Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

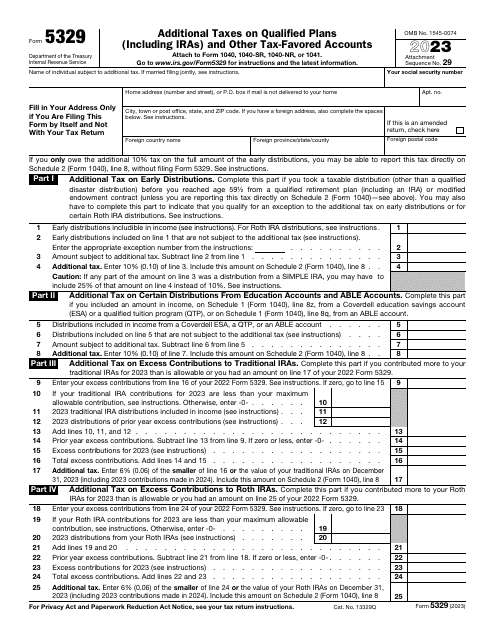

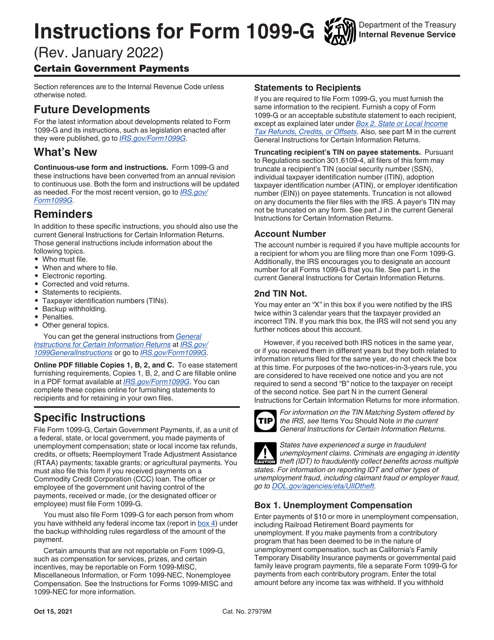

This is a fiscal document individual taxpayers need to prepare and file to demonstrate whether they need to pay the government penalties on education savings plans or retirement plans as well as a percentage of distributions they got throughout the tax year.

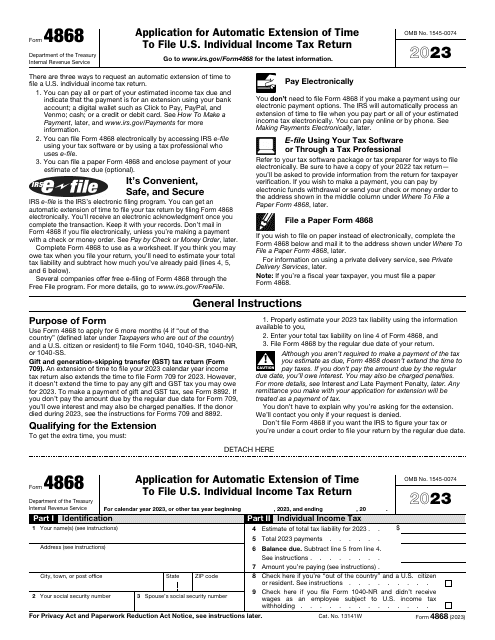

This is an IRS form that needs to be filled out to request an automatic extension to submit income tax return forms.

