Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

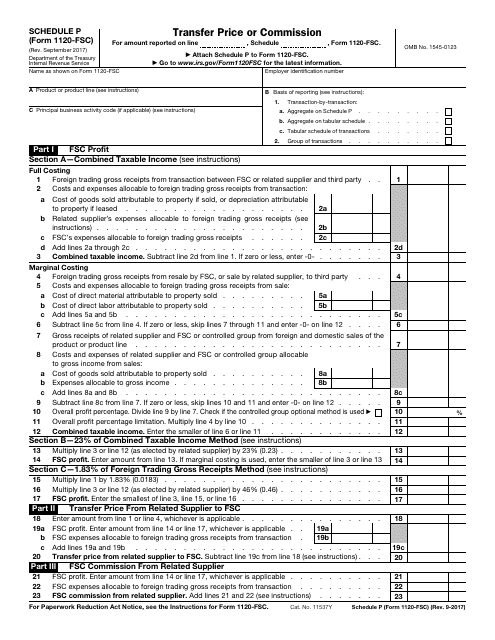

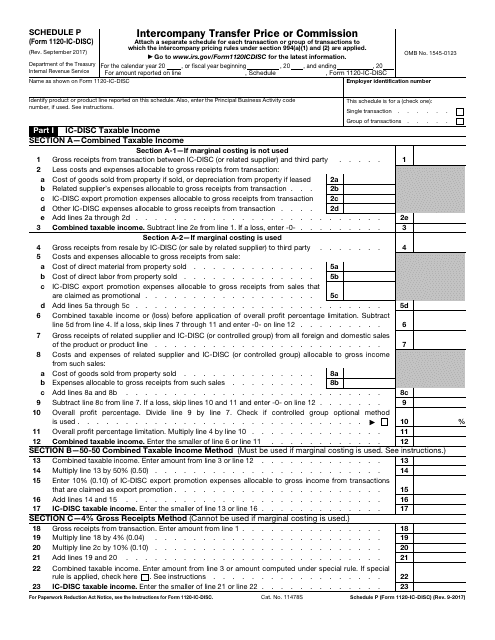

This is a formal IRS document business entities need to file with the fiscal authorities to outline the income they received during the tax year via methods that involve third parties.

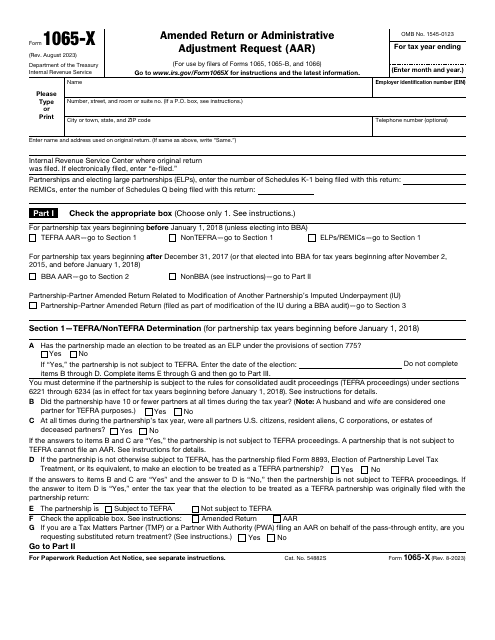

This is a fiscal statement used by partnerships and real estate mortgage investment conduits to fix the errors in previously filed IRS Form 1065, IRS Form 1065-B, IRS Form 1066.

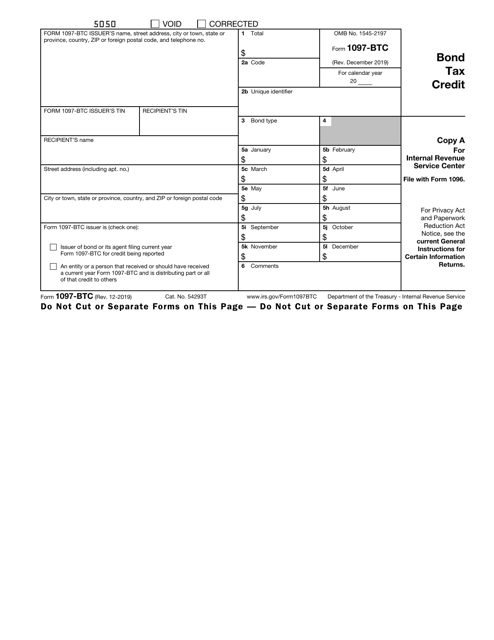

This is a formal IRS document prepared by tax credit bond issuers and taxpayers that distribute the credit in question.

