United States Tax Forms and Templates

Related Articles

Documents:

2432

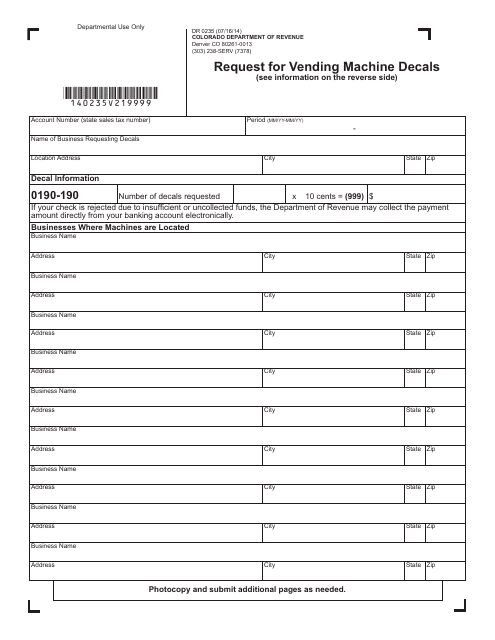

This form is used for requesting vending machine decals in the state of Colorado.

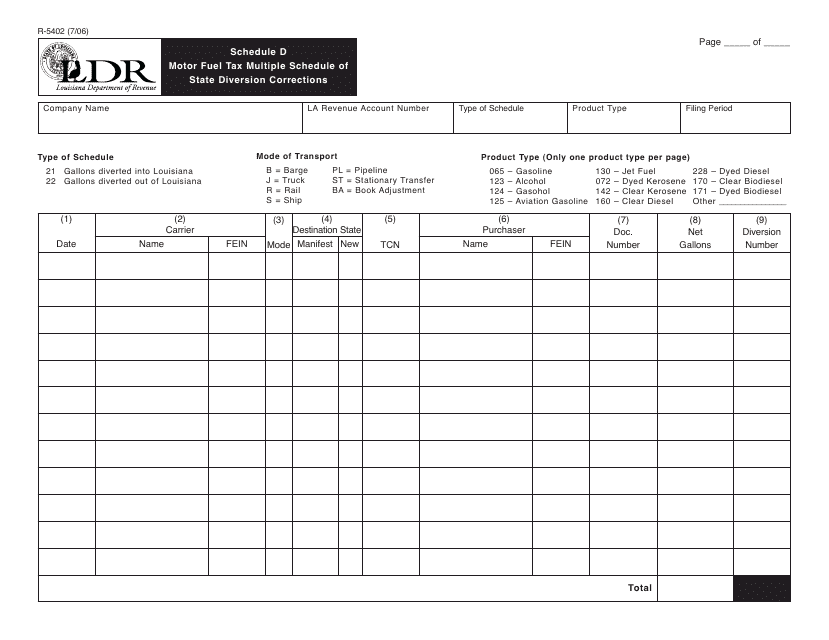

This form is used for reporting and correcting any errors or discrepancies in the motor fuel tax diversion amounts for multiple locations within the state of Louisiana.

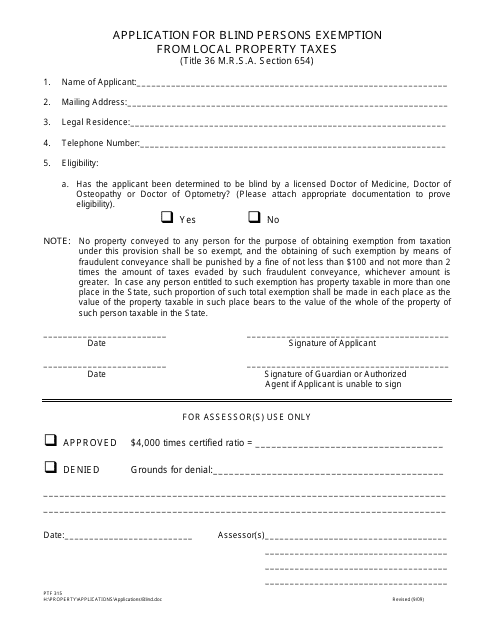

This form is used for applying for an exemption from local property taxes in Maine for blind persons.

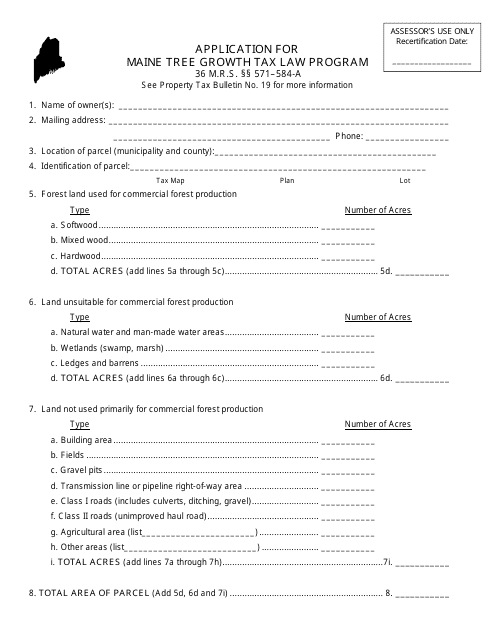

This document is an application form for the Maine Tree Growth Tax Law Program, a program in the state of Maine that provides tax incentives for landowners who actively manage their forest lands for timber production.