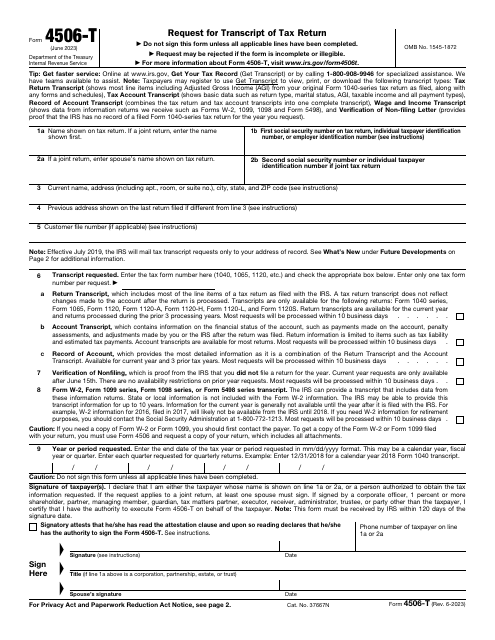

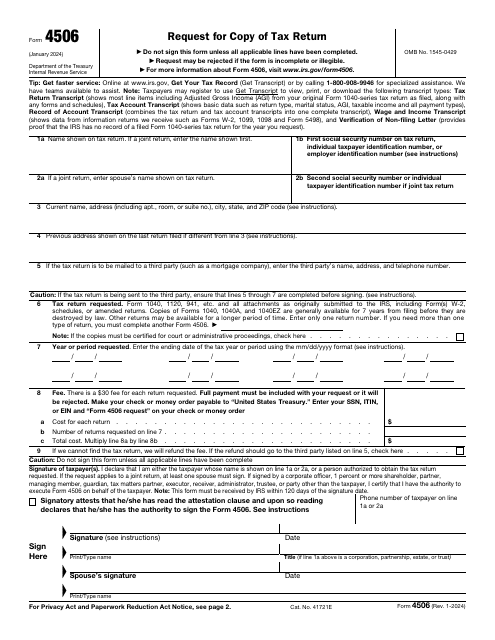

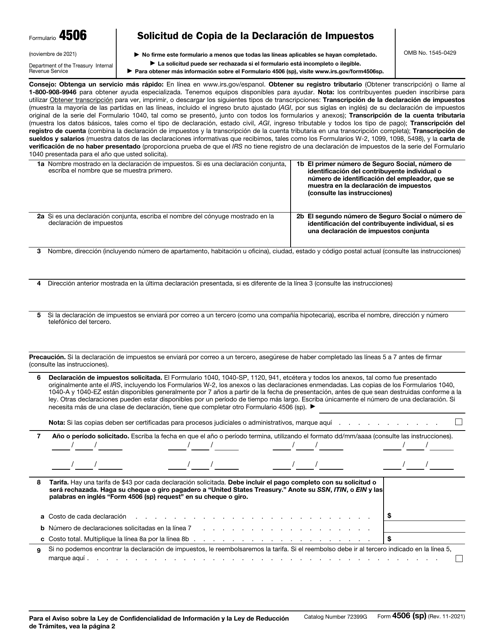

Fill in this form if you would like to request tax return information, such as different types of transcripts, a record of an account, and/or verification of nonfiling.

Use this document as a compilation or a summary information sheet to physically transmit paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G to the Internal Revenue Service (IRS). If you opt to file the forms electronically, you are not required to submit a 1096 transmittal form.

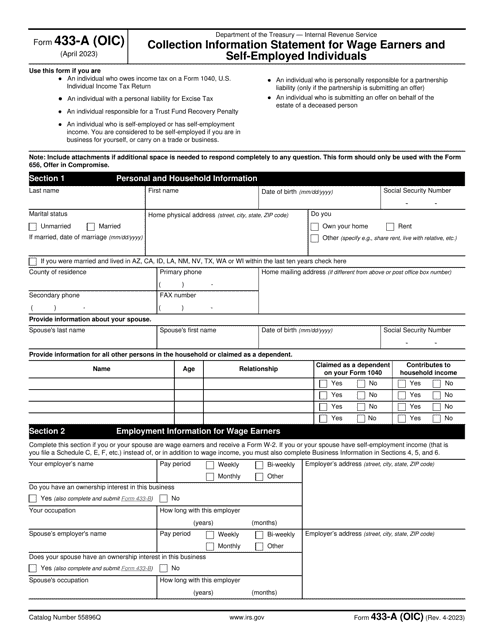

IRS Form 433-A (OIC) Collection Information Statement for Wage Earners and Self-employed Individuals

