United States Tax Forms and Templates

Related Articles

Documents:

2432

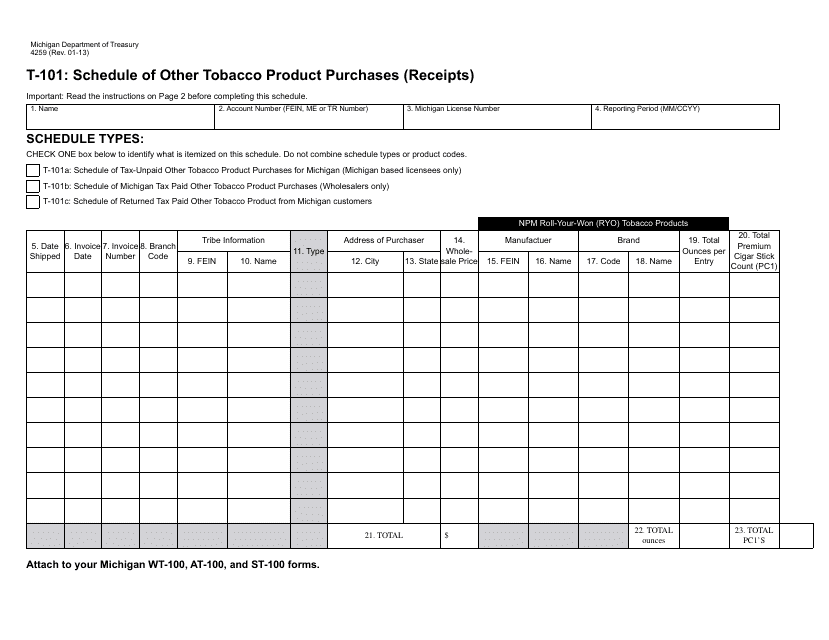

This form is used for reporting the purchase and receipt of other tobacco products in the state of Michigan.

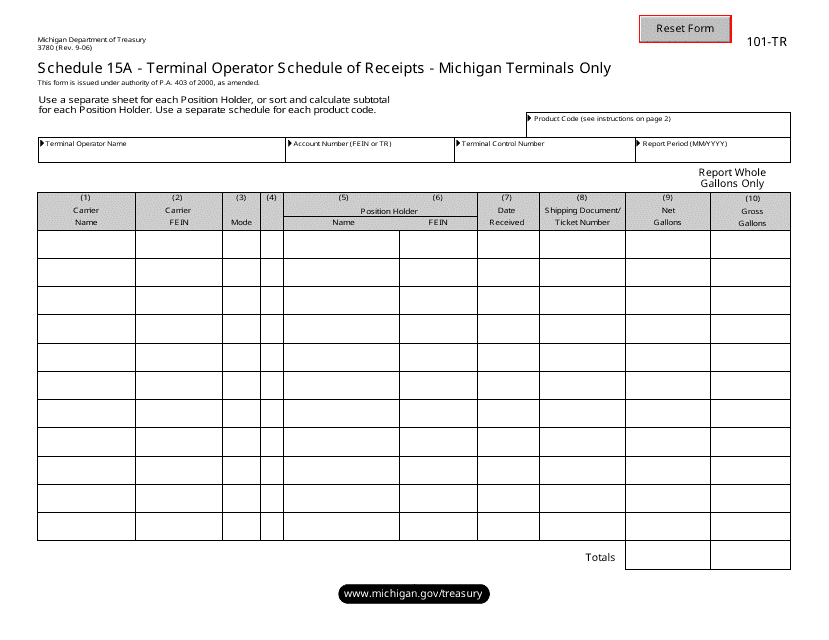

This form is used for Michigan terminals to report their schedule of receipts.

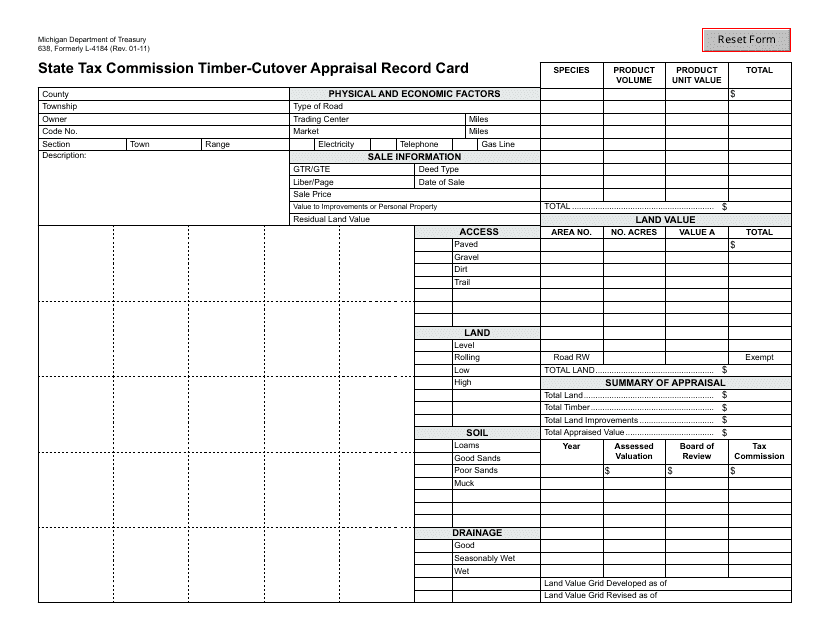

This form is used for recording information related to timber-cutover appraisal in Michigan for state tax commission purposes.

