United States Tax Forms and Templates

Related Articles

Documents:

2432

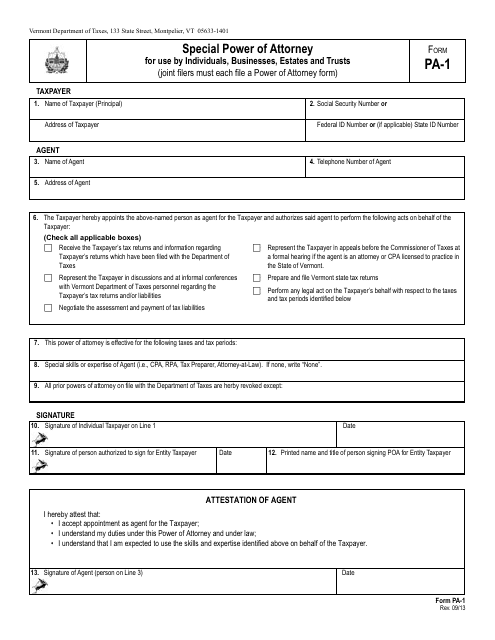

This document is a special power of attorney form that can be used by individuals, businesses, estates, and trusts in the state of Vermont. It grants someone the authority to act on behalf of the person or entity that is granting the power of attorney.

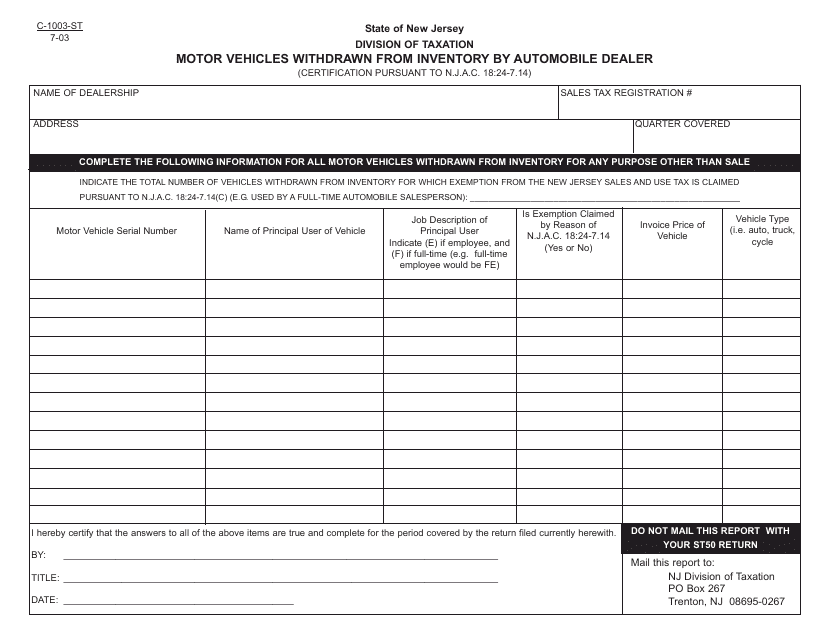

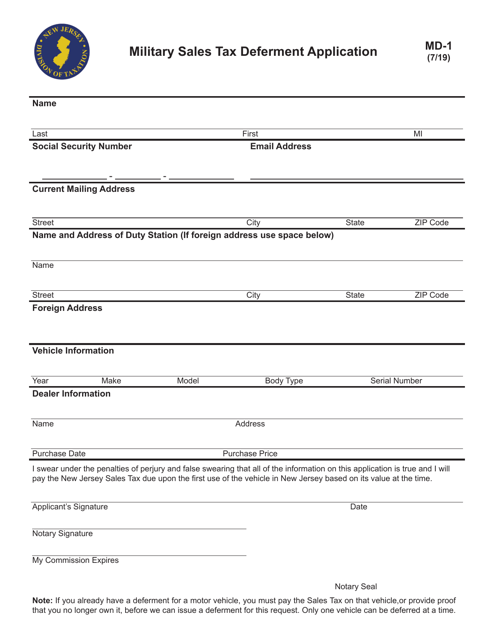

This form is used for automobile dealers in New Jersey to withdraw motor vehicles from their inventory.

