United States Tax Forms and Templates

Related Articles

Documents:

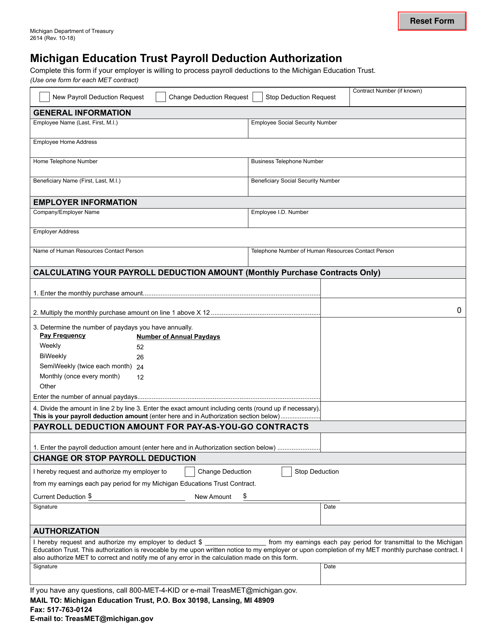

2432

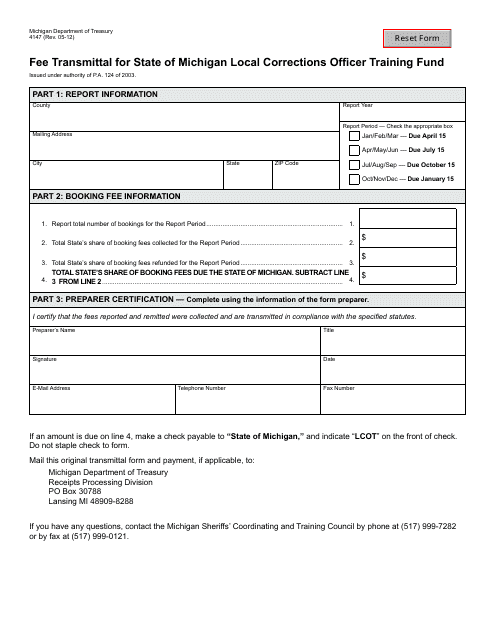

This form is used for submitting fees to support local corrections officer training in Michigan.

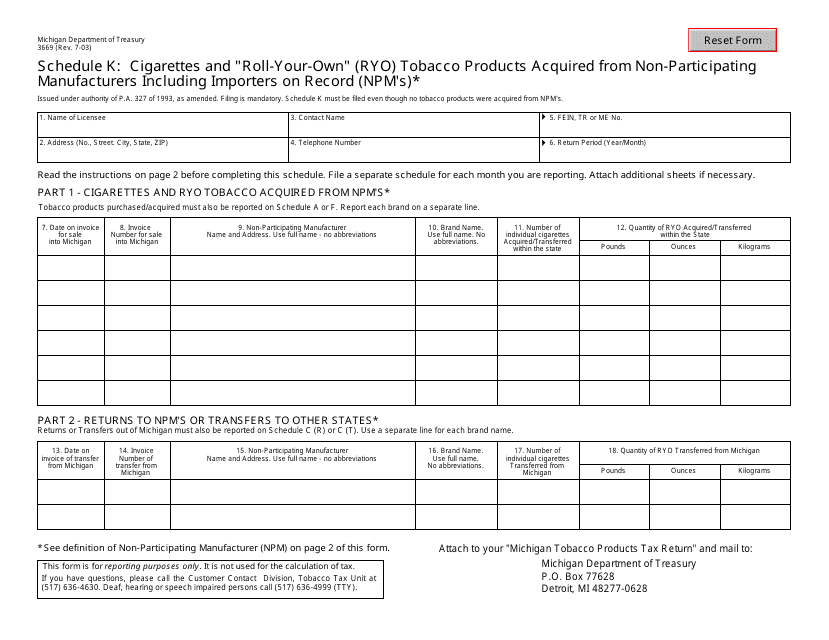

This form is used for reporting the acquisition of cigarettes and "roll-your-own" tobacco products from non-participating manufacturers and importers on record in the state of Michigan.

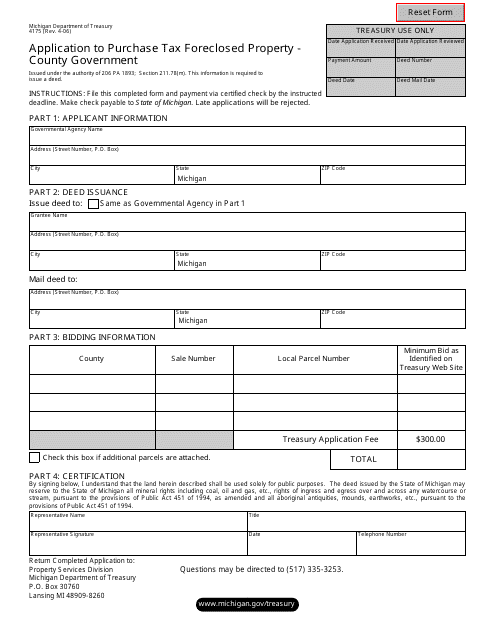

This form is used to apply for purchasing tax foreclosed property in Michigan.

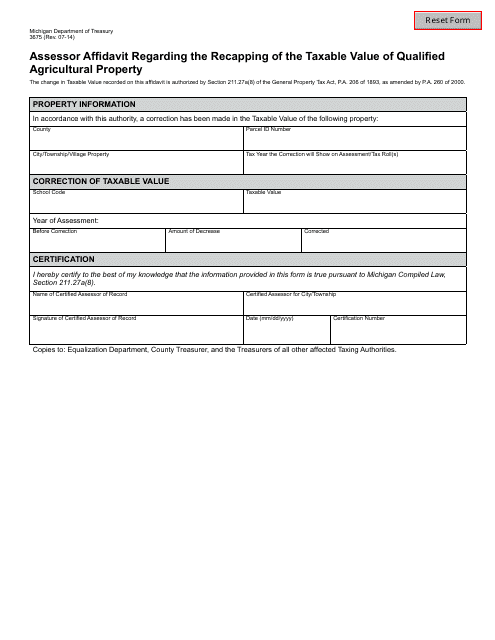

This form is used for assessor affidavit regarding the recapping of the taxable value of qualified agricultural property in the state of Michigan.

