Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

This Form is used for state and local government entities to assess their retirement plan coverage compliance.

This form is used for state and local government entities to complete a self-assessment of their compliance with social security coverage requirements.

This document is used for public employers to assess compliance with employee or independent contractor classification rules.

This document is used for filing a civil rights complaint in the Chinese language with the IRS.

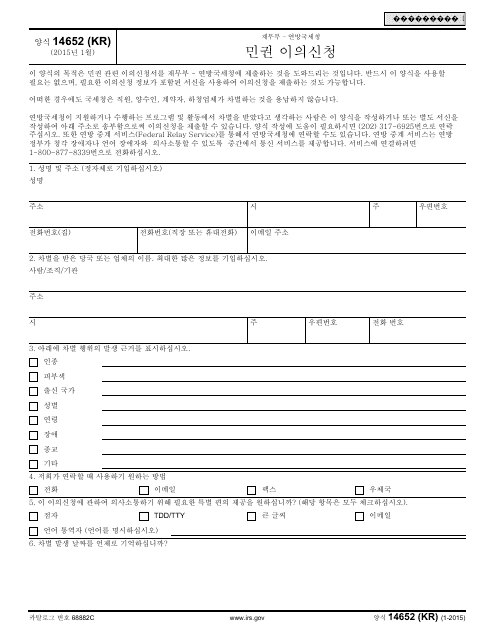

This form is used for filing a civil rights complaint with the IRS, specifically for individuals who prefer to fill it out in Korean.

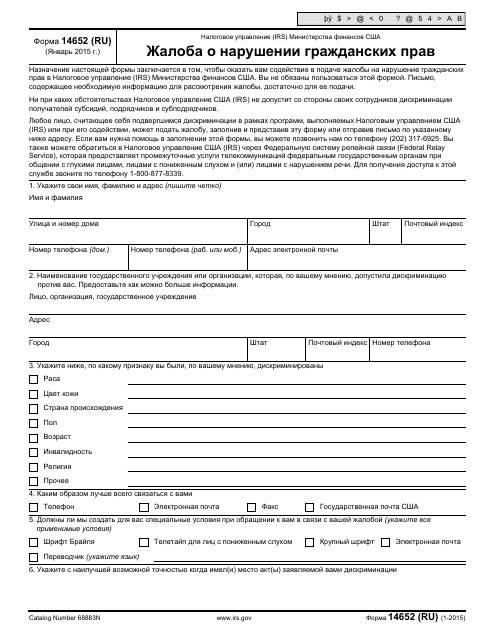

This document is used for filing a civil rights complaint in Russian with the Internal Revenue Service (IRS).

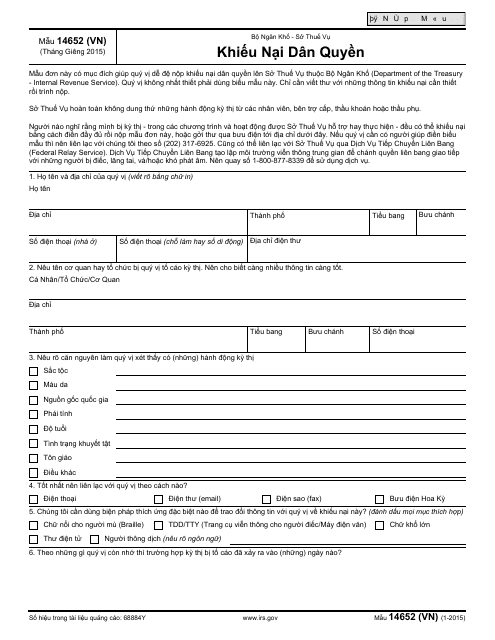

This document is a civil rights complaint form in Vietnamese for the IRS. It is used to file a discrimination complaint related to civil rights violations.

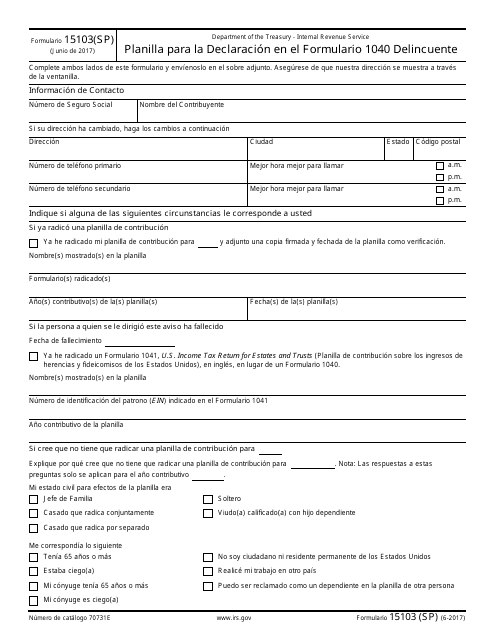

This Form is used for filing a tax return for individuals who have committed a crime and need to declare their income on Form 1040. (Spanish)

This is a fiscal document completed by a taxpayer to describe their financial contributions to the qualified education expenses of other people.

