Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

These are instructions for IRS Form 1128, Application to Adopt, Change, or Retain a Tax Year.

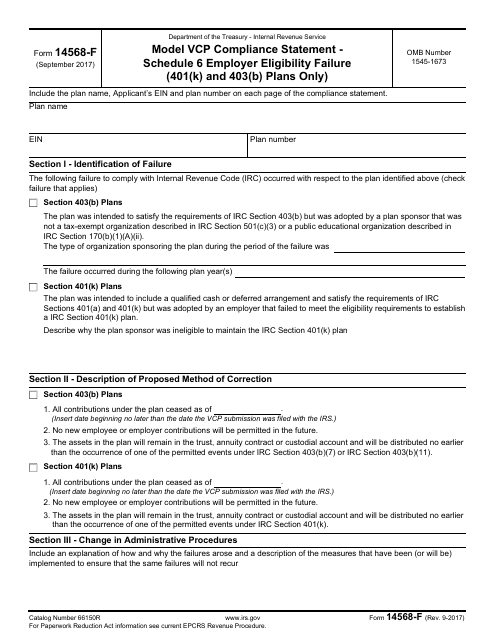

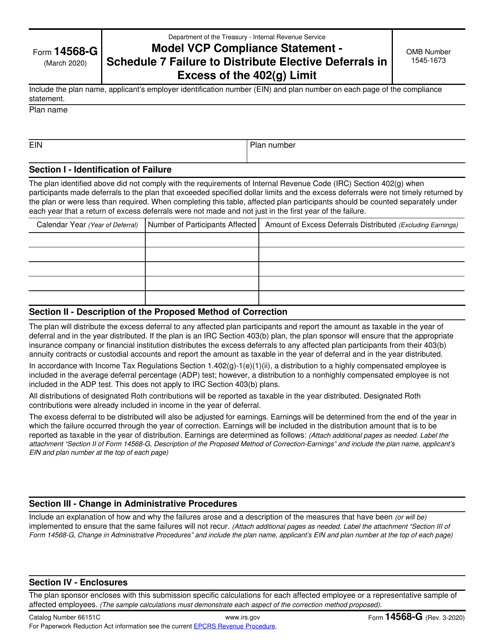

This Form is used for reporting employer eligibility failures for 401(k) and 403(b) plans. It is part of the VCP compliance statement required by the IRS.

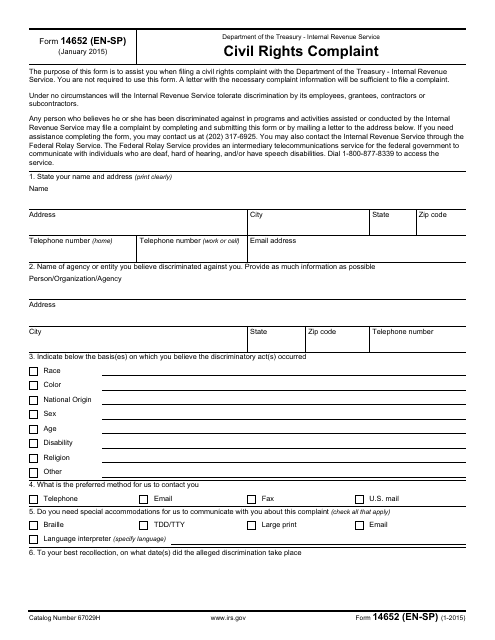

This Form is used for filing a civil rights complaint with the IRS in either English or Spanish.