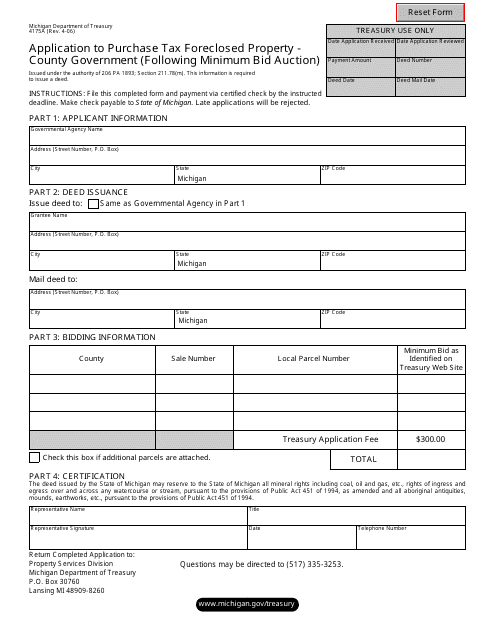

This form is used for applying to purchase tax foreclosed property after a minimum bid auction conducted by the County Government in Michigan.

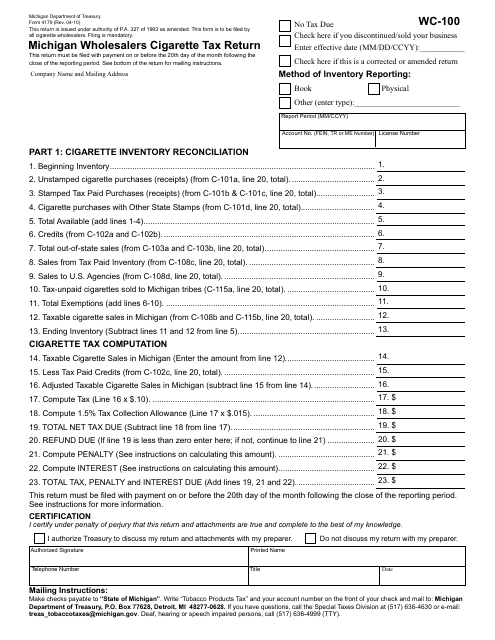

This form is used for Michigan wholesalers to file their cigarette tax return.

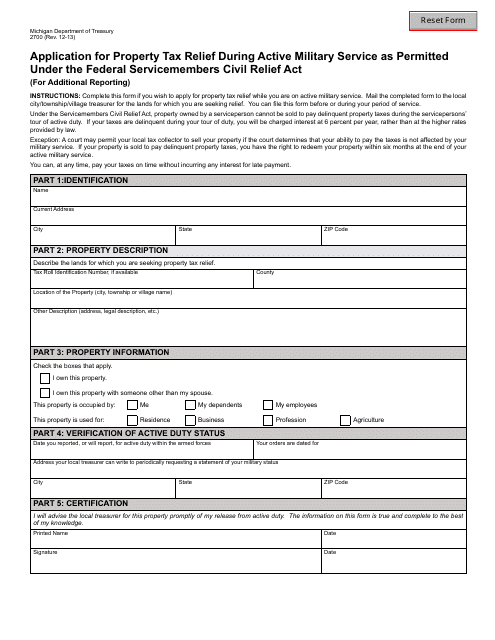

This Form is used for applying for property tax relief in Michigan for individuals serving in active military duty under the Federal Service Members Civil Relief Act.

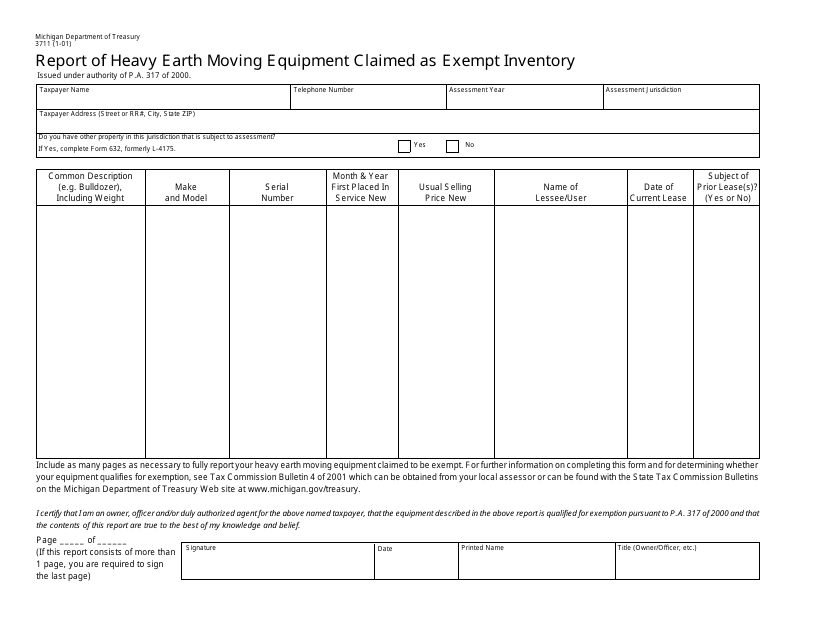

This form is used for reporting heavy earth moving equipment claimed as exempt inventory in the state of Michigan.

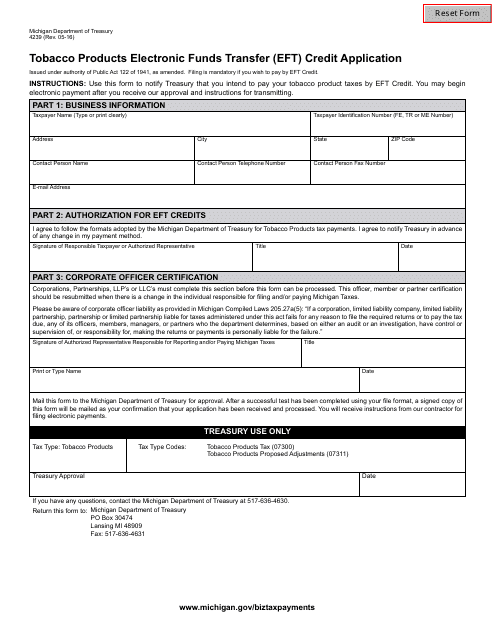

This form is used for applying for electronic funds transfer credit for tobacco products in the state of Michigan.