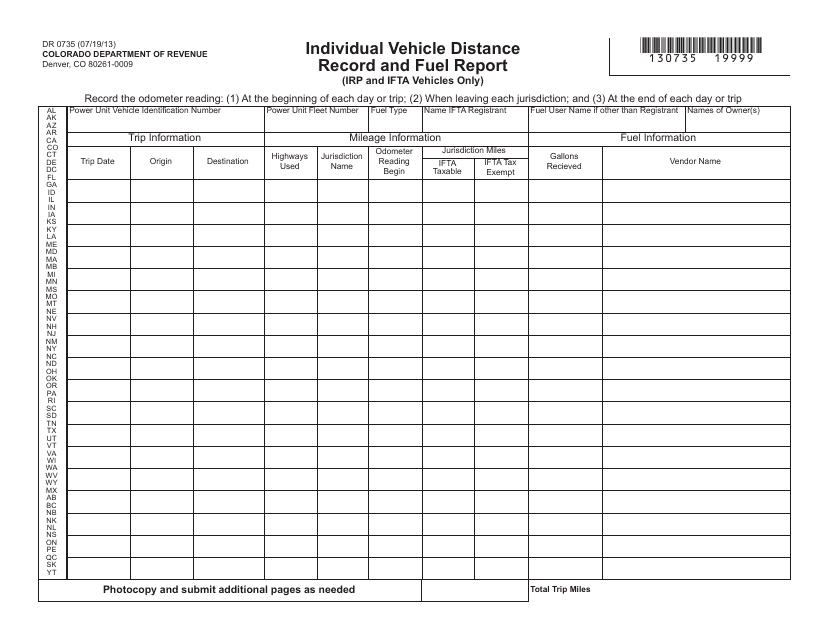

This form is used for recording the distance traveled and fuel consumption of an individual vehicle in Colorado. It is used to track and report fuel usage for various purposes.

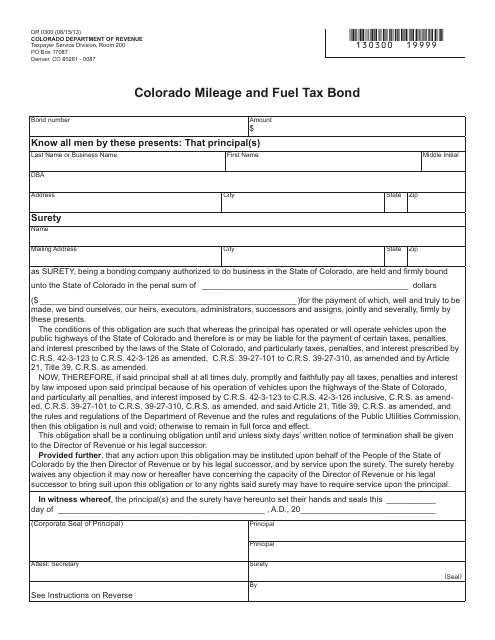

This form is used for obtaining a Mileage and Fuel Tax Bond in the state of Colorado.

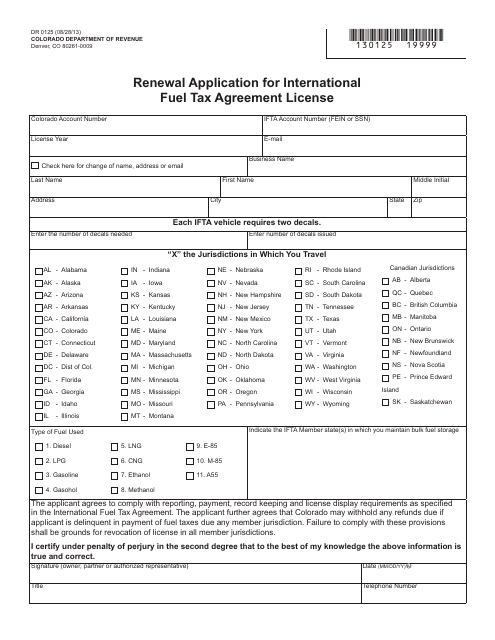

This Form is used for renewing an International Fuel Tax Agreement (IFTA) License in Colorado.

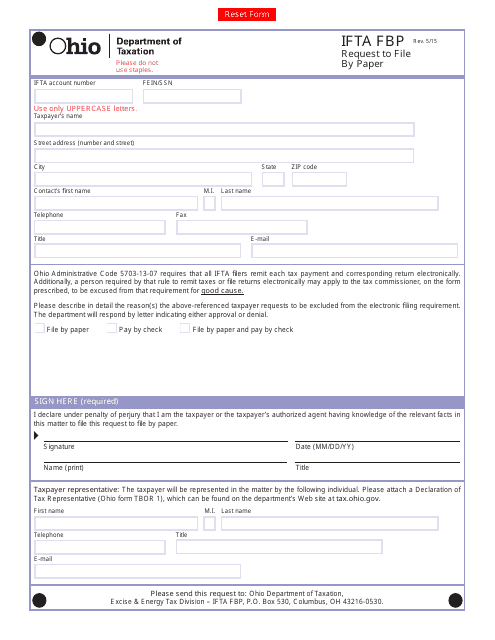

This form is used for requesting to file the International Fuel Tax Agreement (IFTA) Fuel Use Tax return by paper in the state of Ohio.

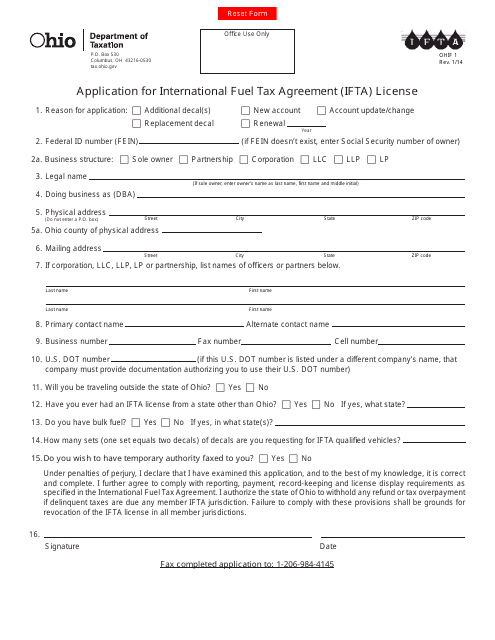

This Form is used for applying for an International Fuel Tax Agreement (IFTA) license in Ohio.

