Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

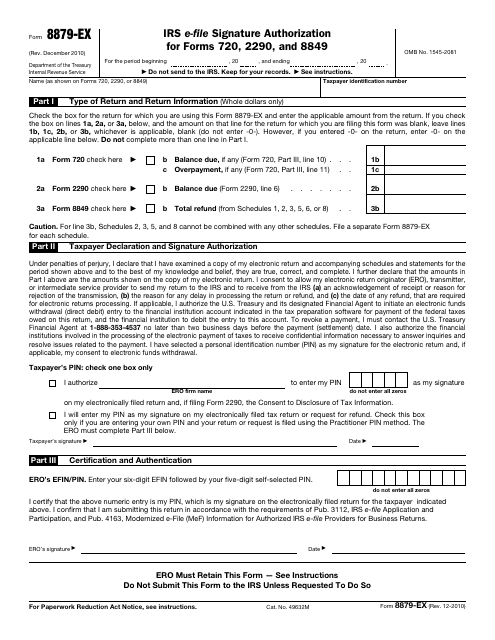

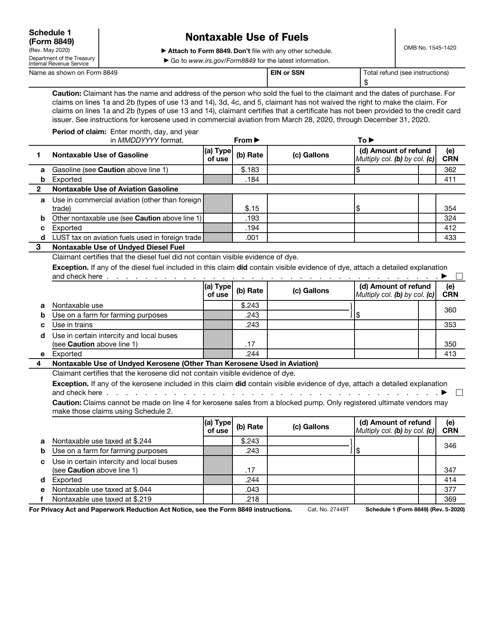

This form is used for IRS e-file signature authorization for Forms 720, 2290, and 8849. It allows taxpayers to authorize the electronic filing of these specific forms with the IRS.

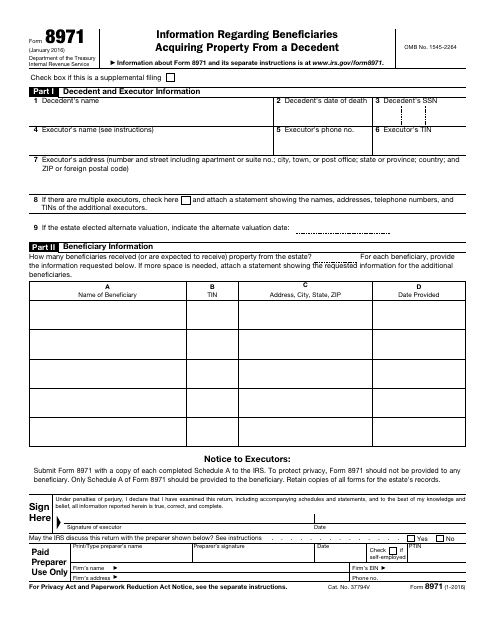

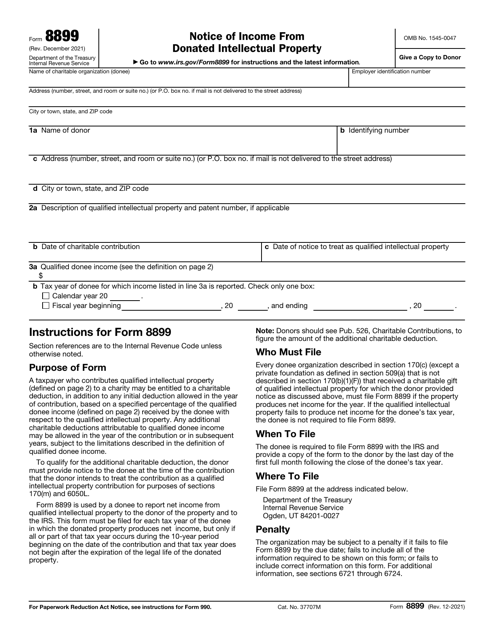

This form is used for providing information about beneficiaries who acquire property from a deceased person.