Submit this form to the Internal Revenue Service (IRS) if you are a corporation that offers their employees an incentive stock option (ISO) to report to the IRS about your transfers of stock made to any transferee when that transferee exercises an ISO under Section 422(b).

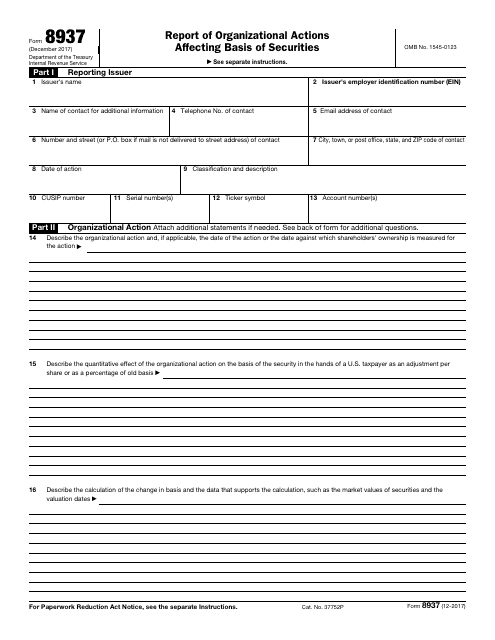

This Form is used for reporting any organizational actions that may have an impact on the basis of your securities for tax purposes. It is required by the Internal Revenue Service (IRS) to ensure accurate reporting of capital gains or losses.

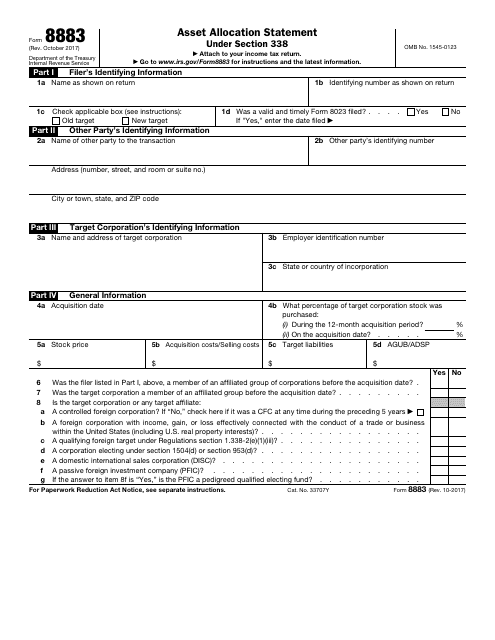

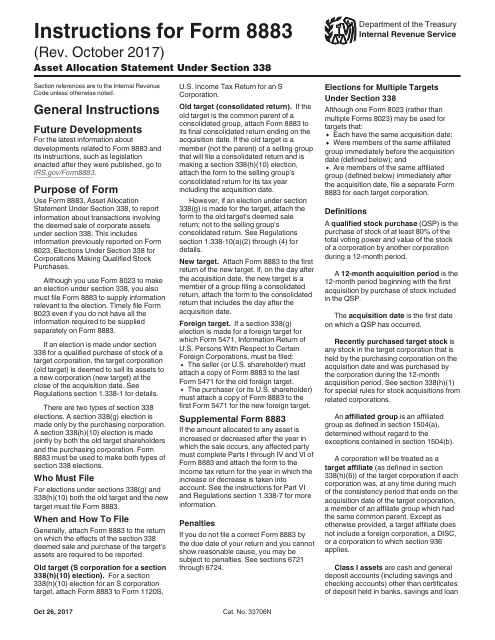

This form is used for reporting asset allocation statement under Section 338 to the IRS.