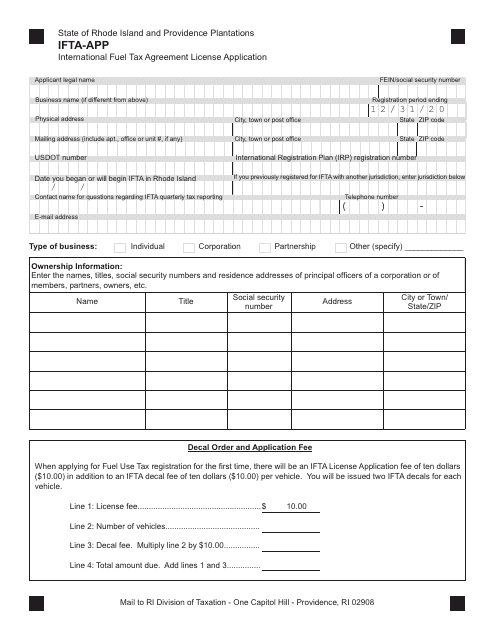

This document is an application form for obtaining an International Fuel Tax Agreement (IFTA) license in Rhode Island. It is used by individuals or businesses engaged in interstate commercial transportation to report and pay fuel taxes.

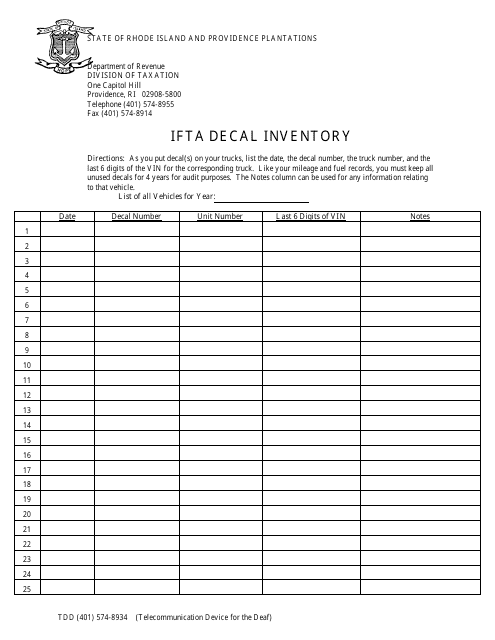

This form is used to track the inventory of IFTA decals in Rhode Island. It helps to ensure that the correct number of decals are available for distribution to qualifying vehicles.

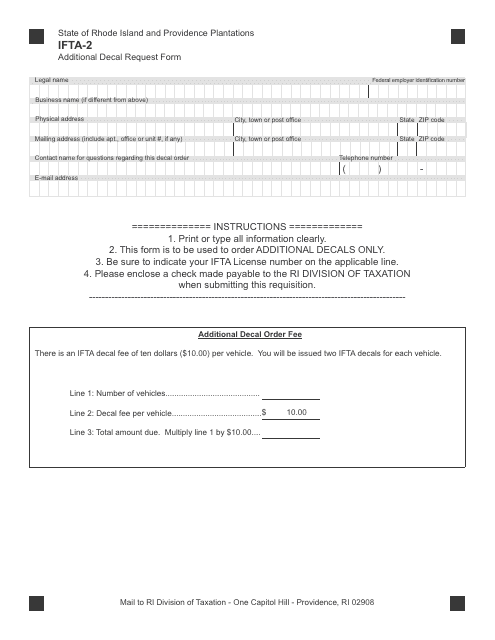

This Form is used for requesting additional decals under the International Fuel Tax Agreement (IFTA) in Rhode Island.

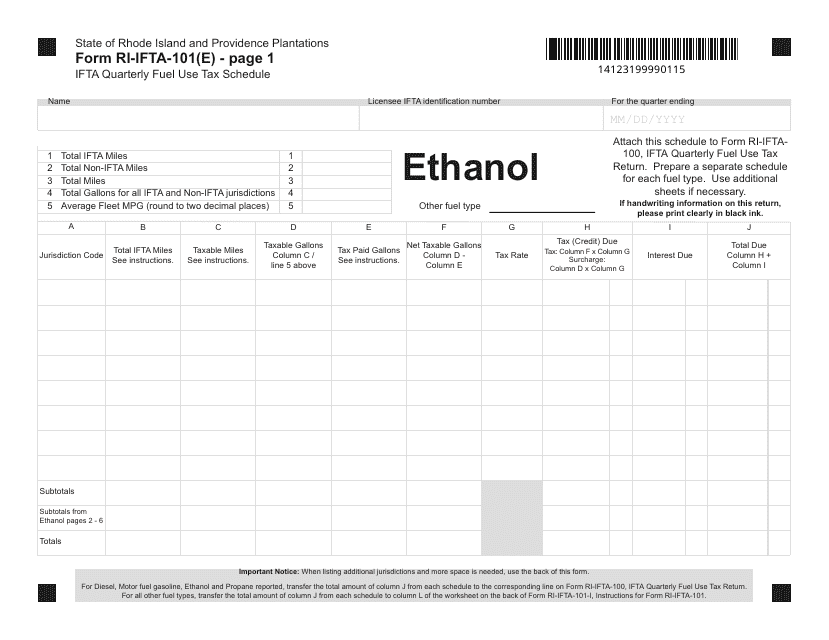

This Form is used for reporting quarterly fuel use tax for ethanol in Rhode Island.