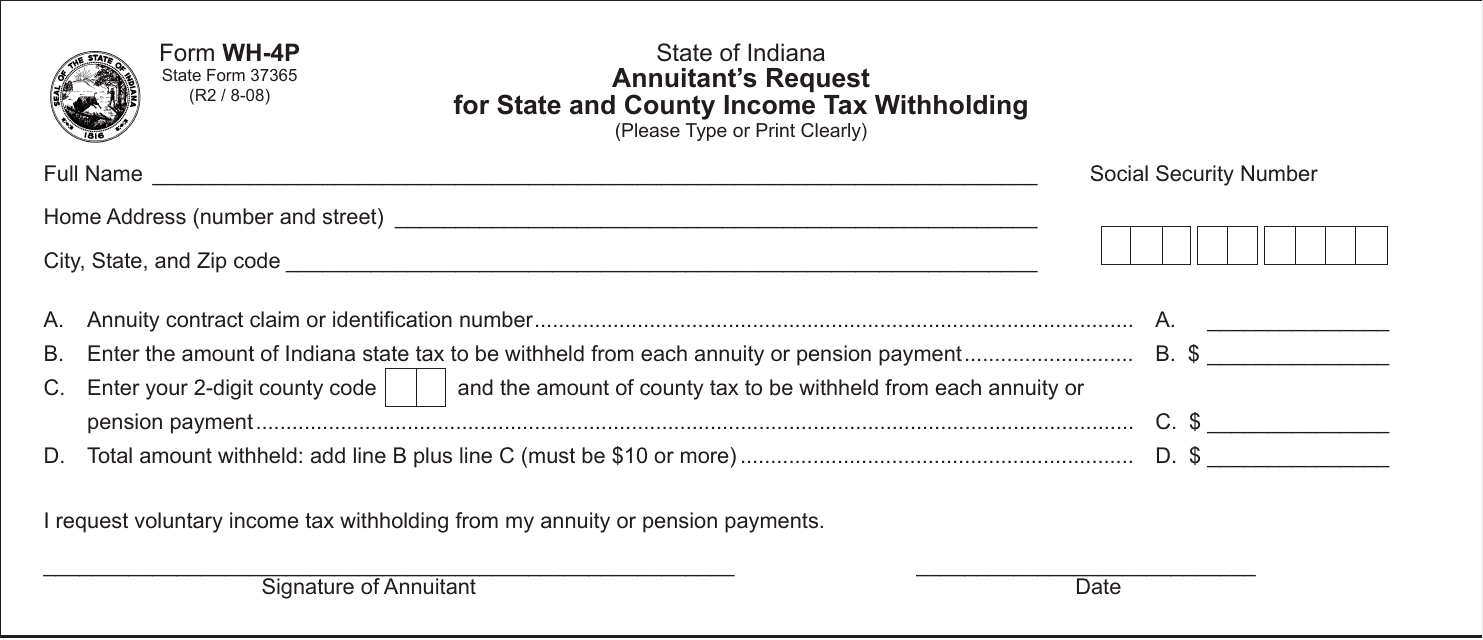

This form is used for annuitants in Indiana to request state and county income tax withholding.

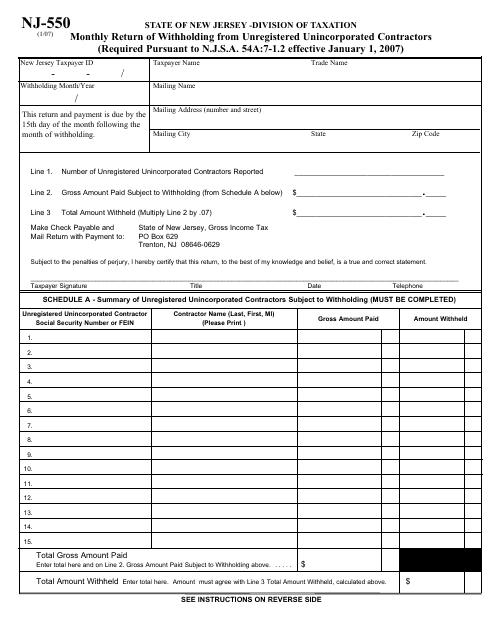

This Form is used for reporting monthly withholding from unregistered unincorporated contractors in the state of New Jersey.

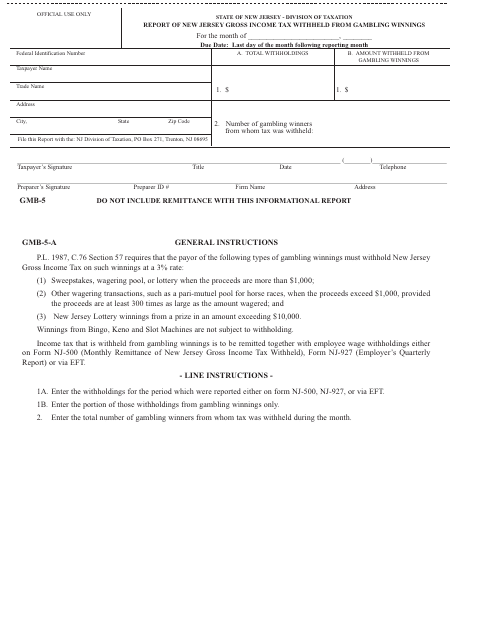

This form is used for reporting the amount of New Jersey Gross Income Tax withheld from gambling winnings in New Jersey.