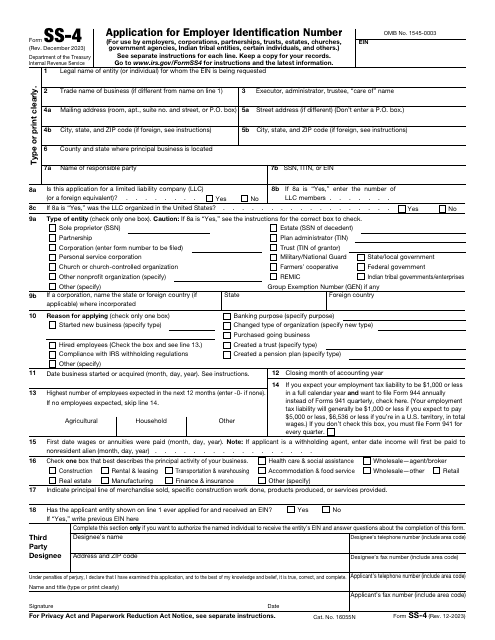

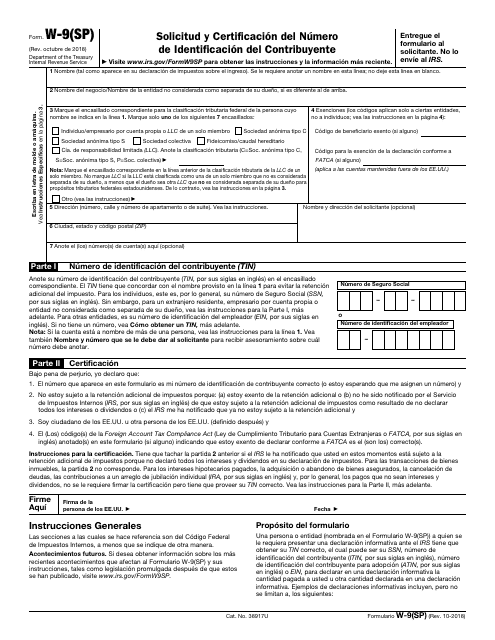

This is a fiscal document used by taxpayers - from sole proprietors to corporations - to ask tax organizations for a unique identification number.

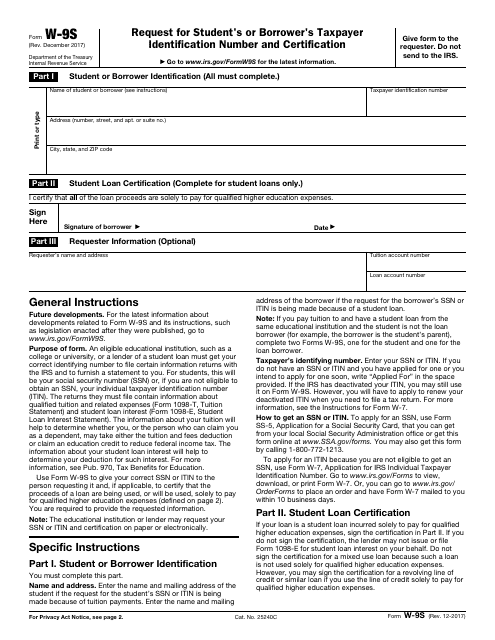

This is an IRS application requested from students to provide their taxpayer information to an educational institution (a college or university) or a lender of a student loan.