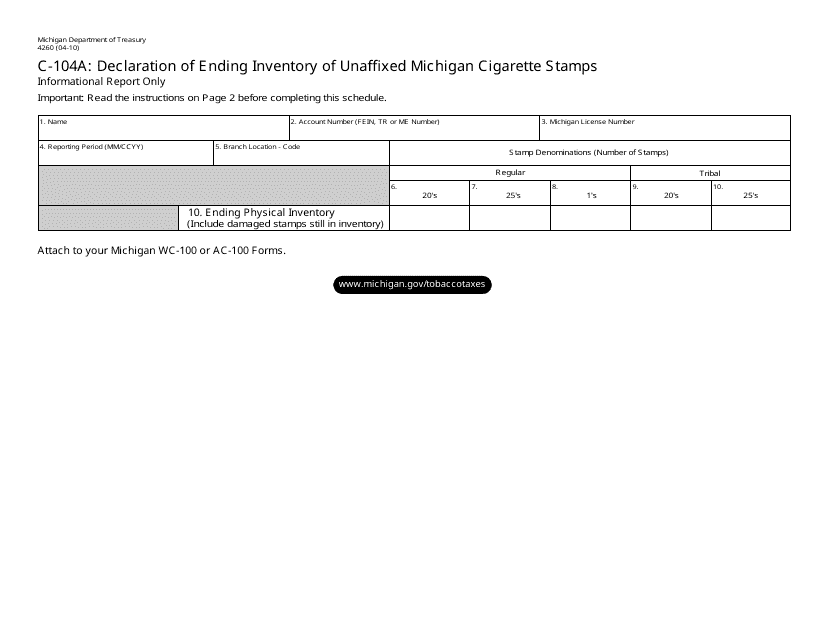

This form is used for declaring the ending inventory of unaffixed Michigan cigarette stamps in the state of Michigan.

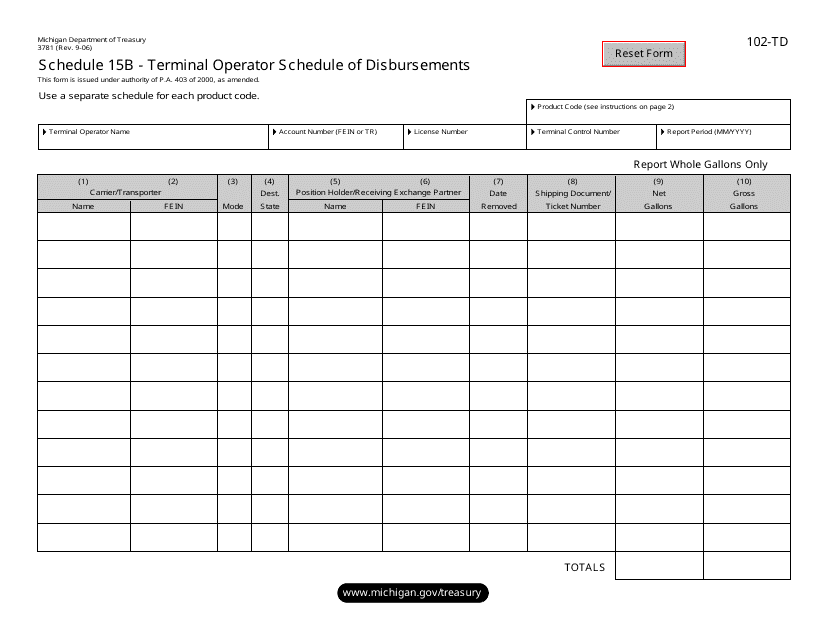

This form is used for reporting the schedule of disbursements for terminal operators in Michigan.

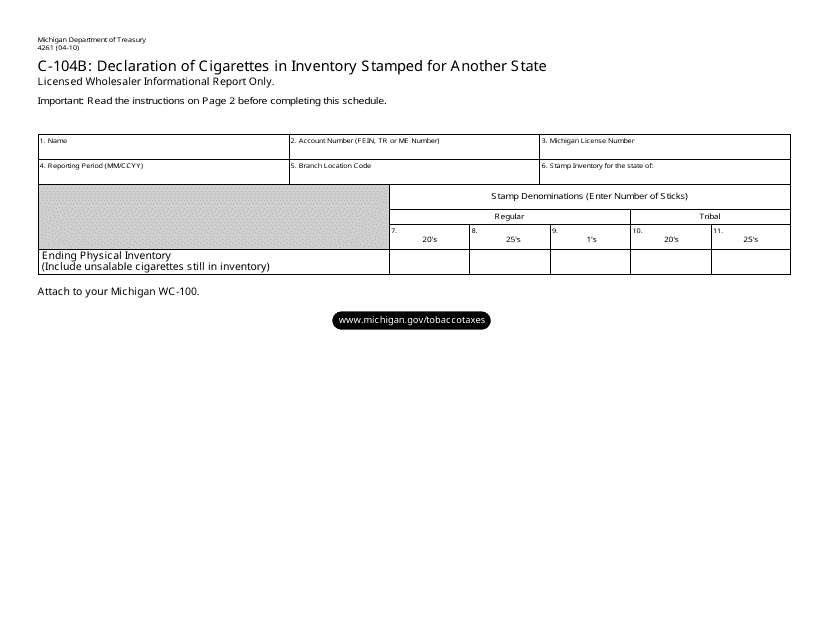

This Form is used for declaring cigarettes in inventory that are stamped for another state, specifically for the state of Michigan.

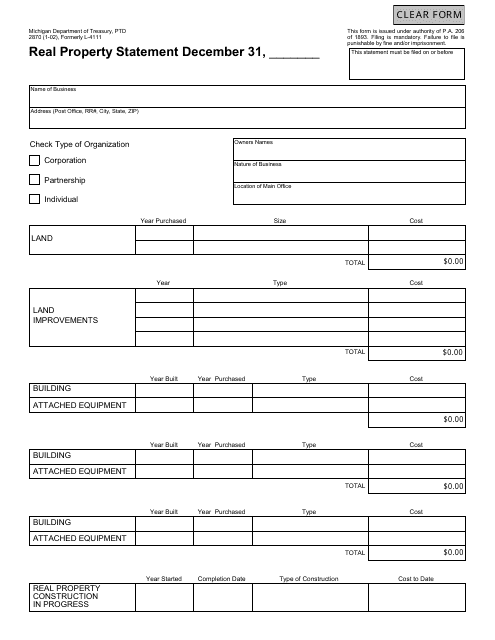

This form is used for filing a Real Property Statement in Michigan. It is also known as Form PTD2870 or Formerly L-4111.