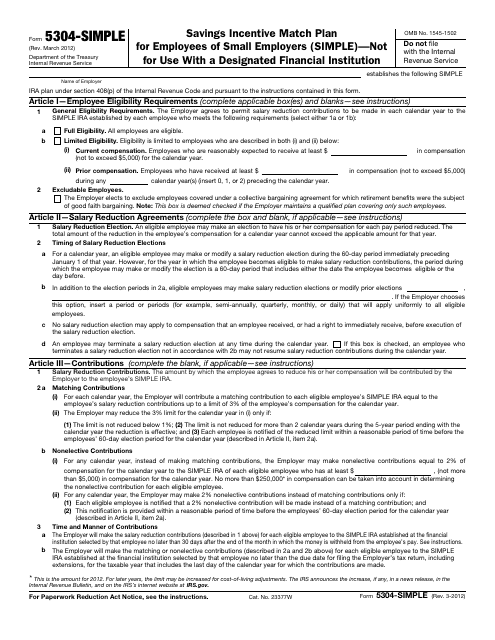

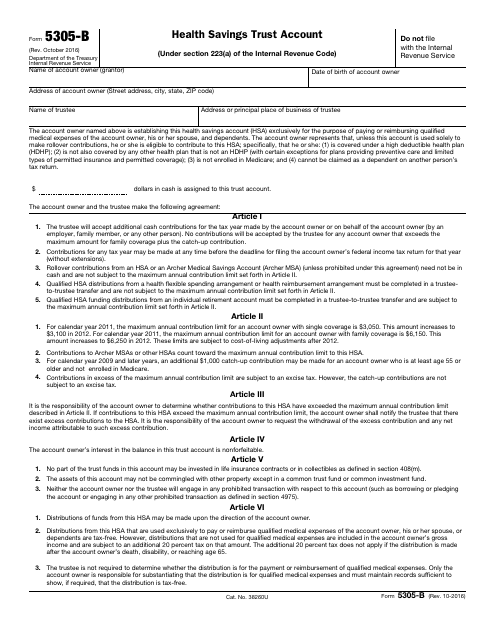

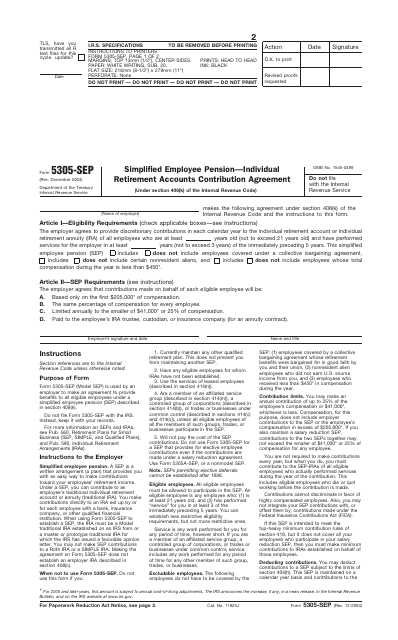

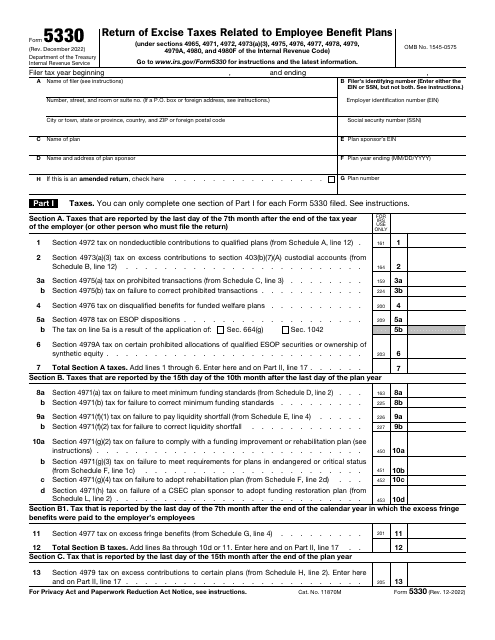

This is a fiscal document that outlines the details of a retirement plan