Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

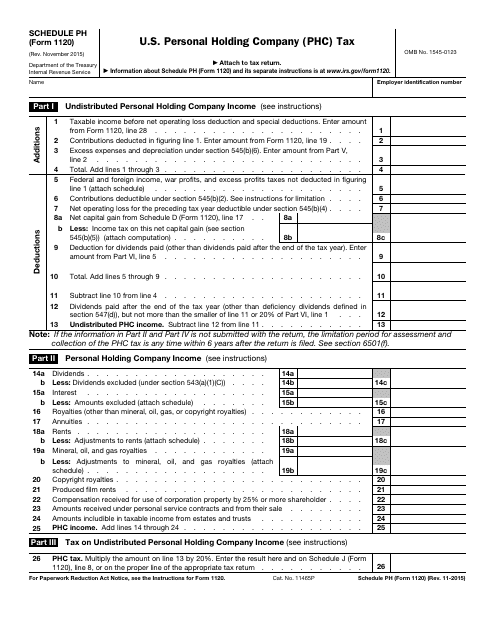

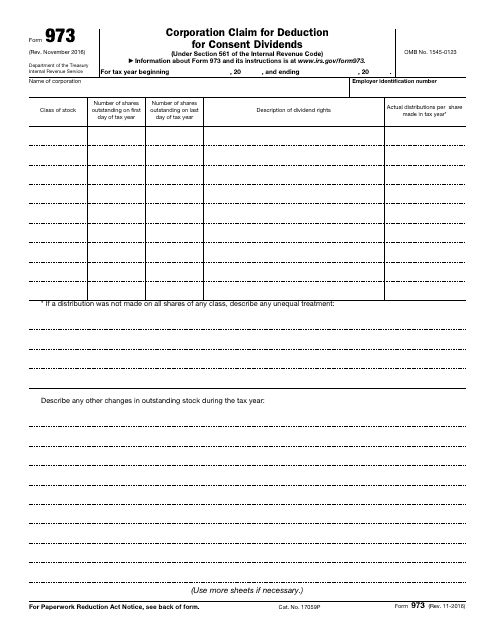

This form is used for reporting and paying U.S. Personal Holding Company (PHC) Tax for companies classified as personal holding companies.

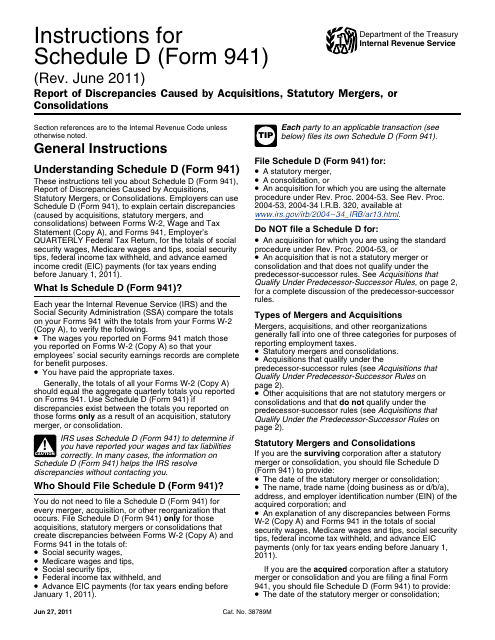

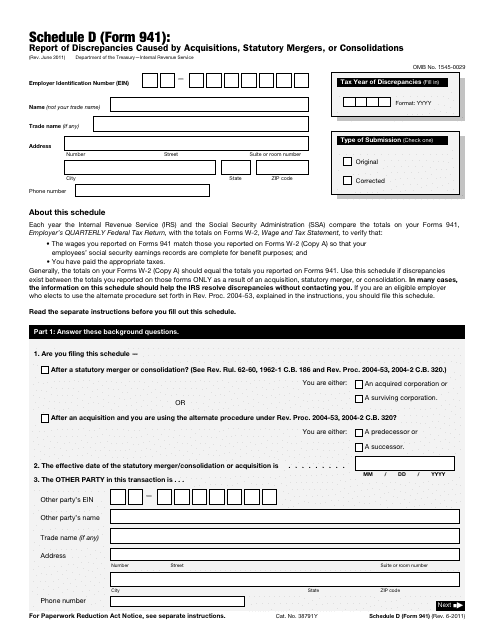

This document is used for reporting discrepancies caused by acquisitions, statutory mergers, or consolidations when filing IRS Form 941. It provides instructions on how to accurately fill out Schedule D of the form.

