United States Tax Forms and Templates

Related Articles

Documents:

2432

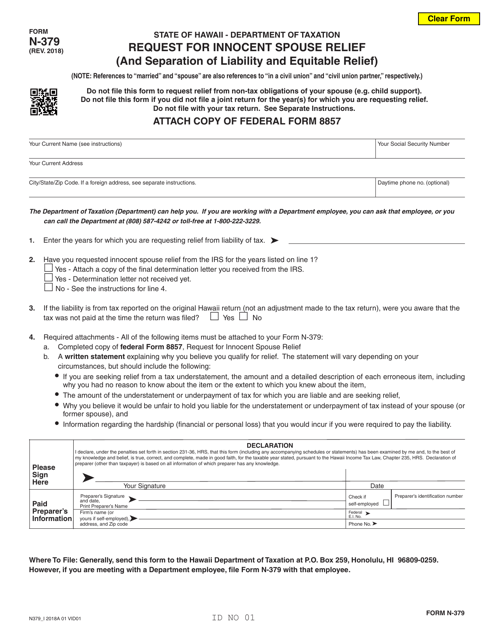

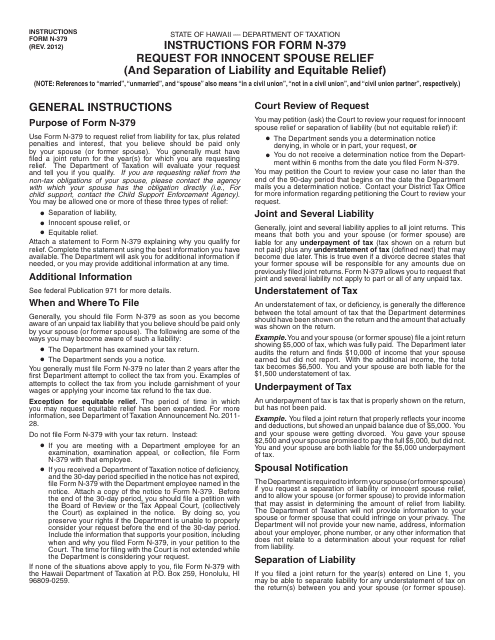

This Form is used for requesting innocent spouse relief in the state of Hawaii. It provides instructions on how to apply for relief from joint tax liability when a spouse or former spouse believes they should not be held responsible for the other spouse's tax obligations.

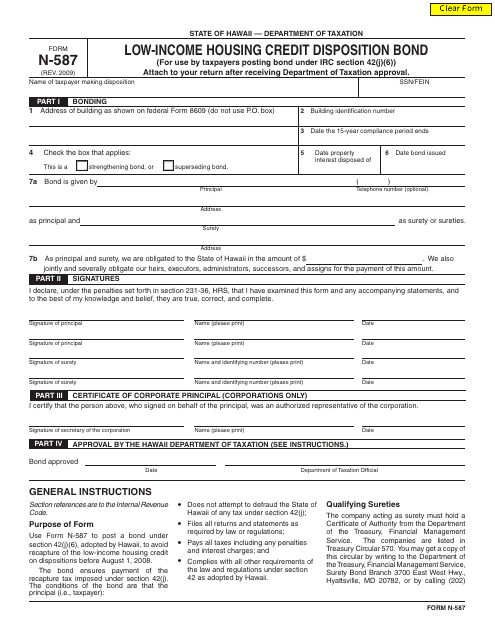

This Form is used for low-income housing credit disposition bond in Hawaii. It helps individuals and organizations in Hawaii to claim tax credits for Low-Income Housing projects.

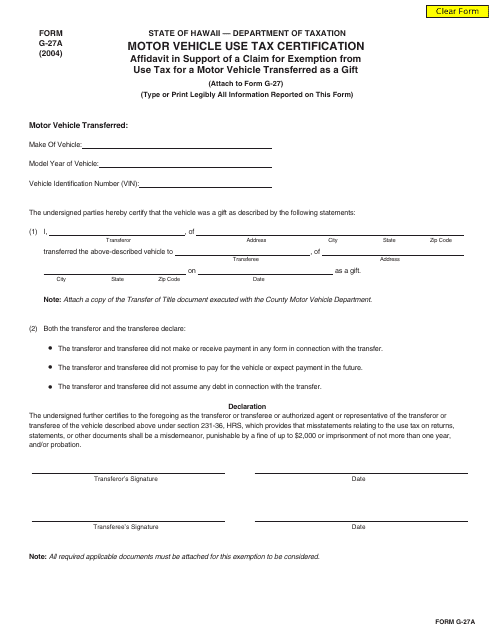

This document is used for claiming an exemption from motor vehicle use tax in Hawaii when transferring a vehicle as a gift.

