Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

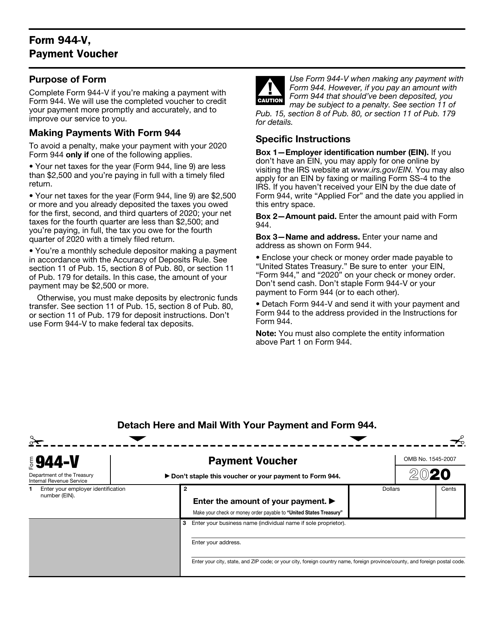

This Form is used for making payments to the IRS for certain small employers. It serves as a payment voucher when submitting payments with Form 944.

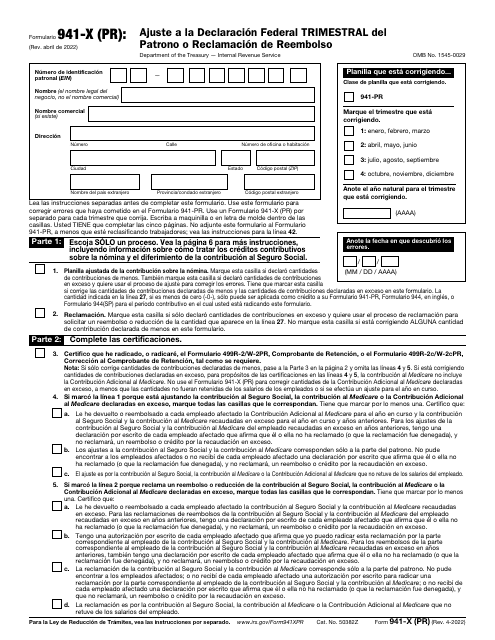

This is a formal instrument used by taxpayers that need to fix the mistakes they have discovered upon filing IRS Form 941, Employer's Quarterly Federal Tax Return.

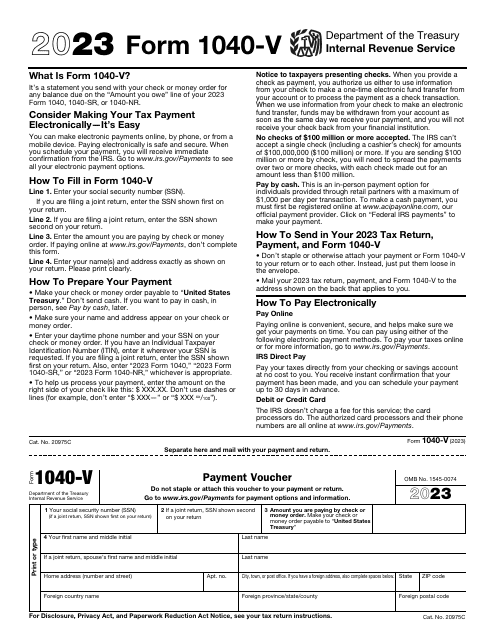

This is a supplementary document completed by taxpayers that chose to fulfill their financial obligations to fiscal organizations with the help of a check or money order.

This form is also known as the healthcare marketplace tax form. It is used to inform the IRS about individuals and families enrolled in a health plan via the Health Insurance Marketplace.