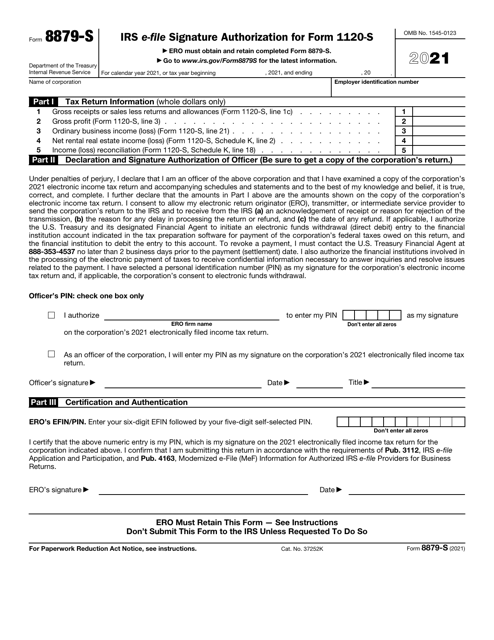

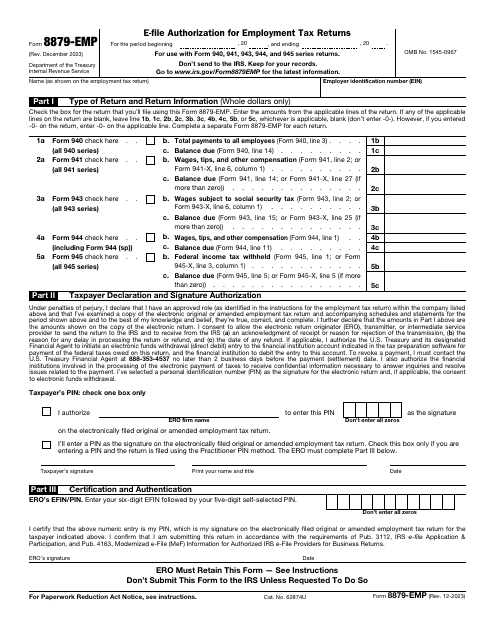

This is a supplementary form taxpayers may sign if they want to confirm their willingness to utilize a personal identification number that will allow them to provide an electronic signature when certifying employment tax returns or asking for a filing extension.

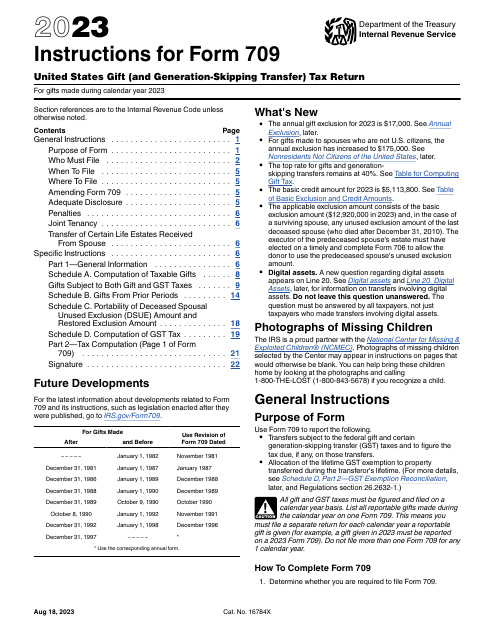

Instructions for IRS Form 709 United States Gift (And Generation-Skipping Transfer) Tax Return, 2023

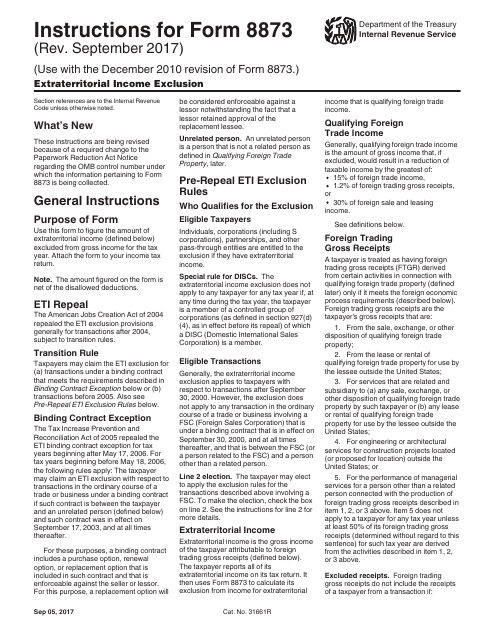

This form is used for reporting and claiming the extraterritorial income exclusion. It provides instructions on how to accurately complete IRS Form 8873.

This type of document, IRS Form 8883, is used for reporting asset allocation statements under Section 338 of the Internal Revenue Code. It provides instructions for completing and filing this form with the IRS.