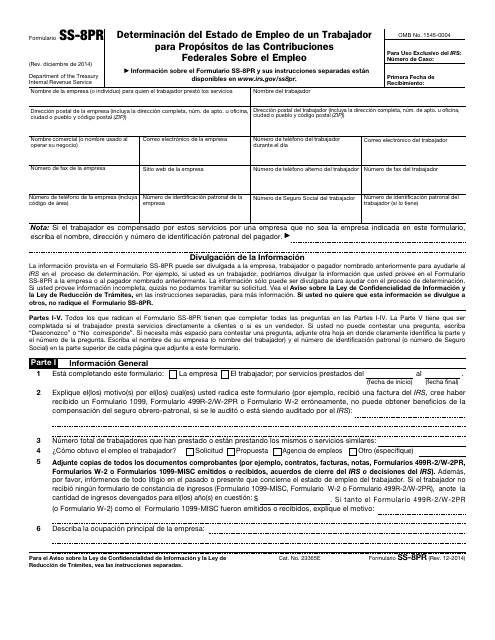

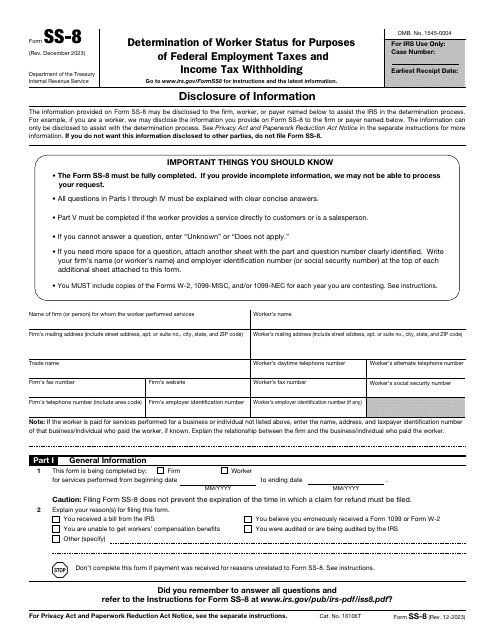

This form is used to determine the employment status of a worker for the purposes of federal employment taxes in Puerto Rico.

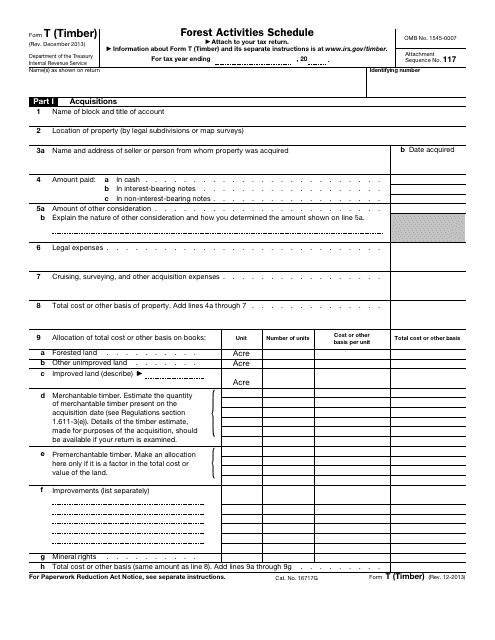

This document for reporting forest activities related to timber to the IRS.