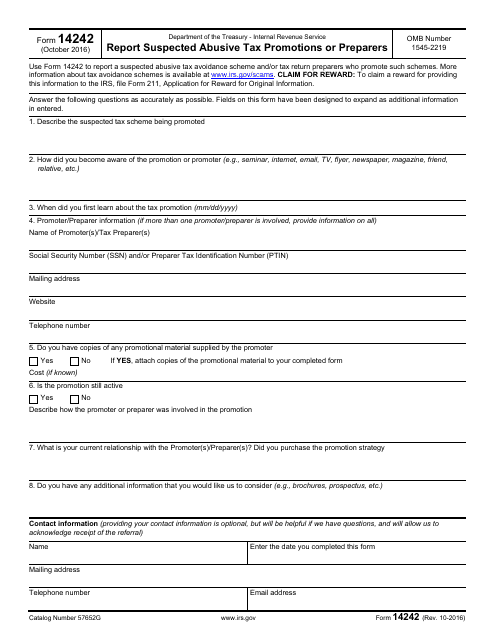

This form is used for reporting suspected abusive tax promotions or preparers to the IRS.

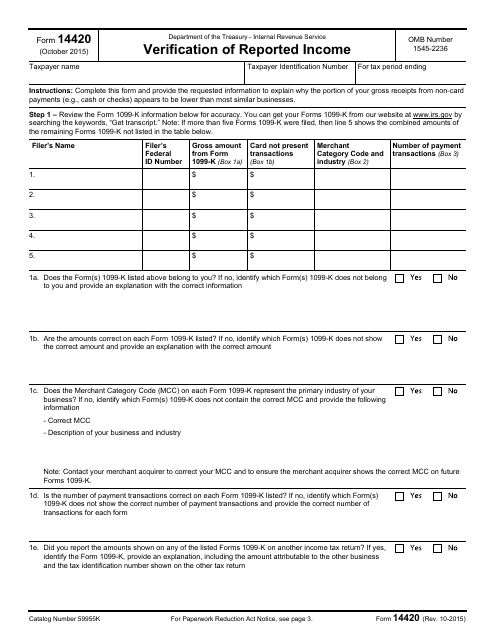

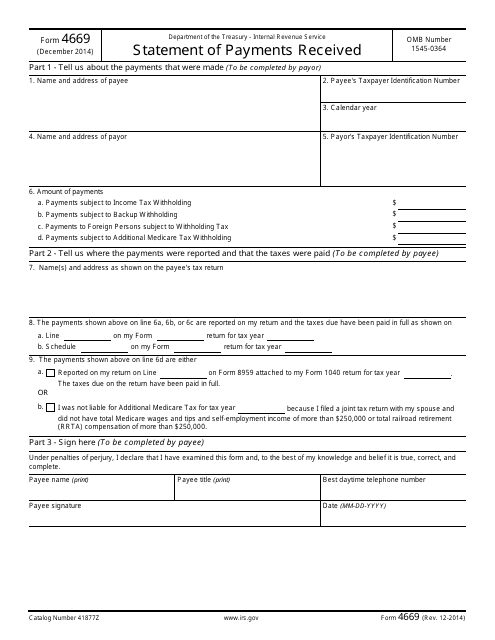

This form is used for verifying reported income to the IRS. It helps to ensure accuracy in tax reporting and compliance with tax laws.