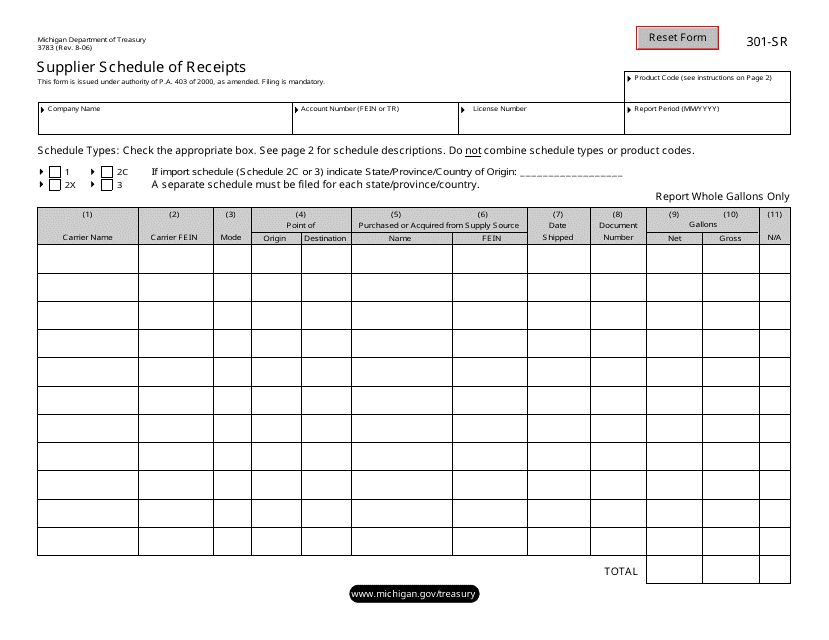

This form is used for suppliers in Michigan to provide a schedule of their receipts.

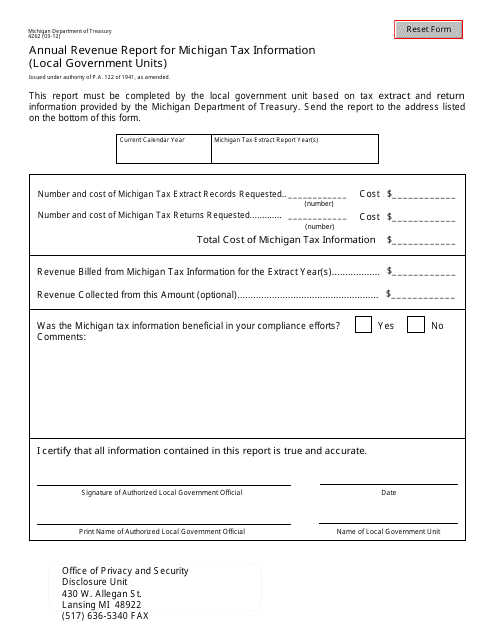

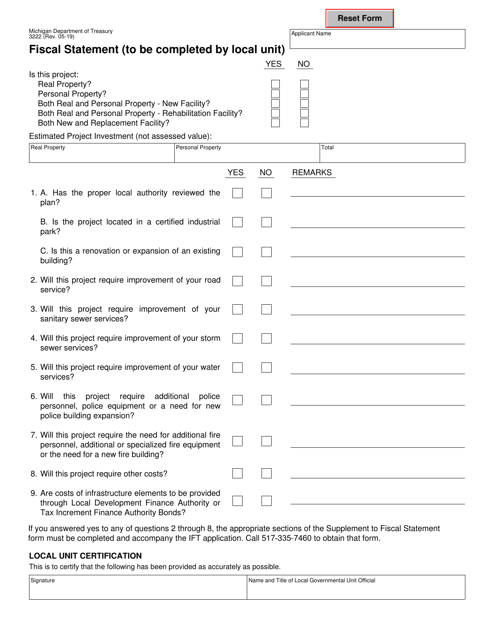

This form is used for reporting the annual revenue of local government units in Michigan for tax purposes.

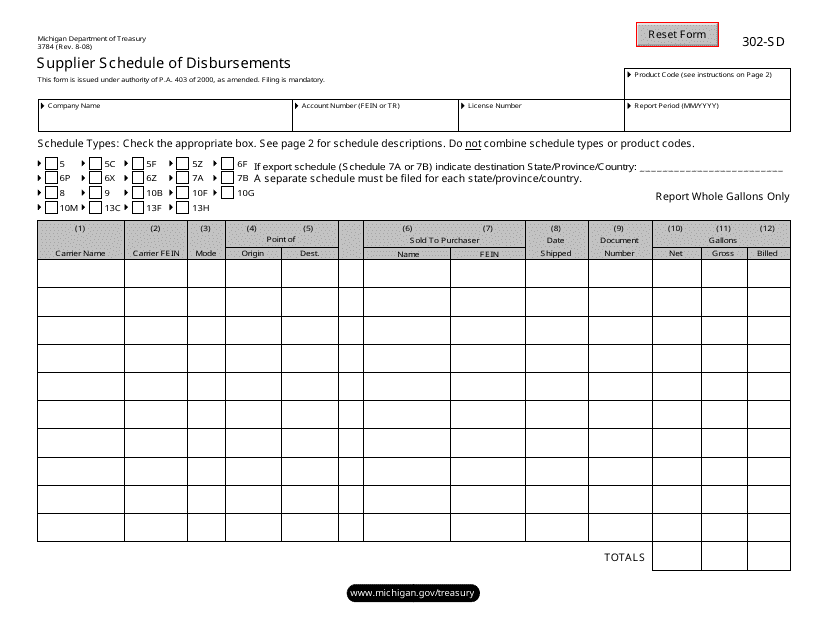

This form is used for suppliers in Michigan to provide a schedule of their disbursements.