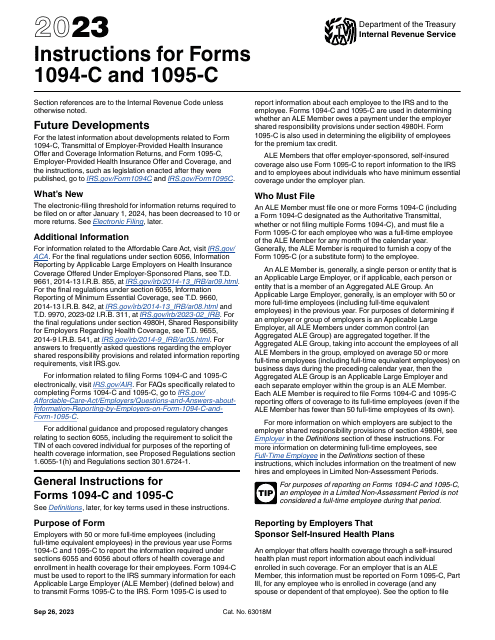

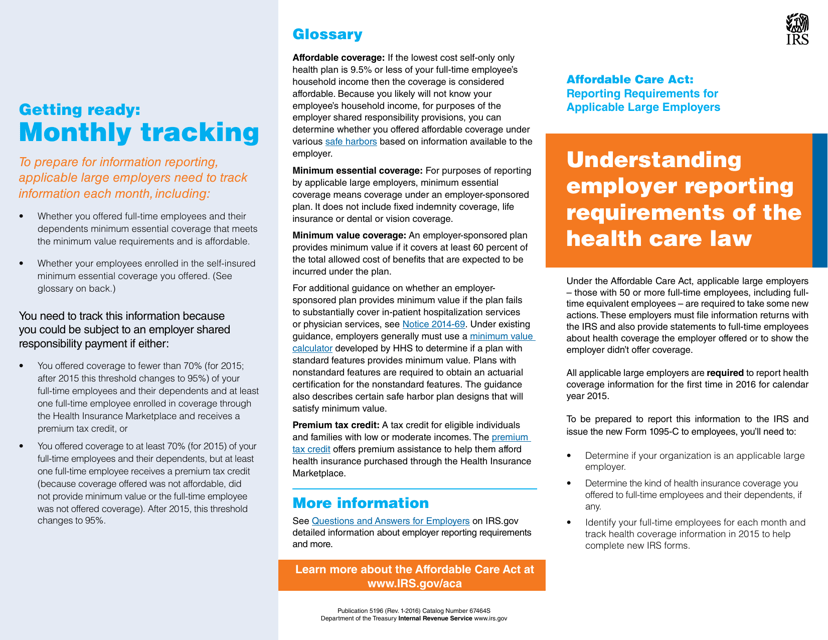

This document outlines the reporting requirements for businesses that are considered "applicable large employers" under the Affordable Care Act. It explains the information that these employers need to provide to the government regarding their health insurance coverage for employees.

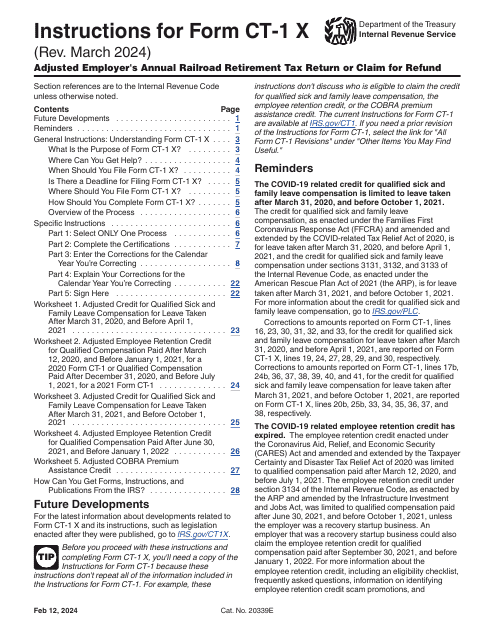

Instructions for IRS Form 941-X Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund

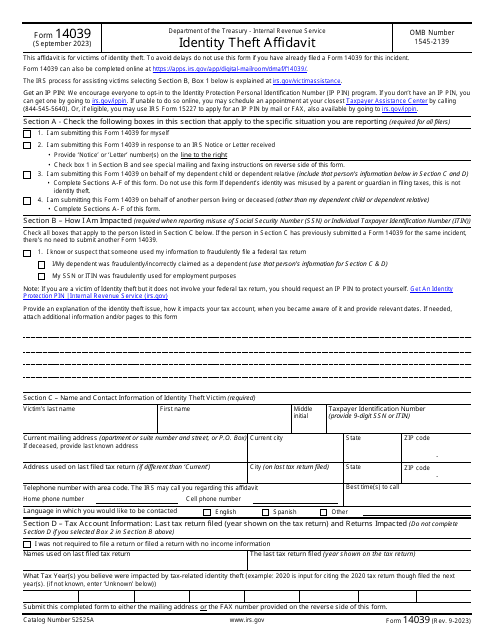

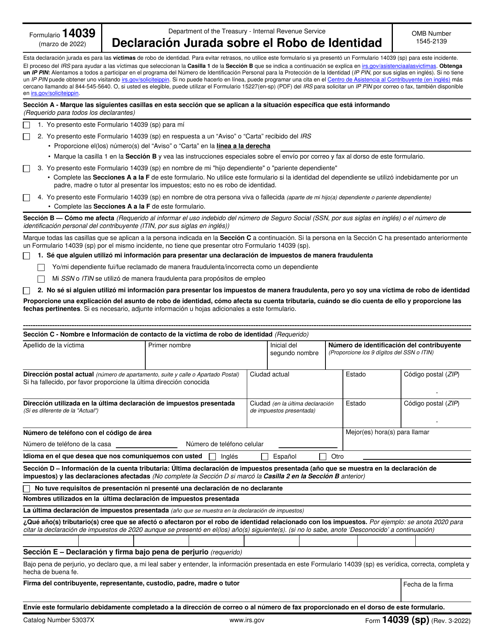

This document is for reporting identity theft to the IRS, and it is in Spanish.

