Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

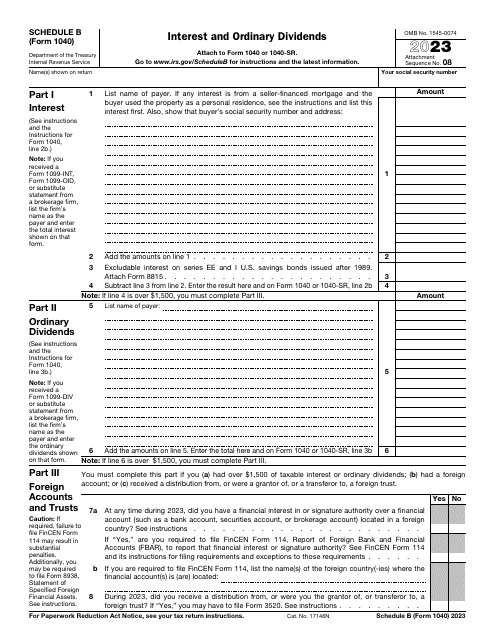

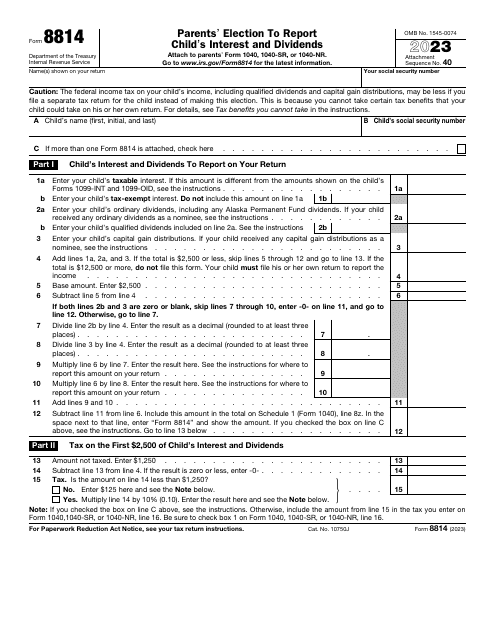

This is a supplementary form individuals are supposed to use to calculate income tax they owe after receiving interest from bonds and earning dividends.

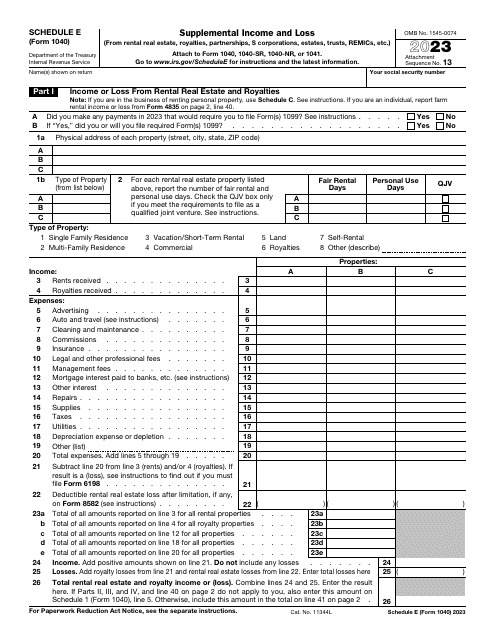

This form is part of the IRS 1040 series, which is used to calculate and submit different types of federal individual income tax returns. File this form to inform the Internal Revenue Service (IRS) about your income and loss from royalties, rental real estate, trusts, and S corporations among others.

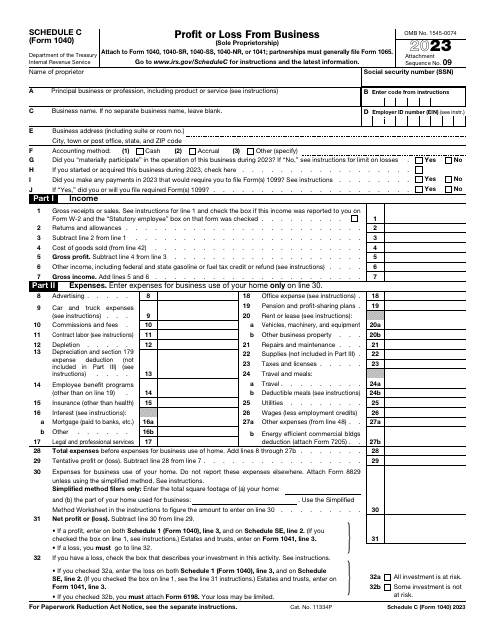

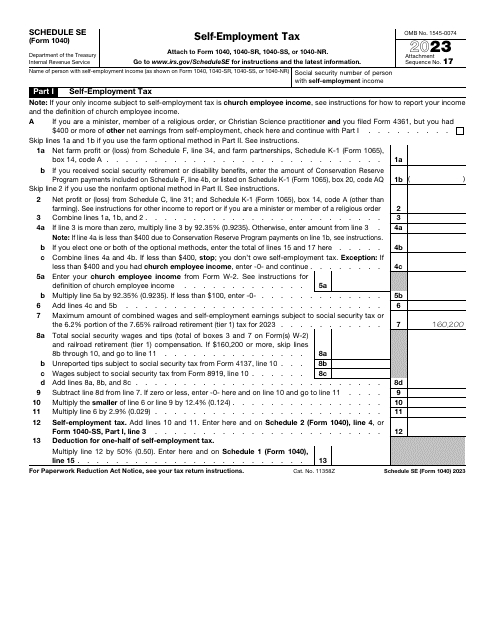

This is an IRS form that contains the breakdown of the self-employment tax the taxpayer figures out after analyzing their net earnings.