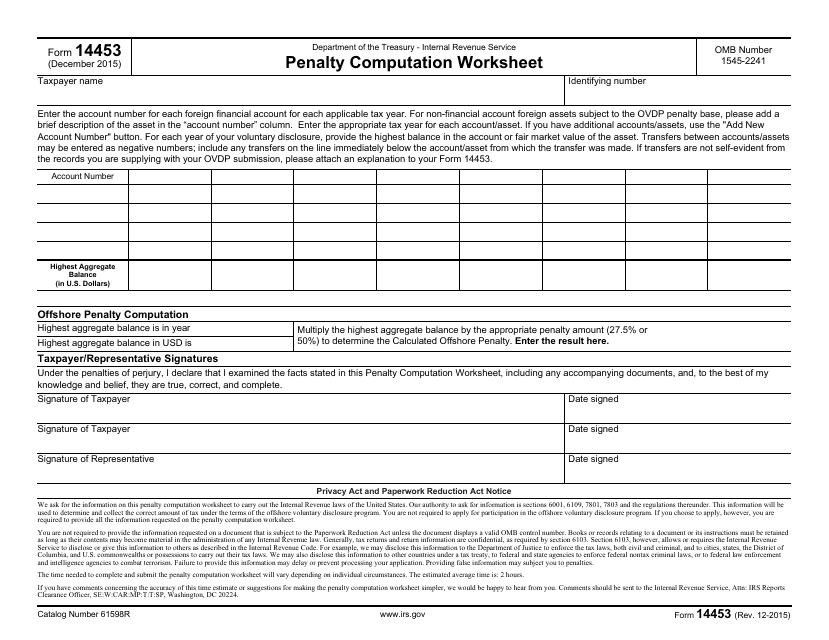

This document is used to calculate penalties owed to the IRS. It provides a worksheet for determining the amount of the penalty.

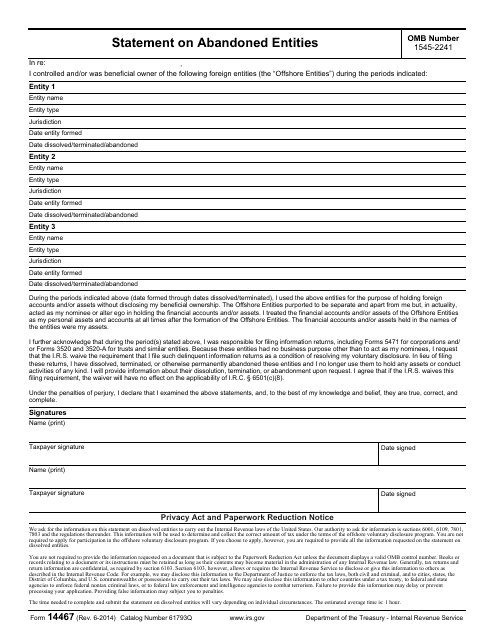

This document is a statement used by the IRS to report abandoned entities.

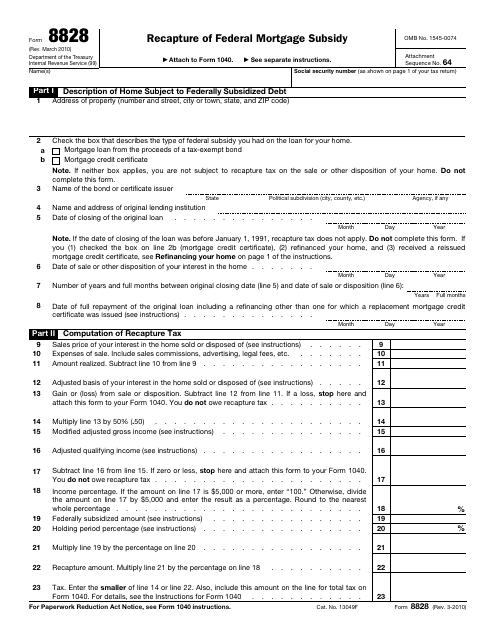

This form is used to recapture the federal mortgage subsidy. It helps taxpayers report and calculate the amount of subsidy that needs to be repaid to the IRS.

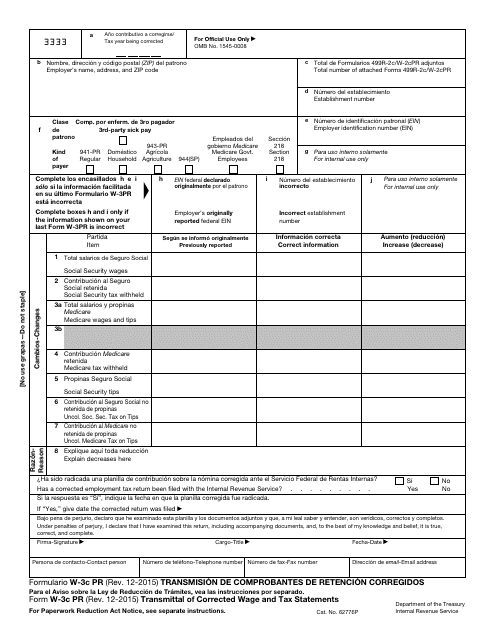

This document is used for transmitting corrected withholding statements in Puerto Rican Spanish.