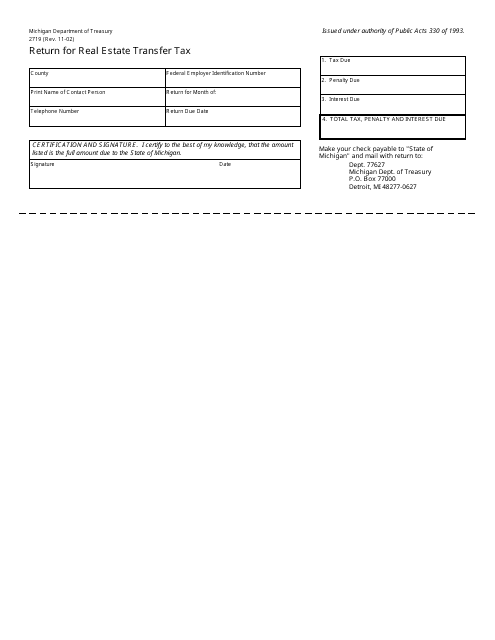

This form is used for reporting and paying the real estate transfer tax in the state of Michigan. It is required when a property is sold or transferred.

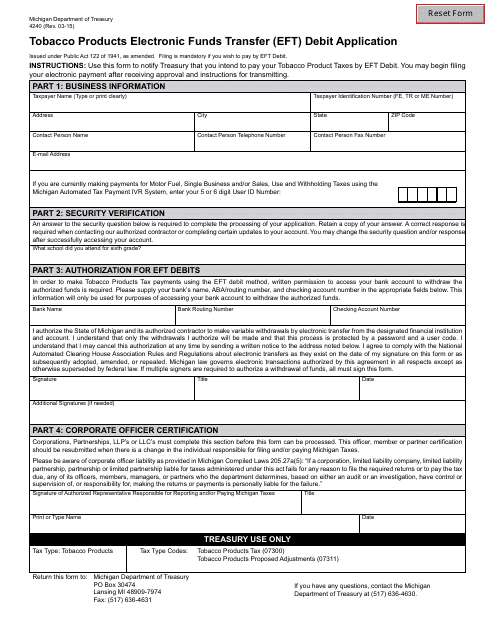

This form is used for applying for electronic funds transfer (EFT) debit authorization for tobacco products in Michigan.

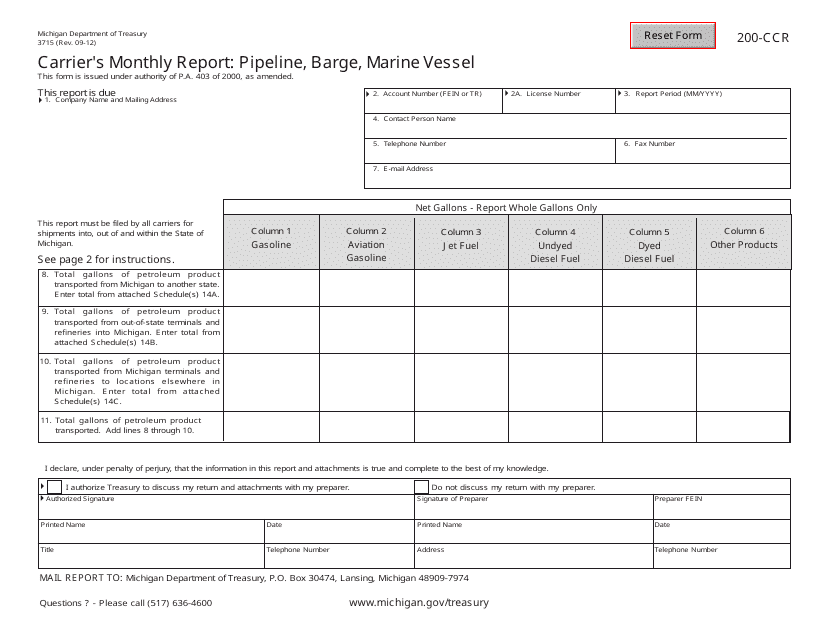

This Form is used for carriers in Michigan to report their monthly activities for pipeline, barge, and marine vessel transportation.

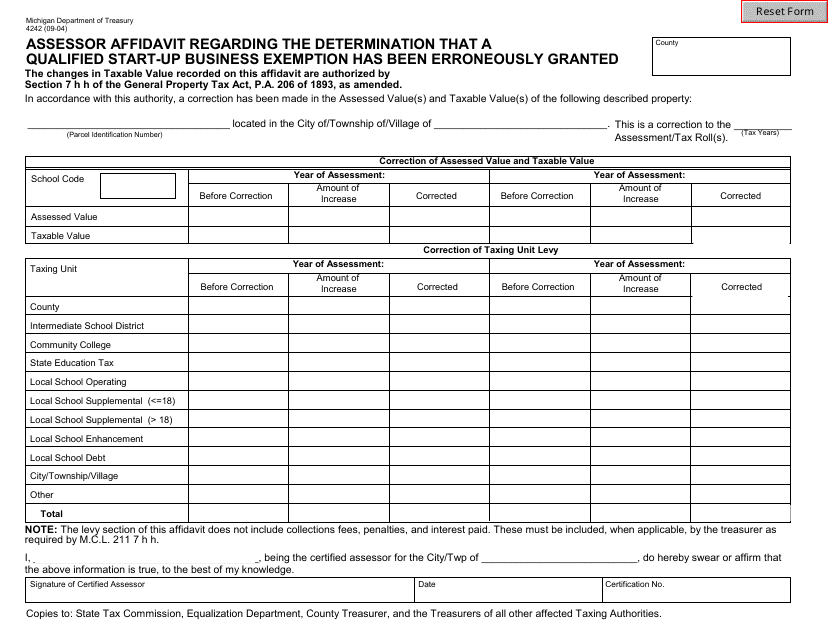

This form is used for submitting an affidavit by an assessor in Michigan to acknowledge that a qualified start-up business exemption has been mistakenly granted.

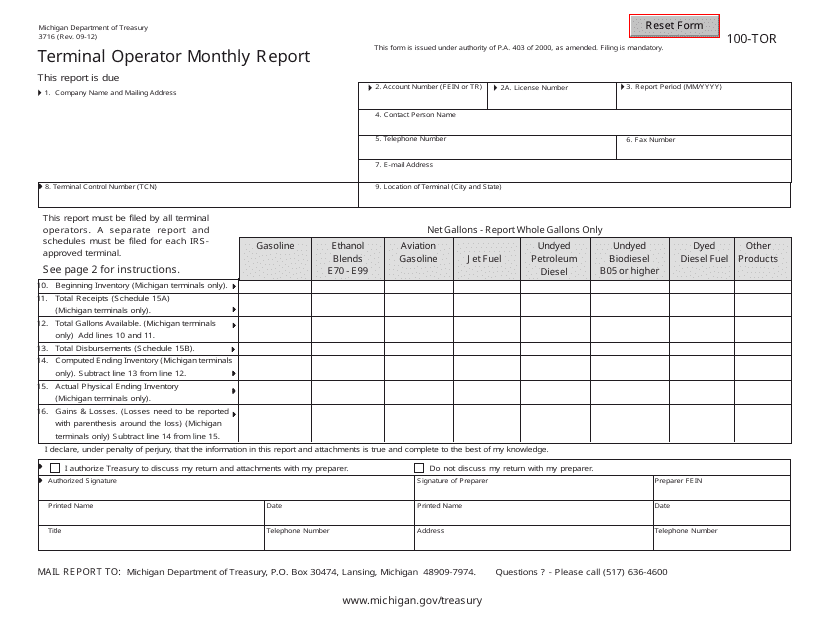

This form is used for terminal operators in Michigan to submit monthly reports.