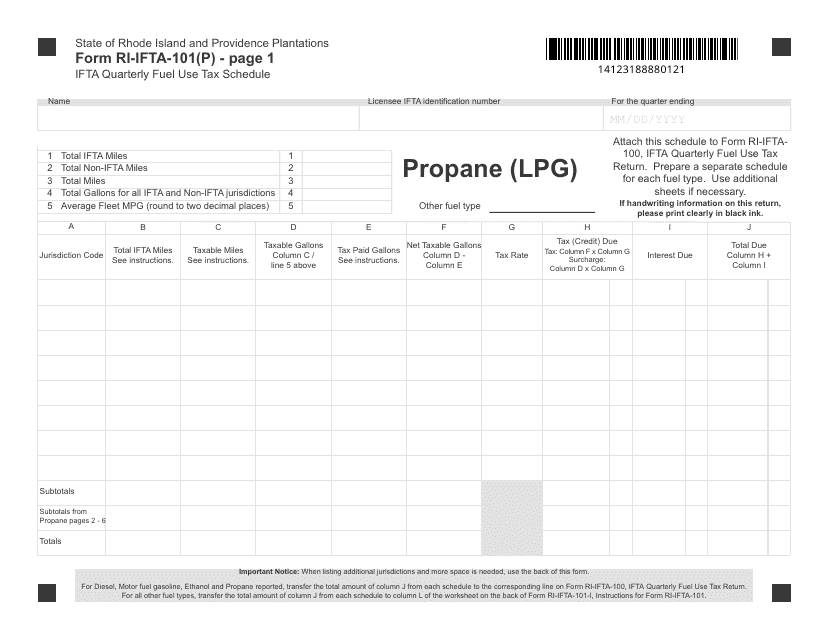

This form is used for reporting the quarterly fuel use tax for propane (LPG) in Rhode Island.

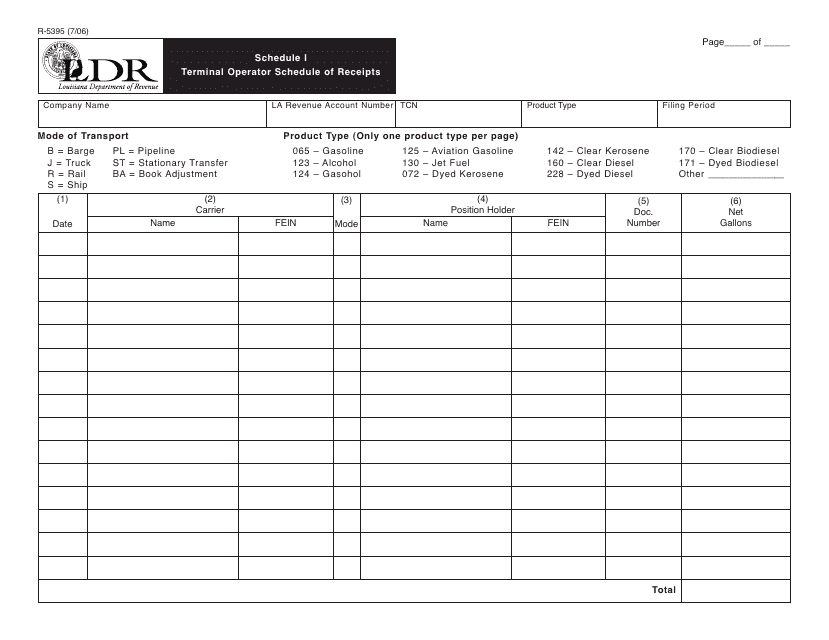

This document is used for reporting the schedule of receipts for terminal operators in Louisiana.

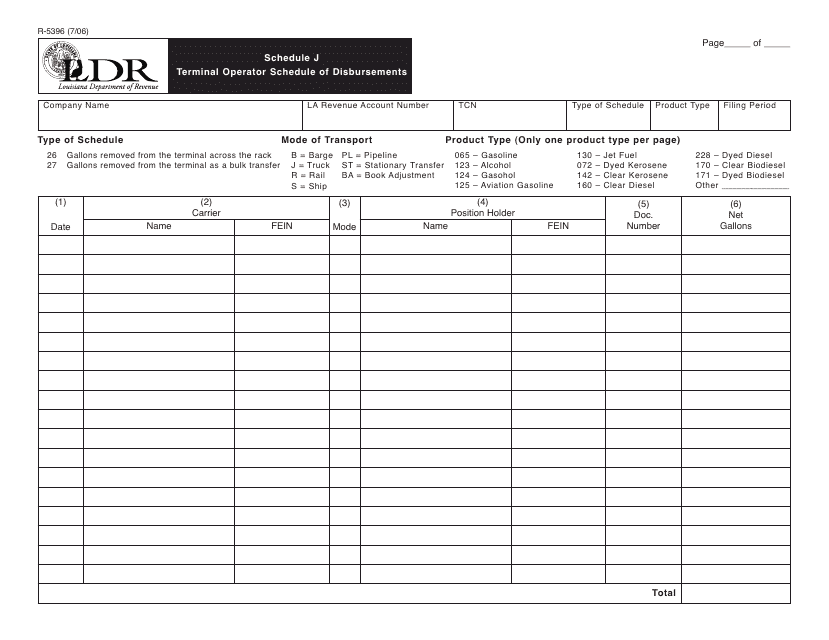

This form is used for reporting the schedule of disbursements for terminal operators in Louisiana.