This is a formal statement filled out by the organization that manages certain retirement accounts to inform the recipient of the distribution about the income they generated and report the details to tax organizations.

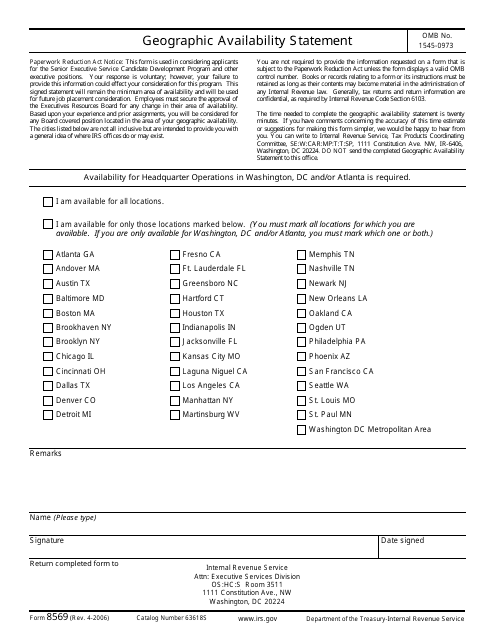

This form is used for providing information about the geographic availability of services provided by an organization to the Internal Revenue Service (IRS).

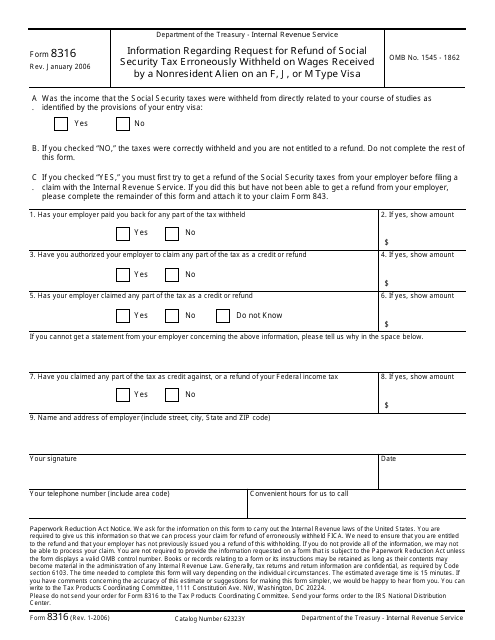

This form is used for providing information regarding a request for refund of social security tax that was mistakenly withheld on wages received by a nonresident alien on an F, J, or M type visa.

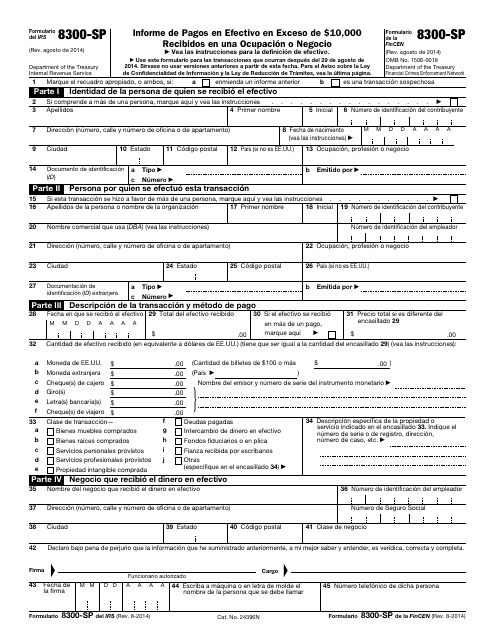

This Form is used for reporting cash payments over $10,000 received in a trade or business. (Spanish)

