Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

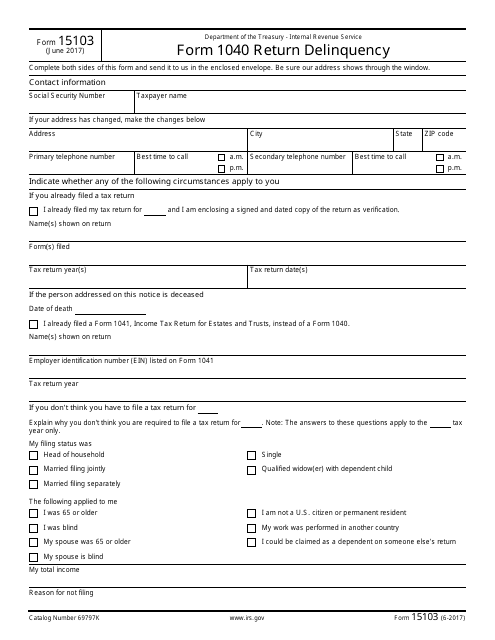

This Form is used for reporting delinquent tax returns to the IRS.

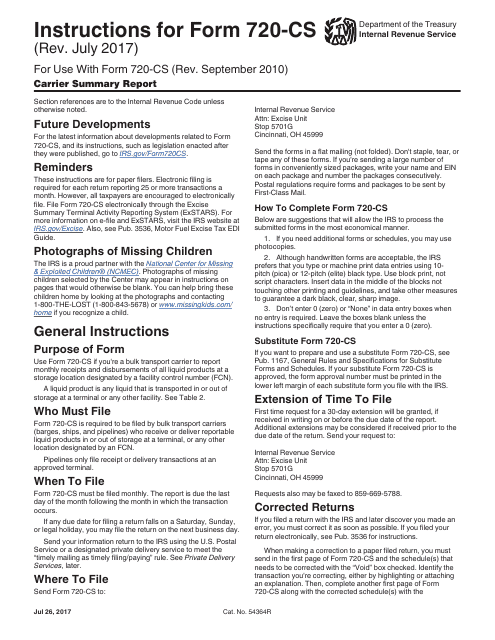

This form is used for providing a summary report of carriers to the Internal Revenue Service (IRS). It includes information such as carrier name, address, and total taxable amounts for various services.

This document is for reporting activities of terminal operators to the IRS.

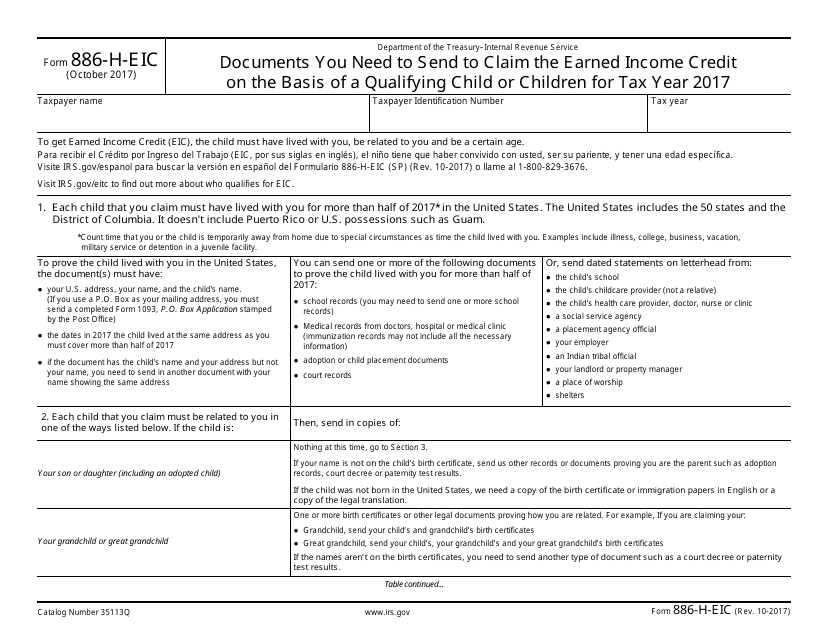

This form is used to provide the necessary documentation required to claim the Earned Income Credit (EIC) based on having a qualifying child or children. It outlines the specific documents that need to be submitted to the IRS in order to support your claim.