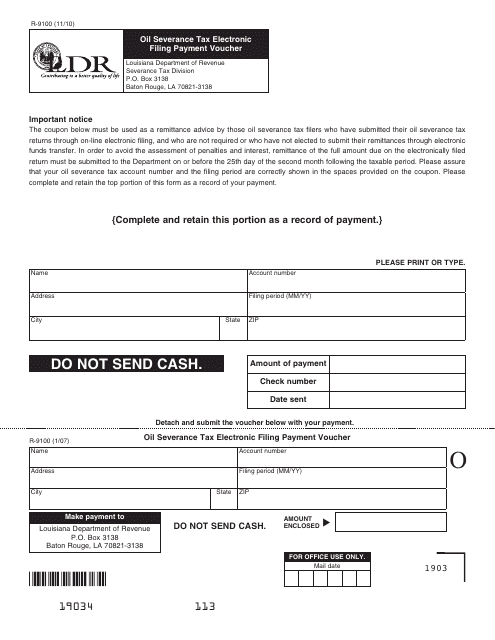

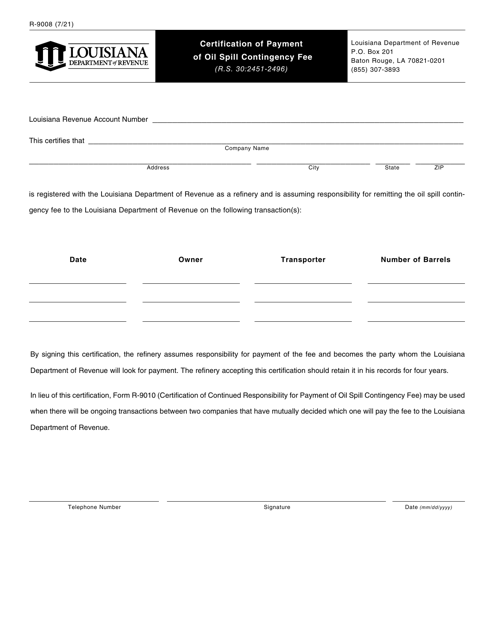

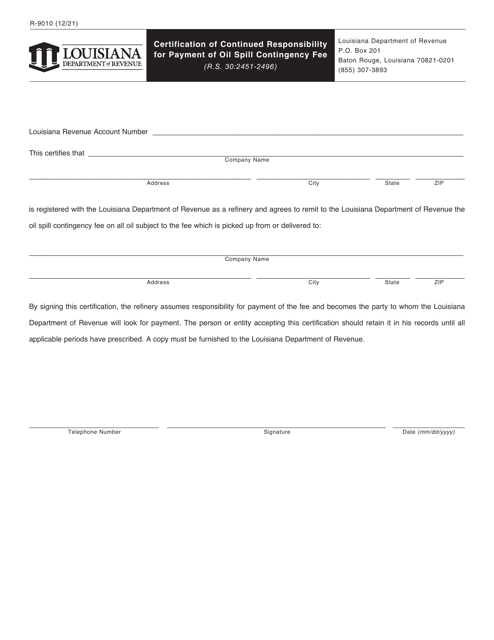

This form is used for making electronic payments related to the oil severance tax in Louisiana.

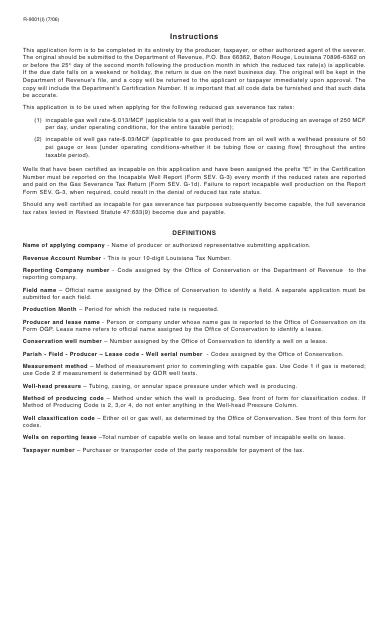

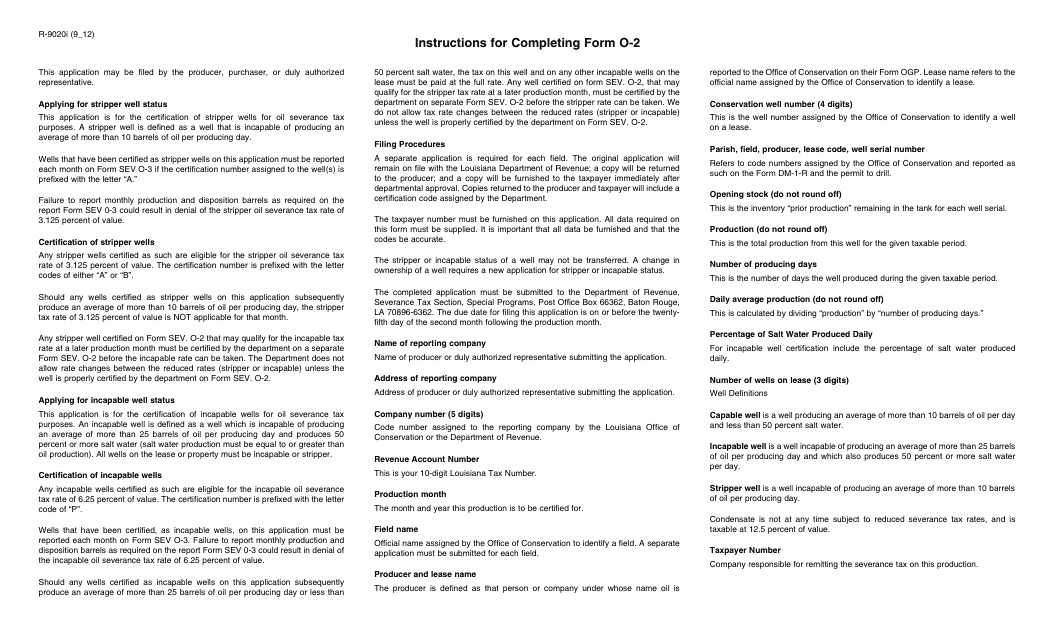

This Form is used for applying for certification of incapable wells in Louisiana. It provides instructions on how to complete the application process.

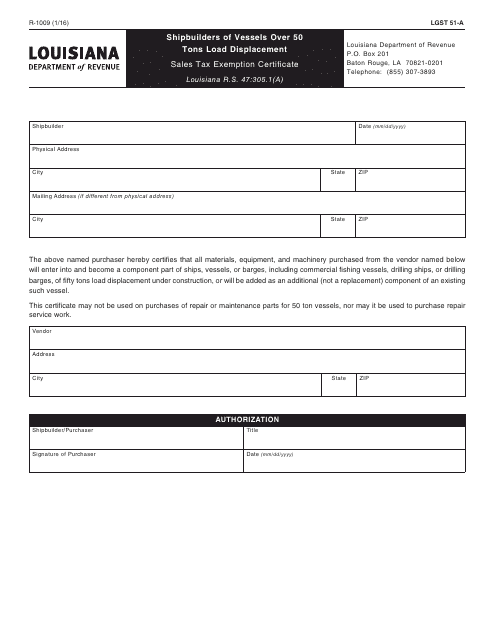

This form is used for shipbuilders in Louisiana to claim a sales tax exemption on vessels over 50 tons load displacement.