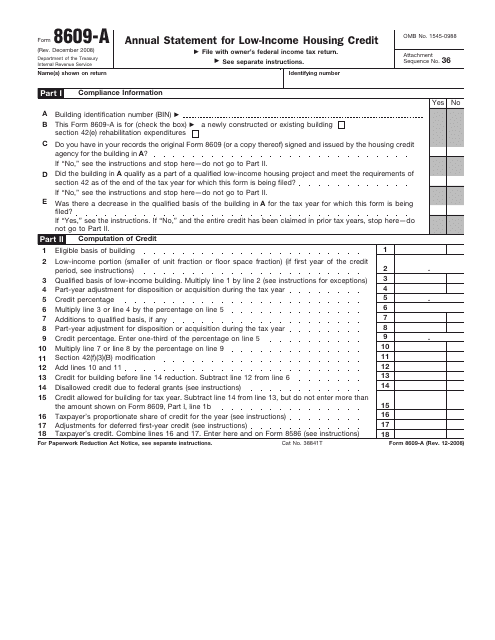

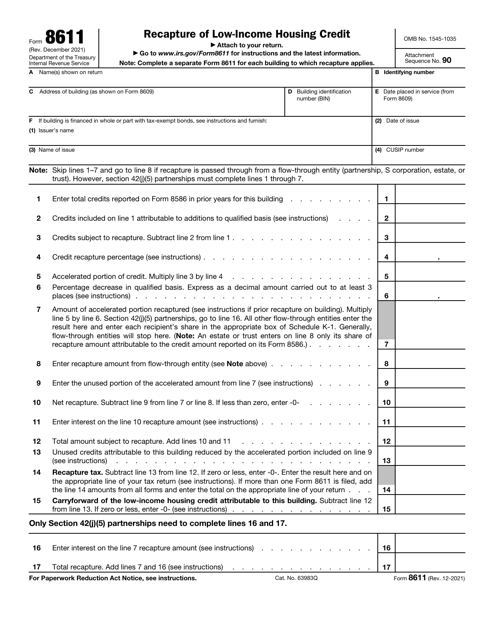

This document is used for reporting the annual statement for the Low-Income Housing Credit, as required by the IRS.

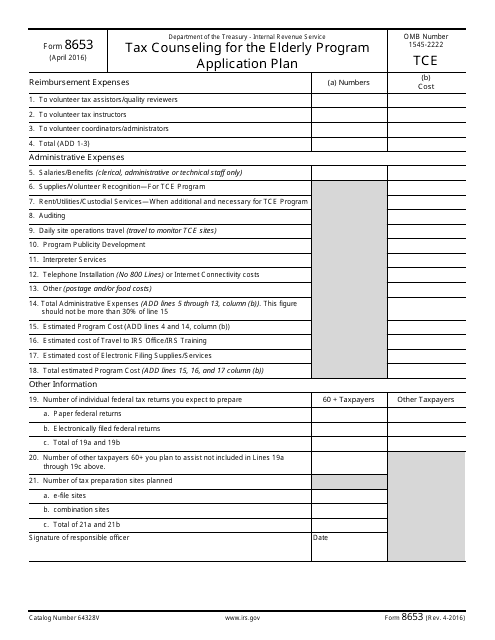

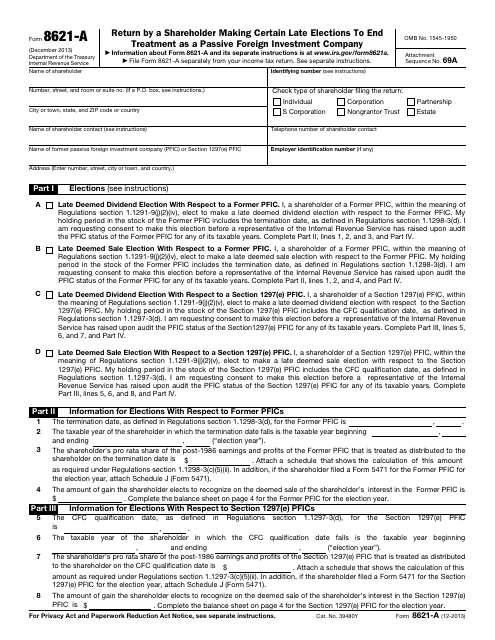

This Form is used for shareholders who need to make certain late elections to end treatment as a Passive Foreign Investment Company.