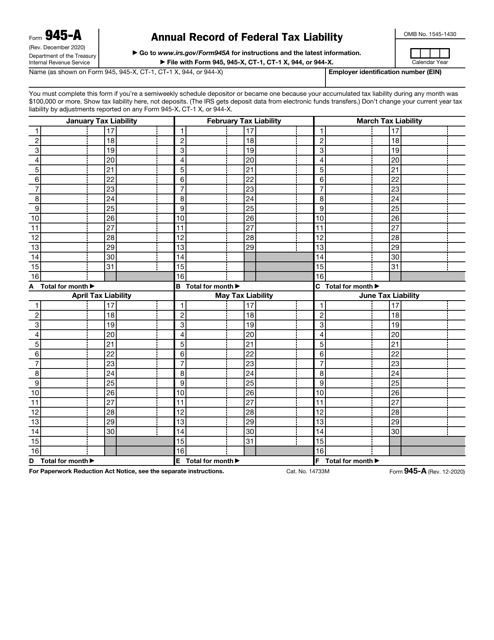

This is a formal document employers use to reconcile their tax liability over the course of the calendar year.

This form is used to report a mortgage interest paid by an individual or sole proprietor during a tax year to the government, in order to receive a mortgage interest deduction on the borrower's federal income tax return.

This is a formal IRS document that outlines the details of a property foreclosure.

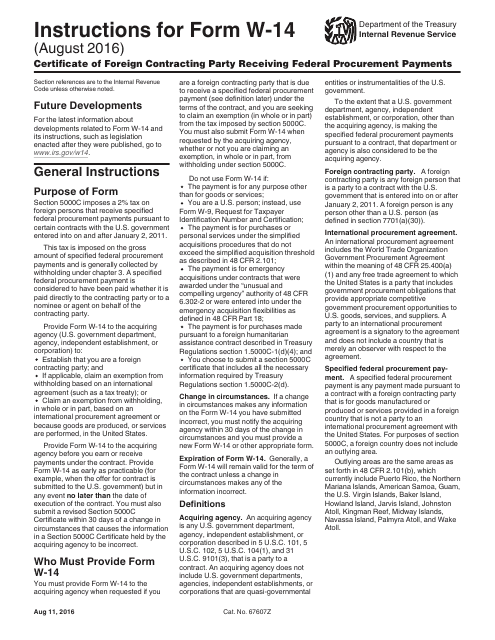

This form is used for reporting information about foreign contracting parties who receive federal procurement payments. It provides instructions on how to fill out the IRS Form W-14 accurately.

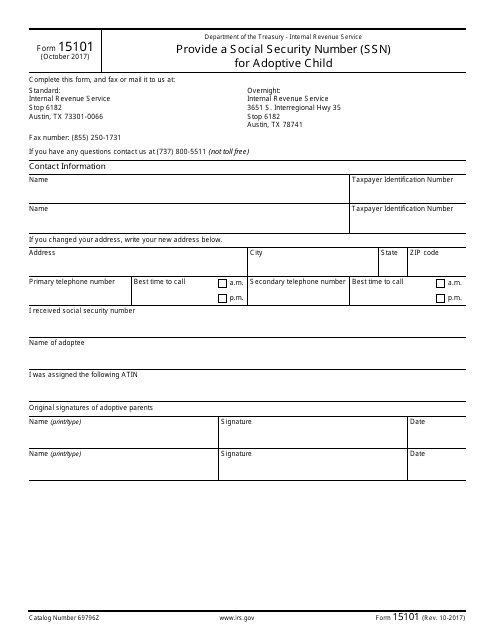

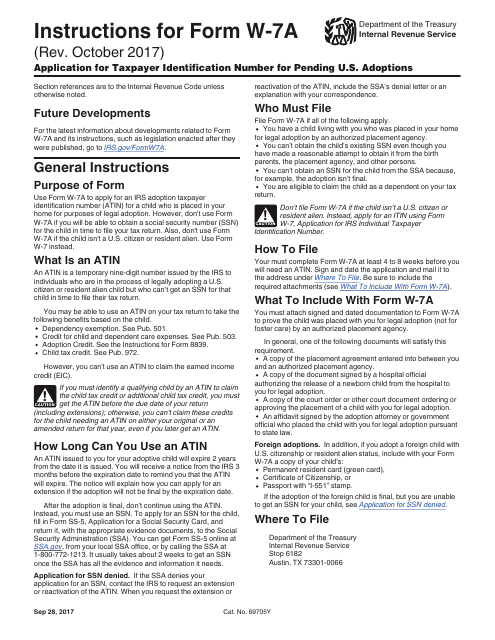

This document is used for applying for a Taxpayer Identification Number for pending U.S. adoptions. It provides instructions on how to fill out the IRS Form W-7A.