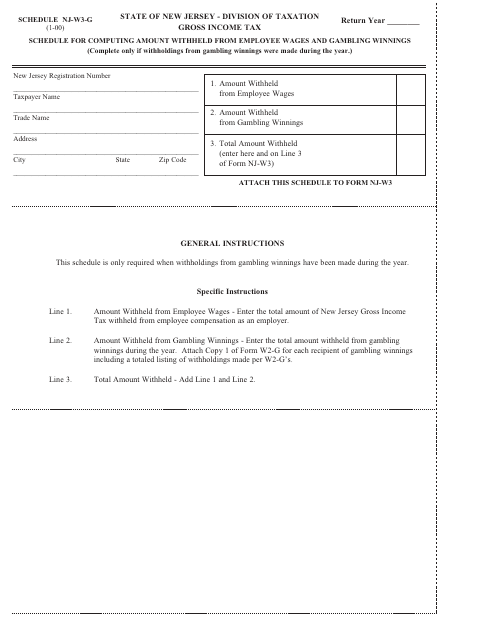

This document is used for computing the amount withheld from employee wages and gambling winnings in New Jersey.

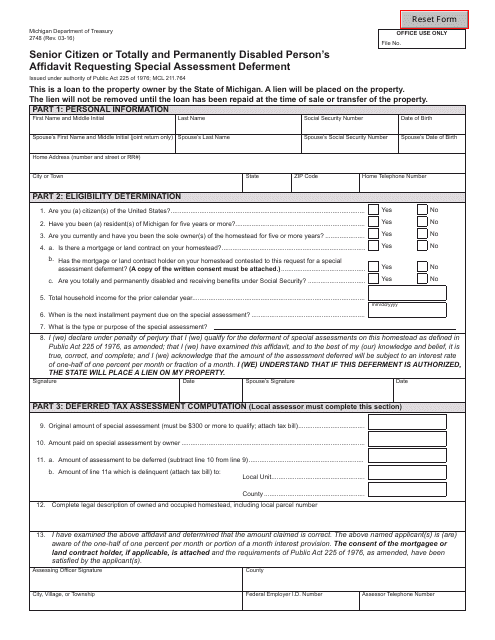

This form is used for senior citizens or individuals who are totally and permanently disabled to request special assessment deferment in the state of Michigan.