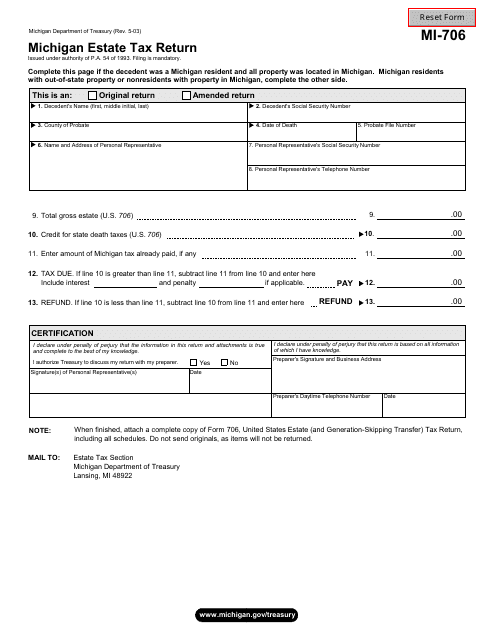

This form is used for filing the Michigan Estate Tax Return in the state of Michigan.

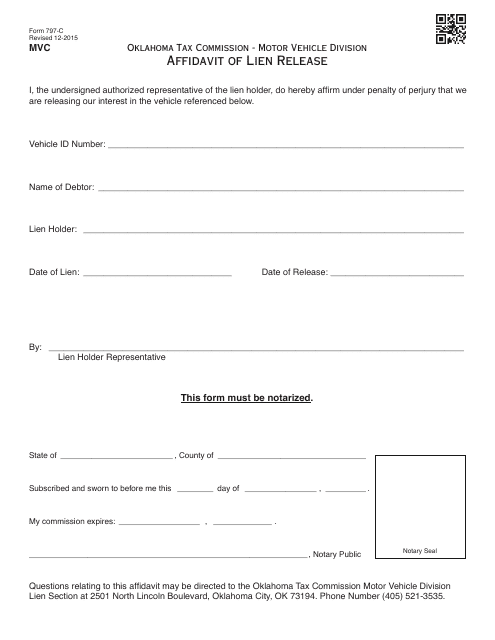

This Form is used for releasing a lien on a property or vehicle in Oklahoma. It is an affidavit that confirms the lien has been satisfied and provides proof of its release.

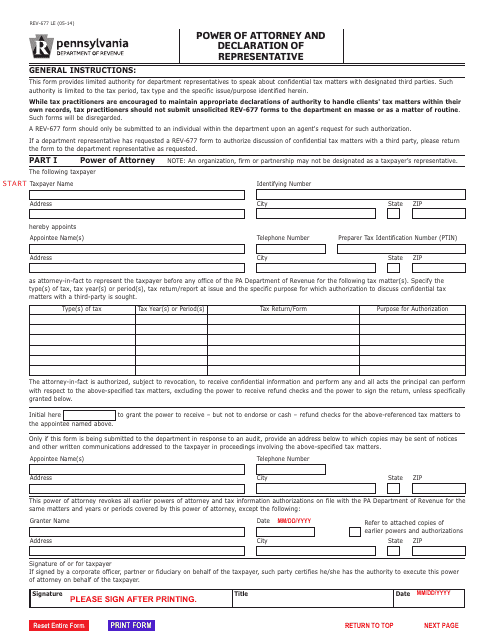

This form is used for creating a power of attorney and declaring a representative in the state of Pennsylvania.

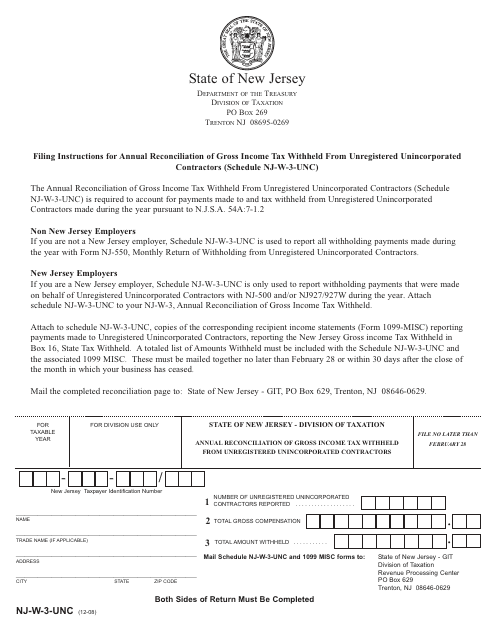

This form is used for the annual reconciliation of gross income tax withheld from unregistered unincorporated contractors in New Jersey.