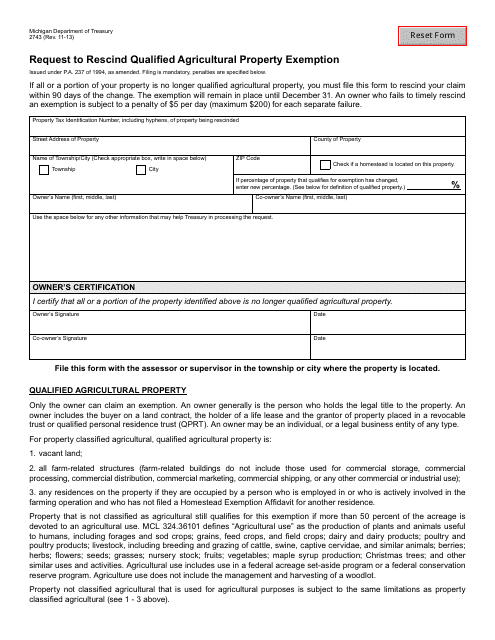

This form is used for requesting the rescinding of a qualified agricultural property exemption in the state of Michigan.

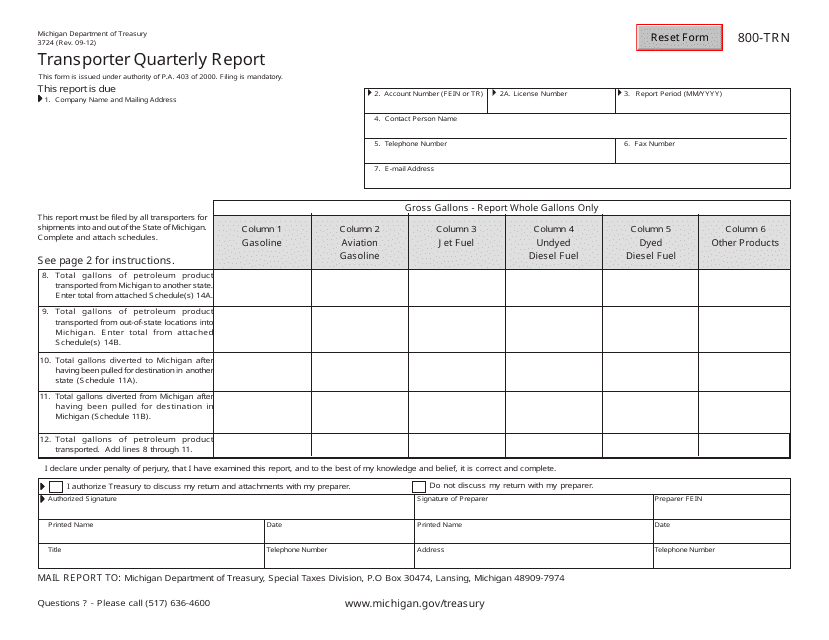

This document is used for filing the Transporter Quarterly Report in Michigan.

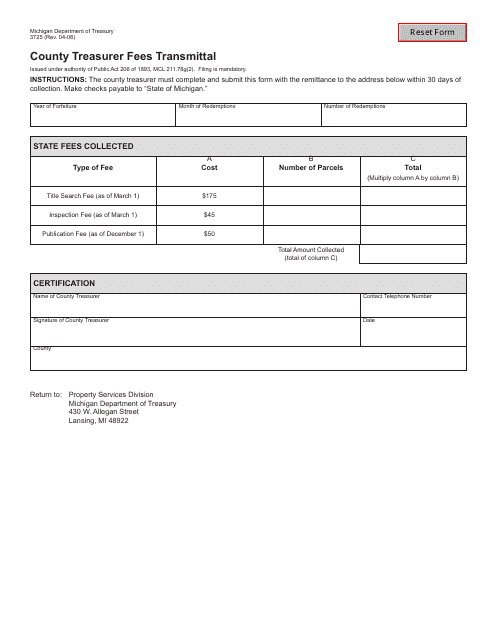

This form is used for transmitting fees to the County Treasurer in Michigan. It is used to provide detailed information about the fees being submitted and ensure accurate processing.

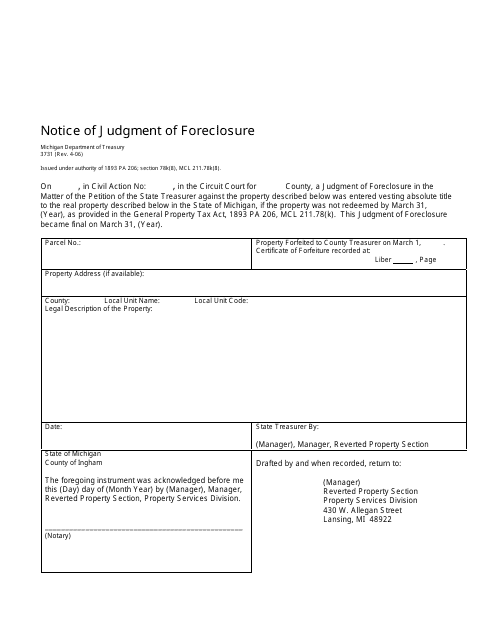

This form is used for providing a notice of judgment of foreclosure in Michigan. It is a legal document that informs the parties involved about the foreclosure judgment.