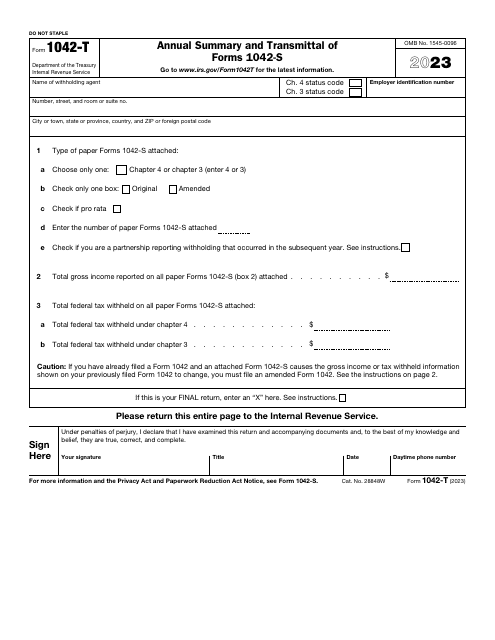

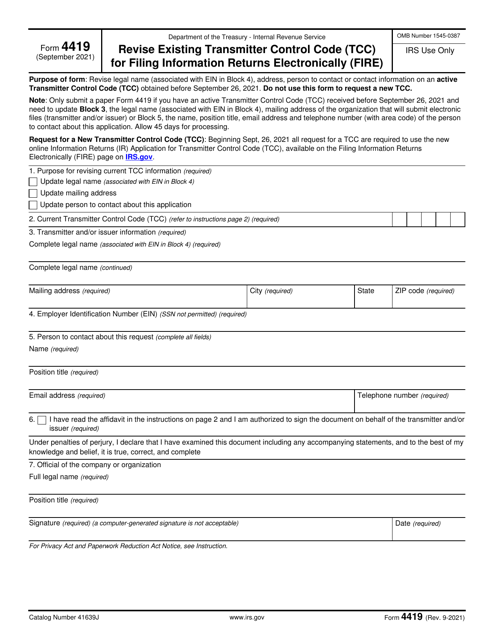

This is a formal IRS statement prepared and submitted by taxpayers that have active Transmitter Control Codes.

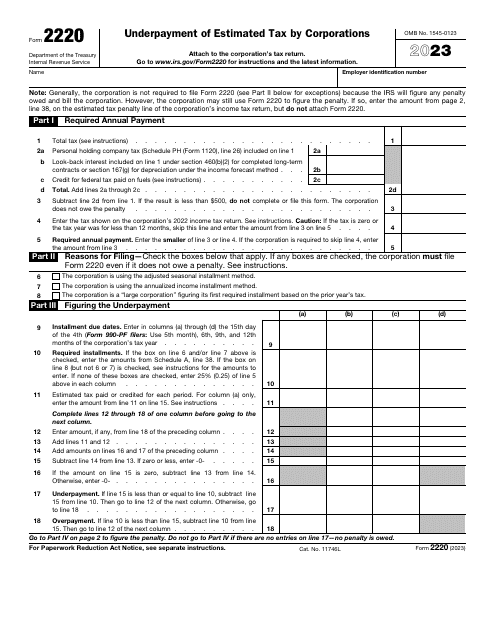

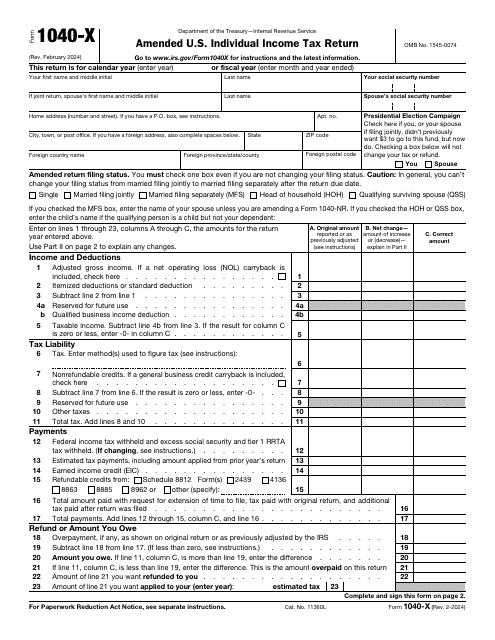

This document is used for correcting records on your tax return form. A separate form is used every year for which information is changed. Do not submit this document to request a refund of interest and penalties, or addition to the tax you have already paid.

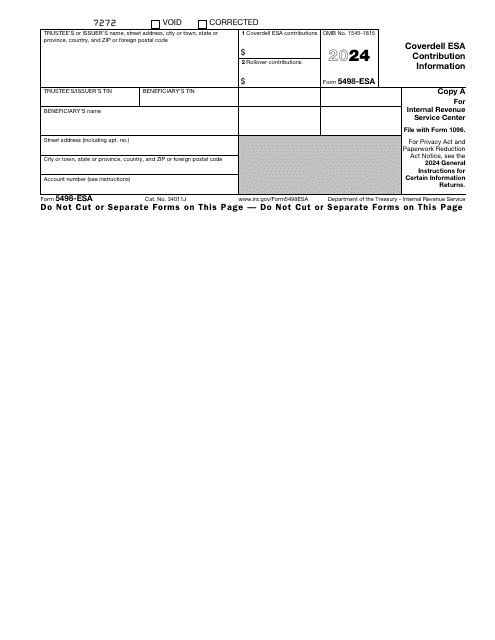

This is a fiscal document completed by a taxpayer to describe their financial contributions to the qualified education expenses of other people.

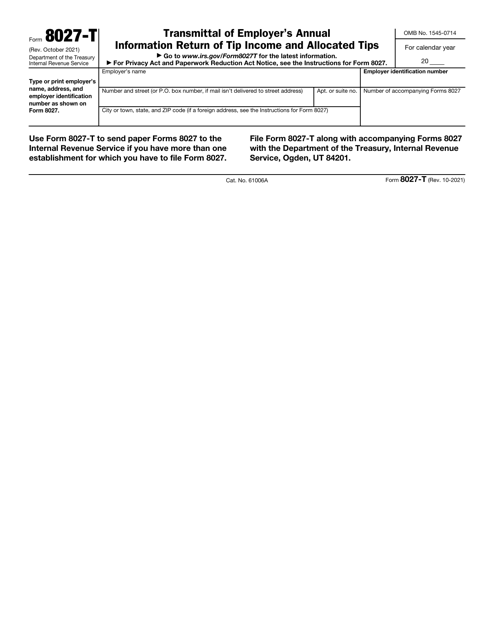

IRS Form 8027-T Transmittal of Employer's Annual Information Return of Tip Income and Allocated Tips

Download this supplemental form if you are an employer who owns one or more food or beverage establishments and wishes to submit Form 8027 in a paper format.