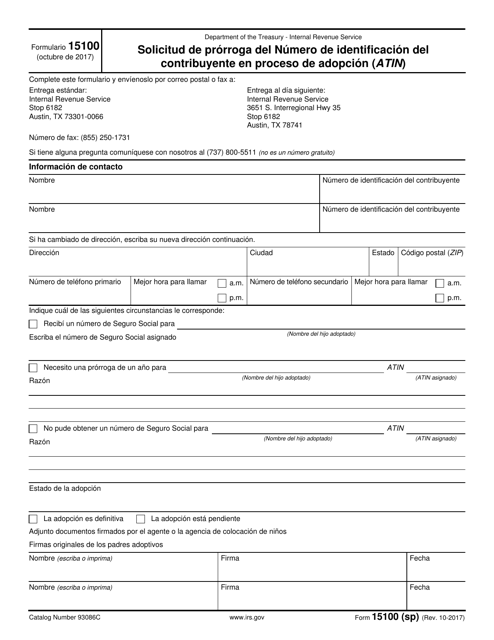

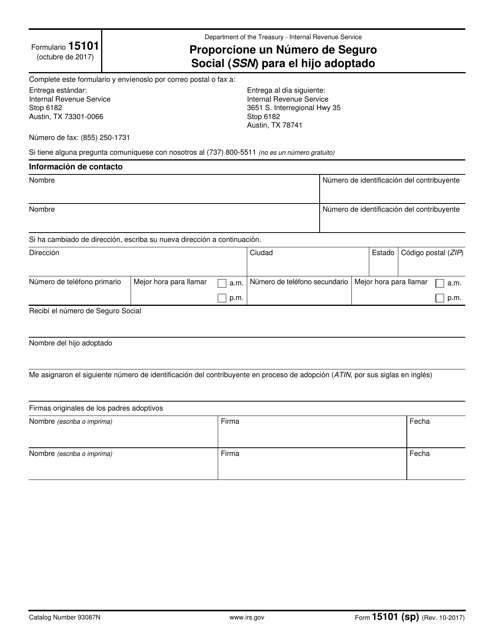

This Form is used for requesting an extension of the taxpayer identification number for individuals in the adoption process.

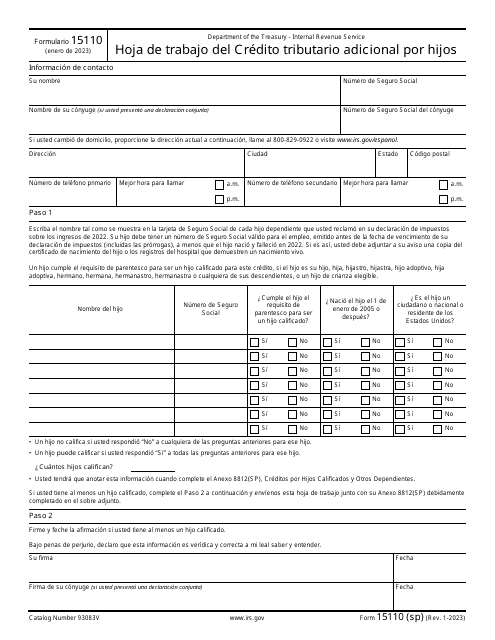

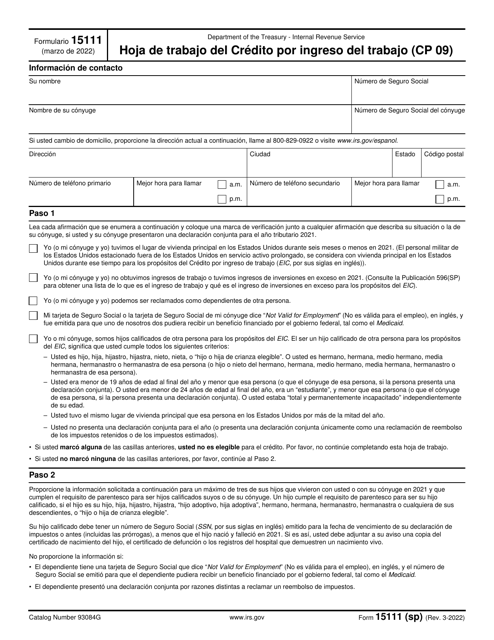

This Form is used for claiming the Earned Income Tax Credit (EITC) on your tax return. It is available in Spanish and is used to calculate the amount of the credit you may be eligible for.