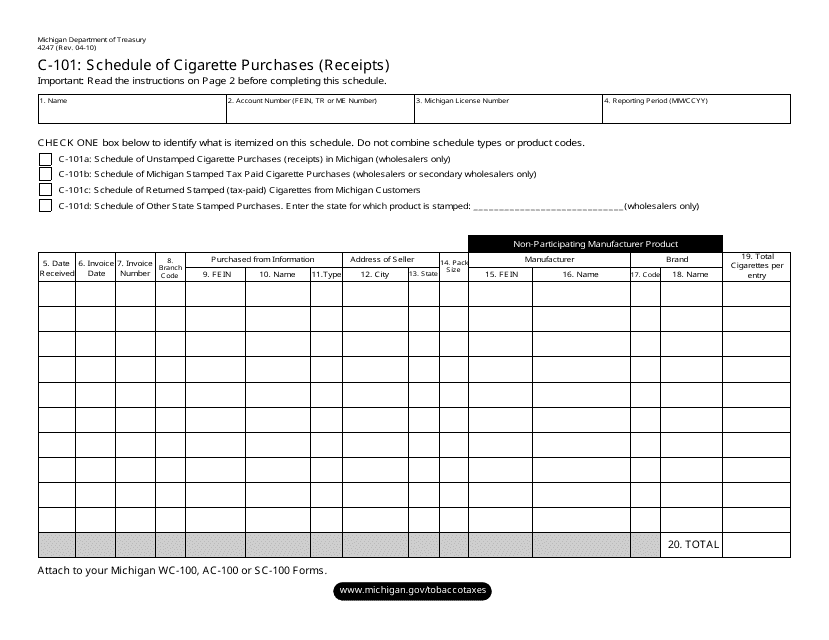

This form is used for reporting cigarette purchases (receipts) in the state of Michigan.

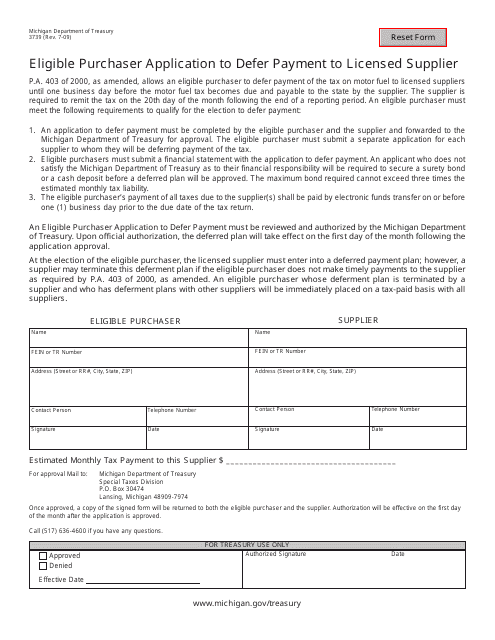

This form is used for Michigan residents who are eligible purchasers looking to defer payment to a licensed supplier.

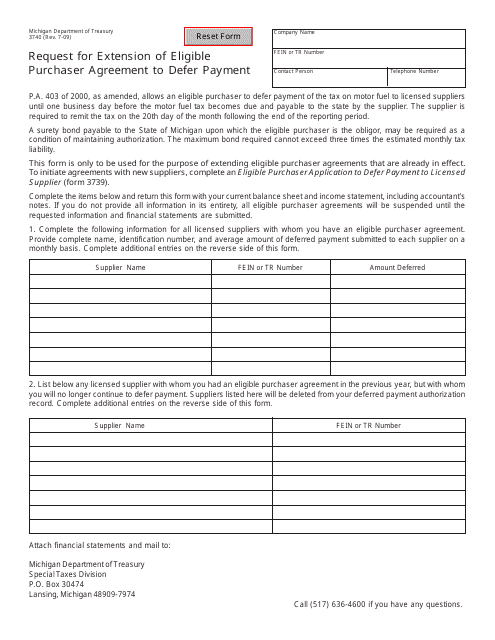

This form is used for requesting an extension of an eligible purchaser agreement in Michigan to defer payment.

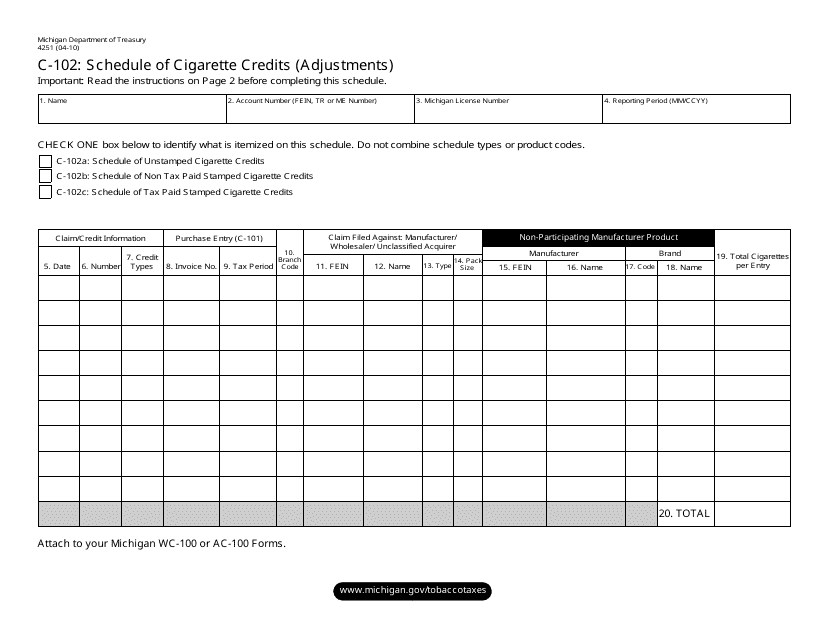

This form is used for reporting and adjusting cigarette credits in the state of Michigan.

