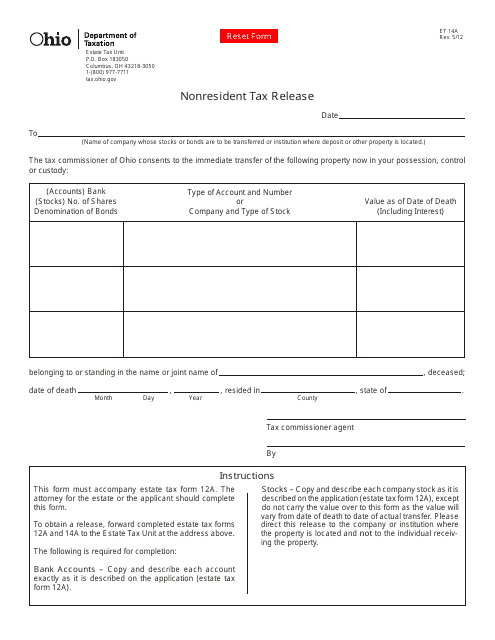

This form is used for nonresidents in Ohio to request a tax release.

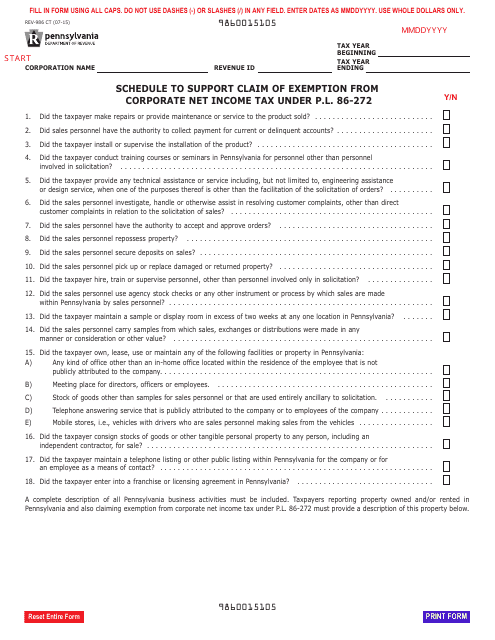

This Form is used for claiming exemption from corporate net income tax in Pennsylvania under P.l. 86-272.

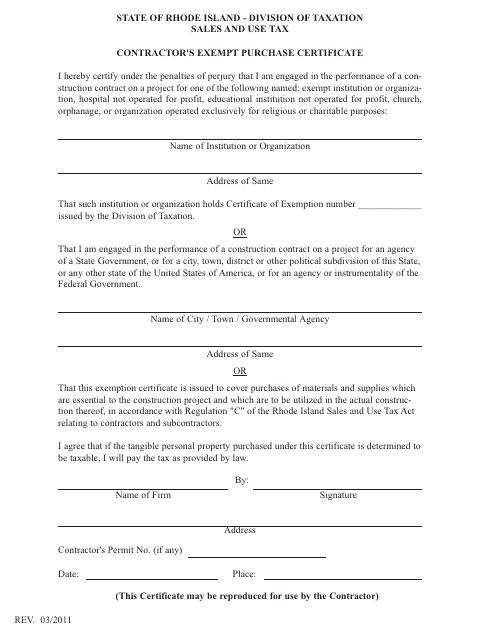

This Form is used for contractors in Rhode Island to claim exemptions on certain purchases. It allows them to avoid paying sales tax on qualifying items.

This Form is used for obtaining an Exemption Certificate in Rhode Island for the purpose of recycling, reusing or treating hazardous waste.

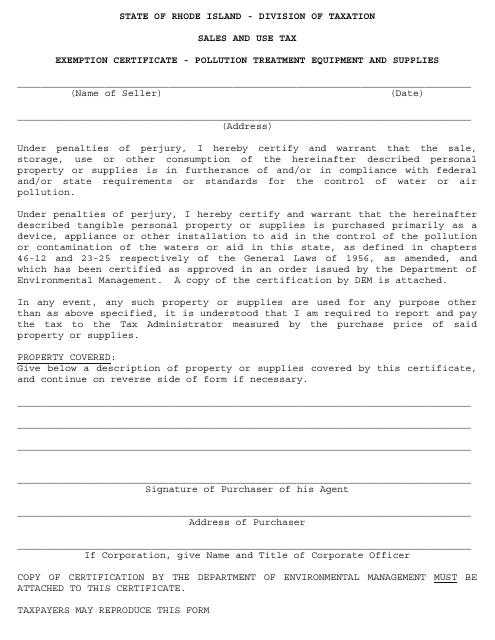

This form is used for applying for an exemption certificate for pollution treatment equipment and supplies in the state of Rhode Island.