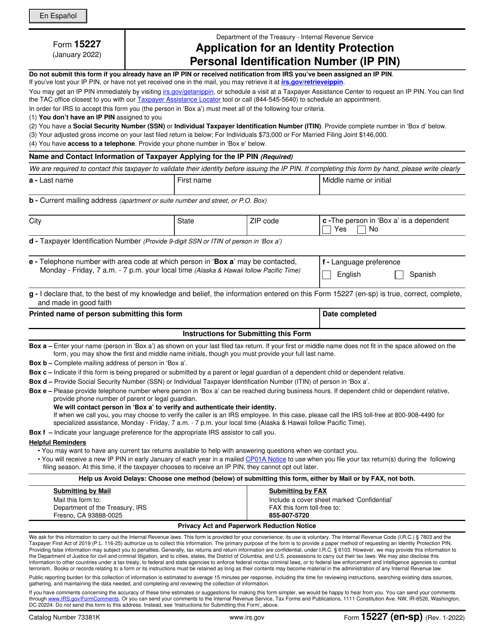

This is a formal document used by taxpayers to request the issuance of a unique identification number they will later use to submit income statements.

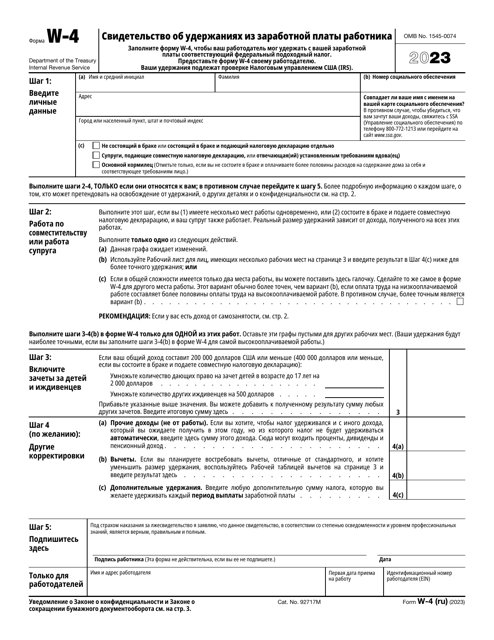

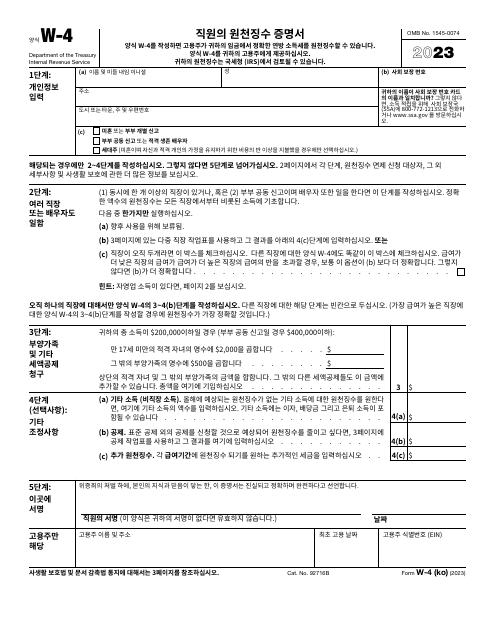

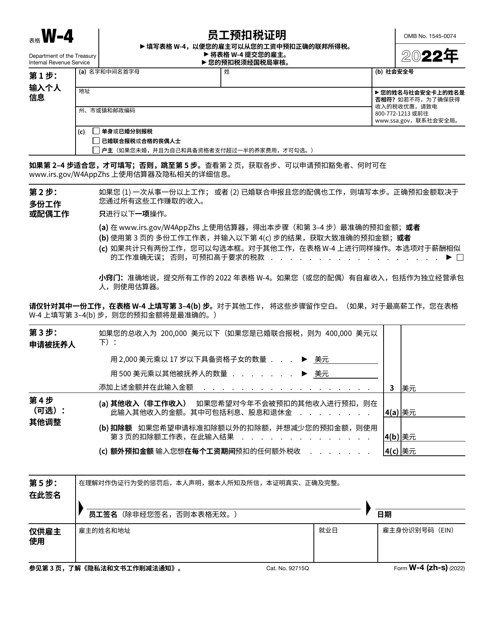

This Form is used for Chinese Simplified version of the IRS Form W-4 Employee's Withholding Certificate. It is used by employees to indicate their tax withholding preferences for income earned in the United States.