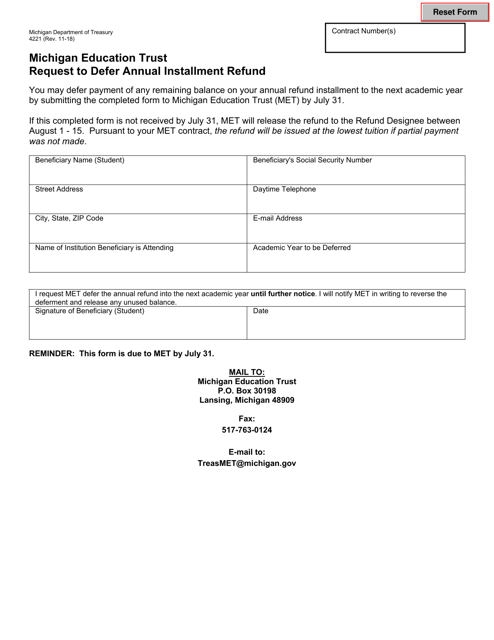

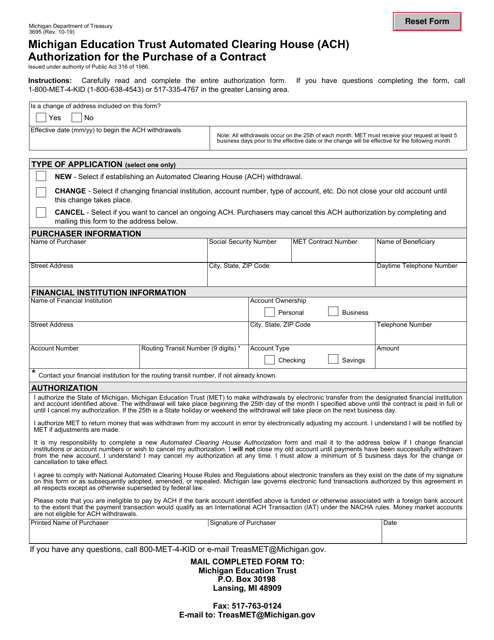

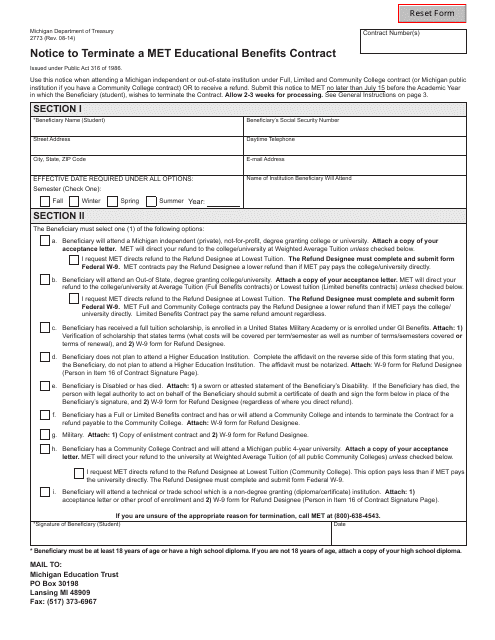

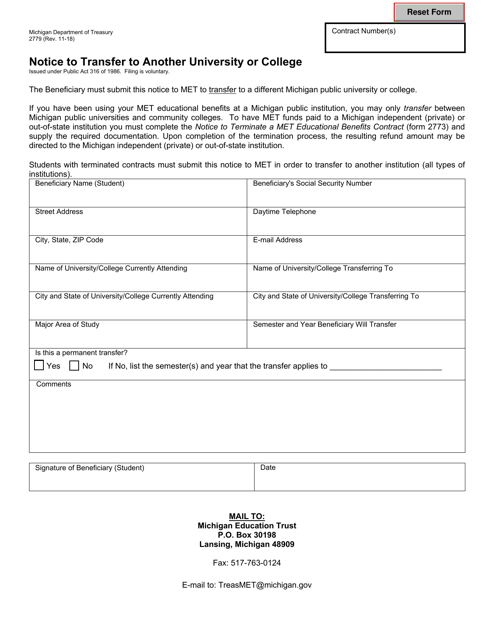

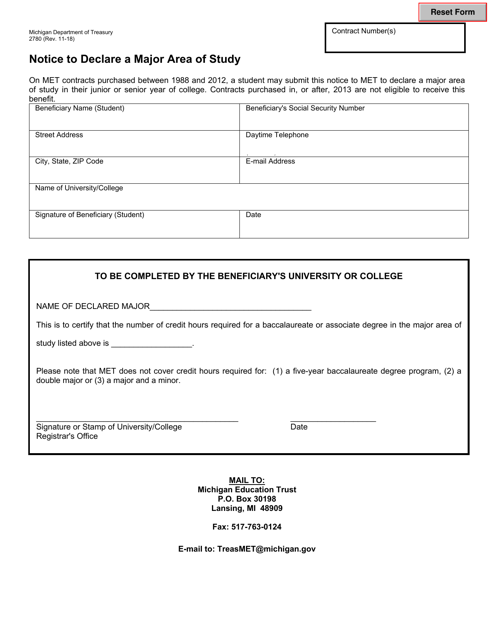

This form is used for terminating a Michigan MET Educational Benefits contract.

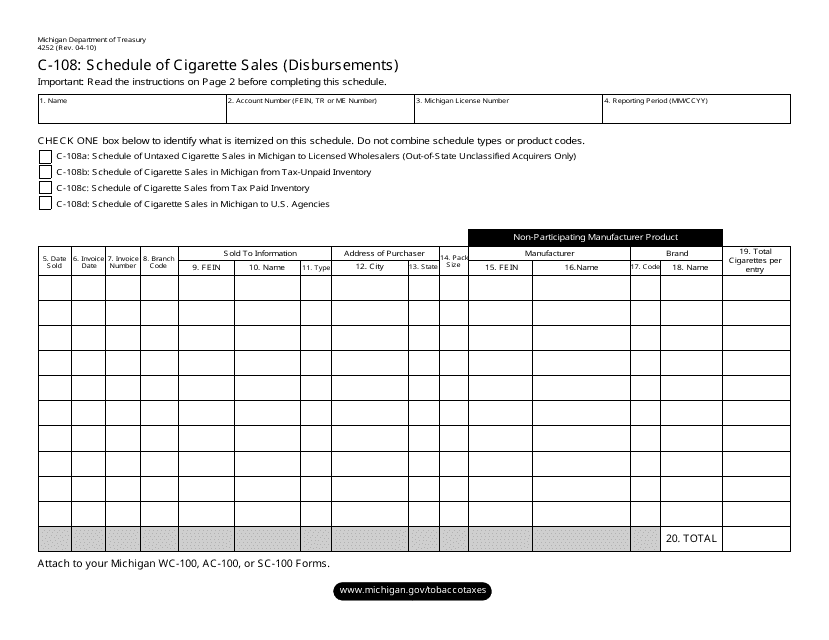

This form is used for reporting and documenting cigarette sales disbursements in the state of Michigan.