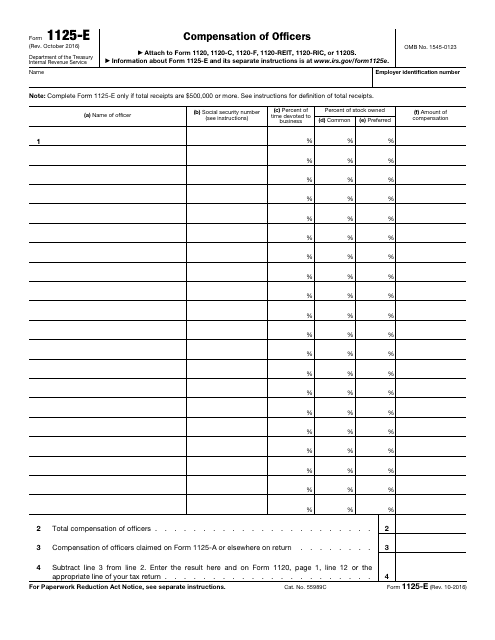

This IRS form is used to provide a detailed report in regards to the deduction for compensation of officers when an entity has $500,000 or more in total receipts.

Download this form if you are an educational institution and need information about qualified tuition and related fees paid during the tax year. The information can be used by the paying student to calculate their education-related tax deductions and credits.

This Form is used for applying to adopt, change, or retain a tax year with the IRS. It is typically used by businesses or organizations that want to align their tax year with their fiscal year or have a specific reason for changing their tax year.

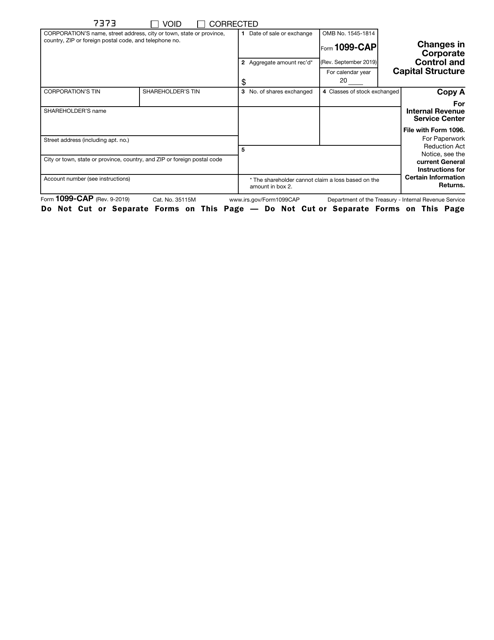

This is a formal IRS document used by entities that charge their customers a commission or fee for handling buy and sell orders to report how much capital gain or loss every client has got.

This form is a fiscal instrument used by creditors to inform their debtors about the debts they canceled over the course of the calendar year.

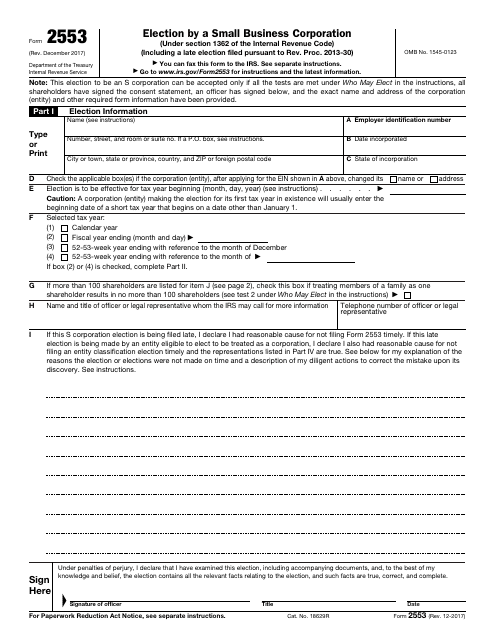

This is a fiscal statement filed by companies that want to be recognized as S corporations.

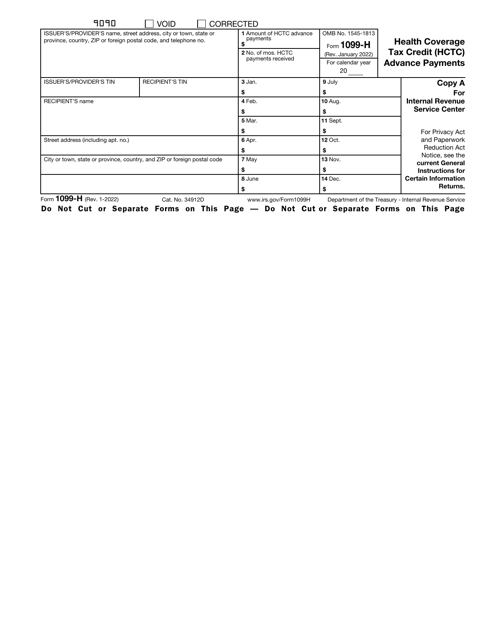

This is an IRS document released for those individuals who got payments during the calendar year of qualified health insurance payments for the benefit of eligible trade adjustment assistance.

This is a detailed form a partnership sends to every partner that participates in joint management of the entity to let the partner determine what to include in their personal tax returns.