This is an IRS form that includes the details of an installment sale.

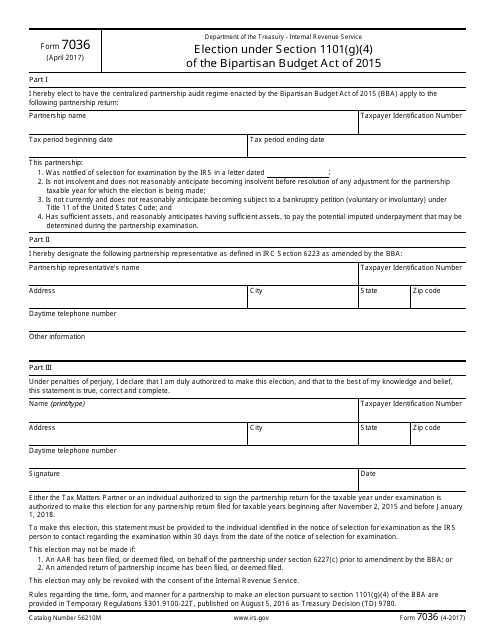

This form is used for making an election under Section 1101(G)(4) of the Bipartisan Budget Act of 2015.

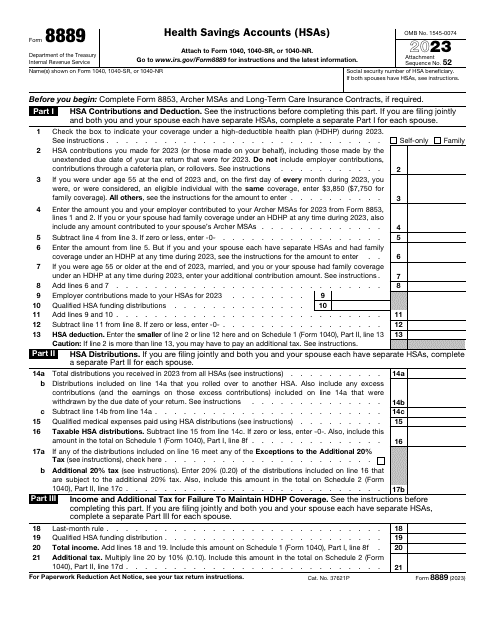

This is a formal instrument used by taxpayers to clarify how much investment income they have received and to figure out the amount of supplementary tax they have to pay.

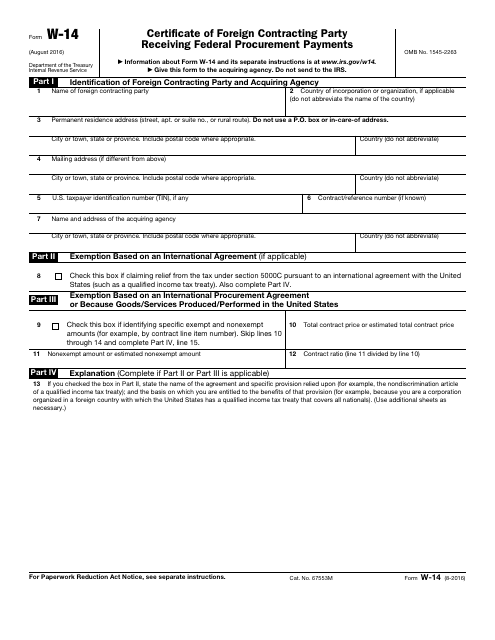

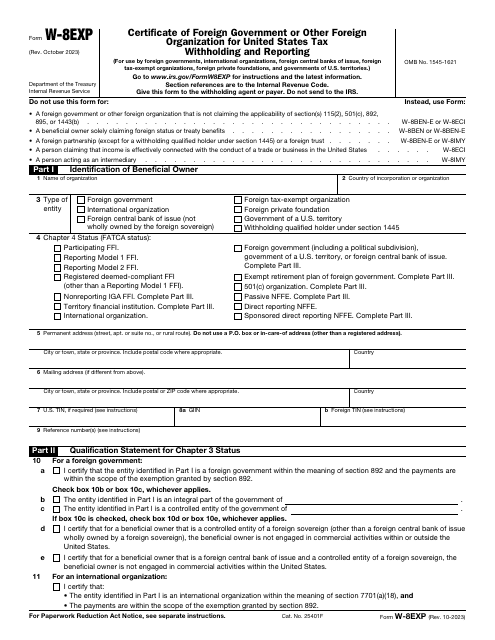

This document is used for reporting information about a foreign contracting party that receives payment for federal procurement contracts.