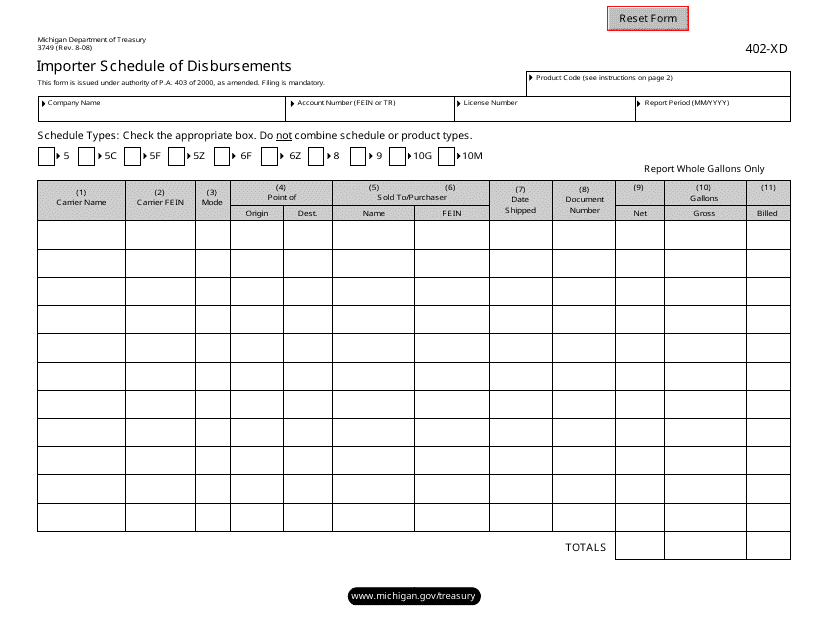

This Form is used for reporting the schedule of disbursements by an importer in Michigan.

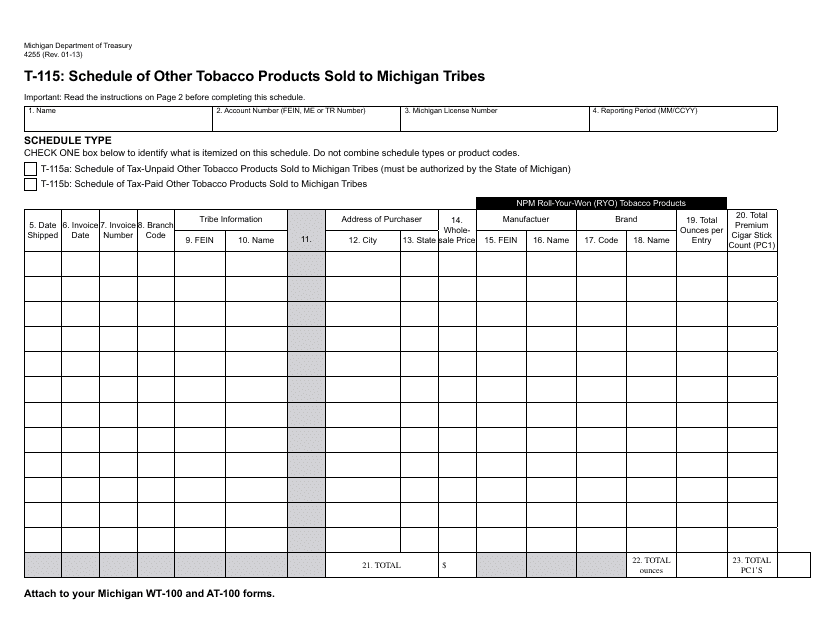

This form is used for reporting the sale of other tobacco products to Michigan tribes.

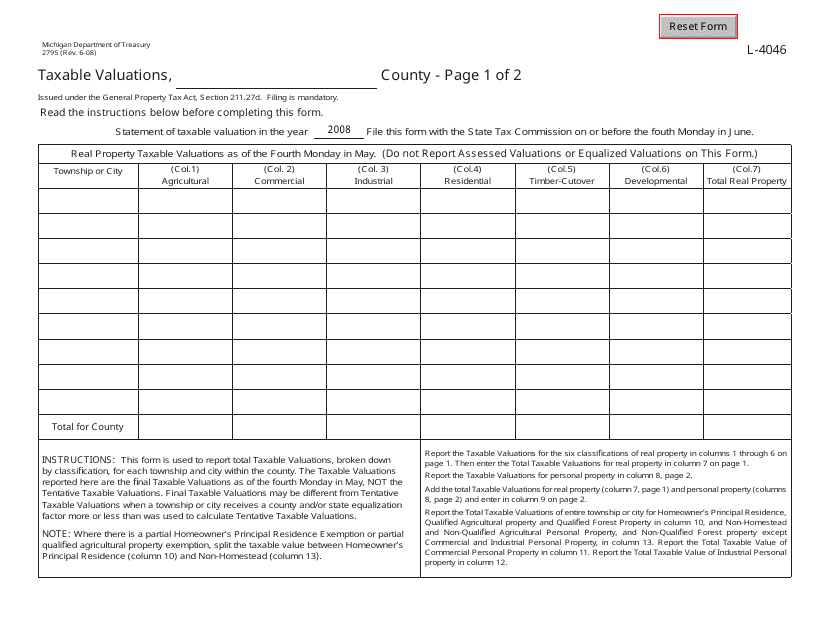

This form is used for reporting taxable valuations in the state of Michigan. It is used by property owners to determine the value of their property for tax purposes. The form must be filed annually with the local tax assessor's office.

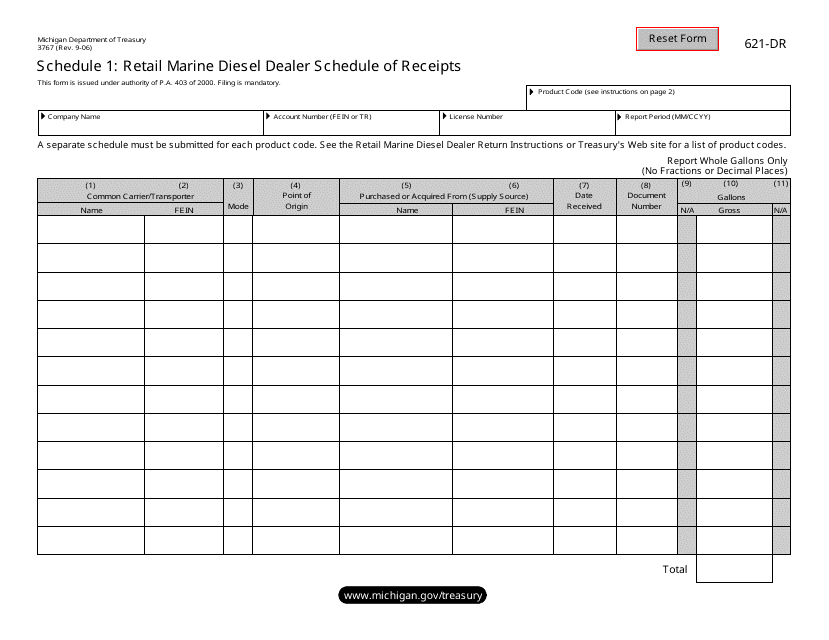

This Form is used for reporting the schedule of receipts for retail marine diesel dealers in Michigan.

