Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

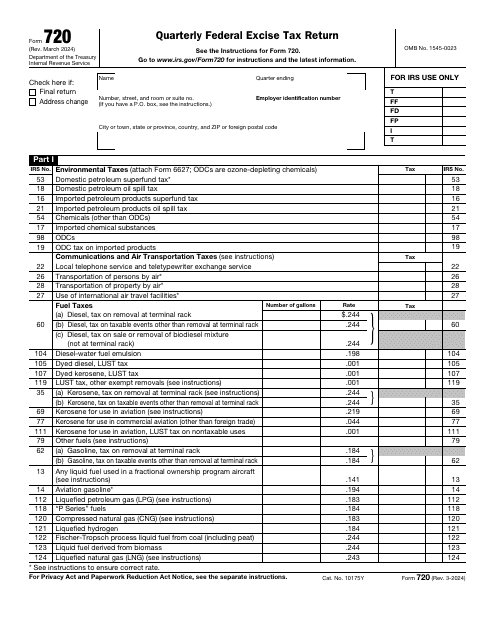

This is a fiscal document used by taxpayers to outline the excise taxes charged on certain services and goods.

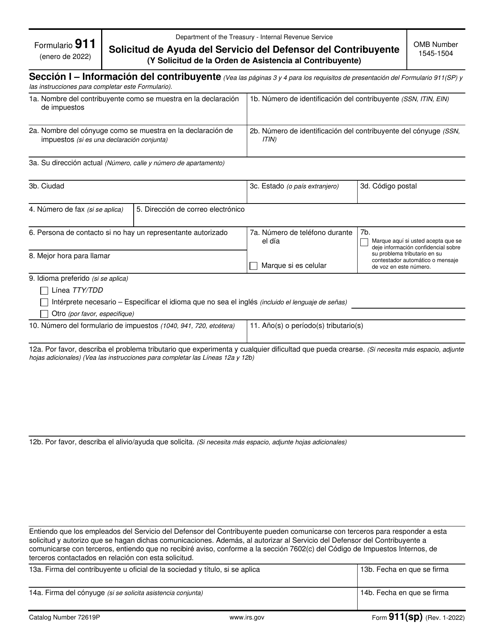

This Form is used for requesting assistance from the Taxpayer Advocate Service (TAS) and requesting an order of assistance for taxpayers who are experiencing significant hardships or have urgent tax issues.

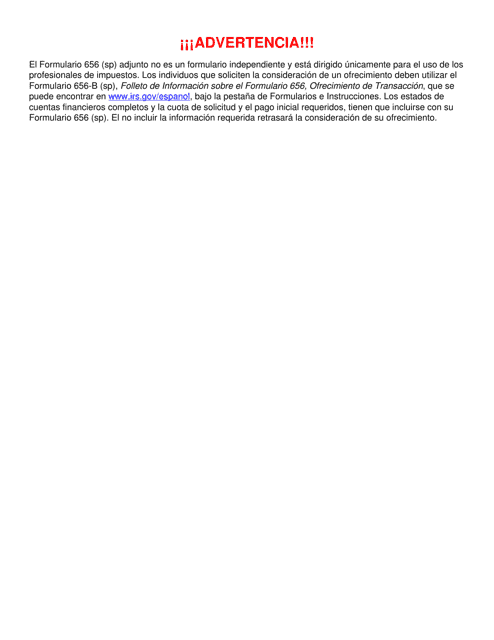

This is a formal document prepared and filed by a taxpayer to clarify the terms of the agreement they wish to enter to settle their tax debt.