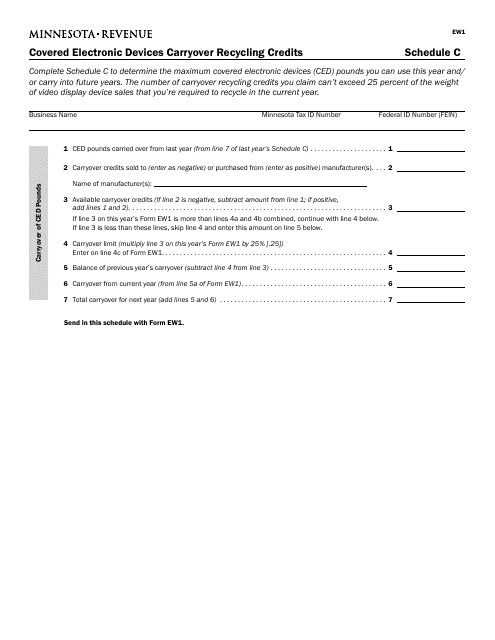

This form is used for reporting and claiming carryover recycling credits for covered electronic devices in Minnesota.

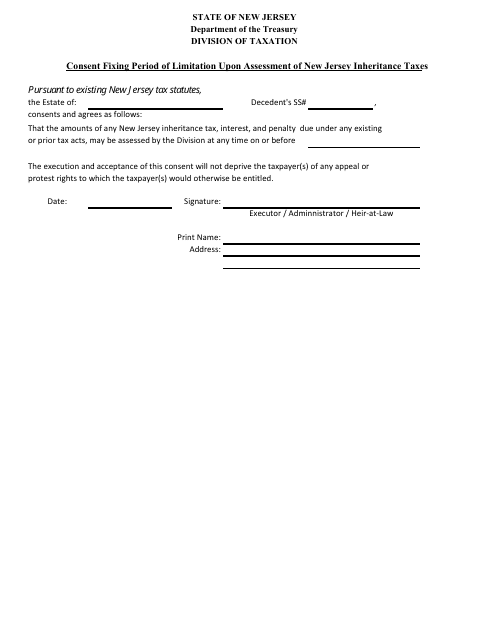

This document is used for fixing the period of limitation for assessing inheritance taxes in the state of New Jersey. It involves obtaining consent for any changes to the assessment of these taxes.

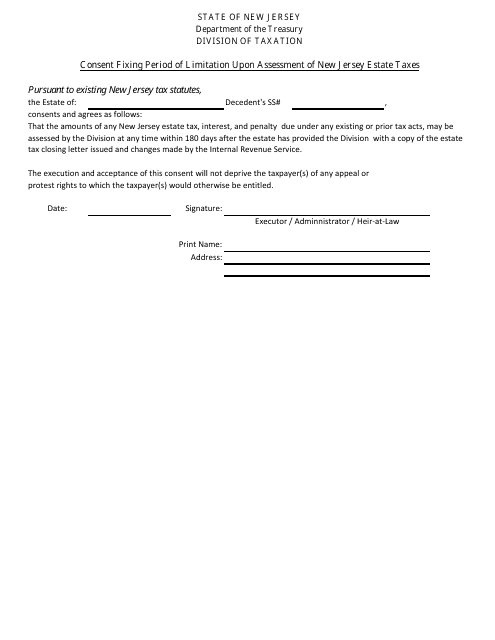

This document establishes the time limit for assessing New Jersey estate taxes.

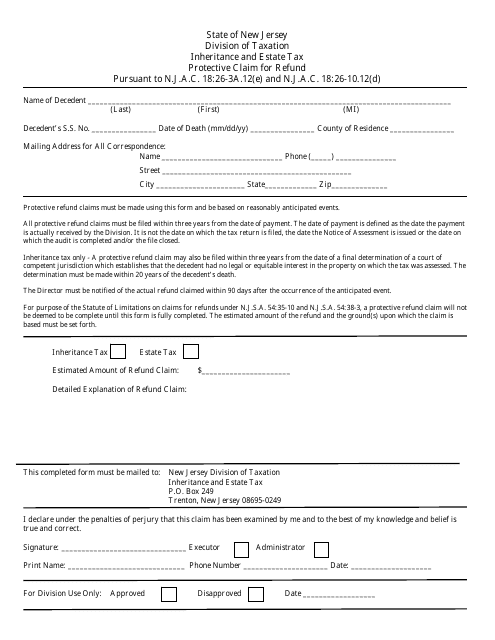

This Form is used for claiming a refund for inheritance and estate taxes paid in New Jersey.