established with the agreement of the company and its employees.

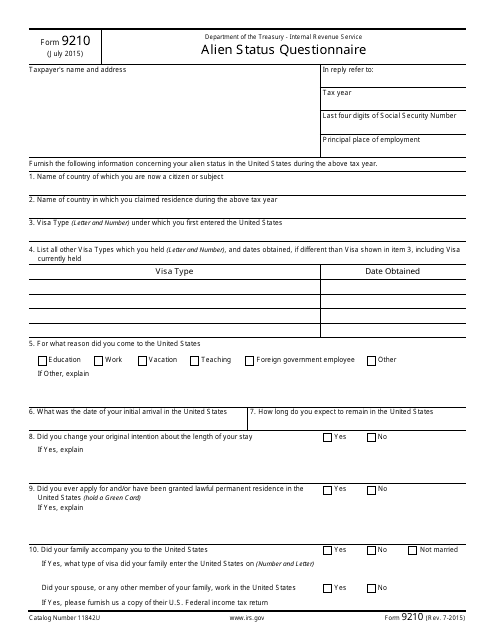

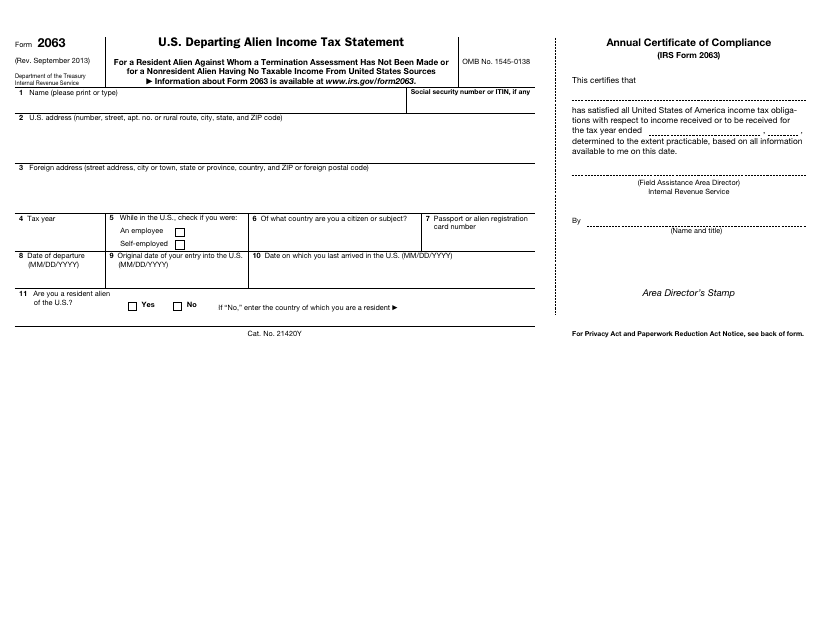

This document is used for determining the alien status of an individual for tax purposes.