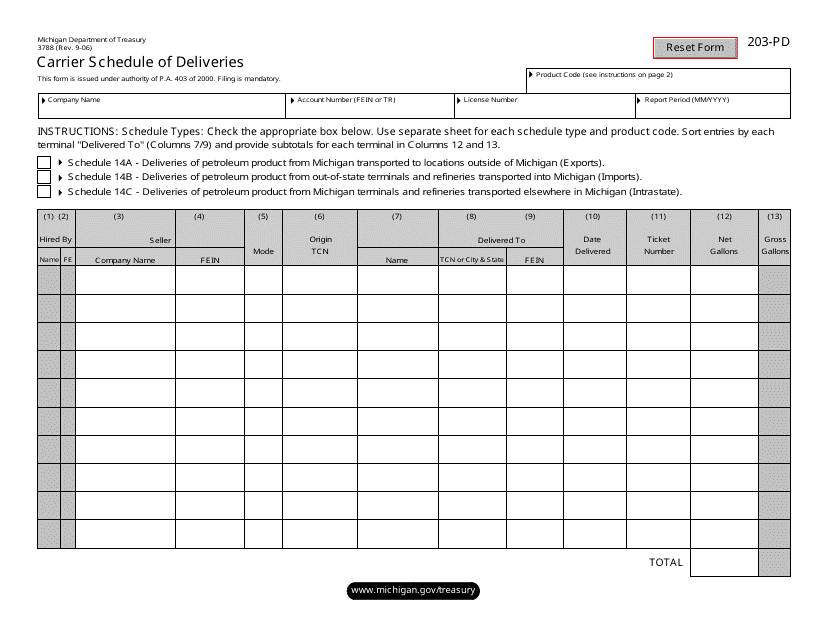

This form is used for carriers in Michigan to schedule their deliveries.

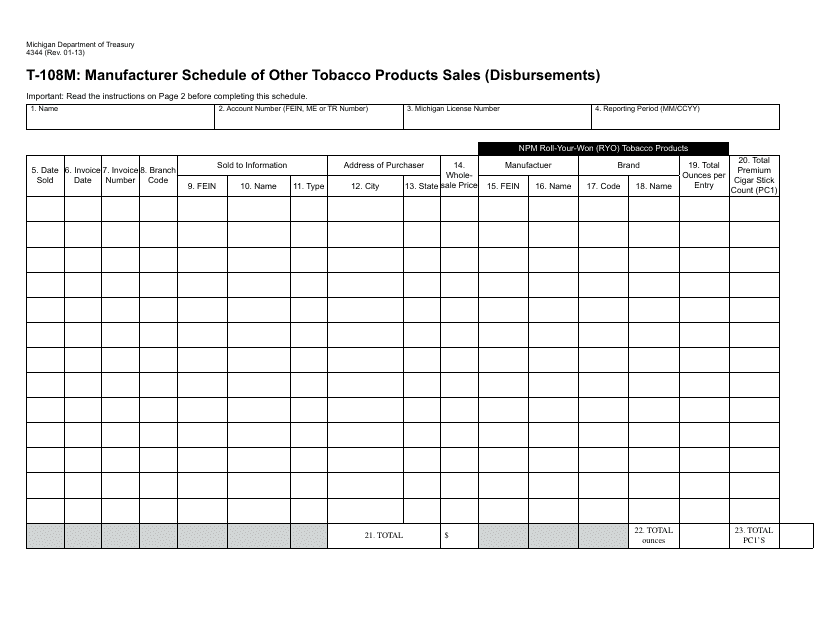

This Form is used for manufacturers in Michigan to report sales and disbursements of other tobacco products.

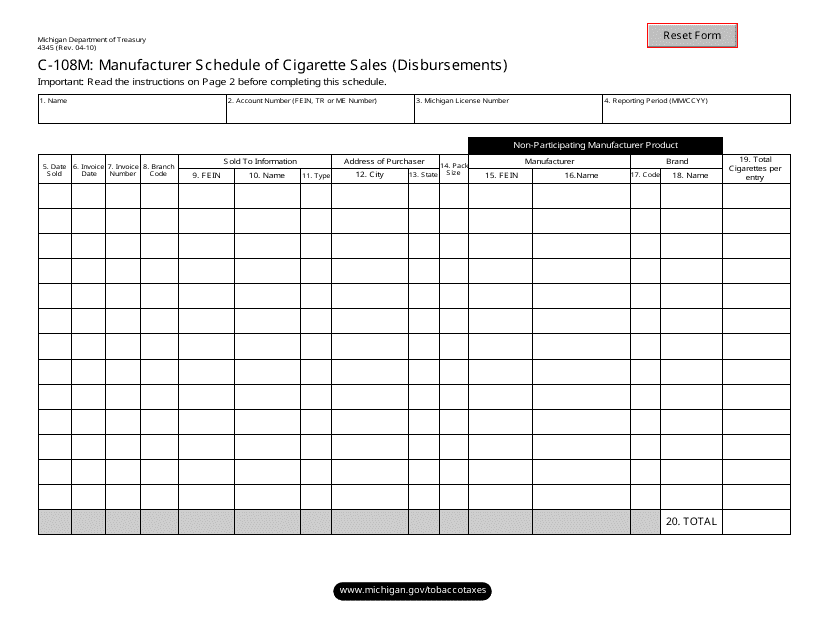

This form is used for reporting cigarette sales and disbursements by manufacturers in the state of Michigan.