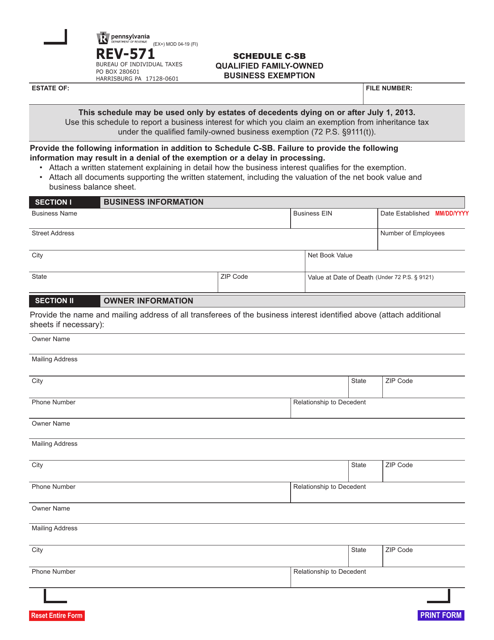

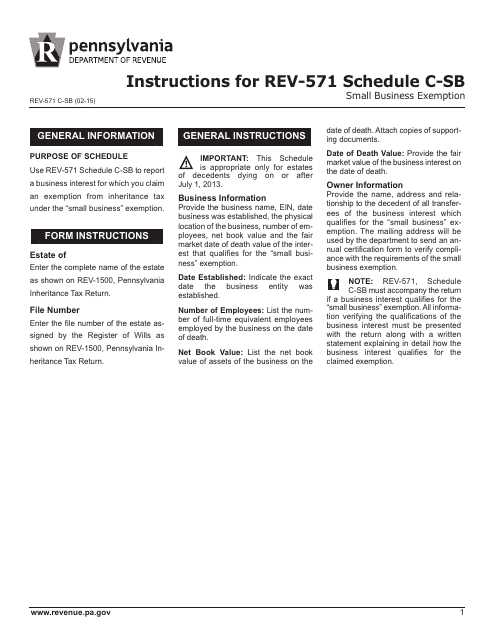

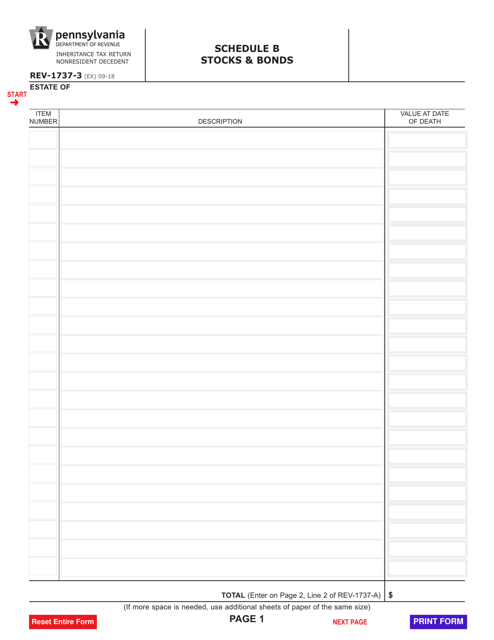

This Form is used for claiming small business exemption in Pennsylvania. It provides instructions on filling out Schedule C-SB.

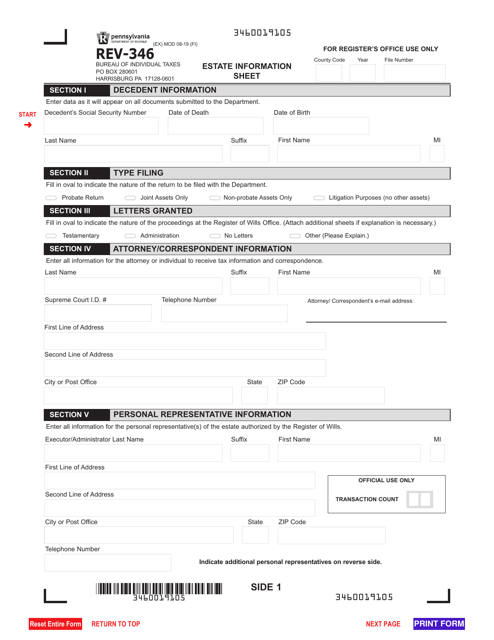

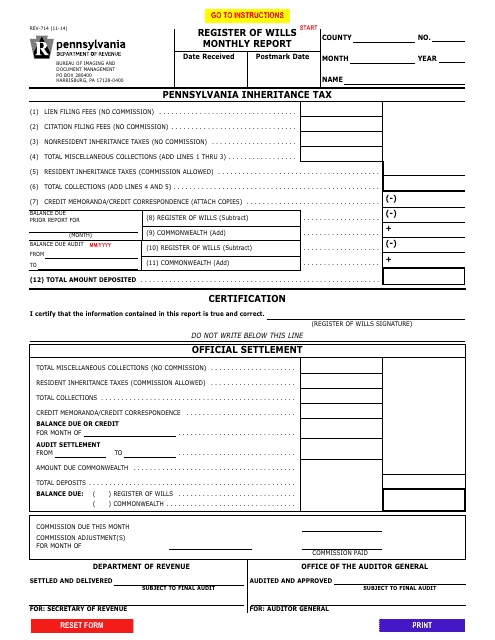

This form is used for submitting a monthly report to the Register of Wills in Pennsylvania. It provides information about the activities and transactions handled by the Register of Wills office.