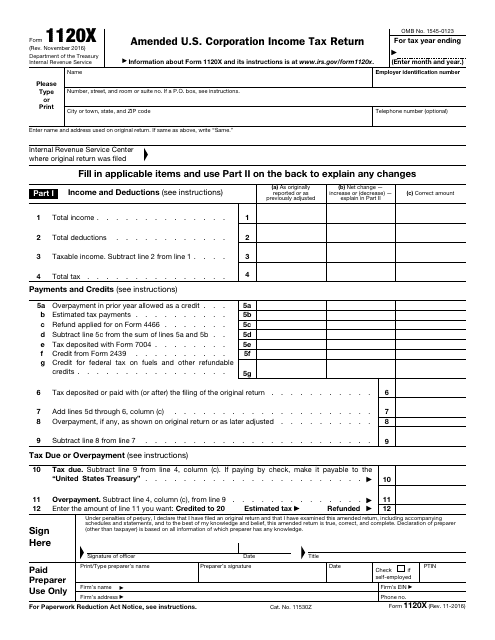

This document is filled out by corporations in order to correct Form 1120 (or Form 1120-A), a claim for a refund, or an examination, as well as to make certain elections after the prescribed deadline.

This form is used for reporting income earned by non-resident aliens who are leaving the United States.

This is a formal agreement signed by an employer to arrange a simplified employee pension.

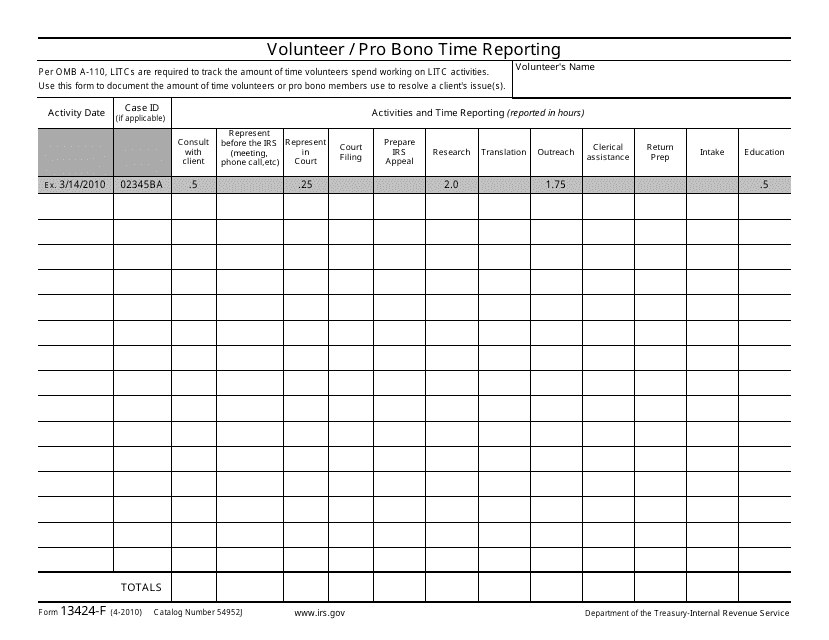

This form is used for reporting volunteer or pro bono time to the IRS. It helps individuals or organizations document the time they have devoted to providing free services to the community.