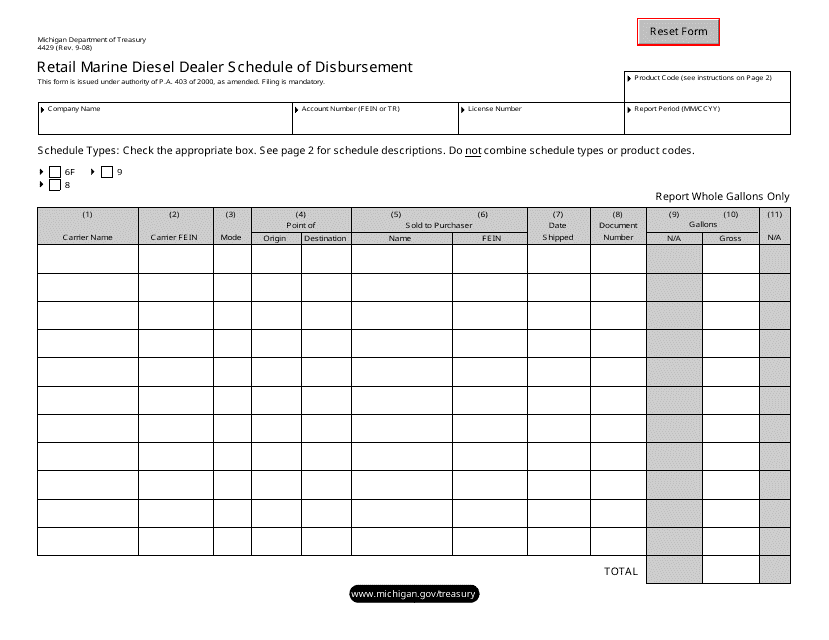

This form is used for retail marine diesel dealers in Michigan to provide a schedule of their disbursements.

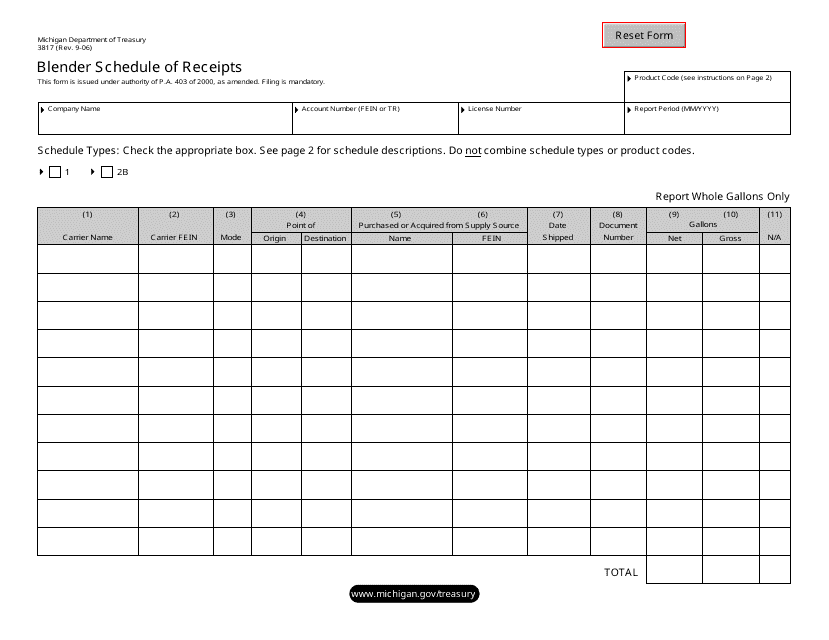

This form is used for keeping track of receipts for blenders in the state of Michigan.

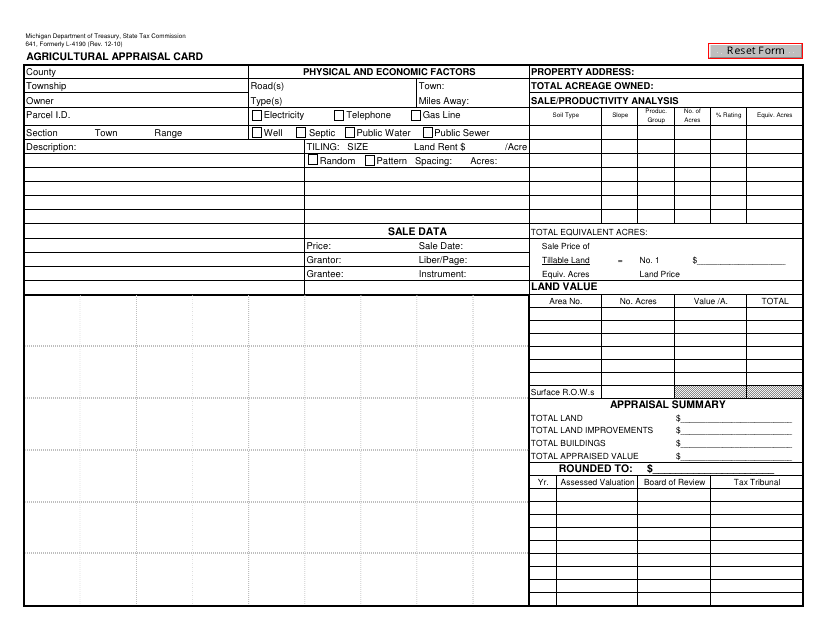

This form is used for agricultural property owners in Michigan to apply for a property tax assessment based on the agricultural use of their land.

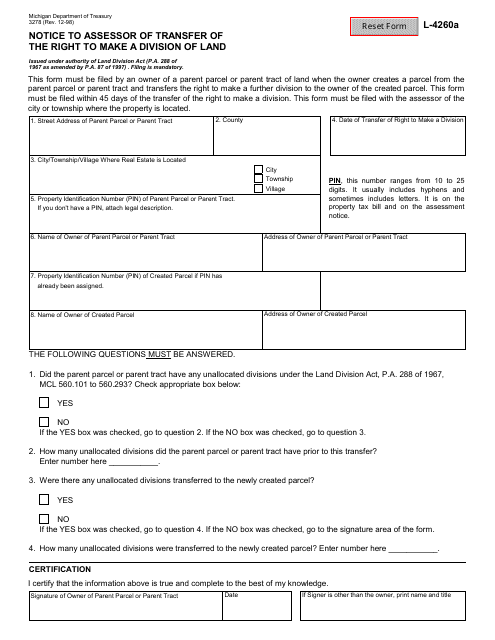

This Form is used for notifying the assessor in Michigan about the transfer of the right to make a division of land.