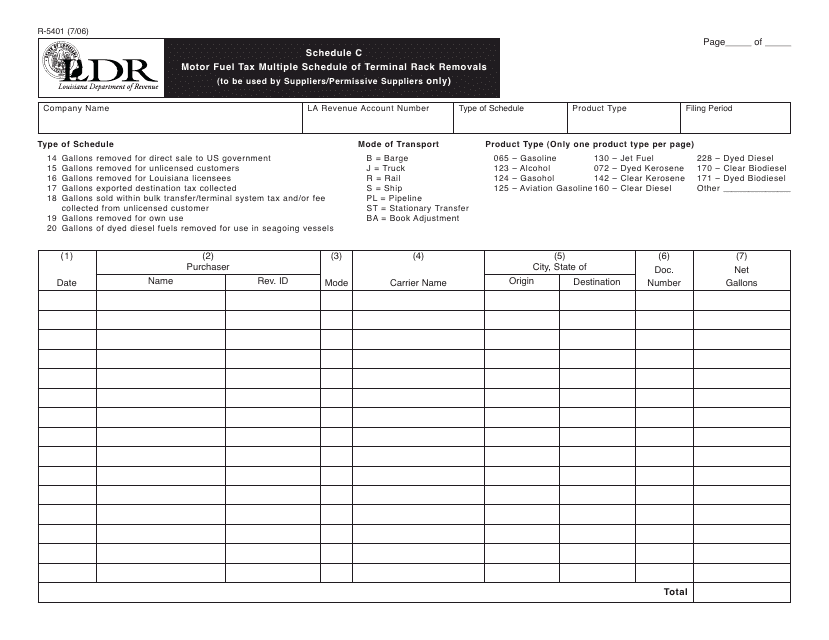

This document is used for reporting multiple terminal rack removals of motor fuel in Louisiana for tax purposes.

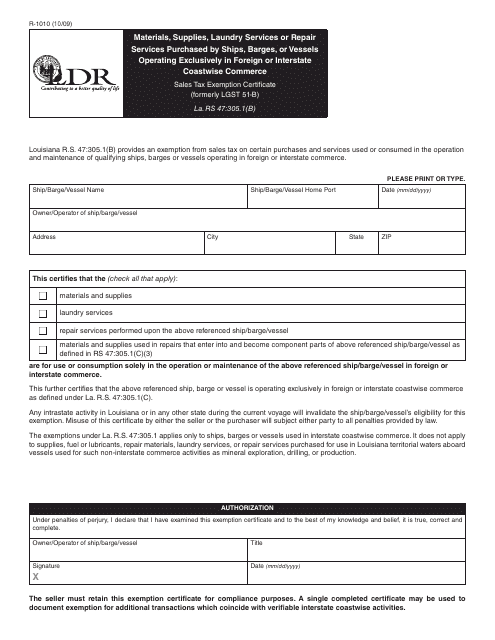

This form is used for recording the materials, supplies, laundry services, or repair services purchased by ships, barges, and vessels that operate exclusively in foreign or interstate coastwise commerce in Louisiana.

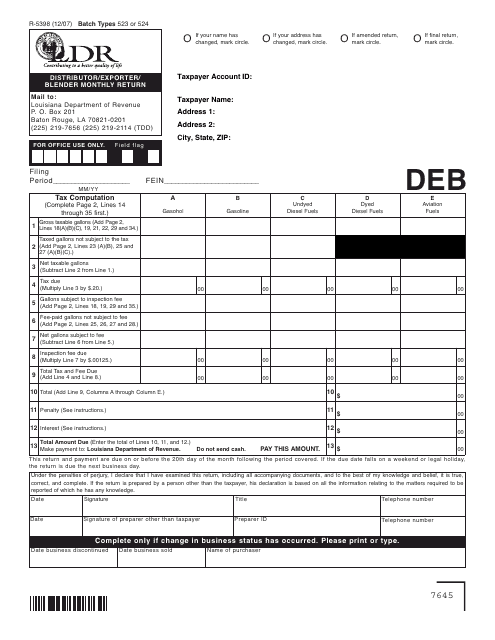

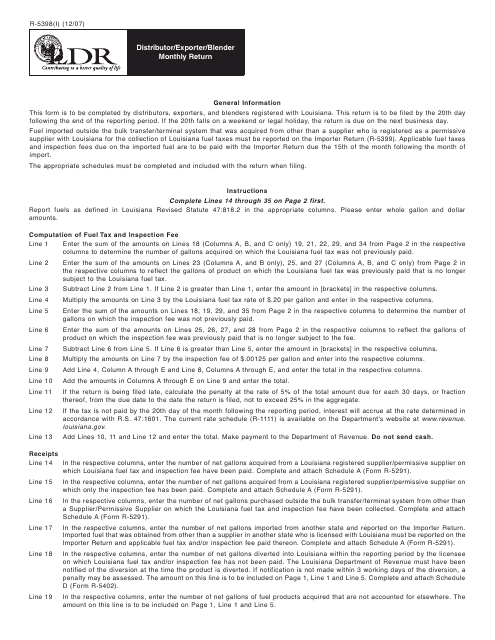

This form is used for distributors, exporters, and blenders in Louisiana to file their monthly returns.

This form is used for reporting monthly sales and use tax information for distributors, exporters, and blenders in the state of Louisiana. It provides instructions on how to fill out and submit the Form R-5398.