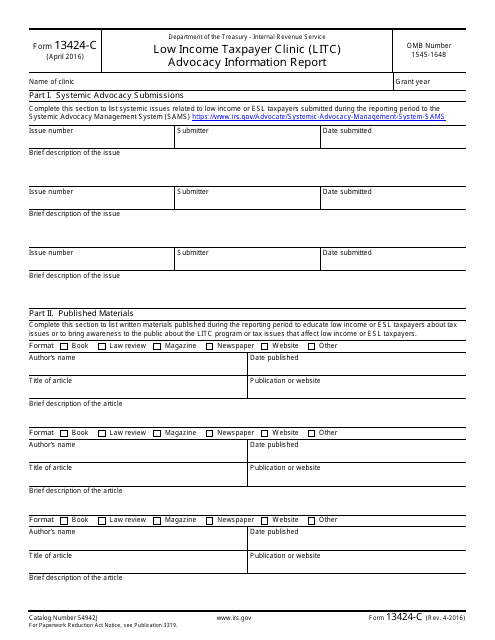

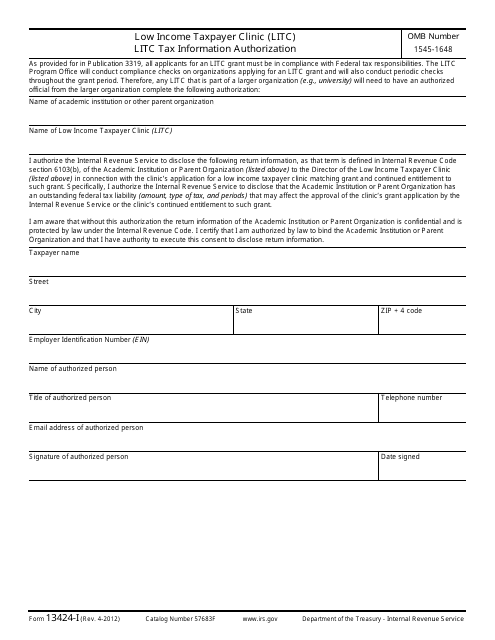

This document is for a Low Income Taxpayer Clinic (LITC) to authorize the tax information for LITC tax purposes.

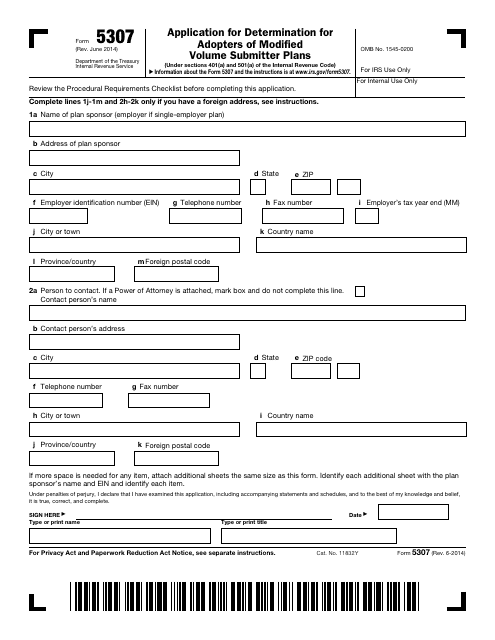

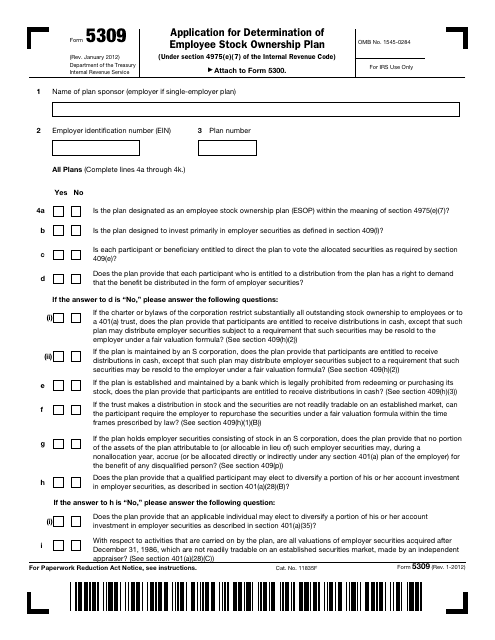

This Form is used for applying for determination for adopters of master or prototype or volume submitter plans with the IRS.