This document is used to report discrepancies resulting from acquisitions, statutory mergers, or consolidations. It is specific to Form 941, which is used by employers to report employment taxes.

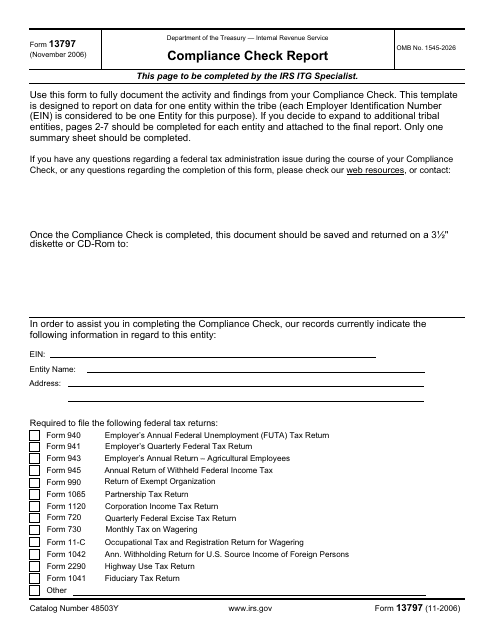

This document is used for reporting compliance checks to the IRS. It helps ensure that individuals and businesses are meeting their tax obligations.

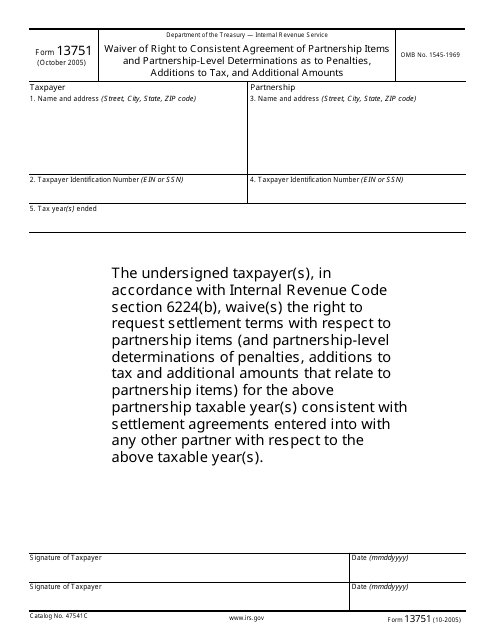

This form is used for waiving the right to consistent agreement on partnership items and penalties.

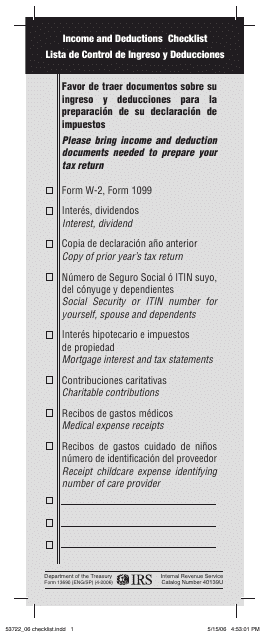

This form is used for checking income and deductions. It is available in both English and Spanish.

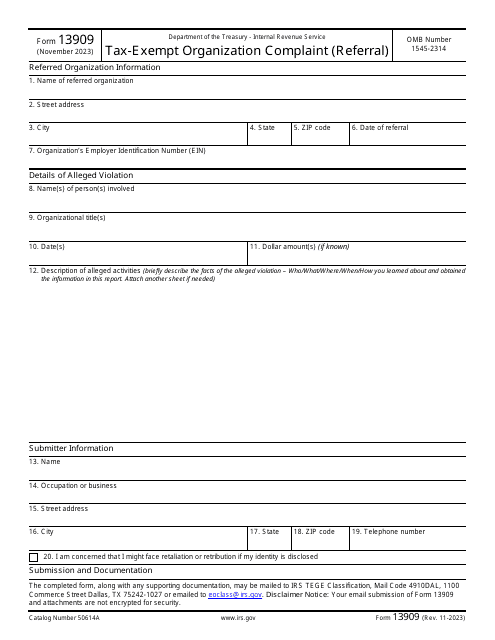

This is a written statement prepared by a concerned individual who believes a tax-exempt organization is violating tax laws.