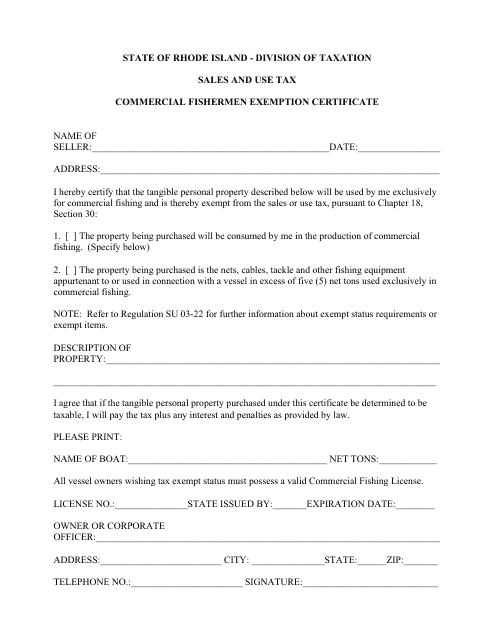

This document is for commercial fishermen in Rhode Island who are exempt from specific regulations.

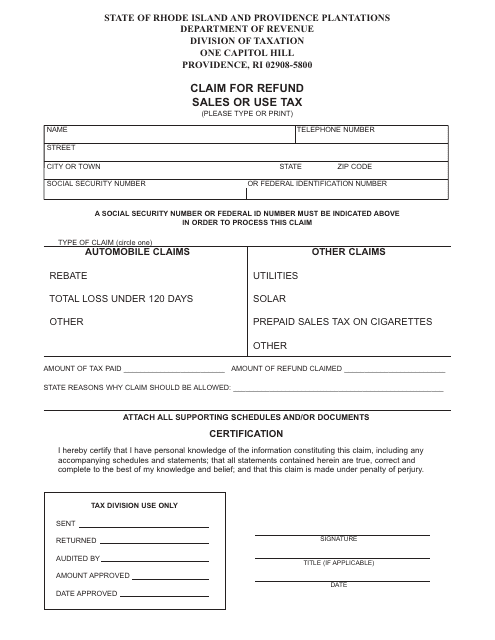

This document is for claiming a refund of sales or use tax paid in Rhode Island. You can use this form to request a refund if you believe you have overpaid or are eligible for a tax exemption.

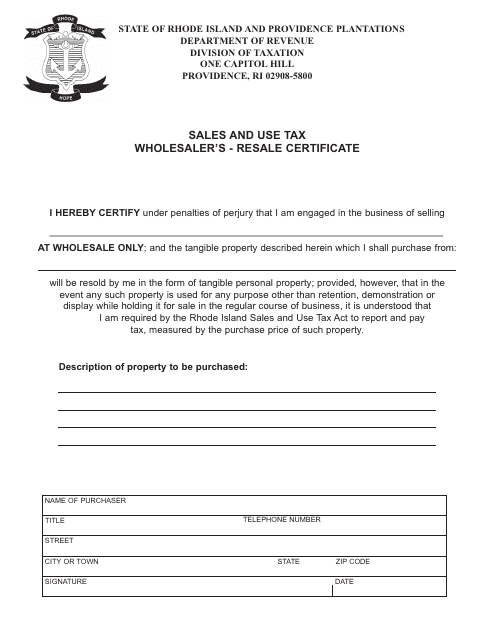

This document is used by wholesalers in Rhode Island to obtain a resale certificate, which allows them to purchase goods for resale without paying sales tax.

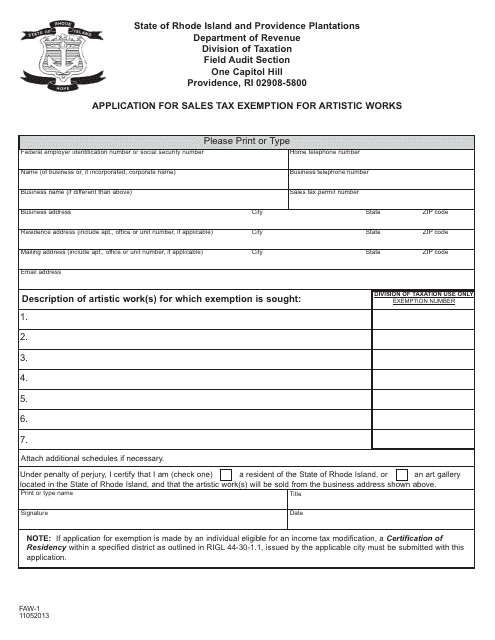

This form is used for applying for sales tax exemption on artistic works in Rhode Island. It is used by artists and sellers of artistic works to claim exemption from paying sales tax on their sales.