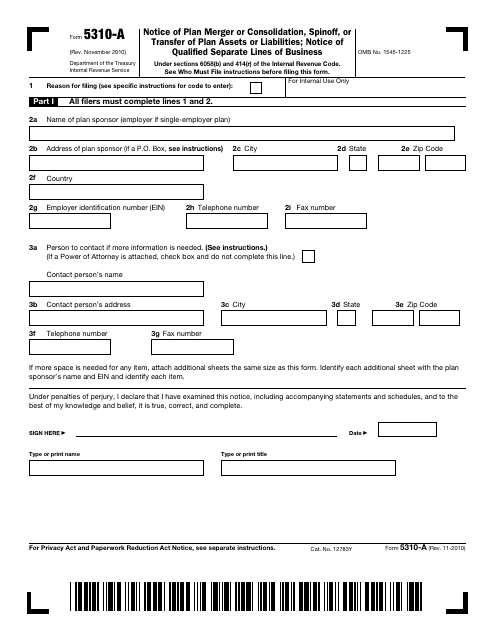

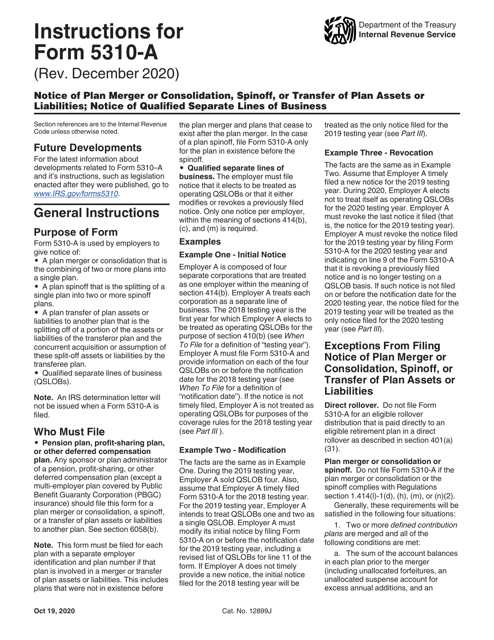

This Form is used for reporting a plan merger or consolidation, spinoff, transfer of plan assets or liabilities, or qualified separate lines of business.

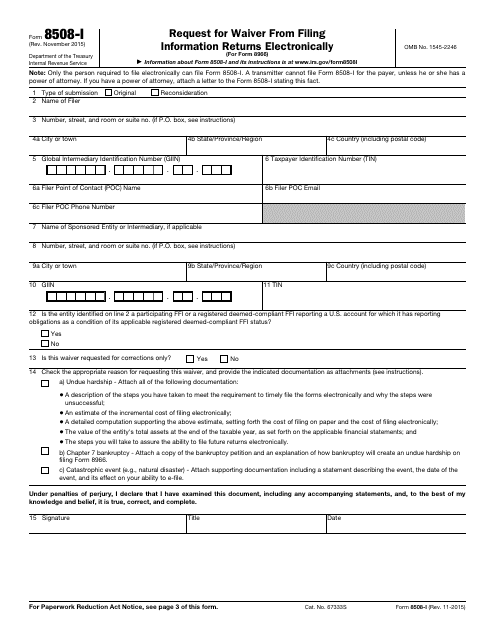

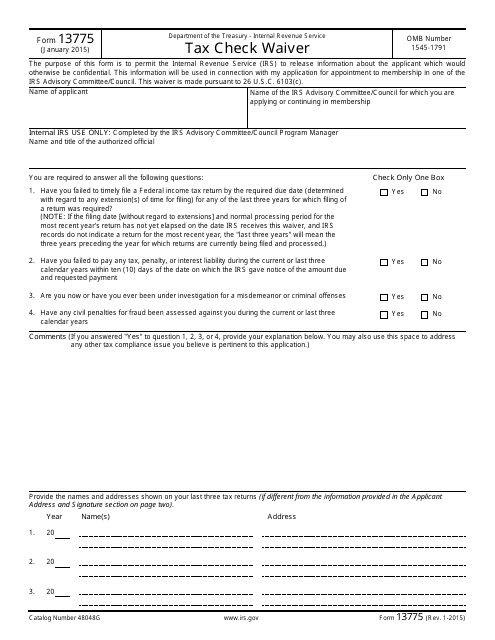

This form is used for requesting a waiver for tax checks from the IRS.