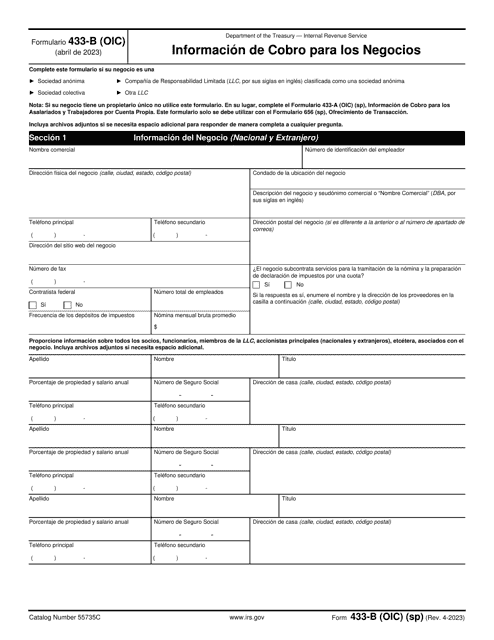

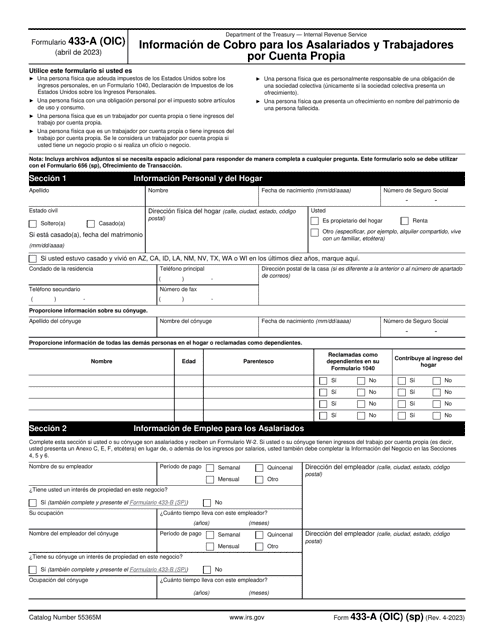

This is a formal IRS document that outlines the financial health of a business entity that owes a tax debt to the government.

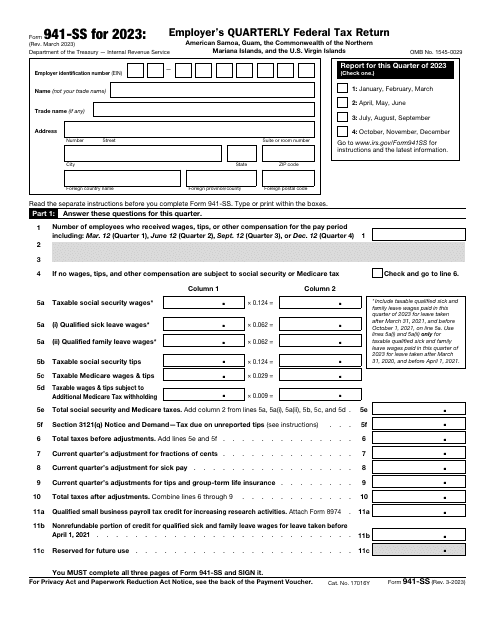

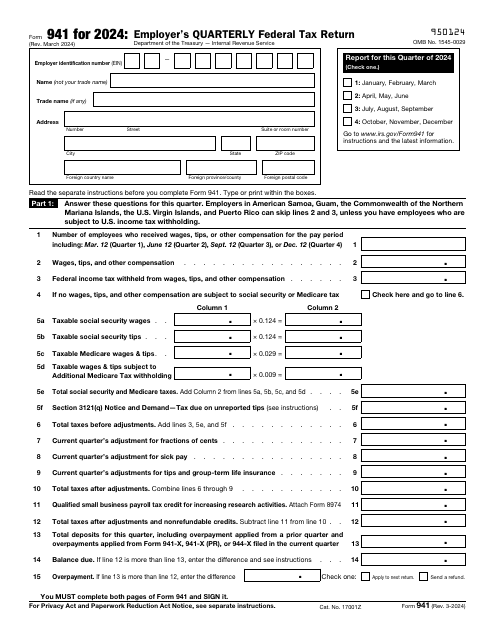

This document, otherwise known as the Employer's Quarterly Federal Tax Return, is a form downloaded to report about your social security and Medicare taxes. This form is used only if the official place of business is located within the specified territories.

This is a formal statement used by companies to tell tax organizations about the salaries and tips their employees have received over the course of the previous quarter and the tax already subtracted from the workers' salaries.

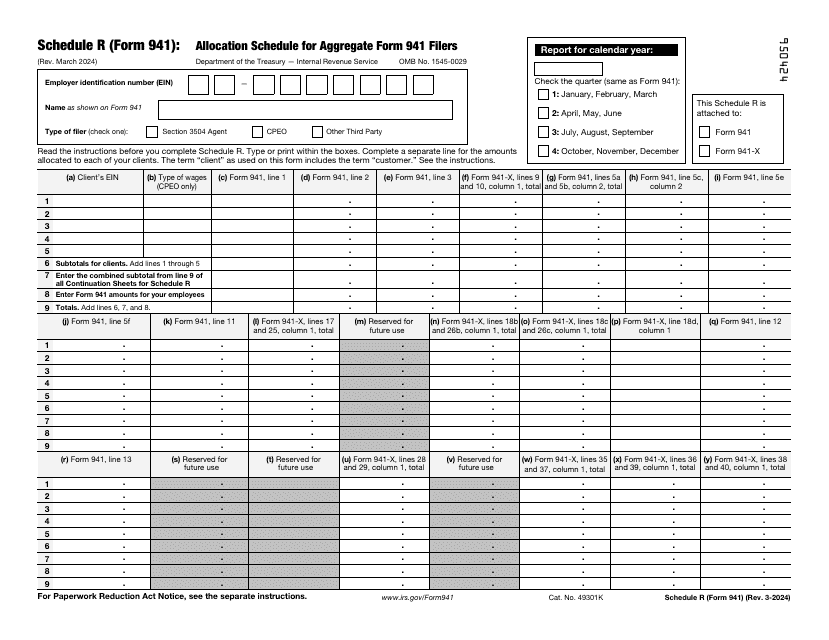

This is a formal instrument used by taxpayers that need to fix the mistakes they have discovered upon filing IRS Form 941, Employer's Quarterly Federal Tax Return.