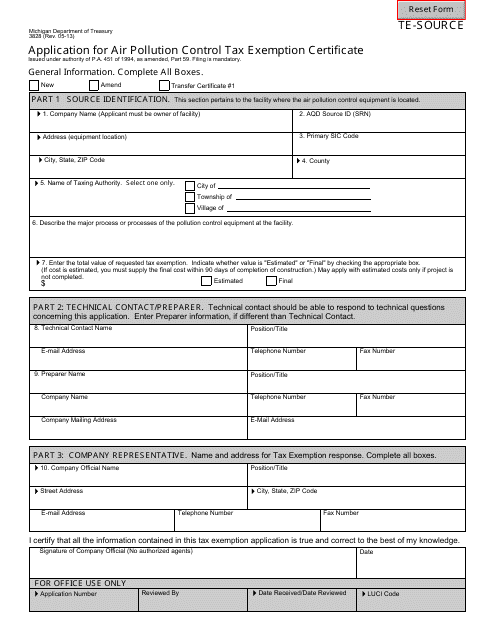

This form is used for applying for an air pollution control tax exemption certificate in Michigan. It allows businesses to request a tax exemption for equipment used to control air pollution.

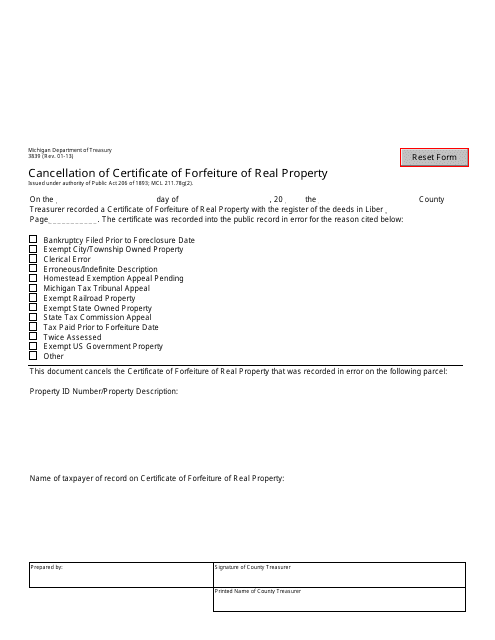

This Form is used for cancelling a certificate of forfeiture of real property in Michigan.

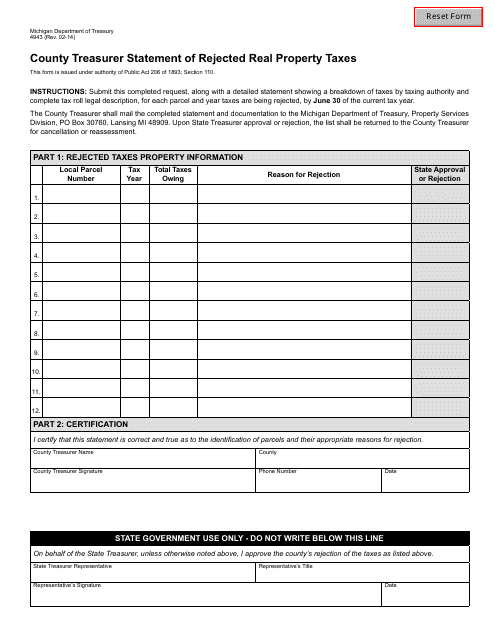

This Form is used for reporting rejected real property taxes to the County Treasurer in Michigan.

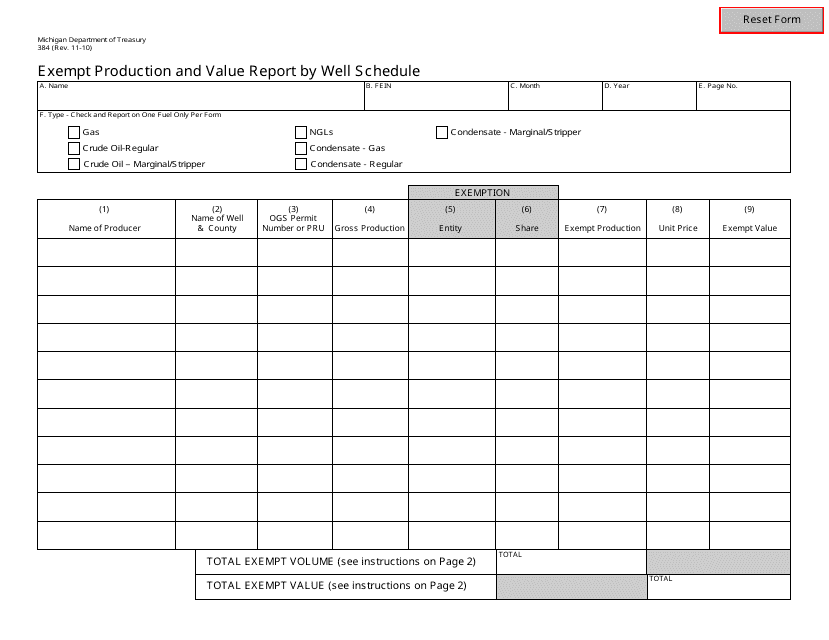

This form is used for reporting exempt production and value of oil and gas wells in Michigan.

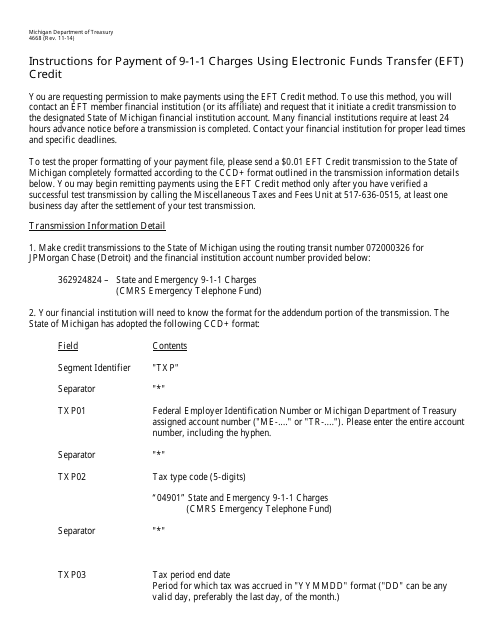

This Form is used for making electronic payments for 9-1-1 charges in Michigan.