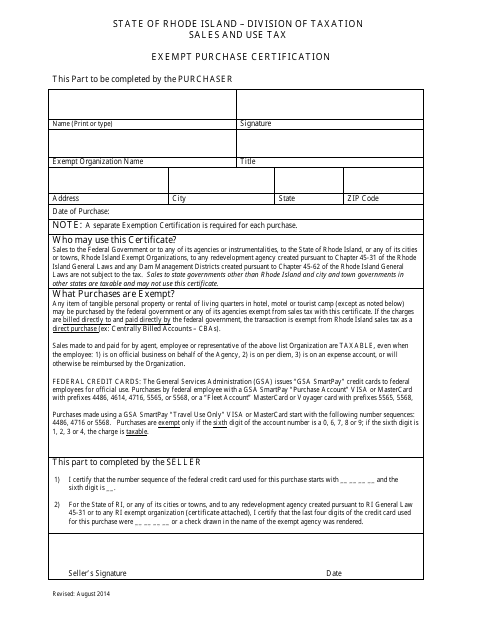

This form is used for certifying that a purchase is exempt from certain taxes in the state of Rhode Island.

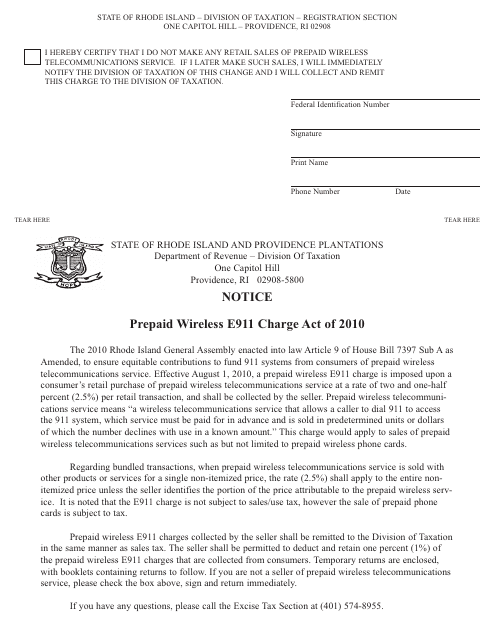

This Form is used for opting out of the Prepaid Wireless Telecommunications Charge in Rhode Island.

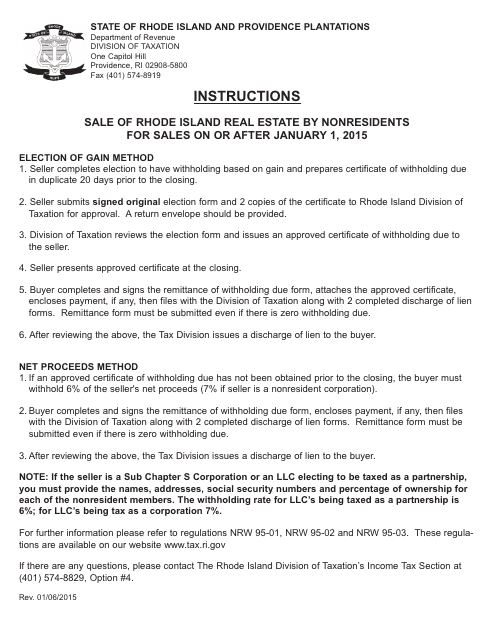

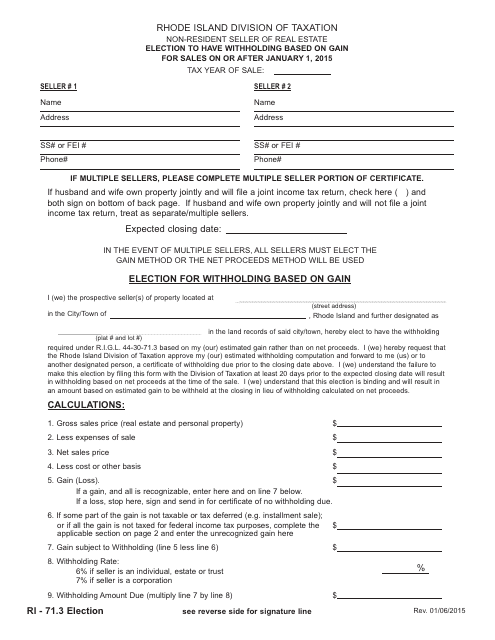

This document provides instructions for nonresidents on how to sell real estate in Rhode Island for sales that occurred on or after January 1, 2015. It outlines the specific requirements and steps that need to be followed during the sales process.