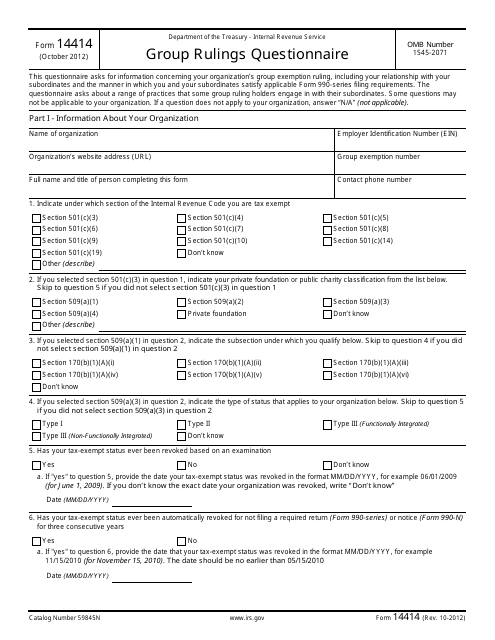

This Form is used for requesting a group ruling from the Internal Revenue Service (IRS). It is a questionnaire that must be completed to provide all necessary information for the group ruling application.

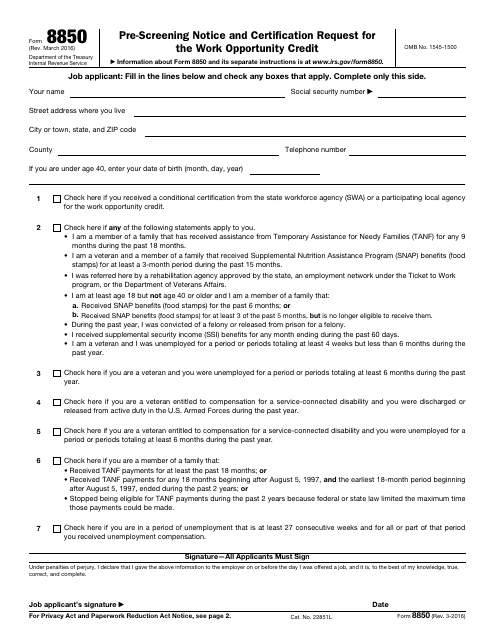

This is a formal document prepared by employers to apply for a specific tax credit they qualify for by hiring employees from targeted groups.

This is a supplementary form used by employers to handle errors they have made upon filing IRS Form W-2, Wage and Tax Statement.

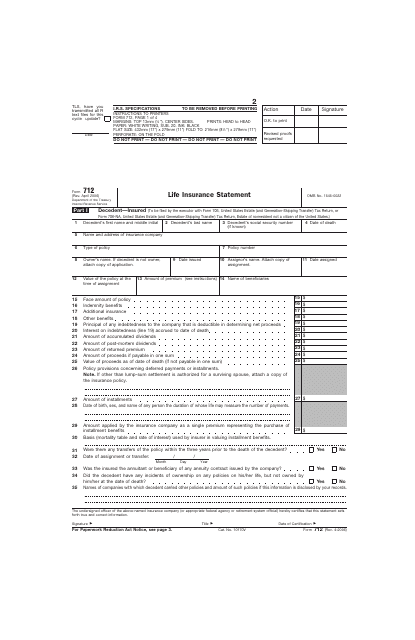

This is a supplementary form the executor of the decedent's estate must file to elaborate on the insurance policy the deceased person obtained before passing.