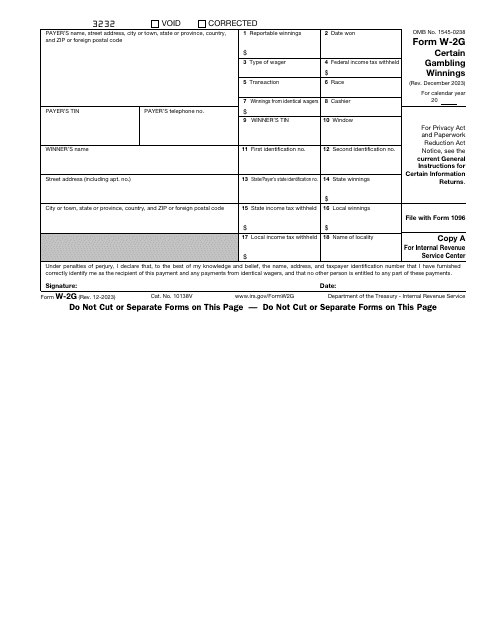

This is a formal report filed by gambling facilities to outline the winnings of their clients and certify they deducted taxes from the sum of money won.

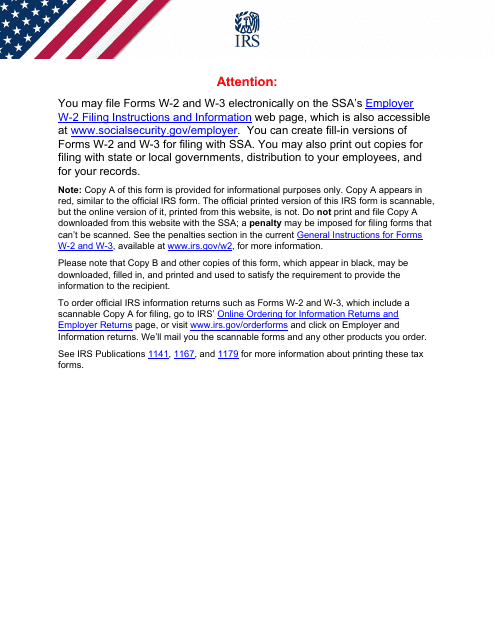

If you are an employer and have to file Form W-2, Wage and Tax Statement, you need to fill out this form. This form is needed for transmitting a paper Copy A of Form W-2, to the SSA. Make sure you supply your employees with a copy of Form W-2.

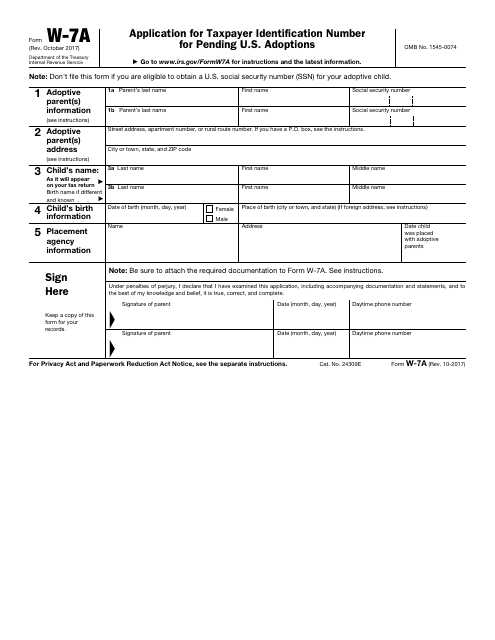

This form is used for applying for a taxpayer identification number for pending U.S. adoptions. It is required to establish the adoptive parent's identity for tax purposes.