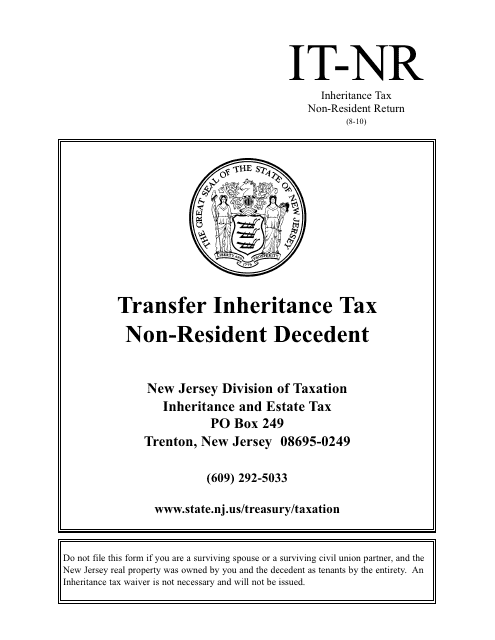

This form is used for transferring inheritance tax for non-resident decedents in New Jersey.

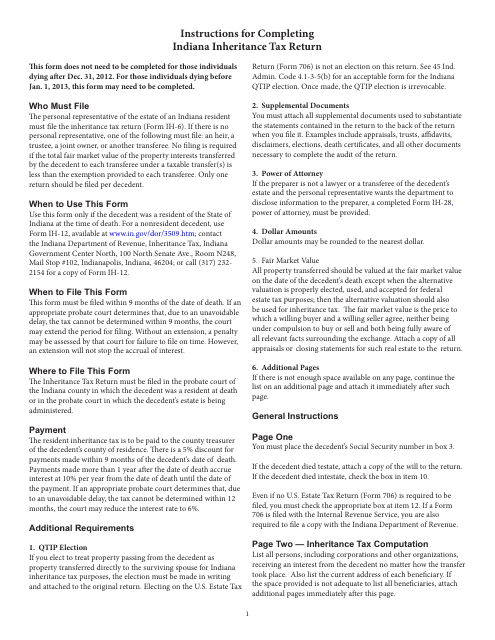

This Form is used for filing an Indiana Inheritance Tax Return in the state of Indiana. It is used to report any inheritance taxes owed on an estate.

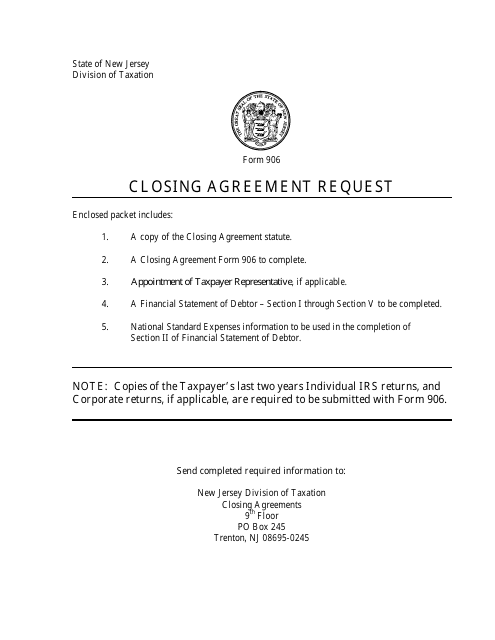

This Form is used for requesting a closing agreement in the state of New Jersey.

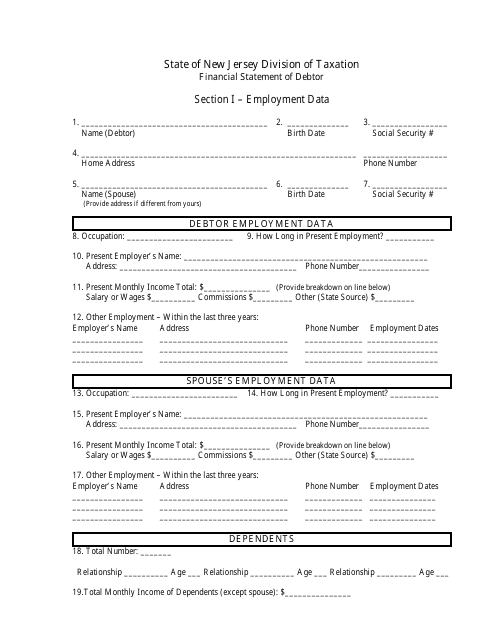

This document provides a detailed overview of the financial status of a debtor residing in New Jersey. It includes information about their income, assets, liabilities, and overall financial health.