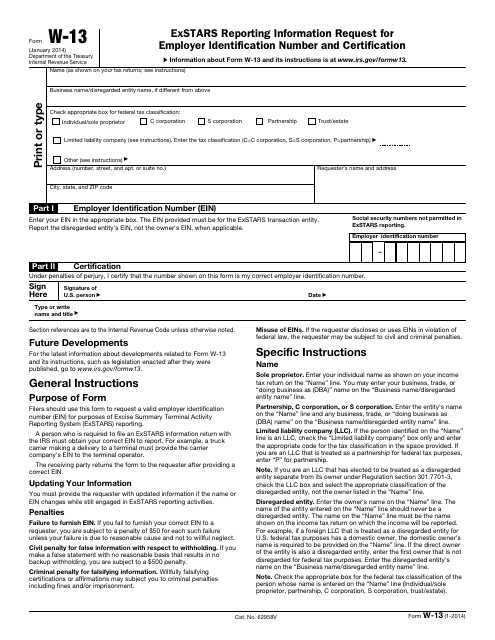

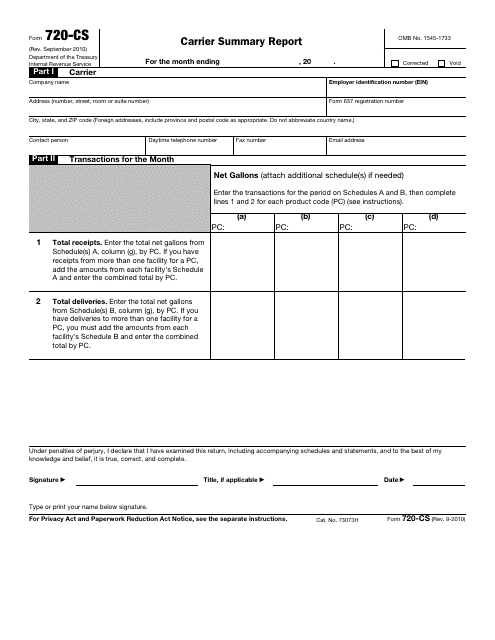

This document is used for reporting carrier information to the IRS. It provides a summary of the carriers and their activities.

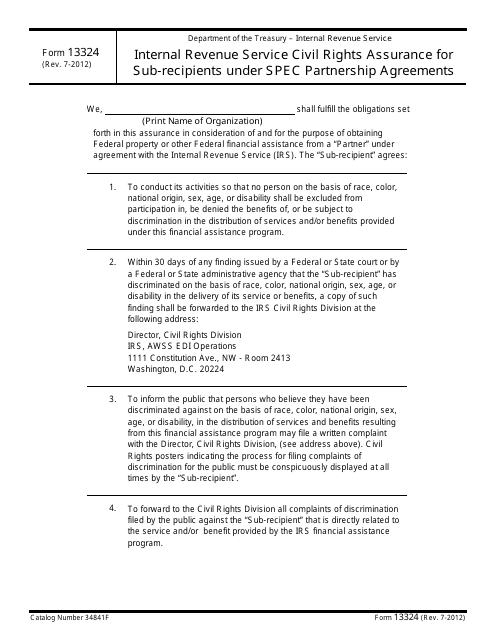

This form is used for subrecipients under specified partnership agreements to provide assurance of civil rights compliance with the Internal Revenue Service (IRS).

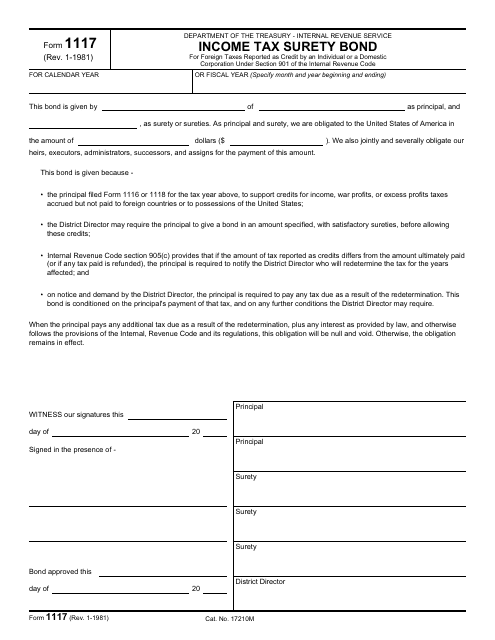

This document is used for filing an income tax surety bond with the Internal Revenue Service (IRS).