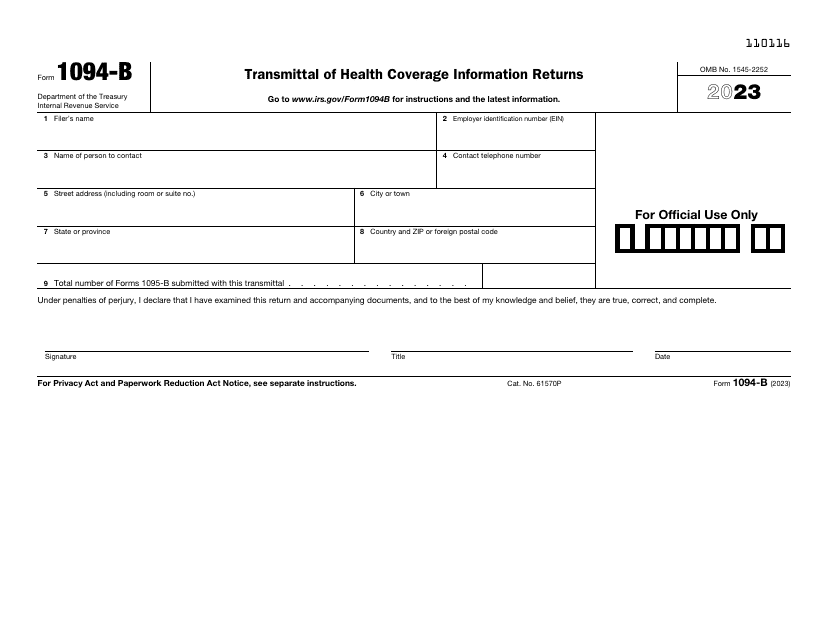

Use this form if you are an insurance provider and wish to inform the IRS about taxpayers who are eligible to receive minimum essential health coverage that meet the standards of the Affordable Care Act.

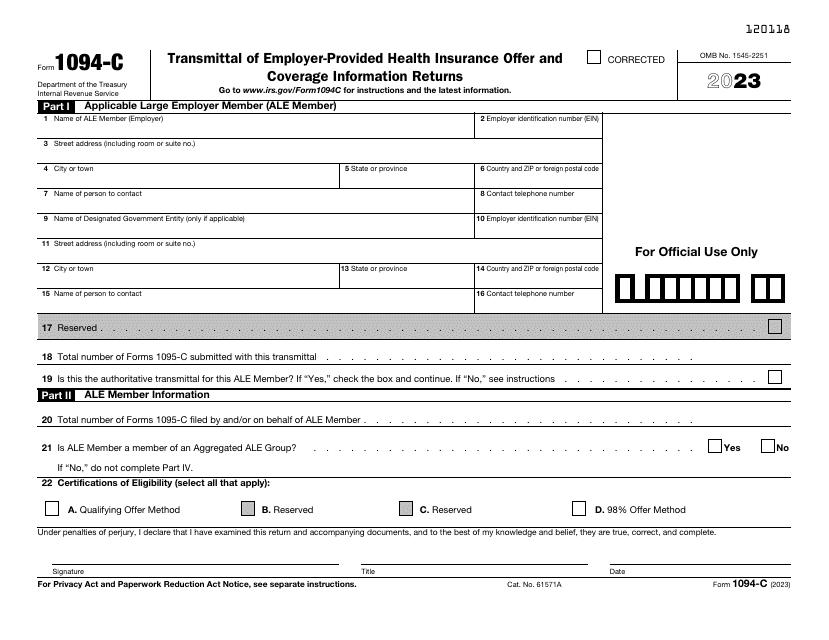

Download these cover sheets in order to report a summary about the Applicable Large Employer (ALE) and to transmit Form 1095-C, Employer-Provided Health Insurance Offer and Coverage to the Internal Revenue Service (IRS).