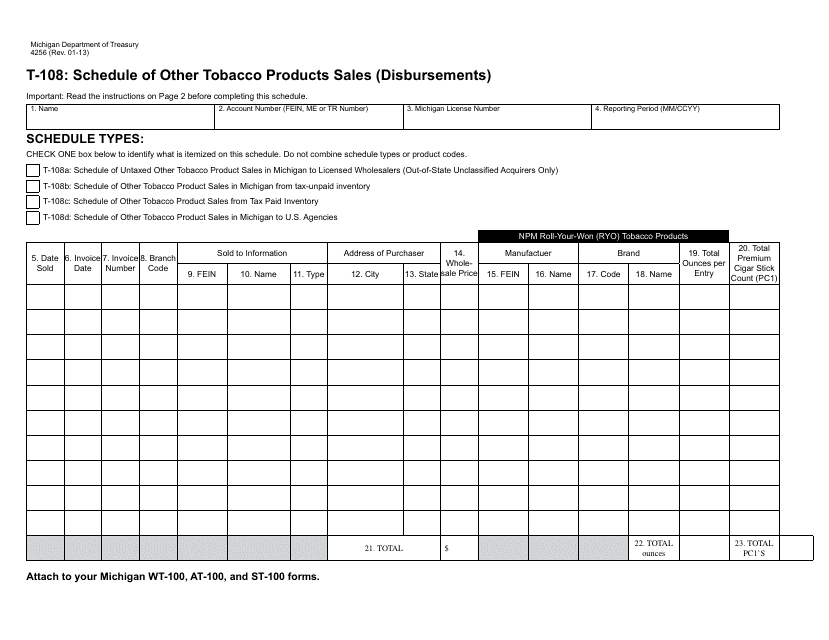

This form is used for reporting the sales or disbursements of other tobacco products in the state of Michigan. It is a schedule within Form 4256 Schedule T-108.

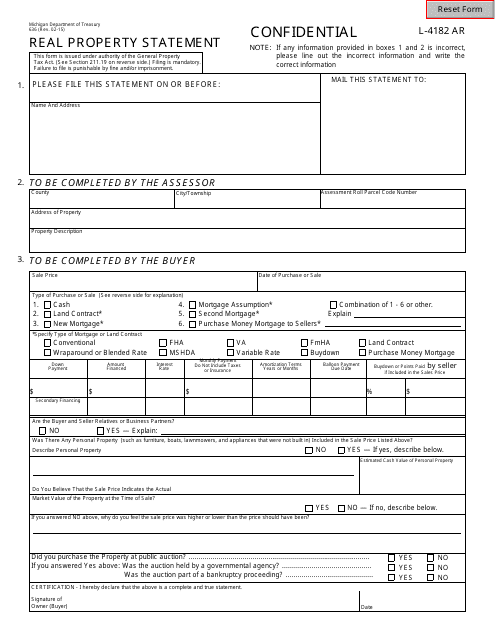

This Form is used for declaring real property in Michigan. It contains information about the property, its ownership, and its assessed value.

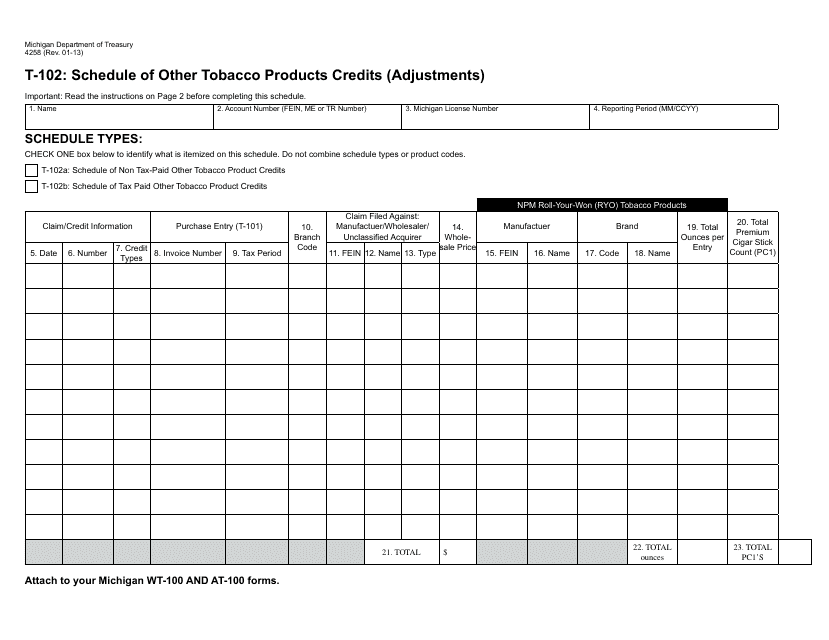

This form is used for reporting adjustments and credits related to other tobacco products in the state of Michigan.

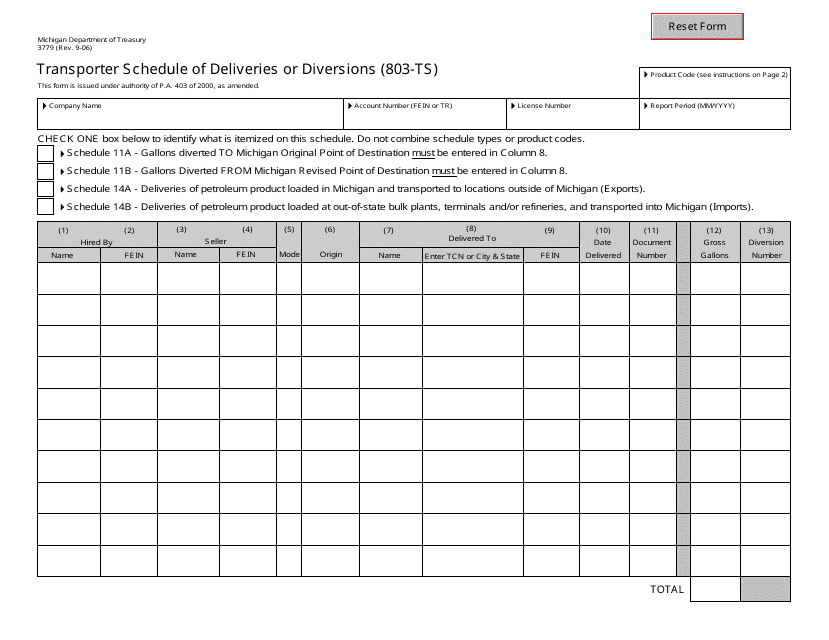

This form is used for scheduling and recording deliveries or diversions by transporters in the state of Michigan.