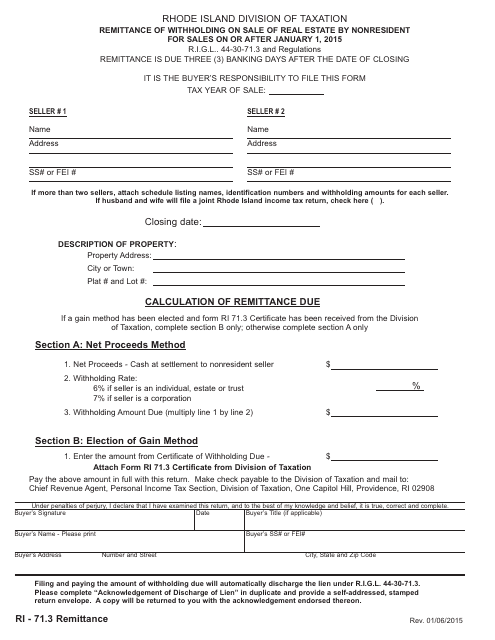

This type of document is used for remitting withholding taxes on the sale of real estate by nonresidents in Rhode Island.

This form is used for non-resident sellers of real estate in Rhode Island who want to elect to have withholding based on their gain from the sale. This is applicable for sales that occurred on or after January 1, 2015.

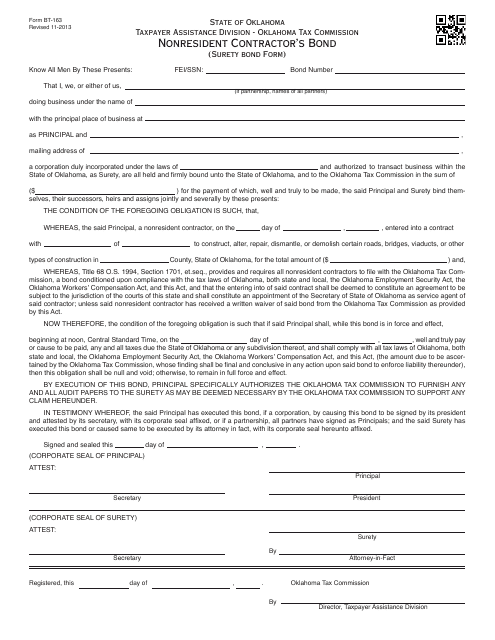

This type of document is used for obtaining a nonresident contractor's bond in Oklahoma. It is for contractors who are not residents of Oklahoma but want to work on construction projects in the state. The bond ensures that the contractor will fulfill their obligations and responsibilities as outlined in their contract.

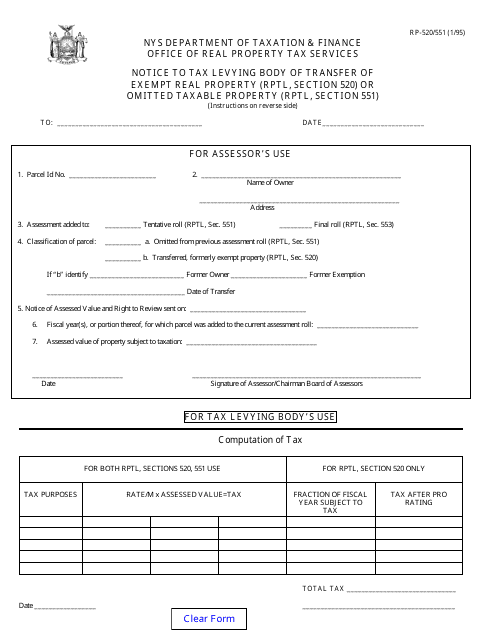

This form is used to notify the tax levying body in New York about the transfer of exempt real property or omitted taxable property in accordance with Rptl, Section 520 or Rptl, Section 551.