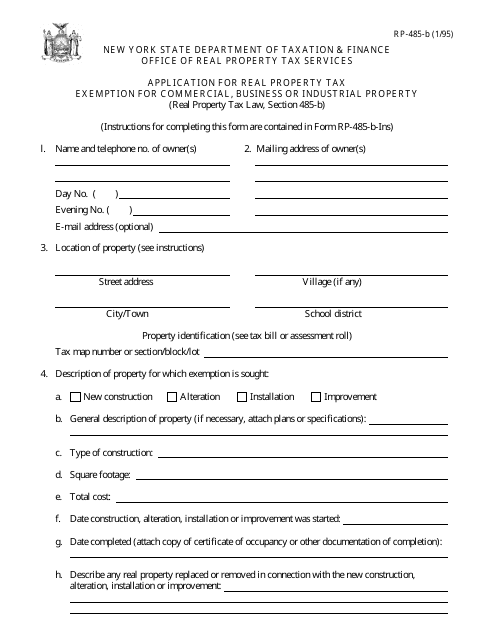

This form is used for applying for a real property tax exemption for commercial, business or industrial property in the state of New York. It allows property owners to potentially receive a tax exemption for their eligible properties.

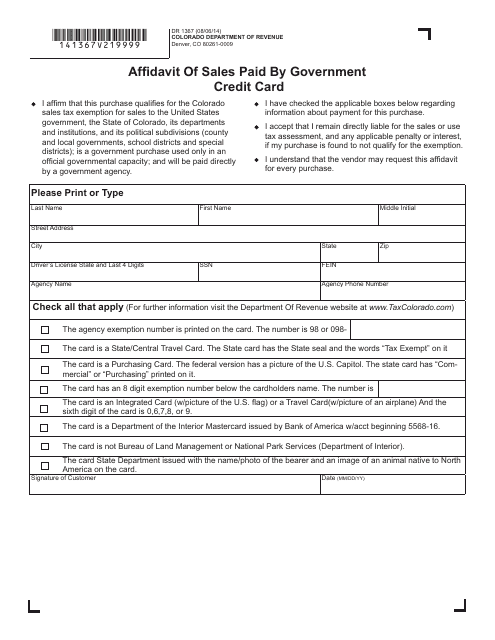

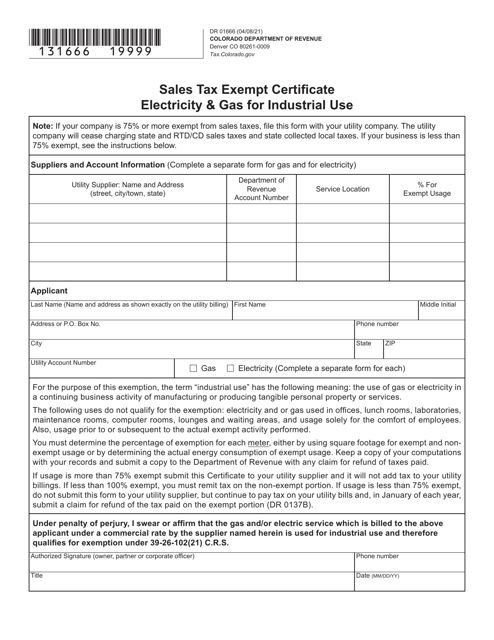

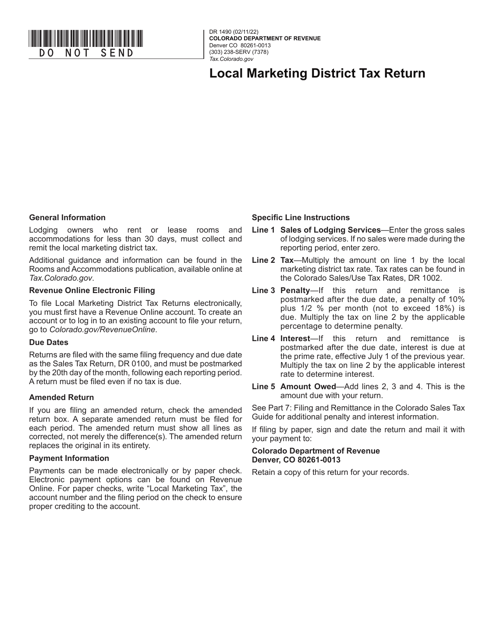

This form is used for reporting sales paid by a government credit card in the state of Colorado.

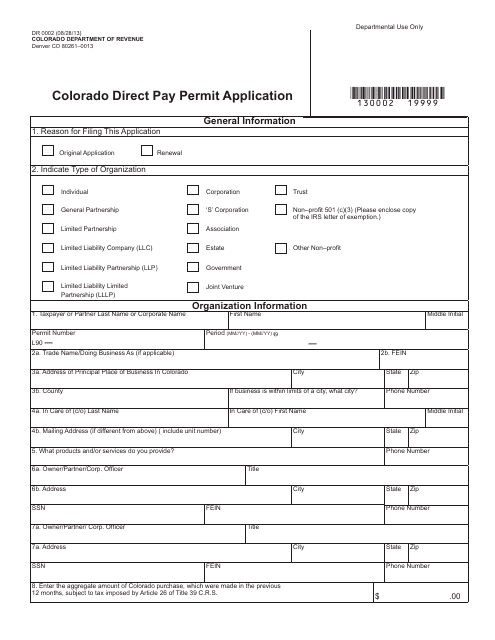

This form is used for applying for a direct pay permit in the state of Colorado.