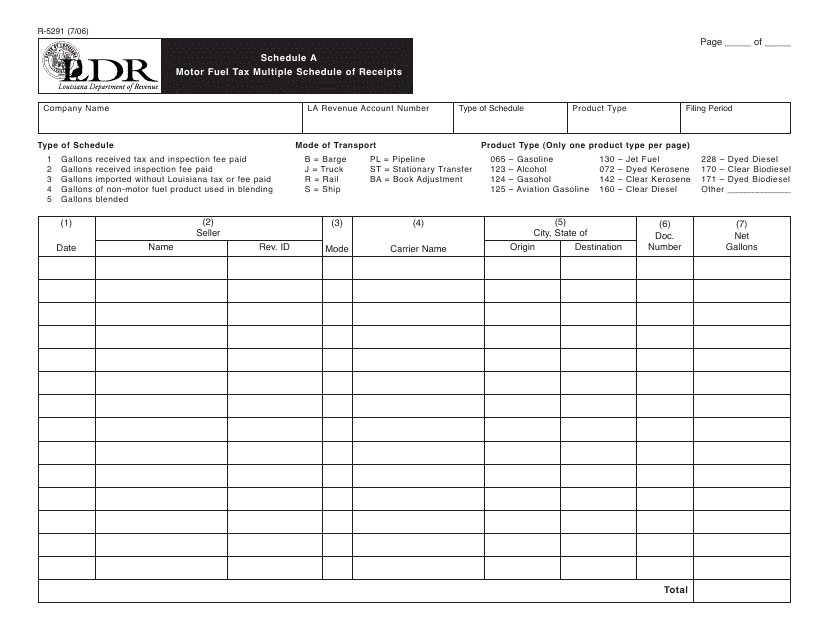

This form is used for reporting multiple motor fuel tax receipts in Louisiana.

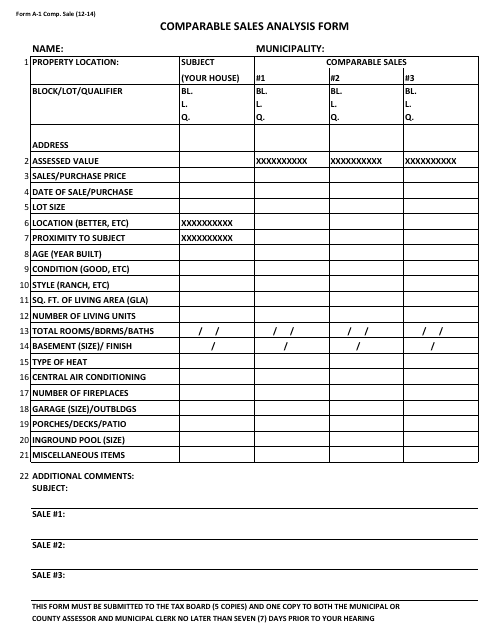

This Form is used for conducting a Comparable Sales Analysis in New Jersey. It helps in evaluating the market value of a property by comparing it to similar properties that have recently sold in the area.

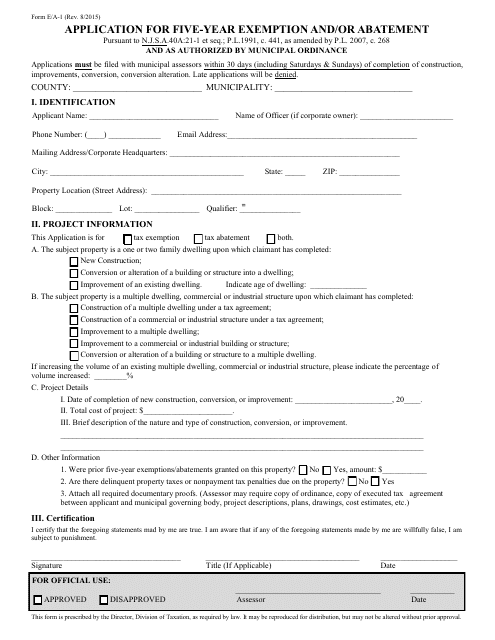

This form is used for applying for a five-year exemption and/or abatement in New Jersey.