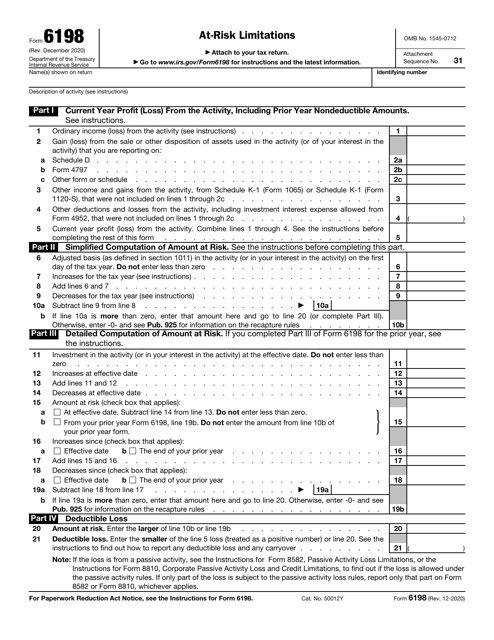

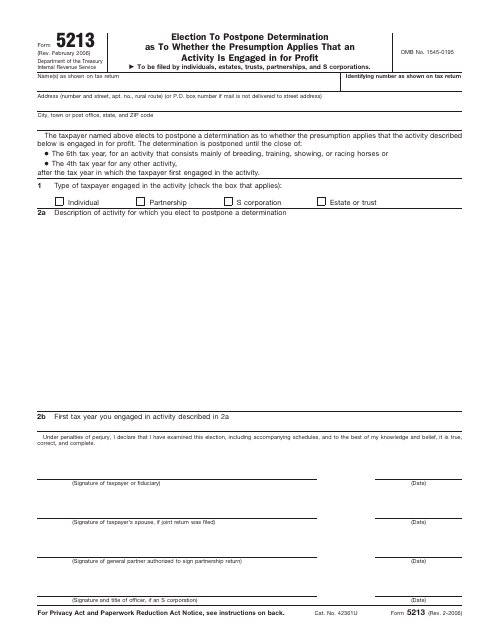

You file this form to ask for a postponement of the determination whether your business is profitable or non-profit. The document is filed by persons, estates, trusts, and S corporations.

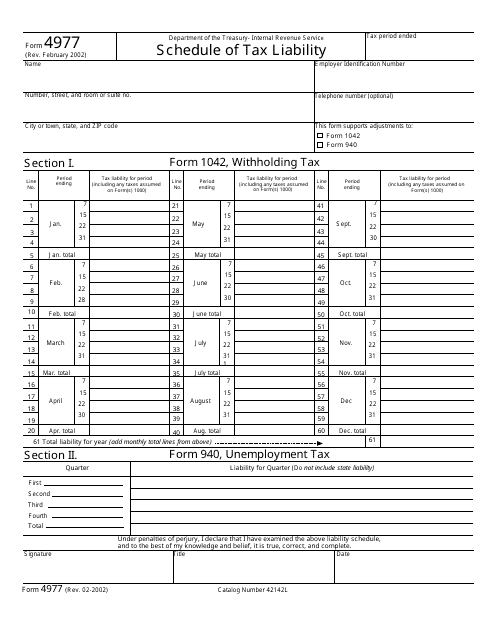

This form is used for reporting tax liability to the Internal Revenue Service (IRS). It provides a comprehensive schedule of the various taxes owed by an individual or organization.