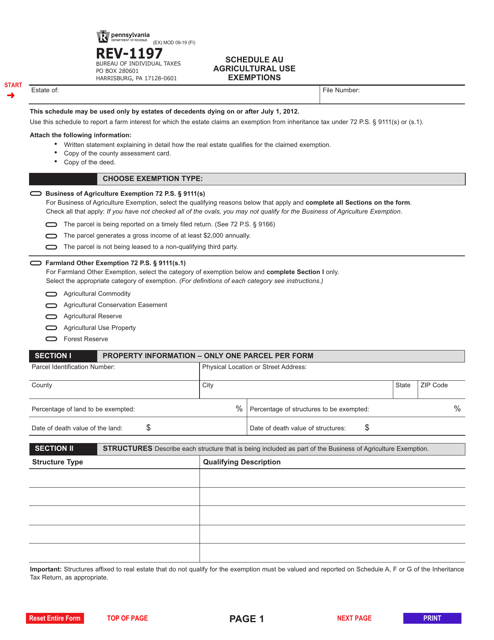

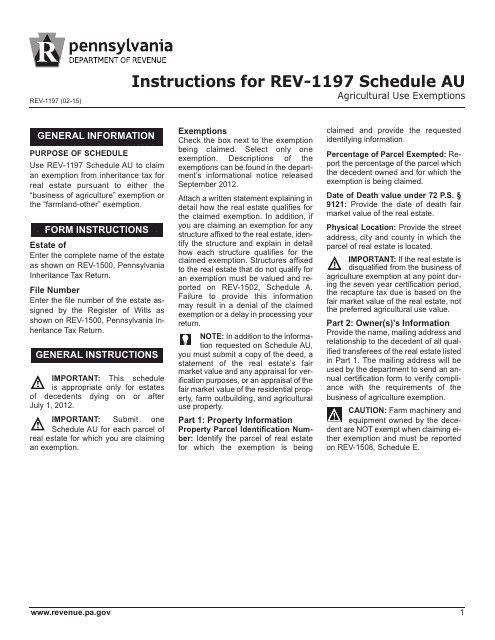

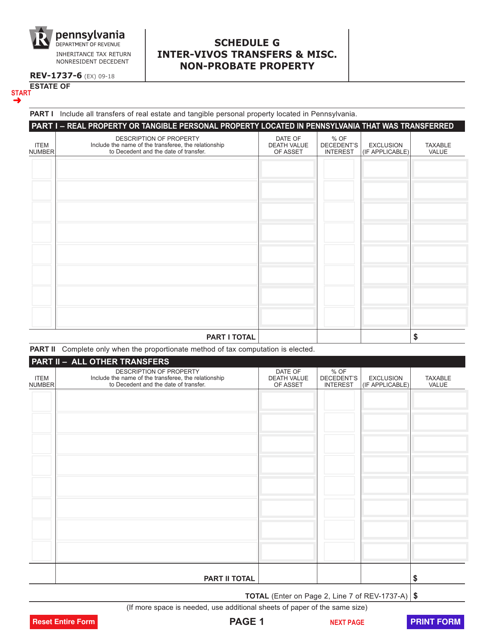

This Form is used for reporting agricultural use exemptions in Pennsylvania. It provides instructions on how to fill out Schedule AU for claiming tax exemptions on agricultural properties.

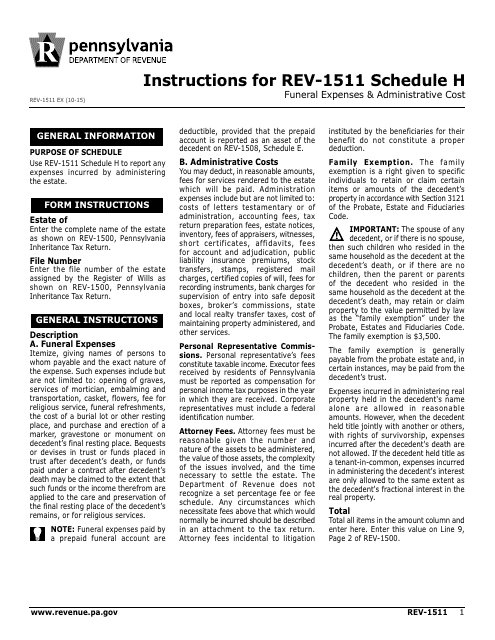

This form is used for reporting funeral expenses and administrative costs in Pennsylvania. It provides instructions on how to fill out Schedule H of Form REV-1511.