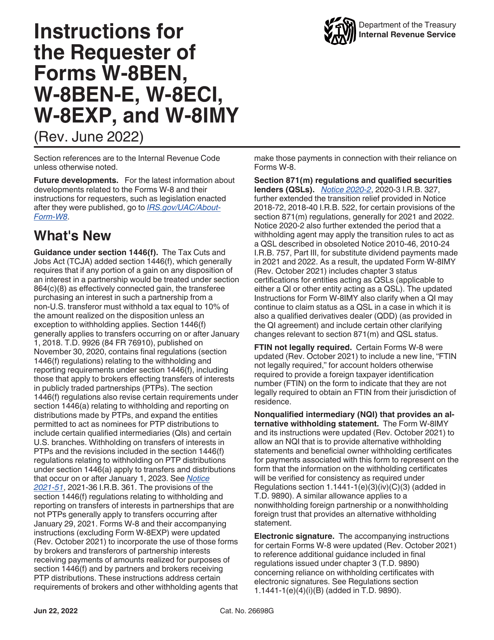

This document provides instructions for individuals or entities requesting Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. It explains how to complete these forms necessary for tax purposes.

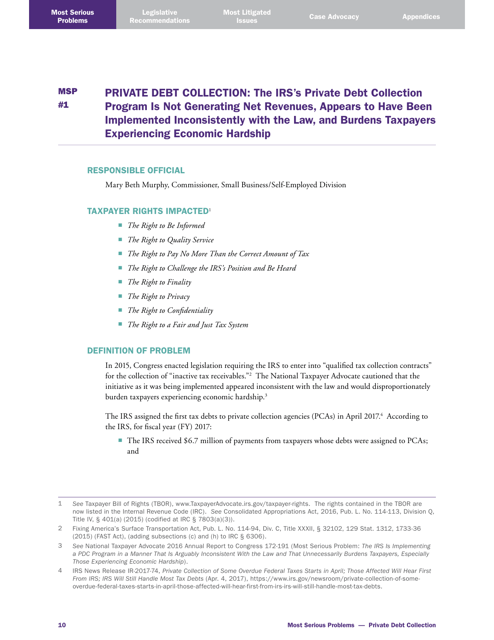

This document provides the Annual Report to Congress from the Taxpayer Advocate Service. It addresses various issues and concerns related to taxpayer rights and offers recommendations for improvement.

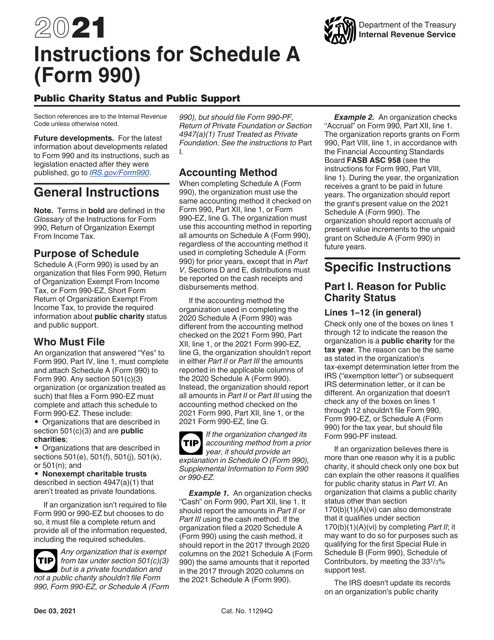

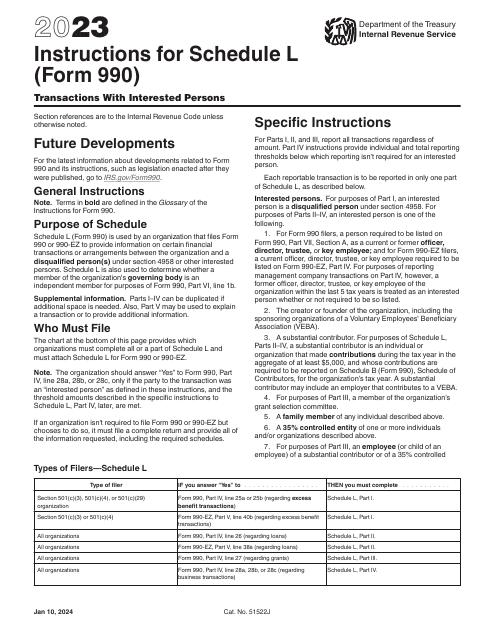

This Form is used for reporting public charity status and public support on the IRS Form 990. It provides instructions on how to complete Schedule A of the form.