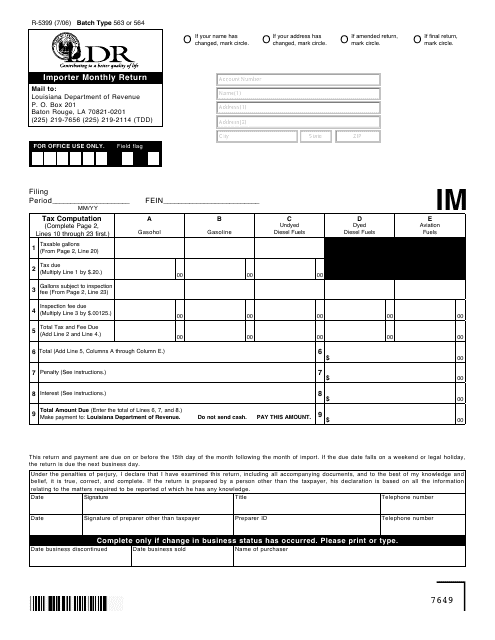

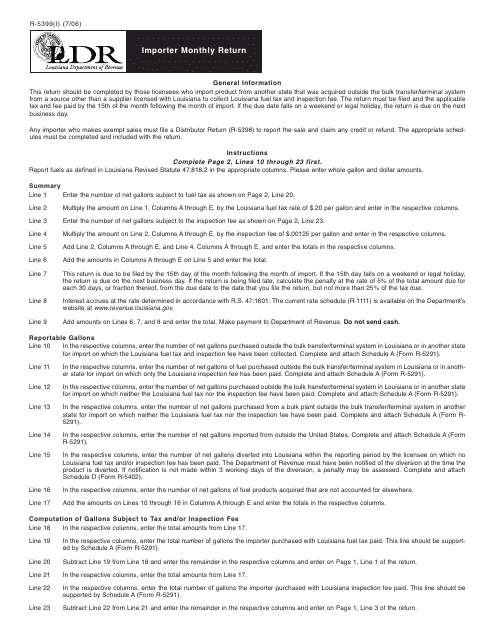

This Form is used for filing monthly import data by businesses in Louisiana.

This Form is used for reporting monthly imports to the state of Louisiana.

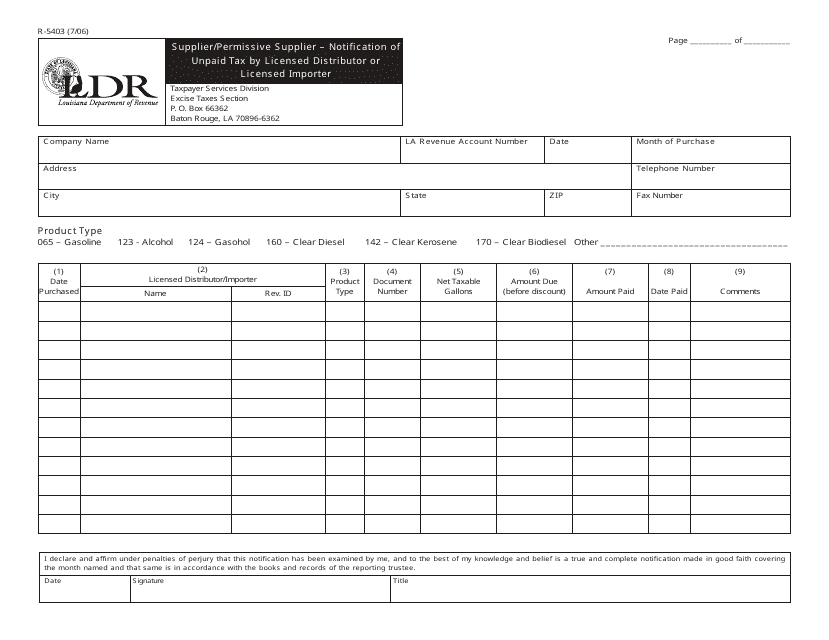

This form is used for licensed distributors or importers in Louisiana to notify the state of any unpaid taxes by suppliers or permissive suppliers.

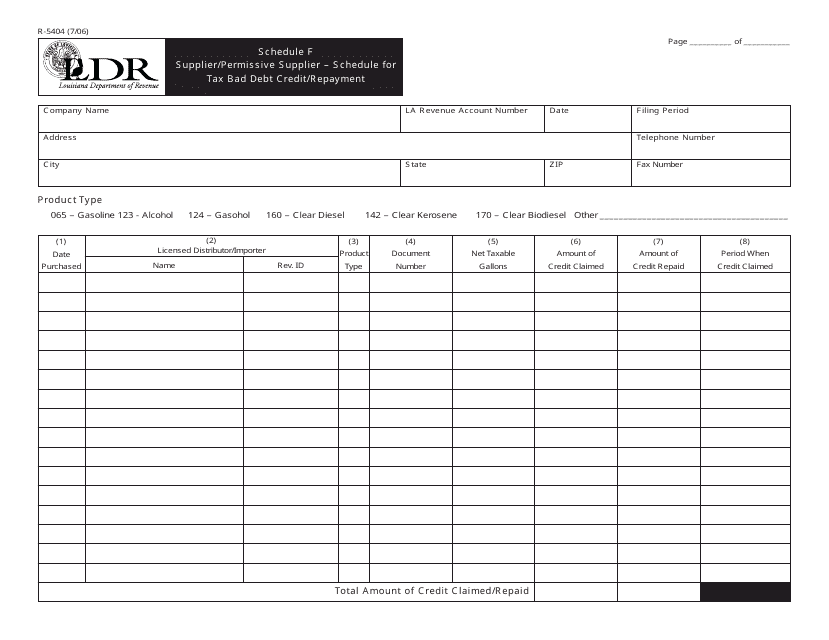

This form is used for reporting tax bad debt credit or repayment for suppliers and permissive suppliers in the state of Louisiana.

This document is used for applying for certification of stripper/incapable wells in Louisiana. It provides instructions for filling out Form O-2.