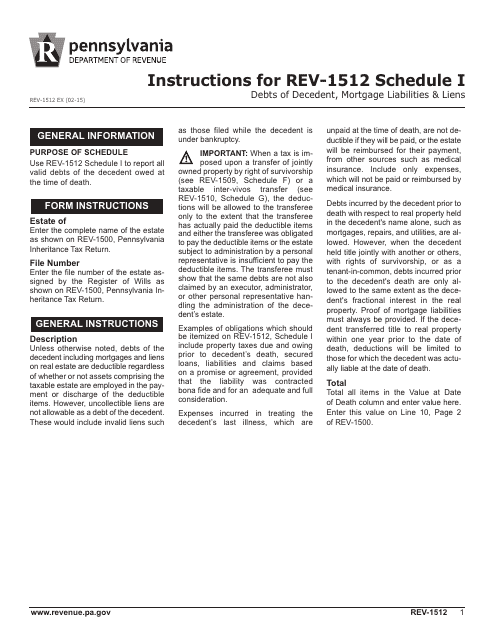

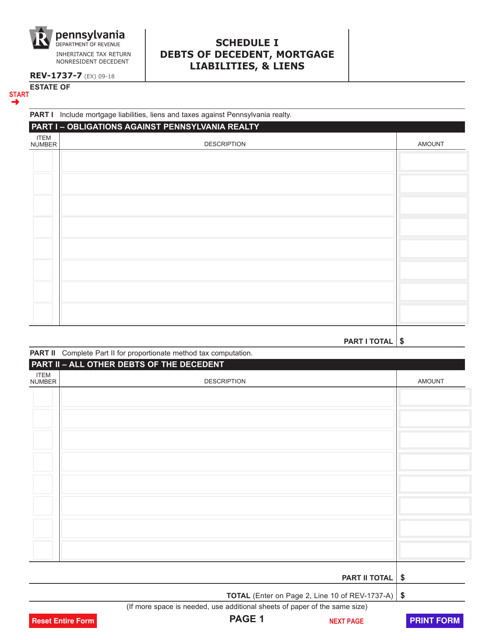

This Form is used for reporting the debts of a deceased person, including mortgage liabilities and liens, in the state of Pennsylvania. It provides instructions on how to accurately fill out the Schedule I section of Form REV-1512.

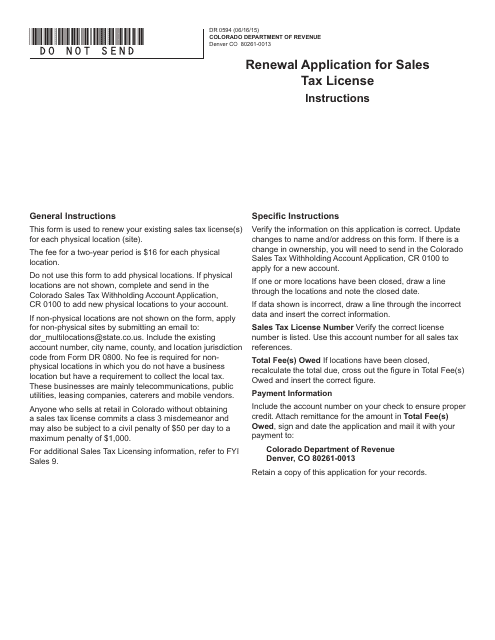

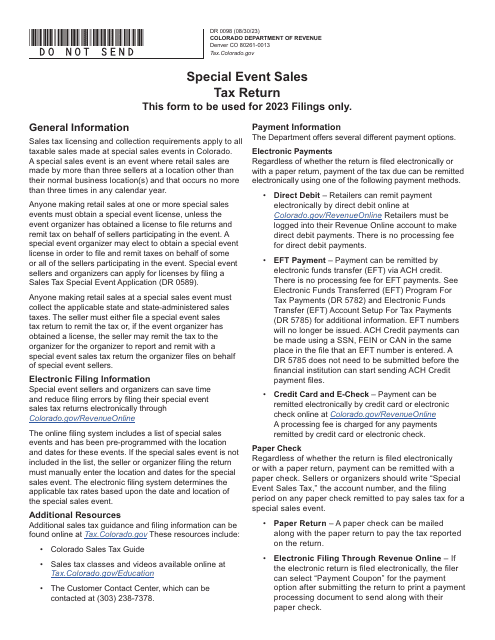

This form is used for renewing a sales tax license in the state of Colorado. It allows businesses to legally collect and remit sales taxes in the state.

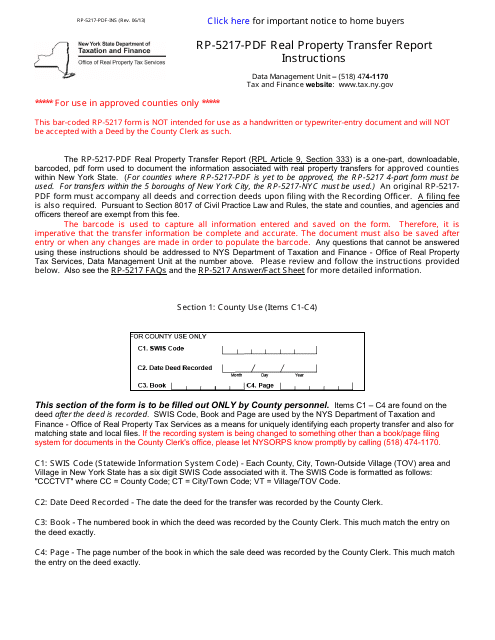

This form is used for reporting the transfer of real property in New York. It provides instructions on how to fill out the RP-5217-PDF form accurately and completely.