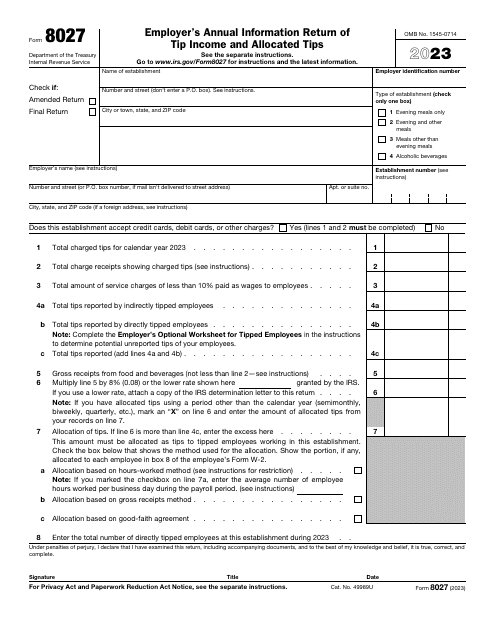

Every year, this form is filled out by employers wishing to report to the Internal Revenue Service (IRS) the receipts and tips their employee received, as well as to determine allocated tips.

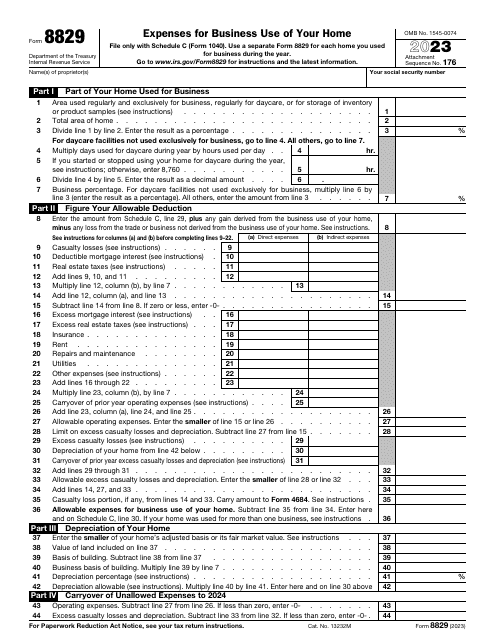

This is an IRS form used by taxpayers who work from home and want to inform tax organizations about the business expenses they wish to deduct from their taxes.

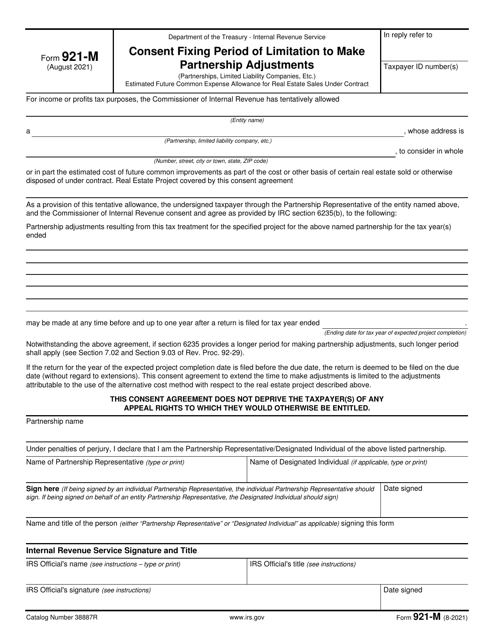

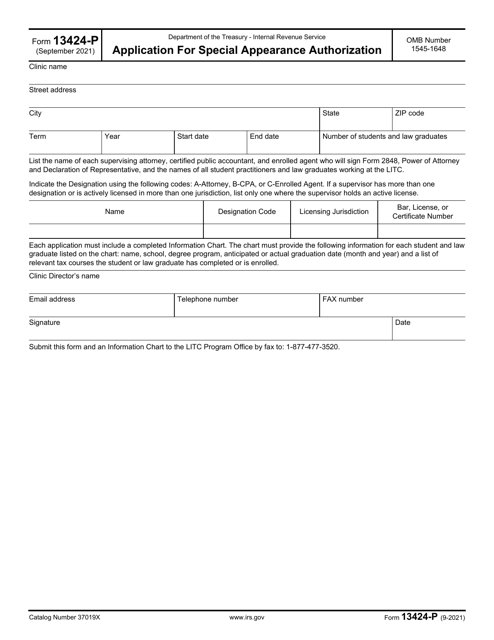

This Form is used for applying for Special Appearance Authorization with the IRS.