Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

This is a document you may use to figure out how to properly complete IRS Form 6765

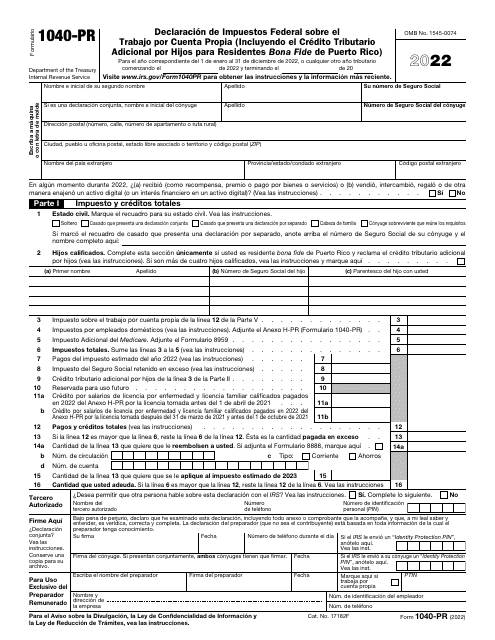

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

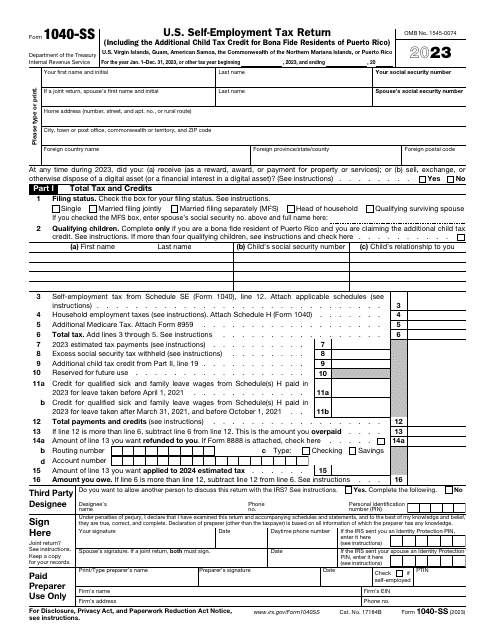

Use this document only if you are a resident of the United States Virgin Islands (USVI), Commonwealth of Puerto Rico, Commonwealth of the Northern Mariana Islands (CNMI), Guam, and American Samoa and wish to report your self-employment net earnings to the United States.

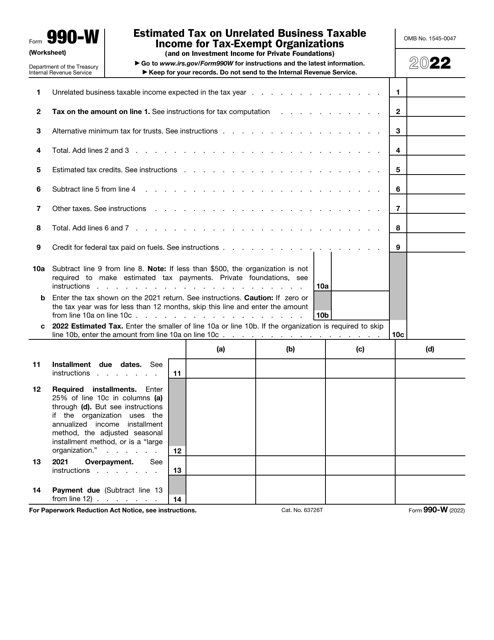

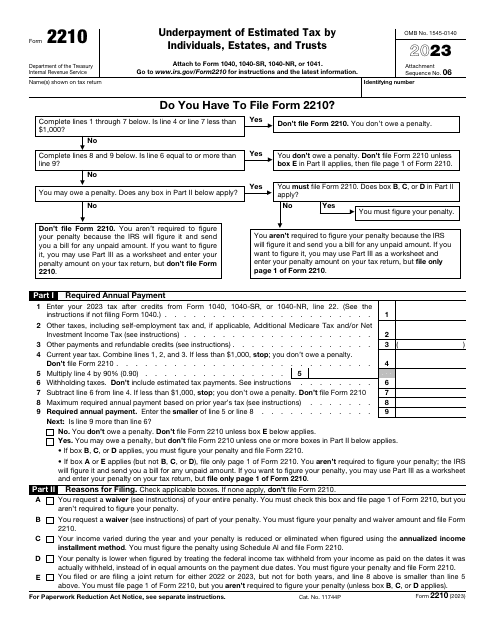

This is a fiscal instrument used by a taxpayer to find out whether they are liable for paying a penalty after underpaying their estimated tax.