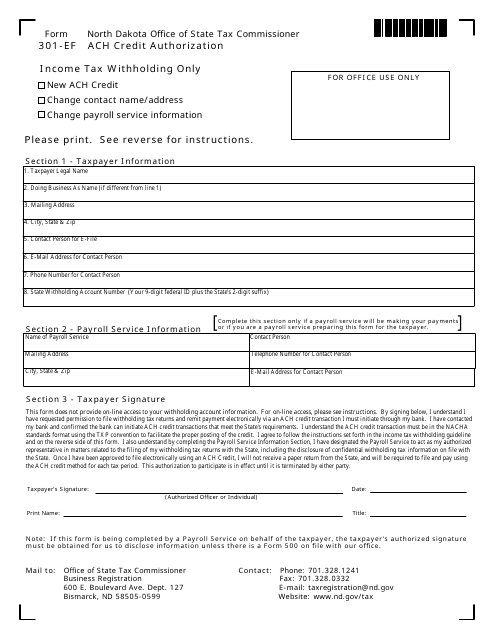

This form is used for applying for withholding and authorizing ACH credits in North Dakota.

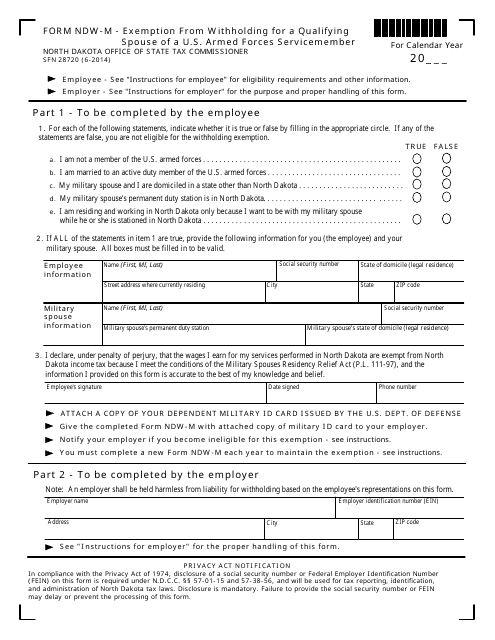

This form is used for claiming exemption from withholding for a qualifying spouse of a U.S. Armed Forces servicemember in North Dakota.

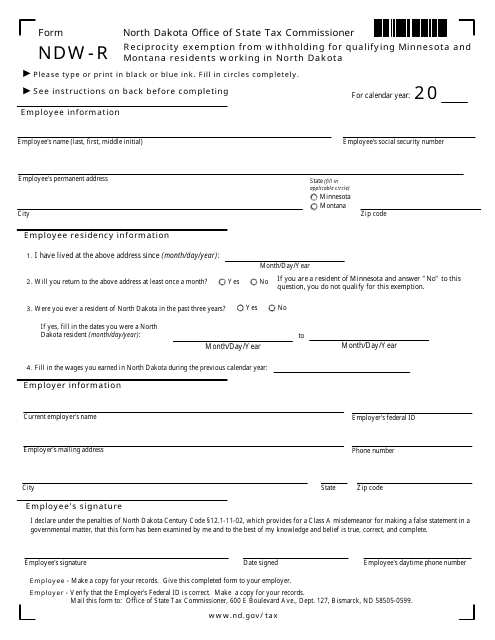

This form is used by qualifying residents of Minnesota and Montana who are working in North Dakota to claim an exemption from withholding taxes.

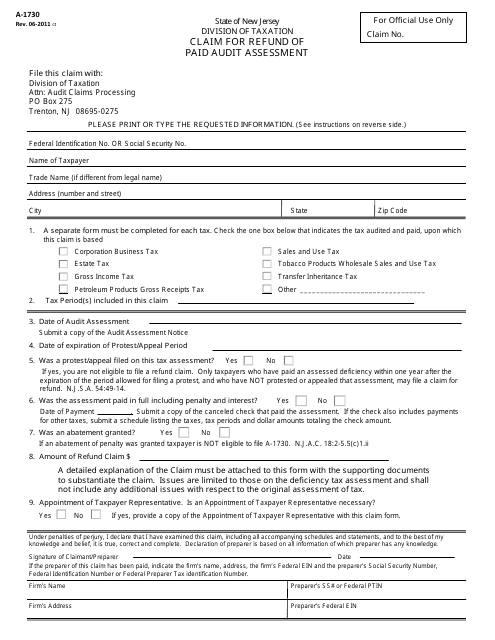

This Form is used for residents of New Jersey to claim a refund for a paid audit assessment.