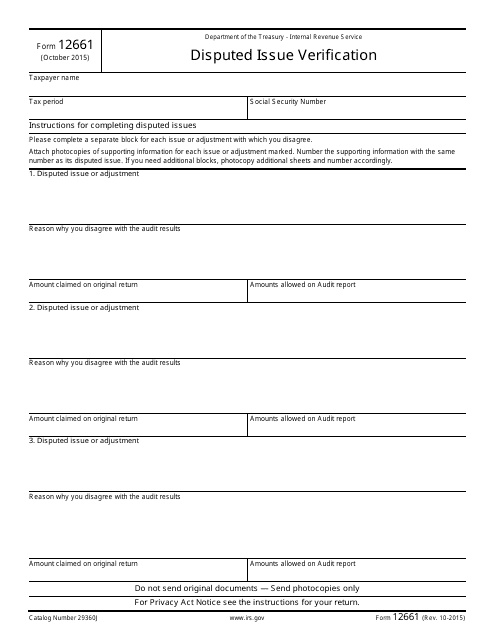

This document is used for verifying disputed issues with the Internal Revenue Service (IRS). It helps individuals and businesses provide evidence and documentation to support their claims and resolve disputes with the IRS.

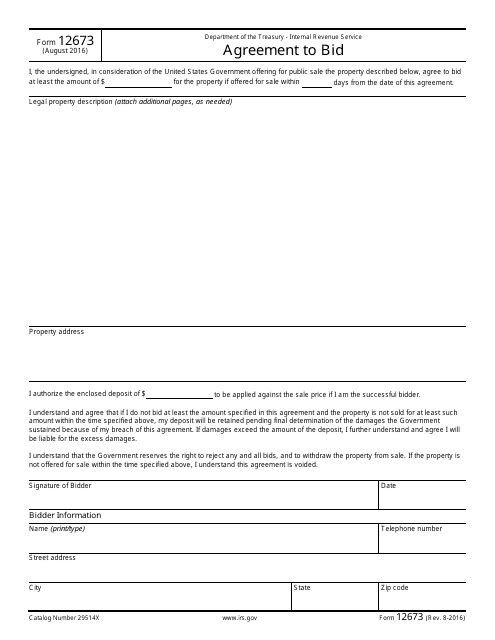

This form is used for taxpayers who want to enter into an agreement with the Internal Revenue Service (IRS) to participate in an auction or bidding process.

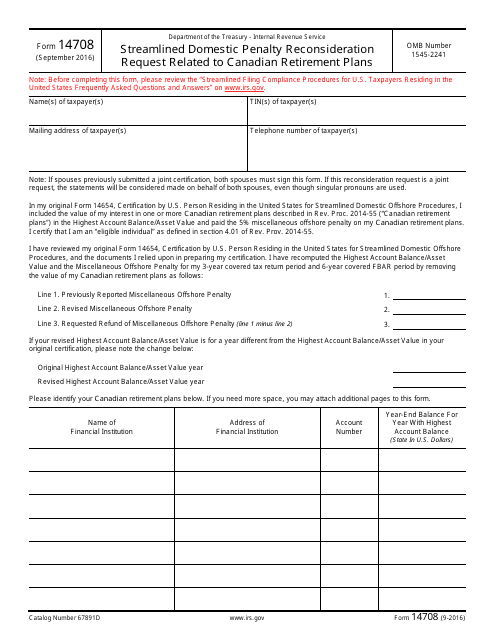

This document is used for requesting a reconsideration of penalties related to Canadian retirement plans under the Streamlined Domestic Offshore Procedures.

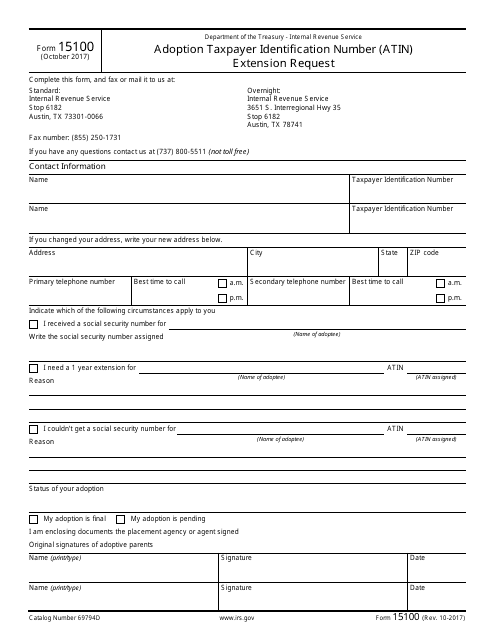

This form is used for requesting an extension of an Adoption Taxpayer Identification Number (ATIN) from the IRS.