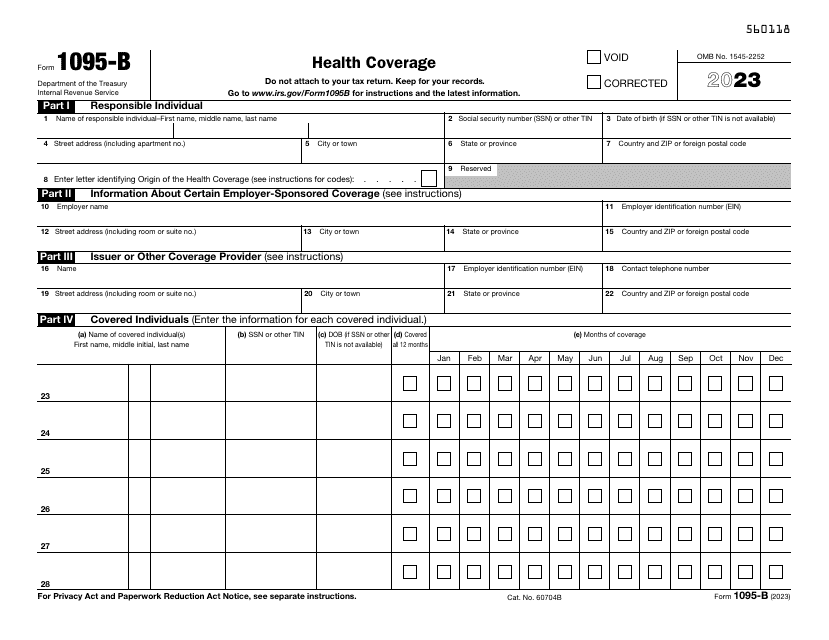

Use this document, otherwise known as the IRS Health Coverage Form, for submitting a report to the Internal Revenue Service (IRS) and to taxpayers about individuals with minimum essential coverage who are not liable for the individual shared responsibility payment.

Download this form to report the interest amount paid on a qualified student loan during the past calendar year in cases when the amount exceeded $600.

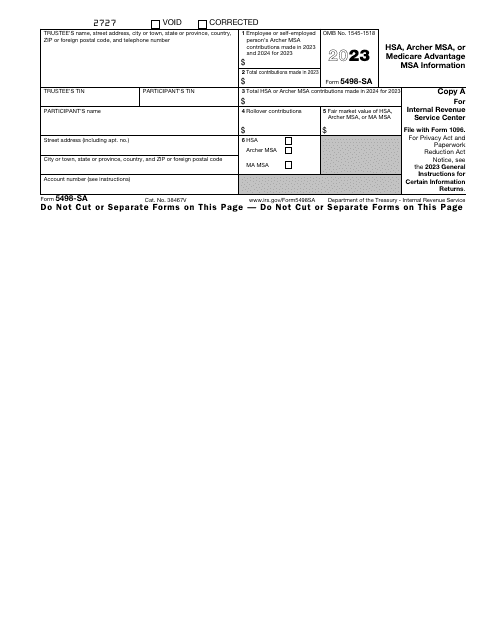

This is a formal document used by particular healthcare-related savings account custodians and trustees to furnish information about the contributions made to those accounts.

This is an IRS form that includes the details of an installment sale.

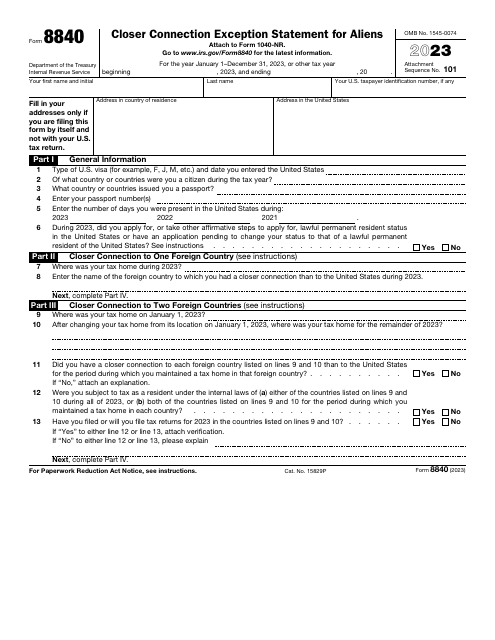

This is an application issued by the Internal Revenue Service (IRS) especially for alien individuals who use it to claim the closer connection to a foreign country exception to the substantial presence test.

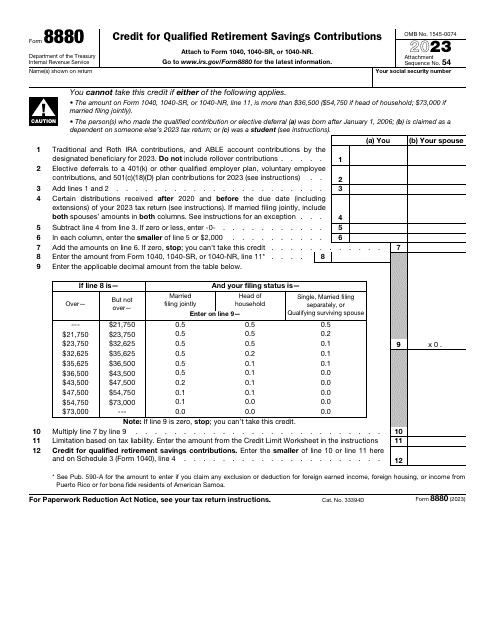

This is a formal instrument that allows individuals to express their intention to receive a saver's credit after contributing money to their retirement savings plans.