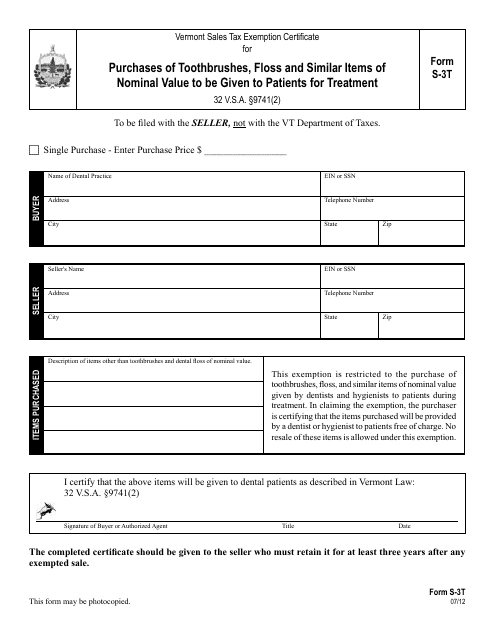

This form is used for claiming sales tax exemption on purchases of toothbrushes, floss, and similar items that are given to patients for treatment in Vermont.

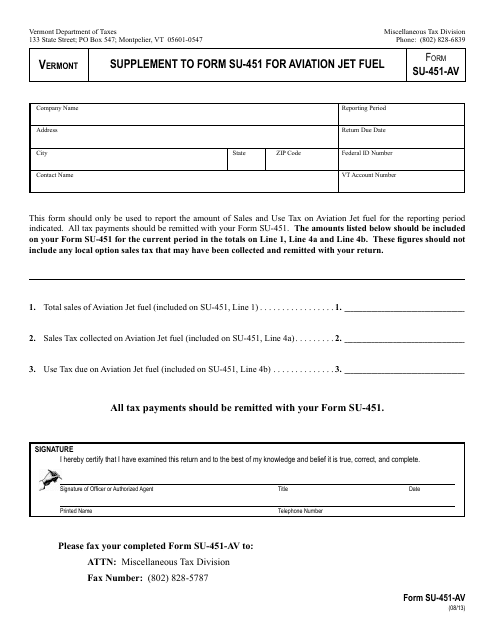

This Form is used for supplementing Form SU-451 for aviation jet fuel in Vermont.

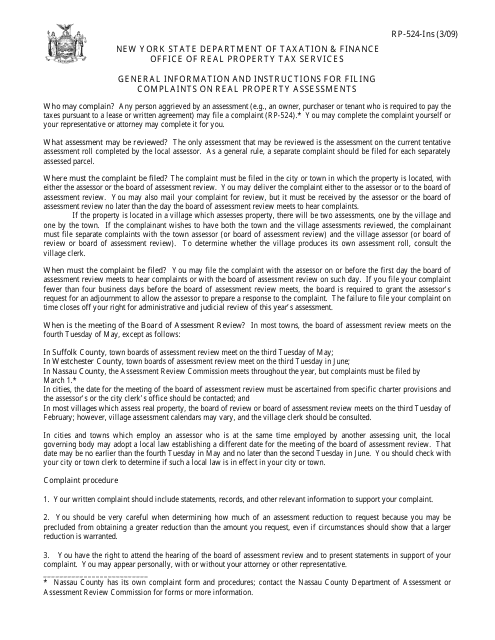

This Form is used for filing complaints regarding real property assessments in the state of New York. It provides instructions on how to submit a complaint and seek resolution for issues related to property assessments.

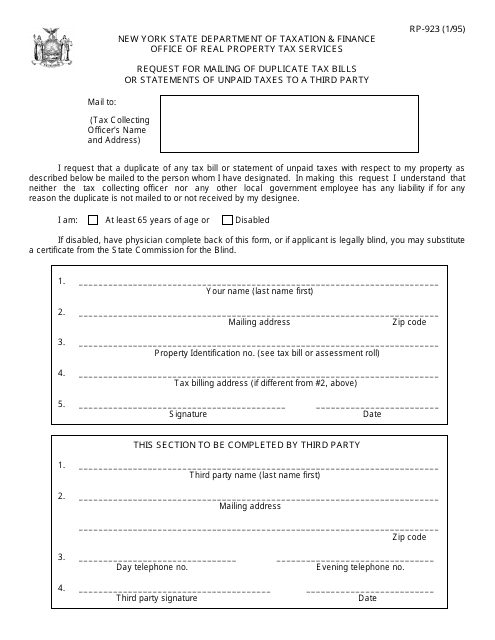

This form is used to request the mailing of duplicate tax bills or statements of unpaid taxes to a third party in New York.