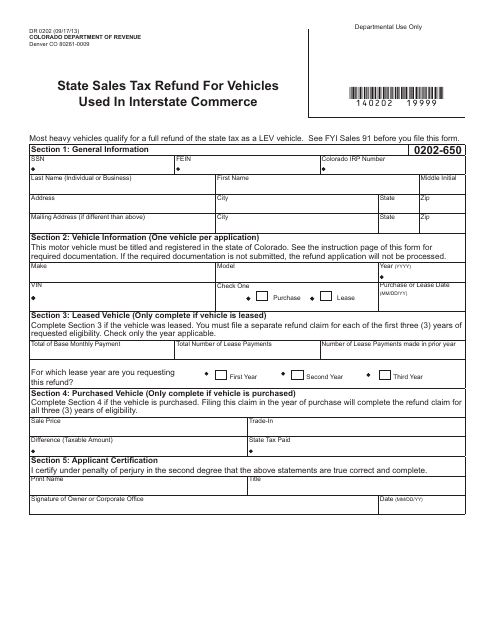

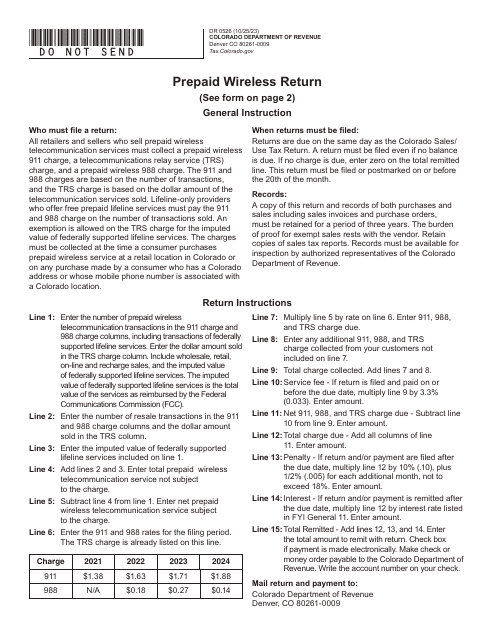

This form is used for claiming a refund of state sales tax paid on vehicles used for interstate commerce in the state of Colorado.

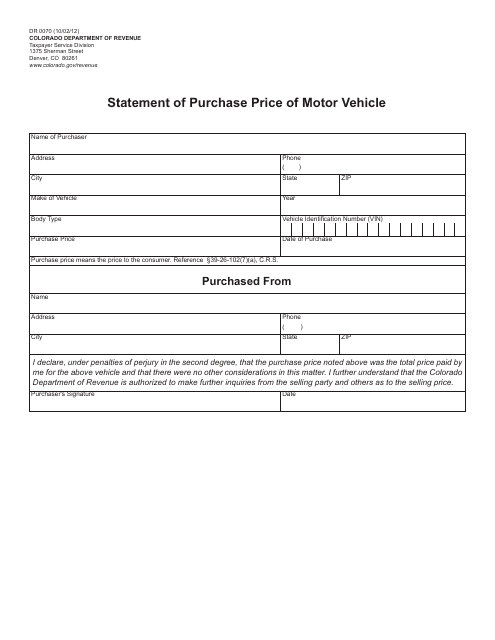

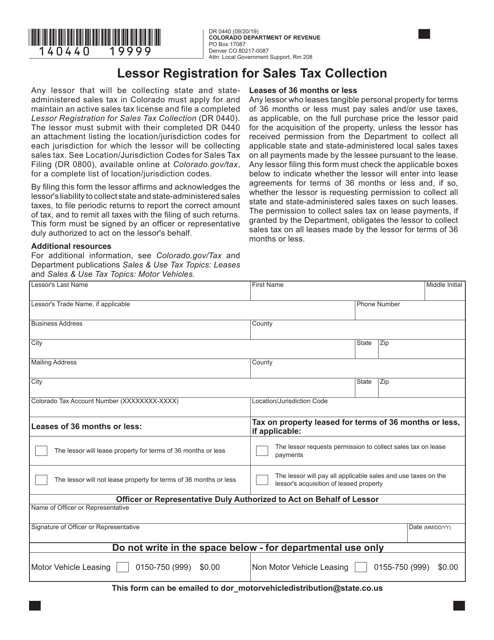

This form is used for recording the purchase price of a motor vehicle in the state of Colorado.

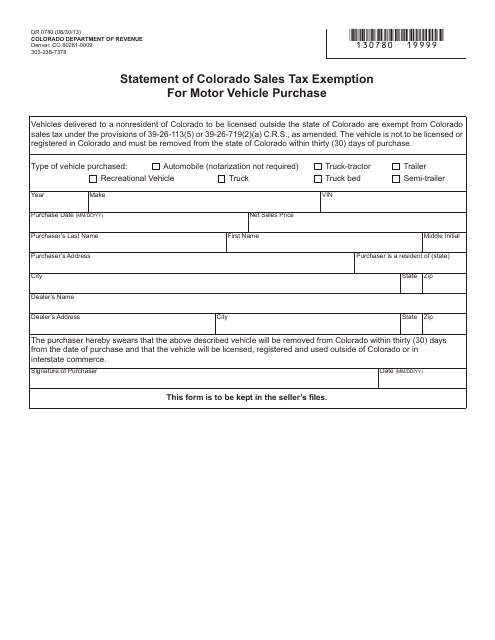

This form is used to declare an exemption from sales tax when purchasing a motor vehicle in Colorado.

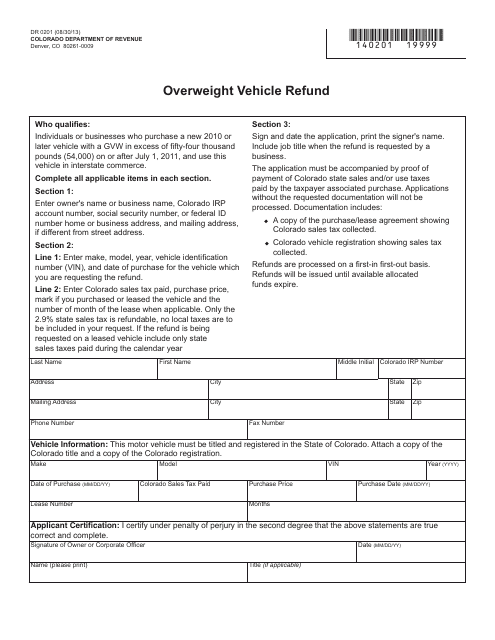

This Form is used for requesting a refund on vehicle registration fees for overweight vehicles in Colorado.