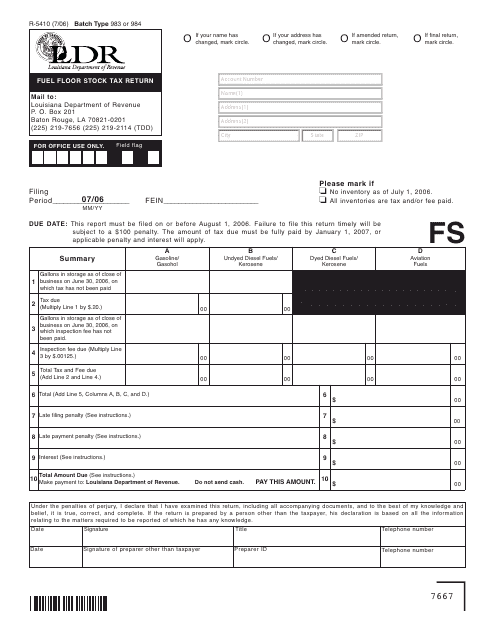

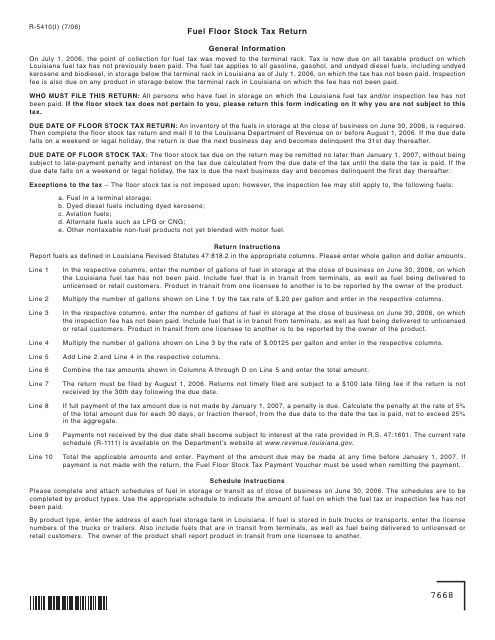

This form is used for reporting and paying fuel floor stock tax in the state of Louisiana. It is required for businesses that store fuel for sale or use in the state.

This Form is used for filing the Fuel Floor Stock Tax Return in the state of Louisiana. It provides instructions for reporting and paying taxes on fuel that is in stock for future use.

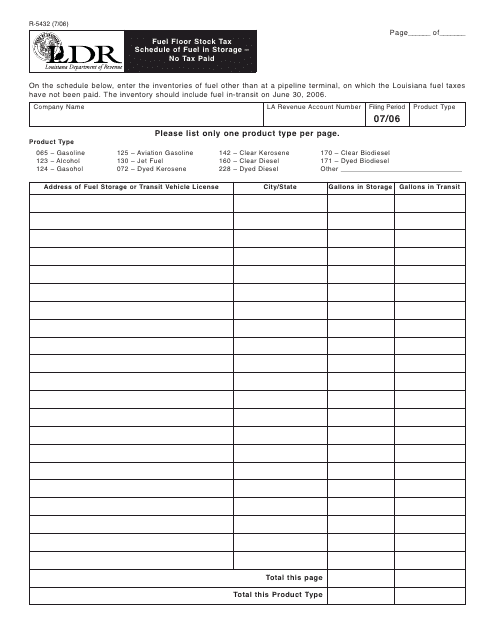

This form is used for reporting the amount of fuel in storage for which no tax has been paid in the state of Louisiana.

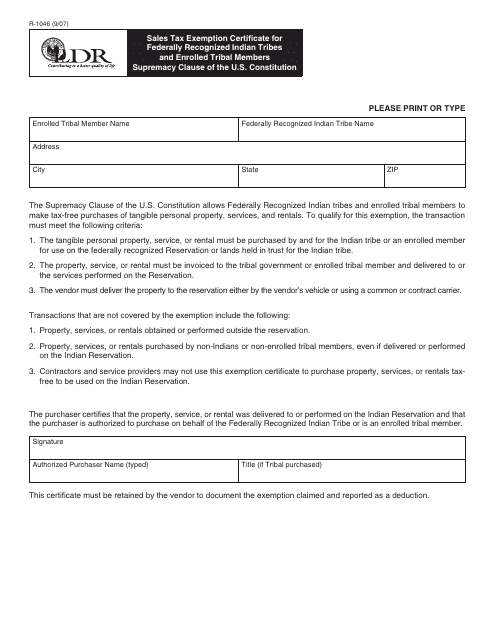

This form is used for obtaining a sales tax exemption for federally recognized Indian tribes and enrolled tribal members in Louisiana. It is based on the Supremacy Clause of the U.S. Constitution.

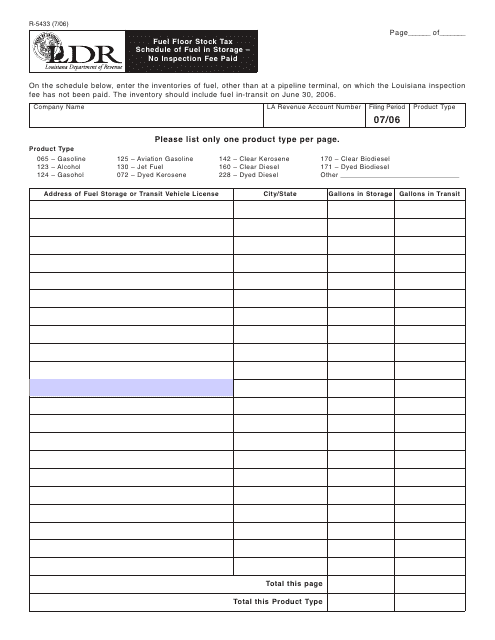

This form is used for reporting the amount of fuel in storage and no inspection fee has been paid for it in Louisiana.