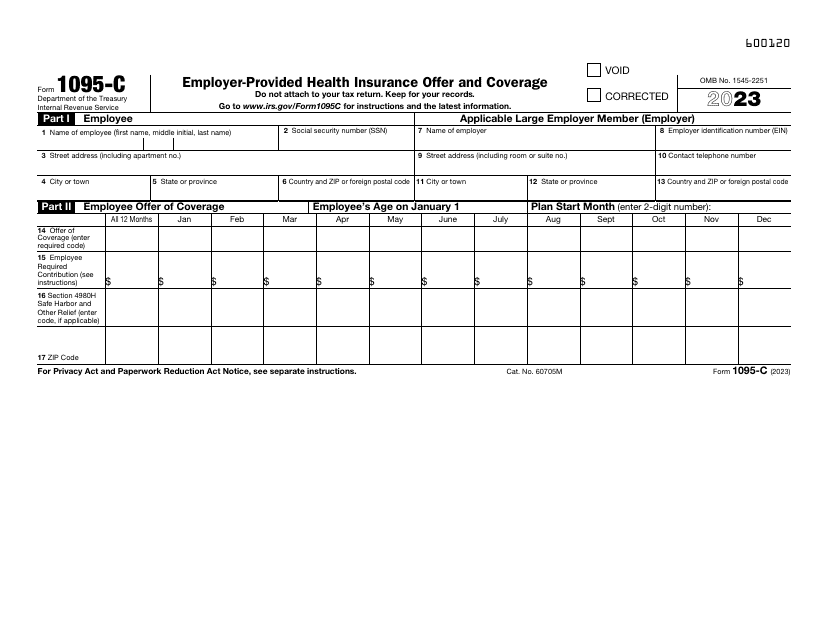

This form is filed by employers with 50 or more full-time employees in order to provide information about their enrollment in health coverage required under sections 6055 and 6056 of the Internal Revenue Code.

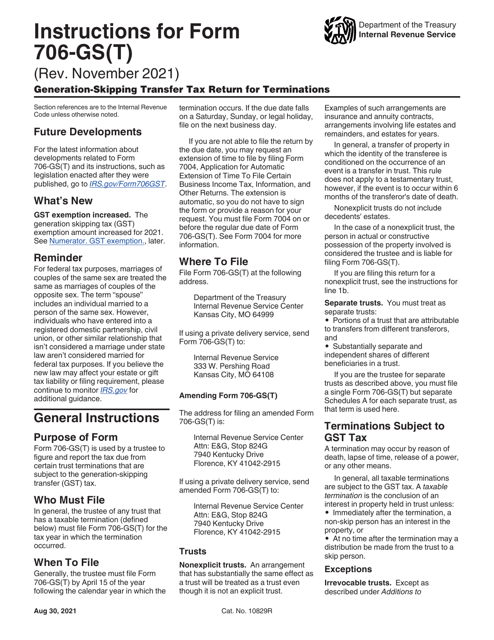

Instructions for IRS Form 709 United States Gift (And Generation-Skipping Transfer) Tax Return, 2023

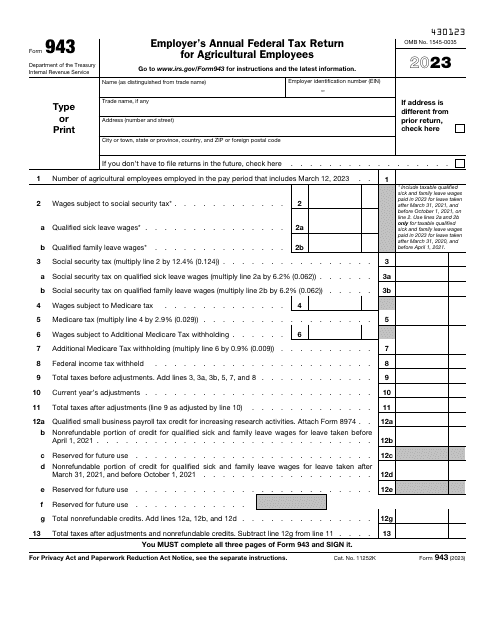

If you paid wages in the reported tax year to one or more farm workers, file this form for your annual federal tax return in case the wages you paid to your farmworkers were subject to the federal income, Medicare, or social security tax withholdings.